Professional Documents

Culture Documents

Putnam Equity Income Fund Q&A Q3 2012

Uploaded by

Putnam InvestmentsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Putnam Equity Income Fund Q&A Q3 2012

Uploaded by

Putnam InvestmentsCopyright:

Available Formats

Q3 | 2012Putnam Equity Income Fund Q&A

At the close of a strong quarter, compelling opportunities remain for value investors

Darren A. Jaroch, CFA Portfolio Manager

Portfolio management team

Darren Jaroch leads a team of veteran investors responsible for day-to-day management of the fund.

Key takeaways The funds new manager brings significant value and yield investing experience to the role. This is a compelling time to be a value investor, as the spread in valuation has broadened considerably. Almost all sectors today including those with rapid growth potential offer attractive yield opportunities.

Walter D. Scully, CPA Assistant Portfolio Manager (industry since 1990)

You recently became manager of Putnam Equity Income Fund, and you bring 16 years of investment industry experience to the role. What is your investing background? Early in my Putnam career, I worked with the value teams to develop quantitative models, and in 2000, I joined Putnams domestic Large Cap Value team. Over time, I have contributed to the investment process for all of Putnams value portfolios. In 2005, I was named to the management team of Putnam International Value Fund, and today I manage that fund as well domestic, international, and global value portfolios for institutional clients. Can you describe your philosophy and approach to managing Putnam Equity Income Fund? I share the investment approach that has been the cornerstone of the fund since its inception seeking a combination of growth and income potential for investors, striving for positive returns over a full investment cycle, and employing disciplined risk management. I seek to maintain a diversified portfolio, focusing on fundamental research of individual stocks, and avoiding significant overweights of a single security or sector. In building the portfolio, I look for high cash-flow generating businesses with the willingness and ability to return cash to shareholders when appropriate.

PUTNAM INVESTM ENTS| putnam.com

Q32012| At the close of a strong quarter, compelling opportunities remain for value investors

Youve spent much of your career focusing on international and global equities. How significant is the transition to managing a domestic portfolio? Most professional investors would agree that global expertise is imperative, regardless of whether you are managing a global, international, or U.S.-mandated product. I am fortunate to have years of global investing experience to bring to my role in managing this fund, since virtually every U.S. large-cap company has an international component to its business. For many of these companies, that overseas business is far larger than its U.S. business. In building an equity portfolio of any type, when you look at the competitive dynamics that have emerged in the global marketplace, it is limiting to have a U.S.-only focus. There are clearly some sectors that are more regionally focused, such as utilities and some health care, but for the vast majority of equities particularly among the largest U.S. companies the analysis must include a distinct understanding of global markets. Turning to the third quarter, can you tell us about the investing environment for value stocks? Overall, equities delivered solid performance, but it was a tale of two quarters for value stocks, which underperformed in the early part of the rally, then finished so strongly that they outperformed growth for the quarter as a whole. From a broad style perspective, growth equities have outperformed value for several years. However, its worth noting that the spread in valuation that is, the difference between the most expensive and least expensive equities has broadened considerably. In my view, this is a compelling time to be a value investor, as a vast opportunity set has been laid out for us. In terms of sectors, we saw many cyclicals rebound in the quarter. Energy was among the strongest performers, followed closely by consumer discretionary stocks. The laggards consisted mainly of high-dividend-paying companies, with staples and utilities struggling most. The market delivered a notable bifurcation between cyclical and defensive sectors for the quarter.

The number of dividend-paying companies recently rose to its highest level since 1999. Has this created opportunities for the fund? If you go back 10 years and look at the landscape for dividend-paying stocks, you will find that investors were pigeonholed into a few sectors: electric utilities, telecommunications, and some large-cap health-care companies, for example. In recent years, there has been quite a shift in terms of investor focus and corporate focus in favor of dividends. The payment of a dividend is no longer perceived as a sign that a business has weaker growth prospects, and we are seeing much greater diversity among dividend payers. While the classic yield sectors are still paying the highest dividends, almost all sectors today including those with rapid growth potential offer attractive yield opportunities. As we enter the final quarter of 2012, what is your outlook? I believe equity markets will continue to experience volatility in the closing months of the year. We have seen a continual exchange of risk-on and risk-off sentiment, and in this most recent risk-on period, cyclical sectors have rebounded. However, from a longer-term perspective over the next 6 or 12 months I am more bullish on defensive sectors, and I believe these stocks, particularly the higher-yielding names, will be the better performers. They have been a favorite of the market for some time now, and valuations from a historical context have been stretched. However, we saw this unwind somewhat in the third quarter, and valuations in defensive sectors have been coming back to more attractive levels. I continue to seek opportunities to increase dividend yield for the portfolio, which may mean more of an emphasis on larger-cap holdings. However, capital appreciation potential remains a critical component of the funds strategy, and we continually conduct rigorous fundamental research to ensure we have solid, differentiated insights on the companies we select.

Q32012| At the close of a strong quarter, compelling opportunities remain for value investors

Putnam Equity Income Fund (PEYAX)

Annualized total return performance as of September 30, 2012 Class A shares (inception 6/15/77)

Last quarter 1 year 3 years 5 years 10 years Life of fund Total expense ratio: 1.12%

Before sales charge

8.17% 30.83 10.45 1.97 8.77 9.82

After sales charge

1.97% 23.30 8.30 0.77 8.13 9.64

Russell 1000 Value Index

6.51% 30.92 11.84 -0.90 8.17

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance of class A shares before sales charge assumes reinvestment of distributions and does not account for taxes. After-sales-charge returns reflect a maximum 5.75% load. To obtain the most recent month-end performance, visit putnam.com. The funds expense ratio is based on the most recent prospectus and is subject to change. Quarterly returns are cumulative. The Russell 1000 Value Index is an unmanaged index of those companies in the large-cap Russell 1000 Index chosen for their value orientation. You cannot invest directly in an index.

The views and opinions expressed are those of Darren A. Jaroch, CFA, Portfolio Manager, as of September 30, 2012. They are subject to change with market conditions and are not meant as investment advice. Consider these risks before investing: Value stocks may fail to rebound, and the market may not favor value-style investing. Income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies in which the fund invests. The prices of stocks may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market conditions and factors related to a specific issuer or industry. Request a prospectus or summary prospectus from your financial representative or by calling 1-800-225-1581. The prospectus includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing.

Putnam Retail Management | One Post Office Square | Boston, MA 02109 | putnam.com

EO14827680110/12

You might also like

- Putnam White Paper: The Outlook For U.S. and European BanksDocument12 pagesPutnam White Paper: The Outlook For U.S. and European BanksPutnam InvestmentsNo ratings yet

- Independent Equity Research: How We Do It, and Why It Matters To InvestorsDocument12 pagesIndependent Equity Research: How We Do It, and Why It Matters To InvestorsPutnam InvestmentsNo ratings yet

- Optimizing Your LinkedIn ProfileDocument2 pagesOptimizing Your LinkedIn ProfilePutnam Investments60% (5)

- Financial Advisors' Use of Social MediaDocument2 pagesFinancial Advisors' Use of Social MediaPutnam InvestmentsNo ratings yet

- Affluent Investors Use of Social MediaDocument2 pagesAffluent Investors Use of Social MediaPutnam InvestmentsNo ratings yet

- Putnam Research Fund Q&A Q3 2012Document4 pagesPutnam Research Fund Q&A Q3 2012Putnam InvestmentsNo ratings yet

- Muni Rally May Continue, But Must Navigate Policy RisksDocument3 pagesMuni Rally May Continue, But Must Navigate Policy RisksPutnam InvestmentsNo ratings yet

- Asset ProtectionDocument4 pagesAsset ProtectionPutnam InvestmentsNo ratings yet

- Putnam Gifting Opportunities in 2012Document4 pagesPutnam Gifting Opportunities in 2012Putnam InvestmentsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Asma SiddiqaNo ratings yet

- Byju The UnicornDocument1 pageByju The Unicornashwin moviesNo ratings yet

- Hero HondaDocument32 pagesHero HondanainatakNo ratings yet

- Forex TrendlinesDocument11 pagesForex Trendlinesirinaciurla1No ratings yet

- Vodafone Idea Limited: PrintDocument1 pageVodafone Idea Limited: PrintPrakhar KapoorNo ratings yet

- Entrepreneurship Week 3 and 4Document10 pagesEntrepreneurship Week 3 and 4hyunsuk fhebieNo ratings yet

- Booths - Strategic Marketing ManagementDocument25 pagesBooths - Strategic Marketing ManagementSyed Muhammad AhmedNo ratings yet

- Random Problem 2 Pinkypdf PDF FreeDocument23 pagesRandom Problem 2 Pinkypdf PDF FreeTokis SabaNo ratings yet

- Industrial Arts VI: at The End of The Lesson, The Students Are Expected ToDocument2 pagesIndustrial Arts VI: at The End of The Lesson, The Students Are Expected ToNikki MalapitanNo ratings yet

- Task 1: FintechDocument4 pagesTask 1: Fintechmango chaunsaNo ratings yet

- Enhancing Market-Oriented Urban Agriculture in The Gaza Strip: Networking For Policy Change and ResilienceDocument9 pagesEnhancing Market-Oriented Urban Agriculture in The Gaza Strip: Networking For Policy Change and ResilienceOxfamNo ratings yet

- High Probability Trading Slide - Kathy Lien (Part 1)Document57 pagesHigh Probability Trading Slide - Kathy Lien (Part 1)IsabelNogales100% (2)

- Activity 11 AnswersDocument3 pagesActivity 11 AnswersJOHИ ТΛЯUƆΛИNo ratings yet

- Marketing Is All About Putting The Right Product in The Right Place, at The Right Price, at The Right TimeDocument5 pagesMarketing Is All About Putting The Right Product in The Right Place, at The Right Price, at The Right Timekhan officialNo ratings yet

- IGNOU MBA MS-45 Solved Assignments December 2012Document8 pagesIGNOU MBA MS-45 Solved Assignments December 2012Girija Khanna ChavliNo ratings yet

- Economics: (PDF Version of Ibook)Document436 pagesEconomics: (PDF Version of Ibook)Vinit Mehta100% (2)

- Fish Philosophy POADocument18 pagesFish Philosophy POAPius Osiriamhe Anyiador100% (1)

- 7 understanding-market-capitalization-types-explanation-and-practical-applications-for-investors-20231007100811DiKLDocument11 pages7 understanding-market-capitalization-types-explanation-and-practical-applications-for-investors-20231007100811DiKLAani RashNo ratings yet

- Devaluation of RupeeDocument3 pagesDevaluation of RupeeAmmy kNo ratings yet

- CH 12Document19 pagesCH 12Ahmed Al EkamNo ratings yet

- The Effects of Price Changes: Substitution and Income EffectsDocument1 pageThe Effects of Price Changes: Substitution and Income EffectspenelopegerhardNo ratings yet

- MohammadDocument2 pagesMohammadxfzm99mr8rNo ratings yet

- Priciples of Marketing by Philip Kotler and Gary Armstrong: Products, Services, and BrandsDocument44 pagesPriciples of Marketing by Philip Kotler and Gary Armstrong: Products, Services, and BrandsBlank OneNo ratings yet

- Unit 6Document10 pagesUnit 6bubbles82No ratings yet

- Company G Marketing Plan WGU Marketing Management Tasks - AST1Document10 pagesCompany G Marketing Plan WGU Marketing Management Tasks - AST1MichaelNo ratings yet

- Chapter 7Document5 pagesChapter 7Saleemah Msskinnyfiber0% (1)

- Investment Analysis and Portfolio Management: Question: Explain TheDocument4 pagesInvestment Analysis and Portfolio Management: Question: Explain TheMo ToNo ratings yet

- 0b231module VII BDocument18 pages0b231module VII BsplenderousNo ratings yet

- 12 Principles of Intelligent InvestorsDocument27 pages12 Principles of Intelligent InvestorsJohn KohNo ratings yet

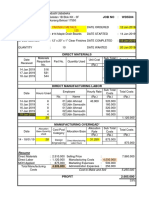

- COST SHEET Atau JOB COSTDocument1 pageCOST SHEET Atau JOB COSTWiraswasta MandiriNo ratings yet