Professional Documents

Culture Documents

Analysis of Cost Estimation

Uploaded by

ccsreddyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis of Cost Estimation

Uploaded by

ccsreddyCopyright:

Available Formats

Capital

source

and sink

V, manufacturing

fixed capital

investment for

project

A

x

, non-

manufacturing

fixed capital

investment for

project

W, working capital

investment for

project

Operations for

complete project

Loans

Preferred stock Bonds

Common stock

Other capital input

Stockholders

dividends

Repayment of

borrowed capital

Other

investments

T

o

t

a

l

c

a

p

i

t

a

l

i

n

v

e

s

t

m

e

n

t

(

w

i

t

h

o

u

t

l

a

n

d

)

C

oj

Costs for

operations (not

including

depreciation)

s

j

Total income from

sales $

s

j

-c

oj

Gross profit

(before depreciation

charge)

Total capital

Investment

(without

land),

T=W+A

x

+V

(s

j

c

oj

d

j

)(1-) Net profit after taxes

d

j

Depreciation charge

(s

j

c

oj

d

j

)(1-) Gross profit

(s

j

c

oj

d

j

) Income taxes

( is generally 35% of gross profit)

A

j

Net cash flow from

the project including

depreciation charge

A

j

= (s

j

c

oj

d

j

)(1-) + d

j

=(s

j

c

oj

)(1-) + d

j

Capital

source

and sink

V, manufacturing

fixed capital

investment for

project

A

x

, non-

manufacturing

fixed capital

investment for

project

W, working capital

investment for

project

Operations for

complete project

Operations for

complete project

Loans

Preferred stock Bonds

Common stock

Other capital input

Stockholders

dividends

Repayment of

borrowed capital

Other

investments

T

o

t

a

l

c

a

p

i

t

a

l

i

n

v

e

s

t

m

e

n

t

(

w

i

t

h

o

u

t

l

a

n

d

)

C

oj

Costs for

operations (not

including

depreciation)

s

j

Total income from

sales $

s

j

-c

oj

Gross profit

(before depreciation

charge)

Total capital

Investment

(without

land),

T=W+A

x

+V

(s

j

c

oj

d

j

)(1-) Net profit after taxes

d

j

Depreciation charge

(s

j

c

oj

d

j

)(1-) Gross profit

(s

j

c

oj

d

j

) Income taxes

( is generally 35% of gross profit)

A

j

Net cash flow from

the project including

depreciation charge

A

j

= (s

j

c

oj

d

j

)(1-) + d

j

=(s

j

c

oj

)(1-) + d

j

Analysis of Cost

Estimation

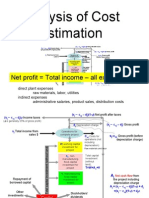

Net profit = Total income all expenses

direct plant expenses

raw materials, labor, utilities

indirect expenses

administrative salaries, product sales, distribution costs

Capital

source

and sink

Operations for

complete project

Loans

Preferred stock Bonds

Common stock

Other capital input

Stockholders

dividends

Repayment of

borrowed capital

Other

investments

T

o

t

a

l

c

a

p

i

t

a

l

i

n

v

e

s

t

m

e

n

t

(

w

i

t

h

o

u

t

l

a

n

d

)

s

j

Total income from

sales $

s

j

-c

oj

Gross profit (before

depreciation charge)

V, manufacturing

fixed capital

investment for

project

A

x

, non-

manufacturing

fixed capital

investment for

project

W, working capital

investment for

project

C

oj

Costs for

operations (not

including

depreciation)

Total capital

Investment

(without

land),

T=W+A

x

+V

(s

j

c

oj

d

j

)(1-) Net profit after taxes

d

j

Depreciation charge

(s

j

c

oj

d

j

) Gross profit

(s

j

c

oj

d

j

) Income taxes

( is generally 35% of gross profit)

A

j

Net cash flow from

the project including

depreciation charge

A

j

= (s

j

c

oj

d

j

)(1-) + d

j

=(s

j

c

oj

)(1-) + d

j

Cash flow for industrial operations

Raw materials and labor

Estimation of

Capital

Investment

V, manufacturing

fixed capital

investment for

project

A

x

, non-

manufacturing

fixed capital

investment for

project

W, working

capital investment

for project

Total capital

Investment

(without land)

T = W + A

x

+ V

T

o

t

a

l

c

a

p

i

t

a

l

i

n

v

e

s

t

m

e

n

t

(

w

i

t

h

o

u

t

l

a

n

d

)

Total capital investment (without land)

Fixed capital

Investment A

x

+ V

Some of the capital investment

can occur as a lump sum.

The flow of cash for the fixed

capital investment is usually

spread over the entire

construction period.

Because income from sales

and cost of operations may

occur on an irregular time

basis, a reservoir of working

capital must be available to

meet these requirements.

Cumulative cash position effects of cash flow over full life cycle of

industrial operation (time value of money was neglected)

Here the total capital investment is repaid in 5 years

Factors Affecting Investment and

Production Costs

The engineer must be aware of actual prices for raw materials and

equipment, company policies, government regulations and others

Sources of Equipment

Price fluctuations

Company policies

Operating time and rate of production

Government policies

Must keep up to date with

prices and wage fluctuations:

Monthly Labor Review (US

Bureaus of Labor Statistics)

Major effect on the

profits!

Direct effect!

Occupational Employment and Wage Estimates:

http://www.bls.gov/oes/oes_data.htm

e.g., Raleigh Durham area:

http://www.bls.gov/oes/current/oes_6640.htm

If equipment stands idle for an extended period,

raw materials and labor costs are usually low;

HOWEVER, many other costs (fixed costs) like

maintenance, protection, depreciation, continue

even though the equipment is not active.

Not producing a product no producing revenue

Downtime should be kept to a necessary

minimum (main source of poor profitability in

process plants).

Maximum

gross earnings

T

o

t

a

l

p

r

o

d

u

c

t

c

o

s

t

T

o

t

a

l

I

n

c

o

m

e

(

a

l

l

p

r

o

d

u

c

t

s

)

Fixed Costs

Breakeven

point

Gross earnings

Loss

Breakeven chart for chemical processing plant

Rate of Production, Kg/s

D

o

l

l

a

r

s

$

0 0.05 0.1 0.15 0.2

0.005

0.010

0.015

0.020

0.025

0

Government Policies

Law and regulations that have a direct effct

on industrial costs

Export tariff regulations

Depreciation taxes

Income tax rules

Environmental and safety regulations

See also http://www.itepnet.org/corp00an.pdf

V, manufacturing

fixed capital

investment for

project

A

x

, non-

manufacturing

fixed capital

investment for

project

W, working

capital investment

for project

Total capital

Investment

(without land)

T = W + A

x

+ V

T

o

t

a

l

c

a

p

i

t

a

l

i

n

v

e

s

t

m

e

n

t

(

w

i

t

h

o

u

t

l

a

n

d

)

Total Capital Investment (without land)

Fixed capital

Investment A

x

+ V

Capital: a stock of

accumulated

wealth Capital is

savings that may

be used. Used for

example in

investment to

promote the

production of other

goods

V, manufacturing

fixed capital

investment for

project

A

x

, non-

manufacturing

fixed capital

investment for

project

W, working

capital investment

for project

Total

capital

Investment

(TCI)

(without land)

T = W + A

x

+ V

T

o

t

a

l

c

a

p

i

t

a

l

i

n

v

e

s

t

m

e

n

t

(

w

i

t

h

o

u

t

l

a

n

d

)

Fixed capital

Investment

A

x

+ V

Working capital (WC): The capital

necessary for the operation of the

plant

Fixed-capital Investment (FCI): The

capital needed to supply the

required manufacturing and plant

facilities

Direct cost

Indirect cost

(WC/TCI) = varies with different companies

Most chemical plants used 10-20% (it may

increase to as much as 50% for companies

producing products of seasonal demand)

V, manufacturing

fixed capital

investment for

project

A

x

, non-

manufacturing

fixed capital

investment for

project

W, working

capital investment

for project

T

o

t

a

l

c

a

p

i

t

a

l

i

n

v

e

s

t

m

e

n

t

(

w

i

t

h

o

u

t

l

a

n

d

)

Fixed Capital Investment (FCI)

Fixed capital

Investment

A

x

+ V

Direct Costs: Capital necessary for the

installed process equipment with all

components that are needed for

complete process operation and also:

Site preparation

Piping

Instruments

Insulation

Foundations

Auxiliary facilities

Indirect cost: Construction overhead

(field office, supervision expenses,

contractors fees, etc) and for all plant

components that are not directly related

to the process operation:

Processing building

Administrative and other offices

Warehouses

Laboratories

Shops

V, manufacturing

fixed capital

investment for

project

A

x

, non-

manufacturing

fixed capital

investment for

project

W, working

capital investment

for project

Total capital

Investment

(without land)

T = W + A

x

+ V

T

o

t

a

l

c

a

p

i

t

a

l

i

n

v

e

s

t

m

e

n

t

(

w

i

t

h

o

u

t

l

a

n

d

)

Fixed capital

Investment

A

x

+ V

Total amount of money invested in:

1. Raw materials and supplies

carried in stock (*)

2. Finished products in stock

3. Semi-finished products being

manufactured

4. Accounts receivable

5. Cash kept on hand for monthly

payment of operating expenses

(salaries, wages and raw

materials purchases)

6. Accounts payable

7. Taxes payable

Working Capital (WC)

(*) Usually 1-month supplies valued at delivery prices

Types of Capital Cost Estimates

1. Order-of-magnitude estimate (ratio estimate) based on similar

previous cost data (+/- 30%)

2. Study estimate (factored estimate) based on knowledge of major

items of equipment (+/- 30%)

3. Preliminary estimate (budget authorization estimate or scope

estimate) based on sufficient data to permit the estimate to be

budgeted (+/- 20%)

4. Definitive estimate (project control estimate) based on almost

complete data but before completion of drawing and

specifications (+/- 10%)

5. Detailed estimate (contractors estimate) based on complete

engineering drawings, specifications and site surveys (+/- 5%)

Cost Indexes

An index value for a given time showing the cost

at that time relative to a certain base time.

obtained was cost original time at value index

time present at value index

cost original cost Present =

Ok if less than 10 years

We can project costs forward by using extrapolated values of

an index or an expected inflation rate.

Most common indexes:

Marshall and Swift all-industry

Process-industry equipment indexes

Engineering News-record construction index

Nelson-Farrar refinery construction index

Chemical Engineering plant cost index

Cost Indices

Marshall & Swift Equipment Cost Indexes

all-industry equipment index - arithmetic average of indexes for

47 different types of industrial, commercial, and housing

equipment

based on an index value of 100 for the year 1926

account for cost of machinery and major equipment plus costs

for installation, fixtures, tools, office, and minor equipment

Engineering News-Record Construction Cost Index

indicates variance in labor rates and materials costs for industrial

construction

one of three basis used: 100 for 1913, 1949 or 1967

Nelson-Farrar Refinery Construction Cost Index

petroleum industry construction costs

basis - 100 for 1946

Cost Indices

Chem. Engr. Plant Cost Index (CEPCI)

construction costs for chemical plants

equipment, machinery and supports, 61%;

erection and installation labor, 22%; buildings,

materials, and labor, 7%; engineering and

supervision, 10%

major components subdivided as: fabricated

equipment, 37%; process machinery, 14%; pipe,

valves, and fittings, 20%; process instruments

and controls, 7%; pumps and compressors, 7%;

electrical equipment and materials, 5%;

structural supports, insulation and paint, 10%

basis - 100 for 1957-1959

Cost Indices

Chem. Engr. Plant Cost Index (CEPCI)

CAPCOST

CAPCOST is a Microsoft Excel

program for estimating bare module, total

module, and grass roots costs of complex

chemical plants.

CHEMICAL ENGINEERING WWW.CHE.COM JANUARY 2006

CHEMICAL ENGINEERING

CHEMICAL ENGINEERING WWW.CHE.COM JANUARY 2006

Chemical Engineering Plant Cost Index from 1950 to 2005

y = 2E-07x

6

- 0.0028x

5

+ 13.738x

4

- 35882x

3

+ 5E+07x

2

- 4E+10x + 1E+13

R

2

= 0.9933

0

50

100

150

200

250

300

350

400

450

500

1940 1950 1960 1970 1980 1990 2000 2010

468.2 2005

444.2 2004

401.7 2003

395.6 2002

394.3 2001

394.1 2000

390.6 1999

389.5 1998

386.5 1997

381.7 1996

381.1 1995

368.1 1994

359.2 1993

358.2 1992

361.3 1991

357.6 1990

355.4 1989

342.5 1988

323.8 1987

318.4 1986

325.3 1985

322.7 1984

316.9 1983

314 1982

297 1981

261.2 1980

CEI YEAR

Update

Aug 2006 Final - CHEMICAL

ENGINEERING PLANT COST

INDEX

351.9 Engineering & Supervision

475.2 Buildings

312.9 Construction Labour

637.7 Structural Supports & Misc.

414.2 Electrical Equipment

788.3 Pumps and Compressors

437.2 Process Instruments

731.7 Pipe, valves and fittings

556.2 Process Machinery

560.9 Heat Exchangers and Tanks

602.3 Equipment

Detailed breakdown for Aug 2006 (final)

CEPCI 510 Aug 2006

Other cost indexes for materials and labors for various

types of industries are published monthly by the US

Bureau of Labor Statistics in the Monthly Labor

Review

http://www.bls.gov/opub/mlr/mlrhome.htm

Current Labor Statistics

"Current Labor Statistics" from the print edition of Monthly Labor Review

Pre-formatted data tables

BLS data for use in databases and spreadsheets

"Current Labor Statistics" from the print edition of Monthly Labor Review

The print edition of Monthly Labor Review regularly features 56 tables of current labor statistics. These tables can be downloaded and printed for reference. (PDF

624K).

--------------------------------------------------------------------------------

Employment and Unemployment Tables

Historical Data for the "A" Tables of the Employment Situation Release (Household/CPS data)

Historical Data for the "B" Tables of the Employment Situation Release (Establishment/CES data)

Tables from Employment and Earnings (Household/CPS data)

Annual average data

Monthly data

Quarterly data

Tables from Employment and Earnings (Establishment/CES data)

Monthly data

Occupational Employment and Wage Data

Employment Projections Tables

http://www.bls.gov/opub/mlr/mlrhome.htm

Occupational

Labor force (demographic)

Education and training

Earnings, occupations

Prices and Living Conditions Tables

Consumer Price Index for All Urban Consumers (CPI-U), All Items, Indexes and Annual Percent Changes from 1913 to the present

International Price IndexesHistorical Tables

Consumer Expenditure Survey data

Standard Bulletin (e.g. Age of reference person, Income before taxes)

Cross-tabulated Bulletin (e.g. Age of reference person by income before taxes)

Metropolitan Statistical Areas (MSAs)

All Consumer Units

Compensation and Working Conditions Tables

Employment Cost Index, Historical Listing (TXT) (PDF 500K)

National Compensation Surveys

Productivity Tables

Industry Labor Productivity Data Tables

Industry Multifactor Productivity Data Tables

Foreign Labor Statistics Tables

International Comparisons of Foreign Labor Statistics

International Price IndexesHistorical Tables

Cost Index and Depreciation Schedules

http://www.dor.state.nc.us/publications/cost_archive/99archive/costindex.html

Cost Components in Capital Investment

Capital investment is the total amount of money needed to supply the

necessary plant and manufacturing facilities plus the amount of money

required as working capital for operation of the facilities.

Example 6-1: Make a study estimate of the fixed-capital investment for a process

plant if the purchased-equipment cost is $100,000. Use the ranges of process-plant

component cost (Table 6-3) for a process plant handling both solids and fluids with

a high degree of automatic controls and essential outdoor operation. Do not include

land.

Sizes and specifications determined

from equipment parameters fixed or

calculated along with the material

and energy balances

Purchased Equipment

The cost of purchased equipment is the basis of several predesign methods for

estimating capital investment.

Equipment:

1. Processing equipment

2. Raw materials handling and storage equipment

3. Finished-products handling and storage equipment.

Most accurate method: obtain firm bids from fabricators and suppliers.

Second best: cost values from the file of past purchase orders (must be

corrected with the appropriate cost index ratio)

Estimating Equipment Cost by Scaling

Predictions can be made using the six-tenths factor rule

b equipment of Capacity

a equipment of Capacity

b equipment of Cost a equipment of Cost

=

=

X

X

.6 0

Use only in the

absence of other

information. Do

not use beyond

10-fold range of

capacity

Purchased-equipment prices are usually quoted as f.o.b. (free on

board, meaning that the purchaser pays the freight).

Pre-design estimates od delivery allowance: 10% of the purchased-

equipment cost is recommended

f.o.b. prices!

Check Example

The six-tenths factor rule

Typical exponents in the six-tenths factor rule

Purchased-Equipment Installation (25-55%!!!)

Involves costs for labor, foundations, supports, platforms, construction

expenses, etc.

There is wide variations of installation labor cost depending on equipment size.

Instrumentation and Controls

8-50 % of the total delivered cost (taking 26%, this is about 5% of the

total capital investment).

Piping

Includes labor, valves, fitting, pipe, support, etc.

Can run as high as 80% of the total delivered cost (about 20 % of the

total fixed capital investment).

Electrical Systems

15-30% of the delivered purchased equipment cost (4-8 % of fixed capital investment)

Buildings

Buildings

Including services, consist of labor, materials and supplies. Plumbing, heating,

ventilation are included.

Yard Improvements

Fencing, grading, roads, sidewalks, railroad sidings, landscaping: 10-20% of

the delivered purchased equipment cost (2-5 % of fixed capital investment)

Service Facilities

Utilities for supplying steam, water, power, compressed air and fuel. Also

includes shop, first aid, cafeteria...30-80% of the delivered purchased

equipment cost (55% on average for plant handling solid/liquids). This is

equivalent to 8-20 % - 14% avg - of fixed capital investment)

Health, Safety, and environmental Functions

See previous table. This is an increasingly important issue. Pollution

mitigation is sometimes the driving force for new process development

Land

Cost factor per acre as high as 30-50% between a rural district and highly

industrialized area. Average land cost for industrial plants amount to 4-8%

of the delivered purchased equipment cost (1-2 % of fixed capital

investment)

By law, land cost cannot be depreciated not included in the fixed-capital

investment.

Engineering and Supervision

Considered as an indirect capital; cost investment approx. 30% of the

delivered purchased equipment cost (8 % of fixed capital investment)

Legal Expenses

1-3 % of fixed capital investment

Construction expenses

Indirect cost associated to temporary construction, and operation,

construction tools and rentals, home office personnel, construction payroll,

travel and living, taxes and insurance, and other construction overhead.

8-10 % of fixed capital investment.

Contractors Fee

2-8% of direct plant cost or 1.5-6% of fixed capital investment

Contingencies

Unexpected events and changes (storms, floods, strikes, etc.)

5-15 % of fixed capital investment (8 % average)

Methods for Estimating Capital Investment

A: Detailed-Item Estimate

B: Unit Cost Estimate

C: Percentage of Delivered-Equipment Cost

D: Lang Factors for Approximation of Capital Investment

E: Power factor Applied to Plant/Capacity ratio

F: Investment cost per unit capacity

G: Turnover ratio

Less detailed information required!

Less preparation time!

Degree of accuracy decreases!

Methods for Estimating Capital Investment

A: Detailed-Item Estimate

Accuracy of +/- 5%

Methods for Estimating Capital Investment

B: Unit Cost Estimate

For preparing definitive and preliminary estimates, requires detailed

estimates of purchased price (quotation or index-corrected costs and

published data)

10-20% accuracy

( )

F

f

n

d

d

f

e

H

e

f

L

M

y

f

x

M

x

f

L

E E

n

C

(

+ +

|

.

|

\

|

+ + + =

'

new

capital

investment

delivered

purchased-

equipment

cost

delivered-

equipment

labor cost

specific

material

unit cost

specific

material

quantity

specific

material

labor unit

cost per

employee-

hours

labor

employee-

hour for the

specific

material

unit cost for

engineering

Engineering

employee-

hour

unit cost for

drawings or

specifications

number of

drawings or

specifications

Construction /

field expense

factor (>1)

Methods for Estimating Capital Investment

C: Percentage of Delivered-Equipment Cost

Requires determination of delivered equipment cost

20-30% accuracy

see next table and textbook spreadsheet

|

.

|

\

|

+ + + + + =

|

.

|

\

|

+ + + + + =

n n

f f f f E E f E f E f E f E

n

C ... ...

3 2 1 3 2 1

1

E is the delivered purchased-equipment cost

f

i

are multiplying factors for piping, electrical, indirect costs, etc. (average %

values presented in next table)

Percentage of Delivered-Equipment Cost (contd)

Check Example

Percentage of Delivered-Equipment Cost (contd)

9. A second evaluation sheet, 'Year-0 $', also is included. It is the same as sheet 'Evaluation', except that all the inflated $

values are converted to constant, year-0 dollars (as discussed in the text). This method is considered to reflect more

realistically the effect of inflation on the profitability measures. The user may change the default inflation rates in order to

study their impacts on profitability.

8. The sheet 'Evaluation' uses values from other sheets to calculate the common profitability measures. The user may

change defaults, or enter desired values into the sheet. In particular, the user may change the default inflation rates in order

to study their effects on profitability. All calculations in 'Evaluation' are made in current (i.e. inflated) dollars. Inflation

adjustments are made from the time of the estimates. To make evaluations for periods of less than 10 years, leave

unneeded columns blank. For periods greater than 10 years, insert columns as needed and copy from an existing year

column into the new columns. Check equations for correct cell references.

7. On the 'Annual TPC' sheet, all values are calculated from information available on other sheets. The user may change

defaults or enter preferred values. The calculated annual TPC is transferred to 'Evaluation'.

6. The 'Depreciation' sheet is used only if the user wishes to change the default (5-year MACRS) depreciation method. To

make a change, copy the appropriate MACRS row to the 'Annual depreciation" row of sheets 'Evaluation' and 'Year-0 $', or,

enter constant annual (straight line) value into depreciation row of those sheets.

5. On the sheet 'Utilities' the quantity of each utility needed annually must be entered in appropriate units. The total annual

utilities cost is transferred to sheet 'Annual TPC'.

4. On the sheet 'Materials & Labor' enter the product prices and flowrates, the raw materials prices and flow rates, and the

labor requirements and current ENR labor index.

3. On the sheet 'Capital Inv.' enter the estimated current total purchased cost of the process equipment. For the proposed

plant type, copy the corresponding "Fraction of calculates and transfers results to appropriate subsequent sheets.

2. Purchased Equipment Costs may be obtained from the file "Equipment Costs, the graphs in the text, or otherwise, and

entered manually into cell H12 on the Capital Inv.' spreadsheet.

1. The sheets are intended for use in the sequence presented. However, any sheet may be by-passed so long as the

information skipped is input manually where needed in subsequent sheets. Default values may be replaced by the user.

The basis for all costs is Jan. 2002.

Cost & Evaluation Workbook accompanying Plant Design and Economics for

Chemical Engineers, 5th edition

Methods for Estimating Capital Investment

D: Lang Factors for Approximation of

Capital Investment

To obtain order-of-magnitude estimates.

Obtained by multiplying the equipment cost by some factor to

approximate the fixed or total capital investment.

D: Lang Factors for Approximation of Capital Investment (contd)

Greater accuracy if a number of factors are used:

(

+ +

|

.

|

\

|

+ + + = A E

m

f

p

f f E f

n

C

i

F

I

1

'

( )

|

|

.

|

\

|

+

|

|

.

|

\

|

=

' '

'

. . . log . . log

E

f

E

e

E f

v

F

506 0 992 0 001 0 154 0 635 0

( )

|

|

.

|

\

|

+

|

|

.

|

\

|

=

' '

'

. . . log . . log

E

p

E

e

E f

p

556 0 156 0 001 0 014 0 266 0

The three installation costs defined as follows:

( )

|

|

.

|

\

|

+ + =

'

'

. . log . . log

E

t

E f

m

194 1 001 0 033 0 344 0

E is the purchased equipment on an f.o.b basis, f

I

is the indirect cost factor (1.4), f

F

is the

cost factor for field labor, f

p

the cost factor for piping materials, f

m

the cost factor for

misellaneous items, E

i

the cost of equipment already installed, A the incremental cost of

corrosion-resistant alloy materials, e the total heat exchanger cost, f

v

the total cost of field-

fabricatd vessels, p the total pump plus driver cost and t the total cost of tower shells.

Methods for Estimating Capital Investment

E: Power factor Applied to

Plant/Capacity ratio

To obtain order-of-magnitude estimates.

Obtained by relating the fixed-capital investment of a new process plant

(C

n

) to the fixed-capital investment of similar previously constructed

plants (C) by an exponential power ratio (x):

x

e n

R f C C =

f

e

is the cost index at the time of cost C

n

to that at the time of C.

( ) I DR f C

x

n

+ =

Closer approximation:

f is a lumped cost index factor relative to the original facility cost,

D is the direct cost for previously installed facility

I is the indirect cost for previously installed facility

f is the product of a geographic labor cost index, area labor productivity

index, and a material and equipment cost index:

Check Example (2)

Methods for Estimating Capital Investment

F: Investment cost per unit capacity

Methods for Estimating Capital Investment

G: Turnover ratio

Turnover ratios range from 0.2 to 4 (rule of

thumb for chemical industry: turnover ratio =1)

The reciprocal of this ratio is the so-called

capital ratio or the investment ratio.

investment capital - fixed

sales annual Gross

ratio Turnover =

Instructions for file EQUIPMENT COSTS accompanying Plant Design and Economics for Chemical Engineers, 5th

edition, Peters, Timmerhaus, and West

1. The opening sheet of the file EQUIPMENT COSTS is called CALCULATION PAGE. The column at the left lists equipment

types alphabetically. The names used are the same as those on the cost figures in the text. CLICK a name to SELECT an

EQUIPMENT TYPE. This brings up a panel in the upper right of the screen.

2. The upper right panel shows the text Figure # and title for the source of the cost data plus additional equipment

specifications as needed. CLICK to SELECT the APPROPRIATE LINE. This brings up a panel on the lower right.

3. In the lower right panel input REQUIRED DESIGN PARAMETERS, as requested. An equipment number is requested, and

must be supplied by the user in order for results to be transferred to the EQUIPMENT LIST. CLICK appropriate RADIO

BUTTONS, if shown, to select discreet parameters, such as operating pressure and material of construction. When entries are

complete, CLICK on CALCULATE. All calculated values are purchased costs unless otherwise noted.

4. The lower right panel shows the calculated cost of the item in $. "Add value" TRANSFERS the equipment information to the

EQUIPMENT LIST. "Display Results" shows the EQUIPMENT LIST, and "Clear Results" deletes all EQUIPMENT LIST

entries. The use of the button "Display CSV" is described below.

5. Upon clicking "Display Results," the user will be asked for a date, and then for the value of the Chemical Engineering (CE)

Plant Cost Index. The default values are Jan. 2002 and CE index = 390.4 (the basis for the calculated costs). Any appropriate

date may be entered; the CE index entered should correspond to that date; the index must be extrapolated for dates beyond

the most recently available value. Costs shown on the EQUIPMENT LIST are updated with the index provided. Only one date

and CE index may be used per session (the latest entered is applied to all costs).

6. At the top of the EQUIPMENT LIST, the user may enter project identification information. In the last column on the right of

the EQUIPMENT LIST, the user may insert additional information about the equipment, such as a dimension or design

pressure.

7. Return to the CALCULATION PAGE and continue, by repeating the foregoing steps, adding equipment until project costing

is complete.

8. The EQUIPMENT LIST can be PRINTed. WARNING: EQUIPMENT LIST is not saved when the EQUIPMENT COST file is

closed.

9. The EQUIPMENT LIST can be transferred to a spreadsheet as follows:

a. Open a notepad.

b. Click "Display CSV." Copy the resulting page and paste it in the notepad.

c. Save the notepad file with a '.csv' extension (without quotes) to a convenient location.

d. Open a spreadsheet application. The following instructions are for Excel.

e. Click 'Data' -> 'Get External Data -> 'Import Text File.'

f. Find and select the .csv file saved in step c. Make sure that you see all file types if it doesn't show up.

g. Follow the instructions of the wizard. In step 2, check 'Other' and insert '#' (without quotes) into the box next to Other.

10. To continue with an economic analysis, the total Purchased Equipment Cost may be manually entered into cell H12 on the

"Capital Inv." spreadsheet, or copied from the spreadsheet made in step 9.

You might also like

- Cost Estimation 001 L6toL12Document103 pagesCost Estimation 001 L6toL12Manish Bisht100% (1)

- AACEI Houston Jan 2008Document84 pagesAACEI Houston Jan 2008klibiNo ratings yet

- Process Equipment Cost Estimation GuidelinesDocument80 pagesProcess Equipment Cost Estimation Guidelineswriteandrewpaul7707100% (1)

- ChE 141 Lecture 9 - Estimation of Capital and Operating Costs Part 1 - Sept2019Document93 pagesChE 141 Lecture 9 - Estimation of Capital and Operating Costs Part 1 - Sept2019Ysabela Angela Flores0% (1)

- Best Practices in Cost EngineeringDocument9 pagesBest Practices in Cost EngineeringAl-Kawthari As-SunniNo ratings yet

- Cost Engineering ManualDocument312 pagesCost Engineering ManualSamuel John83% (6)

- Process Plant Estimating StandardsDocument15 pagesProcess Plant Estimating StandardsCarl Williams75% (4)

- Detailed Unit Rate Estimating in Aspen Capital Cost EstimatorDocument12 pagesDetailed Unit Rate Estimating in Aspen Capital Cost EstimatorOsama El-ShafieyNo ratings yet

- General Plant Cost EstimatingDocument27 pagesGeneral Plant Cost EstimatingAnand Gupta73% (11)

- Capital Projects Cost EstimationDocument87 pagesCapital Projects Cost EstimationRapee PuaksungnoenNo ratings yet

- Estimation and Cost ControlDocument7 pagesEstimation and Cost Controlgrtuna100% (1)

- Cost EstimationDocument46 pagesCost EstimationvinaykdrNo ratings yet

- Cost Estimating HandbookDocument158 pagesCost Estimating Handbookcocko01100% (4)

- 01 DACE - Labour - Norms - General - Description - V2 PDFDocument16 pages01 DACE - Labour - Norms - General - Description - V2 PDFSaulo RicoNo ratings yet

- Module 8-Equipment Cost Estimation TechniquesDocument48 pagesModule 8-Equipment Cost Estimation TechniquesIqbal January PratamaNo ratings yet

- Capital Costs EstimationDocument7 pagesCapital Costs Estimationajaypathak85100% (1)

- Estimation of Project Cost Beyond EPC Construction CostDocument6 pagesEstimation of Project Cost Beyond EPC Construction CostPhan SNo ratings yet

- Cost Estimation PDFDocument91 pagesCost Estimation PDFNitesh Sardar100% (2)

- Cost Estimating MethodsDocument2 pagesCost Estimating Methodsdghfhh444t5566gfgNo ratings yet

- Estimating 100 Introduction To EstimatingDocument23 pagesEstimating 100 Introduction To EstimatingCarina Anselmo de Lima88% (8)

- Modern Cost EngineeringDocument38 pagesModern Cost Engineeringamcandia100% (5)

- Making Sense Your Project Cost EstimateDocument5 pagesMaking Sense Your Project Cost Estimateromulussikalit100% (1)

- AACE Cost Engineering JournalDocument48 pagesAACE Cost Engineering Journalgopinathan_karutheda100% (1)

- Lec 1 Fixed Capital Cost EstimationDocument42 pagesLec 1 Fixed Capital Cost Estimationibrahim3318No ratings yet

- The Total Cost Management (TCM) Framework: PrefaceDocument6 pagesThe Total Cost Management (TCM) Framework: PrefaceRonald Kahora100% (1)

- Sharpen Your Cost Estimating SkillsDocument9 pagesSharpen Your Cost Estimating SkillsKokil JainNo ratings yet

- Construction Cost IndicesDocument142 pagesConstruction Cost IndicesAnjan Mohapatro100% (1)

- Cost Estimate PDFDocument44 pagesCost Estimate PDFananyo_sengupta100% (2)

- Construction EstimatingDocument19 pagesConstruction EstimatingMatthew Mullan100% (1)

- Cost Engineer's NotebookDocument25 pagesCost Engineer's NotebookSoeghy Alie75% (4)

- Project Cost Estimating Guide - PracticeDocument58 pagesProject Cost Estimating Guide - PracticeMurat Syzdykov100% (5)

- Valuation of Mining Projects Using Option Pricing TechniquesDocument8 pagesValuation of Mining Projects Using Option Pricing TechniquesgeyunboNo ratings yet

- 58R-10 - AACE InternationalDocument21 pages58R-10 - AACE InternationalMurad89100% (1)

- DACE Cost - Engineering - Introduction - PDFDocument34 pagesDACE Cost - Engineering - Introduction - PDFLupul50No ratings yet

- CostManagement Lecture12 13 PDFDocument29 pagesCostManagement Lecture12 13 PDFiftikharNo ratings yet

- Cost Estimation of Fixed Roof (Cone) Carbon Steel Storage Tanks - CheresourcesDocument3 pagesCost Estimation of Fixed Roof (Cone) Carbon Steel Storage Tanks - CheresourcesjkNo ratings yet

- DACE Labour Productivity Norms The New Gulf CoastDocument25 pagesDACE Labour Productivity Norms The New Gulf Coastiplaruff0% (2)

- Cost EstimationDocument85 pagesCost EstimationTowfiq AhmedNo ratings yet

- Capital and Operating Cost EstimationDocument48 pagesCapital and Operating Cost EstimationGaluizu00167% (3)

- 2009 Front End Conceptual Estimating YearbookDocument470 pages2009 Front End Conceptual Estimating YearbookGerardo Delgado100% (4)

- Hydrocarbon Processing: Brown, T. RDocument13 pagesHydrocarbon Processing: Brown, T. REl_GasistaNo ratings yet

- Cost EstimationDocument45 pagesCost EstimationRamphani Nunna100% (2)

- 15 Use and Misuse of Capital Cost Estimate ContingencyDocument8 pages15 Use and Misuse of Capital Cost Estimate ContingencyHéctor Patricio ValdiviaNo ratings yet

- 1 How To Benchmark With CIIDocument20 pages1 How To Benchmark With CIIMd Rakibul HasanNo ratings yet

- Capital Cost EstimationDocument55 pagesCapital Cost EstimationMohammad Reza Anghaei100% (1)

- Guide To Cost PredictabilityDocument26 pagesGuide To Cost Predictabilityal-gazNo ratings yet

- Turnaround Manhour Norms BlancoDocument106 pagesTurnaround Manhour Norms BlancoElias Rizk86% (7)

- Cost Estimation BasisDocument58 pagesCost Estimation BasisFredy ZumbanaNo ratings yet

- CH 4.7-Project Financial Analysis - CH 5Document41 pagesCH 4.7-Project Financial Analysis - CH 5yemsrachhailu8No ratings yet

- WGC Guidance On Non-Gaap MetricsDocument2 pagesWGC Guidance On Non-Gaap MetricsMiguel SanchezNo ratings yet

- Manufacturing AccountDocument36 pagesManufacturing AccountSaksham RainaNo ratings yet

- Cost Estimation: (CHAPTER-3)Document43 pagesCost Estimation: (CHAPTER-3)fentaw melkieNo ratings yet

- Chemical Process Design - Economic EvaluationDocument18 pagesChemical Process Design - Economic EvaluationMartín Diego MastandreaNo ratings yet

- Toluene Cost Estimation&EconomicsDocument10 pagesToluene Cost Estimation&EconomicssapooknikNo ratings yet

- Introduction To Engineering EconomicsDocument7 pagesIntroduction To Engineering EconomicsEmmanuel NwankwoNo ratings yet

- Cost EstimationDocument7 pagesCost Estimationrubesh_rajaNo ratings yet

- Plant Design and EconomicsDocument3 pagesPlant Design and EconomicsAnonymous NayakNo ratings yet

- Guidance On All in Costs PR PDFDocument4 pagesGuidance On All in Costs PR PDFOwenNo ratings yet

- Estimation of Capital InvestmentDocument13 pagesEstimation of Capital InvestmentJu Naid MalikNo ratings yet

- Estimation of ExpensesDocument23 pagesEstimation of ExpensesBayu MaulidaNo ratings yet

- Flying High - HindiDocument20 pagesFlying High - HindiPratham BooksNo ratings yet

- Diary-2012Document14 pagesDiary-2012ccsreddyNo ratings yet

- Treating Process Waste Water Employing Vacuum Distillation and Heat PumpDocument4 pagesTreating Process Waste Water Employing Vacuum Distillation and Heat PumpccsreddyNo ratings yet

- Flowserve Cavitation Control PDFDocument20 pagesFlowserve Cavitation Control PDFEric KnowlesNo ratings yet

- Direct Heat Recovery of A On Unit Saves Utilities and Reduces EmissionsDocument7 pagesDirect Heat Recovery of A On Unit Saves Utilities and Reduces EmissionsccsreddyNo ratings yet

- The Great Inventions Fair BagrutDocument5 pagesThe Great Inventions Fair Bagrutapi-25895447No ratings yet

- Kinross Gold Corporation: Institutional Equity Research Intraday NoteDocument6 pagesKinross Gold Corporation: Institutional Equity Research Intraday NoteAvi CohenNo ratings yet

- Rotman Case BookDocument7 pagesRotman Case BookhansikaNo ratings yet

- Free Float Requirements at Indonesian Stock ExchangeDocument3 pagesFree Float Requirements at Indonesian Stock ExchangeIndra Tri JunialdiNo ratings yet

- Total Outside Liability Total Liabilities: Bal-CmaDocument4 pagesTotal Outside Liability Total Liabilities: Bal-CmabbasyNo ratings yet

- Capital MarketDocument10 pagesCapital Marketसम्राट सुबेदीNo ratings yet

- 2023 Sma Mid Term Test (SS)Document3 pages2023 Sma Mid Term Test (SS)Kieu Anh Bui LeNo ratings yet

- Sfo Group Project Questions Answer All QuestionsDocument2 pagesSfo Group Project Questions Answer All QuestionsVangelis GeorgopoulosNo ratings yet

- Final Exam Fin 599Document81 pagesFinal Exam Fin 599muraleepatro100% (1)

- Risk and Return Analysis of Equity Mutual FundDocument90 pagesRisk and Return Analysis of Equity Mutual Fundmajid_khan_4No ratings yet

- Financial StatementDocument13 pagesFinancial StatementkeyurNo ratings yet

- Crypto Wall Crypto Snipershot OB Strategy - Day Trade SwingDocument29 pagesCrypto Wall Crypto Snipershot OB Strategy - Day Trade SwingArete JinseiNo ratings yet

- K-Electric SukukDocument16 pagesK-Electric SukukAlaikaNo ratings yet

- PHD Consolidated Financials - 31 December 2020Document46 pagesPHD Consolidated Financials - 31 December 2020Aly A. SamyNo ratings yet

- Meaning of LeasingDocument12 pagesMeaning of LeasingSidhant kumarNo ratings yet

- Loan Application: Annex 1Document18 pagesLoan Application: Annex 1NinoSawiranNo ratings yet

- Effect of Capital Structure On Earning Per ShareDocument10 pagesEffect of Capital Structure On Earning Per ShareRITUKANT MAURYANo ratings yet

- ChennaiDocument41 pagesChennaiJAJNo ratings yet

- Notes - You Can Be A Stock Market GeniusDocument2 pagesNotes - You Can Be A Stock Market GeniusRyan ReitzNo ratings yet

- Solution For Ca Final SFM Nov 15 Paper (Practical Questions) by Ca Praviin MahajanDocument18 pagesSolution For Ca Final SFM Nov 15 Paper (Practical Questions) by Ca Praviin MahajanPravinn_Mahajan50% (2)

- Hedge Fund Due DiligenceDocument38 pagesHedge Fund Due DiligenceMartin K Mwananshiku100% (1)

- Term Sheet 2014 CleanDocument16 pagesTerm Sheet 2014 CleanvishnusudhirNo ratings yet

- How To Create Portfolios For Different Risk Groups and What To ConsiderDocument62 pagesHow To Create Portfolios For Different Risk Groups and What To ConsiderSana BraiekNo ratings yet

- Neville Wadia Institute of Management Studies and Research, Pune - 411001 Mba-Ii Sem-Iv Enterprise Performance Management McqsDocument12 pagesNeville Wadia Institute of Management Studies and Research, Pune - 411001 Mba-Ii Sem-Iv Enterprise Performance Management McqsPRATHAMESH SURVENo ratings yet

- 2010 07 06 - 010528 - Byp1 4Document3 pages2010 07 06 - 010528 - Byp1 4Muhammad RamadhanNo ratings yet

- MBF14e Chap08 Interest Rate Derviatives PbmsDocument16 pagesMBF14e Chap08 Interest Rate Derviatives PbmsVũ Trần Nhật ViNo ratings yet

- Ichimoku Charting UBS FORMATIONDocument19 pagesIchimoku Charting UBS FORMATIONemerzak100% (4)

- Investment ProjectDocument28 pagesInvestment ProjectYashiNo ratings yet

- Tutorial 2Document5 pagesTutorial 2K60 Trần Công KhảiNo ratings yet

- Issue of WarrantsDocument1 pageIssue of WarrantsDhruvi KothariNo ratings yet