Professional Documents

Culture Documents

Setup Credit Card Payments in Oracle Receivables

Uploaded by

Mag MarinaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Setup Credit Card Payments in Oracle Receivables

Uploaded by

Mag MarinaCopyright:

Available Formats

Oracle Champions http://www.oraclechamps.

com

CREDITCARD PAYMENT SETUPS

The purpose of this Document is to provide credit card set up steps for Oracle Account Receivables (AR) module. Oracle Receivables allow customers to use a credit card to remit payments for open debit items. The procedure for processing credit card payments in receivables is similar to the procedure for creating automatic receipts. Automatic receipts allows you collect payments according to a predefined agreement with your customer by transferring funds from the customers bank account to yours on the receipt maturity date. By providing a credit card number as payment, your customer expects that the credit card issuer will transfer funds to your bank account as payment for their open debit items. The following steps are required to process credit card payments in receivables: Flag transactions to be paid by credit card. Create a batch of automatic receipts to close transactions flagged for credit card payment. Approve the automatic receipts batch to reserve the payment mount from the card holders account. Create and approve a remittance batch to request transfer of funds from the credit card issuer to your bank.

Following Are The Key Set Up Considerations In Credit Card Set Up . Step-1 Define Remittance (Internal) Bank Account Step-2 Define Receipt Class Step-3 Create and Assign Document Sequence for Automatic Receipts Step-4 Verify That the Ipayment Serve r URL Is Defined Step-5 Create Invoice and Flag for Credit Card Processing Step-6 Run Automatic Receipts For Approval Step-7 Run Automatic Remittances for Capture

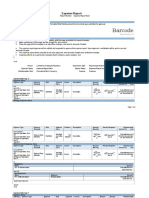

Below Are The Steps In Detail: Step-1 -----Define Remittance Bank ->Setup->Receipts->Bank

Oracle Champions http://www.oraclechamps.com

The customer's credit card number is defined as an account number under a central 'credit card' bank and branch. The expiration date is the inactive date. a credit card receipt class and payment method are also defined with the user's remittance bank. Step-2 -----Define Receipt Class Setup->Receipts->Receipt Class Name: Receipt_Class_Name Creation Method: Automatic Remittance Method: Standard Clearance Method: By Matching (If You Are Using Cash Management) By Automatic Clearing (If Cash Management NOT In Use) Payment Method Zone Name: Visa (Example) Automatic Receipts Zone Number Of Receipts Rules: One Per Invoice Receipt Maturity Date Rule: Earliest Automatic Print Programs: Print Receipts Program Payment Type: Credit Card Lead Days: 35 Merchant ID: 12345 (this is the number that you have defined as your merchant or payee id in ipayment) To verify the merchant id value in release 11.5 Select Name, Payeeid, Mpayeeid From Iby_Payee; Merchant ID selected in AR should exist in i-payment Iby_Payee . Payeeid Attach Your Remittance Bank To The Payment Method. Click Bank Accounts Button Bank Name: Bank_Name Branch Name: Bank_Branch Account Name: Bank_Account_Name Minimum Receipt Amount: 100.00 (Example) GL Accounts entered in the remittance bank should populate.

Oracle Champions http://www.oraclechamps.com

Step-3 -----Login As Sysadmin. A) Application->Document->Define Name: Credit_Card_Sequence Application: Oracle Receivables Type: Automatic Initial Value: 1 ACCESS ZONE AT THE BOTTOM OF THE FORM Oracle Username: AR, APPS SAVE

B) Application->Document->Category Application: Oracle Receivables Code: Visa (This Must Be Exactly The Same As Your Payment Method) Name: Credit_Card_Category Table Name: AR_CASH_RECEIPTS_ALL SAVE

C) Application->Document->Assign Application: Oracle Receivables Category: Credit_Card_Category Set Of Books: Vision Operations(Example) Method: Automatic Assignment Tab Start Date: 19-Aug-2009 (Example) Sequence: Credit_Card_Sequence

Oracle Champions http://www.oraclechamps.com

SAVE

Step-4 -----In Sysadmin Profile->System Check Site Level Query Profile: ICX: Payment Server URL Verify that your base URL for the ipayment server is populated. There is not a lov on this field you must enter the value.

Step-5 -----(For Manual Invoices) Transactions->Transactions Enter invoice and populate the paying customer alternate region. Enter the paying customer, and location Enter the visa payment method from LOV Enter a valid credit card number or test number provided by the credit card vendor. Complete. Save. Step-6 -----Receipt -> Batches Provide appropriate values for Automatic Receipts Payment Method Receipt Class Click Create Button Enter criteria to determine eligible transactions; if you have defined a payment method for each credit card you can limit your criteria by credit card number range. Select Create, Approve

Oracle Champions http://www.oraclechamps.com

Click OK Button Review the log and output file to see that there receipts were created and approved. This program creates and authorizes the receipts via the ipayment server.

Step-7 -----Receipts->Remittance Choose the batch that you created and run automatic remittances. This program captures (settles) the funds via the ipayment server. Review the log and verify that there are no errors.

To check the data in ipayment. select tangibleid,reqdate,reqtype from iby_trxn_summaries_all where TANGIBLEID in ('106011_ONT','AR_94585')---This are the Payment Server Order Number..

Oracle Champions http://www.oraclechamps.com

New Creditcards addition Setup

Oracle Champions http://www.oraclechamps.com

Oracle Champions http://www.oraclechamps.com

(Funds Capture)Payment P rocess profile setups

Oracle Champions http://www.oraclechamps.com

Oracle Champions http://www.oraclechamps.com

Oracle Champions http://www.oraclechamps.com

Payment System & Payment system Accounts

Oracle Champions http://www.oraclechamps.com

Oracle Champions http://www.oraclechamps.com

Oracle Champions http://www.oraclechamps.com

Oracle Champions http://www.oraclechamps.com

Oracle Champions http://www.oraclechamps.com

Oracle Champions http://www.oraclechamps.com

Oracle Champions http://www.oraclechamps.com

Oracle Champions http://www.oraclechamps.com

Oracle Champions http://www.oraclechamps.com

Oracle Champions http://www.oraclechamps.com

You might also like

- AR - Direct DebitDocument37 pagesAR - Direct DebitObilesu Rekatla100% (2)

- OracleApps88 - Credit Card Payments Setups and Process in Oracle R12Document65 pagesOracleApps88 - Credit Card Payments Setups and Process in Oracle R12kottamramreddyNo ratings yet

- Innovation in Banking SectorDocument66 pagesInnovation in Banking Sectorpappu_jaiswal43767% (3)

- R12 - Bank Account Transfer Ver 1.0Document644 pagesR12 - Bank Account Transfer Ver 1.0phanisure100% (5)

- How To Set Up Intercompany Balancing Rules For Bank Account TransfersDocument9 pagesHow To Set Up Intercompany Balancing Rules For Bank Account TransfersflavioNo ratings yet

- How to associate bank account to multiple sitesDocument5 pagesHow to associate bank account to multiple sitesMadhurima ChatterjeeNo ratings yet

- Overview of Credit ManagementDocument25 pagesOverview of Credit Management060920720No ratings yet

- Creating Credit Card Validation ServiceDocument32 pagesCreating Credit Card Validation ServicekslnNo ratings yet

- American Express File SpecificationsDocument62 pagesAmerican Express File SpecificationsMag MarinaNo ratings yet

- FUN Balancing Troubleshooting Guide1Document11 pagesFUN Balancing Troubleshooting Guide1MaqbulhusenNo ratings yet

- Asset Lease WPDocument34 pagesAsset Lease WPJehad DarwishNo ratings yet

- Asset Lease WPDocument34 pagesAsset Lease WPJehad DarwishNo ratings yet

- CSWIP Five Year Renewal ApplicationDocument10 pagesCSWIP Five Year Renewal ApplicationSujoy SinghNo ratings yet

- Auto Repair Invoice TemplateDocument2 pagesAuto Repair Invoice TemplateEscapayd ENo ratings yet

- Oracle Cash ManagementDocument14 pagesOracle Cash ManagementCA Vara Reddy100% (2)

- Oracle Apps Credit Card in AP & IExpenseDocument2 pagesOracle Apps Credit Card in AP & IExpensesivaramsvNo ratings yet

- Credit Card PaymentsDocument14 pagesCredit Card PaymentscanjiatpNo ratings yet

- Automatic Receipts and Remittance A Complete Guide For R12 Oracle Receivables Users Document 745996.1Document32 pagesAutomatic Receipts and Remittance A Complete Guide For R12 Oracle Receivables Users Document 745996.1Tino PiazzardiNo ratings yet

- Ar Setup 12Document48 pagesAr Setup 12soireeNo ratings yet

- Credit Card Payments Setups and Process in Oracle R12Document55 pagesCredit Card Payments Setups and Process in Oracle R12Seenu DonNo ratings yet

- Import External Bank Accounts r12 Oracle AppsDocument12 pagesImport External Bank Accounts r12 Oracle AppsashibekNo ratings yet

- How To Set Up Bank Accounts For Use by Multiple Operating UnitsDocument9 pagesHow To Set Up Bank Accounts For Use by Multiple Operating UnitsMadhurima ChatterjeeNo ratings yet

- Oracle Applications - Oracle R12 Credit Card Payments Setups and ProcessDocument34 pagesOracle Applications - Oracle R12 Credit Card Payments Setups and ProcessAsif Sayyed100% (1)

- Auto Cash Rule SetDocument4 pagesAuto Cash Rule SetSingh Anish K.No ratings yet

- Setup and processing for procurement cardsDocument5 pagesSetup and processing for procurement cardsGuhanadh Padarthy100% (1)

- Bank Transaction Codes in R12Document4 pagesBank Transaction Codes in R12Nageshwar RaoNo ratings yet

- Payment Process ProfileDocument10 pagesPayment Process ProfileRajesh100% (1)

- Creating AP Checks in Oracle R12Document5 pagesCreating AP Checks in Oracle R12pibu128No ratings yet

- New Features in R12 Oracle PayablesDocument157 pagesNew Features in R12 Oracle Payableserpswan100% (1)

- Oracle EBS R 12.2.3 Creating Bank AccountDocument5 pagesOracle EBS R 12.2.3 Creating Bank AccountdbaahsumonbdNo ratings yet

- Credit Card Functionality Within OracleDocument5 pagesCredit Card Functionality Within OracleAmith Kumar IndurthiNo ratings yet

- R12 Payment Process Request - Functional and Technical Information (ID 821133.1)Document8 pagesR12 Payment Process Request - Functional and Technical Information (ID 821133.1)orafinphrNo ratings yet

- Application: Account Receivables Title: Customer Refund: OracleDocument23 pagesApplication: Account Receivables Title: Customer Refund: OraclesureshNo ratings yet

- Procure To Pay P2P Accounting EntriesDocument10 pagesProcure To Pay P2P Accounting EntriesAkash100% (1)

- ACH in R12Document11 pagesACH in R12Surya Maddiboina67% (6)

- Cash Management: Training GuideDocument25 pagesCash Management: Training Guidedevender_bharatha3284No ratings yet

- Cash Management Oracle R12 - Basic Setups and Transactions For ReconciliationDocument57 pagesCash Management Oracle R12 - Basic Setups and Transactions For ReconciliationRohit Daswani100% (1)

- Payment Gateways Day 1Document9 pagesPayment Gateways Day 1veda sai kiranmayee rasagna somaraju AP22322130023No ratings yet

- Procure To Pay Cycle Accounting EntriesDocument7 pagesProcure To Pay Cycle Accounting Entriesrajeev200362No ratings yet

- R12 Payment Process RequestDocument9 pagesR12 Payment Process RequestAmit ChauhanNo ratings yet

- R12 Overview of Issuing PaymentsDocument22 pagesR12 Overview of Issuing Paymentsraacero100% (2)

- r12 Ach StepsDocument4 pagesr12 Ach StepsPradeep Kumar ShuklaNo ratings yet

- Oracle R12 AP Check Printing Setups and Process DocumentDocument48 pagesOracle R12 AP Check Printing Setups and Process DocumentCA Vara Reddy50% (2)

- Paypal OviDocument20 pagesPaypal OviOlivia Barcelona NstNo ratings yet

- Multibanking Online Transaction Processing Using Data Transfer Security ModelDocument25 pagesMultibanking Online Transaction Processing Using Data Transfer Security ModelVinoth ChitraNo ratings yet

- Import and Export Bank AccountsDocument6 pagesImport and Export Bank AccountsYazeed_GhNo ratings yet

- IT Project: As/Prof Shashank Sharma Tes-3365 LT Tran Y SonDocument8 pagesIT Project: As/Prof Shashank Sharma Tes-3365 LT Tran Y SonNgay Tro VeNo ratings yet

- Credit Card Processing For Microsoft Dynamics AX 2012Document32 pagesCredit Card Processing For Microsoft Dynamics AX 2012Saankhya2030% (1)

- SRS For Bank Management System - RemovedDocument12 pagesSRS For Bank Management System - RemovedPriyam YadavNo ratings yet

- R12 Bank Account Transfer Ver 1 0 PDFDocument644 pagesR12 Bank Account Transfer Ver 1 0 PDFram knlNo ratings yet

- Oracle Cash Management-Bank Statement LoadDocument21 pagesOracle Cash Management-Bank Statement LoadAmith Kumar IndurthiNo ratings yet

- Tax Setup Steps R12.1.2Document37 pagesTax Setup Steps R12.1.2Rashid Jamal97% (32)

- Payment Gateway Original DataDocument6 pagesPayment Gateway Original DataAshrithaNo ratings yet

- Bank Acct Trans White PaperDocument30 pagesBank Acct Trans White Papersrinivas_apps100% (1)

- Oracle petty cash cycle and reconciliation in R12Document22 pagesOracle petty cash cycle and reconciliation in R12SAlah MOhammed100% (1)

- Oracle R12 AR Receivables Enhancement - OverviewDocument54 pagesOracle R12 AR Receivables Enhancement - Overviewsanjayapps100% (5)

- Automate Cash Application FeatureDocument47 pagesAutomate Cash Application FeatureupmuthukumarmcomNo ratings yet

- Steps To Create Payment Document in R12 PayablesDocument2 pagesSteps To Create Payment Document in R12 Payablessrees_15No ratings yet

- Make Money Surfing The WebDocument11 pagesMake Money Surfing The Webclash designNo ratings yet

- Discover How We Made $15,775 In 7 Days With Free Secret Systems that Generates Real and Unlimited HQ Backlinks that Rank Your Website, Video and Blog On Top of Google, Youtube, Yahoo and Bing In Just 60 Seconds: Unleash the Backlink Alchemy and Turbocharge Your Online Success and IncomeFrom EverandDiscover How We Made $15,775 In 7 Days With Free Secret Systems that Generates Real and Unlimited HQ Backlinks that Rank Your Website, Video and Blog On Top of Google, Youtube, Yahoo and Bing In Just 60 Seconds: Unleash the Backlink Alchemy and Turbocharge Your Online Success and IncomeNo ratings yet

- E-Payment Gateway A Complete Guide - 2019 EditionFrom EverandE-Payment Gateway A Complete Guide - 2019 EditionRating: 1 out of 5 stars1/5 (1)

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- How to Turn $30 Into $3000 Within 3 Months With Just 3 Hours of Work Per Day - Proof InsideFrom EverandHow to Turn $30 Into $3000 Within 3 Months With Just 3 Hours of Work Per Day - Proof InsideRating: 2 out of 5 stars2/5 (1)

- Bad Credit Loans: The Complete Guide to Getting Loan With Bad CreditFrom EverandBad Credit Loans: The Complete Guide to Getting Loan With Bad CreditNo ratings yet

- Credit Card RefundsDocument8 pagesCredit Card RefundsthulaseeNo ratings yet

- Auto Receipt in R12Document17 pagesAuto Receipt in R12Rajasekhar Reddy Adam100% (2)

- P CardDocument17 pagesP Cardawer99100% (1)

- Spotlight or ADocument2 pagesSpotlight or AJohnNo ratings yet

- Oracle Integrated Invoice Imaging Guide 2019 0603 FinalDocument26 pagesOracle Integrated Invoice Imaging Guide 2019 0603 Finalramkee999No ratings yet

- Spotlight or ADocument2 pagesSpotlight or AJohnNo ratings yet

- Expense Report To Reimbursement: Process Credit Card Feeds Define Expense Policies Process Expense ReportsDocument16 pagesExpense Report To Reimbursement: Process Credit Card Feeds Define Expense Policies Process Expense ReportsMag MarinaNo ratings yet

- Worksheet For Building Learning Opportunities: InstructionsDocument2 pagesWorksheet For Building Learning Opportunities: InstructionsMag MarinaNo ratings yet

- Fin Exm Expense TemplateDocument4 pagesFin Exm Expense TemplateMag MarinaNo ratings yet

- PPTDocument55 pagesPPTMag MarinaNo ratings yet

- Global Overview White PaperDocument17 pagesGlobal Overview White PaperMag MarinaNo ratings yet

- OraAppsIntroduction FINANCIALDocument16 pagesOraAppsIntroduction FINANCIALMag MarinaNo ratings yet

- Fusion Adv Collections Ds 1558290Document4 pagesFusion Adv Collections Ds 1558290Mag MarinaNo ratings yet

- Global Overview White PaperDocument17 pagesGlobal Overview White PaperMag MarinaNo ratings yet

- Oum Brief 1968918Document2 pagesOum Brief 1968918Mag MarinaNo ratings yet

- Fusion Expenses Ds 1558296Document4 pagesFusion Expenses Ds 1558296Mag MarinaNo ratings yet

- Fusion Finance Solution Brief 173012Document2 pagesFusion Finance Solution Brief 173012Ahmed Mohamed MehrezNo ratings yet

- Fusion Financials Ds 1558102Document6 pagesFusion Financials Ds 1558102Mag MarinaNo ratings yet

- KPMG Infrastructure Report For PSRDocument94 pagesKPMG Infrastructure Report For PSRi06lealeNo ratings yet

- Hospital Account StatementDocument2 pagesHospital Account StatementMary Kris Sumampong MalonNo ratings yet

- Grokking The Object Oriented Design InterviewDocument178 pagesGrokking The Object Oriented Design InterviewMayank SinghNo ratings yet

- Experience Life: in True PlatinumDocument11 pagesExperience Life: in True PlatinumakashNo ratings yet

- Acca Toronto LSBFDocument5 pagesAcca Toronto LSBFMohamed KhalidNo ratings yet

- Joint Conference On Remittances: 12-13 September 2005 ADB, Manila, PhilippinesDocument55 pagesJoint Conference On Remittances: 12-13 September 2005 ADB, Manila, PhilippinesPurnendu BaraiNo ratings yet

- Chase Sapphire Preferred Credit Card OfferDocument1 pageChase Sapphire Preferred Credit Card OfferOrangeNo ratings yet

- SEC v. Merrill Am ComplaintDocument51 pagesSEC v. Merrill Am ComplaintWWMTNo ratings yet

- The Revenue Cycle - Sales To Cash CollectionsDocument20 pagesThe Revenue Cycle - Sales To Cash CollectionsEmeraldine Cyanne100% (1)

- Reservation Confirmed: Tel: +971 6 558 0000, Fax: +971 6 558 0008Document4 pagesReservation Confirmed: Tel: +971 6 558 0000, Fax: +971 6 558 0008Koteswar MandavaNo ratings yet

- WHMCS Bahasa Indonesia New Release 2013 (Versi WHMCS 5.2.Xx)Document28 pagesWHMCS Bahasa Indonesia New Release 2013 (Versi WHMCS 5.2.Xx)YubLi Audy WarokkaNo ratings yet

- Pay Credit Card Bill OnlineDocument2 pagesPay Credit Card Bill Onlinekishore kumarNo ratings yet

- Purchase confirmation emailDocument1 pagePurchase confirmation emailAndrés HidalgoNo ratings yet

- Scamper Sample.Document11 pagesScamper Sample.BasighJavaidNo ratings yet

- Application Form For CSWIP 5 Year Renewal (Overseas) No LogbookDocument7 pagesApplication Form For CSWIP 5 Year Renewal (Overseas) No LogbookPalani JayakumarNo ratings yet

- CE Insurance GuidelinesDocument5 pagesCE Insurance GuidelinesRichard L. DunnamNo ratings yet

- Firstsource Solutions (FIRSOU) : El Clasico!Document27 pagesFirstsource Solutions (FIRSOU) : El Clasico!api-234474152No ratings yet

- HSBC Bank (Singapore) Limited HSBC Credit / Debit Card - Dispute Declaration FormDocument2 pagesHSBC Bank (Singapore) Limited HSBC Credit / Debit Card - Dispute Declaration FormYeong WheeNo ratings yet

- Bill 8368xxxx62Document2 pagesBill 8368xxxx62saurabh92prasadNo ratings yet

- Gds PlaybookDocument53 pagesGds Playbookserviciolegal1100% (1)

- Guerrilla Tactics That Will Give You A Good Credit RatingDocument10 pagesGuerrilla Tactics That Will Give You A Good Credit Ratinglvn_reviewer55% (11)

- Citibank Vs TeodoroDocument7 pagesCitibank Vs TeodoroCaroline DulayNo ratings yet

- Detailed Adv 113 JFEJFODocument6 pagesDetailed Adv 113 JFEJFOMillo NovinNo ratings yet

- Monetary PolicyDocument7 pagesMonetary PolicyAppan Kandala VasudevacharyNo ratings yet

- Victory Liner VoucherDocument16 pagesVictory Liner VoucherJoyce BerongoyNo ratings yet

- Masdar City Free Zone - Schedule of Charges 202287Document13 pagesMasdar City Free Zone - Schedule of Charges 202287Liau Cheong ZerNo ratings yet

- IELTS Application Terms & ConditionsDocument12 pagesIELTS Application Terms & Conditionsrv nidinNo ratings yet