Professional Documents

Culture Documents

OSK Rubber Glove Industry in Malaysia Report

Uploaded by

Choh Shee TeohCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OSK Rubber Glove Industry in Malaysia Report

Uploaded by

Choh Shee TeohCopyright:

Available Formats

PP10551/10/2010(025682) 22 June 2010

MALAYSIA EQUITY Investment Research Daily News

Sector Update

Jason Yap +60 (3) 9207 7698 Jason.yap@my.oskgroup.com

Rubber Gloves

Demand Still Ahead of Supply

Recently, we invited Supermax Executive Chairman and Group Managing Director Dato Seri Stanley Thai to give fund managers an update on the rubber glove industry. We gather that demand is still strong as most of the rubber glove manufacturers have sold forward up to September 2010 in spite of the currently high selling prices of gloves reflecting a rise in latex price. Although margins will dip going forward as glove makers only pass on the cost increase to their customers, most importantly the absolute net profit figures will be maintained and therefore EPS and fair values are intact. We remain Overweight on the sector, with our top picks being Top Glove (Buy, TP: RM15.15), Supermax (Buy, TP: RM9.11) and Kossan (Buy, TP: RM11.30). Annual global demand at 8%-10%. The global annual consumption of medical examination and surgical gloves is expected to reach about 155bn pieces by 2011 from 135bn pieces in 2009, boosted by growing healthcare awareness after the H1N1 pandemic and healthcare reforms in many countries after the recent passing of reforms in US as standards of living improve. Of the total world exports, Malaysia supplies 63% of global demand. Also, about 54% of the global market is shared among the top 6 rubber glove companies listed in Malaysia. Developed countries still favor powder-free natural rubber medical gloves. Medical grade gloves make up about 85% of Malaysias total glove exports. The product mix between natural rubber and nitrile gloves is in the ratio 74%:26% while that for powder-free and powdered gloves is 67%:33%. More than 70% of these gloves are sold to developed countries while there is huge potential demand from developing countries like China and India in the coming years. Latex price and USD strength exert some influence on the industry. Currently, latex price has remained at a high of about RM7.00/kg while the USD is still struggling to regain lost ground against the MYR. Although rubber glove manufacturers can pass on most of the costs associated with these negative factors to their customers, they may experience a time lag in adjusting prices, especially in supplying to non-healthcare MNCs. Nevertheless, as supply still lags demand since most of gloves are sold forward up to September 2010, we believe these 2 factors would not pose a major threat to the rubber glove industry. Maintain Overweight. We remain positive owing to: 1) continuously strong demand from the medical and hygiene markets; 2) increasing awareness of health and cleanliness following the H1N1 pandemic; 3) the possibility of governments in developing countries making compulsory the use of gloves for the medical sector; 4) a recovery in the global economy and living standards rise, and 5) local rubber glove manufacturers again embarking on capacity expansion to boost revenue and profits. Top Glove, Supermax and Kossan remain our top picks.

OVERWEIGHT

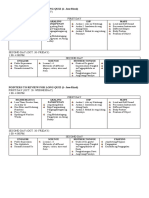

Stock

Price RM 3.28 7.93 7.57 5.85

Target RM 5.37 9.89 11.30 9.11

Mkt Cap RMm 470.7 1921.5 1210.2 1551.8

Volume 000 1362.8 259.1 535.7 2731.2

PER (x) FY1 12.7 13.4 10.2 7.9 FY2 9.1 12.4 9.4 7.7

FY0 ROE % 9.2 33.1 18.7 23.3

FY1 DY % 2.1 1.5 2.0 1.5 1.4

Rel. Performance % 1-mth -5.6 3.2 -4.3 -2.3 0.4 3-mth -8.9 6.6 2.2 5.1 6.1 12mth 143.8 86.7 66.0 233.5 71.4

P/NTA (x) 2.4 8.2 3.4 2.9 5.2

Rating

Adventa Hartalega Kossan Supermax

BUY BUY BUY BUY BUY

Top Glove 13.10 15.15 3975.9 992.6 15.1 14.3 20.5 To Note that Supermax target price adjusted from RM11.39 to RM9.11 after 1-for-4 bonus issue

OSK Research | See important disclosures at the end of this report

OSK Research

BACKGROUND ON THE RUBBER GLOVE INDUSTRY Global demand growing at 8%-10% p.a. We gather that annual global consumption of medical examination and surgical gloves totalled 135bn pieces in 2009, which is expected to grow further at 8%-10% a year. Going into 2011, global demand is expected to hit 155bn pieces p.a. whereby the H1N1 scare and continued alert on another outbreak as well as demand arising from the US healthcare reform will spur growth over and above the normal 8%-10% yearly increase. And, out of this total, Malaysia is the largest contributor, supplying 63% of global demand. This huge market share is mainly due to: 1) the long learning curve required for new rubber glove manufacturers; 2) being located centrally in a latex producing region (from Malaysia itself, Thailand and Indonesia), and 3) having the support from the Government in providing natural gas, water and allowing the hiring of foreign labour. Figure 1: Major rubber glove producing countries

9%

3%

25% Malaysia Thailand Indonesia Others 63%

Source: Various companies, OSK

Top 6 major listed companies command 54% share of the global market. The remaining share is split between other global players at 37% and 8.9% share held by Malaysian manufacturers. These other Malaysian players are generally smaller sole-proprietor owned rubber glove manufacturers, but also includes WRP, which is quite big in size and was ranked the 5th largest exporter of all gloves in 2009. Although the examination glove market is monopolized by the Top 6 listed companies together with WRP, there is also a market for the smaller companies as they supply mainly to retailers as well as the non-medical industry. Figure 2: Global market share of rubber glove manufacturers

Others Malaysia 8.9%

Top Glove 22.1% Supermax 12.3%

Others - World 37.0% Kossan 8.1% Adventa 3.1% Latexx 4.1% Hartalega 4.4%

Source: Various companies, OSK

Industry divided into 3 key sectors. The rubber glove industry is divided into the upstream, midstream and downstream sectors. The upstream sector comprises owners of rubber plantations and latex concentration plants (for instance, Top Glove owns 2 latex plants in Thailand with a capacity of 78.5k tonnes p.a.). The midstream sector is the most common sector as it includes all rubber glove companies manufacturing both natural rubber and synthetic gloves. Finally, the downstream sector includes distributors, with the notable players being Supermax and Adventa while we understand that Top Glove, Kossan and Hartalega have healthcare MNCs as their distributors. We believe that having their own distribution units (such as Supermax) and relying on others to a certain degree (like Top Glove) does not vary in terms of customer and geographical reach as we gather that both of these companies sell to more than 750 customers in more than 150 countries.

OSK Research | See important disclosures at the end of this report

See important disclosures at the end

OSK Research

Developed countries still favor powder-free natural rubber medical gloves. Firstly, the type of gloves which Malaysia is famous for producing is medical grade gloves, which make up about 85% of the countrys total glove exports. In fact, more than 95% of all the top 6 listed rubber glove manufacturers product mix comprises medical grade gloves; these companies also export 95% of their gloves. Next, we have 2 types of medical grade gloves natural rubber and nitrile gloves. Based on 2009 statistics, natural rubber gloves are the preferred choice, commanding 74% of the pie while nitrile gloves make up the remaining 26%. This is because natural rubber gloves are cheaper and give a more natural feel compared to nitrile gloves. Also, the problem of protein content - once a major threat to the use of rubber gloves has now become less of an issue given the technological improvements over the years. Finally, the third category of gloves covers powder or powder-free gloves. This selection is usually based on personal preference although powder-free gloves are usually more expensive by USD2-USD3.00/1000 pieces. Developed countries consume the bulk of sales. We understand that more than 70% of medical grade gloves is exported to developed countries, with North America topping the list and taking up 38% of gloves from the market, followed by Europe with a 36% market share. Having said that, we believe the growth in this market is at a consistent 5%-8% while we think developing countries like China and India have potential of contributing growth of more than 20%. Figure 3: Medical vs non-medical exports in 2009 Figure 4: Natural rubber vs nitrile glove export in 2009

15%

26%

Medical Non-medical

Natural rubber Nitrile

85%

74%

Source : MREPC, OSK

Source : MREPC, OSK

Figure 5: Powder vs powder-free gloves export in 2009

Figure 6: Export regions for Malaysian gloves in 2009

8%

33%

5% 38% North America Europe

13%

Powder-free Powder

Asia South America Others

67%

36%

Source : MREPC, OSK

Source : MREPC, OSK

Figure 7: Top 5 exporters of all types of gloves in 2009

Figure 8: Top 5 exporter of natural rubber gloves in 2009

Company Ranking Top Glove Supermax Kossan Hartalega WRP

Source : MREPC, OSK

Company Ranking Top Glove Supermax WRP Kossan Ansell

Source : MREPC, OSK

1 2 3 4 5

1 2 3 4 5

OSK Research | See important disclosures at the end of this report

See important disclosures at the end

OSK Research

INDUSTRY DYNAMICS High barriers to entry. The number of players in the global rubber glove industry has dwindled from more than 200 in 1990 to only 45 players in 2009. Over the years, there has been aggressive industry consolidation whereby the more efficient players had acquired the smaller and less efficient players to scale up their production capacity to achieve economies of scale to slash their production cost/piece. Although there are now only 45, the top 6 global players are Malaysian rubber glove manufacturers which dominate about 54% of the global market. Hence, it is not easy for new players to enter the industry as there would be a lot of catching given the steep learning curve of some 20 years, as well as the need to quickly have sufficient capacity and technological efficiency to mass produce and come up with an end product that can compete with those from the big boys. Technology keeps on improving. Some of the notable technological improvements include: 1) higher production capacity/line (2010 production lines can produce 15.0k pieces/hour/line versus 2.5k pieces/hour/line in 1988; 2) heating systems (now we have natural gas or biomass versus 1988 when only natural gas or diesel were available), and 3) extensive automation (i.e. there is now automatic stripping of the rubber gloves from their molds compared with manual stripping in 1988). Going forward, we believe that further technological improvements will play an increasingly important role as the profitability of rubber glove manufacturers will depend on their ability to achieve economies of scale more rapidly and cost efficiently. We understand that some of the technology being studied include automatic packaging, especially when there is uncertainty in the supply of foreign labour, which may delay shipments of gloves. We gather that currently, the bulk of the 50k manual workers employed by the rubber glove industry is foreign. Developing countries the next growth market. Braziil is a good example of a market where the surge in demand was mainly driven by 3 factors: 1) the Brazilian government tightening regulations by requiring each glove entering the country to carry the name of the manufacturer, which the smaller glove makers are unable to implement immediately; 2) the spread of the H1N1 pandemic, and 3) increased awareness of glove usage. This exceptionally strong demand has mainly benefited Top Glove and Supermax, which command about 40% and 30% respectively of the entire Brazilian market. Going forward, the developing countries would be a major growth driver for rubber glove manufacturers, led by China followed by India. We gather that the combined population of both regions is more than 2.5bn people, and hence the prospects for greater healthcare spending would be huge when the respective governments implement reforms or new health regulations. Also, we gather that China and India only spend some USD342 and USD109 per capita on average for healthcare compared to USD6,714 per capita in US. Figure 9: Chinas population on a rising trend

Bn'People 1.33 1.32 1.31 1.30 1.29 1.28 1.27 1.26 2003 2003 2004 2005 2006 2007

Source: OSK

OSK Research | See important disclosures at the end of this report

See important disclosures at the end

OSK Research

ISSUES CONFRONTING THE INDUSTRY Latex price to gradually top out. Latex price had hit a high of RM7.72/kg in mid-April before falling back to close to RM7.00/kg recently. Of course, some of the major factors influencing this fall are: 1) the misperception that the general health of the global economy may affect the demand for latex. With the European nation facing financial problems coupled with the potential of a faster-than-expected slowdown in Chinas economy, there were concerns over the future demand for various commodities, including latex, which has dampened sentiment, and 2) drop in crude oil price, which has direct corelation with the price of synthetic latex, which is seen as a direct substitute for natural rubber latex. Other factors influencing latex price. These include: 1) the wintering season for rubber trees from Feb-May each year, during which latex price is generally higher since latex production from rubber trees is at its lowest; 2) the El-Nino effect, which cause latex production to fall in early 2010; 3) demand from the tire industry, which uses about 70% of global latex supply, and 4) prices of other commodities prices in general since latex is a tradable commodity. Going forward, we believe that latex price would not continue to remain at the all-time high as higher output is expected to come from the South-West Vietnam and South-East Cambodia regions. Figure 10: Latex price trend

Sen/Kg 900 800 700 600 500 400 300 200 100 0 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Nov-09 Jan-10 Mar-10 May-10

Figure 11: Crude oil price trend

USD/barrel 90 80 70 60 50 40 30 20 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Nov-09 Jan-10 Mar-10

Source : OSK, Bloomberg

Source : OSK, Bloomberg

Figure 12: Average latex price/quarter

Se n/ Kg 800 700 600 500 400 300 200 100 0 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10

Source: OSK, Bloomberg

Natural gas issue likely to be resolved sooner or later. We understand that the lack of new natural gas supply is a major stumbling block to the growth of the rubber glove industry. Although some of the players may partly resolve this issue by scrapping some of their older or less efficient lines and replacing them with more new lines and resort to the use of biomass as an alternative to natural gas, we believe that all these measures can only increase their total capacity to a certain extent only as natural gas is still the preferred means of energy. Also, judging that the contribution of this industry to Malaysias total export income, we believe it would be a matter of time before the government steps up natural gas supply to the industry.

OSK Research | See important disclosures at the end of this report

See important disclosures at the end

OSK Research

Figure 13: Malaysias rubber glove exports

RM 'bn 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 2002 2003 2004 2005 2006 2007 2008 2009

Source: MREPC

Minimal impact from weakening of USD against MYR. Although more than 90% of rubber gloves produced by the top Malaysian rubber glove manufacturers are exported in USD, we understand that the weakening of USD against MYR would still have minimal impact on their accounts. This is because glove manufacturers usually price their products at a higher or lower price range in anticipation of volatility in the exchange rate. Also, since latex comprises about 40%-50% of revenue and is priced in USD, this acts as a naturally hedge. For the balance 50%-60% of glove manufacturers revenues in USD, the companies usually hedge some 50% of this, thus leaving about 25% of USD revenues unhedged. Figure 14: USD/MYR

U SD/ MYR 3.8 3.7 3.6 3.5 3.4 3.3 3.2 3.1 3 2.9 2.8 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10

Source: OSK, Bloomberg

OSK Research | See important disclosures at the end of this report

See important disclosures at the end

OSK Research

VALUATIONS AND RECOMMENDATIONS Maintain Overweight on the sector. Our positive call is on the basis that there is: 1) persistently strong demand for examination rubber gloves from both the medical and hygiene markets; 2) increasing health and cleanliness awareness following the H1N1 pandemic; 3) high possibility of governments in developing countries implementing compulsory use of gloves, especially for the medical market; 4) a recovery in the global economy, especially the US and Europe regions, which will ultimately lead to higher living standards across the globe, and 5) local rubber glove manufacturers re-embarking on capacity expansion to boost revenue and profits. Top Glove, Supermax and Kossan remain the top picks. We continue to like Top Gloves global market leadership and its good product mix (80% of which is natural rubber gloves), which are the basic and entry level examination rubber gloves targeting the developing countries. We believe that demand from these countries would be the growth driver of rubber glove companies going forward. Supermax, which is the worlds second largest rubber glove producer, also has a product mix similar to Top Gloves, and is also targeting the developing countries. Finally, Kossan stands out as a balanced rubber glove manufacturer with a neutral mix of natural rubber and nitrile gloves targeting all markets. Do note that our Supermax target price has been adjusted from RM11.39 to RM9.11 to account for the 1 for 4 bonus issue. Figure 15: Valuations of rubber glove companies

Stock

Adventa Hartalega Kossan Supermax Top Glove

Source: OSK

Target Price (RM) 5.37 9.89 11.30 9.11 15.15

FY11 PER Valuation (x) 15 14 14 15 17

OSK Research | See important disclosures at the end of this report

See important disclosures at the end

OSK Research

OSK Research Guide to Investment Ratings Buy: Share price may exceed 10% over the next 12 months Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain Neutral: Share price may fall within the range of +/- 10% over the next 12 months Take Profit: Target price has been attained. Look to accumulate at lower levels Sell: Share price may fall by more than 10% over the next 12 months Not Rated (NR): Stock is not within regular research coverage All research is based on material compiled from data considered to be reliable at the time of writing. However, information and opinions expressed will be subject to change at short notice, and no part of this report is to be construed as an offer or solicitation of an offer to transact any securities or financial instruments whether referred to herein or otherwise. We do not accept any liability directly or indirectly that may arise from investment decision-making based on this report. The company, its directors, officers, employees and/or connected persons may periodically hold an interest and/or underwriting commitments in the securities mentioned. Distribution in Singapore This research report produced by OSK Research Sdn Bhd is distributed in Singapore only to Institutional Investors, Expert Investors or Accredited Investors as defined in the Securities and Futures Act, CAP. 289 of Singapore. If you are not an Institutional Investor, Expert Investor or Accredited Investor, this research report is not intended for you and you should disregard this research report in its entirety. In respect of any matters arising from, or in connection with, this research report, you are to contact our Singapore Office, DMG & Partners Securities Pte Ltd (DMG).

All Rights Reserved. No part of this publication may be used or re-produced without expressed permission from OSK Research. Published and printed by :OSK RESEARCH SDN. BHD. (206591-V) (A wholly-owned subsidiary of OSK Investment Bank Berhad)

Chris Eng

Kuala Lumpur

Malaysia Research Office OSK Research Sdn. Bhd. 6th Floor, Plaza OSK Jalan Ampang 50450 Kuala Lumpur Malaysia Tel : +(60) 3 9207 7688 Fax : +(60) 3 2175 3202

Hong Kong

Singapore

Singapore Office DMG & Partners Securities Pte. Ltd. 20 Raffles Place #22-01 Ocean Towers Singapore 048620 Tel : +(65) 6533 1818 Fax : +(65) 6532 6211

Jakarta

Jakarta Office PT OSK Nusadana Securities Indonesia Plaza Lippo, 14th Floor, Jln. Jend. Sudirman Kav 25, Jakarta 12920 Indonesia Tel : +(6221) 520 4599 Fax : +(6221) 520 4598

Shanghai

Shanghai Office OSK (China) Investment Advisory Co. Ltd. Room 6506, Plaza 66 No.1266, West Nan Jing Road 200040 Shanghai China Tel : +(8621) 6288 9611 Fax : +(8621) 6288 9633

Hong Kong Office OSK Securities Hong Kong Ltd. 12th Floor, World-Wide House 19 Des Voeux Road Central, Hong Kong Tel : +(852) 2525 1118 Fax : +(852) 2810 0908

OSK Research | See important disclosures at the end of this report

See important disclosures at the end

You might also like

- Strategies for Successful Small Business Ownership in an Unstable EconomyFrom EverandStrategies for Successful Small Business Ownership in an Unstable EconomyRating: 5 out of 5 stars5/5 (2)

- Rubber Products Innovation Draft-SEENDocument20 pagesRubber Products Innovation Draft-SEENZi Lin HeNo ratings yet

- Hartalega Holdings Berhad: Corporate Presentation 2013Document47 pagesHartalega Holdings Berhad: Corporate Presentation 2013Piyu Mahatma100% (1)

- Top Glove 20080414 Initiate PDFDocument20 pagesTop Glove 20080414 Initiate PDFChin Hoong50% (2)

- Accenture ATIOS Publication Natural Rubber Trading MarketsDocument36 pagesAccenture ATIOS Publication Natural Rubber Trading MarketsLuis Carrillo100% (1)

- Supermax PDFDocument7 pagesSupermax PDFperkisasNo ratings yet

- Top Glove Corporation BHD Corporate PresentationDocument21 pagesTop Glove Corporation BHD Corporate Presentationalant_2280% (5)

- Rub Co IndustryDocument13 pagesRub Co IndustryAnonymous XZUyueNNo ratings yet

- Managing Cultural Diversity Consultancy Report: Impact of COVID-19 On Cotton-On-GroupDocument10 pagesManaging Cultural Diversity Consultancy Report: Impact of COVID-19 On Cotton-On-GroupSahana SrinivasNo ratings yet

- Mango CultivationDocument4 pagesMango CultivationPartha SaradhiNo ratings yet

- Marketing Assignment 1Document27 pagesMarketing Assignment 1Samia Ilma TarshaanNo ratings yet

- Omar Nasif Abdullah: Submitted To: Submitted byDocument12 pagesOmar Nasif Abdullah: Submitted To: Submitted byMegha RahmanNo ratings yet

- 001 Businessplan-Rubberplantation FinalDocument29 pages001 Businessplan-Rubberplantation FinalAung Naing SoeNo ratings yet

- Limmas Gloves - Certifications - OpulentDocument24 pagesLimmas Gloves - Certifications - Opulentsaisridhar99No ratings yet

- Mostafa Oil LTDDocument21 pagesMostafa Oil LTDNafisa Tausif AhmedNo ratings yet

- Adhersives & BondingDocument19 pagesAdhersives & BondingSavindra SilvaNo ratings yet

- Edible Oil Sector (Industry Analysis)Document8 pagesEdible Oil Sector (Industry Analysis)Umair AyazNo ratings yet

- Natural Rubber Different Marketable Forms - Dr.K.T.ThomasDocument50 pagesNatural Rubber Different Marketable Forms - Dr.K.T.Thomasmmpambhar100% (1)

- Diaper Write UpDocument6 pagesDiaper Write UpMehedi HasanNo ratings yet

- Final Project On Century Textiles Industry LTDDocument27 pagesFinal Project On Century Textiles Industry LTDBhagyashree MohiteNo ratings yet

- SGX SICOM Rubber Factsheet 201801-English PDFDocument6 pagesSGX SICOM Rubber Factsheet 201801-English PDFKien TrungNo ratings yet

- Top 100 Chemical Companies 2012Document10 pagesTop 100 Chemical Companies 2012Emilio PassettiNo ratings yet

- Particulars Page N: Pakistan Edible Oil Industry-OverviewDocument56 pagesParticulars Page N: Pakistan Edible Oil Industry-OverviewDe Eventia GuruNo ratings yet

- Paper Sector BDDocument6 pagesPaper Sector BDFarin KaziNo ratings yet

- Oleochemical ReportDocument3 pagesOleochemical ReportAkshay KhandelwalNo ratings yet

- Latex GlovesDocument22 pagesLatex GlovesThang Cao75% (4)

- Olive Oil ReportDocument46 pagesOlive Oil ReportjohnsondhanrajNo ratings yet

- Project Profile On Tissue Paper: ISISO 12625-1:2019 (En) 12625-1 Tissue Paper and Tissue Paper ProductsDocument9 pagesProject Profile On Tissue Paper: ISISO 12625-1:2019 (En) 12625-1 Tissue Paper and Tissue Paper ProductsAniket Jadhav100% (1)

- Project Report On Production of Condom Manufacturing From LatexDocument7 pagesProject Report On Production of Condom Manufacturing From LatexEIRI Board of Consultants and PublishersNo ratings yet

- China Pastry Bread Market ReportDocument10 pagesChina Pastry Bread Market ReportAllChinaReports.comNo ratings yet

- Profile On Production of Cinnamon OilDocument15 pagesProfile On Production of Cinnamon OilYogesh SethNo ratings yet

- Thoosan Wheat Plate ProjectDocument56 pagesThoosan Wheat Plate ProjectApple Computers100% (2)

- Agc 604/3 Operations StrategyDocument32 pagesAgc 604/3 Operations StrategyYeohNo ratings yet

- Natural RubberDocument15 pagesNatural Rubberphyrdows100% (1)

- Pakistan Palm Oil IndustryDocument53 pagesPakistan Palm Oil IndustryKalNo ratings yet

- Project Report On Courier Bags and Air Bubble PackagingDocument9 pagesProject Report On Courier Bags and Air Bubble PackagingSachin SharmaNo ratings yet

- Packaging Industry in IndiaDocument5 pagesPackaging Industry in Indiaamith_reddyNo ratings yet

- Fortune vs. Saffola: The Competitive Edge of Adani Wilmar Over MaricoDocument35 pagesFortune vs. Saffola: The Competitive Edge of Adani Wilmar Over Maricosameer_mech11No ratings yet

- Report On Shinepukur Ceramics LimitedDocument16 pagesReport On Shinepukur Ceramics Limitedifazkh0% (1)

- Baby Diapers Market ReportDocument17 pagesBaby Diapers Market ReportshiriishNo ratings yet

- Problems Faced by Cotton Ginning Industries in PakistanDocument5 pagesProblems Faced by Cotton Ginning Industries in PakistanSahaab AkbarNo ratings yet

- Manufacture of NR GloveDocument12 pagesManufacture of NR Glovesimbua72No ratings yet

- BranddossiersundropoiDocument46 pagesBranddossiersundropoiRiya McoyNo ratings yet

- Domestic Technical Textile Industry Surgical Sutures Marekt Size PDFDocument440 pagesDomestic Technical Textile Industry Surgical Sutures Marekt Size PDFranachamanNo ratings yet

- Century Enka Ltd.Document12 pagesCentury Enka Ltd.sanjay chandwaniNo ratings yet

- Denim Jeans Stitching UnitDocument25 pagesDenim Jeans Stitching UnitSaad NaseemNo ratings yet

- Non Woven Bag Word 1Document11 pagesNon Woven Bag Word 1Bhimsen100% (1)

- Textile IndustryDocument31 pagesTextile IndustryVineet KumarNo ratings yet

- Malaysia Fertiliser MarketDocument21 pagesMalaysia Fertiliser MarketRamkannan Parasumanna Chandrasekaran0% (1)

- Recycled Plastics Manufacture and Usage Rules. 1999.Document3 pagesRecycled Plastics Manufacture and Usage Rules. 1999.Mahesh MenonNo ratings yet

- Geita Investment Guide PDFDocument80 pagesGeita Investment Guide PDFDenisNo ratings yet

- Swot Analysis On SundropDocument20 pagesSwot Analysis On SundropGopal Chandra Saha100% (1)

- Global PP Non-Woven MarketDocument1 pageGlobal PP Non-Woven MarketManan PandyaNo ratings yet

- Rubber Glove20101001Time To Put Your Gloves Back OnDocument9 pagesRubber Glove20101001Time To Put Your Gloves Back OnTodd BenuNo ratings yet

- Top Glove CorporationDocument13 pagesTop Glove CorporationVivek BanerjeeNo ratings yet

- FM Final AssDocument37 pagesFM Final AssWay Chun LeeNo ratings yet

- Latexx Partners Alliance Bank Initiate CoverageDocument11 pagesLatexx Partners Alliance Bank Initiate CoveragePiyu MahatmaNo ratings yet

- CIMB Research Report: Rubber GlovesDocument36 pagesCIMB Research Report: Rubber GlovesChong Koon ChiangNo ratings yet

- BBB 2163 Operation ManagementDocument12 pagesBBB 2163 Operation ManagementShao WeiNo ratings yet

- NKEA: Positioning of The Malaysian Rubber Gloves Industry: November 2019Document4 pagesNKEA: Positioning of The Malaysian Rubber Gloves Industry: November 2019Sri GaneshNo ratings yet

- Rebecca Sanchez Resume 2016Document2 pagesRebecca Sanchez Resume 2016api-311997473No ratings yet

- Front Desk Staff-Giezel Bell Staff - Marc Client - Augustus Friend - AthenaDocument4 pagesFront Desk Staff-Giezel Bell Staff - Marc Client - Augustus Friend - Athenagener magbalitaNo ratings yet

- Office of The Divisional Forest Officer, Durgapur DivisionDocument30 pagesOffice of The Divisional Forest Officer, Durgapur Divisionrchowdhury_10No ratings yet

- Negros Oriental State University Bayawan - Sta. Catalina CampusDocument6 pagesNegros Oriental State University Bayawan - Sta. Catalina CampusKit EdrialNo ratings yet

- Athenian Democracy DocumentsDocument7 pagesAthenian Democracy Documentsapi-2737972640% (1)

- Invoice 141Document1 pageInvoice 141United KingdomNo ratings yet

- Rubberworld (Phils.), Inc. v. NLRCDocument2 pagesRubberworld (Phils.), Inc. v. NLRCAnjNo ratings yet

- Freemason's MonitorDocument143 pagesFreemason's Monitorpopecahbet100% (1)

- Study Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Document1 pageStudy Guide For Brigham Houston Fundamentas of Financial Management-13th Edition - 2012Rajib Dahal50% (2)

- FloridaDocument2 pagesFloridaAbhay KhannaNo ratings yet

- Blockchain in ConstructionDocument4 pagesBlockchain in ConstructionHasibullah AhmadzaiNo ratings yet

- 5.2.1 List of Placed Students VESIT NAAC TPCDocument154 pages5.2.1 List of Placed Students VESIT NAAC TPCRashmi RanjanNo ratings yet

- A Study On Bindal Group of IndustriesDocument100 pagesA Study On Bindal Group of IndustriesShivam RaiNo ratings yet

- Internal Assignment Applicable For June 2017 Examination: Course: Cost and Management AccountingDocument2 pagesInternal Assignment Applicable For June 2017 Examination: Course: Cost and Management Accountingnbala.iyerNo ratings yet

- London To Delhi by Bus PDFDocument28 pagesLondon To Delhi by Bus PDFMPA76 Ravindra Kumar SahNo ratings yet

- Key Area IIIDocument26 pagesKey Area IIIRobert M. MaluyaNo ratings yet

- Ilm-e-Hadees Sikhne Wale Ke Liye Kuch AadaabDocument5 pagesIlm-e-Hadees Sikhne Wale Ke Liye Kuch AadaabSalman KhanNo ratings yet

- Calendar PLS MCLE MAY - JULYDocument1 pageCalendar PLS MCLE MAY - JULYBernard LoloNo ratings yet

- ACCA - Generation Next - Managing Talent in Large Accountancy FirmsDocument34 pagesACCA - Generation Next - Managing Talent in Large Accountancy FirmsIoana RotaruNo ratings yet

- The Ugly Duckling - ScriptDocument5 pagesThe Ugly Duckling - Scriptapi-620031983No ratings yet

- SCP DemandPlanningScalability R13Document20 pagesSCP DemandPlanningScalability R13javierNo ratings yet

- Land Use Management (LUMDocument25 pagesLand Use Management (LUMgopumgNo ratings yet

- Advantages and Disadvantages of Free HealthcareDocument1 pageAdvantages and Disadvantages of Free HealthcareJames DayritNo ratings yet

- Tutorial LawDocument5 pagesTutorial LawsyafiqahNo ratings yet

- Motion To Voluntarily DismissDocument6 pagesMotion To Voluntarily DismissChicagoCitizens EmpowermentGroupNo ratings yet

- Besanko SummaryDocument30 pagesBesanko SummaryCindy OrangeNo ratings yet

- Pointers To Review For Long QuizDocument1 pagePointers To Review For Long QuizJoice Ann PolinarNo ratings yet

- English 6: Making A On An InformedDocument30 pagesEnglish 6: Making A On An InformedEDNALYN TANNo ratings yet

- The Glass Menagerie - Analytical EssayDocument2 pagesThe Glass Menagerie - Analytical EssayJosh RussellNo ratings yet

- Chernobyl Disaster: The Worst Man-Made Disaster in Human HistoryDocument13 pagesChernobyl Disaster: The Worst Man-Made Disaster in Human HistoryGowri ShankarNo ratings yet