Professional Documents

Culture Documents

1 Project On Religare

Uploaded by

Nitin Jaiswal0 ratings0% found this document useful (0 votes)

16 views30 pagesMASTER OF BUSINESS ADMINISTRATION (MBA) (MARKETING) CERTIFICATE This is to certify that the project titled "Customer Relationship Management in Religare Securities Ltd, Pune" Is a bonafide work carried out by Mr. / Ms. MD. Junaid Y. Dhariwala a student of MASTER OF BUSINESS ADMINISTRATION semester 3rd, specialization marketing.

Original Description:

Original Title

1 Project on Religare

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMASTER OF BUSINESS ADMINISTRATION (MBA) (MARKETING) CERTIFICATE This is to certify that the project titled "Customer Relationship Management in Religare Securities Ltd, Pune" Is a bonafide work carried out by Mr. / Ms. MD. Junaid Y. Dhariwala a student of MASTER OF BUSINESS ADMINISTRATION semester 3rd, specialization marketing.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views30 pages1 Project On Religare

Uploaded by

Nitin JaiswalMASTER OF BUSINESS ADMINISTRATION (MBA) (MARKETING) CERTIFICATE This is to certify that the project titled "Customer Relationship Management in Religare Securities Ltd, Pune" Is a bonafide work carried out by Mr. / Ms. MD. Junaid Y. Dhariwala a student of MASTER OF BUSINESS ADMINISTRATION semester 3rd, specialization marketing.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 30

1 PROJECT ON

CUSTOMER RELATIONSHIP MANAGEMENT

WITH

RELIGARE SECURITIES LTD

(REGIONAL OFFICE, BMCC ROAD, PUNE)

MASTER OF BUSINESS ADMINISTRATION (MBA)

(MARKETING)

SUBMITTED IN PARTIAL FULFILLMENTS OF

REQUIREMENTS FOR AWARD OF

MASTER OF BUSINESS ADMINISTRATION OF TILAK

MAHARASHTRA

UNIVERSITY, PUNE

Submitted By

Md. Junaid Y. Dhariwala

PRN:

Of PAI International Centre for Management Excellence, Pune

Tilak Maharashtra University

Gultekdi, Pune 411037

2

Tilak Maharashtra University, Pune

(Deemed Under Section 3 of UGC Act 1956 Vide Notification

No. F.9-19/85- U3 dated 24th April 1987 By the Government of India.)

Vidyapeeth Bhawan, Gultekdi, Pune - 411 037.

CERTIFICATE

This is to certify that the project titled Customer Relationship Management in

Religare Securities Ltd, Pune Is a bonafide work carried out by Mr. /Ms.

MD. Junaid Y. Dhariwala a student of Master of Business Administration

Semester 3rd, Specialization Marketing.

P.R.N. _____ Under Tilak Maharashtra University in the year 2009.

Head of Department Examiner Examiner Internal External

Date:

Place: University Seal

3

ACKNOWLEDGEMENT

It is said, the most important single word is WE and the zero important single word is I. This

true even in todays modern era. It is absolutely impossible for a single individual to complete

the assigned job without help and assistance from others.

It is my greatest pleasure to acknowledge sincere gratitude towards Mrs. Priya Venkatraman

(Sr. Relationship Manager) Religare Securities Ltd., Pune, for the completion of the project

work.

I would also like to acknowledge to my sincere gratitude to our Director Prof. R Ganesan and

my project guide Prof. Roshan Kazi for helping me in this project work.

I am thankful to all of my friends and batch mates for their help in completing this project work.

Finally, I am thankful to my entire family members for their great support and encouragement.

Md. Junaid Dhariwala

4

TABLE OF CONTENTS

Chapter 1. Rationale of the Study.

Chapter 2. Objectives of the study.

Title of the project

Objective of the study

Scope of the study

Chapter 3. Profile of the company.

Chapter 4. Review of Literature.

Chapter 5. Research Methodology

Research Design

Data Collection Methods / Sources

Sampling Plan which should include sampling unit, sampling size and sampling

methods viz. questionnaire methods interview methods observation etc.

Chapter 6. Data Analysis and interpretations using various charts and graphs

Chapter 7. Findings

Chapter 8. Limitations (if any)

Appendix

Copies of questionnaire

Copies of form or any from the company

Bibliography

5

CHAPTER 1.

RATIONALE OF THE STUDY

6

RATIONALE OF THE STUDY

Customer Relationship Management (CRM) is a business approach which recognizes the

importance of customers as the driving force behind the success of failure of any business. It

enables the business organization to maintain, analyze and act upon the information which the

business identifies as relevant to improve its relationships with the customer, and thus enhance

its chances of success.

Customer Relationship Management (CRM) helps companies improve the profitability of their

interactions with customers while at the same time making the interactions appear friendly

through individualization and personalization of services. This management includes Data

Mining with the help of which Customer Life Cycle can be managed well in Acquiring new

customers, increasing value of the customers, retaining good customers.

The basic steps of Data Mining for effective CRM are:

1. Define Business Problem

2. Build Marketing Database

3. Explore Data

4. Prepare data for modeling

5. Build Model

6. Deploy model and results

7

The company can then use the information to learn about the behavior of its customers and

improve the way it does a business. It can look at recurring complaints from multiple customers

to solve a problem which would otherwise go unchecked with a normal formats and management

system of the company.

The main objective of my project is to find effective solution for the Customer Relationship

Management and accordingly increase the credibility and profitability of the company. This

study is more related to consumer behavior and perception about the facilities and convenience

provided by the company, Customer Satisfaction is emphasized in this management.

o Helping an enterprise to enable its marketing departments to identify and target their

best customers, manage marketing campaigns with clear goals and objectives, and generate

quality leads for the sales team.

o Assisting the organization to improve telesales, account, and sales management by

optimizing information shared by multiple employees, and streamlining existing processes (for

example, taking orders using mobile devices)

o Allowing the formation of individualized relationships with customers, with the aim of

improving customer satisfaction and maximizing profits; identifying the most profitable

customers and providing them the highest level of service.

o Providing employees with the information and processes necessary to know their

customers, understand their needs, and effectively build relationships between the company, its

customer base, and distribution partners.

8

CHAPTER 2.

OBJECTIVE OF THE STUDY

9

OBJECTIVES OF THE PROJECT

A. Title of the project:

Customer Relationship Management (CRM) with Religare Securities

B. Objective of the Study:

The objective of the project was to analyze Effective Customer Relationship Management for

Religare Securities Ltd., Pune for that we have to understand current CRM System and Services

provided from the company and its effect on Customer Needs, Satisfaction Level, their response

and emotions. The objective of this study to analyze existing customer satisfaction as those

customers are the key sources to new customers with respect to the performance, sales efforts

and sales service.

As the company stands second in India in aspect of turnover after Kotak Mahindra Securities,

its clear that it has very strong Customer Relationship Management System and perfect people

to handle it properly for the benefit of customers and company as well.

Actual and personal meeting with existing customers and employees has brought me to the

reality of the effectiveness of the system and their success. For analyzing the same factor I staked

my whole duration of the project and simultaneously for internal study and market watch and

other group assignments.

10

Questionnaire is based on the existing services and the satisfaction level of the existing

customers which includes questions like Name, Age, Gender, Income, Investment Frequency,

feedback about services which they are provided like conformation, calls, suggestions, solutions

on stuck money like dead investment and all.

On an average all the customers are happy with the company and look forward to the growth of

it.

C. Scope of the study:

Scope the this study is it will assist Religare to get its own Customer Relationship Management

system mirror well and it will get all the important things before eyes to apply all the possible

ways to provide a superb service to the customers and accordingly make them loyal and retain

them long lasting and also to get new customers to be served. Scopes can be stated in few points

as follows.

o Maintain current / existing customers.

o Achieve new potential customers.

o Retain all the customers.

o Profitability Increment

o Reputation and credibility Increment, etc.

11

The heart of CRM is not being customer centric but rather to use customer profitability as a

driver for decision making and action. Before exploring this assertion, it is useful to review the

process of resource allocation as it is practiced in most organizations. The budget process largely

consists of an extrapolation of the past. Resource constraints pit function against function with

back room deals that are based on internal politics versus the marketplace. This decision process

has little insight as to what is working and what is not working (as it applies to the marketplace)

or for that matter why? Without insight relative to cause and effect, the organization has no

choice but to follow intuition and anecdote. It is analogous to the story about the marketing VP

who admitted that half the advertising budget was wasted; the problem was he did not know

which half.

12

CHAPTER 3.

PROFILE OF THE COMPANY

13

Profile of company

Religare Enterprises Limited (REL):

Religare, a Ranbaxy promoter group company, is one of the leading integrated

financial services institutions of India. The company offers a large and diverse

bouquet of services ranging from equities, commodities, insurance broking, to

wealth advisory, portfolio management services, personal finance services,

Investment banking and institutional broking services. The services are broadly

clubbed across three key business verticals- Retail, Wealth management and the

Institutional spectrum. Religare Enterprises Limited is the holding company for all

its businesses, structured and being operated through various subsidiaries.

Religares retail network spreads across the length and breadth of the country with

its presence through more than 1,217 locations across more than 392 cities and

towns. Having spread itself fairly well across the country and with the promise of

not resting on its laurels, it has also aggressively started eyeing global geographies

Religare Enterprises Limited (REL) is one of the leading integrated financial

services groups of India. RELs businesses are broadly clubbed across three key

verticals, the Retail Institutional and Wealth spectrums, catering to a diverse and

wide base of clients. The vision is to build Religare as a globally trusted brand in

the financial services domain and present it as the Investment Gateway of India.

14

All employees of the group guided by an experienced and professional

management team are committed to providing financial care, backed by the core

values of diligence and transparency. REL offers a multitude of investment options

and a diverse bouquet of financial services with its pan India reach in more than

1800 locations across more than 490 cities and towns. REL operates globally

following its acquisition of Londons oldest brokerage and investment firm,

Hichens, Harrison and Co. plc. With a view to expand, diversify and introduce

offerings benchmarked against global best practices, Religare operates its Life

Insurance business in partnership with the global major- AEGON. For its wealth

management business Religare has partnered with Australia based financial

services major- Macquarie. Religare has also partnered with Vistaar Entertainment

to launch Indias first SEBI approved Film Fund offering a unique alternative asset

class of investments.

Religare Securities Limited (RSL), a 100% subsidiary of Religare Enterprises

Limited is a leading equity and securities firm in India. The company currently

handles sizeable volumes traded on NSE and in the realm of online trading and

investments; it currently holds a reasonable share of the market. The major

activities and offerings of the company today are Equity Broking, Depository

Participant Services, Portfolio Management Services, International Advisory Fund

Management Services, Institutional Broking and Research Services. To broaden

the gamut of services offered to its investors, the company offers an online

investment portal armed with a host of revolutionary features.

15

o RSL is a member of the National Stock Exchange of India, Bombay

Stock Exchange of India, Depository Participant with National Securities

Depository Limited and Central Depository Services (I) Limited, and is a SEBI

approved Portfolio Manager.

o Religare has been constantly innovating in terms of product and services

and to offer such incisive services to specific user segments it has also started the

NRI, FII, HNI and Corporate Servicing groups. These groups take all the portfolio

investment decisions depending upon a clients risk / return parameter.

o Religare has a very credible Research and Analysis division, which not

only caters to the need of our Institutional clientele, but also gives their valuable

inputs to investment dealers.

Trading in Equities with Religare truly empowers you for your investment needs.

We ensure you have superlative trading experience through

16

-class dealing rooms

Further, Religare also has one the largest retail networks, with its presence in more

than 1800* locations across more than 490* cities and towns. This means, you can

walk into any of these branches and connect to our highly skilled and dedicated

relationship managers to get the best services.

The Religare Edge

o Pan India footprint

o Powerful research and analytics supported by a pool of highly skilled

research analysts

o Ethical business practices

o Single window for all investment needs through your unique CRN

17

Religare Enterprise Limited, through its subsidiaries, offers a range of integrated

financial products and services to retail inventors, high net worth individuals, and

corporate and institutional clients in India. It operates in three divisions: Retail

Spectrum, Wealth Spectrum, and Institutional Spectrum. The Retail Spectrum

division offers equity brokerage, commodities brokerage, personal financial

services, including insurance brokerage and mutual fund distribution; internet

trading; loans against shares; and personal loans. The Wealth Spectrum division

provides portfolio management services, wealth advisory services, and private

client equity services, such as international equity services. The company was

formerly known as Religare Enterprises Private Limited and changed its name to

Religare Enterprises Limited in July 2006. The company was incorporated in 1984

and is based in New Delhi, India.

18

Industry Profile

19

Industry Profile

While regulation and reforms have made major improvements in the quality of the

equity markets in India, its rapid growth and development are largely due to strong

and efficient market intermediation. The robustness of the Indian markets today is

attributable to a healthy blend of the quality of market Structure and efficient

intermediation. Even as several countries are instituting procedures to commence.

Equity derivative markets, India ranks amongst the top five countries globally in

this segment, in less than five years of its introduction. This is an example of the

proactive and progressive nature of the Indian brokerage industry.

In the last decade, the Indian brokerage industry has undergone a dramatic

transformation. From being made of close groups, the broking industry today is

one of the most transparent and compliance oriented businesses. Long settlement

cycles and large scale bad deliveries are a thing of the past with the advent of T+2

(Trading day + 2 days) settlement cycle and dematerialization. Large and fixed

commissions have been replaced by wafer thin margins, with competition driving

down the brokerage fee, in some cases, to a few basis points.

20

There have also been major changes in the way business is conducted. Technology

has emerged as the key driver of business and investment advice has become

research based. At the same time, adherence to regulation and compliance has

vastly increased. The scope of services have enhanced from being equity products

to a wide range of financial services. Investor protection has assumed significance,

and so has providing them with education and awareness. Greater need for

capitalization has induced several firms to access the capital market; foreign firms

are showing increasing interest in taking equity stakes in domestic broking firms.

Major developments in equity brokerage industry in India:

1. Corporate memberships

There is a growing surge of corporate memberships (92% in NSE and 75% in

BSE), and the scope of functioning of the brokerage firms has transformed from

that of being a family run business to that of professional organized function that

lays greater emphasis on observance of market principles and best practices. With

proliferation of new markets and products, corporate nature of the memberships is

enabling broking firms to expand the realm of their operations into other

exchanges as also other product offerings. Memberships range from cash market to

derivatives to commodities and a few broking firms are making forays into

obtaining memberships in exchanges outside the country subject to their

availability and eligibility.

21

2. Wider product offerings

The product offerings of brokerage firms today go much beyond the traditional

trading of equities. A typical brokerage firm today offers trading in equities and

derivatives, most probably commodities futures, exchange traded funds, distributes

mutual funds and insurance and also offers personal loans for housing,

consumptions and other related loans, offers portfolio management services, and

some even go to the extent of creating niche services such as a brokerage firm

offering art advisory services. In the background of growing opportunities for

investors to invest in India as also abroad, the range of products and services will

widen further.

In the offing will be interesting opportunities that might arise in the exchange

enabled corporate bond trading, soon after its commencement and futures trading

that might be introduced in the near future in the areas of interest rates and Indian

currency.

22

3. Greater reliance on research

Client advising in India has graduated from personal insights, market tips to

becoming extensively research oriented and governed by fundamentals and

technical factors. Vast progress has been made in developing company research

and refining methods in technical and fundamental analysis. The research and

advice are made online giving ready and real time access to market research for

investors and clients, thus making research important brand equity for the

brokerage firms.

4. Accessing equity capital markets

Access to reliable financial resources has been one of the major constraints faced

by the equity brokerage industry in India since long. Since the banking system is

not fully integrated with the securities markets, brokerage firms face limitations in

raising financial resources for business and expansion. With buoyancy of the stock

markets and the rising prospects of several well organized broking firms, important

opportunity to access capital markets for resource mobilization has become

available. The recent past witnessed several leading brokerage firms accessing

capital markets for financial resources with success.

23

5. Foreign collaborations and joint ventures

The way the brokerage industry is run and the manner in which several of them

pursued growth and development attracted foreign financial institutions and

investment banks to buy stakes in domestic brokerage firms, paving the way for

stronger brokerage entities and possible scope for consolidation in the future.

Foreign firms picked up stake in some of the leading brokerage firms, which might

lead to creating of greater interest in investing in brokerage firms by entities in

India and abroad.

6. Specialized services/niche broking

While supermarkets approach are adopted in general by broking firms, there are

some which are creating niche services that attract a particular client group such as

day traders, arbitrage trading, investing in small cap stocks etc, and providing

complete range of research and other support to back up this function.

7. Online broking

Several brokers are extending benefits of online trading through creation of

separate windows. Some others have dedicated online broking portals. Emergence

of online broking enabled reduction in transaction costs and costs of trading. Keen

competition has emerged in online broking services, with some of these offering

trading services at the cost of a few basis points or costs which are fixed in nature

irrespective of the volume of

24

trading conducted. A wide range of incentives are being created and offered by

online brokerage firms to attract larger number of

clients.

8. Compliance oriented

With stringent regulatory norms in operation, broking industry is giving greater

emphasis on regulatory compliance and observance of market principles and codes

of conduct. Many brokerage firms are investing time, money and resources to

create efficient and effective compliance and reporting systems that will help them

in avoiding costly mistakes and possible market abuses. Brokerage firms now have

a compliance officer who is responsible for all compliance related aspects and for

interacting with clients and other stake holders on aspects of regulation and

compliance.

9. Focus on training and skill sets

Brokerage firms are giving importance and significance to aspects such as training

on skill sets that could prove to be beneficial in the long run. With the nature of

markets and products becoming more complex, it becomes imperative for the

broking firms to keep their staff continuously updated with latest development in

practices and procedures. Moreover, it is mandated for certain types of

dealers/brokers to seek specific certification and examinations that will make them

eligible to carry business or trade. Greater emphasis on aspects such as research

and analysis is giving scope

25

for in-depth training and skills sets on topics such as trading programs, valuations,

economic and financial forecasting and company research.

10. From owners to traders

A fundamental change that has taken place in the equity brokerage industry, which

is a global trend as well, is the transformation of broking from owners of the stock

exchange to traders of the stock market. Demutualization and corporatization of

stock exchanges bifurcated the ownership and trading rights with brokers vested

only with the later and ownership being widely distributed.

Demutualization is providing balanced welfare gains to both the stock exchanges

and the members with the former being able to run as corporations and the latter

being able to avoid conflict of interests that sometimes came as a major deterrent

for the long term growth of the industry.

Emerging challenges and outlook for the brokerage industry .Brokerage firms in

India made much progress in pursuing growth and building professionalism in

operations. Given the nature of the brokerage industry being very dynamic,

changes could be rapid and so as the challenges that emerge from time to time. A

brief description on some of the prospects and challenges of the brokerage firms

are discussed below.

26

11. Fragmentation

Indian brokerage industry is highly fragmented. Numerous small firms operate in

this space. Given the growing importance of technology in operations and

increasing emphasis on regulatory compliance, smaller firms might find it

constrained to make right type of investments that will help in business growth and

promotion of investor interests.

12. Capital Adequacy

Capital adequacy has emerged as an important determinant that governs the scope

of business in the financial sector. Current requirements stipulation capital

adequacy in regard to trading exposure, but in future more tighter norms of capital

adequacy might come into force as a part of the prudential norms in the financial

sector. In this background, it becomes imperative for the brokerage firms to focus

on raising capital resources that will enable to give continuous thrust and focus on

business growth.

13. Global Opportunities

Broking in the future will increasingly become international in character with the

stock markets being open for domestic and international investors including

institutions and individuals, as also opportunities for investing abroad. Keeping

abreast with developments in international markets as also familiarization with

global standards in broking operations and assimilating major practices and

procedures will become relevant for the domestic brokerage firms.

27

14. Opportunities from regional finance

Regional economic integration such as that under the European Union and the

ASEAN have greatly benefited businesses in the individual countries with cross

border opportunities that helped to expand the scope and significance of the

business. Initial measures to promote South Asian economic integration is being

made by governments in the region first at the political level to be followed up in

regard to financial markets. South Asian economic integration will provide greater

opportunities for broking firms in India to pursue cross border business. In view of

several of common features prevailing in the markets, it would be easier to make

progress in this regard.

15. Product Dynamics

As domestic finance matures and greater flow of cross border flows continue, new

market segments will come into force, which could benefit the domestic brokerage

firms, if they are well prepared. For instance, in the last three to four years,

brokerage firms had newer opportunities in the form of commodities futures,

distribution of insurance products, wealth management, mutual funds etc, and as

the market momentum continues, broking firms will have an opportunity to

introduce a wider number of products.

28

16. Competition from foreign firms

Surging markets and growing opportunities will attract a number of international

firms that will increase the pace of competition. Global firms with higher levels of

capital, expertise and market experience will bring dramatic changes in the

brokerage industry space which the local firms should be able to absorb and

compete. Domestic broking firms should always give due focus to emerging trends

in competition and prepare accordingly.

17. Investor Protection

Issues of investor interest and protection will assume centre stage. Firms found not

having suitable infrastructure and processes to ensure investor safety and

protection will encounter constraints from regulation as also class action suits that

investors might bring against erring firms. The nature of penalties and punitive

damages would become more severe. It is important for brokerage firms to

establish strong and streamlined systems and procedures for ensuring investor

safety and protection.

29

Chapter 4.

Literature Review

30

Literature Review

Historical Background:

Customer relationship management (CRM), a concept that has been around since

the mid 90s, has its roots in the technology of sales automation and call center

operations. At that time, it was thought that merging the customer data from the

field (sales) with the call center interactions would result in more informed

interactions with the customer. The concept resonated with user organizations and

soon mergers and acquisitions created a host of software vendors all claiming to

have an integrated set of capabilities that became known as CRM.

On a parallel track, Internet-based tools such as e-commerce, Internet marketing,

personalization, and self-help were evolving. These products competed outside of

the CRM sphere due to the newness of the technology, and they were referred to as

e-business. When the concepts of CRM and e-business melded together there was a

short period of e-madness where vendors talked about eCRM and e-everything.

There are still vestiges of this transition in the industry such as essentially using e-

business to add value to vendors and referring to it as partner relationship

management (PRM) or providing tools for employees and referring to it as

employee relationship management (ERM).

31

Similarly, enterprise resource planning (ERP) vendors realized that the 360-degree

view of the customer has to include transaction data, so they have likewise

developed an integrated package with CRM capabilities.

Thus from a technology perspective CRM consists of a set of applications that

address the needs of customer-facing functions that in turn feed a common

database that is supported by business analytics. Each vendor has variations on this

theme.

On the other hands, CRM can be defined as a process or methodology used to learn

more about customers needs and behaviors in order to manage and develop

stronger relationships in an organized way with them.

32

Components of CRM:

1. Contact an Account Management:

Relevant data for customer profile is captured with the help of the software.

Necessary information is captured from prospective customers. CRM system stores

data in common customer database. The database integrates customer account

information and presents it in desirable format to the company. The data is used for

sales, marketing, services and other applications.

33

2. Sales:

Sales process management follows a customized sales methodology with specific

sales policies and procedures. Sales activities include Product information,

Product configuration, sales prospectus and sales quote generation. CRM also

provide the history of customer account so that the sales call can be scheduled

accordingly.

3. Marketing and fulfillment:

CRM helps the professionals in product marketing, target marketing, relationship

marketing and campaign management. By analyzing customer and business value

of direct marketing can be estimated. CRM also helps in customer retention,

behavior prediction, channel optimization, personalization. Customer response and

requests can be quickly scheduled and hence sales contacts.

34

4. Customer Service and support:

CRM system provides service representatives with adequate access to customer

database. It also helps to create, assign and manage the service requests by

customers. Calling format is designed to route customer calls to respective

attendants as per the skills and authority to handle special cases. Help desk system

is developed to help customer service representative to help customers who face

problems with product or service to resolve it.

Web-based Self Service means help customer to access personalized information at

company website.

5. Retention and loyalty programs:

The primary objective of CRM is to enhance and optimize customer retention and

loyalty. CRM systems are also useful in determining most loyal and profitable

customers and reward.

35

The essential link between Marketing, Sales and Customer Service: Too often, the

three key functions that directly affect customers -Marketing, Sales and Customer

Service operate independently of one another. This can create confusion and

inconsistency in how you communicate and service your customers. For examples,

marketing staff may come up with a price promotion. However, if that is not

communicated to the sales team, the result could be incorrect billing, which may

take time or resources from the customer to rectify and could create ill will and

mistrust, making it seem like your company does not adhere to its word.

36

Similarly, if a salesperson makes a sale and gives certain guarantees to a customer

but those are not communicated to the customer service team or even to the other

sales team members, then the customer may fees as if the company is not standing

behind its assurance. This can be particularly problematic if there is employee

turnover and poor communication between or even departments. This silo effect

where information is between vertically in departments that may or may not

communicate with each other- could actually damage your business.

With comprehensive CRM system, however, customer communication is captured

and housed in an accessible database, making the most current information

available to anyone who needs it and has access to the system. By breaking

through barriers between various business functions and making communication

transparent, your company can act in a more consistent and unified fashion with its

customers, instilling a greater level of trust and strengthening customer

relationships.

Religare Securities Limited (RSL) provides a host of financial services under one

roof following a ONE STOP SHOP philosophy. It has a dedicated team of

professionals to cater to the variety of services to Individuals, Corporate and

Institutions. The team updates its clients with opportunities - with a sense of

competitive urgency and risk management. Whats more, their special analysts

design customized services for HNI and Institutions.

37

Over the years Religare Securities Ltd. has played a successful role in client's

wealth creation. In the process Religare Securities Ltd. also refined itself, as an

investment advisor and is poised to provide complete Investment Management

Solutions to its valued clientele.

The following is the product profile of the company.

- BSE and NSE

- Online Trading

- NCDEX & MCX

- NSDL & CDSL

38

Stock Data

Religare Securities Limited (RSL)

Current Price (9/4/2009): INR-391.10

Recent Stock Performance:

1 Week

-0.1%

13 Weeks

5.6%

4 Weeks

-17.6%

52 Weeks

1.8%

Religare Enterprises Limited Key Data:

Ticker: 532915 Country: INDIA

Exchanges: BOM Major Industry: Financial

Sub Industry: Securities Brokerage

2008 Sales 8,964,404,553 (Year Ending Jan 2009). Employees: N/A

Currency: Indian Rupees Market Cap: 29,854,462,060

Fiscal Yr Ends: March Shares Outstanding: 76,334,600

Share Type: Closely Held Shares: 41,187,500

39

NEWS:

Religare Securities bags LIPPER-STARMINE Award for Excellence in Research

Mumbai, February 18, 2009: Religare Securities Limited a wholly owned

subsidiary of Religare Enterprises Limited has been recently awarded the LIPPER-

STARMINE broker award for "Earnings Estimates in Midcap Research for 2008".

The Lipper| StarMine Awards organized by Thomson Reuters, for Asset

Management and sell-side broking Companies in India, were announced last week

in Mumbai. The awards recognize analysts who are more accurate than their peers

in forecasting earnings, awarding credit to those who demonstrate an ability to

make accurate estimates earlier than their peers.

On receiving the award, Mr. Amitabh Chakraborty, President (Equity), said, "We

are extremely proud to receive this award as a validation of our efforts in what was

the most difficult and volatile year in stock market and corporate history. It is in

these difficult times that the ability of a team to accurately estimate corporate

earnings stands its truest test and we have succeeded in enabling our customers to

make informed buy or sell recommendations in order to give above average returns

to investors."

40

Equities

What is equity?

Funds brought into a business by its shareholders is called equity. It is a measure of

a stake of a person or group of persons starting a business.

What does investing in equity mean?

When you buy a company's equity, you are in effect financing it, and being

compensated with a stake in the business. You become part-owner of the company,

entitled to dividends and other benefits that the company may announce, but

without any guarantee of a return on your investments.

Dematerialization

What is Demat?

Demat is a commonly used abbreviation of Dematerialisation, which is a process

whereby securities like shares, debentures are converted from the "material" (paper

documents) into electronic data and stored in the computers of an electronic

Depository (SEE next page).

You surrender material securities registered in your name to a Depository

Participant (DP). These are then sent to the respective companies

41

who cancel them after dematerialization and credit your Depository Account with

the DP. The securities on dematerialization appear as balances in the Depository

Account. These balances are transferable like physical shares. If at a later date you

wish to have these "Demat" securities converted back into paper certificates, the

Depository can help to revive the paper shares.

What is the procedure for the dematerialisation of securities?

Check with a DP as to whether the securities you hold can be dematerialised. Then

open an account with a DP and surrender the share certificates.

What is a Depository?

A Depository is a securities "bank," where dematerialised physical securities are

held in custody, and from where they can be traded. This facilitates faster, risk-free

and low cost settlement. A Depository is akin to a bank and performs activities

similar in nature.

At present, there are two Depositories in India, National Securities Depository

Limited (NSDL) and Central Depository Services (CDS). NSDL was the first

Indian Depository.

It was inaugurated in November 1996. NSDL was set up with an initial capital of

Rs 124 crores, promoted by Industrial Development Bank of

42

India (IDBI), Unit Trust of India (UTI), National Stock Exchange of India Ltd.

(NSEIL) and the State Bank of India (SBI).

Who is a Depository Participant (DP)?

NSDL carries out its activities through business partners - Depository Participants

(DPs), Issuing Corporates and their Registrars and Transfer Agents, Clearing

Corporations/Clearing Houses. NSDL is electronically linked to each of these

business partners via a satellite link through Very Small Aperture Terminals

(VSATS). The entire integrated system (including the VSAT linkups and the

software at NSDL and at each business partner's end) has been named the "NEST"

(National Electronic Settlement & Transfer) system. The investor interacts with the

Depository through a Depository Participant of NSDL. A DP can be a bank,

financial institution, a custodian or a broker.

43

Chapter 5.

Research Methodology

44

Research Methodology

Research Design:

Research design means adopting that type technique of research which is most

suited for the research and study of the problem. For the study and the research of

the problem proper material has to be selected and collected for the investigation.

A research design is the arrangement of conditions for collection and analysis of

data in a manner that aims to combine relevance to the research purpose with

economy in procedure.

- Jahoda, deutish. Cook.

In order to know about effectiveness of Customer Relationship Management in

Religare Securities Ltd., it was necessary to interact with the customer. The sample

taken comprised of respondents from Pune city. A questionnaire had to be

designed to collect valuable information from the different customer groups. The

questionnaire which was designed suitably to meet the objective of research work.

45

Nature of Research:

In this project report I have undertaken quantitative type of study.

Type of the questions:

The questions in the questionnaire asked to the visiting customers of Religare

Securities Ltd, Regional office in Pune, are Straight Forward and Limited Probing.

Type of the Questionnaire:

The questionnaire in this project report is straight forward and formalized.

Type of Analysis:

The analysis done in this particular project report is statistical.

46

Sources of Data:

a. Primary Data:

The Primary data are those data which are collected fresh and for the first time and

thus happen to be original in character. The primary data that was collected

through interview conducted in Regional Branch with daily visiting customers. The

primary data sources include copies of questionnaire and data of their respective

responses.

b. Secondary Data:

The secondary data are those which have already been collected by someone else

and which have been passed through the statistical process. Secondary data was

collected through company websites.

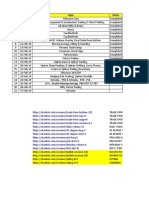

Some of the web sites http://www.religaresecurities.com/ and some others like.

47

Chapter 6.

Primary Data Collection

48

Primary Data Collection

Research Technique:

As the researcher, I adopted survey method as a research technique for this

particular project report.

Contact Method:

I as a researcher interviewed the respondents by personal interview.

Sampling Plan:

a) Population:

The population covered in this project report refers to the existing (Office Coming)

customers of Regional Office, who have their trading and Dmat A/c with Religare

Securities Ltd.

b) Sample Size

The sample size undertaken by me for this particular project report is 100

respondents.

49

c) Sample Element

The respondents contacted and interviewed in this project report are all from

different domain some of them were Businessmen, High Net-worth Investors,

Proprietors, even Students also invest in Share Market.

d) Sample Extent

As a researcher, I conducted this survey only for the customers in Regional Office

of Religare Securities, Pune.

e) Sample Duration

The survey was undertaken from the 01st June, 2009 to 30th July, 2009 i.e. for two

months.

f) Research Instrument:

Questionnaires containing both open ended and close ended questions were used as

a research instrument in this particular project report.

50

Chapter 7.

Data Analysis & Interpretation

51

30%

8%

24%

38%

Businessmen

HNIs

Proprietors

Individuals

Data Analysis & Interpretation

1. Respondents:

Respondents Businessmen HNIs Proprietors Individuals

Number of respondents 30 8 24 38

Interpretation:

Above pie chart represents that research contains 100 respondents which are Businessmen, HNIs,

Proprietors and Individuals and they are 30, 8, 24, 38 respectively in numbers and percentages.

52

43%

37%

13%

7%

10000 -1 Lakh

1 Lakh -5 Lakh

5 Lakh -10 Lakh

10 Lakh -Above

2. Income Group(Annual):

Income Group

(INR)

10000 - 1

Lakh

1 Lakh - 5

Lakh

5 Lakh-10

Lakh

10 Lakh -

Above

Number of

respondents

43 37 13 7

Interpretation:

Above pie chart represents that the research contained 100 investors and customers of Religare

Securities Ltd. All the people were from different different Income group which are in numbers

shown above. W e can clearly see sample includes more customers from first income group i.e.

INR 10,000 1 Lakh

53

Excellent

Good

Fair

Poor

2. Company Interaction via Email and Telephone Calls:

Interaction Via Email and Telephone Calls Poor Fair Good Excellent

Number of respondents 2 11 59 18

Interpretation:

From the above result of Company Interaction via Email and Telephone calls, we can imagine

the satisfaction level of customers and accordingly Customer Relationship is managed through

electronic media to maximize the wealth of customers. In Religare mostly dealers are in touch of

regular traders / customers and customers also get loyal to the company through this practice.

Every call is taped by default for the evidence of orders to buy or sell the stocks and Emails too.

54

96%

1%

3%

Yes

No

Can't Say

3. Do you find companys investment tips useful and beneficial?

Investment Tips Yes No Cant Say

Number of respondents 96 1 3

Interpretation:

When it was asked sudden and on the time answer was the same of maximum people, it means

the credibility and trustworthiness of the company is on the height. Its nothing but the result of

Relationship Management.

It is said that Share Market means Well of Loss, nevertheless Religares Customer dont have

any tension in investing because they believe in Companys Researchers and Analysts and their

investment tips too.

55

4%

14%

40%

42%

4

6

8

10

4. Where do you rate Religare on the scale of 10 in terms of Services?

Religare on the scale of 1 to 10 4 6 8 10

Number of respondents 4 14 40 42

Interpretation:

From the above answers Customer Relationship can be very well highlighted because out of 100,

43 people have rated Religare on the scale of 1 to 10 and again in remaining maximum

customers say that they rate Religare at on the scale of 1 to 10.Every customer has his own value

and consideration about Religare because they invest their Hard Earned money and take risk to

earn more cause of Religares Services and Attachment and it is all the output of Customer

Relationship Management.

56

66%

19%

15%

Equity

Commodity

Currency

5. Where do you invest/ trade mostly?

Where Customers Invest mostly Equity Commodity Currency

Number of respondents 66 19 15

Interpretation:

One general question was asked in questionnaire to know the investment flow of customers

towards Religare Services. When it was asked why they invest in specific area mostly then it was

answered by many people that liquidity market is easy to make money out of investment and

take money out whenever we feel not to put.

And other reason many customers dont want to invest for long time.And about currency some

people were not interested.

57

48%

37%

15%

Intraday

Delivery

Both

6. Where do you trade mostly?

Where Customers Trade mostly Intraday Delivery Both

Number of respondents 48 37 15

58

Interpretation:

From the above view of graph we come to know that maximum people, 61%

customers trade in Intraday Trading. On this customers say they like to trade in

Intraday because of Short term investment and high level of excitement and

sometimes they feel their money seems to sink. Its like One Day Cricket play for

many customers.

In Delivery, people say here is No / Low Risk, More Money , in this people say

if scrip goes down like Satyam, then also we get chance to book profit buying

current stocks in low price and putting old stock aside temporarily. Here we find

people hesitate to invest in Intraday and confident to trade in Delivery trading.

Very less traders population do trade in both area, for few people its nothing but

fund managing, if one finds difficulty in making money in Intraday, they

simultaneously manage their fund for Delivery, but very few people feel do this

type of management.

Eventually Religare is the Broking firm and it doesnt lose its attention from

making money for its customers and lose its attention from Customer Relationship

Management.

59

73%

27%

Yes

No

7. Do you trade in any other broking firm?

Trade in other Broking Firm Yes No

Number of respondents 73 27

Interpretation:

Above pie chart represents the maximum people have their Dmat A /c and Trading A/c

somewhere else also nevertheless they say they trade from Religare only and few of their other

A/cs are put Non-Operating by them.

Here we get a fact that Religares Customer Relationship Management really has something very

attractive and attachable to emotions cause of services.

Few of them were hesitating while answering this question.

60

64%

35%

1%

0%

Strongly Yes

Slightly Yes

No

Slightly No

8. Are you satisfied with the services provided by Religare?

Satisfaction Strongly

Yes

Slightly

Yes

No Strongly

No

Slightly

No

Number of

respondents

64 35 1 0 0

Interpretation:

Above chart represents us the output of Customer Relationship Management with the help of the

services and customers satisfaction can show a mirror of the efforts of the company towards

making their customers loyal to them.

Here 64% customers have selected and stated that they are fully satisfied with the services that

they are getting from Religare Securities Ltd.

61

17%

26%

57%

Less than 1 year

More than 1 year

More than 2 years

9. Since last how many years you are in field of trading?

Since when customers are

trading ?

Less than 1

year

More than

1year

More than 2

years

Number of respondents 26 57 17

Interpretation:

This question was asked intentionally to know the loyalty of customers with Religare Securities

Ltd., which is nothing but the back-screen coding of on screen output. These all things are the

proud of Religare and its customers are also very proud to be in Religare.

62

Findings

63

Findings

Customer Relationship Management Business Drivers and Benefits

It empowers management with a real-time pipelines and forecasting so

they can build and focus on high profit, sustainable relationships.

empowers staff wit customer intelligence and best practices to increase

their likelihood of successful transactions.

integrating information across the enterprise.

enables executive and management to gain customer insight.

64

Customer Relationship Management Risks

Effective internal controls must be in place to prevent customer

information from becoming scattered across databases and servers.

e associated with significant revenue cycle.

only otherwise Customers Database can be misused by rivals.

Customer Common Findings while contacting:

Generally people whom I have contacted they were from different domains

like Business, Proprietors, High Net worth Income Group (HNIs) and students.

Room.

red very genuine but is

this case it misrepresents the Reality and Credibility.

65

this questionnaire is from Religare Securities internal.

people did not take it serious because this was not important to

them as they are busy for trading at dealing Room.

results because this study is for only two months altogether.

66

Chapter 8.

Limitations

67

Limitations

Findings are according to the observations.

1. Many consultants, vendors, and analysts today define CRM in terms of

being a customer-centric business strategy that is enabled by a set of applications

that support customer-facing functions and management decision making. That

may capture the essence of what CRM is, but while it does not concentrate on the

extra expenses occurring on Companys A/c due to increment in expenses in

serving customers all the ways and Return on investment means consideration may

not be more than expected. Customer may not give that much business transactions

which is estimated or expected.

2. It needs specific staffs to handle all the tasks of Customer Relationship

Management because the data that is feed in system cannot be handled merely by

Relationship Managers who has to make new customers and take care of their

dealings and also to accomplish their additional responsibilities.

68

Suggestions

69

Suggestions

1. Short Duration:

o Project research duration was only for two months, in this tenure neither

study nor observation can be done properly. For example, we saw sample plan in

that only 100 customers could be contacted and now the problem is- from this

samples we cannot think of Macro Level Perception of customers. Many people

may be from same point of view and many may not and those 100 people may not

contain these type of people. So duration of Research Project should be more than

two months.

2. Customer Category:

o To find effective Customer Relationship Management, Broking firm can

do one more thing which will be very beneficial to them in finding Asset

Customers from the bottom level management to top level management. Religare

should adopt system of allotting Customer Categories according to their

transactions, due payments, exposure, loyalty, frequency of trading and all.

70

o In this system at all the level where CRM is handled and watched by Top

class officials of the company, they also get to know the list names and details of

the loyal customers and CEO or Board of Directors also get to know total

customers and at last their turnover of the total transaction.

3. Affiliated Awareness Programs:

o Religare should arrange affiliated programs within its own groups to

come to the sense of new people and accordingly to prospecting and acquiring new

customers.

o With the help of it companies CRM will help it to get height of success

and dominate the world of Services. Because CRM affects Marketing, Sales and

profitability and these all can be achieved by CRM.

o For E.g., Religare Securities can play few awareness documentaries and

Advertisement with Religare Vistaar this will result in getting more and more

customers to serve and accordingly Religare can become the first ranker in

turnover very soon.

71

Appendix

I. Copy of questionnaire

II. Bibliography

,

72

Questionnaire

1. Name:________________________________________________

2. Contact No:________________________________________________

3. Occupation:

LBusinessman LProprietor LHNI LIndividual

4. Income Group(Annual):

L 10000 - 1 Lakh L1 Lakh - 5 Lakh

L 5 Lakh-10 Lakh L 10 Lakh - Above

5. How do you find Company Interaction via Email and Telephone Calls

?

LPoor LFair LGood L Very Good

73

6. Do you find companys investment tips useful and beneficial?

LYes LNo LCant Say

7. Where do you rate Religare on the scale of 10 in terms of Services?

L L L L_

8. Where do you invest/ trade mostly?

LEquity LCommodity LCurrency

9. Where do you trade mostly?

LIntraday trading LDelivery Trading

10. Do you trade in any other broking firm?

Lm1 LC

If Yes, name of the broking firm__________________________________

74

11. Are you satisfied with the services provided by Religare?

Lm1 LC

Since last how many years you are in field of trading?

LLess than 1 Year LMore Than 1 Year LMore than 5 Year

12. What improvement do you want be done in companys services?

L!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

!!!!!!!!!!!!!!!!!!!

13. Which service do you like most in Religare?

L!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

!!!!!!!!!!!!!!!!!!!

Bibliography

Websites =

http://deadpresident.blogspot.com

http://religareonline.com

http://www.religaresecurities.com

Newspapers =

The Hindu

Books =

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Thomas Stridsman Trading Systems That Work PDFDocument366 pagesThomas Stridsman Trading Systems That Work PDFJuan Carlos Escobar100% (2)

- Option Analysis in TamilDocument18 pagesOption Analysis in Tamilpradeep.jaganathan81% (16)

- Market Profile's: Basic ComponentsDocument108 pagesMarket Profile's: Basic Componentskakadiya piyush100% (4)

- Day Trading With Pivot Points & Price Aaction Vikram PrabhuDocument104 pagesDay Trading With Pivot Points & Price Aaction Vikram PrabhuAshish Singh100% (3)

- GannDocument11 pagesGannrajivnk100% (1)

- Calhoun ADX Breakout ScanDocument5 pagesCalhoun ADX Breakout Scanedsnake80% (5)

- Day Traders Manual PDFDocument64 pagesDay Traders Manual PDFVoice of Reason100% (1)

- Basics of Share Market OperationsDocument8 pagesBasics of Share Market Operationslelesachin100% (2)

- Momentum PicksDocument29 pagesMomentum PicksSujoy SikderrNo ratings yet

- Katalyst Wealth - A Free Guide To Grow Your Wealth by 190 TimesDocument21 pagesKatalyst Wealth - A Free Guide To Grow Your Wealth by 190 TimesKatalyst WealthNo ratings yet

- Batch 10 ExcelDocument139 pagesBatch 10 ExcelRajeshKancharla100% (1)

- Intraday Strategy Using CPR Suresh Kumar047Document13 pagesIntraday Strategy Using CPR Suresh Kumar047KkrkumarNo ratings yet

- Date: 01/08/2017 Market: ES Mini Timeframe(s) : Intraday - 5m, 15m, 60m, 3500T News: Yesterday: HIGH: 2475.00 LOW: 2465.25 CLOSE: 2468.00Document3 pagesDate: 01/08/2017 Market: ES Mini Timeframe(s) : Intraday - 5m, 15m, 60m, 3500T News: Yesterday: HIGH: 2475.00 LOW: 2465.25 CLOSE: 2468.00RICARDONo ratings yet

- Tape ReadingDocument51 pagesTape ReadingtheCatalyst100% (2)

- How To Make Money in Day TradingDocument136 pagesHow To Make Money in Day Tradingahmet50% (2)

- IfmDocument12 pagesIfm777priyankaNo ratings yet

- New Trader Rich Trader How To Make Money Steve Burns PDFDocument677 pagesNew Trader Rich Trader How To Make Money Steve Burns PDFMarian Raga100% (3)

- ContinueDocument3 pagesContinueChoudhary ToursNo ratings yet

- (Ebook) Guide To Profitable Forex Day TradingDocument42 pages(Ebook) Guide To Profitable Forex Day TradingThie Chen100% (1)

- The Discerning Trader LBRDocument8 pagesThe Discerning Trader LBRSteven Watson100% (2)

- Hedge 17Document7 pagesHedge 17vishalastrologer5331No ratings yet

- PDF Trading Stocks IntradaypdfDocument10 pagesPDF Trading Stocks IntradaypdfBommaNo ratings yet

- Gettes DayTradingDocument9 pagesGettes DayTradingsatish s100% (2)

- Santosh BabaDocument137 pagesSantosh BabaAkshi KarthikeyanNo ratings yet

- How To Trade Intraday Using Advanced Volatility CalculatorDocument6 pagesHow To Trade Intraday Using Advanced Volatility CalculatorShubham WaghmareNo ratings yet

- Best Stochastic Trading Strategy - How To Use Stochastic IndicatorsDocument25 pagesBest Stochastic Trading Strategy - How To Use Stochastic IndicatorssudhakarrrrrrNo ratings yet

- Fibo BulkowskiDocument10 pagesFibo BulkowskifgaluppoNo ratings yet

- Andrew Aziz How To Day Trade For A Living AUDIOBOOK FIGSDocument50 pagesAndrew Aziz How To Day Trade For A Living AUDIOBOOK FIGSjrrguitar50% (16)

- Day 1 Session 1Document72 pagesDay 1 Session 1msamala09No ratings yet

- Fibonacci Combined With Pivot Points: by John L. PersonDocument11 pagesFibonacci Combined With Pivot Points: by John L. PersonIsma ColomaNo ratings yet