Professional Documents

Culture Documents

MMFS

Uploaded by

NiteSh SnghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MMFS

Uploaded by

NiteSh SnghCopyright:

Available Formats

Asia Pacific Equity Research

19 January 2012

Mahindra & Mahindra Financial Services

A strong franchise, but macro headwinds are building up

MMFS enjoys a strong franchise in the auto financing NBFC space. Over the last few years, it has been a key beneficiary of rising rural spends which have enabled it to grow its loan book by 36% over FY09-12E. Incrementally, however, we see a moderation in rural economic growth. Hence, credit costs which are at cyclical lows will probably move up and growth should moderate a bit. On the upside, rate cycle seems to have peaked and any sharp downtick hereon will be a positive but this we believe is probably better played on some beaten down names. Valuations at 2.4x/1.9x FY12/13E P/B, are at a relative premium to peer group. Our Mar-13 PT at Rs600 implies 10% downside from current levels. We will become more constructive, if either valuations become more accommodative or asset quality continues to hold up despite macro challenges for another few Qs. Outlook for rural economy points to softness ahead: On balance, while we are constructive on the rural demand story in the medium term; in FY13, we see challenges emanating from a) slowing government spends given constraints on fiscal situation and b) increased pressure on farm margins given rising input costs.

Macro offers multiple challenges, though MMFS has withstood them well so far: Product diversification/scope for market share improvement, in our view, allows MMFS to counter auto sales slowdown. Tightening regulatory norms for NBFCs are likely to impact profits/capital position a bit. The company, however, appears to be well placed to benefit from any reversal in rate cycle and could claw back some part of ~80bps of funding cost it hasnt passed onto customers. Credit costs for MMFS continue to be at cycle low levels, though we assume some deterioration hereon.

Initiation

Underweight

MMFS.NS, MMFS IN Price: Rs672.00 Price Target: Rs600.00

India India NBFCs Saurabh Kumar

AC

(91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com J.P. Morgan India Private Limited

Gunjan Prithyani

(91-22) 6157-3593 gunjan.x.prithyani@jpmorgan.com J.P. Morgan India Private Limited

Seshadri K Sen, CFA

(91-22) 6157-3575 seshadri.k.sen@jpmorgan.com J.P. Morgan India Private Limited

Josh Klaczek

(852) 2800-8534 josh.klaczek@jpmorgan.com J.P. Morgan Securities (Asia Pacific) Limited

Price Performance

800 Rs 700 600 500

Jan-11 Apr-11 Jul-11 Oct-11 Jan-12

Valuations, PT: MMFS currently trades at 1.9x FY13E book with forward ROEs of 19-20%. The premium valuations in part reflect asset quality for the business, which has continued to hold up, and growth rates that are far outpacing the industry. Our Mar13 PT of Rs600 (COE=15%, ROE=20%) is based on 1.7x forward book at 10% discount to its post 2009 trading range. Key upside risks: a) earlier than anticipated sharp reversal in rates; b) sustained buoyancy in rural markets and c) asset quality holding up.

Mahindra & Mahindra Financial Services (Reuters: MMFS.NS, Bloomberg: MMFS IN) Year-end Mar (Rs in mn) FY10A FY11A FY12E FY13E Operating Profit (Rs mn) 7,420 8,592 10,685 14,283 Net Profit (Rs mn) 3,426 4,631 5,370 6,831 Cash EPS (Rs) 35.7 45.2 52.4 59.0 DPS (Rs) 7.6 10.2 11.5 13.0 EPS growth (%) 59.4% 26.6% 15.9% 12.6% ROE 21.4% 22.0% 20.0% 19.3% P/E 18.8 14.9 12.8 11.4 P/BV 3.7 2.8 2.4 1.9

Source: Company data, Bloomberg, J.P. Morgan estimates.

MMFS.NS share price (Rs) BSE30 (rebased)

Abs Rel

YTD 7.1% 1.0%

1m 4.9% -2.2%

3m 4.2% 7.5%

12m 5.3% 18.1%

Company Data 52-wk range (Rs) Market cap ($ mn) Price (Rs) Date Of Price 3mth Avg daily volume Average 3m Daily Turnover ($ mn) BSE30 Exchange Rate

840.00 - 590.00 1,378 672.00 19-Jan-12 0 1.55 16,466 50.71

See page 34 for analyst certification and important disclosures, including non-US analyst disclosures.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. www.morganmarkets.com

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Company Description Mahindra & Mahindra Financial services (MMFS) is a leading non banking finance company catering to rural and semi urban markets. MMFS is primarily engaged in providing financing for new and preowned auto, utility vehicles, tractors, cars and commercial vehicles. MMFS is a part of Mahindra group, which is one of the largest conglomerates in India. M&M Auto sales account for ~30% of MMFS financing portfolio.

P&L sensitivity metrics NIMs Impact of each 10bps Cost to Income Impact of each 10bps Source: J.P. Morgan estimates

FY12E ROA impact (%) 0.07%

FY12E ROE impact (%) 0.4%

0.07%

0.4%

Price target and valuation analysis Initiate with Underweight. Our Mar13 PT of Rs600 is based on 1.7x FY13 book. Our normalized ROE assumption is based on NIMs of 10.5% and credit costs (at 1.9%) which are higher by 50bps vs. current levels. Key upside risks include a) an earlier than anticipated sharp reversal in rates; b) sustained buoyancy in rural markets and c) asset quality holding up well. Valuation Assumptions Risk free rate Equity risk premium Beta Cost of Equity Terminal growth Stage 2 growth Mar-13 Price Target Normalized ROE NII/AUM Cost to income Provisions/AUM ROA ROE Consensus 55.8 68.6

O/S loan book (as of Jun-11)

Off books (securitization) 10%

8.7% 6% 1.2 15.0% 11% 14% 600 10.5% 3.7% 1.9% 3.2% 20%

Loans (On books) 124,650 90%

Source: Company

EPS: J.P. Morgan vs consensus J. P. Morgan FY12E 52.4 FY13E 59.0

Source: Bloomberg, J.P. Morgan estimates

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Earnings estimates for the company have been going up but there have been some cuts at the margin

Table of Contents

Investment thesis .....................................................................5

Growth is likely to moderate in rural economy.........................................................5 Asset quality is at cyclical low levels; we expect some worsening incrementally ......6 Market share gain/new segment diversification offer opportunities to more than offset macro growth concerns..................................................................................7 Regulatory norms will impact headline numbers but impact is technical and not likely a big stock catalyst.........................................................................................8 Rates have likely peaked. Timing and extent of rate cut are more important from stock price perspective ............................................................................................8 Capital adequacy currently is healthy. However it is consuming capital fast- May look to dilute in FY13. ............................................................................................9

Rural growth slowing at the margin; longer term outlook albeit remains positive Dec-11 Sales Bajaj Auto Domestic Sales TVS Motors Domestic Sales Mahindra Tractor Sales % ch Y/Y 3% -2% 0%

SWOT analysis........................................................................11 Valuation and share price analysis.......................................12

Normalized ROE of 20%.......................................................................................12 Share price performance........................................................................................12 Valuations 1.9x P/B levels are in line with average of post GFC trading range....13

Business outlook....................................................................15

Outlook for rural economic growth seems sedate ...................................................15 Market share gains, new growth segments should help offset slowdown in auto sales .............................................................................................................................17 Asset quality improvement driven by new product lines and better collection efficiency..............................................................................................................19 Strong parentage offers brand recall and synergistic benefits ..............................19 Established track record with a wide branch network and dealer tie ups..................21 Capital adequacy is strong. But since co is consuming capital fast, it may need to dilute in FY13. ......................................................................................................21 Regulatory uncertainty persists. However, company should be able to withstand the headwinds.............................................................................................................22 NIM compression imminent given growth in lower yield segments and increased funding costs.........................................................................................................24

Valuations in line with post GFC trading range

3.0 2.5 2.0 1.5 1.0

Avg - 1.9x

Nov-09

Nov-10

Nov-11

Capital raise may be required in FY13E

20.00% 16.00% 12.00% 8.00% 4.00% 0.00% FY09 FY10 Tier I Tier II FY11 FY12E 2.10% 2.40% 3.30% 2.1% 17.30% 16.10% 17.00% 14.2%

Source: Bloomberg, J.P. Morgan estimates, Company reports

May-09

May-10

May-11

Business and management brief ..........................................26 Financial Analyses .................................................................29

Mahindra & Mahindra Financial Services: Summary of financials..........................33

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Initiate with Underweight; Price Target Rs600

We initiate on Mahindra Finance with Underweight rating and Mar-13 PT of Rs600/share. This is a relative sector UW vis-a-vis stock positioning in the financials space. While we like the strong business model of the company and its positioning in the semi urban/rural business on a medium term basis; for FY13 , we see a slowing rural macro as a key overhang on the business. Further, we think a rate cut story can be played better by looking at more beaten down names within the peer group. The PT implies 1.7x FY13E P/B and is derived from a 3 stage Gordon Growth model based on a normalized ROE of 20% with a COE of 15%. This implies a 10% discount to the post 2009 trading range for the company. Our normalized ROE assumption is consistent with last 3 years historical and forecast realized returns for the business. Key upside risks to our rating and price target are a) earlier than anticipated sharp reversal in rates; b) Sustained buoyancy in rural markets and; c) Asset quality continues to hold up well.

Table 1: MMFS - Key financial forecasts

NIM (%) GNPA (%) ROA (%) ROE (%) EPS (Rs/share)

Source: Company reports and J.P. Morgan estimates.

FY10 12.7% 6.1% 4.1% 21.4% 35.7

FY11 12.0% 4.4% 4.1% 22.0% 45.2

FY12E 10.6% 3.7% 3.2% 20.0% 52.4

FY13E 10.4% 3.9% 3.0% 19.3% 59.0

Figure 1: MMFS - Valuation Assumptions

Mar-13 Price Target Cost of Equity Normalized ROE Terminal growth Stage 2 growth

Source: J.P. Morgan estimates.

600 15.0% 20% 11% 14%

Figure 2: MMFS - ROA trends (%)

4.5% 4.0% 3.5% 3.0% 2.5% 2.0% FY08 FY09 FY10 FY11 FY12E FY13E

Source: Company reports and J.P. Morgan estimates.

Figure 3: MMFS- ROE trends (%)

22.0% 4.1% 4.1% 20.0% 3.2% 18.0% 3.0% 16.0% 14.0% FY09 FY10 FY11 FY12E FY13E

Source: Company reports and J.P. Morgan estimates.

22.0% 21.4% 20.0% 19.3%

2.9% 2.5%

15.4%

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Investment thesis

Growth is likely to moderate in rural economy

The last couple of years have been exceptionally good for rural economic buoyancy driven by fiscal measures and programs such as MNREGA, good monsoons and improvement in farm productivity. This in turn has aided growth for semi urbanrural financing companies like MMFS. Going ahead, however, outlook for rural economic growth looks sedate. Margins in the farm sector are getting compressed due to rising cost of fertilizers/seed and labor. Further, inflation/ fiscal deficit will likely prompt the government to curtail expenditure growth. Added to this is a high base effect of last two years growth and inherent unpredictability of monsoons. Hence, growth rates of the past might not be achievable in FY13. This is becoming evident in the commentary from OEMs and FMCG players. In Dec-2011, Bajaj Auto and TVS Motors and Maruti reported sedate domestic sales trends and Mahindras tractor sales were flat Y/Y.

Table 2: Monthly Sales Trends (In unit nos)

Bajaj Auto Domestic Sales TVS Motors Domestic Sales Mahindra Tractor Sales Maruti Domestic Sales

Source: Companies

Dec-11 185,982 146,747 16,389 77,475

Dec-10 181,415 149,357 16,334 89,469

%YoY 3 (2) 0 (13)

Nov-11 245,221 148,558 17,527 82,870

%MoM (24) (1) (6) (7)

FY12YTD 2,099,986 1,441,811 183,300 6,84,892

FY11YTD 1,947,859 1,319,998 154,266 8,20,350

% YTD 8 9 19 (17)

Having noted this, on a longer term basis, in our view, the rural farm sector is likely to remain a focus area for the government and fiscal stimuli may keep coming in some form or other. Tabling of the recent food security bill, mandatory increases in minimum support prices (MSP) and enhanced compensation demanded for farmers in the land acquisition bill are just a few points which support this case. Hence, on balance, while we are constructive on a medium term basis on the rural demand story; for FY13 we see challenges emanating from slowing fiscal spends , pressure on farm margins given rising input costs, which would likely moderate rural business growth.

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Historical drivers of rural spend

Figure 4: Nominal rural wages pre and post NREGA Figure 5: Real rural wages trends

Source: Ministry of Statistics and Program Implementation

Source: Ministry of Statistics and Program Implementation

Figure 6: Trends in MSP of Wheat and Paddy

25% 20% 15% 10% 5% 0% 1999-00 11% 7% 8% 5% 5% 4% 2000-01 2001-02 4% 4% 3% 2% 2% 0% 0% 2002-03 2003-04 2004-05 2005-06 9% 9% 21% 20% 18% 11% 8% 21%

Figure 7: Monsoons have been near normal levels in India last year

15% 8% 4% 0% 2011-12

2006-07

2007-08

2008-09

2009-10

2010-11

Paddy MSP % ch Y/Y

Wheat MSP % ch Y/Y

Source: Ministry of Statistics and Program Implementation

Source: Ministry of Statistics and Program Implementation

Asset quality is at cyclical low levels; we expect some worsening incrementally

Going back into history, MMFS had consistently clocked GNPA levels of 7-8%, which have since come down, thanks to rural economic growth. Diversification out of core tractor business into lower NPA segments like Cars/ UVs have also helped the asset quality. However, in our view, current credit costs for the company are currently at near cycle low levels. Going ahead, we expect some increase given an overhang of rural growth moderation. Till now, to its credit, the company hasnt shown any signs of stress

6

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

herein which is a marked variance from other peers /banks. For our normalized ROE calculation, we work with 1.9% credit cost, which is almost at 40bps premium to current credit cost levels.

Figure 8: MMFS - Gross NPA and NPA (%)- current levels combination of cyclicality and structural change away from tractors

10.0% 9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% 8.7% 7.5% 7.7% 6.4% 4.8% 2.8% 3.7% 3.2% 5.5% 2.5% 2.9% 7.6% 6.4% 4.0% 2.6% 0.9% FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 0.6% FY11 0.7% 0.9% FY12E FY13E 3.7% 3.9%

2.3%

GNPA (%)

Source: Company reports and J.P. Morgan estimates.

Net NPA (%)

Market share gain/new segment diversification offer opportunities to more than offset macro growth concerns

MMFS has been steadily diversifying into newer segments of auto financing over the last few years. This diversification has enabled the company to counter slowdown in specific parts of the auto industry and compensate with market share gains in new growth areas. Asset quality has also improved for the company as a result of this and overall buoyancy in rural markets. Over 1HFY12, MMFSs loan book growth of 45% has far outpaced industry growth, highlighting the resilience of the business. Going ahead, while industry sales are likely to show some moderation and so would MMFS, growth rate for the company should be better than industry average.

Table 3: MMFS: Product Segments and yields

Avg. financing Yields Utility Vehicle (UVs) Cars Tractors Commercial Vehicles (CVs) 17-19% 15-18% 18-21% 14-16% JPM FY13 industry growth outlook 12-14% 12-14% 10-12% 10-12% Outlook for MMFS sales In line with parent company sales. This should register above industry growth on new product launches by M&M Better than industry. Targeting higher share here on tie ups with new entrants in rural markets like Volkswagen, Hyundai, Tata etc. Historically, Maruti accounted for majority of portfolio (75-80%) herein In line with parent. Tractor growth rates should moderate to 10-12% levels. Recent datapoints on slowdown in Nov/Dec have been concerning Better than industry. Newer segment and hence lower base. Company expects market share to increase given low base and M&M rural footprint. It expects CV share to increase to 15% from c11% of overall portfolio over the next 2-3 years. Overall industry numbers are likely to be below historical avg given sluggish IIP trends . Better than industry. Newer segment. Company expects market share to increase given low base and M&M rural footprint. It expects pre owned vehicle share to increase to 10% from c6% of the portfolio over the next 23 years.

Pre-Owned

22-23%+

NA

Source: Company, J.P. Morgan

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Regulatory norms will impact headline numbers but impact is technical and not likely a big stock catalyst

Regulations are a big overhang on the NBFC sector in general. Specifically for MMFS the key regulations that would impact its business would be: 1. 2. 3. Introduction of a 90-day NPA recognition norm and tightening of provisioning requirements; No credit enhancements being offered on assignment transactions and; Ensuring Tier 1 capital at minimum at 12% with overall CAR at 15%.

Impact: Regarding 90-day norm, if it comes through, the NPA levels (even though technical) are likely to move up by 100-150bps and would then impact earnings by 5% downwards. Regarding securitization and Tier 1 capital, we think MMFS is comfortable on both those accounts as off balance sheet portfolio was never a big funding source for the company (10% of assets) and FY12E tier 1 capital at 14.2% is comfortably above regulatory norms. There could likely be a marginal hit to the companys Tier 1 capital, if securitization shifts to PTC route as opposed to direct assignments. We note that most of these suggested norms are already in the public domain and as such market has taken cognizance of the same. NBFCs are currently trying to reason with RBI for some concessions. Further, even if the regulations come in, NBFCs will likely get a reasonably long (1-3 years) time frame to implement it, thus cushioning any impact. As such this overhang, in our view, is looking at the rear view mirror and since close to worst combination is already known it can be priced in.

Rates have likely peaked. Timing and extent of rate cut are more important from stock price perspective

Given the growth inflation trade off, in its last policy RBI has stuck to a dovish tone indicating that from this point on, monetary policy actions are likely to reverse the cycle, responding to the risks to growth. Looking at the forward market, short end of the curve (overnight rates) are now forecasting a sharp 140bps cut over the next 12 months. J.P. Morgan economists, however, expect a pause till April and currently do not believe that sharp rate cuts may come through. Extent and timing of rate cuts then are likely to be important for stock performance hereon. In our assumptions we are factoring in a 50bps cut in FY13.

Table 4: Overnight rate expectations

12M swap Overnight 8.0 8.7 Fall expected in wholesale financing rates over next 12 months -140

Source: Bloomberg, J.P. Morgan

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Table 5: MMFS - NIM Sensitivity to rates

100bps 50bps 0bps

Source: Company reports and J.P. Morgan estimates.

FY13 NIM (%) 10.5% 10.4% 10.3%

Capital adequacy currently is healthy. However it is consuming capital fast; May look to dilute in FY13E

MMFS's capital adequacy is strong at 23.3% (as of FY11) and comfortably above regulatory CAR requirement of 15%. However, given growth in asset base, the company is consuming capital fast, and we believe might need to raise capital. We estimate it would need to raise Rs8B to get back its FY13 tier 1 to 17% (historical average), which would otherwise fall below 14%. We note that in the interim, the company has additional levers to fund growth, i.e. raising of tier 2 capital, which is currently low at 3.3%, and resorting to additional securitization, which the company has held back due to regulations.

Figure 9: MMFS - Capital Adequacy ratios

20.00% 16.00% 12.00% 8.00% 4.00% 0.00% FY09 FY10 Tier I

Source: Company reports and J.P. Morgan estimates.

17.30%

16.10%

17.00%

FY13 may require a capital raise to sustain the growth

14.2%

2.10%

2.40%

3.30%

2.1% FY12E

FY11 Tier II

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

MMFS trades at a premium to sector on relative valuations

Post 2008 GFC, MMFS has traded at an average P/B valuation of 1.9x. MMFSs current valuation at 1.9x forward P/B is in line with the aforesaid trading range. From a risk reward perspective, the stock has traded between 1.1-1.9x forward P/B, which then places it at the mid point of the post GFC trading range. Relative to sector and auto financing NBFCs, however, the company trades at a marked premium despite its ROE not being far better than peer group. Valuation in this context then looks a bit stretched, in our view.

Figure 10: NBFC Valuations (FY13 P/B)

2.5

2.0 MMFS 1.5 IDFC 1.0 POWF GICHF 0.5 10.0 12.0 14.0 16.0 18.0 20.0 22.0 DEWH REC SUF SHTF

LICHF

24.0

26.0

Source: J.P. Morgan estimates, Bloomberg

Figure 11: MMFS - Average trading range post GFC

3.0 2.8 2.6 2.4 2.2 2.0 1.8 1.6 1.4 1.2 1.0

Average - 1.9x

May-09 Aug-09 Nov-09 Feb-10 May-10 Aug-10 Nov-10 Feb-11 May-11 Aug-11 Nov-11

Source: Company, J.P. Morgan estimates, Bloomberg

10

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

SWOT analysis

Strength One of the leading players in the auto financing market with strong parent (Mahindra). The company has 570 offices covering 24 states / 4 union territories, with over 1.7million vehicle finance customer contracts since inception. Weaknesses Funding costs face upside pressures. Company till date has had to absorb around 80bps of funding cost increase which it hasnt passed on to customers. Slowdown in certain sectors of auto sales like tractors and cars might pressure loan growth near term.

Exposure primarily to rural and semi urban market where Monsoons can have a significant impact on rural sector cashflow buoyancy has ensured growth and sound asset cash flows and as such a weak monsoon can be challenging quality. for asset quality. Contribution from parent business (M&M) sales. 30% of the company's business comes from Mahindra sales. Diversification in newer segments ensures higher than industry average growth given low base and companys existing rural footprint. Opportunities Threats Implementation of new government policies to aid rural Regulation especially on account of transitioning to a 90consumption on the lines of NREGA (i.e. Food Security day NPA norm and securitization guidelines which Bill, Higher compensation for land under proposed Land effectively means direct assignment transactions will be Acquisition Act). difficult to close. Entry into newer segments such as CVs and pre owned vehicles. Up-scaling of average loan ticket size by upgrading to a higher ticket size market. Diversification out from Mahindra into newer manufacturers especially in cars to offset a slowdown there. Longer term value accretion from subsidiaries i.e. Rural housing finance, Insurance broking , USA LLC and in house BPO. Competition from other NBFCs and Banks exists, but we dont think it is serious enough at this stage to challenge MMFSs core business growth currently.

11

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Valuation and share price analysis

Normalized ROE of 20%

We are working with a normalized ROE of 20% compared to last 2-year average levels of 21.7%. On our assumptions current low levels of credit costs are far below cycle average and hence will likely inch up. There is however some scope for improvement via operating cost efficiencies and NIM expansion which have been under pressure given spate of rate hikes.

Table 6: MMFS - ROE assumptions

Normalized ROE NIM Opex Provisions PBT PAT Leverage Normalized ROE

Source: Company reports and J.P. Morgan estimates.

Normalized 10.50% -3.70% -1.90% 4.9% 3.2% 6.25 20%

FY12E 10.6% -4.1% -1.5% 4.9% 3.2% 6.2 20%

FY13E 10.4% -4.0% -1.7% 4.6% 3.0% 6.4 19%

Share price performance

MMFS's stock has seen sharp re-rating post the 2008 GFC meaningfully outperforming the broader markets. This is on the back of strong loan growth and historic low NPA levels reported by the company over the last two years. The stock is closely correlated to the performance of the rural economy, which has been good over the past two years on the back of NREGA scheme and favorable monsoon. Recent share price performance (over last one month) has been weak on a relative basis due to the slowdown in the auto industry and funding pressures. Parent M&M also reported sluggish tractor sales numbers for Nov/Dec, which has led to some concerns on weakening rural demand. These concerns coupled with regulatory headwinds (securitization norms/NPA recognition cycle) could continue to weigh on the stock price in the near term, in our view.

Figure 12: MMFS - Relative share price performance to Sensex

450 400 350 300 250 200 150 100 50 -

12/1/2006

12/1/2007

12/1/2008

12/1/2009

12/1/2010

MMFS

Source: Bloomberg

Sensex

12

12/1/2011

6/1/2006

9/1/2006

3/1/2007

6/1/2007

9/1/2007

3/1/2008

6/1/2008

9/1/2008

3/1/2009

6/1/2009

9/1/2009

3/1/2010

6/1/2010

9/1/2010

3/1/2011

6/1/2011

9/1/2011

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Table 7: MMFS & M&M share price performance

MMFS M&M

Source: Bloomberg

1M 1.8 6.9

3M 4.2 (13.2)

6M (4.0) (2.2)

12M 5.3 (4.2)

Valuations 1.9x P/B levels are in line with average of post GFC trading range

Post GFC, MMFS has traded at an average P/B multiple of 1.9x. MMFSs current valuations (at forward P/B of 1.9x) are in line with the aforesaid average trading range. From a risk reward perspective, the stock historically has bottomed out at 1.1x book and peaked at 2.9x forward book. Current valuations then place it broadly near the mid point of that range.

Figure 13: Post GFC, Average P/B valuation range

3.0 2.8 2.6 2.4 2.2 2.0 1.8 1.6 1.4 1.2 1.0

Average - 1.9x

May-09 Aug-09 Nov-09 Feb-10 May-10 Aug-10 Nov-10 Feb-11 May-11 Aug-11 Nov-11

Source: Company, Bloomberg, J.P. Morgan

Figure 14: Historical P/B Valuation range

3.2 2.8 2.4 2.0 1.6 1.2

11/1/2007 12/1/2009 10/1/2010

Figure 15: Historical P/E Valuation range

16.0 14.0 12.0

Mean - 10.3x

Mean - 1.8x

10.0 8.0 6.0

3/31/2006 8/31/2006 1/31/2007 6/30/2007 4/30/2008 9/30/2008 2/28/2009 7/31/2009 5/31/2010 3/31/2011 11/30/2007 12/31/2009 10/31/2010 8/31/2011

0.8

3/1/2006 8/1/2006 1/1/2007 6/1/2007

4.0

4/1/2008 9/1/2008 2/1/2009 7/1/2009 5/1/2010 3/1/2011 8/1/2011 1/1/2012

P/B

Mean

Mean - 1SD

Mean + 1SD

P/E

Source: Company, Bloomberg, J.P. Morgan.

Mean

Mean - 1SD

Mean + 1SD

Source: Company, Bloomberg, J.P. Morgan

13

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Relative to other NBFCs, MMFS on a P/B vs. ROE framework, falls above the relative value range. While premium relative to peers is partly attributable to solid asset quality and loan growth trends registered by the company; we believe valuations at current levels appear stretched especially as RoEs are not far superior relative to its peers. Further, MMFS is also trading at a premium (20-30%) to private sector banks (ICICI/Axis Bank). The valuation premium, on P/B basis, for the company (relative to banks) is on the higher end of the historical trading range.

Figure 16: Valuations FY13 P/B vs. RoE

2.5

2.0 MMFS 1.5 IDFC 1.0 POWF GICHF 0.5 10.0 12.0 14.0 16.0 18.0 20.0 22.0 DEWH REC SUF SHTF

LICHF

24.0

26.0

Source: Company, Bloomberg, J.P. Morgan estimates.

Figure 17: MMFS P/B valuation relative to Axis Bank

1.4 1.2 1.0 0.8 0.6

11/1/2006 11/1/2007 11/1/2008 11/1/2009 11/1/2010 11/1/2011

Figure 18: MMFS P/B valuation relative to ICICI Bank

1.6 1.4 1.2 1.0 0.8 0.6 0.4

8/1/2006

0.4

8/1/2006

2/1/2007

5/1/2007

8/1/2007

2/1/2008

5/1/2008

8/1/2008

2/1/2009

5/1/2009

8/1/2009

2/1/2010

5/1/2010

8/1/2010

2/1/2011

5/1/2011

8/1/2011

11/1/2006

11/1/2007

11/1/2008

11/1/2009

11/1/2010

MMFS/AXSB

MMFS/ICICIB

Source: Bloomberg, J.P. Morgan estimates Source: Bloomberg, J.P. Morgan estimates

Table 8: Indian NBFC Valuations

Name MMFS Shriram Transport LIC Housing Finance HDFC IDFC REC POWF GIC Housing Finance Dewan Housing SUF Mkt Cap US$MM 1,369 2,472 2,368 19,902 3,406 3,335 4,026 92 426 594 Price/book FY12E FY13E 2.3 1.8 2.0 1.7 2.4 2.0 5.0 3.9 1.5 1.4 1.1 1.0 1.0 0.9 0.9 0.8 1.2 1.0 1.7 1.5 RoE FY12E 20.0 24.1 21.9 22.4 13.1 20.3 15.3 14.2 18.4 19.0 FY13E 19.3 21.8 23.9 22.0 13.3 20.8 16.2 16.5 20.4 19.9 P/E FY12E 12.6 9.4 11.9 23.7 11.5 5.9 7.2 6.6 6.9 9.8 FY13E 11.2 8.5 9.0 20.2 10.2 5.0 5.6 5.1 5.3 8.1 Earnings growth FY12E FY13E 16% 13% 7% 10% 2% 32% 18% 17% 16% 12% 9% 18% -9% 29% -44% 31% 27% 32% -22% 20%

Source: Company, Bloomberg estimates. Pricing as of Jan-18th close.

14

11/1/2011

2/1/2007

5/1/2007

8/1/2007

2/1/2008

5/1/2008

8/1/2008

2/1/2009

5/1/2009

8/1/2009

2/1/2010

5/1/2010

8/1/2010

2/1/2011

5/1/2011

8/1/2011

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Business outlook

Outlook for rural economic growth seems sedate

The last couple of years have been exceptionally good for rural economic buoyancy driven by fiscal measures and programs such as MGNREGA, good monsoons and improvement in farm productivity. This in turn has aided growth for semi urbanrural financing companies like MMFS. However, near term outlook for rural economic growth appears sedate as inflation/ fiscal deficit prompts the government to curtail expenditure growth. Also, margins in the farm sectors are getting compressed given rising cost of fertilizers/seed and labor. This along with a high base effect of last two years growth and inherent unpredictability of monsoons imply that growth at margins will likely moderate. This is becoming evident in the commentary from OEMs and FMCG players. In Dec-2011, Bajaj Auto and TVS Motors reported sedate domestic sales trends and Mahindras tractor sales were flat y/y. Correspondingly, managements have lowered volume guidance as well.

Table 9: Monthly Sales Trends (In unit nos)

Bajaj Auto Domestic Sales TVS Motors Domestic Sales Mahindra Tractor Sales

Source: Companies

Dec-11 185,982 146,747 16,389

Dec-10 181,415 149,357 16,334

%YoY 3 (2) 0

Nov-11 245,221 148,558 17,527

%MoM (24) (1) -6

FY12YTD 2,099,986 1,441,811 183,300

FY11YTD 1,947,859 1,319,998 154,266

% YTD 8 9 19

Having said this, however on a longer term basis, the rural farm sector is likely to remain a focus area for the government. Tabling of the recent food security bill, mandatory increases in minimum support prices (MSP) and enhanced compensation demanded for farmers in the land acquisition bill are just a few points which support this case. On balance, while we are constructive on a longer term basis on the rural demand story, for FY13, we see challenges emanating from slowing fiscal spends, pressure on farm margins (rising input costs), which would likely slow down near term rural growth. What have been the historical drivers of consumption growth? A brief look back at history might be instructive here to see the main propellers of rural growth and assess risks for each of them. Over the last few years we find the principal drivers of the rural economy (40%+ of Indias GDP) have been twofold i.e. 1. Fiscal stimuli (MGNREGA) that has helped push up wages and improve mechanization- Advent of NREGA has resulted in a sharp increase in rural wage inflation. Real rural wages have increased by 13% Y/Y in 2011. The numbers pre and post NREGA are striking. Rural nominal wages post NREGA (i.e. between 2006 and 2009) have registered a CAGR of 9.7% Y/Y, a 3x increase compared to pre NREGA increase of just 2.7% pa (i.e. b/w 1999-2006). Importantly, the desire to index NREGA wages to

15

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

inflation has effectively institutionalized the wage-price in the rural economy.

Figure 19: Nominal rural wages pre and post NREGA Figure 20: Real rural wages trends

Source: Ministry of Statistics and Program Implementation

Source: Ministry of Statistics and Program Implementation

Additionally, going ahead in 2012, the government has recently tabled the Food Security Bill. This aims to enhance the scale and scope of food subsidies across the country (75% of the rural population and 50% of urban population). To implement this, a massive effort will be needed to procure 60-65 million tones (vs. c50-55 mt) of food grains to fulfill the mandated requirement. Minimum support prices (MSPs) might then have to be increased in order to incentivize production. Note that minimum support prices of key crops i.e. paddy and rice for FY12 anyway have been hiked by 8%/ 15% Y/Y respectively and are higher than average increases done over the last 10 years.

Figure 21: Minimum Support Prices for key crops on a rise

25% 20% 15% 10% 5% 0% 1999-00 11% 7% 8% 4% 2000-01 2001-02 5% 4% 2002-03 5% 4% 2003-04 3% 0% 2% 0% 2% 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 20% 9% 9% 21% 21% 18% 11% 8%

15% 8% 4% 0%

Paddy MSP % ch Y/Y

Source: Food Corporation of India

2004-05

2011-12

Wheat MSP % ch Y/Y

16

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

The main issue on hand then for FY13 is the financing of this fiscal stimuli. Fiscal deficit / high inflation in India is constraining governments ability to continue with such spends. Growth slowdown and correspondingly lower revenue numbers only add to such pressures and could keep additional spending in check. Further, issues on lack of productivity of subsidy schemes also remain. MGNREGA spends in 2012 have already moderated to some extent. In sum, while the rural economy will likely continue to be a focus area for the government longer term, in the near term the governments ability to finance any major fiscal program would be challenged and will likely lead to growth moderation. 2. Favorable monsoon In 2011, the monsoon has turned out to be quite favorable with a good spatial distribution across the country. Cumulative rainfall over Jun-Sep was 2% above normal, with normal rains across most of the India (ex- some parts of North Eastern region). This should then ensure that cash flows due to crop harvest in 2011 should continue into at least 1H12. However, given inherent unpredictability of this, an outlook on 2012 is difficult to provide here.

Figure 22: India Monsoon - Rainfall Distribution

Source: IMD

Market share gains, new growth segments should help offset slowdown in auto sales

MMFS has been steadily diversifying into newer segments of auto financing over the last few years. The company has moved out of its traditional bastion of tractor/UV financing business into newer markets such as cars, CVs and construction equipment. Overall share of UV/tractor financing over time has fallen to 52% in FY11 from 62% levels in FY05 and almost 100% prior to FY02. This diversification has then enabled the company to counter slowdown in specific parts of the auto industry and compensate with market share gains in new growth areas. Asset quality has also improved for the company as a result of this.

17

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Going ahead, while industry sales are likely to show some moderation, we believe MMFS is likely to better industry growth rates on the back of market share gains especially in car and CV financing. Over 1HFY12, the company's loan book growth of 45% has far outpaced industry growth, highlighting the resilience of the business. Our industry growth outlook for specific business is listed below.

Table 10: MMFS: Product Segments and yields Avg. financing Yields Utility Vehicle (UVs) Cars 17-19% 15-18% JPM FY13 industry growth outlook 12-14% 12-14% Outlook for MMFS sales

In line with parent company sales. This should register above industry growth on new product launches by M&M Better than industry. Targeting higher share here on tie ups with new entrants in rural markets like Volkswagen, Hyundai, Tata etc. Historically, Maruti accounted for majority of portfolio (7580%) herein In line with parent. Tractor growth rates should moderate to 10-12% levels. Recent slowdown in Nov/Dec has been a point of concern in an overall decent year Better than industry. Newer segment and hence lower base. Company expects market share to increase given low base and M&M rural footprint. It expects CV share to increase to 15% from c11% of overall portfolio over the next 2-3 years. Overall industry numbers are likely to be below historical average given sluggish IIP trends Better than industry. Newer segment. Company expects market share to increase given low base and M&M rural footprint. It expects pre owned vehicle share to increase to 10% from c6% of the portfolio over the next 2-3 years

Tractors Commercial Vehicles (CVs)

18-21% 14-16%

10-12% 10-12%

Pre-Owned

22-23%+

NA

Source: Company, J.P. Morgan

Figure 23: MMFS - Segment wise AUM break up

100% 80% 60% 40% 20% 0% FY08 FY09 FY10 Tractors (M&M) Pre owned vehicles & others FY11 FY12 FY13 Auto/ Utility Vehicles (M&M) Commercial vehicles and construction equipments

Source: Company reports and J.P. Morgan estimates.

7% 7% 23% 25% 38%

6% 7% 24% 25% 38%

6% 8% 30% 23% 33%

6% 9% 31% 23% 31%

6% 10% 33% 22% 29%

6% 12% 35% 20% 27%

Cars and others (including non M&M)

18

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Asset quality improvement driven by new product lines and better collection efficiency

Asset quality trends have witnessed meaningful improvement over the last two years with gross non performing assets coming down to ~4% levels from highs of 8.7% in FY09. This has been supported by following factors1. Product diversification- Shift in product mix to lower yield segments like CVs, CE and cars is likely to result in NIM compression; however, these are relatively low risk segments and provide comfort of better asset quality. UVs/tractors (primarily M&M portfolio) now account for 52% of overall loan book vs. 62% in FY05 and almost 100% prior to FY02. Lower LTVs and better collection efficiency- Overall the company has brought down the LTVs to 70% levels and higher focus has been placed on improving recovery processes over the last few years. Technological improvements coupled with NPA linked incentives for employees have helped the company keep better control over collections and NPA levels. Buoyant rural cashflows have also resulted in asset quality improvement. MMFS made aggressive provisions for bad quality loans over FY08-09; however robust rural economy led to loan upgrades with net NPA coming down to 0.6% from 2.5-3% pre FY09. Correspondingly, provision coverage has increased to >85% from 50% levels.

2.

3.

Overall retail asset quality has been better than historical trend thanks to rural economy. Going ahead, we expect it to remain largely stable over the next 2 years despite the shift to lower risk segments.

Figure 24: MMFS - GPA and net NPA trends

10.0% 9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% 8.7% 7.6% 5.50% 2.9% 2.6% 0.9% FY07 FY08 FY09 GNPA

Source: Company, J.P. Morgan estimates

6.4% 4.0% 2.50% 3.7% 0.7% FY12 3.9% 0.9% FY13

0.6% FY11

FY10 Net NPA

Strong parentage offers brand recall and synergistic benefits

M&M, promoter of MMFS and flagship company of Mahindra Group, is one of the leading players in automotive and farm equipment in semi urban and rural markets with a presence of over 65 years. M&M has a strong presence in the utility vehicles and tractor segment commanding a market share of 61% and 42% respectively. M&Ms leadership position in UV and tractor segment offers synergistic benefits with MMFS being the preferred financier for M&M sales in rural markets. Further,

19

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

MMFS also enjoys strong brand recall and customer trust in these markets given the long track record (65 years), local market knowledge and dealership network of the parent (>1000 dealerships). MMFSs growth in tractor/UV segment has largely been tracking M&Ms volume trends. Currently, MMFS accounts for ~30% of the parent's sales primarily coming from UV/tractor segment; however this should continue to come down as company gains market share in newer growth areas. On the funding side, a strong parent also supports MMFS good credit ratings (AA+) from rating agencies and thereby lowering cost of funds relative to competition.

Figure 25: M&M Long term volume trends

800 700 600 500 400 300 200 100 0 2002

Source: Company

758 664 567 457 294 326

FY02-11 CAGR of 19%

232 272

123

133

167

210

2003

2004

FY05

FY06

FY07

FY08

FY09

FY10

FY11 FY12E FY13E

Figure 26: Tractor Sales Recent data points (over Nov/Dec) have been sedate

35000 30000 25000 20000 15000 10000 5000 0 41% 43% 28% 14% 3% -9% 27% 29% 31% 21% 37% 23% 14% 9% 15% 37% 19% 31% 50% 40% 30% 20% 10% -3%0% 0% -10%

Tractor sales (units)

Source: Company

% ch Y/Y

Table 11: M&M financial Services- Credit rating

Fixed Deposit Program Short tem Debt Long term and subordinated debt Long term and subordinated debt Long term and subordinated debt

Source: Crisil,, Fitch, Brickwork

Crisil Rating FAAA A1+ AA+ Brickwork Rating AA+ Fitch Rating AA+ (ind)

Outlook Stable Stable Stable Outlook Positive Outlook Stable

20

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Established track record with a wide branch network and dealer tie-ups

MMFS has over 15 years of operating experience in rural and semi urban markets and a widespread branch network of 570 branches spread across 24 states (30% CAGR over past 5 years). Further, the company also has tie-ups for providing on site financing to customers purchasing vehicle at various dealerships (like Maruti/M&M). Majority of the loan processes are fairly decentralized with loan origination, approvals and collection being undertaken at branch level. This enables prompt processing and better understanding of the local markets.

Figure 27: MMFS - Branch network

600 500 400 300 200 100 0 FY02

Source: Company

547 436 459

570

256 151

FY05

FY08

FY10

FY11

Sep-11

Capital adequacy is strong. But since company is consuming capital fast, it may need to dilute in FY13E

MMFS's capital adequacy is strong at 23.3% (as at FY11end) and comfortably above regulatory CAR requirement of 15%. However, given growth in asset base, the company is consuming capital fast, and in our view might need to raise capital. We estimate it may need to raise Rs 8B to get back its FY13 tier 1 to 17% (historical average) which would other wise run down to 13.5%. We note that in the interim, the company has additional levers to fund growth, i.e. raising of tier 2 capital which is currently low at 3.3% and resorting to additional securitization, where the company has been holding back given haziness around regulations.

21

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Figure 28: MMFS - Capital Adequacy ratios

20.00% 16.00% 12.00% 8.00% 4.00% 0.00% FY09 FY10 Tier I

Source: Company reports and J.P. Morgan estimates.

17.30%

16.10%

17.00%

FY13 may require a capital raise to sustain the growth rate

14.2%

2.10%

2.40%

3.30%

2.1% FY12E

FY11 Tier II

Regulatory uncertainty persists. However, company should be able to withstand headwinds

RBI has, over the last one year, been tightening regulatory norms for NBFCs to increase the oversight of the sector. The measures taken or proposed are primarily aimed to reduce regulatory gaps and arbitrage between banks and NBFCs and make banks responsible for their own priority sector lending targets. Various specific measures for the NBFC taken include1. Increase in capital adequacy for deposit taking NBFCs to 15% from 12% earlier 2. Declassification of loans to NBFCs (ex MFI) as priority sector loans thereby resulting in increase in funding costs. This has been done with a view to encourage banks to meet the targets on their own 3. Provisioning introduced on standard assets for 0.25% In addition to these, various recommendation pending notification include4. Introduction of 90-day NPA recognition norm - Proposal to increase NPL recognition cycle to 90 from 180 days, in line with the banks. This could have a meaningful impact on provisioning costs and NPL ratios for MMFS given the lumpy nature of rural cash flows. As per management, this can result in NPA increase of 100-150bps. This while being more accounting impact should adjust over a period of time but there will be initial bumpiness. 5. Higher provision requirement RBI is looking to increase the provisioning and reserve requirements for NBFCs to narrow the gap between banks and NBFCs. MMFS has been following provisioning norms stricter than RBI mandated norms and has high provision coverage ratio (+80% in FY11). This could then offset some impact of higher provisioning requirement. A 90-day norm will most likely impact provisioning in the first bucket (15% norm). 6. Increase tier 1 CAR to 12% - This, in our view, is not a big issue as MMFS has been operating at a much higher Tier 1 ratio. Rating agencies also typically mandate a much higher level of capital for NBFCs vs. regulatory requirements.

22

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

7. Securitization norms RBI recently placed draft guidelines on securitization (refer to table below for details). Overall the proposed norms are prima facie not a big negative with the exception of disallowance of credit enhancement for assignment transactions. Further, there is no clarity as yet on qualification of securitization as priority sector loans. While MMFS was not very aggressively using this financing (10% of overall book), it did allow for some capital management. Overall, assuming 90-day norms come in and if NPAs rise by 150bps it will impact our earnings estimates by approx 5%. Our estimates which are 7% below street anyway allow for this.

Table 12: MMFS - Provisioning policy vs. RBI current norms for NBFC

Duration (months) >5 and <=18 >18 and <=30 >30 and <=54 >54 months

Source: Company

RBI Norms 10% 20% 30% 50%

Duration (months) >5 and <=11 >11 and <=24 >24 months

MMFS 10% 50% 100%

Table 13: Proposed norms for securitization Proposed Minimum holding period Impact Minimum holding period for loans with monthly payments is at 6 months vs. expectations of 12 months. This in order to encourage some seasoning of loans before they are sold off. Common practice was to season loans for 3-6 months anyway. Minimum retention requirement for loans with maturity of over 24 months is 10% and in our view not a big impediment. This is being done with the intention of making the originator have some stake in the loans it sells. As regarding due diligence of underlying loans, atleast 5% need to be verified by the banks officers, in cases where it used services of third party firms. This in our view is a relief as carrying entire KYC on underlying portfolio was a big problem. In case of bilateral assignments, the guideline prohibits credit enhancement or liquidity facilities. Normally these used to be 8-10% of the loan being sold. This could be a negative as banks may be reluctant to buy loans with no credit enhancement by the originator (though the MRR requirement takes care of the issue to some extent Capital treatment of credit enhancement being written off 50% from Tier 1 and 2 is slightly lenient vs. other markets where it is written off completely from Tier 1. The guidelines have not provided all important clarity on if securitised loans will continue to be eligible for priority sector lending classifications for banks to meet their requirement

Minimum retention requirement

Due diligence of underlying loans

Prohibition of credit enhancement

Capital treatment of credit enhancement No clarity on priority sector qualification

Source: RBI

23

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

NIM compression imminent given growth in lower yield segments and increased funding costs

Net interest margins (NIMs) for MMFS have come off given product diversification to lower yield segments (i.e. cars, CVs etc), increase in funding costs and lower levels of securitization. On a like to like basis the company has withheld an 80bps cost increase to customers and hence will likely try and claw back some of it as and when the rate cycle turns. Recent financing done by the company at 10.2% is at a 100bps premium to companys average cost of funds at 9.1%. Given bank base rates at 10.5-10.75% even if rates come down average cost of funds may not come down a lot. As regarding margin compression due to product diversification, while NIM compression is likely to continue, overall impact on ROAs should be offset by lower operating and provisioning costs for newer segments. Correspondingly, on a ROA level, we do not forecast any meaningful compression on this account.

Figure 29: MMFS - Net Interest Margin (%)

13.0% 12.7% 12.0% 11.0% 10.0% 9.0% FY08 FY09 FY10 FY11 FY12E FY13E

Source: Company reports and J.P. Morgan estimates.

Figure 30: MMFS - ROA trends (%)

4.5% 4.0% 3.5% 4.1% 4.1%

11.9%

12.0%

3.2% 2.9% 2.5% 3.0%

10.8%

10.6% 10.4%

3.0% 2.5% 2.0% FY08

FY09

FY10

FY11

FY12E

FY13E

Source: Company reports and J.P. Morgan estimates.

Financial profile- Share of financing of banks has gone up over last 3 years but expect this to reverse hereon

Looking at the funding mix over last 3 years, contribution of bank funding has increased to 54% from 40% in FY09; while funding via NCDs has been coming down and has almost halved to 18% over the last 3 years (vs. 40% in FY09). Going ahead, we expect this to reverse. NCD share to total funding mix should rise to 25% and funding via securitization should be 15-20% (once regulatory clarity emerges). Share of CP in incremental financing has gone up over the last 6 months as bank base rates at 10.5-10.75% are at a premium to CP market (9.5-10%) and correspondingly the company has increased its reliance on them.

24

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Table 14: Liability profile

Banks CPs NCDs FDs Securitization

Source: Company

Sep-11 54% 10% 18% 8% 10%

FY11 57% 0% 19% 7% 17%

FY10 44% 2% 27% 6% 21%

FY09 40% 3% 40% 1% 22%

25

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Business and management brief

Mahindra & Mahindra Financial services (MMFS) is a leading non banking finance companies catering to rural and semi urban markets. MMFS is primarily engaged in providing financing for new and pre-owned auto, utility vehicles, tractors, cars and commercial vehicles. The company through its subsidiaries also provides housing finance, personal loans, insurance broking and mutual fund distribution. Mahindra & Mahindra Financial services (MMFS) is a part of Mahindra group, which is one of the largest conglomerates in India. The group has a strong presence in the utility vehicles, tractors, information technology, financial services, aerospace, real estate, and hospitality and logistics sectors. Incorporated in 1993, the company began operations as a subsidiary of M&M to finance parent M&M's products primarily UVs and tractors. In 2002-03, company started financing non M&M vehicles and in FY07 entered into an agreement with Maruti to finance its cars in semi urban and rural areas.

Figure 31: M&M financials - Group structure

Source: Company

26

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Figure 32: M&M financial services Shareholding Pattern

DII 5% Others 4%

FII 34%

Promoter 57%

Source: Company

Figure 33: MMFS - Product portfolio

Source: Company

Credit rating overview MMFS enjoys good credit ratings (AA+) from key rating agencies given strong parentage and comfortable capital position. This enables it to access capital even when liquidity is very tight and generally not available to other NBFCs. In its recent rating outlook the agency commentedThe ratings continue to reflect Mahindra Finances majority ownership by, and strategic importance to, its parent, Mahindra & Mahindra Ltd. The ratings are also underpinned by Mahindra Finances strong position in utility vehicle (UV) and tractor financing business in rural and semi-urban areas, comfortable capital position, and stable resource profile. These rating strengths are partially offset by Mahindra Finances modest asset quality.

27

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Table 15: M&M financial Services- Credit rating

Fixed Deposit Program Short tem Debt Long term and subordinated debt Long term and subordinated debt Long term and subordinated debt

Source: Crisil,, Fitch, Brickwork

Crisil Rating FAAA A1+ AA+ Brickwork Rating AA+ Fitch Rating AA+ (ind)

Outlook Stable Stable Stable Outlook Positive Outlook Stable

Key subsidiaries

Mahindra Rural Housing Finance Ltd Started in Arp-07, MRHFL is a majority owned subsidiary of MMFS to provide rural housing finance. MMFS plans to leverage on its existing strong foot print in rural markets to provide housing loans to untapped semi urban and rural sector. Mahindra Finance holds 87.5% in the subsidiary; while the remaining 12.5% is held by NHB. Currently operating in 8 states, the business is in expansion stage. Overall the company is targeting a Rs50B AUM over the next 5 years. As of Sep-11, company has an outstanding loan book of Rs4.2B.

Table 16: MRHFL Key operating and financial details

Rs M Loans Disbursed No. of Customer Contracts (Nos) Outstanding loan book Total income PBT PAT

Source: Company, J.P. Morgan

1HFY12 1,215 12,525 4,183 367 50 38

1HFY11 829 7044 2110 192 49 36

Mahindra Insurance Brokers Ltd Started in May-04, MIBL is a wholly owned subsidiary of MMFS to provide insurance broking in life and non-life segments with a focus on rural/semi urban markets. During FY11, MIBL crossed the 5,00,000 mark in terms of policies serviced, with a total of 5,08,878 polices for both Life and Non- Life retail business lines.

Table 17: Mahindra Insurance - Key operating and financial details

Total income Net premium PBT PAT No. of Policies for the Period (nos.) No. of employees (nos.)

Source: Company, J.P. Morgan

1HFY12 162 1,819 39 26 307,656 408

1HFY11 234 1,333 146 94 205,715 368

28

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Financial Analysis

AUM growth of 45%/ 30% expected over FY12/13E We are working with an AUM growth target of 45% and 30% respectively over FY12/13E. This compares with 45% growth the company has been running at in 1H and FY09-11 growth rate of 31%. The moderation in growth in FY13 is on account of higher base and a expected slowdown in tractor/UV sales. This however is much better than industry growth estimates (10-15%), as we expect the new business segments to more than make up for any moderation in tractors and UVs

Figure 34: MMFS - AUM growth trends

300,000 250,000 200,000 150,000 100,000 50,000 0 FY09 4% FY10 AUM

Source: Company reports and J.P. Morgan estimates.AUM growth trends

50% 42% 45% 40% 30% 22% 30% 20% 10% 0% FY11 FY12E AUM growth (%) FY13E

Estimate NIM moderation NIMs for MMFS have been moderating on account of two reasons: 1. Mix change and peaking out of asset yields in different segments as a result of which the company has not been able to fully pass on cost increases to customers (80bps impact). Also new businesses (i.e. cars) have lower yields than the traditional tractor business. Pressures on funding costs- Persistent rate hikes have led to increase in borrowing costs for the company. Average borrowing cost for the company at 9.1% is up by 120bps over last 6 quarters. Further incremental borrowing costs at 10.2% (NCD, Bank base rates at 10.15-10.75%) are again higher by 110bps vs. last Q average. While we are forecasting a rate decrease, given the differential between incremental and average, average cost may not come down soon.

2.

29

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Figure 35: MMFS - NIM trends

13.0% 12.7% 12.0% 11.0% 10.0% 9.0% FY08 FY09 FY10 FY11 FY12E FY13E

Source: Company reports and J.P. Morgan estimates.NIM chart

11.9%

12.0%

10.8%

10.6% 10.4%

Scope for operating leverage flow through remains but we dont model it. MMFS runs a lean shop but given rapid growth in the branches, lower operating costs for newer segments and increase in loan ticket sizes there is scope for operating leverage to come through. Cost to AUM for the company has remained in the 3.5-4% range over the last three years. Going ahead we do not model any change in this and conservatively work at the top end of the historical range (3.9%).

Figure 36: MMFS - Operating costs

4.0% 3.9% 3.8% 3.7% 3.6% 3.5% 3.4% 3.3% 3.2% FY09 FY10 FY11 Cost to AUM FY12E FY13E 3.4% 3.5% 4.0% 3.9% 3.9%

Source: Company reports and J.P. Morgan estimates.

Asset quality is at cyclical low levels currently. Expect some normalization GNPAs for MMFS have over time come down from almost ~9% levels to 4% currently. As 2H is normally better than 1H, we think there is scope for improvement over the next two Qs. Also, mix change in favor of new segments favors better asset quality. Correspondingly given offsetting factors at play we model in stable GNPA at 4% levels. In case the new regulations come in as proposed this would rise to 5.5%. ROA moderation given NIM compression. Capital raise may be required in FY13E Given moderation in NIM and some increase in provisioning costs, we expect ROA (AUM Basis) to come down from 4% levels to 3-3.2% range. This, we estimate, should in turn drive ROE of 19-20% over FY12-13E. Leverage for the company does rise and this then might require a capital raise next year to maintain growth rates. To come back to 17% levels (historical), the company in our view may require Rs8B of additional capital or a ~13% dilution (assuming a Rs 600/share price).

30

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Figure 37: MMFS - RoA trends

4.5% 4.0% 3.5% 3.0% 2.5% 2.0% FY08 FY09 FY10 FY11 FY12E FY13E

Source: Company reports and J.P. Morgan estimates.

Figure 38: MMFS - RoE trends (%)

22.0%

4.1% 4.1%

22.0% 21.4% 20.0% 19.3%

20.0%

3.2%

18.0% 16.0% 14.0% FY09 FY10 FY11 ROE (%)

Source: Company and J.P. Morgan estimates

2.9% 2.5%

3.0%

15.4% FY12E FY13E

Table 18: MMFS - Forecast Assumptions

% AUM growth Off book as % of AUM Interest income Interest expense NIM Income from securitization NIM IEA/ Total Assets Total income Cost Employees Opex Depreciation Total Cost to income (as % of NIM) PPOP Provisions & write offs PBT Tax ROA (AUM) ROA (Assets) Leverage ROE

Source: Company reports and J.P. Morgan estimates.

FY10 22% 12% 17.1% 6.0% 11.2% 1.5% 12.7% 1.0 12.7% -1.5% -2.2% -0.1% -3.9% 30.5% 8.8% -2.6% 6.2% -2.1% 4.1% 4.1% 5.3 21.4%

FY11 42% 10% 17.0% 5.8% 11.2% 0.8% 12.0% 1.0 12.0% -1.3% -2.9% -0.1% -4.4% 36.5% 7.6% -1.4% 6.2% -2.1% 4.1% 4.1% 5.4 22.0%

FY12E 45% 8% 17.1% 7.1% 10.0% 0.6% 10.6% 1.0 10.6% -1.3% -2.7% -0.1% -4.1% 39.2% 6.4% -1.5% 4.9% -1.7% 3.2% 3.2% 6.2 20.0%

FY13E 30% 10% 17.1% 7.5% 9.6% 0.8% 10.4% 1.0 10.4% -1.3% -2.7% -0.1% -4.0% 39.0% 6.3% -1.7% 4.6% -1.6% 3.0% 3.0% 6.4 19.3%

31

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

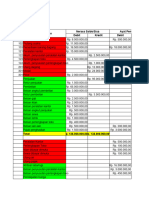

Table 19: MMFS - Income Statement

Rs MM Interest income Interest expense NII Income from securitization Total income Y/Y Cost Employees Opex Depreciation Total Cost to income PPOP Provisions PBT Tax Tax Rate PAT Shares EPS Y/Y FY10 14,434 5,017 9,417 1,254 10,671 22% (1,281) (1,871) (99) (3,250) -30.5% 7,420 (2,215) 5,205 (1,779) 34% 3,426 96 35.7 59% FY11 19,220 6,602 12,618 906 13,524 27% (1,515) (3,259) (158) (4,932) -36.5% 8,592 (1,567) 7,024 (2,393) 34% 4,631 102 45.2 27% FY12E 28,407 11,788 16,619 947 17,566 30% (2,197) (4,503) (182) (6,881) -39.2% 10,685 (2,549) 8,136 (2,766) 34% 5,370 102 52.4 16% FY13E 38,496 16,854 21,642 1,770 23,412 33% (2,856) (6,073) (200) (9,129) -39.0% 14,283 (3,932) 10,351 (3,519) 34% 6,831 116 59.0 13%

Source: Company reports and J.P. Morgan estimates.

Table 20: MMFS - Balance Sheet

Rs MM Net Fixed Assets Investments Loans and Advances Cash Other Assets Total Assets Current Liabilities Provisions Debt Share Capital Reserves Shareholder equity Total liabilities FY10 476 2,159 87,945 2,420 2,150 95,150 5,999 7,288 64,578 960 16,326 17,286 95,150 FY11 818 6,746 124,650 2,976 2,352 137,541 7,802 8,088 96,750 1,025 23,876 24,901 137,541 FY12E 736 6,746 185,051 7,364 2,379 202,276 8,000 8,638 156,750 1,025 27,864 28,888 202,276 FY13E 636 6,746 240,566 5,709 2,411 256,068 8,500 9,857 195,750 1,158 40,804 41,962 256,068

Source: Company reports and J.P. Morgan estimates.

32

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Mahindra & Mahindra Financial Services: Summary of financials

Income Statement Rs in millions, year end Mar Interest income Interest expense NIM (%) Employees Opex Depreciation Total Cost Pre-Prov. Profits Provisions PBT Tax PAT Per Share Data Rs EPS DPS Payout Book value PPOP per share Key Balance sheet Rs in millions Net Fixed Assets Investments Loans and Advances Cash Other Assets Total Assets Current Liabilities Provisions Debt Shareholder Equity Growth Rates FY10 14,434 5,017 12.7% (1,281) (1,871) (99) (3,250) 7,420 (2,215) 5,205 (1,779) 3,426 FY10 35.7 7.6 21% 180 77 FY11 19,220 6,602 12.0% (1,515) (3,259) (158) (4,932) 8,592 (1,567) 7,024 (2,393) 4,631 FY11 45.2 10.2 22% 243 84 FY12E 28,407 11,788 10.6% (2,197) (4,503) (182) (6,881) 10,685 (2,549) 8,136 (2,766) 5,370 FY12E 52.4 11.5 22% 282 104 FY13E 38,496 16,854 10.4% (2,856) (6,073) (200) (9,129) 14,283 (3,932) 10,351 (3,519) 6,831 FY13E 59.0 13.0 22% 362 123 Loans AUM Assets Equity RWA Net Interest Income Revenues Costs Pre-Provision Profits Provisions Pre-Tax Attributable Income Balance Sheet Gearing Investment/assets Loan/Assets AUM/ Assets Equity / AUM Asset Quality/Capital Loan loss reserves/loans NPLs/loans Loan loss reserves/NPLs FY10 476 2,159 87,945 2,420 2,150 95,150 5,999 7,288 64,578 17,286 FY11 818 6,746 124,650 2,976 2,352 137,541 7,802 8,088 96,750 24,901 FY12E 736 6,746 185,051 7,364 2,379 202,276 8,000 8,638 156,750 28,888 FY13E 636 6,746 240,566 5,709 2,411 256,068 8,500 9,857 195,750 41,962 Growth in NPLs Tier 1 Ratio Total CAR Du-Pont Analysis NIM (as % of Avg. Assets) Cost/Income Cost/Assets Pre-Provision ROA LLP/Advances Loan/Assets Pre-Tax ROA Tax rate ROA Equity/Assets ROE FY10 22% 22% 21% 18% 22% 22% 13% -2% 22% -22% 60% 60% FY10 2% 68% 105% 19% FY10 9.5% 0.8% 8.2 -57% 16.1% 18.5% FY10 12.7% 30.5% 3.9% 8.8% 2.6% 67.9% 6.2% 34.2% 4.1% 19.0% 21.4% FY11 42% 42% 45% 44% 41% 27% 33% 32% 16% -29% 35% 35% FY11 5% 70% 101% 19% FY11 6.8% 0.5% 4.7 -10% 17.0% 20.3% FY11 12.0% 36.5% 4.4% 7.6% 1.4% 70.3% 6.2% 34.1% 4.1% 18.6% 22.0% FY12E 48% 45% 47% 16% 42% 30% 48% 79% 24% 63% 16% 16% FY12E 3% 77% 99% 16% FY12E 4.5% 0.7% 2.9 88% 14.2% 16.5% FY12E 10.6% 39.2% 4.1% 6.4% 1.5% 77.5% 4.9% 34.0% 3.2% 16.2% 20.0% FY13E 30% 30% 27% 45% 27% 33% 36% 43% 34% 54% 27% 27% FY13E 3% 76% 102% 16% FY13E 4.2% 0.9% 2.7 75% 16.9% 20.2% FY13E 10.4% 39.0% 4.0% 6.3% 1.7% 76.4% 4.6% 34.0% 3.0% 15.7% 19.3%

Source: Company, J.P. Morgan estimates.

33

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

Analyst Certification: The research analyst(s) denoted by an AC on the cover of this report certifies (or, where multiple research analysts are primarily responsible for this report, the research analyst denoted by an AC on the cover or within the document individually certifies, with respect to each security or issuer that the research analyst covers in this research) that: (1) all of the views expressed in this report accurately reflect his or her personal views about any and all of the subject securities or issuers; and (2) no part of any of the research analyst's compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed by the research analyst(s) in this report.

Important Disclosures

Beneficial Ownership (1% or more): J.P. Morgan beneficially owns 1% or more of a class of common equity securities of Mahindra & Mahindra Financial Services. Client: J.P. Morgan currently has, or had within the past 12 months, the following company(ies) as clients: Mahindra & Mahindra Financial Services. Company-Specific Disclosures: Important disclosures, including price charts, are available for compendium reports and all J.P. Morgan covered companies by visiting https://mm.jpmorgan.com/disclosures/company, calling 1-800-477-0406, or emailing research.disclosure.inquiries@jpmorgan.com with your request.

Mahindra & Mahindra Financial Services (MMFS.NS) Price Chart

1,314

1,095

876 Price(Rs) 657

438

219

0 Jan 09 Apr 09 Jul 09 Oct 09 Jan 10 Apr 10 Jul 10 Oct 10 Jan 11 Apr 11 Jul 11 Oct 11 Jan 12

Source: Bloomberg and J.P. Morgan; price data adjusted for stock splits and dividends.

The chart(s) show J.P. Morgan's continuing coverage of the stocks; the current analysts may or may not have covered it over the entire period. J.P. Morgan ratings: OW = Overweight, N= Neutral, UW = Underweight Explanation of Equity Research Ratings and Analyst(s) Coverage Universe: J.P. Morgan uses the following rating system: Overweight [Over the next six to twelve months, we expect this stock will outperform the average total return of the stocks in the analyst's (or the analyst's team's) coverage universe.] Neutral [Over the next six to twelve months, we expect this stock will perform in line with the average total return of the stocks in the analyst's (or the analyst's team's) coverage universe.] Underweight [Over the next six to twelve months, we expect this stock will underperform the average total return of the stocks in the analyst's (or the analyst's team's) coverage universe.] In our Asia (ex-Australia) and UK small- and mid-cap equity research, each stocks expected total return is compared to the expected total return of a benchmark country market index, not to those analysts coverage universe. If it does not appear in the Important Disclosures section of this report, the certifying analysts coverage universe can be found on J.P. Morgans research website, www.morganmarkets.com. Coverage Universe: Kumar, Saurabh S: Ascendas India Trust (AINT.SI), DLF Limited (DLF.BO), Housing Development and Infrastructure Ltd. (HDIL) (HDIL.BO), Indiabulls Real Estate (INRL.BO), Indian Hotels (IHTL.BO), Ishaan Real Estate Plc (ISH.L), Jaypee Infratech (JYPE.BO), LIC Housing Finance (LICHF.BO), Oberoi Realty (OEBO.BO), Prestige Estate Projects Limited (PREG.BO), Shriram Transport Finance (SRTR.BO), Unitech Ltd (UNTE.BO)

34

Saurabh Kumar (91-22) 6157-3590 saurabh.s.kumar@jpmorgan.com

Asia Pacific Equity Research 19 January 2012

J.P. Morgan Equity Research Ratings Distribution, as of January 6, 2012

Overweight (buy) 47% 52% 45% 72% Neutral (hold) 42% 45% 47% 62% Underweight (sell) 12% 36% 8% 58%

J.P. Morgan Global Equity Research Coverage IB clients* JPMS Equity Research Coverage IB clients*

*Percentage of investment banking clients in each rating category. For purposes only of FINRA/NYSE ratings distribution rules, our Overweight rating falls into a buy rating category; our Neutral rating falls into a hold rating category; and our Underweight rating falls into a sell rating category.

Equity Valuation and Risks: For valuation methodology and risks associated with covered companies or price targets for covered companies, please see the most recent company-specific research report at http://www.morganmarkets.com , contact the primary analyst or your J.P. Morgan representative, or email research.disclosure.inquiries@jpmorgan.com. Equity Analysts' Compensation: The equity research analysts responsible for the preparation of this report receive compensation based upon various factors, including the quality and accuracy of research, client feedback, competitive factors, and overall firm revenues, which include revenues from, among other business units, Institutional Equities and Investment Banking. Registration of non-US Analysts: Unless otherwise noted, the non-US analysts listed on the front of this report are employees of non-US affiliates of JPMS, are not registered/qualified as research analysts under NASD/NYSE rules, may not be associated persons of JPMS, and may not be subject to FINRA Rule 2711 and NYSE Rule 472 restrictions on communications with covered companies, public appearances, and trading securities held by a research analyst account.

Other Disclosures