Professional Documents

Culture Documents

Ca Final May 2012 Exam Paper 3

Uploaded by

Asim DasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ca Final May 2012 Exam Paper 3

Uploaded by

Asim DasCopyright:

Available Formats

'.

"

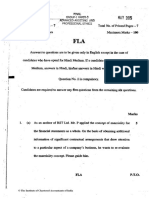

Roll No. Total No. of Questions

~

'........

7

MAY 2012

FINAL. GROUP-} PAPER.3 ADVANCED AUDITING AND PROFESSIONALETHICS TotalNo. of PrintedPages - 4

Maximum Marks - 100

Time Allowed - 3 Hours

HBO

Answers to questions are to be given only in English except in the case of candidates who have opted for Hindi Medium. If a candidate has not opted for Hindi Medium, his answers in Hindi will not be valued. Question No.1 is compulsory. Answer any five from the rest. Marks

1.

"

(a)

A Ltd is a manufacturer of readymade garments. It sells its products to franchisees located across the country. Readymade garment industry is subject to change in trends of fashion and as such, some of the goods are returned and A Ltd accepts them back as sales returns. On the basis of past trends such returns are estimated to be at 20% of the sales of any year. For the financial year 2011-12, A Ltd had accounted for the actual sales return made upto 31st March 2012 but has not reversed the possible expected retUrn that are likely to happen after 31st March 2012, in respect of the sale made for the FY 11-12. Mr. X the auditor of A Ltd wants this to be considered in the a~counts for the year ended on 31st March 2012 but the company is of the opinion;:thatalthough there is a probability of some goods being returned :by the franchisees, there is no

,

significant uncertainty regarding the amount of consideration that will be derived from the sale of goods, since the goods are not in the possession of the company and risk and rewards of ownership still lie with the franchisees and the company cannot record sales returns in its books of account in respect of goods that are likely to be received after the date of balance sheet. Comment. HBO \,',

..

P.T.O.

(2) HBO (b) Marks 10

R & Co. is the statutory auditor of S Ltd. For the financial year ended on 31st March 2012, S Ltd had disclosed in the notes (Note No. X) "The state pollution control board had ordered the closure of the company's only manufacturing plant on the ground that it is environmentally damaging, which the company had challenged in a law suit. Pending the outcome of the law suit the financial statements are prepared on a going concern basis". Further the financial statements prepared by the management of S Ltd include financial statements of certain branches which are audited by other auditors. What are the reporting responsibilities of R & Co ?

(c)

In the course of the statutory audit of Z Ltd, its statutory auditors, having detennined that the work of internal auditor is likely to be adequate for the purpose of statutory audit, wanted to use the work of internal auditor in respect of physical verification of fixed assets. How an evaluation of this specific work done by the internal auditor can be done?

2.

(a)

Give your comments with reference to the Chartered Accountants Act, 1'949 and Schedules thereto. Z, a practicing Chartered Accountant issued a certificate of circulation of a periodical without going into the most elementary details of how the circulation of a periodical was being maintained i.e. by not looking into the financial records, bank statements or bank pass books, by' not examining evidence of actual payment of printers bills and by not caritig to .ascertain how many copies were sold and paid for. (b) X, a practicing Chartered Accountant in an application for pennission to study submitted by his Articled Assistant to the council h~d confinned that the nonnal working hours of his office were from 11 A.M. to 6 P.M. and the hours during which the Articled Assistant was required to attend classes were 7.00 A.M. to 9.30 A.M. According to the infonnation from College, the Articled Assistant attended the College from 10 AM. to 1.55 P.M. on all week days. About the Articled Assistant attending the classes even during office hours, X pleaded ignorance. HBO

','

(3) HBO (c)

Marks

K, a practicing Chartered Accountant gave 50% of the audit fees received by him to L, who was not a Chartered Accountant, under the nomenclature of office allowance and such an arrangement continued for a number of years.

(d)

M, a practicing Chartered Accountant sent a letter to another firm of Chartered Accountants, claiming himself to be a pioneer in liasoni~g with Central Government Ministries and its allied Departments for getting various Government clearances for which he had claimed to have expertise and had given a list of his existing clients and details of his staff etc.

3.

(a)

As the concurrent auditor of Z Bank Ltd you are requested by its management to draft an internal control policy in respect of loans and advances. What factors do you consider as important while drafting such a policy?

10

(b)

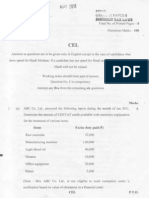

T Ltd's previousyear ended on 31stMarch 2012. During that period it made a

claim for refund of customs duty which was admitted as due by the customs authorities during April 2012. T Ltd neither credited the claim in the profit and loss account nor reported the same in clause 13(b) of Form 3CD for the reason that this has been admitted as due by the authorities only in the next fmancial year. Further T Ltd had changed the method of determination of cost formula

1

for the purpose of stock valuation from FIFO basis to Weighted Average Cost basis, but that was also not reflected in clause 11(b) of Foqn 3CD which requires reporting on change in accounting method employed. Comment, k (a) In tile course of audit of Q Ltd, its statutory auditor wants to be sure of the adequacy of related party disclosures? Kindly guide the auditor in identifying the possible source of related party information. (b) Z Ltd is intending to acquire A Ltd. It hires B & Co., a firm of Chartered Accountants to conduct a due diligence. B & Co., wants to reduce the risk of over valuation of assets in its due diligence exercise. Kindly guide B & Co. HBO'

P.T.O. 8" 8

\.".

.,,# lJ

(4) RBO

Marks 4

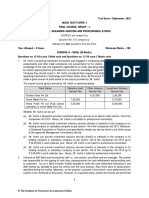

5.

(a)

A, a practicing Chartered Accountant is appointed to conduct the peer review of another practicing unit. What areas A should review in the assessment of independence of the practicing unit ?

(b) (c)

State the key differences between financial and operational audit. "Non-compliance of Section 58 AA inserted by the Companies (Amendment) Act, 2000 would occur where the company fails to intimate the Company Law Board, any default in repayment of deposits made by small depositors or part thereof or any interest there on." Discuss this statement and state reporting requirements under the Companies (Auditor's Report) Order, 2003 for non-compliance of Section 58 AA of the Companies Act, 1956.

4 8

6.

(a)

In the audit of K Ltd, its auditor wants to use CAATs for performing various audit procedures. Guide him as to what procedures can be performed using CAATs.

(b) (c)

State the "Mandatory Review" areas of the audit committee. In the course of audit of A Ltd you suspect the management has indulged in fraudulent financial reporting? State the possible source of such fraudulent financial reporting.

4 6

7.,

Write short notes on any four ofthe following: (a) (b) (c) (d) (e) Mark to Market Margin Cost Statements Matter to be reported in respect of inventory in the case of a special audit of a non-corporate borrower of a Bank. Solvency Margin Statistical and Non-Statistical Sampling 4 4 4 4 4

RBO

\. .

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Its The Bankers or UsDocument273 pagesIts The Bankers or UsDaniel Skipp100% (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- BarclaysDocument1 pageBarclaysEtherikal CommanderNo ratings yet

- Bank Audit ProjectDocument87 pagesBank Audit Projectlaxmi sambre78% (9)

- Lending ProcessDocument15 pagesLending ProcessRed HulkNo ratings yet

- ADVANCED AUDITING Revision QNS, Check CoverageDocument21 pagesADVANCED AUDITING Revision QNS, Check CoverageRewardMaturure100% (2)

- Functions of The State Bank of PakistanDocument13 pagesFunctions of The State Bank of PakistanHamadBalouchNo ratings yet

- Cases 1-25Document16 pagesCases 1-25Jane889233% (3)

- Customer Satisfaction-ICICI BankDocument98 pagesCustomer Satisfaction-ICICI BankSabinYadav88% (16)

- Question No.1 Is Compulsory. Answer Any Five From The RestDocument4 pagesQuestion No.1 Is Compulsory. Answer Any Five From The RestAsim DasNo ratings yet

- Assessment Test 1Document3 pagesAssessment Test 1Arslan AhmadNo ratings yet

- Final Auditing Question Paper - May - 2008Document5 pagesFinal Auditing Question Paper - May - 2008Khristine CaserialNo ratings yet

- PCC - Auditing - RTP - June 2009Document18 pagesPCC - Auditing - RTP - June 2009Omnia HassanNo ratings yet

- Audit ExamDocument13 pagesAudit Examvyom rajNo ratings yet

- F MauditDocument4 pagesF MauditPaulomee JhaveriNo ratings yet

- 2023 AFRM1 Question BankDocument8 pages2023 AFRM1 Question BankKieu Anh Bui LeNo ratings yet

- Term Test 1Document3 pagesTerm Test 1Hassan TanveerNo ratings yet

- May 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument19 pagesMay 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonnieNo ratings yet

- 1st Mid Term Exam Spring 2013Document4 pages1st Mid Term Exam Spring 2013SarahZeidatNo ratings yet

- Audit and Assurance Spring 2015Document6 pagesAudit and Assurance Spring 2015Piyal HossainNo ratings yet

- Audit and Assurance (International) : Thursday 6 June 2013Document6 pagesAudit and Assurance (International) : Thursday 6 June 2013Asim NazirNo ratings yet

- Audit and Assurance: Certificate in Accounting and Finance Stage ExaminationDocument3 pagesAudit and Assurance: Certificate in Accounting and Finance Stage ExaminationAdil AfridiNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument11 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- 1Document8 pages1neelamNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument11 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestAditya MaheshwariNo ratings yet

- Audit QPDocument4 pagesAudit QPRajat ModiNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument13 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestGJ ELASHREEVALLINo ratings yet

- Audit MTP Nov'22Document22 pagesAudit MTP Nov'22Kushagra SoniNo ratings yet

- AL Audit Assurance May June 2012Document3 pagesAL Audit Assurance May June 2012Fakhrul IslamNo ratings yet

- Final Examination Advice ACC3200 T2 2020 Date of Exam: 11 November 2020 Time: 4 PM - 7 PM (3 Hours) - Part A: Multiple Choice Questions (50 Marks)Document10 pagesFinal Examination Advice ACC3200 T2 2020 Date of Exam: 11 November 2020 Time: 4 PM - 7 PM (3 Hours) - Part A: Multiple Choice Questions (50 Marks)Hariprasad KSNo ratings yet

- ICAG Paper 3 - Advance AuditingDocument57 pagesICAG Paper 3 - Advance AuditingScott MensahNo ratings yet

- Case Study Based (Without Answers)Document14 pagesCase Study Based (Without Answers)mshivam617No ratings yet

- Audit (MTP 1) May 2024 QuestionsDocument13 pagesAudit (MTP 1) May 2024 Questionsaaron.dsilva02No ratings yet

- Extracted Chapter 1Document103 pagesExtracted Chapter 1PalisthaNo ratings yet

- Aplication Level Audit Assurance Nov Dec 2013Document2 pagesAplication Level Audit Assurance Nov Dec 2013Noman_TufailNo ratings yet

- Ca Final (Advanced Auditing & Professional Ethics) Mock Test - IDocument18 pagesCa Final (Advanced Auditing & Professional Ethics) Mock Test - ISrinivas RevankarNo ratings yet

- D11 AudDocument2 pagesD11 AudNafees AhmedNo ratings yet

- Acct3708 Finals, Sem 2, 2010Document11 pagesAcct3708 Finals, Sem 2, 2010nessawhoNo ratings yet

- Terminal SP21 AuditingDocument5 pagesTerminal SP21 AuditingMariam AfzalNo ratings yet

- f8 2016 Sep QDocument10 pagesf8 2016 Sep QAnonymous QRT4uuQNo ratings yet

- Advanced Auditing: T I C A PDocument4 pagesAdvanced Auditing: T I C A PDanish KhanNo ratings yet

- Microsoft Word - Practice Paper Advanced Auditing Mock Test November 2016Document4 pagesMicrosoft Word - Practice Paper Advanced Auditing Mock Test November 2016Asim JavedNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- D11 AudDocument2 pagesD11 AudaskermanNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsDocument5 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsRobinxyNo ratings yet

- 1773006669aaa - LPS 4 - Q PDFDocument2 pages1773006669aaa - LPS 4 - Q PDFAhmad Ali AyubNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument12 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument12 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestshankitNo ratings yet

- Acca f8 MockDocument8 pagesAcca f8 MockMuhammad Kamran Khan100% (3)

- Audit and Internal ReviewDocument7 pagesAudit and Internal ReviewkhengmaiNo ratings yet

- Caf-9 AudDocument3 pagesCaf-9 AudaskermanNo ratings yet

- Test Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsDocument4 pagesTest Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsRobinxyNo ratings yet

- Fauint Pilot PaperDocument14 pagesFauint Pilot PaperSara DoweNo ratings yet

- Advanced Auditing and Professional Ethics-3 QDocument16 pagesAdvanced Auditing and Professional Ethics-3 QCAtestseriesNo ratings yet

- Paper - 2: Auditing and Assurance QuestionsDocument20 pagesPaper - 2: Auditing and Assurance Questions9331934775100% (1)

- Advanced Auditing and Professional Ethics - QDocument16 pagesAdvanced Auditing and Professional Ethics - QCAtestseriesNo ratings yet

- Audit Papers DecDocument164 pagesAudit Papers DecKeshav SethiNo ratings yet

- D15 Hybrid F8 QP AssuranceDocument5 pagesD15 Hybrid F8 QP AssuranceIan Bob WilliamsNo ratings yet

- Tsa Audit TestsDocument8 pagesTsa Audit TestsMunira SheraliNo ratings yet

- Auditing: The Institute of Chartered Accountants of PakistanDocument3 pagesAuditing: The Institute of Chartered Accountants of PakistanadnanNo ratings yet

- Case StudyDocument16 pagesCase StudyRahulNo ratings yet

- f8hkg 2011 Jun QuDocument6 pagesf8hkg 2011 Jun Qudavidip1991No ratings yet

- Professional P4 - QA Dec 2016Document23 pagesProfessional P4 - QA Dec 2016twizas3926No ratings yet

- Ca Ipcc Nov 2011 Qustion Paper 1Document11 pagesCa Ipcc Nov 2011 Qustion Paper 1Asim DasNo ratings yet

- Ca Ipcc Nov 2011 Qustion Paper 7Document8 pagesCa Ipcc Nov 2011 Qustion Paper 7Asim DasNo ratings yet

- Ca Ipcc Nov 2011 Qustion Paper 6Document4 pagesCa Ipcc Nov 2011 Qustion Paper 6Asim DasNo ratings yet

- Ca Ipcc Nov 2011 Qustion Paper 3Document16 pagesCa Ipcc Nov 2011 Qustion Paper 3Asim DasNo ratings yet

- Ca Ipcc Nov 2011 Qustion Paper 4Document11 pagesCa Ipcc Nov 2011 Qustion Paper 4Asim DasNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 3Document16 pagesCa Ipcc May 2011 Qustion Paper 3Asim DasNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 4Document11 pagesCa Ipcc May 2011 Qustion Paper 4Asim DasNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 5Document11 pagesCa Ipcc May 2011 Qustion Paper 5Asim DasNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 6Document4 pagesCa Ipcc May 2011 Qustion Paper 6Asim DasNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 1Document11 pagesCa Ipcc May 2011 Qustion Paper 1Asim DasNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 2Document8 pagesCa Ipcc May 2011 Qustion Paper 2Asim DasNo ratings yet

- Ca Ipcc Nov 2010 Qustion Paper 3Document16 pagesCa Ipcc Nov 2010 Qustion Paper 3Asim DasNo ratings yet

- Ca Ipcc Nov 2010 Qustion Paper 7Document12 pagesCa Ipcc Nov 2010 Qustion Paper 7Asim DasNo ratings yet

- Ca Ipcc Nov 2010 Qustion Paper 6Document8 pagesCa Ipcc Nov 2010 Qustion Paper 6Asim DasNo ratings yet

- Ca Ipcc Nov 2010 Qustion Paper 4Document11 pagesCa Ipcc Nov 2010 Qustion Paper 4Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 6Document3 pagesCa Final Nov 2011 Qustion Paper 6Asim DasNo ratings yet

- Ca Ipcc Nov 2010 Qustion Paper 1Document16 pagesCa Ipcc Nov 2010 Qustion Paper 1Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 8Document8 pagesCa Final Nov 2011 Qustion Paper 8Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 2Document8 pagesCa Final Nov 2011 Qustion Paper 2Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 7Document11 pagesCa Final Nov 2011 Qustion Paper 7Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 3Document7 pagesCa Final Nov 2011 Qustion Paper 3Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 4Document7 pagesCa Final Nov 2011 Qustion Paper 4Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 1Document12 pagesCa Final Nov 2011 Qustion Paper 1Asim DasNo ratings yet

- Ca Final May 2011 Qustion Paper 8Document8 pagesCa Final May 2011 Qustion Paper 8Asim DasNo ratings yet

- Barangay Kagawad: Hon. Mohamad Jimmy D. AmpatuanDocument2 pagesBarangay Kagawad: Hon. Mohamad Jimmy D. AmpatuanNawaf A. BalatukayNo ratings yet

- B B F A R: ANK OF Aroda Inancial Nalysis EportDocument31 pagesB B F A R: ANK OF Aroda Inancial Nalysis Eportlaxmi_bodduNo ratings yet

- Land OrdinanceDocument123 pagesLand OrdinanceAini RoslieNo ratings yet

- 392 T 1 W 12 SolnDocument2 pages392 T 1 W 12 SolnHongyi Frank LiangNo ratings yet

- Synopsis Tittle of The Project: A Study of Rural Banking in A State (Maharashtra)Document4 pagesSynopsis Tittle of The Project: A Study of Rural Banking in A State (Maharashtra)Rohit UbaleNo ratings yet

- Công Ty VinamilkDocument28 pagesCông Ty VinamilkHiếu Linh100% (1)

- Customer StatmentDocument4 pagesCustomer StatmentmaksuhailNo ratings yet

- Background of The Case: Jbims MSCB ScamDocument4 pagesBackground of The Case: Jbims MSCB Scammanasi nikamNo ratings yet

- Corporate Action Processing: What Are The Risks?: Sponsored By: The Depository Trust & Clearing CorporationDocument45 pagesCorporate Action Processing: What Are The Risks?: Sponsored By: The Depository Trust & Clearing CorporationMalcolm MacCollNo ratings yet

- Part Withdrawal or Surrender FormDocument1 pagePart Withdrawal or Surrender FormAkshay MalhotraNo ratings yet

- The Brand Finance MENA 50 The Middle East's Most Valuable BrandsDocument1 pageThe Brand Finance MENA 50 The Middle East's Most Valuable BrandsAhmed KorraNo ratings yet

- MEDP Beacon For Stand Up IndiaDocument106 pagesMEDP Beacon For Stand Up IndiaKamzalian TomgingNo ratings yet

- RRL ResearchDocument1 pageRRL ResearchEzel May ArelladoNo ratings yet

- Banking Finance Tax Test SK2019 - 1Document4 pagesBanking Finance Tax Test SK2019 - 1Vishwas JNo ratings yet

- Week 1: Derivatives Markets: Week 2: Probability and StatisticsDocument5 pagesWeek 1: Derivatives Markets: Week 2: Probability and StatisticsAshvini KumarNo ratings yet

- 5.4 Statement of Financial PositionDocument4 pages5.4 Statement of Financial PositionHiNo ratings yet

- Panel de Control Obras Civiles - Luceli - Semana 09.1Document48 pagesPanel de Control Obras Civiles - Luceli - Semana 09.1Leydi BecerraNo ratings yet

- Income-Tax-Act-2014 (Kenya) PDFDocument298 pagesIncome-Tax-Act-2014 (Kenya) PDFRealNo ratings yet

- Compoun Interest LessonDocument6 pagesCompoun Interest Lessonsonamaegarcia23No ratings yet

- Module One Introduction To MicrofinanceDocument5 pagesModule One Introduction To MicrofinanceMaimon AhmetNo ratings yet

- About Goldman SachsDocument2 pagesAbout Goldman SachsanujNo ratings yet

- Bass vs. de La Rama DigestDocument2 pagesBass vs. de La Rama Digestdexter lingbananNo ratings yet

- AnnualReport2013 PDFDocument210 pagesAnnualReport2013 PDFMuhammad AdnanNo ratings yet

- Chase by Phone Menu GuideDocument2 pagesChase by Phone Menu GuideG. I. IvanovNo ratings yet