Professional Documents

Culture Documents

Rare Earth Elements Letter - INVESTMENT ALERT - August 2012

Uploaded by

Greenland Minerals and Energy LtdOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rare Earth Elements Letter - INVESTMENT ALERT - August 2012

Uploaded by

Greenland Minerals and Energy LtdCopyright:

Available Formats

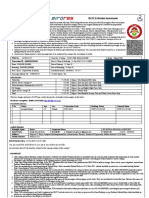

Rare Earth Elements Letter

I N T E R N A T I O N AL

the ind ep en den t info rma tion and ad vice bul letin for R are Ea rth E l em ents a nd rela t ed in ve st men ts

INVESTMENT ALERT August 2012

www.ggg.gl

Greenland Minerals and Energy Ltd. (A$ 0.39)

ASX OTC.US H+L prices (12 months) Net issued shares Fully diluted Market capitalization Next price target: A$ 1.50 : GGG : GDLNF : A$ 0.732 0.34 : 416.4 million : 440.6 million : A$ 160.3 million

INVESTMENT ALERT

Greenland Minerals and Energy (GMEL) finalises full ownership of Kvanefjeld Multi-Element Project

GMEL announced that it has finalised an agreement with Westrip Holdings (Westrip) and Rimbal Pty to complete the acquisition for the outstanding 39% of the exploration licence (EL 2010/02) that contains the Kvanefjeld, Srensen and Zone 3 deposits, with an equity-based transaction. In order to complete the transaction, GMEL was required under the original agreement (August 2011) to pay A$ 39 million in cash to Westrip/Rimbal, in addition to issuing 7,825,000 shares, and 5 million options exercised at A$ 1.50. Under the new equity-based terms, the cash component of the agreement can be finalised through the payment of A$ 5 million to Westrip/Rimbal, in addition to issuing 67 million ordinary shares in GMEL, priced at A$ 0.45 per share. The equity component of 7,825,000 shares from the original agreement remains, taking the total number of shares issued to complete the transaction to 74,825,000. The agreement is subject to shareholders approval with completion scheduled for 5 business days following approval.

Rare Earth Elements Letter International

Special Situation August 2012 Investment Alert

Post-finalization the shares issued in order to complete the acquisition of the outstanding 39% of the Companys core asset, the Kvanefjeld multi-element Project will represent 15.4% of the Companys issued capital (not inclusive of the required A$ 5 million cash payment). The board of GMEL believes that the terms outlined above represent a highly favorable outcome, and one that offers the least-dilutive path to finalizing the acquisition of the outstanding 39% of the Kvanefjeld Project. The equity terms agreed upon by all parties reflect continued advances in the Kvanefjeld Project including the introduction of a uranium-licencing framework for Kvanefjeld in late 2012, major resource expansions, and strong outcomes of the Kvanefjeld pre-feasibility study released in May 2012. GMEL is looking to make a decision on the preferred funding option to meet cash requirements in the coming weeks. The Company is well advanced in pursuing a number of options. The agreement outlined herein sees the cash required to complete the acquisition reduced from A$ 39 million to A$ 5 million; a position that places GMEL in a considerably stronger position. Importantly, the move to 100% ownership of the Kvanefjeld Project allows the Company to focus on structuring investment opportunities for potential strategic partners to participate in the development of the Project.

The Knavefjeld Project is the worlds largest undeveloped multi-element occurrence of uranium, REE and zinc. GMEL is featured as a Special Situation by REE Letter International (latest update June 2012). For further information visit: www.ggg.gl

Rare Earths Elements Letter, a publication by Goldletter International, incorporated in France Postal address: P.O. Box 76988, 1070 KG Amsterdam, the Netherlands Marino G. Pieterse, Publisher and Editor Information and investment comments are independently and thoroughly researched and believed correct. No guaranty of absolute accuracy can be given however Investment decisions are fully made for own risk tel.: +33-466-936-455 www.goldletterint.com e-mail: info@goldletterint.com

You might also like

- BPI Payment ProcedureDocument1 pageBPI Payment ProcedureConcepcion R. AquinoNo ratings yet

- Infrastructure and Gas MonetisationDocument22 pagesInfrastructure and Gas MonetisationRasholeenNo ratings yet

- Seymourpierceoilgasfebruary 2012Document158 pagesSeymourpierceoilgasfebruary 2012thanos_umNo ratings yet

- A Closer Look at Production and CashflowDocument0 pagesA Closer Look at Production and CashflowbzigNo ratings yet

- Swot Analysis of The Manufacturing and Service IndustryDocument15 pagesSwot Analysis of The Manufacturing and Service Industrypramita160775% (8)

- Oil companies and the energy transitionFrom EverandOil companies and the energy transitionNo ratings yet

- Golar FLNG PresentationDocument19 pagesGolar FLNG Presentationstavros7100% (1)

- #01 Accounting ProcessDocument3 pages#01 Accounting ProcessZaaavnn VannnnnNo ratings yet

- SCC Manual of Rules and RegulationsDocument67 pagesSCC Manual of Rules and RegulationsShy Ng100% (1)

- Schlumberger 2012 ArDocument100 pagesSchlumberger 2012 ArUma Maheshwaraa50% (2)

- LNG Industry March 2012Document100 pagesLNG Industry March 2012erojaszaNo ratings yet

- Ielts 15Document15 pagesIelts 15cherry tejaNo ratings yet

- FSRUDocument15 pagesFSRUMaria Khan100% (5)

- ONGC Annual Report 10-11 PDFDocument256 pagesONGC Annual Report 10-11 PDFRachit Kumar StudentNo ratings yet

- Kvanefjeld EIA Review-Revision Near CompletionDocument3 pagesKvanefjeld EIA Review-Revision Near CompletionTimBarrowsNo ratings yet

- Navigator 5Document11 pagesNavigator 5Westshore ShipbrokersNo ratings yet

- Mini-Gtl Technology Bulletin: Volume 6, September 2019Document12 pagesMini-Gtl Technology Bulletin: Volume 6, September 2019Madina AsanbaevaNo ratings yet

- Oil N Gas Sector 100304Document2 pagesOil N Gas Sector 100304Adrian LimNo ratings yet

- Press Release Note - Golar Cameroon FLNG ProjectDocument2 pagesPress Release Note - Golar Cameroon FLNG ProjectMahad AbdiNo ratings yet

- For Web FLEX LNG and InterOil Presentation at Seoul FLNG Conference 25 October 2011Document39 pagesFor Web FLEX LNG and InterOil Presentation at Seoul FLNG Conference 25 October 2011stavros7No ratings yet

- NSR288 20140827Document27 pagesNSR288 20140827srpadronNo ratings yet

- q1 2013 Media Presentation TranscriptDocument6 pagesq1 2013 Media Presentation TranscripthutuguoNo ratings yet

- Parkmead Group Online Annual Report 2013Document64 pagesParkmead Group Online Annual Report 2013jjones99040348No ratings yet

- AGC Business Plan FinalDocument130 pagesAGC Business Plan FinalMaria MariaaNo ratings yet

- Schlumberger PitchDocument1 pageSchlumberger PitchspalluvNo ratings yet

- 2014 11 06 Eg Mou Excelerate Amended FinalDocument2 pages2014 11 06 Eg Mou Excelerate Amended Finalgv360No ratings yet

- Golar Q4 2011 ReportDocument23 pagesGolar Q4 2011 Reportguzman87No ratings yet

- Floating LNG: Project Structures and Risk John D. White, Hannah LongleyDocument8 pagesFloating LNG: Project Structures and Risk John D. White, Hannah LongleyMarcelo Varejão CasarinNo ratings yet

- Keppel Investment ReportDocument30 pagesKeppel Investment ReportMarina100% (1)

- Annual Reports ONGC Annual Report 10-11Document256 pagesAnnual Reports ONGC Annual Report 10-11Amit VirmaniNo ratings yet

- 2013 NGC Annual ReportDocument162 pages2013 NGC Annual ReportCurtis DookieNo ratings yet

- BIMBSec - Oil Gas - 20120720 - Sector Update - Unleashing MoreDocument5 pagesBIMBSec - Oil Gas - 20120720 - Sector Update - Unleashing MoreBimb SecNo ratings yet

- 2018 Press ReleasesDocument96 pages2018 Press Releasesxtrooz abiNo ratings yet

- Cannacord - RKHDocument17 pagesCannacord - RKHShane ChambersNo ratings yet

- Oil Stocks - Galvan ResearchDocument3 pagesOil Stocks - Galvan ResearchCraig WilsonNo ratings yet

- NovaGold Q2 CNE CallDocument7 pagesNovaGold Q2 CNE CallRKT SOLUTION TP Help DeskNo ratings yet

- Afren 1H13Document37 pagesAfren 1H13mikejimmy111No ratings yet

- Argus Global LNG APRIL 07Document32 pagesArgus Global LNG APRIL 07tausif79No ratings yet

- RIL Motilal 220612Document10 pagesRIL Motilal 220612JK RastogiNo ratings yet

- Petrojack ASA Initial Public OfferingDocument38 pagesPetrojack ASA Initial Public Offeringshenaz10No ratings yet

- PHP MPPD ObDocument5 pagesPHP MPPD Obfred607No ratings yet

- Mena-2 Monday Morning Round-Up: EgyptDocument3 pagesMena-2 Monday Morning Round-Up: Egyptapi-66021378No ratings yet

- AcadianEnergyInc2012 03 01Document3 pagesAcadianEnergyInc2012 03 01likeme_arpit09No ratings yet

- Spe 128342 MSDocument23 pagesSpe 128342 MSOlimene BabatundeNo ratings yet

- Riviera - News Content Hub - First US Floating LNG Export Facility Clears EngineDocument5 pagesRiviera - News Content Hub - First US Floating LNG Export Facility Clears EngineTee Shi FengNo ratings yet

- Coterra ThesisDocument5 pagesCoterra ThesisNguyễn Khánh Tùng K58No ratings yet

- Focus ON Powder Coatings: LegislationDocument1 pageFocus ON Powder Coatings: Legislation3056vivekNo ratings yet

- TAG News Release 11-15-11Document4 pagesTAG News Release 11-15-11mpgervetNo ratings yet

- Ras GasDocument17 pagesRas GasOm PrakashNo ratings yet

- OSH Quarterly Report To 30 June 2015Document15 pagesOSH Quarterly Report To 30 June 2015stavros7No ratings yet

- Issue 2-2018 PDFDocument28 pagesIssue 2-2018 PDFBruno SilvaNo ratings yet

- GLOBALATOMIC SPU Oct2019Document8 pagesGLOBALATOMIC SPU Oct2019mushava nyokaNo ratings yet

- Petronet LNG - A Recovery in KochiDocument6 pagesPetronet LNG - A Recovery in KochiPunit JainNo ratings yet

- SoundEnergyplc ResearchUpdate 23april2020 FINAL BGDocument3 pagesSoundEnergyplc ResearchUpdate 23april2020 FINAL BGJohn SmithNo ratings yet

- 1st QTR 2015 MPCLDocument33 pages1st QTR 2015 MPCLmhuf89No ratings yet

- BIMBSec - Company Update - Wah SeongDocument4 pagesBIMBSec - Company Update - Wah SeongBimb SecNo ratings yet

- Greenspring Fund: Greenspring Fund Performance For The Periods Ended December 31, 2014Document6 pagesGreenspring Fund: Greenspring Fund Performance For The Periods Ended December 31, 2014Anonymous Feglbx5No ratings yet

- Navigator 6Document8 pagesNavigator 6Westshore ShipbrokersNo ratings yet

- Punj report12111PDFDocument14 pagesPunj report12111PDFGaurav SomaniNo ratings yet

- PFS-15 11 2019-1Document82 pagesPFS-15 11 2019-1Energiebleu ProjectsNo ratings yet

- Cygnus Energy LNG News Weekly 21th May 2021Document11 pagesCygnus Energy LNG News Weekly 21th May 2021Sandesh Tukaram GhandatNo ratings yet

- Woodlark Gold Project Execution UpdateDocument21 pagesWoodlark Gold Project Execution UpdateArdita S IrwanNo ratings yet

- Coastal - Stock ReportDocument7 pagesCoastal - Stock ReportGabriel NgNo ratings yet

- On May 31 2015 Reber Company Had A Cash BalanceDocument1 pageOn May 31 2015 Reber Company Had A Cash BalanceAmit PandeyNo ratings yet

- Balance of Payment 20Document79 pagesBalance of Payment 20Anshul SinhaNo ratings yet

- Hindu Marriage Registration-User Manual For Online Citizen - Ver 1.0Document10 pagesHindu Marriage Registration-User Manual For Online Citizen - Ver 1.0Pudeti RaghusreenivasNo ratings yet

- Office of The PO Cum DWO, PURULIA District: Government of West BengalDocument3 pagesOffice of The PO Cum DWO, PURULIA District: Government of West BengalJharna RoyNo ratings yet

- Updated KYCDocument3 pagesUpdated KYCSarvar PathanNo ratings yet

- Tiếng Anh PtDocument19 pagesTiếng Anh Ptbechipp2002No ratings yet

- Case DigestDocument4 pagesCase DigestJohn Robert BautistaNo ratings yet

- Stockbridge Company (Billing and Cash Receipts) Solutions (See Note On Pg. 11-4) P11-1 ANS. A. Table of Entities and Activities For Stockbridge Company (Billing and Cash Receipts)Document33 pagesStockbridge Company (Billing and Cash Receipts) Solutions (See Note On Pg. 11-4) P11-1 ANS. A. Table of Entities and Activities For Stockbridge Company (Billing and Cash Receipts)NuriAisyahHikmahNo ratings yet

- GFC2007Document15 pagesGFC2007Nur Hidayah JalilNo ratings yet

- TifrDocument3 pagesTifrgrasheedNo ratings yet

- Economy Questions in UPSC Prelims (2022-2011)Document42 pagesEconomy Questions in UPSC Prelims (2022-2011)annu14307No ratings yet

- Indicative Profit Rates: Savings Accounts Term DepositsDocument1 pageIndicative Profit Rates: Savings Accounts Term DepositsHammad HaseebNo ratings yet

- Cerulli Asset Management in Southeast Asia 2012 Info PacketDocument13 pagesCerulli Asset Management in Southeast Asia 2012 Info PacketHaMy TranNo ratings yet

- Ok, Paper by RISIDocument30 pagesOk, Paper by RISILavneesh VarshneyNo ratings yet

- CV - Ca. Vaibhav GattaniDocument2 pagesCV - Ca. Vaibhav GattaniCA Vaibhav GattaniNo ratings yet

- Recruitment of Officers and Executives in Cent Bank Home Finance Limited - 2015-16Document10 pagesRecruitment of Officers and Executives in Cent Bank Home Finance Limited - 2015-16JeshiNo ratings yet

- Fee Information DocumentDocument2 pagesFee Information DocumentJaviMartínezNo ratings yet

- Simple Interest (Future Value)Document21 pagesSimple Interest (Future Value)アンジェロドンNo ratings yet

- Banking Careers Guide 09 2022Document117 pagesBanking Careers Guide 09 2022李深淼No ratings yet

- Statement of Fees 04 May 2023Document4 pagesStatement of Fees 04 May 2023wendyclaridg75No ratings yet

- Books of Himanshu JournalDocument4 pagesBooks of Himanshu Journalrakesh19865No ratings yet

- Rail Ticket 12 M WouDocument2 pagesRail Ticket 12 M WouTiyyagura RoofusreddyNo ratings yet

- Chap 004Document15 pagesChap 004Student 235No ratings yet

- Future Value ProblemsDocument2 pagesFuture Value Problemsrohitrgt4uNo ratings yet