Professional Documents

Culture Documents

Financial Management Assignment 1

Uploaded by

Humaira ShafiqOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management Assignment 1

Uploaded by

Humaira ShafiqCopyright:

Available Formats

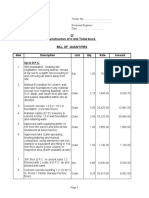

Financial Management Assignment 1

Submitted by: Humaira Shafiq STD: 2012-3-49-14004 Submitted to: Mr. Rizwan Siddiqui

Relationship of interest rates and cash flows

The interest rate used in determining the present value of future cash flows. The interest rate used in discounted cash flow analysis to determine the present value of future cash flows. The discount rate takes into account the time value of money (the idea that money available now is worth more than the same amount of money available in the future because it could be earning interest) and the risk or uncertainty of the anticipated future cash flows (which might be less than expected). The process of finding present values is called Discounting and the interest rate used to calculate present values is called the discount rate. In finance, discounted cash flow (DCF) analysis is a method of valuing a project, company, or asset using the concepts of the time value of money. All future cash flows are estimated and discounted to give their present values (PVs) the sum of all future cash flows, both incoming and outgoing, is the net present value (NPV), which is taken as the value or price of the cash flows in question. Using DCF analysis to compute the NPV takes as input cash flows and a discount rate and gives as output a price; the opposite process taking cash flows and a price and inferring a discount rate, is called the yield. Discounted cash flow analysis is widely used in investment finance, real estate development, and corporate financial management.

Relationship between IRR and NPV

Net present value, or NPV, and internal rate of return, or IRR, are measures that you can use to evaluate a potential capital project or investment. With both IRR and NPV, you evaluate a stream of expected cash inflows and outflows to help determine if you should make a specific investment. The IRR indicates the potential growth percentage of the investment. The NPV, on the other hand, indicates the value of a project's income potential today. Calculations Although the calculations for both the IRR and the NPV utilize the same data, the IRR gives insight into the potential profitability of an investment when the NPV still equals zero. The IRR is also commonly known as the discount rate. When you compare potential investments, a higher IRR usually indicates a better investment choice.

Amounts of Return Consider the minimum rate of return you find acceptable. For an investor, the IRR must at least equal the minimum amount of return expected for a particular investment. If the IRR does not meet this minimum, look for another investment. The NPV, on the other hand, shows the investment's value in today's dollars. The NPV will equal zero if the investment's future discounted income, minus the initial cash outflow of the project, does not carry any present-day value.

Short Notes on IRR and Modified IRR

'Internal Rate Of Return - IRR' The discount rate often used in capital budgeting that makes the net present value of all cash flows from a particular project equal to zero. Generally speaking, the higher a project's internal rate of return, the more desirable it is to undertake the project. As such, IRR can be used to rank several prospective projects a firm is considering. Assuming all other factors are equal among the various projects, the project with the highest IRR would probably be considered the best and undertaken first. You can think of IRR as the rate of growth a project is expected to generate. While the actual rate of return that a given project ends up generating will often differ from its estimated IRR rate, a project with a substantially higher IRR value than other available options would still provide a much better chance of strong growth. IRRs can also be compared against prevailing rates of return in the securities market. If a firm can't find any projects with IRRs greater than the returns that can be generated in the financial markets, it may simply choose to invest its retained earnings into the market. The formula for IRR, using this example, is as follows:

Where the initial payment (CF1) is $200,000 (a positive inflow) Subsequent cash flows (CF 2, CF 3, CF N) are negative $1050 (negative because it is being paid out) Number of payments (N) is 30 years times 12 = 360 monthly payments Initial Investment is $200,000 IRR is 4.8% divided by 12 (to equate to monthly payments) = 0.400%

'Modified Internal Rate Of Return - MIRR' While the internal rate of return (IRR) assumes the cash flows from a project are reinvested at the IRR, the modified IRR assumes that positive cash flows are reinvested at the firm's cost of capital, and the initial outlays are financed at the firm's financing cost. Therefore, MIRR more accurately reflects the cost and profitability of a project. For example, say a two-year project with an initial outlay of $195 and a cost of capital of 12%, will return $121 in the first year and $131 in the second year. To find the IRR of the project so that the net present value (NPV) = 0: NPV = 0 = -195 + 121/(1+ IRR) + 131/(1 + IRR)2 NPV = 0 when IRR = 18.66% To calculate the MIRR of the project, we have to assume that the positive cash flows will be reinvested at the 12% cost of capital. So the future value of the positive cash flows is computed as: $121(1.12) + $131 = $266.52 = Future Value of positive cash flows at t = 2 Now you divide the future value of the cash flows by the present value of the initial outlay, which was $195, and find the geometric return for 2 periods. =sqrt($266.52/195) -1 = 16.91% MIRR You can see here that the 16.91% MIRR is materially lower than the IRR of 18.66%. In this case, the IRR gives a too optimistic picture of the potential of the project, while the MIRR gives a more realistic evaluation of the project.

You might also like

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- CB 1Document3 pagesCB 1Shreyas KothiNo ratings yet

- Cap. Budgetinf ChapterDocument7 pagesCap. Budgetinf Chapterbhagat103No ratings yet

- Net Present Value: Problems in Using IRR in Risk AnalysesDocument11 pagesNet Present Value: Problems in Using IRR in Risk AnalysesAndrew LeeNo ratings yet

- Project Valuation: Financial ManagementDocument16 pagesProject Valuation: Financial Managementknowledge informationNo ratings yet

- CORP FIN Final TheoryDocument5 pagesCORP FIN Final Theoryjesin.estiana09No ratings yet

- Internal Rate of ReturnDocument4 pagesInternal Rate of ReturnMaria Ali ZulfiqarNo ratings yet

- Internal Rate of Return, DCF, NPVDocument4 pagesInternal Rate of Return, DCF, NPVMihir AsherNo ratings yet

- Internal Rate of Return (IRR)Document1 pageInternal Rate of Return (IRR)LJBernardoNo ratings yet

- Ques No 1-Difference Between NVP and IRR?: What Is Capital Budgeting?Document4 pagesQues No 1-Difference Between NVP and IRR?: What Is Capital Budgeting?Istiaque AhmedNo ratings yet

- Ques No 1-Difference Between NVP and IRR?: What Is Capital Budgeting?Document4 pagesQues No 1-Difference Between NVP and IRR?: What Is Capital Budgeting?Istiaque AhmedNo ratings yet

- Weighted Average CostDocument5 pagesWeighted Average CostsureshdassNo ratings yet

- FM Mid Term TestDocument14 pagesFM Mid Term TestAnkita SinghNo ratings yet

- Enter Project Name HereDocument11 pagesEnter Project Name HereMatthew AdeyinkaNo ratings yet

- Concepts of Capital Budgeting: Prime AcademyDocument4 pagesConcepts of Capital Budgeting: Prime AcademyAbhishek RamarchaNo ratings yet

- Net Present ValueDocument8 pagesNet Present ValueDagnachew Amare DagnachewNo ratings yet

- Net Present Value vs. Internal Rate of ReturnDocument15 pagesNet Present Value vs. Internal Rate of ReturnSumaira BilalNo ratings yet

- Net Present Value - NPV: Capital BudgetingDocument4 pagesNet Present Value - NPV: Capital BudgetingCris Marquez100% (1)

- What Is Internal Rate of Return (IRR) ?Document10 pagesWhat Is Internal Rate of Return (IRR) ?anayochukwuNo ratings yet

- Corporate Finance: NPV and DefinitionDocument8 pagesCorporate Finance: NPV and Definitionzubair attariNo ratings yet

- Weighted Average Cost of CapitalDocument6 pagesWeighted Average Cost of CapitalStoryKingNo ratings yet

- FinanceDocument2 pagesFinanceRaj KishoreNo ratings yet

- Internal Rate of ReturnDocument6 pagesInternal Rate of ReturnNeeraj DhariaNo ratings yet

- Am - Assessment 2..Document3 pagesAm - Assessment 2..Harpreet KaurNo ratings yet

- NotesFMF FinalDocument52 pagesNotesFMF FinalKyrelle Mae LozadaNo ratings yet

- Internal Rate of ReturnDocument4 pagesInternal Rate of Returnram_babu_59No ratings yet

- Why Is The Time Value of Money So Important in Capital Budgeting Decisions?Document3 pagesWhy Is The Time Value of Money So Important in Capital Budgeting Decisions?jatinNo ratings yet

- Internal Rate of ReturnDocument6 pagesInternal Rate of ReturnDagnachew Amare DagnachewNo ratings yet

- Capital Iq MaterialDocument38 pagesCapital Iq MaterialMadan MohanNo ratings yet

- Main Project Capital Budgeting MbaDocument110 pagesMain Project Capital Budgeting MbaRaviKiran Avula65% (34)

- What Is Discounted Cash FlowDocument2 pagesWhat Is Discounted Cash FlowDEVERLYN SAQUIDONo ratings yet

- Deposit MobilizationDocument6 pagesDeposit MobilizationJesan Jesu50% (4)

- Chapter 6: Introduction To Capital BudgetingDocument3 pagesChapter 6: Introduction To Capital BudgetingDeneree Joi EscotoNo ratings yet

- Chapter 6: Introduction To Capital BudgetingDocument3 pagesChapter 6: Introduction To Capital BudgetingDeneree Joi EscotoNo ratings yet

- Definition of 'Internal Rate of Return - IRRDocument2 pagesDefinition of 'Internal Rate of Return - IRRsagarramakaNo ratings yet

- Time Value of Money Discounting and Compounding: Required Rate of ReturnDocument8 pagesTime Value of Money Discounting and Compounding: Required Rate of ReturnGiddy KenduiwaNo ratings yet

- Time Value of MoneyDocument3 pagesTime Value of MoneyPankaj2cNo ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingRajatNo ratings yet

- Why Do Most Capital Budgeting Methods Focus On Cash Flows?Document3 pagesWhy Do Most Capital Budgeting Methods Focus On Cash Flows?Aryan LeeNo ratings yet

- Capital Budgeting TheoryDocument8 pagesCapital Budgeting TheorySweta AgarwalNo ratings yet

- Internal Rate of Return - WikipediaDocument6 pagesInternal Rate of Return - Wikipediapuput075No ratings yet

- Definition of IrrDocument3 pagesDefinition of IrrRajesh ShresthaNo ratings yet

- Net Present ValueDocument12 pagesNet Present ValueRamya SubramanianNo ratings yet

- Phase 2 Task 1 - DBDocument5 pagesPhase 2 Task 1 - DBDanita VaughanNo ratings yet

- Chapter 10Document42 pagesChapter 10LBL_LowkeeNo ratings yet

- Cheat SheetDocument6 pagesCheat Sheetm parivahanNo ratings yet

- Investment Decisions: Decisions Through The Life-Cycle of A Petroleum ProjectDocument6 pagesInvestment Decisions: Decisions Through The Life-Cycle of A Petroleum Projectjhon berez223344No ratings yet

- Capital BudgetingDocument11 pagesCapital BudgetingRonak MehtaNo ratings yet

- Internal Rate of ReturnDocument1 pageInternal Rate of ReturnpilotNo ratings yet

- Profitability IndexDocument3 pagesProfitability IndexSaira Ishfaq 84-FMS/PHDFIN/F16No ratings yet

- FM Asgmt Cycle 2Document13 pagesFM Asgmt Cycle 2Bhavana PedadaNo ratings yet

- Recall The Flows of Funds and Decisions Important To The Financial ManagerDocument27 pagesRecall The Flows of Funds and Decisions Important To The Financial ManagerAyaz MahmoodNo ratings yet

- Payback Period: Equal The Amount of Money Invested Into The ProjectDocument4 pagesPayback Period: Equal The Amount of Money Invested Into The ProjecteldhosekjnitNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingVarsha KastureNo ratings yet

- Significance of Capital Budgeting: Discounted Cash Flow MethodDocument8 pagesSignificance of Capital Budgeting: Discounted Cash Flow MethodSarwat AfreenNo ratings yet

- Accounting and FinanceDocument28 pagesAccounting and FinanceSimon silaNo ratings yet

- Time Value of MoneyDocument6 pagesTime Value of MoneyNurun KamilaNo ratings yet

- Capital Budgeting Technique: Md. Nehal AhmedDocument25 pagesCapital Budgeting Technique: Md. Nehal AhmedZ Anderson Rajin0% (1)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Speaking Topic FamilyDocument18 pagesSpeaking Topic FamilyHumaira ShafiqNo ratings yet

- IELTS-Style Speaking Test Questions and AnswersDocument4 pagesIELTS-Style Speaking Test Questions and AnswersHumaira ShafiqNo ratings yet

- VocabularyDocument58 pagesVocabularyHumaira ShafiqNo ratings yet

- Speaking TopicDocument6 pagesSpeaking TopicHumaira ShafiqNo ratings yet

- VocabularyDocument58 pagesVocabularyHumaira ShafiqNo ratings yet

- Part 1 IELTS Speaking PDF Jeans 1Document1 pagePart 1 IELTS Speaking PDF Jeans 1Humaira ShafiqNo ratings yet

- Increase, D For Decrease and NE For No EffectDocument1 pageIncrease, D For Decrease and NE For No EffectHumaira ShafiqNo ratings yet

- Equivalence Degree IssuanceDocument2 pagesEquivalence Degree IssuanceHumaira ShafiqNo ratings yet

- Confusing WordsDocument10 pagesConfusing WordsHumaira ShafiqNo ratings yet

- Human Resource Problems at Soneri Bank LTD.: PREPARED BY: Dr. Anjum Younus 11683Document51 pagesHuman Resource Problems at Soneri Bank LTD.: PREPARED BY: Dr. Anjum Younus 11683Humaira ShafiqNo ratings yet

- Business and Organisation Structure of Standard Chartered BankDocument17 pagesBusiness and Organisation Structure of Standard Chartered BankHumaira Shafiq0% (1)

- Servce Marketing Report On KFCDocument58 pagesServce Marketing Report On KFCHumaira ShafiqNo ratings yet

- HRM Shah SaadDocument1 pageHRM Shah SaadHumaira ShafiqNo ratings yet

- Business and Organisation Structure of Standard Chartered BankDocument17 pagesBusiness and Organisation Structure of Standard Chartered BankHumaira Shafiq0% (1)

- Increase, D For Decrease and NE For No EffectDocument1 pageIncrease, D For Decrease and NE For No EffectHumaira ShafiqNo ratings yet

- Search Engine MarketingDocument6 pagesSearch Engine MarketingHumaira ShafiqNo ratings yet

- PartnershipDocument5 pagesPartnershipHumaira ShafiqNo ratings yet

- Law Assignment 1Document5 pagesLaw Assignment 1Humaira ShafiqNo ratings yet

- Business Law Assignment 2Document15 pagesBusiness Law Assignment 2Humaira ShafiqNo ratings yet

- Human Resource Problems at Soneri Bank LTD.: PREPARED BY: Dr. Anjum Younus 11683Document51 pagesHuman Resource Problems at Soneri Bank LTD.: PREPARED BY: Dr. Anjum Younus 11683Humaira ShafiqNo ratings yet

- Basel 2Document1 pageBasel 2Humaira ShafiqNo ratings yet

- Definition of 'Accounting'Document10 pagesDefinition of 'Accounting'Humaira ShafiqNo ratings yet

- Business Law Assignment 2Document15 pagesBusiness Law Assignment 2Humaira ShafiqNo ratings yet

- Business Law Assignment 3Document15 pagesBusiness Law Assignment 3Humaira Shafiq100% (1)

- HRM Case Study-PatelDocument11 pagesHRM Case Study-PatelHumaira ShafiqNo ratings yet

- Organization Development: Engro Foods LimitedDocument22 pagesOrganization Development: Engro Foods Limitedzahoor19480% (4)

- Organization Development: Engro Foods LimitedDocument22 pagesOrganization Development: Engro Foods Limitedzahoor19480% (4)

- Eggplant: Do You Know That Eggplant and Cholesterol Are Closely Related?Document11 pagesEggplant: Do You Know That Eggplant and Cholesterol Are Closely Related?Humaira ShafiqNo ratings yet

- Gate Ki SabziDocument3 pagesGate Ki SabziHumaira ShafiqNo ratings yet

- HW4 Fa17Document4 pagesHW4 Fa17mikeiscool133No ratings yet

- Mayor Breanna Lungo-Koehn StatementDocument2 pagesMayor Breanna Lungo-Koehn StatementNell CoakleyNo ratings yet

- Introduction To Radar Warning ReceiverDocument23 pagesIntroduction To Radar Warning ReceiverPobitra Chele100% (1)

- ACC403 Week 10 Assignment Rebecca MillerDocument7 pagesACC403 Week 10 Assignment Rebecca MillerRebecca Miller HorneNo ratings yet

- CC Anbcc FD 002 Enr0Document5 pagesCC Anbcc FD 002 Enr0ssierroNo ratings yet

- Annotated Portfolio - Wired EyeDocument26 pagesAnnotated Portfolio - Wired Eyeanu1905No ratings yet

- Solutions To Questions - Chapter 6 Mortgages: Additional Concepts, Analysis, and Applications Question 6-1Document16 pagesSolutions To Questions - Chapter 6 Mortgages: Additional Concepts, Analysis, and Applications Question 6-1--bolabolaNo ratings yet

- Mentorship ICT at A GlanceDocument5 pagesMentorship ICT at A GlanceTeachers Without Borders0% (1)

- Oops in PythonDocument64 pagesOops in PythonSyed SalmanNo ratings yet

- To The Owner / President / CeoDocument2 pagesTo The Owner / President / CeoChriestal SorianoNo ratings yet

- Finaniial AsceptsDocument280 pagesFinaniial AsceptsKshipra PrakashNo ratings yet

- Tax Accounting Jones CH 4 HW SolutionsDocument7 pagesTax Accounting Jones CH 4 HW SolutionsLolaLaTraileraNo ratings yet

- Comparative Analysis of Mutual Fund SchemesDocument29 pagesComparative Analysis of Mutual Fund SchemesAvinash JamiNo ratings yet

- Marshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianDocument3 pagesMarshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianValenVidelaNo ratings yet

- Andrews C145385 Shareholders DebriefDocument9 pagesAndrews C145385 Shareholders DebriefmrdlbishtNo ratings yet

- Change Language DynamicallyDocument3 pagesChange Language DynamicallySinan YıldızNo ratings yet

- Double Inlet Airfoil Fans - AtzafDocument52 pagesDouble Inlet Airfoil Fans - AtzafDaniel AlonsoNo ratings yet

- Apst GraduatestageDocument1 pageApst Graduatestageapi-253013067No ratings yet

- Verma Toys Leona Bebe PDFDocument28 pagesVerma Toys Leona Bebe PDFSILVIA ROMERO100% (3)

- CORDLESS PLUNGE SAW PTS 20-Li A1 PDFDocument68 pagesCORDLESS PLUNGE SAW PTS 20-Li A1 PDFΑλεξης ΝεοφυτουNo ratings yet

- IBMC Competition Booklet 2013Document40 pagesIBMC Competition Booklet 2013Rollins Center at BYUNo ratings yet

- Cinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Document8 pagesCinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Social Scientists' AssociationNo ratings yet

- Moparm Action - December 2014 USADocument100 pagesMoparm Action - December 2014 USAenricoioNo ratings yet

- Land Use Paln in La Trinidad BenguetDocument19 pagesLand Use Paln in La Trinidad BenguetErin FontanillaNo ratings yet

- Crivit IAN 89192 FlashlightDocument2 pagesCrivit IAN 89192 FlashlightmNo ratings yet

- 3.1 Radiation in Class Exercises IIDocument2 pages3.1 Radiation in Class Exercises IIPabloNo ratings yet

- National Senior Certificate: Grade 12Document13 pagesNational Senior Certificate: Grade 12Marco Carminé SpidalieriNo ratings yet

- Ewellery Ndustry: Presentation OnDocument26 pagesEwellery Ndustry: Presentation Onharishgnr0% (1)

- Type BOQ For Construction of 4 Units Toilet Drawing No.04Document6 pagesType BOQ For Construction of 4 Units Toilet Drawing No.04Yashika Bhathiya JayasingheNo ratings yet

- Perhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020Document6 pagesPerhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020andreas evanNo ratings yet