Professional Documents

Culture Documents

When Interest Is Allowed

Uploaded by

ttobaiwaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

When Interest Is Allowed

Uploaded by

ttobaiwaCopyright:

Available Formats

when interest is allowed, the bank credits it to the customer's account. Thisincreases the balance in the pass book.

The firm would pass the corresponding entryin the cash book only when it receives the intimation from the bank or notices it inthe pass book. Hence, the cash book balance will be lower till such entry is made.b) A mounts collected by t h e bank as per t h e standing instructions: The businessmanoften issues standing instructions authorizing his banker to collect on his behalf certain amounts due to him, such as interest, dividends, etc. The bank credits thecustomer's account as and when it collects such\ amounts and sends the necessaryintimation to him. The firm will pass the\ corresponding entry in the cash book whenit receives such intimation. Sometimes the intimation may be misplaced and no entryis passed in cash book. Thus, as on the date of reconciliation, the balances as per thecash book will be lower than the balance as per the pass book.c) D irect payments into t h e bank made by firm's customers: Sometimes, a customermay directly deposit an amount into a firm's bank account. Firm shall record it in thecash book only when it learns about such deposit. But the pass book would show theentry on the date of deposit itself. If by the date of reconciliation, such entry has notbeen passed in the cash book, the balance shown by pass book will be higher thanthe balance as per cash book.d) Bank c h arges: The banks usually charge their customers for various service providedby them. They may charge for collection of outstation cheques, for making orcollecting payments on standing instructions, and so on. The bank debits thecustomer's account for such charges from time to time. However, the firm will knowabout these charges only when it goes through the pass book. So, on the date of reconciliation the pass book balance may differ from the balance as per cash book.e) I nterest on overdraft: W hen a firm avails of an overdraft facility, the bank chargessome interest which it debits to the firm's account periodically. This would reducethe balance or add to the overdraft depending upon the nature of balance in thebank. However, the corresponding entry for interest on overdraft would be passed inthe cash book only when the pass book is received. So, there may be a disagreementof the two balances on the date of reconciliation.f)

P ayments made by t h e bank as per t h e standing instructions: The businessmanissues standing instructions to his banker to make certain payments on his behalf such as insurance premium, rent, etc. W hen the banker makes such payments, hewould immediately debit the customer's account. So, the balance in the pass book would get reduced. If the corresponding entries for such payments have not beenrecorded in the cash book, the balance as per cash book would remain unchanged.g) D iscounted c h eques/bills receivable dis h onored subsequently: Sometimes, whenthe businessman deposits some outstation cheques and wants paymentimmediately, he may request the bank to credit his account immediately withoutwaiting for the actual collection. The bank usually obliges him by discounting thecheque. This means the bank deducts certain amount towards interest (calleddiscount) and credits the remaining amount to his account. Subsequently, if for somereason, such a cheque is dishonored, the bank would immediately debit the firm'saccount. But, the firm would pass the entry for the dishonor only when it receives theintimation from the bank. Thus, the balance as per cash book would differ from thebalance as per pass book till such entry has been passed. The same thing may happenwhen a discounted bill receivable is dishonored.h) Errors in t h e pass book: The bank may also commit errors while recording thetransactions in customer s accounts which may lead to disagreement of the twobalances. Examples of such errors are:i) Omitting to record certain transactions in customer's account. ii) Recording of a transaction on the wrong side of firm's account. iii) Recording of a transaction in the wrong account where the firm has more thanone account in the bank.iv) Recording of transactions which belong to some other customer in the firm'saccount. P r e p a r ation of Bank Reconciliation

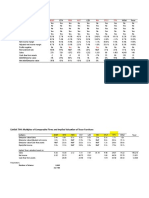

S tatement : After identifying the causes of difference, the reconciliation may be done in the followingtwo ways: ( a) P reparation of bank reconciliation statement wit h out adjusting cas h book balance. ( b) P reparation of bank reconciliation statement after adjusting cas h book balance.

( a) P reparation of Bank R econciliation Statement wit h out adjusting C as h Book Balance: To prepare bank reconciliation statement, under this approach, the balance as per cashbook or as per passbook is the starting item. The debit balance as per the cash book meansthe balance of deposits held at the bank. Such a balance will be a credit balance as per thepassbook. Such a balance exists when the deposits made by the firm are more than itswithdrawals. It indicates the favourable balance as per cash book or favourable balance asper the passbook . On the other hand, the credit balance as per the cash book indicatesbank overdraft . In other words, the excess amount withdrawn over the amount depositedin the bank. It is also known as unfavourable balance as per cash book or unfavourablebalance as per passbook. W e may h ave four different situations w h

ile preparing t h e bank reconciliation statement. Th ese are: 1. W hen debit balance (favourable balance) as per cash book is given and the balance asper passbook is to be ascertained. 2 . W hen credit balance (favourable balance) as per passbook is given and the balance asper cash book is to be ascertained.3. W hen credit balance as per cash book (unfavourable balance/overdraft balance) is givenand the balance as per passbook is to ascertained.4. W hen debit balance as per passbook (unfavourable balance/overdraft balance) is givenand the cash book balance as per is to ascertained.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Electrolux Case StudyDocument4 pagesElectrolux Case StudyEmily GevaertsNo ratings yet

- Case Studies On HR Best PracticesDocument50 pagesCase Studies On HR Best PracticesAnkur SharmaNo ratings yet

- FAR 4204 (Receivables)Document10 pagesFAR 4204 (Receivables)Maximus100% (1)

- Housing Finance and NHBDocument19 pagesHousing Finance and NHBiqbal_puneetNo ratings yet

- Financial Analysis Statement Solution IncompleteDocument9 pagesFinancial Analysis Statement Solution IncompleteJerome BaluseroNo ratings yet

- Franchising: Introduction ToDocument30 pagesFranchising: Introduction Tohemant mohiteNo ratings yet

- Checks Issued by City of Boise Idaho - 14Document31 pagesChecks Issued by City of Boise Idaho - 14Mark ReinhardtNo ratings yet

- Future-Wealth-Gain Bajaj BrochureDocument24 pagesFuture-Wealth-Gain Bajaj BrochureVivek SinghalNo ratings yet

- ChemicalsDocument92 pagesChemicalsBrian KawaskiNo ratings yet

- 35 Powerful Candlestick PatternsDocument21 pages35 Powerful Candlestick PatternsMarcelo_Capellotto50% (2)

- McDonalds RoyaltyfeesDocument2 pagesMcDonalds RoyaltyfeesNidhi BengaliNo ratings yet

- A Study On Technical Analysis As An Indicator For Investment Decision-MakingDocument69 pagesA Study On Technical Analysis As An Indicator For Investment Decision-MakingHarshil Sanghavi100% (1)

- Investment and VC Funds Acting in SEE RegionDocument72 pagesInvestment and VC Funds Acting in SEE Regionpaul_costasNo ratings yet

- Letter-SB-Request For Special Session-11 October 2023Document5 pagesLetter-SB-Request For Special Session-11 October 2023cj.pulga.palNo ratings yet

- EquityDocument126 pagesEquityChristopherNo ratings yet

- Car Loan FormDocument5 pagesCar Loan FormDrumaraNo ratings yet

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- 2018 Business Law Question Paper by My Solution PaperDocument7 pages2018 Business Law Question Paper by My Solution PaperSuman BarmanNo ratings yet

- Chapter 6 KeyDocument44 pagesChapter 6 KeyNatasha Koninskaya100% (2)

- Aptitude Test - Accounts ExecutiveDocument8 pagesAptitude Test - Accounts ExecutiveHARCHARAN SINGH RANOTRANo ratings yet

- Introduction To IFRS: AccountingDocument16 pagesIntroduction To IFRS: AccountingmulualemNo ratings yet

- MAINDocument80 pagesMAINNagireddy KalluriNo ratings yet

- Chapter 1. Introduction To Cost and ManagementDocument49 pagesChapter 1. Introduction To Cost and ManagementHARYATI SETYORINI100% (1)

- Asset AllocationDocument8 pagesAsset AllocationAnonymous Hw6a6BYS3DNo ratings yet

- Sanction Letter MitaBrickDocument15 pagesSanction Letter MitaBricktarique2009No ratings yet

- A Practical Guide To GST (Chapter 15 - Transition To GST)Document43 pagesA Practical Guide To GST (Chapter 15 - Transition To GST)Sanjay DwivediNo ratings yet

- Lecture 5.2-General Cost Classifications (Problem 2)Document2 pagesLecture 5.2-General Cost Classifications (Problem 2)Nazmul-Hassan Sumon75% (4)

- John Arthur Romney Aka John Romney Owner of Folio Ventures Federal Mortgage Fraud IndictmentDocument19 pagesJohn Arthur Romney Aka John Romney Owner of Folio Ventures Federal Mortgage Fraud IndictmentThe Straw BuyerNo ratings yet

- Introduction To IPOsDocument1 pageIntroduction To IPOsaugusthrtrainingNo ratings yet

- Atty. Dionisio Calibo, vs. CA (Cred Trans)Document2 pagesAtty. Dionisio Calibo, vs. CA (Cred Trans)JM CaupayanNo ratings yet