Professional Documents

Culture Documents

Harish Project of NJ India Investment

Uploaded by

harishmnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Harish Project of NJ India Investment

Uploaded by

harishmnCopyright:

Available Formats

P a g e |1

Summer Internship project on

A STUDY OF FACTORS CONSIDERED BY FINANCIAL ADVISORY IN SELECTION OF FINANCIAL COMPANY

AT NJ INDIA INVESTMENT PVT. LTD. Submitted By Nakum Harish MBA Sem-III Guided by Prof. Krunal K Bhuva

Batch Year 2011-2013

Submitted To JAYSUKHLAL VADHAR INSTITUTE OF MANAGEMENT STUDIES (JVIMS) BIPIN T. VADHAR COLLEGE OF MANAGEMENT JAMNAGAR

Affiliated To GUJARAT TECHNOLOGICAL UNIVERSITY AHMEDABAD

P a g e |2

Summer Internship project on

A STUDY OF FACTORS CONSIDERED BY FINANCIAL ADVISORY IN SELECTION OF FINANCIAL COMPANY

AT NJ INDIA INVESTMENT PVT. LTD. Submitted By Nakum Harish MBA Sem-III Guided by Prof. Krunal K Bhuva

Batch Year 2011-2013 Submitted To JAYSUKHLAL VADHAR INSTITUTE OF MANAGEMENT STUDIES (JVIMS) BIPIN T. VADHAR COLLEGE OF MANAGEMENT JAMNAGAR

Affiliated To GUJARAT TECHNOLOGICAL UNIVERSITY AHMEDABAD

P a g e |3

DECLARATION

I undersigned Nakum Harish a student of MBA 3rd semester, declare that I have prepared this dissertation on Factor considering selection of financial company by financial advisory guided by Prof. Krunal Bhuva of JVIMS.

I also declare that this dissertation is my own preparation and not copied from anywhere else.

(Signature)

___________ Student's Name Nakum Harish Enrollment No.:117700592115

P a g e |4

ACKNOWLEDGEMENT

The presentation of this report gives us the feeling of fulfillment, as this Project is the final frontier which is the final step in achieving a Master Degree. The activity of going through project I feel that this leads to one of the practical real-life project-work. Project has prepared us to apply our self to be a good MBA Professional. Naturally, it requires lot of support and strength to complete this project.

I thank our department as they have provided academic advertisement to make the one real-life project. I thank Prof. Krunal K. Bhuva (project guide), Dr. K. J. Thankachan, and Dy. Director Dr. Ajay Shah and I am also thankful to all other faculty members of Jaysukhlal Vadhar Institute of Management Studies (JVIMS) Jamnagar who have directly or indirectly helped me in my project development.

Now, in the end my sincere thanks to our class-mates, who have provided great support in building my strength and provided great support without which this project would have been much tougher.

P a g e |5

PREFACE

The summer training of a management studies play an important role in developing his as well groomed professional. It allows a student to give theoretical concepts a practical in the field of application. If gives the candidate an idea of dynamic & versatile professional world as well as exposure to intricacies & complexities of corporate world.

Doing the summer training at NJ INDIA INVEST was great experience. An opening experience to the concepts of marketing department helped me in understanding the concepts that are applied by the organization since it`s inception has progressed a lot & is walking guideline of success, As the organization is marching with the speeds towards the horizon. This division is holding with a greater speed to keep the pace with the major players in the market.

During the MBA course we are taught dozen of subjects which if not applied properly are a simple waste of time. Implementing & in learning of concept of marketing in the market provider an opportunity to practically. I got a chance to apply our theory & acceptance myself with the functioning of marketing in a period of 8 weeks exposure to the corporate environment. I got a learning of basics of marketing etc.

Real learning places it`s worth only when it gives sweet fruits in future. Summer training is one way to learning at work. I enjoyed the interesting experience & every part of it.

P a g e |6

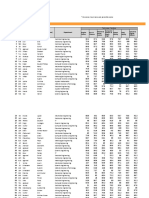

INDIX

Sir No. Name. Page No,

1. 2. 3. 4.

5.

6. 7.

Acknowledgement Preface Executive summary Company Profile Introduction NJ believe in Philosophy Management Quality portfolio advisory Distribution Network Benefit in Mutual Funds 360 Advisory Platform Nj Funds network Nj realty services Nj Gurukul Vision & Mission Quality online wealth account Investment Strategy Risk V/s Return Financial Advisor How to choose financial advisor Finding the right advisor Types of advisors Regulatory compliance Background and experience Services How Financial planner are compensated What to expect from a advisor Review of Literature Research Methodology Introduction Meaning of Research Statement of the problem Significance of Research Objective of Research

4 5 8 10 12 13 14 16 19 20 21 23 24 25 26 27 28 29 31 31 32 33 33 33 34 35 37 43 44 45 45 46

P a g e |7

8. 9.

10.

Need for research design Scope of the study Types of Research Data collection Data Analysis and Interpretation Table and Chart Finding And Suggestion Finding Suggestions Own Experience Conclusion Bibliography Appendix List of the Table List of the Graph Questionnaire

46 46 47 48 50 51-70 72 73 74 75 76 77 78 79

P a g e |8

EXECUTIVE SUMMARY

The project titled A study of mutual fund and awareness among insurance advisors being carried out for NJ INDIA INVESTS PVT. LTD. Today an investor is interested in tracking the value of his investments, whether he invests directly in the market or indirectly through Mutual Funds. This dynamic change has taken place because of a number of reasons. With globalization and the growing competition in the investments opportunity available he would have to make guided and rational decisions on whether he gets an acceptable return on his investments in the funds selected by him, or if he needs to switch to another fund.

In order to achieve such an end the investor has to understand the basis of appropriate preference measurement for the fund, and acquire the basic knowledge of the different measures of evaluating the performance of the fund. Only then would he be in a position to judge correctly whether his fund is performing well or not, and make the right decision. This project is undertaken to help the investors in tracking the performance of their investments in Mutual Funds and has been carried out with the objective of giving performance analysis of Mutual Fund.

The methodology for carrying out the project was very simple that is through secondary data obtained through various mediums like fact sheet of the funds, the Internet, Business magazines, Newspaper, etc. the analysis of Mutual Funds has been done with respect to its various parameters. I hope NJ INDIA INVEST PVT. LTD., Udaipur will recognize this as well as take more references from this project report.

P a g e |9

Company Profile

P a g e | 10

1. INTRODUCTION

Creating Wealth Transforming Lives Success is a journey, not a destination. If we look for examples to prove this quote then we can find many but there is none like that of NJ India Invest Pvt. Ltd. Back in the year 1994, two people created history by establishing NJ India Invest Pvt. Ltd. leading advisors and distributors of financial products and services in India.

P a g e | 11

Doing the 'right' thing is a virtue most desirable. The difference between success and failure is often, not dictated by knowledge or expertise, but by its actual application and perseverance. When it comes to successful wealth creation for customers, it is something that we believe in & practice. For us it is more than a mission; it is what defines our lives and our actions Today NJ India invest Pvt. Ltd. is one of the leading advisors and distributors of financial products and services in India. Established in year 1994, NJ has over a decade of rich exposure in financial investments space and portfolio advisory services. From a humble beginning, NJ, over the years has evolved out to be a professionally managed, quality conscious and customer focused financial / investment advisory & distribution firm. We are headquartered in Surat, India, and have more than INR 10,000* Crores of mutual fund assets under advice, with a wide presence at over 100+ locations in 21 states in India. The numbers are reflections of the trust, commitment and value that NJ shares with 11 Lac plus customer base with over 14000+ Advisors. NJ prides in being a professionally managed, quality focused and customer centric organization. The strength of NJ lies in the strong domain knowledge in investment consultancy and the delivery of sustainable value to clients with support from cutting-edge technology platform, developed in-house by NJ.

P a g e | 12

NJ, believe in...

Having single window, multiple solutions that are integrated for simplicity and sapience Making innovations, accessions, value-additions, a constant process Providing customers with solutions for tomorrow which will keep them above the curve, today NJ has over INR 60 billion* of mutual fund assets under advice with a wide presence in over 120 locations* in 21 states* and 750+ employees in India. The numbers are reflections of the trust, commitment and value that NJ shares with its clients 45

NJ Wealth Advisors, a division of NJ, focuses on providing financial planning and portfolio advisory services to premium clients of high net-worth. At NJ Wealth Advisors, we have developed processes that focus on providing the best in terms of the advice and the ongoing management of your portfolio and financial plans.

At NJ, our experience, knowledge and understanding enables us to provide you with the expected value, in an enhanced way. As a leading player in the industry, we continue to successfully meet the expectations of our clients, through meaningful and comprehensive solutions offered by NJ Wealth Advisors

P a g e | 13

2. PHILOSOPHY:At NJ our Service and Investing philosophy inspire and shape the thoughts, beliefs, attitude, actions and decisions of our employees. If NJ would resemble a body, our philosophy would be our spirit which drives our body.

Service Philosophy:

Our primary measure of success is customer satisfaction We are committed to provide our customers with continuous, long-term improvements and value-additions to meet the needs in an exceptional way. In our efforts to consistently deliver the best service possible to our customers, all employees of NJ will make every effort to: think of the customer first, take responsibility, and make prompt service to the customer a priority deliver upon the commitments & promises made on time anticipate, visualize, understand, meet, exceed our customers needs Bring energy, passion & excellence in everything we do. be honest and ethical, in action & attitude, and keep the customers interest supreme Strengthen customer relationships by providing service in a thoughtful & proactive manner and meet the expectations, effectively.

We aim to provide Need-based solutions for long-term wealth creation

We aim to provide all customers of NJ, directly or indirectly, with true, unbiased, need-based solutions and advice that best meets their stated & un-stated needs. In our efforts to provide quality financial & investment advice, we believe that

P a g e | 14

Clients want need-based solutions, which fits them Long-term wealth creation is simple and straight Asset-Allocation is the ideal & the best way for long-term wealth creation Educating and disclosing all the important facets which the customer needs to be aware of, is important The solutions must be unbiased, feasible, practical, executable, measurable and flexible constant monitoring and proper after-sales service is critical to complete the ongoing process.

3. MANAGEMENT:The management at NJ brings together a team of people with wide experience and knowledge in the financial services domain. The management provides direction and guidance to the whole organization. The management has strong visions for NJ as a globally respected company providing comprehensive services in financial sector The Customer First philosophy in deeply ingrained in the management at NJ. The aim of the management is to bring the best to the customers in terms of -

Range of products and services offered Quality Customer Service

All the key members of the organization put in great focus on the processes & systems under the diverse functions of business. The management also focuses on utilizing technology as the key enabler for all the activities and to leverage the technology for enhancing overall customer experience.

P a g e | 15

Founder of the Company

Mr. Neeraj Choksi Mr. Jignesh Desai Jt. Managing Director Jt. Managing Director

Sales Team In Surat

Mr. Misbah Baxamusa Mr. Naveen Rathod Mr. Kulbhushan Nandwani Mr. Prashant Kakkad National Head V.P. (Sales) A.V.P. (Marketing) A.V.P. (Sales)

Key Executive Team :

Mr. Shirish Patel Mr. Abhishek Dubey Mr. Vinayak Rajput Mr. Dhaval Desai Mr. Col. Dixit Mr. Tejas Soni Mr Viral Shah Mr Rakesh Tokarkar Mr.Ashok Daftari Mr.Amanjeet singh

Information Technology Business Process Operations Human Resources Administration Finance Research compliance Relationship Manager Relationship Manager

P a g e | 16

4. Quality Portfolio Advisory:-

Making money is easy. Managing money is difficult. And managing money in todays complex financial markets with multiple products on an ongoing basis becomes even more difficult.

As investors we often may feel the lack of time and energy to undertake monitoring and managing of our investments in multiple avenues. This requires both dedicated efforts and skills in portfolio management.

At NJ Wealth Advisors we realize the need for quality, unbiased portfolio advisory services. At NJ we would aim to manage your portfolio with a superior, time tested and much effective way of Asset Allocation keeping in mind your risk profile.

Our online Wealth Account covers almost all the investment avenues that you may have: Mutual Funds All AMCs, All Schemes Direct Equity Life Insurance Physical Assets Gold and Property Private Equity Business Debt Products Bank Deposits and Company Deposits RBI / Infrastructure Bonds Postal Savings KVP, MIS, NSC Debentures Small Savings PPF, NSS

P a g e | 17

Mutual Funds: Valuation, Transaction, Profit & Loss, Performance, Portfolio reports like - AMC / Sector / Equity / Credit / Direct Equity: Demat accounts, Transaction, Valuation, Profit & Loss Life Insurance: Policy Report, Premium Reminder, Cash Flow Debt: Transaction, Interest Income, Maturity reports for different Assets Debt Exposure, Weighted Average Maturity, Dividend history, etc.

5. Dedicated team:-

At NJ Wealth Advisors, we work in a team concept to provide quality, effective and timely service to our clients. The team is designed keeping you at the beginning or the end of the flow as the originator and the end receiver of any request or service.

The team handling you consists of the Relationship Manager and the Account Manager who would be in direct touch with you. This would be supported by the Centralized Research Team, the Chief Portfolio Manager and the Service Team. All the important investment decisions and/or plans recommended to you are actually prepared and /or approved by the Chief Portfolio Manager with inputs from the Research Team. The structure ensures that all the Plans and recommendations that you receive are unbiased, based on true research & detailed study, and suited to your needs.

P a g e | 18

Quality Customer Service

NJ realizes the true importance of quality customer service. The service commitments are to guide the actions taken at NJ. Clearly stated, customers can freely communicate any such actions/events wherein they feel that the following commitments have been breached. At NJ we desire to honor our commitments at all points of time and to all customers without any bias.

Quality service:-

Highlights You will receive regular portfolio reports in hard copies to serve as record All records are maintained for the plans and recommendations and minutes of all the meetings are kept. Dedicated Account Manager directly oversees the operational support to you Quality Advisory. True, unbiased recommendations. Each plan is unique in nature to suit your needs and profile. Defined Process followed in investment consultancy / portfolio management. All the plans are prepared and/or approved in line with the set process by Chief Portfolio Manager with inputs from the Research Team.

P a g e | 19

Distribution Network

Proven and accredited leaders in the Financial Services business, NJ India provides you the unique opportunity to trade offline and online while cutting across all geographic barriers.

Strategic Tie-ups that provide latest technology for access and processing 135 office in21 states 13000 advisors 850000 customer One of the largest distributors of leading Mutual Funds in India

In this market various competition that are faced by the different investment company are as under.

o Different software offered of latest version o Systematic and synchronized services o High customer services o Better attractive policies

P a g e | 20

Benefit in Mutual fund

N.J FUNDZ NETWORK Pvt. Ltd. are having a very powerful research team and skillful personnel. The company is well equipped with the updated knowledge of the NFOs coming in to the market. In case of downward trend in market, due to the availability of high profile software, company can predict and maintain status of NAV (Net Asset value) in the interest of esteemed investors.

Benefits

Profit updated information of NFOs What is the current NAV of Mutual Funds? Better return on investments SIP Benefit (Systematic investment plans) Unique & Powerful concept of Trail earning which are calculated on the total value of investment and paid as long as the investment study. This very attractive and sustainable medium to long term earning prospects Mutual fund is a regular investment product & and not a one time sale Great advantage over insurance, postal etc. where commission is generally paid on the premiums received. NJ offers many useful financial tools and calculators to NJ Fundz Partners. Such tools are very useful in creating financial plans for clients, preparation of cash flows, etc. NJ Tools & Calculators

Monthly Dynamic Debt Analyzer Dynamic SIP Calculator Dynamic STP Calculator Delay Cost Calculator Insurance Planning/Comparison Tool NJ Financial Planning Tool

In addition to Financial Tools and Calculators, each NJ Fundz Partner is also presented with NJ Sales Kit a great compilation of selected useful presentations, which would help enrich the knowledge of the Advisors. The presentations can also be used while communicating with their clients.

P a g e | 21

6. . 360 ADVISORY PLATFORM:-

With this philosophy, we try to offer all possible products, services and support which an Advisor would need in his business.

P a g e | 22

The support functions are generally in the following areas Business Planning and Strategy Training and Development Self and of employees Products and Service Offerings Business Branding Marketing Sales and Development Technology Advisors Resources - Tools, Calculators, etc.. Research Communications

With this comprehensive supporting platform, the NJ Fundz Partners stays ahead of the curve in each respect compared to other Advisors/competitors in the market.

Recognition

Some of the awards & recognitions that we have received in past Year2000:-:For Outstanding Performance presented by Chairman, Prudentially. at London. Year2002:-:For Outstanding Performance presented by Group Chief Executive, Prudential Plc. at London. Year2003:-:For Outstanding Performance presented by Group Chief Executive, Prudential Place .at London. Year2004:Among Most Valued Business Associates presented by HDFC Standard Life at Edinburgh, Scotland. Year 2004:-For Outstanding Performance by Deputy CEO, Prudential Singapore at Malaysia. Year2006:-Award for mobilizing the Highest Number of SIPs at National Level byFidelity Mutual Fund Mumbai. Year2006:Award Vietnam\

P a g e | 23

NJ Fundz Network

NJ Fundz Network has been playing a pioneering role in India in providing independent advisors / advisory firms with integrated, comprehensive and practical business solutions for nsuring continuous growth & continuity of business. It provides the financial advisors and the institutions that serve them with insights, strategies and tools to help them significantly grow their businesses. How do we do it? Thats because we understand how financial & wealth management businesses work and what is needed to manage, monitor and grow the practice First in the Indian Mutual Fund Industry to offer a Complete Business Platform to Advisors

P a g e | 24

NJ Realty Services

This is an integrated service model offering solutions for meeting the diverse real-estate needs of corporate & retail customers in transacting properties. Finding the right property at the right value and the best buyer for a property is the crux of any realty solution. At NJ India Realty we value this critical element of retailing and aim to provide the customer with an integrated service model that not only focuses on him meeting his desired needs but also on enhancing the overall experience of the transaction. The scope of properties embraces both commercial & residential projects / properties. The integrated value-added services ensure that the solutions are feasible, authentic, secure & profitable. Leveraging upon the strengths of the parent company NJ, NJ India Realty aims to offer attractive options and operational guidance to satisfactorily realize the customers realty dreams. Today NJ Realty Services has tied up with over 40 developers with over 150 projects across India.

P a g e | 25

NJ Gurukul

Making people benefit from the growing economy is possible by attracting them to participate in Equity for long term, to make their money work for itself and create wealth. For this to happen, a huge force of effective Financial Advisors is needed. Visualizing this need and with a view to bridge the gap, NJ India Invest Pvt. Ltd. has set up NJ Gurukul to offer different training programs at moderate costs. NJ Gurukul works to conceive, craft, design, develop and execute effective training modules to energize people with right inputs through different training programmers at modest cost. Powered by NJ's experience of over 14 years as leaders in financial advisory services, NJ Gurukul has emerged successful in conducting sizeable number of trainings since inception in April 2007 and enjoys lineage of efforts put in by NJ prior to April 07. NJ Gurukul seeks to create an enlightened community of quality financial advisors capable of changing millions of lives across India and even beyond NJ Gurukul also seeks to help people become better professionals / business personalities & achieve success in their own endeavors. For businesses, as a people partner, NJ Gurukul seeks to groom employees & management so that they deliver upon their expectations & responsibilities, successfully. NJ Gurukul is authorized to give training for Certified Financial Planner (CFP) by FBSB India. Today NJ Gurukul has offered over 1200 training programmers with over 20000 candidates

P a g e | 26

Vision and Mission Vision: Creating Wealth Transforming Lives

Total Customer Satisfaction Commitment to Excellence Determination to Succeed with strict adherence to compliance Successful Wealth Creation of our Customers Mission:

We work towards building trusted relationship with our stakeholders, for inclusive growth through constant process of innovation, time bound implementation & execution of ideas and technological developments. We stretch our means and go overboard to make sure that our clients' aspirations, dreams and expectations are met with, through high service standards.

P a g e | 27

Quality online Wealth Account

As a premium client you would have access to one of the best online investment accounts that offer comprehensive reports, many of which are unique in nature and give valuable insights on our investments Our online Wealth Account covers almost all the investment avenues that you may have:

Mutual Funds All AMCs, All Schemes Direct Equity Life Insurance Physical Assets Gold and Property Private Equity Business Debt Products

Bank Deposits and Company Deposits

o o o o

RBI / Infrastructure Bonds Postal Savings KVP, MIS, NSC Debentures Small Savings PPF, NSS

You would have access to Consolidated Net Asset Reports which would give you a single view of all your investments into different avenues as given above. Further, within each of the Asset class we have many more reports and utilities. Some of the reports covered are

Consolidated: Consolidated Asset Allocation, Consolidated Net Asset, Interest Income,

Profit & Loss

P a g e | 28

INVESTMENT STRATEGIES 1. Systematic Investment Plan Under this a fixed sum is invested each month on a fixed date of a month. Payment is made through post dated cheques or direct debit facilities. The investor gets fewer units when the NAV is high and more units when the NAV is low. This is called as the benefit of Rupee Cost Averaging (RCA) 2. Systematic Transfer Plan: Under this an investor invest in debt oriented fund and give instructions to transfer a fixed sum, at a fixed interval, to an equity scheme of the same mutual fund. 3. Systematic Withdrawal Plan If someone wishes to withdraw from a mutual fund then he can withdraw a fixed amount each month.

P a g e | 29

RISK V/S. RETURN:

P a g e | 30

Financial Advisor

P a g e | 31

HOW TO CHOOSE A FINANCIAL ADVISOR

Choosing a financial Advisor can be one of the most important financial decisions you make, but finding the right person may be difficult. Our financial lives have become very complicated. Years ago when you walked into your local savings bank to get a mortgage, you were given two choices: do you want a 20-year or a 30-year mortgage? Today banks offer an overwhelming selection of mortgages and rates to choose from plus a mindboggling array of financial products. As a result, more individuals are using a financial planner. You may need a trusted advisor to help you through the financial mazebut how do you find one?

FINDING THE RIGHT ADVISOER

Begin by asking your friends, work associates and relatives if they use a financial planner. Speak with your other professional advisors such as your attorney or accountant and ask whom they would recommend. Contact professional organizations and ask them to send you the names of planners in your geographical area (see back panel).

Next, interview several planners before you decide to become a client. Many planners offer a free introductory consultationtake advantage of this opportunity to find out about the planner and the firm. Dont be afraid to ask tough questions (see side panel). Remember, this is your money.

P a g e | 32

TYPES OF ADVISORS

Listed below are three general types of advisors, their respective credentials and the credential training requirements:

1. Certified Financial Planner. If you decide to use a financial planner, the preferred credential is the Certified Financial Planner (CFP) designation. This designation is earned after the successful completion of financial planning coursework that often takes two or three years to complete, after which the advisor must pass a rigorous ten-hour exam. An advisor with the CFP designation should be able to help you craft an overall financial and investment plan, but may or may not be someone you would use to manage your money.

2. Full-Service Broker. A broker typically holds a general securities license achieved through coursework covering a variety of investment topics and regulations, and by passing a six-hour exam. Many brokers obtain additional licenses that extend to the supervision of other brokers, the use of options and futures, research report writing, and insurance. Those brokers who are interested in managing money in a fee-based environment often obtain the Certified Investment Management Analyst (CIMA) designation, and those who become more active in the planning role earn the CFP designation noted above.

3. Professional Money Manager. A money manager is often called a portfolio manager or investment manager and typically holds a Chartered Financial Analyst (CFA) charter. To hold a CFA designation, the individual must have at least three years of investment management or investment analysis experience, and pass three levels of examinations.

P a g e | 33

REGULATORY COMPLIANCE

Persons and firms who hold themselves out as providing investment advice must be registered with either the Securities & Exchange Commission or the Massachusetts Secretary of States office. Individuals may be covered under blanket registration of the firms they work for. Are you registered with the Securities & Exchange Commission (SEC)? If not, is your firm registered? Are you registered with the Massachusetts Secretary of States office? If not, is your firm registered?

BACKGROUND AND EXPERIENCE

Registered financial planners must file a form listing their education and experience with the SEC and Secretary of State (form ADV part II). Ask for a copy of this form, too. What credentials have you earned? What is your educational background? How long have you been practicing financial planning? May I have a list of references

SERVICES

What kind of services do you offer? Will you prepare a complete or partial financial plan after listening to my goals? Do you sell financial products? Do you manage investments for a fee? Do you review a clients taxes? What kind of client do you generally service? Do you have a minimum account size? What continuing service will I receive after the initial plan? How often do you send out portfolio reports? What are your research methods and sources?

P a g e | 34

HOW FINANCIAL PLANNERS ARE COMPENSATED

It is important to understand how the financial planner will be compensated for his or her services. Planners generally charge using one of these four methods

Fee-only: This can be an hourly fee, a flat fee for a comprehensive plan or an annual retainer amount. Fee-only planners do not earn any compensation from the investments they recommend; they may not be able to charge on a commission basis because they may not be licensed to sell financial products.

Commission-only: A commission-only planner earns his or her compensation when you actually purchase an insurance or financial product, such as a mutual fund, from him or her. When dealing with commission-only planners, exercise caution because their only source of income is the revenues generated from selling.

Fee and commission: Also known as fee-based planning, this is the most popular form of financial planning compensation. The planner earns an hourly fee for meeting with you and providing advice as well as commissions on financial products you may purchase.

Money management: Some planners manage your investments for you and charge you a percentage of the assets under management as their fee (usually around 1%). Again, exercise caution when choosing a money manager especially if you are giving someone discretionary power over your money.

P a g e | 35

WHAT TO EXPECT FROM A ADVISOR

A good financial planner will n assess your existing financial situation (review your tax returns, income sources, assets, debts, savings and investments, wills, insurance policies, estate and retirement planning documents); n identify your personal and financial needs and goals in order to develop a plan thats right for you; n explain the pros and cons of various options and products (stocks, bonds, mutual funds, IRAs); n assist you in carrying out your plan by referring you to other professionals as necessary (investment brokers, accountants, lawyers); and, n periodically evaluate your plan with you to be sure that it is still in line with your current goals. What all those letters mean AICPAPFPAmerican Institute of Certified Public Accountants/Personal Financial Planning Specialist. A Personal Financial Planning Specialist is a CPA who haspassed a financial planning exam, has practical experience in financial planning and is a member of the AICPA. CFAChartered Financial Analyst CFA is a designation awarded by the Institute of Chartered Financial Analysts to experienced financial analysts who have passed exams in economics, financial accounting, portfolio management, security analysis and standards of conduct. CFPCertified Financial Planner A CFP is a planner who has met educational and experience requirements, agreed to abide by a code of ethics and passed a national test administered by the CFP Board of Standards. The exam covers insurance, investments, taxation, employee benefits, retirement planning and estate planning. ChFCChartered Financial Consultant ChFC is a designation awarded by the American College of Bryn Mawr and is the insurance industrys financial planning designation. Consultants must meet experience requirements and pass exams covering finance and investing.

P a g e | 36

CLUChartered Life Underwriter CLU is a designation awarded by the American College of Bryn Mawr. Recipients must pass national examinations in insurance and related subjects as well as have business experience in these areas. CPACertified Public Accountant A CPA is an experienced accountant who has met the educational, statutory and licensing requirements of the state in which they reside. CPAs perform audits and prepare tax returns they leave the financial planning advising to the Personal Financial Planning Specialists in their field. RIARegistered Investment Advisor An RIA is an individual who has registered with the Securities & Exchange Commission (SEC) and holds himself or herself out to be an investment advisor. Registration is required of anyone who, for compensation and as part of a business, gives advice, makes recommendations, issues reports or furnishes analysis on securities either directly or through publications. If a planner is an employee of an advisory firm such as a brokerage house, the brokerage house will have a blanket registration with the SEC for all employees

P a g e | 37

Review of Literature

P a g e | 38

1. historians were blinded to the importance of the growth of professions before the industrial revolution O'Day (1986) A profession was defined as an occupation which exhibited certain traits including a collegial and hierarchical organization, group control of recruitment, entry qualifications and training, a self-imposed code of behavior, and a claim to monopoly over the a defined body of knowledge and practical service.

2. Nature of professionalization Lee (1995), where he reviewed the nature of professionalization; the birth of the accountancy profession; the establishment and defense of professionalization; and a retrospect and prospect. The most obvious feature of early UK professionalization is the pursuit by accountants and their institutions of economic self-interest in the name of a public interest. Use of entry, examination and training requirements, lobbying over legislative matters, defending the exclusive use of professional designations and attempting statutory registration each illustrate this point. A similar pattern emerged in the USA in the late 1880s, although the specific rationale for professionalization was different from that of the Scots chartered accountants.

3. Investigated perceptions of professionalism in medicine Jha et al (2006). This was an interview study of medical educators, medical students, doctors, allied health professionals and lay professionals to assess views and experiences of professionalism in medicine. It involved thematic content analysis of the interview transcripts (Jha et al. 2006). The present study therefore is similar in that it offers an understanding of the professionalism of financial planners from different stakeholder perspectives. Instead of thematic content analysis, this present study will employ phenomena graphic methods in attempting to understand the phenomenon of the professionalism of financial planners through an investigation of how financial planners, lecturers and professional association managers make meaning of professionalism from their own awareness (should be experience) of the phenomenon

P a g e | 39

4. Parameter zing Interest Rate Models, Ahlgrim, D'Arcy and Gorvett, 1999, Uses simulation to develop future scenarios for various applications. Wilkies Provides a review of historical interest rate movements from 1953-1999, summarizes the key elements of several interest rate models and describes how to select parameters of the models to fit historical movements.

5. Do Interest Rates Really Follow Continuous-Time Markov Diffusions? Ait-Sahalia, 1999, Examines whether interest rates follow a diffusion process (continuous time Markov process), given that only discrete-time interest rates are available. Based on the extended period 1857 to 1995, this work finds that neither short-term interest rates nor long-term interest rates follow Markov processes, but the slope of the yield curve is a univariate Markov process and a diffusion process.

6. An Empirical Comparison of Alternative Models of the Short-Term Interest Rate Chan, Karolyi, Longstaff, and Schwartz, 1992, CKLS estimate the parameters of a class of term structure models using the generalized method of moments technique and the time series of monthly interest rate data from 1964-1989. They find that the volatility of interest rates is extremely sensitive to the level of the rate.

7. What Can Be Learned from Recent Advances in Estimating Models of the Term Structure, Chapman and Pearson, 2001, Provides a comprehensive review of term structure models. They conclude that volatility increases with the level of the short term interest rate and, within normal interest rate ranges, mean reversion is weak. They also point out that the appropriate measure for volatility depends on whether the period 1979-1982 (when the Federal Reserve shifted policy from focusing on interest rates to inflation rates) is treated as an aberration or included in the sample period. They also conclude that more research is needed to determine which interest rate model is best.

P a g e | 40

8. Recent Advances in Estimating Term-Structure Models, Chapman and Pearson, 2001, Provides a summary of term structure literature and contrasts the issues that have been resolved with those areas that require further research. They point out that mean reversion of interest rates is weak and that absolute volatility appears to be related to rate levels. Unfortunately, the specific nature of volatility is currently unresolved.

9. A Theory of the Term Structure of Interest Rates, Cox, Ingersoll, and Ross, 1985, Using a general equilibrium framework, CIR develop a process for the short-term interest rate. The CIR term structure model is: t t t t dr = ( r )dt + r dB

10. The Information in the Term Structure, Fama, 1984 Examines the ability of forward rates to forecast future spot rates. Based on data for 1974 and subsequent, he finds evidence that very short-term (one-month) forward rates can forecast spot rates one month ahead. Data prior to 1974 indicate that this predictive power extends five months into the future.

11. The Information in Long-Maturity Forward Rates, Fama and Bliss, 1987 Examines expected returns on U.S. Treasury securities with maturities of up to five years. They find that the one-year interest rate has a mean-reverting tendency, which results in one-year forward rates having some forecasting power two to four years ahead. Thus, the paper provides evidence that, while forward rates are not good forecasters of very near-term changes in interest rates, they are better at forecasting long-term changes.

P a g e | 41

12. A Regime-Switching Model of Long-Term Stock Returns, Hardy, 2001, North American Using monthly data from the S&P 500 and the Toronto Stock Exchange, a regime switching lognormal model is parameterized and compared with other models. The author finds the performance of the regime-switching model to be favorable.

13. Bond Pricing and the Term Structure of Interest Rates: A New Methodology for Contingent Claims Valuation, Heath, Jarrow, and Morton, 1992, Rather than developing a process for the short rate, HJM model the movements of the entire term structure through a family of forward rate processes.

df (t,T) = (t,T, f (t,T))dt + (t,T, f (t,T))dBt where T ftTPtT ( , ) = ln ( , ) HJM find that the drift in forward rates can be restated in terms of the volatilities, implying that the market price of risk is unimportant in contingent claims valuation.

14. A Stochastic Asset Model & Calibration for Long Term Financial Planning Purposes, Hibbert, Mowbray, and Turnbull, 2001, This paper describes a model that generates consistent values for the term structure of interest rates, both real and nominal, inflation rates, equity returns and dividend payouts. The model can be used to generate multiple potential paths for each of these variables for use in financial modeling. The paper provides an excellent review of interest rates, inflation rates and equity returns over the last 100 years, or longer, as well as for more recent periods.

P a g e | 42

RESEARCH METHODOLOGY

P a g e | 43

INTRODUCTION TO RESEARCH

ALL PROGRESS IS BORN OF INQUIRY

Research inculcates scientific and inductive thinking and it promotes the Development of logical habits of thinking and organization. The research Methodology has gone through which path to solve the research problem and which tools have been adopted to achieve the desired objective and more Importantly it tells why only that path or tools have been chosen and not other?

DEFINITION OF RESEARCH

The simple definition laid down in the Advanced Learners Dictionary of Current English is a careful investigation or inquiry especially through search for new facts in any branch of knowledge.

Research is the manipulation of things, concepts or symbols for the purpose of Generalizing to extend, correct or verify knowledge, whether that knowledge aids in construction of theory or in the practice of an art. - D. Slesinger and M. Stephenson

Research is an endeavor to discover, develop and verify knowledge. It is an intellectual process that has developed over hundreds of years, ever changing in purpose and form and always searching for truth. - C. Francies Rummel

P a g e | 44

MEANING OF RESEARCH

Research is an ORGANISED and SYSTEMATIC way of FINDING ANSWERS to QUESTIONS

SYSTEMATIC because there is a definite set of procedures and steps which you will follow. There are certain things in the research process which are always done in order to get the most accurate results.

ORGANIZED means that there is a structure or method in going about doing research. It is a planned procedure, not a spontaneous one. It is focused and limited to a specific scope.

FINDING ANSWERS is the end of all research. Whether it is the answer to a hypothesis or even a simple question, research is successful when we find answers. Sometimes the answer is no, but it is still an answer

QUESTIONS are central to research. If there is no question, then the answer is of no use. Research is focused on relevant, useful, and important questions. Without a question, research has no focus, drive, or purpose. Actually, research is simply the process of arriving as dependable solution to a problem through the planned and systematic collection, analysis and interpretation of data.

P a g e | 45

STATEMENT OF THE PROBLEM

roblem Statement is a clear concise description of the issues that need to be addressed by a problem solving team and should be presented to them before they try to solve the problem. When bringing together a team to achieve a particular purpose efficiently provide them with a problem statement. The problem statement in this research study is FACTORS CONSIDERIED BY FINANCIAL ADVISORY IN SELECTION OF FINANCIAL COMPANY.

SIGNIFICANCE OF RESEARCH

All progress is born of inquiry. Doubt is often better than overconfidence, for it leads to inquiry, and inquiry leads to invention is a famous Hudson Maxim in context of which the significance of research can well be understood. Increased amounts of research make progress possible. Research inculcates scientific and inductive thinking and it promotes the development of logical habits of thinking and organization.

The role of research in several fields of applied economics, whether related to business or to the economy as a whole, has greatly increased in modern times. The increasingly complex nature of business and government has focused attention on the use of research in solving operational problems. Research, as an aid to economic policy, has gained added importance, both for government and business

P a g e | 46

OBJECTIVES OF RESEARCH

People enlist the help of a financial Advisor because of the complexity of performing the following:

Study about the financial advisor recommended the financial product to investors. Understanding how financial advisor are communicate their investors Understanding the behavior of an investor shown for investing in Mutual Fund. Providing financial security and ensuring that all goals of personal finance are met Understanding how each financial decision affects other areas of finance; NEED FOR RESEARCH DESIGN

Research design is needed because it facilitates the smooth sailing of the various research operations, thereby making research as efficient as possible yielding maximal information with minimal expenditure of effort, time and money. Just as for better, economical and attractive construction of a house, we need a blueprint (or what is commonly called the map of the house) well thought out and prepared by an expert architect, similarly we need a research design or a plan in advance of data collection and analysis for our research project. Research design stands for advance planning of the methods to be adopted for collecting the relevant data and the techniques to be used in their analysis, keeping in view the objective of the research and the availability of staff, time and money.

SCOPE OF THE STUDY

The research study FACTORS CONSIDERIED BY FINANCIAL ADVISORY IN SELECTION OF FINANCIAL COMPANY, has been carried out with an objective to evaluate the performance of mutual funds in terms of risk and return. The scope of this study has been limited to 15 schemes chosen as per the priority given by the respondents of Gujarat state. This research study includes 14 selected Indian mutual fund schemes. The study has been kept limited to only two fund categories namely equity fund and income fund. Thus, scope of the research study is limited to the information collected through secondary data to evaluate the investment performance of sample mutual fund schemes.

P a g e | 47

TYPES OF RESEARCH

The basic types of research are as follows:

(i) Descriptive vs. Analytical: Descriptive research includes surveys and fact-finding enquiries of different kinds. The major purpose of descriptive research is description of the state of affairs as it exists at present. In social science and business research we quite often use the term Ex post facto research for descriptive research studies. The main characteristic of this method is that the researcher has no control over the variables; he can only report what has happened or what is happening.

(ii) Applied vs. Fundamental: Research can either be applied research or fundamental research. Applied research aims at finding a solution for an immediate problem facing a society or an industrial/business organization, whereas fundamental research is mainly concerned with generalizations and with the formulation of a theory. Gathering knowledge for knowledges sake is termed pure or basic research. Research concerning some natural phenomenon or relating to pure mathematics are examples of fundamental research.

(iii) Quantitative vs. Qualitative: Quantitative research is based on the measurement of quantity or amount. It is applicable to phenomena that can be expressed in terms of quantity. Qualitative research, on the other hand, is concerned with qualitative phenomenon.

P a g e | 48

DATA COLLECTION

Type of data collection: 1. Primary data: Primary data are those, which are collected afresh and for the first time, and thus happen to be original in character. We collect primary data during the course of doing experiments in an experimental research but in case we do research of the descriptive type and perform surveys, whether sample surveys or census surveys, then we can obtain primary data either through observation or through direct communication with respondents in one form or through personal interviews. There are several methods of primary data: Observation method Interview method Through questionnaires Through schedules

In these methods, we select questionnaires method for our survey because questionnaires method helps to study the expression of an individual and during that period we observe the situation of working culture also. So according to me questionnaires method is more beneficial in our research. JVIMS- encouraging Curiosity & creativity Questionnaires Quite often questionnaire is considered as the heart of a survey operation. Hence, it should be very carefully constructed. This method of data collection is quite popular. For workers we prepare questionnaires in printed form and for employees we prepare online questionnaires. For both the parties questions are same. All the questions are closed ended so that we got particular and exact answer. 2. Secondary data: Secondary data means data that are already available i.e., they refer to the data which have already been collected and analyzed by someone else. Secondary data has been collected through library and previous research report.

P a g e | 49

LIMITAITION OF THE STUDY

Most stock investors do not invest with risk management as their number one priority. A typical stock investor does some kind of research, whether it is fundamental analysis, technical analysis, or sentiment analysis or even all three. After the analysis is done, then the individual places the order and buys the stock. After the stock is purchased, then the individual decides if they should place a stop order to help manage risk or place an order to sell all or a portion of their stock. This typical investor has gone about their risk management strategy backwards in that they are managing their risk after the fact. 1. The time constraint is the major limitation of this research study. 2. As no work has been done earlier in this regard so scarcity of secondary data is also there. 3. The sample taken for the study is also small i.e. only 143 so an accurate research cannot be done. 4. The improper response of the respondents affects the findings of the study. 5. Geographical aspect also affected the research.

P a g e | 50

Data Analysis & Interpretation

P a g e | 51

Table A

Question 1 A B C D E

What is your monthly income? up to 10000 10000 to 15000 15000 to20000 20000 to 30000 30000 and above Total

percentage 23.77 31.47 19.58 18.18 7 100

Total 34 45 28 26 10 143

Chart A

The above graph if interpreted that highest percentage income group of the advisors are having mothly income 10000 to 15000 second highest earning group of the advisors having income of up to 10000, third , fourth , fifth,are having income of 15000 to 2000 ,20000 to 30000 and above 30000 recpetively.

P a g e | 52

Table B

Question 2 A B C D E F

What is your monthly Expense?

Up to 5000 5000 to 10000 10000 to 12000 12000 to 15000 15000 to 20000` More than 20000 Total

Percentage 28 33.56 24.47 7.69 4.19 2.09 100

Total 40 48 35 11 6 3 143

Chart B

From the above graph it can be interpreted that the highest percentage(33.56%) group of the advisors having monthly expenses of 5000 to 10000. Second highest expence group of the advisors are having 28% up to 5000

P a g e | 53

Table C

Question 3 A B C D E

Being a financial advisory. How many years of experience you are having?

percentage Total 44 45 25 22 7 143

Less then 1 year 1 to 3 year 3 to 5 year 5 to 10 year More than 10 year Total

30.77 31.47 17.48 15.38 4.9 100

Chart C

from the above graph it can be interpreted that highest number of advisors (45) having experience of 1-3 years. Then less no of the advisors are moare then 10 year expereyancce. Second , third ,forth are having a expereyance advisors less then 1 year ,3 to 5 year , 5 to 10 year respectively.

P a g e | 54

Table D

Question 4 A B C D E F

In which financial segment you are working?

Percentage Total 16 12 14 19 78 4 143

Mutual Fund Tax Advisory Equity Post Agent Insurance Other, Specify____________. Total

11.18 8.39 9.8 13.29 54.55 2.79 100

Chart D

From the above graph interpreted that highest percentage (54.55) group advosrs is working in a insurance segment. Secong highest percentage(13.29) group of the advisors is working in post office. Then third, fourth, fifth and, six are working in a mutual funds, equity, tax advisory, other respectively .

P a g e | 55

Table E

Question 5

What kind of investment prefers most? Percentage

Total 62 55 58 21 35 12 36 20 16 6 321

A B C D E F G H I J

Saving Account Fixed Deposit Insurance Mutual Funds Post Office Share /Debt Gold/Silver Real Assets Public Provident Funds Provident Fund Total

19.31 17.13 18.07 6.54 10.9 3.73 11.21 6.23 4.98 1.9 100

P a g e | 56

Chart E

From the above graph interpreted that highest percentage(19.31) group of the customer is invest in saving account. Second highest investment in a insurance segment is having 18.67%.

third,fourth , fifth, six are investing in fixed deposit, gold/silver, post office and mutual funds.. respectively

P a g e | 57

Table F

Question 6

How will you recommend the financial products to investor?

Percentage Total 52 41 27 23 143

A B C D

Knowledge based selling Based on financial planning Need based selling Revenue based\ Total

36.36 28.67 18.9 16.07 100

Chart F

From the above graph interpreted that the taking a first renk of 57 financial advisors are sell theire product base on knowledge. Then the second renk was 41 advisor are sell theire product based on financial planning. third and fourth renk are sell theire product are need based and revenue respectively.

P a g e | 58

Tabel G

Question 7 A B C D

While investing in money which factor you most ?

Percentage Total 25 34 50 34 143

Liquidity Low Price High Return Company Reputation Total

17.48 23.78 34.97 23.77 100

Graph G

From the above graph interpreted that Highest 34.97 percentage advisors are selected factor of high return , second 23.78 percentage advisors are selected factors of Low Price then 23.77% and 17.48% group of the advisoare selected company reputation and liquidity .

P a g e | 59

Tabel H

Question 8 A B

Are you aware about Mutual Fund?

Percentage Yes No Total 55.94 44.06 100 Total 80 63 143

Graph H

From the above gra\ph interpreted that the 56.94% advisors are aware about the Mutual Fund and then the 44.06% advisors are not aware about The Mutul Funds.

P a g e | 60

Table I

Question 9 A B C D E F G H

According to you investors are investing in MF for which of the following reason?

Percentage Total 53 51 24 26 20 31 15 2 222

High Return Tax Saving Wealth Creation Liquidity Profession Management Safety Goal Achievement Other Specify______ Total

26.23 15.35 11.88 12.88 9.9 15.34 7.42 1 100

Graph I

The above table and chart shows different investor are selected mf for following reasion. The data in table and chart shows that 26.23 are of high return, 15.35 are of tax saving, 15.34 are of safety, 12.88 aer of liquidity, 11.88 are of wealth creation ,9.99 are of profession management,

7.42 are of goal achivement and 1.00 are of other .

P a g e | 61

Table J

Question 10 A B

Do you think that MF gives better risk adjusted return compared to other financial instruments? Percentage Total

Yes No Total 56.65 43.35 100 81 62 143

Graph J

From the above graph

it can be interpreted that advisor are think highest

percentage 65.65 mutual fund gives better risk adjustment as compare to other financial product and 43.35 % is think that mutual funds is not gives better risk adjustment as compare to other financial product.

P a g e | 62

Table K

Question 11 A B

Will you recommend investment in MF to investors?

Yes No Total Percentage 46.15 53.85 100 Total 66 77 143

Graph K

From the above graph interpreted that the lowest percentage 46.15 advisors are recommend investment in mutual funds to investors and highest percentage 53.85 advisors are not recommend investment in murual funds to investors.

P a g e | 63

Table L

Question 12 A B

Do you know that earnings in MF advisory business are higher than in any other investment instruments in long term? Percentage Total Yes 45.45 65

No Total 54.55 100 78 143

Graph L

From the above graph we found that most of (55%)the advisors dont know that earnings in MF advisory business are higher than in any other investment instruments in long term

P a g e | 64

Table M

Question 13 A B

Have you passed-out AMFI Examination?

Yes No Total Percentage 16.09 83.91 100 Total 23 120 143

Graph M

From the above graph interoreted that 23 out of 143 advisors are passed out AMFI exam and 120 out of 143 adviosrs are not passed out AMFI exam.

P a g e | 65

Tabel N

Question 14 A B

If no would you like to appear for AMFI Examination?

Yes No Total Percentage 27.97 72.03 100 Total 40 103 143

Graph M

From the above graph it can interpreted that 28 percentage advisors are like to appear for AMFI exmination. And 72 percentage are does not like to appeare for AMFI examination

P a g e | 66

Tabel O

Question 15 A B

Have you heard about NJ India investment which is leading MF distributor in India?

Yes No Total Percentage 29.37 70.63 100 Total 42 101 143

Graph M

From the above Table and Graph interpreted that 29.37 % of advisors are heard about NJ india invest and 70.63% of advisors are do not know about NJ india invest. Which is leading Mutual Funds distribute in india.

P a g e | 67

Tabel P

Do you think that investors will be more satisfied by having all the financial products at the same place with same expertise?

Yes No Total Percentage 49.65 50.35 100 Total 71 72 143

Question 16 A B

Graph P

From the above graph it can be interpreted that 50 % are think that investors will be more satisfied by having all the financial products at the same place with same expertise.

P a g e | 68

Tabel Q

Question 17 A B C D E F G

Do you think which of the following products are offered by NJ funds to investors?

Percentage Total 73 31 49 32 10 32 14 241

Mutual Fund Real Estate Insurance Training & Education PMs Financial Planning Software FD/Bonds Total

30.29 12.86 20.34 13.28 4.15 13.27 5.81 100

Graph Q

From the above grafe it can be iterpreted thet following products are offered by NJ funds to investors .the tabel and chart are shows that 30.29% are of think that mutual fund, 20.34% are of think that insurance , 13.28% are of think that training & education, 13.27 are of think that financial planning softwere, 12.86% are of think that real estet, 5.81% are of think that FD/Bond, and 4.15 are the lovest percent of advisors are think that PMS.

P a g e | 69

Tabel R

Question 18 A B

which mode of invested will you recommend to you customer?

One time Investment Systematic Investment Planning(SIP) Total Percentage 30.77 69.23 100 Total 44 99 143

Graph R

From the above chart we can intepreted that 69.23% of advisors are recommend customer to invest in SIP mode and 30.77% of advisors are recommend customer to invest in one time investment mode.

P a g e | 70

Tabel S

Question 19 A B

Would you like to be a channel partner with NJ India invest?

Yes No Total Percentage 11.89 88.11 100 Total 17 126 143

Graph S

From the above table and chart we can interpreted that 11.89% of advisors would not like to be a chanel part of NJ india investment and 88.11% of advisors are like to be a chanel part of NJ india investment.

P a g e | 71

FINDINGS & SUGGESTIONS

P a g e | 72

FINDINGS

From the study it can be derivd that highest percentage (54.55) group advosrs is working in a insurance segment. From the survery it has been found that most of the investors (35%) are investing for high return and 25% of investors making investment because of the low price. Only 30% of investors are aware about the mutual funds schemes provided by the N J India, 70% of people are unaware about the mutual funds schemes of N J India. Most of the investors like to invest in the Savings account, Insurance and Fixed deposites Financial advisors mostly advises knowledge based selling and financial planning schemes. Majority of the investors are falling in the income class of 10000-15000. At the time of investing in money the investor is giving more preference to highest returns and lowest preference to liquidity. Out of our total research around 54 % investors are aware of mutual fund. At the timmig of investing in murual fund invewstors gives more preference to high return. Most of the investors prefer SIP plan rather than one time return. i.e most of the investors would like to leveraging their investment mode. Out of total study 56 % advisors gives opinion that mutual fund gives more risk adjusted return than other financial instrument but still 53 % advisors not recommending mutual fund to investors.

P a g e | 73

SUGGESTIONS

On the basis of above described market analysis and some other facts which I realized during summer training there are some recommendation for the company which can be beneficial for the growth of company. They are:

Customer interactive session should be organised on a regular basis so that they could have a better learning about mutual fund & its product because there are many people who do not have a clear idea about all mutual fund products & how the mutual fund industry works. By doing so it can attract more investment into this sector. The company have to make the people understand the benefits if they make their investment through NJ INDIA INVEST PVT. LTD. & it should develop a good customer service cell where grievances of a customer can be solved because a satisfied customer will bring more number of customers Company should make awareness in the investors about the schemes provided by N J India. A special BPO should be made to do core calling & problem solving over the phone. Problem solving over the phone require special skilled BPO employees. So, it is required to develop the business of NJ INDIA INVEST PVT. LTD.

P a g e | 74

OWN EXPERIENCE

I have joined NJ INDIA INVEST PVT .Ltd on 15th Junel, 2012 as summer trainee. I was under the mentorship of Mr Ravindra Pansara (Branch Manager) & Mr Vipul Trivedy (Agency Manager). I have gained a real working experience & learned many valuable things by joining this company. I started my work by collecting data of Advisors from the field by visiting various Insurance office of Jamnagar. I got a good response from people from the day 1ast they were giving their contact details. Every day I used to collect 10 contact details by way of normal questionnaire and phone no. I had developed the questionnaire to differentiate me as a MBA student from others. On the very next day, I used to call them up, fix up an appointment over the phone & went to their offices to give a presentation & convince them to buy mutual fund products. Sometimes in the beginning my mentor Mr. Vipul Trivedy took me to joint calls to teach me how to convince a new client & how to talk with them. As soon as I got the appointment I went to the respective persons office/desired place on time and started with the conversation with casual talks, make that person be friendly with me & then start the presentation. What I used to do is to literate the customers about mutual fund industry & then create a need for Mutual Fund in them. As soon as the need was felt I used to get business from them. The summer internship is a valuable learning experience. It gives an insight about the organization, the kind of work and the people involved in it and how business work. During internship I have initially faced a lot of different tasks which helps a person build good relationship at the workplace. It helped in developing my team building skills. To know about the company and its work culture. I improved my communication skills by learning how to talk to different kind of people as it requires the different approach to handle each person. I have gained good knowledge about mutual fund which is very necessary being a finance student. Now my base about mutual fund is totally clear. I have learnt how to handle and convince people when they are totally new to me. Patience was the thing I learnt the most as I have to approach the clients who were to be explained same things again and again while approaching or calling them at regular intervals.

P a g e | 75

CONCLUSION

On the basis of my experience during the 45 Days summer training, analyzing the data that was collected through a questionnaire and face-to-face conversation with the people I conclude this project work with the words thatIn spite of the bleak and grim outlook the future of capital market is growing at a very high pace. Taking these things into consideration there are lots of opportunity for the Investment advisory service providers which already exist and which are due to enter in the Indian market.The fund managers of the schmes of mutual fund are also trying their best in giving more return to the investors by allocating the fund in a most suitable way. There is little awareness about Equity and Mutual funds in India. People have accepted it as one of the major investment avenue. As people have entered in this particular investment avenue they have lost money because of movement in the market which is below the par value and this has shaken the faith of investors in this particular avenue. NJ has emerged a very strong player in the field of distribution of financial product it is giving stiff competition to all players. If the progress of NJ goes in the same way then it will emerge as a major player in the Capital market. They have much more potential to expand their business. Comparing to other investment avenues, investing in mutual fund is lot more profitable. So, everybody should invest a part of their income in this avenue for creation of wealth.

P a g e | 76

BIBLIOGRAPHY

REFERENCES

Following are the sources from where the Primary data has been gathered:

JOURNALS/MAGAZINES

Fundz Watch Mutual Fund Insight

INTERNET WEBSITES

www.njindiainvest.com www.amfiindia.com www.valueresearchonline.com www.scribd.com www.moneycontrol.com www.sebi.gov.in www.nseindia.com

P a g e | 77

Appendix

LIST OF THE TABLE

Sir No. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. Particular Table A Table B Table C Table D Table E Table F Table G Table H Table I Table J Table K Table L Table M Table N Table O Table P Table Q Table R Table S Question Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 Question 7 Question 8 Question 9 Question 10 Question 10 Question 12 Question 13 Question 14 Question 15 Question 16 Question 17 Question 18 Question 19 s 45 46 47 48 49 51 52 53 54 55 56 57 58 59 60 61 62 63 64

P a g e | 78

LIST OF THE GRAPH

Sir No. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. Particular Graph A Graph B Graph C Graph D Graph E Graph F Graph G Graph H Graph I Graph J Graph K Graph L Graph M Graph N Graph O Graph P Graph Q Graph R Graph S Question Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 Question 7 Question 8 Question 9 Question 10 Question 10 Question 12 Question 13 Question 14 Question 15 Question 16 Question 17 Question 18 Question 19 Page No. 45 46 47 48 49 51 52 53 54 55 56 57 58 59 60 61 62 63 64

P a g e | 79

QUESTIONNAIRE

I am Nakum Harish conducting a survey research on FACTORS CONSIDERIED BY FINANCIAL ADVISORY IN SELECTION OF FINANCIAL COMPANY with N J India invest Pvt. Ltd. I assure you that the data given by you will be used on for academic purpose. Name:-__________________________________________________________________ Address:-________________________________________________________________ ________________________________________________________________________ _____________________________________________________. Contact no.:-_________________. Email Id:-_____________________________. Qualification Under graduate Post graduate Graduate professional

1. What is your monthly income?

up to 10000 15000 to20000 30000 and above

10000 to 15000 20000 to 30000

2.

What is your monthly Expense?

Up to 5000 10000 to 12000 15000 to 20000

5000 to 10000 12000 to 15000 More than 20000

P a g e | 80

3. Being a financial advisory. How many years of experience you are having?

Less then 1 year 3 to 5 year More than 10 year

1 to 3 year 5 to 10 year

4. In which financial segment you are working?

Mutual Fund Equity Insurance

Tax Advisory Post Agent Other, Specify______________________.

5. What kind of investment prefers most?

Saving Account Insurance Post Office Gold/Silver Public Provident Funds

Fixed Deposit Mutual Funds Share /Debt Real Assets Provident Fund

6. How will you recommend the financial products to investor?

Knowledge based selling Need based selling

Based on financial planning Revenue based\

7. While investing in money which factor you most ?

Liquidity High Return

Low Price Company Reputation

P a g e | 81

8. Are you aware about Mutual Fund? Yes No

9. According to you investors are investing in MF for which of the following reason?

High Return Wealth Creation Profession Management Goal Achievement

Tax Saving Liquidity Safety Other Specify_____________

10. Do you think that MF gives better risk adjusted return compared to other financial instruments? Yes No

11. Will you recommend investment in MF to investors? Yes No

If no specific reason,__________________________.

12. Do you know that earnings in MF advisory business are higher than in any other investment instruments in long term? Yes No

13. Have you passed-out AMFI Examination? Yes No

14. If no would you like to appear for AMFI Examination? Yes No

15. Have you heard about NJ India investment which is leading MF distributor in India? Yes No

P a g e | 82

16. Do you think that investors will be more satisfied by having all the financial products at the same place with same expertise? Yes No

17. Do you think which of the following products are offered by NJ funds to investors?

Mutual Fund Insurance PMs FD/Bonds

Real Estate Training & Education Financial Planning Software

18. which mode of invested will you recommend to you customer? One time invest systematic investment planning

19. Would you like to be a channel partner with NJ India invest? Yes No

If No, specific reason,______________________________.

You might also like

- Nitish SharmaDocument59 pagesNitish SharmaannnnmmmmmNo ratings yet

- Summer ProjectDocument22 pagesSummer Projectdarshan0% (1)

- Richa Yadav Project FileDocument68 pagesRicha Yadav Project FileRicha YadavNo ratings yet

- Bajaj Capital ProjectDocument17 pagesBajaj Capital Projectharman singh50% (2)

- Project On NJ India Invest PVT LTDDocument68 pagesProject On NJ India Invest PVT LTDbabloo200650% (2)

- NJ India Invest ProjectDocument52 pagesNJ India Invest ProjectPrakash Rathor100% (1)

- Bharati Vidyapeeth (Deemed To Be University), Pune IndiaDocument48 pagesBharati Vidyapeeth (Deemed To Be University), Pune Indiarushil bhatia0% (1)

- Project On NJ India Invest PVT LTDDocument77 pagesProject On NJ India Invest PVT LTDrajveerpatidar69% (26)

- "Systematic Investment Plan: Sbi Mutual FundDocument60 pages"Systematic Investment Plan: Sbi Mutual Fundy2810No ratings yet

- Project On NJ India Invest PVT LTDDocument77 pagesProject On NJ India Invest PVT LTDHatim Ali100% (1)

- Equity Mutual Funds ProjectDocument65 pagesEquity Mutual Funds Projectmanoranjanpatra100% (5)

- Investment Plans in IndiaDocument70 pagesInvestment Plans in IndiaNitesh Singh100% (1)

- Mutual Fund As An Investment AvenueDocument62 pagesMutual Fund As An Investment Avenueamangarg13100% (8)

- Consumer Behaviour Towards Mutual FundDocument169 pagesConsumer Behaviour Towards Mutual FundShanky Kumar100% (1)

- Mutual Fund ProjectDocument70 pagesMutual Fund ProjectPranali ahirraoNo ratings yet

- A Study On Finacial Advisor For Mutual Fund InvestorsDocument53 pagesA Study On Finacial Advisor For Mutual Fund InvestorsPrasanna Belligatti100% (1)

- Comparative Analysis Reliance and SbiDocument69 pagesComparative Analysis Reliance and SbiPreet Singh0% (1)

- Sip Report NJ 2016Document37 pagesSip Report NJ 2016vicky rajputNo ratings yet

- SIP Report OldDocument27 pagesSIP Report OldAbhishek rajNo ratings yet

- Nippon India ProjectDocument93 pagesNippon India ProjectNishath Shaikh100% (1)

- Project On Mutual FundDocument112 pagesProject On Mutual FundSharn GillNo ratings yet

- Comparative Analysis Between Mutual Funds and Equity MarketDocument18 pagesComparative Analysis Between Mutual Funds and Equity MarketAnonymous oRSVOtR4BNo ratings yet

- 3 Investors Behaviour Towards Investment AvenuesDocument8 pages3 Investors Behaviour Towards Investment AvenuessikhaNo ratings yet

- Bajaj Capital 1Document32 pagesBajaj Capital 1Shahnawaz HussainNo ratings yet

- Comparative Analysis of Mutual FundsDocument27 pagesComparative Analysis of Mutual FundsTajinder Pal Saini100% (7)

- Comparative Analysis of Reliance and HDFC Mutual FundDocument59 pagesComparative Analysis of Reliance and HDFC Mutual FundSumit Bhardwaj100% (18)

- Customer Perception Towards Investment in Mutual Funds Presentation NitinDocument10 pagesCustomer Perception Towards Investment in Mutual Funds Presentation NitinNitin singhNo ratings yet

- Summer Project Report On Comparative Analysis of Broking Companies and Financial Performance of Edelweiss Broking LTDDocument71 pagesSummer Project Report On Comparative Analysis of Broking Companies and Financial Performance of Edelweiss Broking LTDSatyendraSinghNo ratings yet

- Bajaj CapitalDocument15 pagesBajaj Capitalharshita khadayteNo ratings yet

- Hemant Kandpal Internship ReportDocument30 pagesHemant Kandpal Internship Reporthemant kandpalNo ratings yet

- Systematic Investment Plan (SIP)Document3 pagesSystematic Investment Plan (SIP)rupesh_kanabar160486% (7)

- Project On Investor Preference in Mutual FundsDocument52 pagesProject On Investor Preference in Mutual FundsKevin IycNo ratings yet

- Investment Avenue Research PaperDocument3 pagesInvestment Avenue Research Paperdeepika gawas100% (1)

- The Mutual Fund Marketing and Sales Strategies at NJ India InvestDocument29 pagesThe Mutual Fund Marketing and Sales Strategies at NJ India InvestbatmanNo ratings yet

- A Project Report On Mutual Fund As An Investment Avenue at NJ India InvestDocument16 pagesA Project Report On Mutual Fund As An Investment Avenue at NJ India InvestYogesh AroraNo ratings yet

- Comparative Analysis On Mutual Fund Scheme MBA ProjectDocument83 pagesComparative Analysis On Mutual Fund Scheme MBA Projectvivek kumar100% (1)

- A Project On Awareness of Derivative StrategiesDocument97 pagesA Project On Awareness of Derivative Strategiesusefulthomas67100% (2)

- Summer Training Report FinalDocument79 pagesSummer Training Report FinalDeepak FarswanNo ratings yet

- A Study About Awareness and Perception of Mutual Fund As InvestmentDocument81 pagesA Study About Awareness and Perception of Mutual Fund As InvestmentFaisal ArifNo ratings yet

- Project Report On Mutual Funds Trends in IndiaDocument41 pagesProject Report On Mutual Funds Trends in IndiaChirag Gohil100% (1)

- Motilal OswalDocument49 pagesMotilal OswalsandeepNo ratings yet

- On NJ India-1Document21 pagesOn NJ India-1Krishna SoniNo ratings yet

- A Summer Internship Project Report On NJDocument89 pagesA Summer Internship Project Report On NJNishan Shah73% (11)

- Comparative Study of Two Mutual Fund CompanyDocument73 pagesComparative Study of Two Mutual Fund CompanySwathi Manthena100% (2)

- An Empirical Study of Factors Affecting Sales of Mutual Funds Companies in IndiaDocument289 pagesAn Empirical Study of Factors Affecting Sales of Mutual Funds Companies in Indiashradha srivastavaNo ratings yet

- Investment AvenuesDocument17 pagesInvestment Avenuessaurav43% (7)

- Questioner On Investment Habits of PeopleDocument2 pagesQuestioner On Investment Habits of Peoplemaulik_mike7100% (5)

- A Study On Investors Perception Towards Share Market (Shriram Insight)Document25 pagesA Study On Investors Perception Towards Share Market (Shriram Insight)akki reddyNo ratings yet

- Summer Internship Report EdelweissDocument35 pagesSummer Internship Report EdelweissDushyant MudgalNo ratings yet