Professional Documents

Culture Documents

TI BI II Instruction Sheet

Uploaded by

hairst15Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TI BI II Instruction Sheet

Uploaded by

hairst15Copyright:

Available Formats

Texas Instruments BA II Plus Time Value Calculations

Solving time value problems with the BA II Plus:

1. [2nd]

Key steps you must know to use this calculator: [CLR TVM] Clears the time value registers, which should be cleared each time before you start a problem. Does not clear P/Y register, however.

[2nd] [P/Y]

Displays current setting of "payments per year". By default the number of compoundings per year will equal the number of payment per year. With calculator in P/Y mode, the number of payments (compoundings) per year can be changed to any number XX by keying: [X] [X] [ENTER] In the rare case that compoundings per year are different than the payments per year, C/Y can be reached by "paging down" by hitting the down arrow once. Exit P/Y mode by keying: [2nd] [QUIT] Note P/Y entry not cleared by the [CLR TVM] function.

[2nd] [FORMAT]

Displays current setting of "places displayed after decimal point". With calculator in FORMAT mode, the number of decimal places displayed can be changed to any number X by keying: [X] [ENTER] Exit FORMAT mode by keying: [2nd] [QUIT]

[2nd] [BGN]

Displays current setting of "timing of annuity payments". Two options are BGN (beginning of period) and END (end of period). With calculator in BGN mode, "toggle" to option not currently displayed by keying: [2nd] [SET] -Note: for most problems END is the appropriate selection. Exit BGN mode by keying: [2nd] [QUIT]

2.

Solving for the present value of a single future sum:

a.

Clear TVM mode of calculator: Note: Once TVM is cleared, order in which inputs are made is irrelevant. [2nd] [CLR TVM]

b.

Enter # of compoundings (payments) per year: If not given a number of compounding periods per year, assume annual compounding, i.e. one compounding period per year. [2nd] [P/Y] [1] [2] [ENTER] [2nd] [QUIT]

c.

Enter total # of compounding periods: Following this entry method provides a "double check" of the P/Y setting. input # of years of compounding [2nd] [xP/Y] [N]

d.

Enter the annual interest rate:

Note rates are almost universally stated as annual rates. input interest rate [I/Y] e. Enter the future value: input future value [FV]

f.

Compute present value: Note that present value is amount investor puts into investment, i.e. a cash outflow for investor, and therefore has a negative sign. Signs merely represent direction of cash flow. [CPT] [PV]

3.

Solving for the future value of a single present sum:

a.

Clear TVM mode of calculator: [2nd] [CLR TVM]

b.

Enter # of compoundings (payments) per year: If not given a number of compounding periods per year, assume annual compounding, i.e. one compounding period per year. [2nd] [P/Y] input compounding payments per year [ENTER] [2nd] [QUIT]

c.

Enter total # of compounding periods: Following this entry method provides a "double check" of the P/Y setting. input total # of compounding periods [2nd] [xP/Y] [N]

d.

Enter the annual interest rate: Note rates are almost universally stated as annual rates. input interest rate [I/Y]

e.

Enter the present value: A cash outflow for investor, and therefore has a negative sign. Signs merely represent direction of cash flow. input present value [+/-] [PV]

f.

Compute future value: Future value is amount investment will provide to investor, i.e. a cash inflow for investor, and therefore has a positive sign. Signs merely represent direction of cash flow. [CPT] [FV]

4.

Solving for the future value of an annuity: Clear TVM mode of calculator: see 3 a above Check to see that calculator is in correct BGN/END mode: Review section 1 above on keystrokes related to BGN/END toggle. Correct mode here is END. Enter # of compoundings (payments) per year: Equals the number of periodic payments per year. see 3b above Enter total # of compounding periods: see 3c above

a. b.

c.

d.

e. f.

Enter the annual interest rate: see 3d above Enter the periodic payment: A cash outflow for investor, and therefore has a negative sign. input periodic interest payment [+/-] [PMT]

g.

Compute future value: A cash inflow for investor, and therefore has a positive sign. [CPT] [FV]

5.

Solving for the present value of an annuity: Clear TVM mode of calculator: see 3a above Check to see that calculator is in correct BGN/END mode: Review section 1 above on keystrokes related to BGN/END toggle. Correct mode here is BGN. Enter # of payments (compoundings) per year: Equals the number of periodic payments per year. see 3b above Enter total # of compounding periods: see 3c above Enter the annual interest rate: see 3d above

a. b.

c.

d. e.

f.

Enter the periodic payment: A cash inflow for investor, and therefore has a positive sign. input periodic payment [PMT] Compute present value: A cash outflow for investor, and therefore has a negative sign. [CPT] [PV]

g.

6.

Computing [N], [I/Y] or [PMT] Given the correct inputs, one can solve for the total number of compounding periods (N), the annual interest rate (I/Y) or, in the case of an annuity, the periodic payment (PMT). In entering input variables, remember that cash outflows have a negative sign. Inflows have a positive sign. [CPT] [N] This computation gives total number of compounding periods. To get the number of years, the result must be divided by the number of compounding periods per year (P/Y). This computation gives the annual interest rate. The rate per compounding period can be determined by dividing the result by the number of compounding periods per year (P/Y). In solving for the periodic payment (PMT), the signs of the entered amounts for PV and/or FV must be entered carefully remembering that inflows are positive, outflows negative.

[CPT] [I/Y]

[CPT] [PMT] 7.

Solving for the net present value (NPV) or (IRR) of a stream of periodic payments. a. Enter CF mode and clear the mode: [CF] [2nd] [CLR Work] b. Enter Cash Flows: i. With prompt for CF0 displayed enter initial cash flow (negative sign for outflow) input initial cash flow [+/-] [ENTER]

ii.

"Page down" to prompt for C01 by hitting down arrow once. Then enter first cash flow amount.

iii.

"Page down" to prompt for F01 by hitting down arrow once. Enter number of times consecutively that first cash flow, C01, occurs. "Page down" to prompt for C02 by hitting down arrow once. Enter second cash flow amount. Continue in same manner until all cash flows are entered.

iv.

c.

Compute IRR: [IRR] [CPT]

d.

Compute NPV: [NPV] The calculator will prompt for discount rate by displaying I = 0 input discount rate [ENTER]

Enter discount rate:

"Page down" to prompt for NPV by hitting down arrow once. Then simply hit CPT button [CPT]. 8. Solving for MIRR. a. b. Obtain FVA by inputting # of years = N, Interest Rate = i/y, PV = 0, input annuity cash flow as PMT, then CPT FV for future value. Obtain MIRR by inputting # of years = N, input cash outflow as PV (as negative value for outflow), PMT = 0, input FV from a above, then CPT i/y for MIRR.

9.

Solving for bond values. a. Input number of years as N. b. Input interest rate I/Y. c. Input coupon as PMT. d. Input $1,000 as FV. e. CPT PV for bond value. Solving for YTC or YTM. a. Input coupon as PMT. b. Input years until maturity or years to call as N, depending on whether you are calculating YTM or YTC.. c. Input FV of bond. d. Input PV of bond. e. CPT I/Y (note yield to call and yield to maturity are calculated in the same manner the only difference is that with YTC, the input values are based on the time until the bond can be called.)

10.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Velocity Analysis-Instantaneous Center MDocument7 pagesVelocity Analysis-Instantaneous Center MSuman_SamadderNo ratings yet

- Electronic - Banking and Customer Satisfaction in Greece - The Case of Piraeus BankDocument15 pagesElectronic - Banking and Customer Satisfaction in Greece - The Case of Piraeus BankImtiaz MasroorNo ratings yet

- Student Management SystemDocument5 pagesStudent Management SystemRamesh Kumar60% (5)

- Drive Shafts For Steel Production/ Industrial EquipmentDocument36 pagesDrive Shafts For Steel Production/ Industrial EquipmentEdna Odette Melo UscangaNo ratings yet

- Excel VBA To Interact With Other ApplicationsDocument7 pagesExcel VBA To Interact With Other ApplicationsgirirajNo ratings yet

- SLES Concentration Effect On The Rheolog TraducidoDocument22 pagesSLES Concentration Effect On The Rheolog TraducidoJose GamezNo ratings yet

- Scale Drawing and Scale Models RubricDocument1 pageScale Drawing and Scale Models RubricArgoNavisNo ratings yet

- Monsoon Booklet 19 FinalDocument64 pagesMonsoon Booklet 19 Finalsantosh kumarNo ratings yet

- Dam From: Safety Valve For A DamDocument28 pagesDam From: Safety Valve For A DamRashmi SahooNo ratings yet

- Warn 2013-2014 Application GuideDocument75 pagesWarn 2013-2014 Application Guideapi-238139220No ratings yet

- Project, Program and Portfolio SelectionDocument40 pagesProject, Program and Portfolio Selectionsaif ur rehman shahid hussain (aviator)No ratings yet

- Civl432 Bridge Design SummaryDocument5 pagesCivl432 Bridge Design SummarySheikh Mizanur RahmanNo ratings yet

- Expansion Test of ConcreteDocument18 pagesExpansion Test of ConcreteAshokNo ratings yet

- 6002 Notes 08 L1Document11 pages6002 Notes 08 L1Srinivasan RajenderanNo ratings yet

- Switchgear and Protection May 2022Document1 pageSwitchgear and Protection May 2022Sanapala RAJENDRA PRASADNo ratings yet

- Commissioning Example 797Document15 pagesCommissioning Example 797linkangjun0621No ratings yet

- Diego 1Document22 pagesDiego 1acs_spNo ratings yet

- TYBTech Syllabus MechanicalDocument49 pagesTYBTech Syllabus MechanicalswapnillkNo ratings yet

- The Effects of GeoGebra Software On Pre-Service Mathematics Teachers' Attitudes and Views Toward Proof and ProvingDocument22 pagesThe Effects of GeoGebra Software On Pre-Service Mathematics Teachers' Attitudes and Views Toward Proof and ProvingLidra Ety Syahfitri Harahap lidraety.2022No ratings yet

- Escape Velocity PDFDocument5 pagesEscape Velocity PDFRatriNo ratings yet

- Matrix Stiffness Method EnglishDocument14 pagesMatrix Stiffness Method Englishsteam2021No ratings yet

- Keystone Retaining WallsDocument98 pagesKeystone Retaining WallsWorld Outdoor Emporium100% (1)

- Software Development Kit 2.1 Programmer's Guide 2.1: Cell Broadband EngineDocument82 pagesSoftware Development Kit 2.1 Programmer's Guide 2.1: Cell Broadband EnginemathurvaibhavNo ratings yet

- Huaweigpon PDFDocument1 pageHuaweigpon PDFRobNo ratings yet

- 2003 - Serriano - Form Follows SoftwareDocument21 pages2003 - Serriano - Form Follows SoftwareMina Hazal TasciNo ratings yet

- Indian Pharmacopoeia 2020 - Vol. 1 (PART 1)Document255 pagesIndian Pharmacopoeia 2020 - Vol. 1 (PART 1)the reader100% (1)

- Thông Gió Cho T - Pdfslide - Net - Electrical-Cabinet-Vbcm-The-Electrical-Cabinet-Ventilation-Serves-To-MaintainDocument26 pagesThông Gió Cho T - Pdfslide - Net - Electrical-Cabinet-Vbcm-The-Electrical-Cabinet-Ventilation-Serves-To-MaintainThành PhạmNo ratings yet

- Statistics & Probability: Q4 - Learning Activity Sheet #1 Testing HypothesisDocument2 pagesStatistics & Probability: Q4 - Learning Activity Sheet #1 Testing HypothesisEeNihc DPNo ratings yet

- Juniper SRX Quickstart-12.1r3Document455 pagesJuniper SRX Quickstart-12.1r3Pichai Ng-arnpairojhNo ratings yet

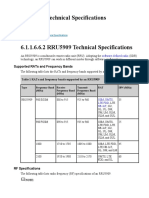

- RRU5909 Technical SpecificationsDocument7 pagesRRU5909 Technical SpecificationsDmitry059100% (1)