Professional Documents

Culture Documents

Tax Relief Allowances in Nigeria

Uploaded by

Osemwegie PaulOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Relief Allowances in Nigeria

Uploaded by

Osemwegie PaulCopyright:

Available Formats

Tax Relief Allowances in Nigeria: What Corporate Employers Should Know March 2009 Vol.

22: Issue # 3

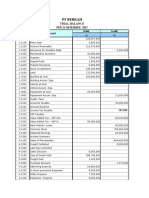

Virtually all modern tax codes make provisions for tax relief allowances to cushion the effects of various taxes and instrumentalities imposed by government. The Nigerian tax code is no exception. Under Nigerian tax laws, tax relief allowances cut across family, life assurance, pension, rents, those living with dependants, leave allowance for the employed, meal subsidy, entertainment, and utility. Under the guidelines issued by the Nigerian Joint Tax Board (JTB), direct tax relief allowance is fixed at 20 percent of earned income plus N5,000. In addition, a family of our is entitled to a tax relief of N2,500 per child up to a maximum of four children. Given that the average number of children in a Nigerian family is six children and that many Nigerian families have more than four children, this provision is inconsistent with cultural and social realities. For families with other dependants, the guideline provides for tax relief of N2,000 per dependant up to a maximum of two dependants. Again, this provision is out of step with the sociocultural norms in Nigeria. For Nigerian tax payers who have life assurance policies, the guidelines provides for a 100 percent tax relief for the sum paid. Similarly, 100 percent of sum paid for pension contribution is given as tax relief. Other allowable tax reliefs include transportation (maximum of N20,000 per annum), rent, leave (maximum of ten percent of annual basic salary), meal subsidy, utilities, entertainment, interest on loans, et cetera. Tax practitioners in Nigeria generally agree that majority of tax payers in Nigeria are unaware of the numerous tax reliefs recognized by the Nigerian tax code. Indeed, many employers are unaware of the tax reliefs. Most employers fail to give their employees forms relating to their taxes. It is not unusual for employees to be paid without pay notifications (often described in local parlance as pay slips) to guide them on the amount they pay as tax. In the few instances where pay notifications or pay slips are issued to employees, tax reliefs are not issued simultaneously so that employees can fill them. This boils down to a frequent issue confronted by tax practitioners: how can a Pay As You Earn (PAYE) taxpayers know what to pay or access as

The increasing level of multiple taxes springing across states and the aggressiveness on the side of revenue authorities have called for an increase in the knowledge of what provision the law makes, especially with regards to Personal Income Tax (PIT).

Therefore, in a bid to keep more money in your purse, especially expendable income, the Federal Inland Revenue Service (FIRS) on its side believes that you need to start asking yourself questions like: what expenses can I deduct before paying PIT? According to FIRS, in calculating income tax, the law allows deduction of all expenses and outgoings from emoluments of the fiscal year in which they are incurred, on the condition that they are: incurred in the production of income, that is the performance of duties and "wholly, exclusively, necessarily and reasonably" so incurred. In a related development, there is also limit to every strategy you use to have more money in your purse, because, according to the law, there are allowed and disallowed expenses. FIRS disclosed that the law allows certain expenses, but disallows others. "Expenses, specifically allowed under the law in calculating income tax include: interest paid on borrowed money employed as capital in acquiring the income; rent and premiums in respect of land and buildings occupied for the purposes of acquiring profits; expenditure on repairs of premises, plant, machinery and fixtures and for the renewal, repair or alteration of such items used in acquiring income; bad and doubtful debts, any recoveries being treated as income when received," FIRS stated. A list of disallowed trading expenses include: domestic or private expenses; capital withdrawn from a trade, business, profession or vocation and any expenditure of a capital nature; any loss or expense recoverable under an insurance or contract of indemnity; taxes on income or profits levied in Nigeria or elsewhere except as provided by the law; the depreciation of any asset. Meanwhile, you need to know which parts of a person's income that is subjected to tax. FIRS disclosed: "Tax is calculated for each year of assessment on the aggregate amounts of the income of every taxable person, for the year. The following incomes are subject to tax under the law: gains or profits from any trade, business, profession or vocation for whatever period of time it may have been carried on by the taxable person; dividends, interests or discounts; any pension, charge or annuity; the gains or profits including any premiums arising from a right granted to any other person for the use or occupation of any property." Are there tax relief and allowances available under PIT? "With effect from January 1, 1999, the following tax relief and allowances were incorporated in the law. They are tax free earned income: annual income of N 30,000 and below is exempted from tax, although a minimum tax of 0.5 percent will be charged. "Others include tax free allowances which include rent subsidy/allowance of N100, 000 per annum; transport allowance N15,000 per annum; meal subsidy/allowance N5,000 per annum; utility allowance N10,000 per annum; and entertainment allowance N6,000 per annum; leave grant 10 percent of annual basic salary," according to PIT Act.

You might also like

- BIR Ruling (DA-031-07)Document2 pagesBIR Ruling (DA-031-07)Jerwin Dave100% (4)

- Netscape IPO ExcelDocument7 pagesNetscape IPO Exceldchristensen5100% (1)

- Your Adv Plus Banking: Account SummaryDocument6 pagesYour Adv Plus Banking: Account Summaryhanh nguyen hoang ngoc100% (1)

- TAXATION PRINCIPLESDocument20 pagesTAXATION PRINCIPLESSony Axle100% (11)

- Botswana Tax Lecture Slides, SydneyDocument84 pagesBotswana Tax Lecture Slides, SydneysmedupeNo ratings yet

- Archbishop Reyes Ave, Cebu City, Cebu, 6000Document5 pagesArchbishop Reyes Ave, Cebu City, Cebu, 6000Ralf Arthur Silverio100% (1)

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAbhishek K. Singh100% (1)

- AC4251 Group Project Written ReportDocument24 pagesAC4251 Group Project Written ReportranniamokNo ratings yet

- Angela Jano - 2C1Document2 pagesAngela Jano - 2C1Angela Bea JanoNo ratings yet

- Tax System: BY Arpita Pali Prachi Jaiswal Mansi MahaleDocument30 pagesTax System: BY Arpita Pali Prachi Jaiswal Mansi MahaleSiddharth SharmaNo ratings yet

- Train Law NotesDocument9 pagesTrain Law NotesMa Angeli Gomez100% (1)

- What Is Taxation AutosavedDocument7 pagesWhat Is Taxation AutosavedMila Casandra CastañedaNo ratings yet

- Business TaxationDocument10 pagesBusiness TaxationImman AgdonNo ratings yet

- TAXATIONDocument17 pagesTAXATIONLamaire Abalos BatoyogNo ratings yet

- Tax LawsDocument4 pagesTax LawsGabby ChebetNo ratings yet

- An Economic Impact Analysis On Tax Reform For Acceleration and Inclusion or Train BillDocument6 pagesAn Economic Impact Analysis On Tax Reform For Acceleration and Inclusion or Train BillZarina BartolayNo ratings yet

- Income Tax Explained: Types, Deductions, and MoreDocument11 pagesIncome Tax Explained: Types, Deductions, and MorePrince Isaiah JacobNo ratings yet

- Etaxation Unit 1Document50 pagesEtaxation Unit 1Rohit Tripathi ModicareNo ratings yet

- Unit 1Document5 pagesUnit 1piyush.birru25No ratings yet

- Taxation Law & Practice Module-1Document298 pagesTaxation Law & Practice Module-1swapbjspnNo ratings yet

- Double TaxationDocument6 pagesDouble TaxationrobertNo ratings yet

- ChinaDocument5 pagesChinacracking khalifNo ratings yet

- Philippine Tax SystemDocument11 pagesPhilippine Tax SystemHyacinth Eiram AmahanCarumba LagahidNo ratings yet

- Act 4.1Document3 pagesAct 4.1Tiffany HwangNo ratings yet

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAman Machra100% (2)

- Bfa 322 - Taxation A Cross Border ActivitiesDocument11 pagesBfa 322 - Taxation A Cross Border Activitiesjoannemutheu8No ratings yet

- Income TaxDocument31 pagesIncome TaxPriyanka BhojaneNo ratings yet

- Aec 209 Act 02Document4 pagesAec 209 Act 02Jaried SumbaNo ratings yet

- Everything You Need to Know About Taxation in IndiaDocument9 pagesEverything You Need to Know About Taxation in IndiaSiva BalanNo ratings yet

- General Principles of TaxationDocument12 pagesGeneral Principles of TaxationJaiavave Linogon100% (1)

- Value Added Tax Black Book 2 2332Document47 pagesValue Added Tax Black Book 2 2332sanket yelaweNo ratings yet

- Unit 4Document112 pagesUnit 4Vetri Velan100% (1)

- Wealth ManagementDocument10 pagesWealth ManagementAditi pandeyNo ratings yet

- Tax Aspects AssignmentDocument5 pagesTax Aspects AssignmentJohn Klein SantillanNo ratings yet

- Concept Note-SumiDocument11 pagesConcept Note-Sumisumi mallaNo ratings yet

- What Is The TaxDocument9 pagesWhat Is The TaxGözde ÇetinkolNo ratings yet

- income taxDocument32 pagesincome taxAeiaNo ratings yet

- Tax Management Assignment on Tax Evasion, Avoidance and TreatiesDocument5 pagesTax Management Assignment on Tax Evasion, Avoidance and TreatiesSaqib KhanNo ratings yet

- Nigeria Tax & Fiscal RegulationsDocument9 pagesNigeria Tax & Fiscal RegulationsAparna SinghNo ratings yet

- TaxationDocument82 pagesTaxationRiah M. De ChavezNo ratings yet

- MidTerm Lesson Part 1Document34 pagesMidTerm Lesson Part 1ARMAN WAYNE ANGELESNo ratings yet

- Bangladesh Tax Law GuideDocument16 pagesBangladesh Tax Law GuideAmeer FaysalNo ratings yet

- Pita Amendment January 2012Document3 pagesPita Amendment January 2012Mark allenNo ratings yet

- Guinea Tax 2Document6 pagesGuinea Tax 2Onur KopanNo ratings yet

- Module 7 LectureDocument8 pagesModule 7 LectureClarence AblazaNo ratings yet

- Taxation ModuleDocument4 pagesTaxation ModuleJefferson Ayubo BroncanoNo ratings yet

- Chapter Seven Tax Planning BackgroundDocument9 pagesChapter Seven Tax Planning BackgroundTriila manillaNo ratings yet

- Research Paper On Tax Evasion in IndiaDocument7 pagesResearch Paper On Tax Evasion in Indiahjuzvzwgf100% (1)

- TAXATIONDocument21 pagesTAXATIONRichelle Ann CarinoNo ratings yet

- CHAPTERDocument20 pagesCHAPTERsanchitNo ratings yet

- Preliminaries Tax'Document14 pagesPreliminaries Tax'J A SoriaNo ratings yet

- (LECTURE NOTES) TOPIC #6 - Individual Tax Planning and ManagementDocument19 pages(LECTURE NOTES) TOPIC #6 - Individual Tax Planning and Managementcourse shtsNo ratings yet

- Egyptian Tax SystemDocument58 pagesEgyptian Tax SystemOld-King Rox100% (1)

- Taxation Research PaperDocument16 pagesTaxation Research PaperreyramachandraNo ratings yet

- Oing Business in GuatemalaDocument16 pagesOing Business in GuatemalaJorge Luis Can MonroyNo ratings yet

- Act02 - Lfca233n022 - Gono VanessDocument2 pagesAct02 - Lfca233n022 - Gono VanessNeting GeeNo ratings yet

- M15a1 RPHFTDocument2 pagesM15a1 RPHFTkristineclaire mapaloNo ratings yet

- DIRECT AND INDIRECT TAXESDocument41 pagesDIRECT AND INDIRECT TAXESlakshyaNo ratings yet

- System of Taxation in The PhilippinesDocument7 pagesSystem of Taxation in The PhilippinesdendenliberoNo ratings yet

- Unit 2Document5 pagesUnit 2piyush.birru25No ratings yet

- Introduction to Taxation PrinciplesDocument13 pagesIntroduction to Taxation PrinciplesApex LionheartNo ratings yet

- Complete BIR Taxation Guide For Self-Employed & FreelancersDocument35 pagesComplete BIR Taxation Guide For Self-Employed & FreelancersKuzan AokijiNo ratings yet

- CTP Unit 3Document10 pagesCTP Unit 3SANDEEP KUMARNo ratings yet

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- The Purpose of Audit TestsDocument2 pagesThe Purpose of Audit TestsOsemwegie PaulNo ratings yet

- Audit ThtreatDocument13 pagesAudit ThtreatOsemwegie PaulNo ratings yet

- Auditor RequestDocument7 pagesAuditor RequestOsemwegie PaulNo ratings yet

- Subsiqent EventsDocument2 pagesSubsiqent EventsOsemwegie PaulNo ratings yet

- Subsiqent EventsDocument2 pagesSubsiqent EventsOsemwegie PaulNo ratings yet

- Understanding The Auditor's ReportDocument8 pagesUnderstanding The Auditor's Reportumesar001No ratings yet

- Auditors: A Quick GuideDocument12 pagesAuditors: A Quick GuideOsemwegie Paul100% (1)

- Lembar Siklus BerkahDocument34 pagesLembar Siklus BerkahSri Muji RahayuNo ratings yet

- Income From Salary GuideDocument53 pagesIncome From Salary GuideBoRO TriAngLENo ratings yet

- TDS Rate With Section FY 2019-2020Document22 pagesTDS Rate With Section FY 2019-2020Iftekhar SaikatNo ratings yet

- Tax: TRAIN Illustrative Problems: Long Problem With FormsDocument23 pagesTax: TRAIN Illustrative Problems: Long Problem With FormsNooroddenNo ratings yet

- Receipt Splitter: IYM: Macros PageDocument4 pagesReceipt Splitter: IYM: Macros PagegelubotNo ratings yet

- ACCDocument16 pagesACCFarah AlyaNo ratings yet

- Part D - International Taxation: 1 Residential Status and Accrual of IncomeDocument2 pagesPart D - International Taxation: 1 Residential Status and Accrual of IncomeChhaya JajuNo ratings yet

- Amazon Invoice - Power Bank PDFDocument1 pageAmazon Invoice - Power Bank PDFAl-Harbi Pvt LtdNo ratings yet

- Withdrawal FormDocument1 pageWithdrawal FormSujith Jayan AlexNo ratings yet

- Forms BrgyDocument13 pagesForms BrgyErlinda LagunaNo ratings yet

- Documento PDFDocument6 pagesDocumento PDFangye08vivasNo ratings yet

- Big Thanks Mock TaxationDocument23 pagesBig Thanks Mock TaxationHussein SeetalNo ratings yet

- Service TaxDocument239 pagesService TaxG Subramaniam100% (1)

- Factual AntecedentsDocument17 pagesFactual AntecedentsRomeo Boy-ag Jr.No ratings yet

- Contex Corp. v. Commissioner of InternalDocument9 pagesContex Corp. v. Commissioner of InternalCamshtNo ratings yet

- Annual Income Tax ReturnDocument2 pagesAnnual Income Tax ReturnRAS ConsultancyNo ratings yet

- Principles of Accounting II Payroll System in Ethiopian ContextDocument16 pagesPrinciples of Accounting II Payroll System in Ethiopian ContextBlen tesfaye67% (3)

- PDFDocument2 pagesPDFSanjiv VermaNo ratings yet

- MARUBENI Vs CIR TAXDocument2 pagesMARUBENI Vs CIR TAXLemuel Angelo M. EleccionNo ratings yet

- DEPOSITSLIP#192792#1Document1 pageDEPOSITSLIP#192792#1AsadNo ratings yet

- Clover - PreApplication NEWDocument1 pageClover - PreApplication NEWgreat augustNo ratings yet

- Lesson 5 Self Check PDFDocument9 pagesLesson 5 Self Check PDFakina miguelNo ratings yet

- 2 Control Sheet - IFPDocument1 page2 Control Sheet - IFPArman KhanNo ratings yet

- Lecture 3 Income Tax JurisdictionDocument22 pagesLecture 3 Income Tax JurisdictionAmsalu BelayNo ratings yet

- 1095a FaDocument1 page1095a FasaranNo ratings yet