Professional Documents

Culture Documents

Budgets in UK Local Authorities

Uploaded by

Samuel BrefoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budgets in UK Local Authorities

Uploaded by

Samuel BrefoCopyright:

Available Formats

Budget Setting Process within Local Governments in the UK Introduction

Finance is one of the key resources available to local authorities for use in providing their services and for meeting their statutory obligations to their residents. Other resources include staff, systems, property/buildings and information. Finance is the resource that allows all the other resources to be secured and as such managing it becomes a very important activity to ensure an efficient use of all resources. Finance also becomes important to local authorities because it represents public money entrusted to them and therefore requires statutory accountability on the part of chief officers of the use of this money. About 75% of Local Authorities funding comes from central government in the form of revenue support grants. The remaining balance comes directly from council tax on residents. Central Governments funding to local authorities represents about 25% of public expenditure in the UK. Although Council tax forms only about 4% of UK the national tax revenue, their impact on the public is very visible as they are seen as an additional tax burden. In the UK, Central Government through Parliament exercises the overall control over public expenditure to ensure that resources are directed and used effectively within the overall economy, This includes the funding it gives to local authorities yearly and the revenues they collect from local taxpayers in the form of council tax. Central government is able to control local government expenditure by limiting the grants it gives to them, by applying pressure over council tax increases and by legal limitations on what local authorities can do. Local authorities must therefore organize their affairs efficiently to ensure that resources they use are within government constraints. The budgetary process is one of the ways of ensuring that this is achieved. Budget Strategy Local authorities generally use their resources to provide services to their residents as required by law and by their constitutions. This is achieved within a framework of locally identified priorities agreed through a policy and resource strategy and met by central government grant settlement constraints and a level of an affordable council tax. Administratively, an integrated business and budget planning process ensures that: a. resources are allocated to achieve an identified national and local priorites and other statutory requirements and obligations, b. financial prudence is satisfied from allocation of resources through to spending, monitoring and evaluation, c. there is a continuous improvement of services by reviewing existing performance levels and d. value for money prescriptions to identify efficiencies are carried out. Objectives of setting budgets Local authorities set budgets for the following reasons:a. to meet statutory requirements and obligations, b. to set council tax, c. to determine rent levels, d. to express service plans for the new year in financial terms, e. to allocate available financial resources,

f. to set targets against which performance are monitored, g. to provide authority to the finance director to commit expenditure within a framework of financial regulations, standing orders and the scheme of delegation and h. to meet the requirement of the external auditors that financial controls are exercised. Types of budgets There are two types of budgets within local authorities, revenue budgets and capital budgets. Revenue budgets are budgets for recurring expenditures and incomes for the year. Capital budgets are budgets for capital expenditure planned for the year as part of a capital program. Capital budgets must conform to the Prudential Code for Capital Finance as approved by CIPFA which requires local authorities to consider the affordability and long term effects of borrowing and also the revenue implications of capital funding. Revenue budgets are divided into two, the general fund budgets and housing revenue budgets. This separation results from a statutory requirement on local authorities to account separately for the provision of housing and the provision of all other services. The General Fund budgets result in the setting of council tax for the budget year and Housing Revenue budgets are for the calculation of rent for the budget year. The General Fund budget are funded by Revenue Support Grant level determined by the government, and National Non Domestic Rate. The government also determines the level of Early Intervention Grant and the Council Tax Freeze Grant. The rest of the of the funding is largely through Council Tax. The Housing Revenue Budgets are funded by rents, service charges, housing subsidy and leasehold service charges and other housing related income. Capital Budgets are funded from the general fund account or from Housing Revenue Account or from special government grants. Revenue Budget The Revenue budgets look at one year at a time in the context of a three or four year plan which projects forward financial plans and include the full year effects of first year decisions. Revenue budgets are formulated on an incremental basis with an emphasis on changes in last years budget rather than zero based or budgets formulated from the scratch. The plans starts from the beginning of the new year where resources are looked at, pressures on budgets are identified and estimated and the current years budgets are projected forward. These projections are reported to the executive of the council in the form of a strategic review and medium term financial forecasts. A strategy for the budget process is identified, formulated and recommended to the Executive of the council on the basis of the review. This could take the form of a savings exercise necessary to bridge the gap between resource availability and expenditure requirement in the new year. To be more effective, the savings exercise would be concentrated on service areas where it is considered acceptable to find savings. Progress reports go to the Executive at every stage of the process to inform, discuss and consult members of the council.

In November to December in the year before the new budget year, the government issues provisional revenue grant information about the level of grant settlement to local authorities in the new year. This gives a clearer picture of the new budgets and are subsequently reported to the Executive of the council. The council on the basis of the government figures also set their own provisional cash limits for each directorate or departments. Individual departments are then able to prepare detailed revenue budgets to present to the Executive in January to February of the year before the new year. As said previously the detailed budget will look at the budget for the current year and adjusted for any pressures or increases in expenditure, savings identified, current years one-offs not needed next year and inflation assumptions in the new year. A final report goes to the Executive at the end of February after the final grant figures are released by the government. The detailed budgets are finalized and referred by the Executive to a full meeting of the council between February and March where they are approved. As part of the process the approved budgets are loaded on the councils financial management system ready for commitment of resources, virement of budgets within departments and for budget monitoring. Capital Budgets Capital budgets are normally prepared from the authorities capital program within the context of its capital strategy. They are normally prepared for the current year and three or four subsequent years depending on the program. Capital budgets are also looked at and approved by the Executive as and when Revenue budget are being approved, They are also loaded on the financial management system for commitment and monitoring in the new year

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Self Talk AbridgedDocument35 pagesSelf Talk AbridgedSamuel Brefo100% (2)

- Personal MagnetismDocument28 pagesPersonal MagnetismMaria Ama100% (4)

- Ashanti Proverbs - R S RattrayDocument204 pagesAshanti Proverbs - R S RattraySamuel Brefo100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- U.S. Individual Income Tax Return: Cruz 605-92-4936 Luis EDocument21 pagesU.S. Individual Income Tax Return: Cruz 605-92-4936 Luis ELui67% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Find You & You Find EverythingDocument17 pagesFind You & You Find EverythingSamuel BrefoNo ratings yet

- The Managers Guide To Systems ThinkingDocument227 pagesThe Managers Guide To Systems ThinkingSamuel Brefo100% (21)

- Canada Tax SetupDocument41 pagesCanada Tax SetupRajendran SureshNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Cloud of The Unknowing StudiesDocument193 pagesThe Cloud of The Unknowing StudiesSamuel Brefo0% (1)

- The Cloud of The Unknowing StudiesDocument193 pagesThe Cloud of The Unknowing StudiesSamuel Brefo0% (1)

- Battersby Man Outside Himself 1942Document147 pagesBattersby Man Outside Himself 1942shamanjagNo ratings yet

- Euclid's Elements of GeometryDocument545 pagesEuclid's Elements of GeometryAlpha1DecoyNo ratings yet

- Fixed Asset Register SampleDocument51 pagesFixed Asset Register SampleRifalino Al-habibieNo ratings yet

- Hypnosis Scripts - New 16Document16 pagesHypnosis Scripts - New 16Samuel Brefo100% (4)

- New DEED OF ABSOLUTE SALE With SPADocument2 pagesNew DEED OF ABSOLUTE SALE With SPAOliver Raymundo50% (2)

- Introduction To Agriculture Lecture Notes NewDocument35 pagesIntroduction To Agriculture Lecture Notes NewAnonymous S8YHHo51M86% (7)

- Tax Planning V/S Tax Management: Dr. Anindhya TiwariDocument18 pagesTax Planning V/S Tax Management: Dr. Anindhya TiwariJAGDISHWAR KUTIYALNo ratings yet

- Obama Hypnosis: A Theory by The RightDocument67 pagesObama Hypnosis: A Theory by The Rightpappalardo100% (2)

- Three Books of Occult Philosophy by Heinrich Cornelius Agrippa Von Nettesheim 1Document97 pagesThree Books of Occult Philosophy by Heinrich Cornelius Agrippa Von Nettesheim 1Samuel BrefoNo ratings yet

- Bustamante TAX CDocument19 pagesBustamante TAX CJean Rose Tabagay BustamanteNo ratings yet

- AON Hewitt TRQ - Vol 5 Issue 2Document15 pagesAON Hewitt TRQ - Vol 5 Issue 2mananshah89No ratings yet

- Tony Buzan - Speed Reading BookDocument235 pagesTony Buzan - Speed Reading BookSamuel Brefo100% (21)

- BVACOP 2011 12 Consultation Subjective AnalysisDocument13 pagesBVACOP 2011 12 Consultation Subjective AnalysisSamuel BrefoNo ratings yet

- BVACOP 2011 12 Consultation Subjective AnalysisDocument13 pagesBVACOP 2011 12 Consultation Subjective AnalysisSamuel BrefoNo ratings yet

- The Holy BibleDocument1,244 pagesThe Holy BibleSamuel BrefoNo ratings yet

- Accrual Accounting in The Public SectorDocument52 pagesAccrual Accounting in The Public SectorSamuel BrefoNo ratings yet

- Bhel-Leasing Vs Buying and Financial DecisionDocument69 pagesBhel-Leasing Vs Buying and Financial DecisionSHIVANK86No ratings yet

- SmartOLT Invoice 2022 Sep 30 SMART700035295Document1 pageSmartOLT Invoice 2022 Sep 30 SMART700035295Luis GorozpeNo ratings yet

- 2modules 1 and 2 - Taxation 1Document6 pages2modules 1 and 2 - Taxation 1Gerard Relucio OroNo ratings yet

- Cement ProjectDocument3 pagesCement ProjectPonnoju ShashankaNo ratings yet

- This Study Resource Was: The Professional CPA Review SchoolDocument4 pagesThis Study Resource Was: The Professional CPA Review SchooljtNo ratings yet

- JBL T160 Wired Headset: Grand Total 549.00Document1 pageJBL T160 Wired Headset: Grand Total 549.00Arpit AwasthiNo ratings yet

- GIS in Land Administration: PfdaleandramclarenDocument18 pagesGIS in Land Administration: PfdaleandramclarenSerghei CucoreanNo ratings yet

- How To Calculate Custom DutyDocument15 pagesHow To Calculate Custom DutyDr-Koteswara Rao0% (1)

- Value Added Statement - A Critical AnalysisDocument23 pagesValue Added Statement - A Critical AnalysisJanani MarimuthuNo ratings yet

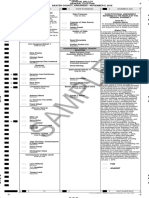

- Sample: Official Ballot General Election Baxter County, Arkansas - November 6, 2018Document2 pagesSample: Official Ballot General Election Baxter County, Arkansas - November 6, 2018Sonny ElliottNo ratings yet

- Ho So San Pham BRAVO 8 - Catalog - E PDFDocument52 pagesHo So San Pham BRAVO 8 - Catalog - E PDFTrung NguyenNo ratings yet

- Oppo Enco M31 Ewn1O Bluetooth Headset: Grand Total 1964.00Document2 pagesOppo Enco M31 Ewn1O Bluetooth Headset: Grand Total 1964.00Ganesh Prabu0% (1)

- 425 1594 1 PBDocument23 pages425 1594 1 PBWOYOPWA SHEMNo ratings yet

- Taxation Law .FDDocument17 pagesTaxation Law .FDAnonymous IDhChBNo ratings yet

- Financial Status-Siyaram Silk Mills LTD 2011-12Document15 pagesFinancial Status-Siyaram Silk Mills LTD 2011-12Roshankumar S PimpalkarNo ratings yet

- CFO Manufacturing Distribution Industrial in San Diego CA Resume Paul ByrneDocument2 pagesCFO Manufacturing Distribution Industrial in San Diego CA Resume Paul ByrnePaulByrneNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)kishanprasadNo ratings yet

- Resa Tracker PDFDocument2 pagesResa Tracker PDFDonita Joy BaltazarNo ratings yet

- EWT On ReimbursementDocument3 pagesEWT On ReimbursementMonica SorianoNo ratings yet

- University of Hargeisa: Semester Student's NameDocument6 pagesUniversity of Hargeisa: Semester Student's NameAbdifatah AbdilahiNo ratings yet

- Ration Analysis of M&SDocument72 pagesRation Analysis of M&SRashid JalalNo ratings yet

- Chapter 1 To 3Document56 pagesChapter 1 To 3Michelle Ann Dela Cruz100% (1)