Professional Documents

Culture Documents

Insurance Persistency

Uploaded by

Tanit PaochindaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Persistency

Uploaded by

Tanit PaochindaCopyright:

Available Formats

Individual Life Persistency

Malaysia

Full Report

Ingrid R. Goodenow, FLMI

International Research 860.285.7835 igoodenow@limra.com

A 2009 Report

INDIVIDUAL LIFE PERSISTENCY MALAYSIA

2009, LIMRA 300 Day Hill Road, Windsor, Connecticut 06095, U.S.A. This publication is a benefit of LIMRA membership. No part may be shared with other organizations or reproduced in any form without LIMRAs written permission.

008306-1209-(562-44-0-J34) Printed in U.S.A.

CONTENTS

Page

INTRODUCTION .............................................................................................................. 5 KEY RESULTS ................................................................................................................ 6 INDIVIDUAL LIFE PERSISTENCY MALAYSIA .............................................................. 7 CONSTANT GROUP TRENDS .......................................................................................... 9 TRENDS IN U.S. INDIVIDUAL LIFE PERSISTENCY........................................................ 10 PARTICIPATING COMPANIES ....................................................................................... 12 RELATED LINKS .......................................................................................................... 13

FIGURES AND TABLES

Page

Figure 1 Average Policy Lapse Rates by Years in Business ..........................................8 Figure 2 Average Face Amount Lapse Rates by Years in Business...............................8 Figure 3 Trends in U.S. Individual Life Policy Lapse Rates ........................................10 Figure 4 Trends in U.S. Individual Life Face Amount Lapse Rates ............................11

Table 1 2008 Average Policy and Face Amount Lapse Rates........................................7 Table 2 Average Face Amounts: 2007 and 2008 In-Force Business (in Ringgit Malaysia) ....................................................................................................8 Table 3 Average Policy Lapse Rates for a Constant Group of Companies ....................9 Table 4 Average Face Amount Lapse Rates for a Constant Group of Companies ........9

Individual Life Persistency Malaysia

INTRODUCTION

LIMRA conducted the Individual Life Persistency Study to examine lapse experience on individual life products in Malaysia. Nine companies participated in this research providing lapse data for 2008. Lapse rates are summarized by the number of years participating companies have been in the individual life insurance business. The results of this study can be used for industry benchmarking and as a source of background information for the product development and planning process. Companies were asked to provide data on all policies sold since beginning individual life insurance operations. An appendix is included for participating companies only showing individual company results using confidential codes. This allows LIMRA to provide valuable company-by-company results while maintaining the confidentiality of participants. If you would like to find out more about participating in this study, please contact Ingrid Goodenow at igoodenow@limra.com. Years in individual life business Data is summarized by companies that have been in the business for less than 10 years, and for 10 years or more. Specific lapse rate calculations are as follows:

Number of policies lapsed during the policy year Policy Count = 100 x (Number of policies at beginning of year + number of policies at year end) 2 Face amount lapsed during the policy year (Face amount at beginning of year + face amount at year end) 2

Face Amount = 100 x

Individual Life Persistency Malaysia

KEY RESULTS

The average policy lapse rate for participating companies in 2008 was 7.0 percent. Company tenure in the individual life business impacts both the policy and face amount lapse rates. The average policy lapse rate for newer companies is 13.9 percent; almost three times higher than that of established companies at 4.7 percent. The average face amount lapse rate for 2008 participants was 4.3 percent. Companies in the business for less than 10 years experienced a 5.5 percent face amount lapse rate. Companies in the business 10 or more years saw 3.9 percent of their face amount lapse. The average face amount per policy for 2008 remained fairly level at 50,833 Ringgit Malaysia. The average policy lapse rate for a constant group of companies was unchanged at 7.4 percent for 2007 and 2008.

Individual Life Persistency Malaysia

INDIVIDUAL LIFE PERSISTENCY MALAYSIA

This study presents the lapse experience of individual life insurance policies. Aggregate averages for all companies show a similar pattern. Comparing companies that are new to the individual life business with the more established companies, both groups have higher lapse rates for policies than for face amounts (Table 1). On an individual company basis, the average policy lapse rate is higher than the face amount lapse rate for eight of the nine participating companies. The rates of U.S. individual life persistency are opposite that of Malaysia with face amount lapse rates slightly higher than policy lapse rates. This implies that smaller policies with lower face amounts are lapsing in Malaysia and fewer policies with larger face amounts are lapsing in the United States. Malaysian companies with 10 or more years in the business are showing rates more in line with the United States, while those with less than 10 years tenure show quite a bit of volatility. The number of years a company has been in the life business has an impact on both policy and face amount lapse rates. This is due to the fact that higher lapse rates occur in the first few policy years. The older the life business, the less influence the newer business has on the overall lapse rates. The two highest rates for policy lapses come from companies that have been in the life business for fewer than 10 years. With the exception of one company, policy lapse rates are higher than face amount lapse rates, implying that most of the lapses are smaller face amount lapses.

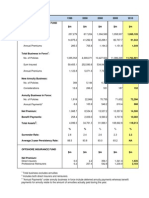

Table 1 2008 Average Policy and Face Amount Lapse Rates*

Policies

Average+ Less than 10 years 10 years or more *Based on data from eight companies +Company averages are equal to the mean of the individual company lapse rates. 7.0% 13.9 4.7

Face Amount

4.3% 5.5 3.9

Average individual life face amounts for all companies remained fairly level, going from 50,253 Ringgit Malaysia (RM) on December 31, 2007, to 50,833 (RM) on December 31, 2008. The aggregate average face amounts of in-force business for companies in the business for 10 years or more are nearly twice as large as those of companies with less than 10 years of service (Table 2).

Individual Life Persistency Malaysia

Table 2 Average Face Amounts: 2007 and 2008 In-Force Business (in Ringgit Malaysia)

In-force on December 31, 2007

Average Less than 10 years 10 years or more 50,253 31,878 59,441

In-force on December 31, 2008

50,833 32,680 59,910

Again, its clear to see the effect a companys tenure in the life business has upon its lapse rates, both for policies and face amounts. Companies with less than 10 years of service have average policy lapse rates almost three times higher than established companies (Figure 1). This emphasizes the vulnerability that a smaller block of in-force business has against lapses; particularly the number of policies that commonly lapse in the first few years.

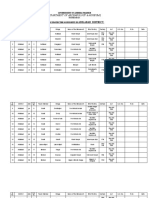

Figure 1 Average Policy Lapse Rates by Years in Business*

13.9% 5.5%

Figure 2 Average Face Amount Lapse Rates by Years in Business

14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% Less than 10 years 10 years or more

4.7%

6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Less than 10 years

3.9%

10 years or more

*Based on data from eight companies

The aggregate average face amount lapse rate for companies in the life business less than 10 years is 5.5 percent (Figure 2). The spread in the aggregate face amount lapse rates for new versus established companies is less than two percentage points.

Individual Life Persistency Malaysia

CONSTANT GROUP TRENDS

One of the most comprehensive ways to view trend data is to compare a constant group of companies. Seven Malaysian companies contributed data for the 2007 and 2008 persistency reports. Results in comparing the two years were similar to 2008 results: Average policy lapse rates exceeded face amount lapse rates. Aggregate, average policy lapse rates were the same for this group of companies from 2007 to 2008 (Table 3). On an individual company basis, however, four of the seven companies had fewer policies lapse in 2008, two companies saw their policy lapse rates increase, and one company experienced no change in this period.

Table 3 Average Policy Lapse Rates for a Constant Group of Companies

2008

Average* 7.4%

2007

7.4%

*Company averages are equal to the mean of the individual company lapse rates.

More fluctuation was seen in the face amount lapse rates with only two companies seeing improvement in their rates from 2007 to 2008 (Table 4). However, the improvements outweighed the decreases with an end result of a slight improvement in the aggregate, average rate.

Table 4 Average Face Amount Lapse Rates for a Constant Group of Companies

2008

Average* 4.3%

2007

4.5%

*Company averages are equal to the mean of the individual company lapse rates.

Individual Life Persistency Malaysia

TRENDS IN U.S. INDIVIDUAL LIFE PERSISTENCY

LIMRA has been measuring life persistency of U.S. insurers for over 90 years. More recently, LIMRA and the Society of Actuaries (SOA) have partnered in doing a collaborative persistency study in which individual policy data is collected, rather than aggregated company results. The most recent U.S. Individual Life Insurance Persistency Study, conducted jointly by LIMRA International and the SOA, presents results of the individual life insurance lapse experience for observation years 2004 and 2005. This study shows results for individual policy years rather than for a total block of in-force business (Figure 3). Thirty-nine individual life insurance writers contributed data for whole life, term, universal life, and variable universal life insurance plans for this study. Over time, it is hoped that with increased participation from Malaysian companies LIMRA can build a database and have similar trend data to present to participating companies. U.S. lapse rates are calculated as follows:

Annualized policy lapse rate = 100 x Number of policies lapsed during the year Number of policies exposed to lapse during the year

The overall, average policy lapse rate for contributing U.S. companies dropped slightly from 4.7 percent in the prior study to 4.3 percent.

Figure 3 Trends in U.S. Individual Life Policy Lapse Rates

12% 10% Lapse Rate 8% 6% 4% 2% 0% 1 2 3 4 Policy Year 5 6-10 11-20 21+

2004-2005

2003-2004

2001-2002

1994-1996

10

Individual Life Persistency Malaysia

The overall, average face amount lapse rate for U.S. companies also decreased slightly during the 2004 and 2005 observation period averaging around 5.2 percent versus 5.7 percent in the prior period.

Figure 4 Trends in U.S. Individual Life Face Amount Lapse Rates

16% 14% 12%

Lapse Rate

10% 8% 6% 4% 2% 0% 1 2 3 4 5 6-10 11-20 21+

Policy Year

2004-2005

2003-2004

2001-2002

1994-1996

11

Individual Life Persistency Malaysia

PARTICIPATING COMPANIES

Allianz Life Insurance American International Assurance Great Eastern Life Assurance Hong Leong Assurance Malaysian Assurance Alliance MAA Takaful Prudential Malaysia TM Asia Life Uni.Asia Life Assurance

12

Individual Life Persistency Malaysia

RELATED LINKS

The following links are valid as of November 20, 2009.

LIMRA U.S. Individual Life Insurance Persistency (2009) This report presents the results of the most recent study of individual life insurance lapse experience in the United States conducted jointly by LIMRA International and the Society of Actuaries (SOA). The observation period for the study is calendar years 2004 and 2005, based on data provided by 38 individual life insurance writers. This study presents lapse experience for whole life, term life, universal life and variable universal life plans issued between 1901 and 2005.

http://www.limra.com/abstracts/abstract.aspx?fid=10127

U.S. Annuity Persistency (2009, 2nd quarter) This quarterly survey tracks both contract and cash value annuity persistency. It measures surrender rates in total and by all combinations of market, product type, distribution channel, and presence of surrender charge.

http://www.limra.com/abstracts/abstract.aspx?fid=10151

Simplified Issue Marketplace (2009) Simplified issue life insurance covers a broad range of individual life insurance products and markets. This study includes product design and underwriting, target markets, sales results, current quotes, and a quick look at the strategic outlook and challenges of the individual life simplified issue market. Twenty-nine companies participated.

http://www.limra.com/abstracts/abstract.aspx?fid=9080

Chile Individual Life Buyer Study (2009) The Individual Life Buyer Study provides a general overview of who is purchasing life insurance and the types of life insurance products they are buying.

http://www.limra.com/abstracts/abstract.aspx?fid=10139

13

HARTFORD

MIAMI

TORONTO

LONDON

KUALA LUMPUR

SHANGHAI

HO CHI MINH CITY

SEOUL

300 Day Hill Road, Windsor, CT 06095, U.S.A. Phone: 860-688-3358 Fax: 860-298-9555 Web: www.limra.com 2009, LIMRA This publication is a benefit of LIMRA membership. No part may be shared with other organizations or reproduced in any form without LIMRAs written permission.

008306-1209 (562-44-0-J34)

You might also like

- D Kuji Za Vyu It Servru Old Cans A Te Msenadal N V Tevu. Tom CaponeDocument1 pageD Kuji Za Vyu It Servru Old Cans A Te Msenadal N V Tevu. Tom CaponeTanit PaochindaNo ratings yet

- Kitchen Us enDocument35 pagesKitchen Us enAbhiyan Anala ArvindNo ratings yet

- BLDocument15 pagesBLTanit PaochindaNo ratings yet

- Athena RagDocument2 pagesAthena RagTanit PaochindaNo ratings yet

- FRM Study Guide 2012 PDFDocument15 pagesFRM Study Guide 2012 PDFDennis LoNo ratings yet

- Bestå: Storage SolutionsDocument13 pagesBestå: Storage SolutionsTanit PaochindaNo ratings yet

- JONOSFÄR pendant lamp, KORKEN jar, STRANDMON chair pricesDocument1 pageJONOSFÄR pendant lamp, KORKEN jar, STRANDMON chair pricesTanit PaochindaNo ratings yet

- Senior LoanDocument3 pagesSenior LoanTanit PaochindaNo ratings yet

- Smart Beta Guide en CADocument68 pagesSmart Beta Guide en CATanit PaochindaNo ratings yet

- The Rise of The Leveraged LoanDocument7 pagesThe Rise of The Leveraged LoanTanit PaochindaNo ratings yet

- White Paper 99Document13 pagesWhite Paper 99Tanit PaochindaNo ratings yet

- Fama & French 3 Factor ExplainedDocument14 pagesFama & French 3 Factor ExplainedvaluatNo ratings yet

- PRN IndexAbbreviations 1011Document1 pagePRN IndexAbbreviations 1011Tanit PaochindaNo ratings yet

- Alternative Investment ObserverDocument29 pagesAlternative Investment ObserverTanit PaochindaNo ratings yet

- ReadmeDocument1 pageReadmeSyed Bilal Haider KazmiNo ratings yet

- A.T. Consulting's Business Unit Strategy TrainingDocument37 pagesA.T. Consulting's Business Unit Strategy TrainingTanit PaochindaNo ratings yet

- Formation 4Document60 pagesFormation 4Tanit PaochindaNo ratings yet

- Consulting Process 3Document145 pagesConsulting Process 3Tanit PaochindaNo ratings yet

- Research Premium Persist Assump ReportDocument88 pagesResearch Premium Persist Assump ReportTanit PaochindaNo ratings yet

- Formation 2Document170 pagesFormation 2alex.nogueira396No ratings yet

- Consulting Process 1Document20 pagesConsulting Process 1Tanit Paochinda100% (1)

- Bot Overview Jan2012Document24 pagesBot Overview Jan2012Tanit PaochindaNo ratings yet

- Life Key Indicators 2010Document1 pageLife Key Indicators 2010Tanit PaochindaNo ratings yet

- Fama & French 3 Factor ExplainedDocument14 pagesFama & French 3 Factor ExplainedvaluatNo ratings yet

- 2011 HK Ifrs Horbatt 41Document11 pages2011 HK Ifrs Horbatt 41Tanit PaochindaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Advacc 2 Chapter 1 ProblemsDocument5 pagesAdvacc 2 Chapter 1 ProblemsClint-Daniel Abenoja100% (1)

- GonorrhoeaDocument24 pagesGonorrhoeaAtreyo ChakrabortyNo ratings yet

- Romanian Society For Lifelong Learning Would Like To Inform You AboutDocument2 pagesRomanian Society For Lifelong Learning Would Like To Inform You AboutCatalin MihailescuNo ratings yet

- Penrock Seeds Catalogue Closing Down SaleDocument26 pagesPenrock Seeds Catalogue Closing Down SalePaoloNo ratings yet

- Lupo Lupangco Vs CA G.R. No. 77372 April 29, 1988 160 SCRA 848Document2 pagesLupo Lupangco Vs CA G.R. No. 77372 April 29, 1988 160 SCRA 848Emil Bautista100% (2)

- Sunat PerempuanDocument8 pagesSunat PerempuanJamaluddin MohammadNo ratings yet

- Question Classify The Different Concepts in Preventing Accidental Compromise of DataDocument1 pageQuestion Classify The Different Concepts in Preventing Accidental Compromise of DataCrystal Marie Jordan Aguhob100% (1)

- Agile Data Warehouse Design For Big Data Presentation (720p - 30fps - H264-192kbit - AAC) PDFDocument90 pagesAgile Data Warehouse Design For Big Data Presentation (720p - 30fps - H264-192kbit - AAC) PDFMatian Dal100% (2)

- International Portfolio TheoryDocument27 pagesInternational Portfolio TheoryDaleesha SanyaNo ratings yet

- Fondazione Prada - January 2019Document6 pagesFondazione Prada - January 2019ArtdataNo ratings yet

- Ballotpedia Writing Style Guide (Spring 2016)Document54 pagesBallotpedia Writing Style Guide (Spring 2016)Ballotpedia67% (3)

- Municipal Best Practices - Preventing Fraud, Bribery and Corruption FINALDocument14 pagesMunicipal Best Practices - Preventing Fraud, Bribery and Corruption FINALHamza MuhammadNo ratings yet

- MBC and SAP Safe Management Measures, Caa 2020-05-28Document9 pagesMBC and SAP Safe Management Measures, Caa 2020-05-28Axel KruseNo ratings yet

- Cooperative by LawsDocument24 pagesCooperative by LawsMambuay G. MaruhomNo ratings yet

- Chapter 2 - Part 1 - Measures of Central Tendency - Practice ProblemsDocument8 pagesChapter 2 - Part 1 - Measures of Central Tendency - Practice ProblemsTejas Joshi0% (3)

- Ebook Service Desk vs. Help Desk. What Is The Difference 1Document18 pagesEbook Service Desk vs. Help Desk. What Is The Difference 1victor molinaNo ratings yet

- The Crown - Episode 7Document7 pagesThe Crown - Episode 7Grom GrimonNo ratings yet

- Hitachi Energy BESS PQpluSDocument9 pagesHitachi Energy BESS PQpluSelpancaseroNo ratings yet

- Ja Shooting ClubDocument6 pagesJa Shooting ClubLeah0% (1)

- SAMPLE Information On RapeDocument2 pagesSAMPLE Information On RapeMay May100% (2)

- Nature and Scope of Sociology of LawDocument6 pagesNature and Scope of Sociology of LawWorkaholicNo ratings yet

- Specific Gravity of FluidDocument17 pagesSpecific Gravity of FluidPriyanathan ThayalanNo ratings yet

- Crisologo-Jose Vs CA DigestDocument1 pageCrisologo-Jose Vs CA DigestMarry LasherasNo ratings yet

- Web Design Wordpress - Hosting Services ListDocument1 pageWeb Design Wordpress - Hosting Services ListMotivatioNetNo ratings yet

- Tso C139Document5 pagesTso C139Russell GouldenNo ratings yet

- Soal Pas SMKDocument3 pagesSoal Pas SMKsofiNo ratings yet

- Women in Indian CinemaDocument16 pagesWomen in Indian CinemaahmerkhateebNo ratings yet

- Protected Monument ListDocument65 pagesProtected Monument ListJose PerezNo ratings yet

- Chapter 1 Imc 407Document14 pagesChapter 1 Imc 407Mayson Chua ShangNo ratings yet

- 978191228177Document18 pages978191228177Juan Mario JaramilloNo ratings yet