Professional Documents

Culture Documents

EWT

Uploaded by

dawngarcia1797Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EWT

Uploaded by

dawngarcia1797Copyright:

Available Formats

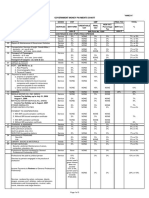

EXPANDED WITHHOLDING TAX RATES

PARTICULARS TAX RATE

CORPORATE PAYEE Professional fees paid to juridical persons Rentals (real property; personal property in excess of P10,000) Rentals for use of Poles, Satellites and Transmission facilities; Billboards Cinematographic film rentals Prime contactors/sub-contractors Amounts paid to certain brokers and agents Medical practitioners Payments made by credit card companies to juridical persons Payments made by government offices to its local/resident suppliers of goods and local/resident suppliers of services Income payments made by top 10,000 corporations to their local/resident supplier of goods and local/resident supplier of services Independent and exclusive distributors, representatives and marketing agents of multilevel marketing companies Tolling fees made to refineries Payments by Pre-need companies to funeral parlors Payments made on purchase of minerals, mineral products and quarry resources Embalmers INDIVIDUAL PAYEE Professionals (Lawyers, CPAs, Engineers, etc.) Professional entertainers Professional athletes Movie, stage, radio, television & musical directors Management and technical consultants Embalmers Business and bookkeeping agents and agencies Insurance agents and insurance adjusters

1

15%* 5% 5% 5% 2% 10% 15%*

1% on of gross amount paid 1% on goods** 2% on services** 1% on goods** 2% on services***

10% 5% 1% 1% 1%

15%* 15%* 15%* 15%* 15%* 1% 15%* 15%*

EXPANDED WITHHOLDING TAX RATES

Other recipients of talent fees Fees of directors who are not employees of the company Rentals (real property; personal property in excess of P10,000) Cinematographic film rentals Rentals for poles, satellites, and transmission facilities; and billboards Prime contractors/sub-contractors Income distribution to beneficiaries of estates and trusts Brokers and agents of professional entertainers Payment to medical practitioner through hospitals/clinics Payments to partners in general professional partnership Payments made by credit card companies to individuals Payments made by government offices to its local/resident supplier of goods and local/resident supplier of services Income payments made by top 10,000 corporations to their local/resident supplier of goods and local/resident supplier of services Additional payments to government personnel from importers, shipping and airline companies or their agents (for overtime services) Commissions of independent and/or exclusive sales representatives and marketing agents of companies Payments made on purchase of minerals, mineral products and quarry resources

PARTICULARS TAX RATE

15%* 15%* 5% 5% 5% 2% 15% 10% 15%* 15%*

1% on of gross amount paid 1% on goods** 2% on services** 1% on goods** 2% on services***

15% 10% 1%

*15% if the current years gross income exceeds P720,000; otherwise use 10%. ** Except single purchase below P10,000. ***Local/Resident Supplier of Services refers to suppliers who are engaged in business or exercise of profession/ calling with whom the taxpayer-buyer has transacted at least six (6) transactions, regardless of amount per transaction, either in the previous year or current year.

FINAL WITHHOLDING TAX RATES

PARTICULARS TAX RATE

CORPORATE PAYEE Interest on foreign loans payable to NRFCs Interest and other income payment on foreign currency transactions/ loans payable to OBUs Interest and other income payment on foreign currency transactions/ loans payable to FCDUs Cash or property dividend payment by domestic corporation to NRFCs whose countries allow tax deemed paid credit (subject to tax sparing rule) All kinds of royalty payments to domestic and resident foreign corporations Branch profit remittances by all corporations except those registered with PEZA/SBMA/CDA. On the gross rental charters and other fees derived by non-resident lessors of aircraft, machineries and equipment On the gross rental charters and other fees derived by non-resident lessor of aircraft, machineries and equipment On payments to oil exploration service contractors/sub-contractors On payments to non-resident foreign corporate cinematographic film owners, lessors or distributors On interest or other payments upon tax-free covenant bonds, mortgages, deeds of trust and other obligations Informers cash reward to juridical persons INDIVIDUAL PAYEE Cash or property dividend payment by domestic corporation to NRAETB Share of NRAETB in the distributable net income after tax a partnership (except general professional partnership) of which he is a partner, or share in the net income after tax of an association, a joint account or a joint venture taxable as a corporation of which he is a member or a co-venture

20% 10% 10% 15% 20% 15% 4.5% 7.5% 8% 25% 30% 10%

20%

20%

FINAL WITHHOLDING TAX RATES

PARTICULARS TAX RATE

Other royalty payments to citizens, resident aliens and NRAETB On prizes exceeding P10,000 & other winnings paid to individuals Informers cash reward to individuals On payments to oil exploration service contractors/sub-contractors Payment to alien individuals employed by OBUs, Foreign Petroleum Service Contractors and sub-contractors and by Regional or Area Headquarters and Regional Operating Headquarters of Multinational Co., including any of its Filipino employees occupying the same position Payments to non-resident aliens not engaged in trade or business Royalties paid to NRAETB on cinematographic films and similar works On interest or other payments upon tax-free covenant bonds, mortgages, deeds of trust or other obligations under Sec. 57C of the National Internal Revenue Code of 1997 Royalties paid to citizens, resident aliens and NRAETB on books, other literary work and musical compositions

20% 20% 10% 8% 15%

25% 25% 30% 10%

ACRONYMS: NRFC OBU FCDU PEZA SBMA CDA NRAETB

Non-Resident Foreign Corporation Offshore Banking Unit Foreign Currency Deposit Unit Philippine Economic Zone Authority Subic Bay Metropolitan Authority Clark Development Authority Non-Resident Alien Engaged in Trade or Business

FORM

NAME OF FORM

MANUAL

EFPS

0605

Payment Form

1600

1601-C

Monthly Remittance Return of Value-Added Tax and Other Percentage Taxes Withheld (Under RAs 1051, 7649, 8241 and 8424) Monthly Remittance Return of Income Taxes Withheld on Compensation

This form shall be accomplished: 1. Every time a tax payment or penalty is due or an advance payment is made; 2. Upon receipt of a demand letter/assessment notice and/ or collection letter from the BIR; and 3. Upon payment of annual registration fee for a new business and for renewals on or before January 31 of every year. Within 10 days after the end of the taxable month.

1601-E

Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) [Except for transactions involving onerous transfer of real property classified as ordinary asset] Monthly Remittance Return of Final Income Taxes Withheld

For the months of January to November - on or before the 10th day of the month following the month in which withholding was made. For the month of December on or before January 15 of the succeeding year. For the months of January to November - on or before the 10th day of the month following the month in which withholding was made. For the month of December - on or before January 15 of the succeeding year. For the months of January to November - on or before the 10th day of the month following the month in which withholding was made.

Subject to BIRs Staggered Filing per RR No. 26-02.

Subject to BIRs Staggered Filing per RR No. 26-02.

1601-F

Subject to BIRs Staggered Filing per RR No. 26-02.

FORM

NAME OF FORM

MANUAL

EFPS

1601-F 1602

Monthly Remittance Return of Final Income Taxes Withheld Monthly Remittance Return of Final Income Taxes Withheld on Interest Paid On Deposits And Yield On Deposit Substitutes/ Trusts/Etc.

1603

1604-CF

1604-E

On or before the 15th Quarterly Remittance day of the month Return of Final Income following the quarter in Taxes Withheld on which withholding was Fringe Benefits Paid to made. Employees Other than Rank and File Annual Information On or before January 31 of the succeeding year. Return of Income Taxes Withheld on Compensation and Final Withholding Taxes Annual Information On or before March 1 of the succeeding year. Return of Creditable Income Taxes Withheld (Expanded)/Income Payments Exempt from Withholding Tax Withholding Tax Remittance Return For Onerous Transfer of Real Property Other Than Capital Asset (Including Taxable and Exempt) For the months of January to November - on or before the 10th day of the month following the month in which withholding was made. For the month of December - on or before January 15 of the succeeding year.

For the month of December - on or before January 15 of the succeeding year. For the months of January to November - on or before the 10th day of the month following the month in which withholding was made. For the month of December - on or before January 15 of the succeeding year. On or before the 10th day of the month following the quarter in which withholding was made.

Subject to BIRs Staggered Filing per RR No. 26-02.

1606

FORM

NAME OF FORM

MANUAL

EFPS

Annual Income Tax Return For Individuals Earning Compensation Income (Including Non-Business/NonProfession Related Income) 1701 Annual Income Tax Return For SelfEmployed, Estates, and Trusts (Including those with both Business and Compensation Income) 1701Q Quarterly Income Tax Return For SelfEmployed, Estates, and Trusts (Including those with both Business and Compensation Income) 1701-AIF Account Information Form For SelfEmployed Individuals, Estates and Trusts (Engaged in Trade or Business) 1702 Annual Income Tax Return For Corporations and Partnerships 1702Q Quarterly Income Tax Return For Corporations and Partnerships

1700

On or before April 15 of each year covering income for the preceding taxable year.

On or before April 15 of each year covering income for the preceding taxable year.

1st Quarter (Jan-Mar) - on or before April 15; 2nd Quarter (Apr-Jun) - on or before August 15 3rd Quarter (Jul-Sept) - on or before November 15

On or before April 15 of each year covering income for the preceding taxable year.

On or before the 15th day of the fourth month following the close of the taxpayers taxable year whether fiscal or calendar year. Within sixty (60) days following the close of each of the 1st three (3) quarters of the taxable year whether calendar or fiscal year.

FORM

NAME OF FORM

MANUAL

EFPS

1702-AIF Account Information Form For Corporations and Partnerships in General 1704 Improperly Accumulated Earnings Tax Return (for domestic corporation) Capital Gains Tax Return For Onerous Transfer of Real Property Classified as Capital Asset (both Taxable and Exempt) Capital Gains Tax Return For Onerous Transfer of Shares of Stock Not Traded Through The Local Stock Exchange Annual Capital Gains Tax Return For Onerous Transfer of Shares of Stock Not Traded Through The Local Stock Exchange Application for Authority to Use Computerized Accounting System or Components thereof/Loose-Leaf Books of Accounts

On or before the 15th day of the fourth month following the close of the taxpayers taxable year whether fiscal or calendar year. Within 15 days after the close of the year immediately succeeding taxpayers covered taxable year. Filed within thirty (30) days following each sale, exchange or disposition of real property. In case of installment sale, the return shall be filed within thirty (30) days following the receipt of the 1st down payment and within thirty (30) days following each subsequent installment payment. One return is filed for every transfer document regardless of the number of each property sold, exchanged or disposed of. Filed within thirty (30) days after each cash sale, barter, exchange or other disposition of shares of stock not traded through the local stock exchange. In case of installment sale, the return shall be filed within thirty (30) days following the receipt of the 1st down payment and within thirty (30) days following each subsequent installment payment. For individual taxpayers, this final consolidated return is filed on or before April 15 of each year covering all stock transactions of the preceding taxable year. For corporate taxpayers, this form is filed on or before the fifteenth (15th) day of the fourth (4th) month following the close of the taxable year covering all transactions of the preceding taxable year. Before actual use of Loose-leaf/Computerized Books of Accounts and/or Accounting Records.

1706

1707

1707-A

1900

FORM

NAME OF FORM

MANUAL

EFPS

1901

1902

Application for Registration For Self-Employed and Mixed Income Individuals, Estates and Trusts Application for Registration For Individuals Earning Purely Compensation Income, and Non-Resident Citizens/ OCWs/Seamen Earning Purely ForeignSourced Income

On or before commencement of new business or before payment of any tax due or before filing a return.

Filed within ten (10) days from the date of employment, or before the payment of any tax due or before filing of a return, or declaration is required.

1903

Application for Regis- On or before commencement of business or before payment tration For Corpora- of any tax due or before filing a return. tions/Partnerships (Taxable/Non-Taxable), Including GAIs and LGUs Application for Regis- Before payment of any tax due or before filing of return or tration For One-time before the issuance of TIN under E.O. 98. Taxpayer and Person Registering under E.O. 98 (Securing a TIN to be able to transact with any government office)

1904

FORM

NAME OF FORM

MANUAL

EFPS

1905

Application for Registration Information Update - Replacement Copy of Certificate of Registration/Replacement of Copy of TIN Card/Cessation of Registration/Cancellation of TIN/Other Update of Registration Information

To be filed each time taxpayer needs to register the change in registration such as but not limited to change in registered activities, change in tax type details, etc. except those changes to be filed under Form 2305; replacement of lost TIN Card/lost Certificate of Registration or cancellation or registration and/or TIN.

1906

Application for Authority to Print Receipts and Invoices Application for Permit to Use Cash Register Machine/Point-of-Sale Machine Documentary Stamp Tax Declaration/Return

To be filed each time taxpayer needs to print receipts and invoices. To be filed each time taxpayer will use a new cash register machine unit or point-of-sale machine unit.

1907

2000

To be filed within (5) days after the close of the month when the taxable document was made, signed, issued, accepted or transferred. To be filed within (5) days after the close of the month when the taxable document was made, signed, issued, accepted or transferred. Payor must furnish the payee on or before January 31 of the year following the year in which the income payment was made.

2000-OT Documentary Stamp Tax Declaration/Return (One Time Transactions) 2304 Certificate of Income Payment Not Subject To Withholding Tax (Excluding Compensation Income)

10

FORM

NAME OF FORM

MANUAL

EFPS

2305

Certificate of Update of Exemption and of Employers and Employees Information

To be filed within ten (10) days after the increase or decrease inexemption, change of status, change in the person of employer, change in the type of employment, acquiring employment after having registered as engaged in business or exercise of profession, change of working status of the spouse, execution of the waiver to claim the Additional Exemption by the husband, or revocation of the previously executed waiver to claim the Additional Exemption by the husband. (This form is given to the main employer, copy furnished the secondary employer). To be issued to payee on or before January 31 of the year following the year in which income payment was made. For EWT - To be issued to payee on or before the 20th day of the month following the close of the taxable quarter. For Percentage Tax On Government Money Payments - To be issued to the payee on the 15th day of the month following the end of the quarter. For VAT Withholding - To be issued to the payee on or before the 15th day of the following month. To be issued to payee on or before January 31 of the succeeding year in which the compensation was paid, or in cases where there is termination of employment, it is issued on the same day the last payment of wages is made.

2306 2307

Certificate of Final Income Tax Withheld Certificate of Creditable Tax Withheld at Source

2316

Employers Certificate of Compensation Payment/Tax Withheld For Compensation Payment With or Without Tax Withheld Monthly Value-Added Tax Declaration

2550M

For non-large taxpayers Within 20 days after the end of each month. For large taxpayers - Not later than the 20th day following the end of each month.

Subject to BIRs Staggered Filing per RR No. 26-02.

11

FORM

NAME OF FORM

MANUAL

EFPS

2550Q

Quarterly Value-Added Tax Return

To be filed not later than the 25th day following the close of each taxable quarter. The return taxable quarter shall mean the quarter that is synchronized to the income tax quarter of the taxpayer (i.e. Calendar quarter or Fiscal Quarter). For non-large taxpayers Within 20 days after the end of each month. For large taxpayers Within 20 days after the end of each month. Subject to BIRs Staggered Filing per RR No. 26-02.

2551M

Monthly Percentage Tax Return (Except Transactions Involving Shares of Stock Listed and Traded Through the Local Stock Exchange, and Percentage Tax Payable Under Special Laws)

12

You might also like

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) : BIR Form No. 1601-E/2307Document5 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded) : BIR Form No. 1601-E/2307i1958239No ratings yet

- BIR Form 2307 Tax CodesDocument16 pagesBIR Form 2307 Tax CodesAnalyn Velasco Matibag100% (1)

- WITHHOLDING TAX OBLIGATIONSDocument152 pagesWITHHOLDING TAX OBLIGATIONSemytherese100% (2)

- BIR Form 1600Document39 pagesBIR Form 1600maeshach60% (5)

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- 1601E - August 2008Document3 pages1601E - August 2008lovesresearchNo ratings yet

- BIR From 1601E - August 2008Document4 pagesBIR From 1601E - August 2008mba_roxascapiz50% (4)

- 1601E - August 2008Document4 pages1601E - August 2008HarryNo ratings yet

- 1601E BIR FormDocument7 pages1601E BIR FormAdonis Zoleta AranilloNo ratings yet

- FinalDocument2 pagesFinalJessica FordNo ratings yet

- Bir 1601fDocument3 pagesBir 1601fJuliet Jayjet Dela CruzNo ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- 2307Document16 pages2307Mika AkimNo ratings yet

- Government Money Payments Chart - BirDocument3 pagesGovernment Money Payments Chart - BirVan Caz89% (9)

- Form 2306 Witn Computation Electric BillDocument5 pagesForm 2306 Witn Computation Electric BillLean IsidroNo ratings yet

- Certificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasRb GutierrezNo ratings yet

- EWT RatesDocument6 pagesEWT RatesBobby Olavides SebastianNo ratings yet

- Bir 2306Document6 pagesBir 2306RodnieGubatonNo ratings yet

- RR 2-98Document21 pagesRR 2-98Joshua HorneNo ratings yet

- 2307Document5 pages2307jblopez66No ratings yet

- 2307Document3 pages2307Anonymous yCFuth7BL80% (1)

- BIR Form 2307Document20 pagesBIR Form 2307Lean Isidro0% (1)

- 2307 PDFDocument2 pages2307 PDFAnonymous BVowhxQPNo ratings yet

- LAwhahahhaDocument21 pagesLAwhahahhaJeselle BagsicanNo ratings yet

- 2306 Manila WaterDocument6 pages2306 Manila WaterRegina Raymundo AlbayNo ratings yet

- EPayments Import TemplateDocument10 pagesEPayments Import TemplateGhulam MustafaNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument3 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- 1600 Tax RatesDocument2 pages1600 Tax RatesmelizzeNo ratings yet

- LIST OF BIR FORMS GUIDEDocument5 pagesLIST OF BIR FORMS GUIDENica MariñoNo ratings yet

- Bir 2306Document2 pagesBir 2306Caroline Sanchez90% (10)

- Withholding Tax RatesDocument35 pagesWithholding Tax RatesZonia Mae CuidnoNo ratings yet

- Form 1600Document4 pagesForm 1600KialicBetito50% (2)

- Withholding Tax at Source OR Expanded Withholding Tax (EWT)Document32 pagesWithholding Tax at Source OR Expanded Withholding Tax (EWT)rickmortyNo ratings yet

- BIR - Invoicing RequirementsDocument17 pagesBIR - Invoicing RequirementsCkey ArNo ratings yet

- Bir 2306Document3 pagesBir 2306Queenie ButalidNo ratings yet

- BIR Form 2306Document4 pagesBIR Form 2306sedanzam80% (15)

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasgioNo ratings yet

- WT Tax RatesDocument2 pagesWT Tax RatesericbacsalNo ratings yet

- Types of Taxes in The PhilippinesDocument4 pagesTypes of Taxes in The PhilippinesJustin Laraño RabagoNo ratings yet

- BIR FormsDocument6 pagesBIR FormsVanessaManaoatNo ratings yet

- Percentage Tax GuideDocument6 pagesPercentage Tax GuideChristine BobisNo ratings yet

- File VAT Returns GuideDocument24 pagesFile VAT Returns Guidealfx216No ratings yet

- List of BIR FORMSDocument2 pagesList of BIR FORMSLoreta Manaol VinculadoNo ratings yet

- Catching the Cooperative Tax TrainDocument163 pagesCatching the Cooperative Tax TrainDeirdre Mae Pitpitunge100% (1)

- Tax Rates For CWT (Expanded) PDFDocument2 pagesTax Rates For CWT (Expanded) PDFRoseAnnFloriaNo ratings yet

- List of Bir Forms: Form NO. Form TitleDocument2 pagesList of Bir Forms: Form NO. Form TitleAiyi AtelierNo ratings yet

- Taxation Report Vina MarieDocument12 pagesTaxation Report Vina MarieAnonymous gmDxRbnwONo ratings yet

- Transfer and Business Taxation - MIDTERMDocument14 pagesTransfer and Business Taxation - MIDTERMYvette Pauline JovenNo ratings yet

- Philippine Income Taxation: Atty. Janine Crystal C. Sayo-Villavicencio, RPMDocument22 pagesPhilippine Income Taxation: Atty. Janine Crystal C. Sayo-Villavicencio, RPMGracely Calliope De JuanNo ratings yet

- Income Taxation LectureDocument78 pagesIncome Taxation LectureMa Jodelyn RosinNo ratings yet

- 2010 Tax Matrix - Special RatesDocument2 pages2010 Tax Matrix - Special Ratescmv mendozaNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- J.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Service Operations As A Secret WeaponDocument6 pagesService Operations As A Secret Weaponclaudio alanizNo ratings yet

- ACC 690 Final Project Guidelines and RubricDocument4 pagesACC 690 Final Project Guidelines and RubricSalman KhalidNo ratings yet

- Thyrocare Technologies Ltd. - IPODocument4 pagesThyrocare Technologies Ltd. - IPOKalpeshNo ratings yet

- Research Article StudyDocument2 pagesResearch Article StudyRica Mae DacoyloNo ratings yet

- Labor Law - Durabuilt Vs NLRCDocument1 pageLabor Law - Durabuilt Vs NLRCEmily LeahNo ratings yet

- Global Hotels and ResortsDocument32 pagesGlobal Hotels and Resortsgkinvestment0% (1)

- KarachiDocument2 pagesKarachiBaran ShafqatNo ratings yet

- Bajaj Chetak PLCDocument13 pagesBajaj Chetak PLCVinay Tripathi0% (1)

- AMULDocument27 pagesAMULSewanti DharNo ratings yet

- Coal Bottom Ash As Sand Replacement in ConcreteDocument9 pagesCoal Bottom Ash As Sand Replacement in ConcretexxqNo ratings yet

- CV Medi Aprianda S, S.TDocument2 pagesCV Medi Aprianda S, S.TMedi Aprianda SiregarNo ratings yet

- Oxylane Supplier Information FormDocument4 pagesOxylane Supplier Information Formkiss_naaNo ratings yet

- Transfer by Trustees To Beneficiary: Form No. 4Document1 pageTransfer by Trustees To Beneficiary: Form No. 4Sudeep SharmaNo ratings yet

- As of December 2, 2010: MHA Handbook v3.0 1Document170 pagesAs of December 2, 2010: MHA Handbook v3.0 1jadlao8000dNo ratings yet

- Ex 400-1 1ST BLDocument1 pageEx 400-1 1ST BLkeralainternationalNo ratings yet

- PresentationDocument21 pagesPresentationFaisal MahamudNo ratings yet

- CRM ProcessDocument9 pagesCRM ProcesssamridhdhawanNo ratings yet

- Woodside in LibyaDocument5 pagesWoodside in LibyaabhishekatupesNo ratings yet

- Common Rationality CentipedeDocument4 pagesCommon Rationality Centipedesyzyx2003No ratings yet

- Determination of Income, Consumption, SavingsDocument24 pagesDetermination of Income, Consumption, SavingsAmit PrabhakarNo ratings yet

- Packaged Tea Leaves Market ShareDocument22 pagesPackaged Tea Leaves Market ShareKadambariNo ratings yet

- HR McqsDocument12 pagesHR McqsHammadNo ratings yet

- Green HolidaysDocument5 pagesGreen HolidaysLenapsNo ratings yet

- Russia and Lithuania Economic RelationsDocument40 pagesRussia and Lithuania Economic RelationsYi Zhu-tangNo ratings yet

- Strama Ch1 Hexa ArchDocument5 pagesStrama Ch1 Hexa ArchKrizNo ratings yet

- No Plastic Packaging: Tax InvoiceDocument12 pagesNo Plastic Packaging: Tax Invoicehiteshmohakar15No ratings yet

- Pre-Feasibility Study of The Guimaras-Iloilo Ferry Terminals System ProjectDocument59 pagesPre-Feasibility Study of The Guimaras-Iloilo Ferry Terminals System ProjectCarl50% (4)

- Soft Power by Joseph S NyeDocument19 pagesSoft Power by Joseph S NyemohsinshayanNo ratings yet

- Compressors system and residue box drawingDocument1 pageCompressors system and residue box drawingjerson flores rosalesNo ratings yet

- Extrajudicial Settlement of Estate With Special Power of Attorney To Sell or To Enter Into Develpoment Agreement-1Document5 pagesExtrajudicial Settlement of Estate With Special Power of Attorney To Sell or To Enter Into Develpoment Agreement-1Lucille Teves78% (23)