Professional Documents

Culture Documents

Share Sansar Samachar of 27th July' 2012

Uploaded by

sharesansarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Share Sansar Samachar of 27th July' 2012

Uploaded by

sharesansarCopyright:

Available Formats

27th July, Friday. Vol-2.

Issue-170 MORNING QUOTE:

Delays in granting of justice very often reduce the speed with which investment could be undertaken, discouraging investors. . - Lucas Papademos

Top Headlines: Scandal in NB Insurance Company Limited operations. Self use of money collected from customers, etc. (Source: Nagarik Daily) UCPN (Maoist) to probe own top leaders properties. (Source: Republica) China concerned over foreign meddling in Nepal: Baidya. (Source: Republica) Kathmandu roads a nuisance in rainy season. The major roads of Kathmandu city were last repaired in 2007. (Source: Republica) Petroleum products, gold top import list. Country buys Rs 84.45 billion worth fuel, Rs 22.82 billion worth precious yellow metal. (Source: The Himalayan Times) Nepal Telecom starts Point of Presence (PoP) in Hong Kong. (Source: The Himalayan Times) Citizen Investment Trust role as market maker delayed. (Source: The Himalayan Times) Partial budget hits private sector hard. (Source: Republica) Macroeconomic model consistent with Millennium Development Goals (MDGs) unveiled. (Source: Republica) Canadian investors interested in energy, water processing. (Source: Republica) Exporters welcome relaxation of refinancing provisions. (Source: Republica) Social security expenses top pension costs. Karnali scheme a failure. (Source: The Kathmandu Post) Distribution of LPG cards held up again. Nepal Gas, Everest Gas and Salt Trading Corporation Gas have declined to provide information demanded by NOC. (Source: The Kathmandu Post) Facilities for former VIPs: As pressure mounts, Nepal, Poudel hand back vehicles to government. (Source: The Kathmandu Post) Hopes fading; govt set to seek new election date. (Source: The Kathmandu Post) Pokhara International Airport Plan on tarmac, Civil Aviation Authority of Nepal wary of financial turbulence. Pokharelis warn of shutting down domestic air terminal. (Source: The Himalayan Times) Court is hindrance against selling apartments to foreign nationals and non residents Nepalese. (Source: Karobar Daily) National Hydropower Company limited share transaction has been barred by Nepse on Share Registrars matter on Thursday. (Source: Karobar Daily)

MARKET INFORMATION

As of 11th Shrawan, 2069 Index NEPSE Sensitive Float Sen. Float NEPSE Sub-Indices Banking Dev. Bank Hydropower Finance Insurance Others Current Points Change %Change

401.54 103.76 31.23 28.27

-3.48 -0.97 -0.246 -0.269

Current Points Change

-0.85 % -0.924 % -0.78 % -0.94 %

%Change

371.58 -4.94 252.8 705.61 509.4 610.95 -0.87 4.04 0.36 -4.7

-1.312 % -0.343 % 0.576 % -0.336 % 0.071 % -0.7635 %

262.49 -0.88

Market Summary

Total Turnover Rs: Total Traded Shares Total Transactions Total Scrips Traded

55,155,815 236,767 1265 85

Total Market Capitalization Rs: 379,426.55 Millions

Floated Market Capitalization Rs:

72,823.09 Millions

www.sharesansar.com.np

International Business: Facebook hopes investors like first quarter earnings. (Source: The Kathmandu Post) India reforms seen on hold; politics to blame. (Source: The Kathmandu Post) Indian carmaker Maruti faces months of supply strain. (Source: The Kathmandu Post) Toyota regains top carmaker position. (Source: The Kathmandu Post) General News: NRB has given consent to Muktinath Bikas Bank Limited to expand its work from existing 3 district network to 10 districts from now on. (Source: Karobar Daily) Big investors names are being blacklisted on non- payment of interest or renew their loans in different BFIs. (Source: Karobar Daily) Sahara Nepal Limited (SAKOS) and Development Planning Service Center (DIPROX) Rs 3 billion is in danger due to continuous labor strike in both the financial companies from quite some time. (Source: Arthik Abhiyan) BFIs deposits have increased by Rs 150 billion during 11 months of fiscal year 2068/69. (Source: Arthik Abhiyan) Govt responsibility to different concerned organization has surpassed Rs 40 billion mark in five years. It increases @ Rs 4 billion every year on service and facility provided to them. (Source: Karobar Daily) Financial Highlights: Butwal based Shine Development Bank Limited has been able to earn Rs 70.30 operating profit during fiscal year 2068/69. (Source: The Himalayan Times)

Current and Upcoming Right Share:

Company

Nepal Express Finance Limited

Source: www.negosida.com.np As of 11th Shrawan, 2069

Open Date

17th Shrawan, 2069

Close Date

19th Bhadra, 2069

Ratio

1:0.11

Issue Manager

NCM Merchant Banking Limited

INVESTMENT DECISION:

The primary purpose of measuring the cost of capital is to use it as a financial standard for evaluating long-term investment projects. The cash flows expected during the life of the project are discounted at certain rate, which is the cost of capital. Cost of capital is required to compute net present value (NPV). Net present value (NPV) is present value of future cash flow discounted at firm's cost of capital less initial investment. If NPV is positive, the project is accepted. Similarly, under internal rate of return (IRR) approach, IRR is compared with cost of capital to take decisions.

Unaudited financial highlights as of 4th quarter of last fiscal year 2068/69:

Company Paid Up (Rs. In millions) Reserve (Rs. In millions) Net Profit/Loss (Rs. In millions) Operating Profit/Loss (Rs. In millions) NPL to total Loan (%) EPS (Rs.) PE Ratio (times) Net Worth Per Share Per Share total Asset Value (Rs.) Liquidity Ratio (%)

Source

City Development Bank 220 93.57 51.9 70.01 0.04 23.56 5.73 142.5 32.48

Karobar

Tinau Development Bank 100 25.38 10.15 15.95 0.39 10.15 10.14 125.39 1450.84 25.65

Arthik Abhiyan

Soaltee Hotel Limited 179.09 475.88 150.6 300.58 _ 8.41 27.35 36.57 _ _

Arthik Abhiyan

www.sharesansar.com.np

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Share Sansar Samachar of 04th October' 2012Document2 pagesShare Sansar Samachar of 04th October' 2012sharesansarNo ratings yet

- Share Sansar Samachar of 3rd October 2012Document2 pagesShare Sansar Samachar of 3rd October 2012sharesansarNo ratings yet

- Share Sansar Samachar of 24th September 2012Document2 pagesShare Sansar Samachar of 24th September 2012sharesansarNo ratings yet

- Share Sansar Samachar of 23rd August' 2012Document3 pagesShare Sansar Samachar of 23rd August' 2012sharesansarNo ratings yet

- Share Sansar Samachar of 5th September 2012Document2 pagesShare Sansar Samachar of 5th September 2012sharesansarNo ratings yet

- Share Sansar Samachar of 8th August 2012Document2 pagesShare Sansar Samachar of 8th August 2012sharesansarNo ratings yet

- Share Sansar Samachar of 7th August 2012Document2 pagesShare Sansar Samachar of 7th August 2012sharesansarNo ratings yet

- Share Sansar Samachar of 01st August' 2012Document2 pagesShare Sansar Samachar of 01st August' 2012sharesansarNo ratings yet

- Share Sansar Samachar of 6th August 2012Document2 pagesShare Sansar Samachar of 6th August 2012sharesansarNo ratings yet

- Share Sansar Samachar of 30th July' 2012Document3 pagesShare Sansar Samachar of 30th July' 2012sharesansarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Saln-Eugene Louie G. Ibarra Fy2023Document3 pagesSaln-Eugene Louie G. Ibarra Fy2023eugene louie ibarraNo ratings yet

- 5 Structured Products Forum 2007 Hong KongDocument11 pages5 Structured Products Forum 2007 Hong KongroversamNo ratings yet

- Annual Report PPFDocument71 pagesAnnual Report PPFBhuvanesh Narayana SamyNo ratings yet

- S4H 966 Sample Configuration TrackerDocument129 pagesS4H 966 Sample Configuration TrackerCleber CardosoNo ratings yet

- Unit 5 Iapm CapmDocument11 pagesUnit 5 Iapm Capmshubham JaiswalNo ratings yet

- Quizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Document3 pagesQuizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Ferb Cruzada80% (5)

- Reading Gaps in Charts PDFDocument11 pagesReading Gaps in Charts PDFkalelenikhlNo ratings yet

- Etf Playbook 1Document12 pagesEtf Playbook 1langlinglung1985No ratings yet

- 3rd LectureDocument4 pages3rd LectureHarpal Singh HansNo ratings yet

- Bank Branch AuditDocument384 pagesBank Branch AuditSachin PacharneNo ratings yet

- Winter Project Report (Mba) "Risk Management in Debt Funds of State Bank of India"Document79 pagesWinter Project Report (Mba) "Risk Management in Debt Funds of State Bank of India"ShubhampratapsNo ratings yet

- 11 Actividad #4 Crucigrama Contabilidad VDocument3 pages11 Actividad #4 Crucigrama Contabilidad VMaria F OrtizNo ratings yet

- FX MrktsDocument46 pagesFX MrktsSoe Group 1No ratings yet

- Isb540 - HiwalahDocument16 pagesIsb540 - HiwalahMahyuddin Khalid100% (1)

- 0450 m18 in 22Document4 pages0450 m18 in 22yoshNo ratings yet

- Non - Life Insurance - 6Document29 pagesNon - Life Insurance - 6Legese TusseNo ratings yet

- Summer Traning Report of Working Capital Manegment (CCBL)Document62 pagesSummer Traning Report of Working Capital Manegment (CCBL)PrabhatNo ratings yet

- Rey-Annjoysemacio: Page1of4 16lacewoodstsouthhillstisalabangon 9 7 9 9 - 2 4 8 7 - 1 1 Cebuprovincecebucity 6 0 0 0Document4 pagesRey-Annjoysemacio: Page1of4 16lacewoodstsouthhillstisalabangon 9 7 9 9 - 2 4 8 7 - 1 1 Cebuprovincecebucity 6 0 0 0Reyann SemacioNo ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023Document39 pagesBeepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023BRAJ MOHAN KUIRYNo ratings yet

- CH 18Document15 pagesCH 18Damy RoseNo ratings yet

- 3.kingsun Financial Statement FinalDocument22 pages3.kingsun Financial Statement FinalDharamrajNo ratings yet

- 705 - PGBP AdjustmentsDocument10 pages705 - PGBP AdjustmentsKumar SwamyNo ratings yet

- Cityam 2010-10-29Document52 pagesCityam 2010-10-29City A.M.No ratings yet

- Balance Sheet AnalysisDocument2 pagesBalance Sheet AnalysisAishaNo ratings yet

- 7 Audit of Shareholders Equity and Related Accounts Dlsau Integ t31920Document5 pages7 Audit of Shareholders Equity and Related Accounts Dlsau Integ t31920Heidee ManliclicNo ratings yet

- Dispute FormDocument1 pageDispute Formuzair muhdNo ratings yet

- 1000 Assets: Account # Account NameDocument24 pages1000 Assets: Account # Account NameGomv ConsNo ratings yet

- NCB Financial Group (NCBFG) - Unaudited Financial Results PDFDocument22 pagesNCB Financial Group (NCBFG) - Unaudited Financial Results PDFBernewsAdminNo ratings yet

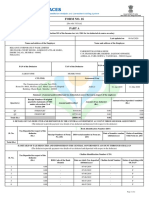

- Form No. 16: Part ADocument8 pagesForm No. 16: Part AParikshit ModiNo ratings yet

- MSC Finance and Strategy Online BrochureDocument12 pagesMSC Finance and Strategy Online BrochureSiphoKhosaNo ratings yet