Professional Documents

Culture Documents

FIM Project Report

Uploaded by

myuza_shrees0 ratings0% found this document useful (0 votes)

72 views5 pagesAN ANALYSIS ON LENDING PROCEDURE OF HIMALAYAN BANK LIMITED BUTWAL By Binam Shrees T.U. Reg. No. Exam roll No. This project work assignment report has been prepared as approved by this department. Loan is a type of investment which investor gets back with interest after the prementioned maturity period. After collecting various documents a final decision can accept or reject the borrower's proposal.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAN ANALYSIS ON LENDING PROCEDURE OF HIMALAYAN BANK LIMITED BUTWAL By Binam Shrees T.U. Reg. No. Exam roll No. This project work assignment report has been prepared as approved by this department. Loan is a type of investment which investor gets back with interest after the prementioned maturity period. After collecting various documents a final decision can accept or reject the borrower's proposal.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

72 views5 pagesFIM Project Report

Uploaded by

myuza_shreesAN ANALYSIS ON LENDING PROCEDURE OF HIMALAYAN BANK LIMITED BUTWAL By Binam Shrees T.U. Reg. No. Exam roll No. This project work assignment report has been prepared as approved by this department. Loan is a type of investment which investor gets back with interest after the prementioned maturity period. After collecting various documents a final decision can accept or reject the borrower's proposal.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

1

AN ANALYSIS ON LENDING PROCEDURE OF HIMALAYAN BANK LIMITED BUTWAL

By

Binam Shrees T.U. Reg. No. Exam Roll No.

A Projectwork Report

Submitted to Tribhuvan University Manimukunda College, Butwal

in partial fulfillment of the requirement for the degree of Bachelor of Business Studies

Butwal Bhadra

Faculty of Management

Tribhuvan University

RECOMMENDATION

This is to certify that the projectwork assignment report

Submitted by Binam Shrees T.U. Reg. No. Exam Roll No.

entitled

An Analysis on Lending Procedure

A Case of Himalayan Bank Ltd, Butwal has been prepared as approved by this department. This project work assignment report is forwarded for examination.

-------------------------------Mr. Sanjeev Shrestha Supervisor

---------------------------------------Tuk Bahadur Kshettri Manimukunda college,Butwal-13

TABLE OF CONTENTS

Acknowledgement List of Abbreviations List of Tables List of Figures Tables of contents

I II III IV V

Chapters

Page No. 1-

1. INTRODUCTION

1.1 Background of the Study 1 1.2 Significance of the Study 1.3 Literature Review .... 1.4 Objectives of the Study 1.5 Methodology of the Study 1.6 Limitations of the Study

2. DATA PRESENTATION AND ANALYSIS .

2.1 Presentation and Analysis of Data 2.2 Major Findings of the Study .

6-

3. SUMMARY AND CONCLUSIONS

3.1 Summary 3.2 conclusions 3.2 Recommendations ..

Bibliography Appendix

PROPOSAL ON An Analysis On Lending Procedure Of Himalayan Bank Limited, Butwal

1.1 Background of the Study

Loan is a type of investment which investor gets back with interest after the prementioned maturity period. Borrower has to pay the interest that may be any specific rate to the investor. After collecting various documents a final decision can accept or reject the borrowers proposal. The loan lending procedure provides analysis and comparison of mortgages and other installment loans. It enables you to input contract terms for any number of loans and analyze and compare various financing alternatives analyze for different types of loan contracts: fixed rate, adjustable rate, buy down rate and balloon rate. Loan may also be provided on the security backing of fixed time deposits certificates. Himalayan Bank Ltd. is one of the commercial banks which was established on 18th January 1993. This bank has been providing several things of services such as: employment opportunity, loan to farmer, loan to tender industrial loan to enterprises & providing loan at cheaper rate of interest. The bank charges interest on loans, which are usually higher than those offered on other deposits. Since the banks in Nepal are now free to fix interest rates, the rate of interest on loans varies from bank to bank.

1.2 Literature Study

Literature review is the descriptive analysis of any specific topic which is related only to that topic and gives more essential information. Robert in 2001 states, Loan approval procedure is one of the pillars of the organization on which most of the banking activities are based on. Brealey, R.A. and S.C. Myers in 1999 states, Lending policy is designed to remove any possible conflict of interest between us and our clients, while giving our borrowers the ability to strike the balance that they want between risk, upfront costs and long-term interest rates. Lending of loan to the client is one of the important aspects of the bank. The procedure by which bank lends the loan determines the profitability and success of the bank. The procedure by which the loan is granted should have some strict rules and regulations.

1.3 Objectives of the study

The main objective of the report is to know the several kinds of information about the bank which are as follows: To analyze the lending procedure of followed by the bank for investment. To evaluate sectorial investment of the bank . To explore the position of the loan recovery. To analyze the rate of interest on different types of loan.

1.4

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Swiss NCP Initial Assessment UBS STP ForpublicationDocument8 pagesSwiss NCP Initial Assessment UBS STP ForpublicationComunicarSe-ArchivoNo ratings yet

- Challenges and Opportunities Facing Brand Management - An IntroducDocument12 pagesChallenges and Opportunities Facing Brand Management - An IntroducLeyds GalvezNo ratings yet

- History of Behavioral Economics PDFDocument17 pagesHistory of Behavioral Economics PDFAntonio Garcês100% (1)

- Term Paper Edit Swizel and VernonDocument10 pagesTerm Paper Edit Swizel and VernonswizelNo ratings yet

- AgentsDocument11 pagesAgentschinchumoleNo ratings yet

- MBM 207 QB - DistanceDocument2 pagesMBM 207 QB - Distancemunish2030No ratings yet

- Toolkit Materiality Assessment 2022 - FINALDocument36 pagesToolkit Materiality Assessment 2022 - FINALtrader123No ratings yet

- The Journal Jan-Mar 2018Document100 pagesThe Journal Jan-Mar 2018Paul BanerjeeNo ratings yet

- Online Shopping Hesitation: Chang-Hoan Cho, PH.D., Jaewon Kang, PH.D., and Hongsik John Cheon, PH.DDocument14 pagesOnline Shopping Hesitation: Chang-Hoan Cho, PH.D., Jaewon Kang, PH.D., and Hongsik John Cheon, PH.DAmber ZahraNo ratings yet

- Criticisms of The Ifrs Conceptual FrameworkDocument9 pagesCriticisms of The Ifrs Conceptual FrameworkTHOMAS ANSAHNo ratings yet

- Clean Edge Razor-Case PPT-SHAREDDocument10 pagesClean Edge Razor-Case PPT-SHAREDPoorvi SinghalNo ratings yet

- Backflush Accounting FM May06 p43-44Document2 pagesBackflush Accounting FM May06 p43-44khengmaiNo ratings yet

- Consultancy Paper FinalDocument20 pagesConsultancy Paper FinalRosemarie McGuireNo ratings yet

- Tck-In Day 9Document3 pagesTck-In Day 9Julieth RiañoNo ratings yet

- Managerial RemunerationDocument18 pagesManagerial RemunerationIshita GoyalNo ratings yet

- WmsDocument43 pagesWmssanthosh kumarNo ratings yet

- AFM 131 Midterm 1 Prof. Bob Sproule Unknown YearDocument6 pagesAFM 131 Midterm 1 Prof. Bob Sproule Unknown YearGqn GanNo ratings yet

- Boulevard 51 250516 Sales Kit 2016Document54 pagesBoulevard 51 250516 Sales Kit 2016api-340431954No ratings yet

- CIRCO Döngüsel Ekonomi 2016 PDFDocument75 pagesCIRCO Döngüsel Ekonomi 2016 PDFŞeyda DağdevirenNo ratings yet

- Architect / Contract Administrator's Instruction: Estimated Revised Contract PriceDocument6 pagesArchitect / Contract Administrator's Instruction: Estimated Revised Contract PriceAfiya PatersonNo ratings yet

- LIST OF YGC and AYALA COMPANIESDocument3 pagesLIST OF YGC and AYALA COMPANIESJibber JabberNo ratings yet

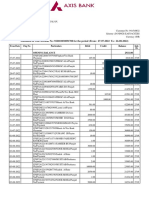

- Acct Statement XX1708 26082022Document4 pagesAcct Statement XX1708 26082022Firoz KhanNo ratings yet

- Engg Eco Unit 2 D&SDocument129 pagesEngg Eco Unit 2 D&SSindhu PNo ratings yet

- ICUMSA 45 Specifications and Proceduers - 230124 - 134605Document3 pagesICUMSA 45 Specifications and Proceduers - 230124 - 134605Alexandre de Melo0% (1)

- Chapter 5 - Asset ValuationDocument4 pagesChapter 5 - Asset ValuationSteffany RoqueNo ratings yet

- Bu040815 PDFDocument86 pagesBu040815 PDFNikita JoshiNo ratings yet

- 2W Multi Brand Repair StudioDocument26 pages2W Multi Brand Repair StudioShubham BishtNo ratings yet

- Fund Card Sample PDFDocument4 pagesFund Card Sample PDFSandeep SoniNo ratings yet

- Dea Aul - QuizDocument5 pagesDea Aul - QuizDea Aulia AmanahNo ratings yet

- Micro Tutorial 8 - 2017Document2 pagesMicro Tutorial 8 - 2017AndyNo ratings yet