Professional Documents

Culture Documents

Asset Light Vs Asset Heavy Valuations

Uploaded by

vaibhavjha123Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asset Light Vs Asset Heavy Valuations

Uploaded by

vaibhavjha123Copyright:

Available Formats

Third-Party Logistics (3PL) Middle Market Valuation Primer

Industry Update by Harris Williams & Co.s Transportation & Logistics Group

Current industry and outsourcing dynamics in the third-party logistics (3PL) sector are driving hot and highly competitive transaction dynamics, particularly in the middle market. Continuing pressure on companies to source, manufacture, and distribute on a global basis has increased the complexity of supply chains, as well as the associated costs, driving companies to outsource critical logistics operations to specialized, third-party supply chain experts. As a result, the $100 billion 3PL market has experienced dramatic growth of approximately 15% per year over the last decade and shows no signs of slowing down. Many experts within the industry have observed that only 10% of logistics services are currently outsourced in the U.S. and believe that the U.S. will transition to a model more similar to that of European countries, where approximately 40% of logistics services are outsourced to 3PL service providers. These trends have spurred significant M&A activity by strategic buyers as well as private equity groups who recognize continued outsourcing to 3PL service providers will propel growth into the future.

The 3PL industry is closely tied to the trucking industry, with many companies offering a combination of services from both sectors. Both industries have been experiencing significant M&A activity over the past several years and numerous transactions have already been announced in 2007, including the pending $2.1 billion acquisition of EGL by CEVA, a portfolio company of Apollo.

Overview of Recent 3PL & Trucking Transactions

Target EGL Jacobson Companies Swift Transportation World Super Services Inmar Gemini Traffic Sales Madison Freight Systems Pro-Am Transportation Greatwide Logistics FMI International LLC PJAX Freight System Arnold Logistics Star Transportation TNT Logistics Watkins Motor Lines Panther Expedited Services MHF Logistics Global Link Logistics Market Industries, Ltd. Transport Corp. of America BAX Global, Inc. ACR Logistics UK Ltd. Acquirer CEVA Logistics Oak Hill Capital Partners Jerry Moyes RoadLink USA New Mountain Capital Fenway Partners Saia, Inc. BNSF Logistics Investcorp International / Hicks Holdings LLC Maritime Logistics US Holdings Inc. Vitran Corp. Oak Hill Capital Partners Covenant Transport Apollo Management LP FedEx Corp. Fenway Partners Allied Capital Golden Gate Logistics, LLC UTi Worldwide Goldner Hawn Deutsche Bahn AG Kuehne + Nagel Date Pending Jun-07 May-07 Apr-07 Apr-07 Feb-07 Feb-07 Jan-07 Dec-06 Nov-06 Oct-06 Oct-06 Sep-06 Aug-06 Jun-06 Jun-06 Jun-06 Jun-06 Mar-06 Feb-06 Jan-06 Jan-06 Target Descriptions Leading provider of supply chain solutions. Provides third-party logistics and warehousing services in the United States. National TL carrier. Provider of outsourced warehouse services. Provides technology-driven logistics management solutions. Regional LTL and nationwide TL carrier. Regional LTL carrier. Transportation broker. Provider of trucking and managed warehousing services. Logistics provider for apparel, retail, and footwear industries. Provider of trucking services. Designs and implements supply chain solutions. Truckload carrier. Provider of supply chain management solutions. Less-than-truckload carrier. Provider of time critical transportation services. Provider of trucking, rail transportation, warehousing services. Provider of international freight forwarding and customs brokerage services. Provides trucking, logistics, and transportation brokerage services. Provides truckload carriage and logistics services. Supply chain solutions and transportation management. Provides logistics and warehousing services.

Page 2 of 4

Valuation multiples across these industries vary dramatically.

Within the 3PL industry, the leading truck

brokerage company (C.H. Robinson) trades for approximately 16x its trailing twelve month (TTM) EBITDA. Similarly, the leading freight forwarder (Expeditors Intl. of Washington) trades for approximately 19x TTM EBITDA. Conversely, in the trucking industry, leading truckload (TL) carriers like Heartland Express and J.B. Hunt trade for approximately 8x TTM EBITDA. Private company valuations evidence similar disparities, as a freight forwarding business might trade for 10x EBITDA while TL carriers trade for 4-5x EBITDA and LTL carriers trade for 5-7x EBITDA. What drives this enormous gap in multiples for companies ostensibly serving similar markets? And more importantly, how do the private markets value businesses offering a combination of these services?

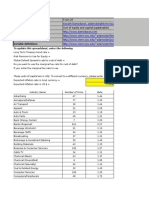

Our experience shows there are two primary valuation drivers in the industry: the nature of the companys service offering and the asset-intensity of its business model. The impact of these factors on valuation is summarized in the following matrix, and both attributes are discussed in more detail below.

The HW&Co. 3PL Valuation Matrix1 TEV/EBITDA Multiples in the Middle Market

Supply Chain / Transportation Management ("3PL Oriented") Transportation Management & Warehousing Characteristics: Fixed Assets (i.e. Trucks/Warehouses/Specialized Handling Equipment) Nature of Service Brokerage, Freight Forwarding, Contract Logistics Characteristics: No Assets, Utilize 3rd Party Suppliers

6.5x to 9.0x

Asset-Heavy Traditional Less-than-Truckload (LTL) and Truckload (TL) Carriers Characteristics: Assets (Trucks)

8.5x to 14.0x

Asset-Light Trucking Carriers Characteristics: Mix of Company-Owned Trucks and Independent Contractors

4.0x to 6.0x

5.0x to 8.0x

Carriers ("Trucking Oriented") Asset-Intensity

(1) The representative public companies do not accurately reflect the current valuations that similar middle market companies are achieving; rather they are meant to serve as analogous business models with similar capital requirements.

Nature of Service Offering As shown in the matrix above, with an increase in demand for services, the extent and nature of the services provided by companies today under the 3PL umbrella is expansive. At the highest level (and on the top end of the

Page 3 of 4

spectrum), there are supply chain and transportation management companies, or traditional 3PL companies, that effectively manage some or all aspects of a companys logistics needs, whether it is the transportation, warehousing, or distribution of its goods. This category is inclusive of truck brokerage and freight-forwarding companies that utilize third-party suppliers (such as trucking carriers) to control the flow of goods from point A to point B, as well as warehouse service providers that provide specialized environments and services to control and manage inventory within the supply chain. These traditional 3PL service providers effectively operate as

distributors of transportation services without regard to the mode of transportation (truck, rail, plane, etc.). They can enhance their value-add by deepening those aspects of their customers supply chains which they manage. Most sophisticated 3PL providers will often influence production schedules, production lot sizes, routing, or even manage a customers entire supply chain. On the other end of the spectrum, there are trucking based platforms that are primarily focused on transporting goods from point A to point B. Although these operations are not true 3PL companies, they are pivotal in the day-to-day operations of the industry as they serve as the suppliers to the supply chain and transportation management companies and are charged with providing the actual service of getting goods from point A to point B. It can be challenging to determine to which category a company belongs, but in general, if a majority of the companys revenue is generated from trucking services, they should fall on the bottom half of the matrix. Given the hot nature of traditional 3PL deals, a fair number of trucking companies are actively repositioning their services to align more with the service offerings of traditional 3PL service providers. Be careful though - many of these trucking companies have simply changed their names from Company A Trucking to Company A Logistics without adding additional value added services and should fall short of premium valuation multiples that are being paid for traditional 3PL service providers.

Why do trucking companies trade at lower valuations than third party logistics providers? 1. Perceived Commoditization of the Service. 2. Significant Driver Shortages. 3. Energy Price Concerns. 4. Higher Capital Expenditure Requirements. 5. Strict Government Regulation. 6. Unionization (in some cases).

Asset-Intensity The second dimension, asset-intensity, relates to the capital requirements of the business. For example, trucking carriers that hire their own drivers and purchase (or lease) their own trucks are considered asset-heavy due to the recurring high capital requirements needed to maintain and grow their business. On the other hand, asset-light and non-asset based 3PL providers utilize the assets of third-party providers to maintain and grow their business

Page 4 of 4

and have modest annual capital expenditure requirements. Asset-light business models generate higher valuations within the market due to the better free cash flow characteristics and the operating flexibility derived from leveraging third-party assets. As a good rule of thumb, a company transitions from asset-heavy to asset-light when annual capital expenditure requirements are less than 25% of the companys EBITDA. At this threshold point, we would consider the company to be moderately asset-intensive. Other Considerations What moves valuation within each quadrant of the matrix? Several other factors will influence valuation levels, including (i) regional versus national infrastructure, (ii) specialization of the services, (iii) end markets served, (iv) market position, (v) customer concentration, (vi) stickiness of the customer base, (vii) level of value add of the service offering, (viii) sophistication of the IT platform, and (ix) degree of integration of services. In extreme cases, these variables can even push valuation outside of the stated ranges. We welcome inquiries regarding valuation and strategy specific to your 3PL business. - Bram Hall, Joe Conner, Will Kilpatrick, and John Wright. For questions about third-party logistics or other transportation sectors, please call Bram or Joe at 804-648-0072. Harris Williams & Co. (www.harriswilliams.com), a member of The PNC Financial Services Group, Inc. (NYSE:PNC), is one of the largest mergers and acquisitions advisory firms in the country focused exclusively on the middle market. With offices in Richmond, San Francisco, Boston, Philadelphia, and Minneapolis, Harris Williams & Co. represents private equity groups as well as publicly and privately held companies worldwide. Harris Williams & Co. is the trade name for Harris Williams, LLC and a registered broker-dealer. Member NASD/SIPC. Bram C. Hall, Managing Director of Harris Williams & Co., heads the firms Transportation & Logistics Group. Mr. Hall and his team have been among the most active advisors in the 3PL industry in the past two years. Other areas of focus within the T&L Group include air services, rail services, and automotive aftermarket distributors, manufacturers, and suppliers.

You might also like

- Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsFrom EverandCredit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsNo ratings yet

- Excel Margin Call CalculationsDocument1 pageExcel Margin Call Calculationsapi-27174321100% (1)

- Mergers and AcquisitionsDocument46 pagesMergers and Acquisitionszyra liam styles0% (1)

- CdosDocument53 pagesCdosapi-3742111No ratings yet

- Hedge Fund Business Plan PDFDocument98 pagesHedge Fund Business Plan PDFMarius AngaraNo ratings yet

- Lehman REIT Sector Overview 2008 05Document49 pagesLehman REIT Sector Overview 2008 05mayorladNo ratings yet

- There'S Something' Weird Going OnDocument33 pagesThere'S Something' Weird Going OnZerohedge100% (7)

- ABCP State StreetDocument28 pagesABCP State StreetAngshujit MajumderNo ratings yet

- (BNP Paribas) DivDax. Trade 2009-2010 Dividend SwapDocument10 pages(BNP Paribas) DivDax. Trade 2009-2010 Dividend SwapaacmasterblasterNo ratings yet

- Final - Real Estate Exchange Traded FundsDocument12 pagesFinal - Real Estate Exchange Traded FundsUrvisha Mistry100% (1)

- Regus SWOT and competitive analysisDocument4 pagesRegus SWOT and competitive analysisحازم صبحىNo ratings yet

- 2020 - 11 - The Future of Fixed Income Technology - CelentDocument26 pages2020 - 11 - The Future of Fixed Income Technology - CelentProduct PoshanNo ratings yet

- BNP Informe ArgDocument8 pagesBNP Informe ArgfacundoenNo ratings yet

- Accelerating used car sales in a digitally disrupted marketDocument1 pageAccelerating used car sales in a digitally disrupted marketSachin ChaudhryNo ratings yet

- NTP Security Tokens Primer - FINALDocument32 pagesNTP Security Tokens Primer - FINALm_vamshikrishna22No ratings yet

- Gensol Engg Initial (JP Morgan)Document14 pagesGensol Engg Initial (JP Morgan)beza manojNo ratings yet

- Trust Preferred CDOs A Primer 11-11-04 (Merrill Lynch)Document40 pagesTrust Preferred CDOs A Primer 11-11-04 (Merrill Lynch)scottrathbun100% (1)

- Taylor & Francis, Ltd. Financial Analysts JournalDocument16 pagesTaylor & Francis, Ltd. Financial Analysts JournalJean Pierre BetancourthNo ratings yet

- Bits & Pieces (We Sold The House - Now What - ..... Part 2) 20210903Document37 pagesBits & Pieces (We Sold The House - Now What - ..... Part 2) 20210903VSNNo ratings yet

- Arbitrage-Free Shifting of Price Forward CurvesDocument17 pagesArbitrage-Free Shifting of Price Forward Curvesalexa_sherpyNo ratings yet

- ps18 14Document412 pagesps18 14Crawford BoydNo ratings yet

- Libor Outlook - JPMorganDocument10 pagesLibor Outlook - JPMorganMichael A. McNicholasNo ratings yet

- Tax Equity Financing and Asset RotationDocument38 pagesTax Equity Financing and Asset RotationShofiul HasanNo ratings yet

- Devonshire Research Group - Tesla Motors - TSLA - Public Release - Part IIDocument37 pagesDevonshire Research Group - Tesla Motors - TSLA - Public Release - Part IIZerohedge100% (1)

- LeasingDocument14 pagesLeasingFelix SwarnaNo ratings yet

- Jazz Pharmaceuticals Investment Banking Pitch BookDocument20 pagesJazz Pharmaceuticals Investment Banking Pitch BookAlexandreLegaNo ratings yet

- Earnings Theory PaperDocument64 pagesEarnings Theory PaperPrateek SabharwalNo ratings yet

- Adelman Presentation 2018Document23 pagesAdelman Presentation 2018danielkting100% (1)

- CampelloSaffi15 PDFDocument39 pagesCampelloSaffi15 PDFdreamjongenNo ratings yet

- BitShares White PaperDocument18 pagesBitShares White PaperMichael WebbNo ratings yet

- Big 4 accounting firms ownership secretsDocument20 pagesBig 4 accounting firms ownership secretssandyskadamNo ratings yet

- Corporate Banking Summer Internship ProgramDocument2 pagesCorporate Banking Summer Internship ProgramPrince JainNo ratings yet

- Thomvest Real Estate Tech Review, September 2019Document32 pagesThomvest Real Estate Tech Review, September 2019Nima WedlakeNo ratings yet

- Airbnb Paper DraftDocument12 pagesAirbnb Paper Draftsayma0farihaNo ratings yet

- Exercises on FRA’s and SWAPS valuationDocument5 pagesExercises on FRA’s and SWAPS valuationrandomcuriNo ratings yet

- Real Options Analysis of Cox CommunicationsDocument1 pageReal Options Analysis of Cox CommunicationsLibayTeaNo ratings yet

- Hedge Fund Collapse Due to Rising Interest RatesDocument1 pageHedge Fund Collapse Due to Rising Interest RatesPoorvaNo ratings yet

- Understanding Total Return SwapsDocument17 pagesUnderstanding Total Return SwapsAditya ShuklaNo ratings yet

- Weather Derivatives in IndiaDocument25 pagesWeather Derivatives in Indiaprateek0512No ratings yet

- Investor Bulletin:: Real Estate Investment Trusts (Reits)Document5 pagesInvestor Bulletin:: Real Estate Investment Trusts (Reits)mssidhu88No ratings yet

- CVVC Insights TOP50 PDFDocument22 pagesCVVC Insights TOP50 PDFFrancesco MiottiNo ratings yet

- Survey of Microstructure of Fixed Income Market PDFDocument46 pagesSurvey of Microstructure of Fixed Income Market PDF11: 11100% (1)

- Leverage Buyout and Junk KbondsDocument31 pagesLeverage Buyout and Junk KbondsChetan VenuNo ratings yet

- 02 Oct 2013 Fact SheetDocument1 page02 Oct 2013 Fact SheetfaisaladeemNo ratings yet

- Survey of Investors in Hedge Funds 2010Document6 pagesSurvey of Investors in Hedge Funds 2010http://besthedgefund.blogspot.comNo ratings yet

- Derivatives and Risk Management JP Morgan ReportDocument24 pagesDerivatives and Risk Management JP Morgan Reportanirbanccim8493No ratings yet

- Financial-Statements BNP ConsolidatedDocument89 pagesFinancial-Statements BNP ConsolidatedJustine991No ratings yet

- Aditya Birla Capital - Information Memorandum (Post Spinoff)Document189 pagesAditya Birla Capital - Information Memorandum (Post Spinoff)me_girish_deshpandeNo ratings yet

- Jpmorgan's 129 Page Internal Report On Whale Jan 16 2013Document132 pagesJpmorgan's 129 Page Internal Report On Whale Jan 16 201383jjmackNo ratings yet

- Lbo Model Short FormDocument4 pagesLbo Model Short FormAkash PrasadNo ratings yet

- Volans 2007-1 CDO Term SheetDocument4 pagesVolans 2007-1 CDO Term Sheetthe_akinitiNo ratings yet

- Cost of Equity and Capital for Over 7000 US CompaniesDocument15 pagesCost of Equity and Capital for Over 7000 US CompaniesPedro CooperNo ratings yet

- 5 Structured Products Forum 2007 Hong KongDocument11 pages5 Structured Products Forum 2007 Hong KongroversamNo ratings yet

- Introduction to Corporate GovernanceDocument16 pagesIntroduction to Corporate GovernanceSourav SenNo ratings yet

- Understand Financial Ratios with Balance Sheet and Income Statement CalculationsDocument3 pagesUnderstand Financial Ratios with Balance Sheet and Income Statement CalculationsMohit Sunil Anju MehtaNo ratings yet

- Open Letter To Senator Levin Aug 2014Document4 pagesOpen Letter To Senator Levin Aug 2014tabbforumNo ratings yet

- CFIRA Response To Investor Advisory CommitteeDocument3 pagesCFIRA Response To Investor Advisory CommitteeCrowdfundInsiderNo ratings yet

- Fundamental Analysis of BNY MellonDocument8 pagesFundamental Analysis of BNY MellonAnjali Angel ThakurNo ratings yet

- The Risk Controllers: Central Counterparty Clearing in Globalised Financial MarketsFrom EverandThe Risk Controllers: Central Counterparty Clearing in Globalised Financial MarketsRating: 5 out of 5 stars5/5 (1)

- Test Bank 11 OprDocument16 pagesTest Bank 11 Oprx56alnNo ratings yet

- BL No. TDL1065BLWCHLDocument1 pageBL No. TDL1065BLWCHLahmad roy muda siregarNo ratings yet

- Carriage Goods Air ChapterDocument32 pagesCarriage Goods Air ChapterShashwat MalhotraNo ratings yet

- SCM-310-Final Project (MHC) PDFDocument22 pagesSCM-310-Final Project (MHC) PDFMahmudul HasanNo ratings yet

- Supply chain surplus: Amul 1L milk pouch generates Rs. 5.17Document5 pagesSupply chain surplus: Amul 1L milk pouch generates Rs. 5.17Tushar RanaNo ratings yet

- Telex BLDocument1 pageTelex BLJORGENo ratings yet

- Catalogue - Shree Venkateshwara Cargo Express inDocument1 pageCatalogue - Shree Venkateshwara Cargo Express inBalaji Plastics BangaloreNo ratings yet

- Global Logistics AssignmentDocument4 pagesGlobal Logistics Assignmentaka619ASHNo ratings yet

- Lesson 3 Supply Chain Operations: Making and DeliveringDocument8 pagesLesson 3 Supply Chain Operations: Making and DeliveringJohn Berni NisayNo ratings yet

- Logistics Principles Functions and TypesDocument4 pagesLogistics Principles Functions and TypesMuchaelNo ratings yet

- Modernize logistics to expand Lahore Tea businessDocument1 pageModernize logistics to expand Lahore Tea businessAnooshaNo ratings yet

- Philippine Logistics Industry: Developing the WorkforceDocument10 pagesPhilippine Logistics Industry: Developing the Workforcekevin nigel martinezNo ratings yet

- Fedex Awb 774163165502-1Document2 pagesFedex Awb 774163165502-1Layeeq AhmedNo ratings yet

- Supply Chain Management Place Distribution DecisionDocument29 pagesSupply Chain Management Place Distribution DecisionMa TeresitaNo ratings yet

- Pepsi - Logistics Pepsi - LogisticsDocument15 pagesPepsi - Logistics Pepsi - LogisticsjamilNo ratings yet

- Supply Chain Management Module 1Document37 pagesSupply Chain Management Module 1Random MusicNo ratings yet

- East Timor - Timor Leste - Shipping - Import - Export - East - Timor - DiliDocument5 pagesEast Timor - Timor Leste - Shipping - Import - Export - East - Timor - DiliDymorea Soares De CarvalhoNo ratings yet

- Group ProjectDocument26 pagesGroup ProjectShakir IsmailNo ratings yet

- School of Commerce: A Presentation On Inland Container DepotDocument18 pagesSchool of Commerce: A Presentation On Inland Container DepotBernard Emmanuel100% (1)

- F&L Panel Discussion Supply Chain Visibility: Elinor Castell, SAP SE Sean Potter, DFDSDocument9 pagesF&L Panel Discussion Supply Chain Visibility: Elinor Castell, SAP SE Sean Potter, DFDSCharly JuárezNo ratings yet

- ABLE Contract Approval.Document5 pagesABLE Contract Approval.Ferris FerrisNo ratings yet

- A Research View of Supply Chain Management DevelopDocument15 pagesA Research View of Supply Chain Management DevelopJohnson NjasotehNo ratings yet

- MBL SWB PDFDocument1 pageMBL SWB PDFMohammed Al-kawak100% (1)

- Transport and Logistics Standard Operating ProceduresDocument3 pagesTransport and Logistics Standard Operating ProceduresHaresh B. RaneNo ratings yet

- WL - Chennai Presentation - MappeduDocument19 pagesWL - Chennai Presentation - Mappeduankit singhNo ratings yet

- Custom DeclarationDocument1 pageCustom DeclarationAgoeng Susanto BrajewoNo ratings yet

- Gul AhmedDocument38 pagesGul AhmedSumama Ikhlas100% (1)

- Hana TesfuDocument55 pagesHana Tesfuendris aliNo ratings yet

- Inside the warehouse: How an eCommerce store manages inventory and operationsDocument35 pagesInside the warehouse: How an eCommerce store manages inventory and operationsAnoopNo ratings yet

- Essential KPIs for Effective Warehouse ManagementDocument2 pagesEssential KPIs for Effective Warehouse ManagementVarunNo ratings yet