Professional Documents

Culture Documents

Hire Purchase Versus Leasing

Uploaded by

Shameem AnwarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hire Purchase Versus Leasing

Uploaded by

Shameem AnwarCopyright:

Available Formats

HIRE PURCHASE VERSUS LEASING HIRE PURCHASE A hire purchase can be defined as a contractual arrangement under which the

owner lets his goods on hire to the hirer and offers an option to the hirer for purchasing the goods in accordance with the terms of the contract. In India the market hire purchase has been predominant with financing of commercial vehicles. This helped the road transport operators to acquire commercial vehicles in a big way. But in the last few years, hire purchase, as a means of financial equipments has also come into popular use. In the Industrial sector purchase of machinery etc is also financed by this method of hire purchase. The basic principle underlying the transaction is that the installment determined is taken as hire (rental) till the time the agreement envisages such payments. On determination of the said period the Hirer (Purchaser) has the option of paying a nominal amount to become the owner of the goods. WHAT IS A HIRE-PURCHASE AGREEMENT

In a hire-purchase agreement, the owner hires goods to the hirer with an option to purchase the goods when he has made the payment of a certain sum. By this system, the purchaser who is unable to pay the full price of the asset at one lump sum, gets facilities to acquire an asset and after making the payment of an initial amount called premium, the purchaser pays the balance consideration money in installments. After the payment of all the installments, the property in the goods passes to the hirer. The hirer has an option to return the goods during the period of hire. In a hire-purchase agreement, the hirer has the right to terminate the agreement for hire at his pleasure and is not bound to pay the value of the goods. A hire-purchase agreement is a form of bailment; the hirer is given the right to purchase the goods on certain conditions. That, however, is an option not an obligation to purchase. The hirer may elect to purchase the goods and when he does so, after he fulfills all the conditions prescribed in the agreement, the title to the goods will pass to him. But he may elect not to do so, and in that event he is entitled to return the goods and terminate the agreement in the manner provided therein.

LEASE FINANCING The purchase of the asset bestows the ownership rights and also responsibility of all consequential gains and losses. Further, the owner has to bear the maintenance cost also. Lease involves the use of an asset without assuming ownership. The owner of the asset is called Lessor and ownership is retained by lessor under leasing arrangement. Lessee, a firm or person acquiring an asset, has to pay rental (or otherwise called lease money) to the lessor. Lease financing is one of the methods of long term financing. Leasing contract stipulates the lease period rental payments, periodic intervals of payments repairs and maintenance, purchase option, taxes, insurance, risk of obsolescence, penalty for delay or non payment of rental etc. It is an agreement under which the use and control of asset is permitted without passing on the title of the asset. In case the agreement provides, the lessor has to do maintenance and bear the cost of maintenance and upkeep of the equipment. In some cases, the lessee has to bear the cost of maintenance. In any case, it has to be stipulated clearly in the leasing contract about the maintenance. If the lease is not renewed the lessor takes the possession of the asset after the expiry of existing lease period.

Differences between Hire Purchase and Leasing Hire Purchase 1. Under this system, hire purchase acquires the possession of goods immediately on signing the hire purchase agreement and payment of down payment (say,20%). 2. The hire purchase price consists of cash price and the interest payable to hire vendor. 3. Depreciation and interest are debitable to P & L A/c of Hirer. Lease 1. Lease involves the use of an asset without assuming ownership. No down payment in lease financing.

2. Lessee has to pay rental to the lessor for the use of an asset. 3. Lessee can claim the rental as business expenditure (Lessor will claim the amount of depreciation) 4. The user has the option to acquire legal title to the 4. Lessor is the owner. Lessee may have the option asset as per the terms of the contract to buy the same at the end of lease period. 5. The goods will become the property of the Hirer 5. Lessee cannot become the owner even after when all instalments have been paid payment of lease rentals of all the years during lease period. 6. Maintenance cost is borne by Hirer. 6. Maintenance cost incase of operating lease, it is borne by lessor. In case of finance lease, it is borne by lessee. 7. Capitalisation is done in the books of Hirer 7. Capitalisation is done in the books of lessor (i.e. leasting company). 8. The risk of obsolescence is borne by Hirer. 8. Risk of obsolescence : In operating lease, it is borne by lessor. In case of finance lease, it is borne by lessee. 9. The asset is shown in the Balance sheet of Hirer 9. The asset is shown as a foot note in the balance and balance installment payment as a liability sheet. 10. Tax benefits: Hirer can claim depreciation and 10. Tax benefits: Lessee can claim lease rentals interest. only and maintenance cost in case of finance lease. Note : Lessor can claim depreciation DIFFERENCES BETWEEN OPERATING LEASE AND FINANCIAL LEASE Operating Lease 1. Operating lease refers to a non payout lease in which lessors obligations may include services attached to his leased property such as maintenance, repair and technical advice. 2. The cost of maintenance, repairs taxes, insurance etc, are all borne by the lessor. 3. It is a revocable one i.e. it can be cancelled by the lessee prior to its expiration date. 4. It is usually of a shorter duration and bears no relation to the economic life of the asset. 5. The lease rental is generally not sufficient to fully amortise the cost of the asset. 6. The lessee is protected against the risk of obsolescence. 7. The lessor has the option to recover the cost of the asset from another party on cancellation of operating lease by leasing out the asset Financial lease 1. Finance lease may be defined as a lease that transfer all the risk and rewards incidental to the ownership of the asset. 2. The burden of all these expenses is placed on the lessee unless the contract provides to the contrary. 3. It is a non revocable contract i.e. it cannot be cancelled by the lessee prior to its expiration date. 4. In this case, the lease period is usually related to the useful life of the asset. 5. The lease rental would cover the lessors original investment cost plus ROI. 6. The lessee has to take the risk of obsolescence in the case of financial 7. The lessor is only financier and is not interested in the asset.

Advantages of Lease 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. A firm with limited funds can make better use of working capital. In case of lease the risk of obsolescence can be shifted to the lessor. Leasing is more flexible than ownership. Incase of assets of technological improvements, leasing on a short term basis is more desirable than acquisition of such assets. It is an insurance against out of data technology. Leasing offers tax benefits also lease rent is tax deductible. Leasing avoids much outlay for down payments. In some cases, it offers 100% financing without any down payment. In the balance sheet, the current ratio and working capital are higher for lessee, as cash is conserved. Leasing helps in financing the assets without disturbing debt equity ratio. It does not disturb cash flow. Leasing should offer cost savings over direct borrowing. The Interest in case of lease financing is usually lower than what is charged by the commercial banks and financial institutions. Immediate availability of funds: Borrowing from commercial banks requires a number of formalities to be followed but in case of leasing companies the formalities are very less. There is no limit for financing by leasing companies. The companies will get funds as much as they need. But now, pay letter: Lease rentals can be paid out of cash generated from the use of new asset obtained on lease. Earnings will be received first and then lease rent will be paid at the end of agreed periods, say, quarterly, half yearly or annually. No interference by the lender. No Government control. Lease financing provides a hedge against inflation. Leasing companies are liberal as compared to the commercial banks and financial institutions. Import of machinery / equipment: Import formalities in regard to import of machinery / equipment can be completed with the help of lessor. Expansion: Since the lease finance offer, in some cases, to the extent of even 100% without any down payment, expansion / diversification can be attempted without experiencing difficulties. Borrowing powers: Generally, all the companies will be having some borrowing powers to the extent limits provided by the commercial banks and financial institutions. These borrowing powers need not be disturbed in case lease financing is resorted to. In case of emergent circumstances, the borrowing powers can be exercised. Disadvantages of Lease

1.

2. 3. 4. 5. 6. 7.

The main drawback of lease is that ownership remains vested with lessor. Long term leasing is generally more expensive to the lessee. During the period of inflation the real estate values may increase during the lease period. In such case, the benefit of capital gain will be enjoyed by the lessor. The lessee losses the advantages of such appreciation in the value of asset. Problems may arise if the lessee decides to alter the physical shape of the asset. The interest cost on leasing is usually higher than the interest on debt. Companies which are not able to borrow at convenient terms are forced to enter into a leasing arrangement with disadvantageous terms and conditions. If a lessee is not able to honour the obligations of lease agreement, a lessor may suffer a loss.

Forms of Lease Financing: Direct leasing. As discussed above. Sale and lease back. Under this arrangement a firm sells an asset to another party at market value and this party leases it back to the firm. Then the firm contracts to make periodic lease payments and gives up title to the asset. The lessee retains the right to use the asset. Generally, this type of lease back arrangement is done by insurance companies, institutional investors, finance companies and now a days independent leasing companies. Leveraged leasing. This type of leasing is linked with the financing of asset which requires large capital outlay. There are three parties involved in leveraged leasing: 1. The lessee 2. The Lessor, and 3. The lender. Under this arrangement, the position of lessee is not changed but role of lessor is changed. He will finance, say; 25% of the cost of asset and the balance 75% is financed by the lender. The loan is secured by a mortgage on the asset, assignment of the lease and lease payments. As usual, the lessor is entitled to deduct depreciation and investment allowance as he is the owner of the assed in question

CONCEPT AND MEASUREMENT OF COST OF CAPITAL, SPECIFIC COSTS AND OVERALL COST OF CAPITAL Cost of Capital to a firm is the minimum return, which the suppliers of capital require. In other words, it is a price of obtaining capital; it is a compensation for time and risk. The cost of capital concept is of vital significance in the financial decision-making. It is used: (a) as a discount, or cut-off, rate for evaluating investment projects, (b) for designing the firms debt-equity mix and (c) for appraising the top managements financial performance. Firms obtain capital for financing investments in the form of equity or debt or both. Also, in practice, they maintain a target debt-equity mix. Therefore, the firms cost of capital means the weighted average cost of debt and equity. Cost of Capital to a firm is the minimum return, which the suppliers of capital require. In other words, it is a price of obtaining capital; it is a compensation for time and risk. Definition Cost of capital is defined as the minimum rate of return which a company has to earn on the total capital employed in order to increase or maintain the market price of its shares. Cost of Debt includes all interest-bearing borrowings. Its cost is the yield (return), which lenders expect from their investment. In most cases, return is equal to annual contractual rate of interest (also called coupon rate). Interest charges are tax deductible. Therefore, cost of debt to the firm should be calculated after adjusting for interest tax exemption.: kd (after tax) = I ( 1- t)

where kd I s before-tax cost of debt and t is the corporate tax rate. Definitions : Cost of debt is defined as the rate at which the company pays interest to its long term creditors with a further adjustment for the tax liability of the company. Cost of debt is defined as that discount rate which equates the present value of the future promised interest and principal repayment with the net proceeds of the issue. Formulae : In case of long term loans : kd (after tax) = I I 1-t) In case of irredeemable debentures / bonds : a. when issued at par : kd (afer tax) when issued at premium or discount : kd (afer tax) = I (1 - t) NP = I (1 - t)

In case of redeemable debentures / bonds : I ( 1-t ) + kd (after tax) = F - NP n F + NP 2

In case the floatation costs (the difference between face value and net proceeds is to be amortized evenly over the life of debentures / bonds : I ( 1-t ) + F - NP (1 t) n F + NP 2

kd (after tax)

Cost of Preference : It is the rate at which the company declares preference dividend for its shareholders. Definition : It is defined as that discount rate which equates the present value of the future promised dividend and principal repayment with the net proceeds of the issue. Formulae : In case of irredeemable preference shares :

a. when issued at par : kp (afer tax) = Dp F b. when issued at premium or discount : kd (afer tax) = Dp NP In case of redeemable preference shares : Dp + F - NP kd (after tax) = n F + NP 2 Cost of Equity Equity has no explicit cost, as payment of dividends is not obligatory. However, it involves an opportunity cost. The opportunity cost of equity is the rate of return required by shareholders on securities of comparable risk. Thus, it is a price, which the company must pay to attract capital from shareholders. In practice, shareholders expect to receive dividends and capital gains. Therefore, the cost of equity can be thought to include expected dividend yield and percentage capital gain: Definition : Cost of equity capital is defined as the minimum rate of return which a company has to earn on the equity capital employed in order to increase or maintain the market price of its shares. The company can expect to increase the MPS for its shares or at least maintain a constant MPS only when the expectations of the equity shareholders are satisfied. Hence cost of equity is always equated with the expectations of the equity shareholders. Approaches for calculation of cost of equity capital : Different approaches have been given for the calculation of cost of equity. They are as follows : a. Dividend Capitalization Approach : D1 Po where D1 is the expected dividend per share and P0 is the market price today. ke =

b. Dividend Capitalization plus growth Approach : + g Po where D1 is the expected dividend per share, P0 is the market price today and g is the expected dividend growth (capital gain). c. Capital Asset Pricing Model CAPM : ke = rf + b j ( rm - rf ) where rf is the risk-free rate equal to current yield on the Treasury bills or government bonds; (rm rf) is the market risk premium measured as average of historical returns of a long series; and bj is the beta of the firm j. Cost of Retained Earnings : When a company issues new share capital, it has to offer shares at a price, which is much less than the prevailing market price. Therefore, the cost of retained earnings will be less than the cost of new issue of equity. In case of retained earnings the company will not have to incur floatation costs and underwriting costs. kr = D1 Po + g ke = D1

Weighted Average Cost of Capital Three steps are involved in calculating the firms weighted average cost of capital (WACC). First, the component costs of debt and equity are calculated. Second, weights to the each component of capital are assigned according to the target capital structure. Third, the product of component costs and weights is summed up to determine WACC. The weighted average cost of new capital is the weighted marginal cost of capital (WMCC). Divisional or Projects Cost of Capital A firm may have several divisions or product lines with different risks. Therefore, the firms WACC cannot be used to evaluate divisions or projects. The following procedure can be used to estimate the divisional or the projects cost of capital: Identify comparable or pure-play firms and determine their equity beta based on the market data Find the average equity beta, and unlever it as follows: Determine the divisions target capital structure, and relever the beta This is division or projects levered or equity beta. Use CAPM to calculate the cost of equity. Calculate the after-tax cost of debt for the division or project. Use the target capital structure to calculate the division or projects WACC.

You might also like

- Supply Chain ManagementDocument3 pagesSupply Chain ManagementShameem AnwarNo ratings yet

- Supply Chain ManagementDocument3 pagesSupply Chain ManagementShameem AnwarNo ratings yet

- Balmer LawrieDocument18 pagesBalmer LawrieShameem AnwarNo ratings yet

- Logistics Management Bba Unit 1 NotesDocument6 pagesLogistics Management Bba Unit 1 NotesShameem Anwar83% (6)

- International: Supply Chain ManagementDocument6 pagesInternational: Supply Chain ManagementShameem AnwarNo ratings yet

- International: Supply Chain ManagementDocument6 pagesInternational: Supply Chain ManagementShameem AnwarNo ratings yet

- Working Capital ManagementDocument8 pagesWorking Capital ManagementShameem AnwarNo ratings yet

- ProjectDocument80 pagesProjectShameem AnwarNo ratings yet

- UNIT NO 1 - FM AMSDocument57 pagesUNIT NO 1 - FM AMSShameem AnwarNo ratings yet

- Results of The StudyDocument8 pagesResults of The StudyShameem AnwarNo ratings yet

- Questionnaire Kindly Indicate Your Answer As Follows: Strongly Disagree 1 Disagree 2 Neither Agree Nor Disagree 3 Agree 4 Strongly Agree 5Document2 pagesQuestionnaire Kindly Indicate Your Answer As Follows: Strongly Disagree 1 Disagree 2 Neither Agree Nor Disagree 3 Agree 4 Strongly Agree 5Shameem AnwarNo ratings yet

- A Study On Derivatives and Its Trends in The Indian Capital Market A First Review ReportDocument6 pagesA Study On Derivatives and Its Trends in The Indian Capital Market A First Review ReportShameem AnwarNo ratings yet

- Social Media As HR Recruitment Tool: !CCCC CCC#CC"C C CCC CCCCCCCC C C CCCDocument6 pagesSocial Media As HR Recruitment Tool: !CCCC CCC#CC"C C CCC CCCCCCCC C C CCCShameem AnwarNo ratings yet

- Efficient Market HypothesisDocument3 pagesEfficient Market HypothesisShameem AnwarNo ratings yet

- A Study of Service Quality in The Hospitality Industry JMDocument12 pagesA Study of Service Quality in The Hospitality Industry JMShameem AnwarNo ratings yet

- A Study On Receivables ManagementDocument3 pagesA Study On Receivables ManagementShameem AnwarNo ratings yet

- Effect of Exchange Rate in Foreign Trade Part IVDocument23 pagesEffect of Exchange Rate in Foreign Trade Part IVShameem AnwarNo ratings yet

- Cultural IntegrationDocument3 pagesCultural IntegrationShameem AnwarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Structure: Default and RepossessionDocument14 pagesStructure: Default and RepossessionAnkit KumarNo ratings yet

- Chapter 3Document47 pagesChapter 3Groove'N'Move GNMNo ratings yet

- Fs Unit-1 Important QuestionsDocument13 pagesFs Unit-1 Important QuestionsKarthick KumarNo ratings yet

- Sale of Goods Act 1930 Bare ActDocument18 pagesSale of Goods Act 1930 Bare ActPrateek KhandelwalNo ratings yet

- Final Assessment LAW416 Final Assessment LAW416Document12 pagesFinal Assessment LAW416 Final Assessment LAW416Haiman HashimNo ratings yet

- HPS TheoryDocument2 pagesHPS TheorySiva SankariNo ratings yet

- Dba1607 Legal Aspects of Business PDFDocument404 pagesDba1607 Legal Aspects of Business PDFsantha3e100% (12)

- Buying and Selling Vocab-1Document3 pagesBuying and Selling Vocab-1Nazwa AzliaNo ratings yet

- Bcom 1-6 SyllabusDocument60 pagesBcom 1-6 Syllabusapi-282343438No ratings yet

- Material For PracticeDocument8 pagesMaterial For PracticeJayaKhemani100% (1)

- Financial Services M.com NotesDocument31 pagesFinancial Services M.com NotesFarhan Damudi75% (8)

- Hire Purchase PDFDocument12 pagesHire Purchase PDFliamNo ratings yet

- Hire PurchaseDocument19 pagesHire PurchaseFaris Hanis100% (1)

- English Commercial Law Module Handbook-Updated 20120612 181831Document46 pagesEnglish Commercial Law Module Handbook-Updated 20120612 181831Roda May DiñoNo ratings yet

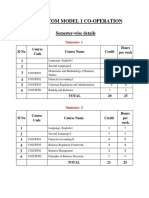

- B Com Model 1 Co OperationDocument37 pagesB Com Model 1 Co OperationHvffNo ratings yet

- REPUBLIC ACT No 6552Document6 pagesREPUBLIC ACT No 6552GraceNo ratings yet

- Financial Accounting (1st Year)Document18 pagesFinancial Accounting (1st Year)RohitNo ratings yet

- Assigment Business LawDocument12 pagesAssigment Business Lawapisj5100% (1)

- Verification of Assets and LiabilitiesDocument62 pagesVerification of Assets and Liabilitiesanon_672065362No ratings yet

- A Critical Appraisal of Al-Ijarah Thumma Al-Bay' (AITAB) Operation: Issues and ProspectsDocument16 pagesA Critical Appraisal of Al-Ijarah Thumma Al-Bay' (AITAB) Operation: Issues and ProspectsNur ShahiraNo ratings yet

- General Banking Activities of Social Islami Bank Limited With Special Reference To Accounts SectionDocument27 pagesGeneral Banking Activities of Social Islami Bank Limited With Special Reference To Accounts Sectioncatseye2050No ratings yet

- English Commercial Law Module Handbook-Updated 20120612 181831Document45 pagesEnglish Commercial Law Module Handbook-Updated 20120612 181831Godslove Minta100% (1)

- SY BCom NewDocument42 pagesSY BCom NewAamir KhanNo ratings yet

- Aqsat FAQs enDocument3 pagesAqsat FAQs enRockroll AsimNo ratings yet

- Module-3 IFSS-NoteDocument29 pagesModule-3 IFSS-NoteAbhisekNo ratings yet

- E Catalogue 86681ff1Document21 pagesE Catalogue 86681ff1Tariq SalimNo ratings yet

- Sales of Goods Act-1930Document22 pagesSales of Goods Act-1930Karan Veer Singh67% (3)

- Sale of Goods Act 1930Document47 pagesSale of Goods Act 1930suhasiniNo ratings yet

- Ownership Transfer FormDocument2 pagesOwnership Transfer FormSambit DasNo ratings yet

- Hire Purchase AgreementDocument16 pagesHire Purchase AgreementKweku JnrNo ratings yet