Professional Documents

Culture Documents

Business Law Assignment (Letter of Credit)

Uploaded by

Amin Xavier TangOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Law Assignment (Letter of Credit)

Uploaded by

Amin Xavier TangCopyright:

Available Formats

Group Member : Tjin Federick Giovano Prio Naufal Williem Hendrik Yulius Pian Amin Xavier Tang (01120080023)

(01120080040) (01120080049) (01120080066) (01120080076)

Business Law Assginment : Letter Of Credit

Terminology The English name letter of credit derives from the French word accreditation, a power to do something, which in turn is derivative of the Latin word accreditivus, meaning trust. This applies to any defense relating to the underlying contract of sale. This is as long as the seller performs their duties to an extent that meets the requirements contained in the letter of credit

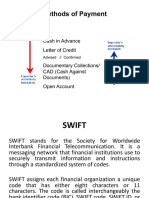

Definition Letter of Credit (LOC, L/C, LC) is a document, consisting of specific instructions by a buyer of goods, that is issued by a bank to the seller who is authorized to draw a specified sum of money under certain conditions, i.e., the receipt by the bank of certain documents within a given time. Letters of credit deal in documents, not goods. A sight Letter of Credit means that payment is made immediately to the beneficiary/seller/exporter upon presentation of the correct documents in the required time frame. A time or date Letter of Credit will specify when payment will be made at a future date and upon presentation of the required documents.

There are 2 basic types letter of credit: a) Documentary Letter of Credit can be revocable or irrevocable. An irrevocable Letter of Credit provides guarantee by the issuing bank in the event that all terms and conditions are met by the buyer (or drawee). A revocable Letter of Credit can be canceled or altered by the drawee after it has been issued by drawee's bank. Charges for each type will also vary. However, the more the risk by guaranteeing payment, the more the charge will likely be for providing the service. b) Standby Letter of Credit is a payment or performance guarantee used primarily in the United States. They are often called non-performing letters of credit because they are only used as a backup should the buyer fail to pay as agreed. Thus, a stand-by letter of credit allows the customer to establish a rapport with the seller by showing that it can fulfill its payment commitments.

Participants in LC Process Buyer Issuing Bank Advising Bank Seller (Beneficiary)

Documents that can be presented for payment To receive payment, an exporter or shipper must present the documents required by the letter of credit. Typical types of documents in such contracts might include : Financial Documents Commercial Documents Shipping Documents Official or Legal Documents Official Documents : License, Embassy legalization, Origin Certificate, : Bill of Exchange, Co-accepted Draft : Invoice, Packing list : Transport Document, Insurance Certificate, Commercial,

Inspection Certificate, Phytosanitary certificate Transport Documents : Bill of Lading (ocean or multi-modal or Charter party),

Airway bill, Lorry/truck receipt, railway receipt, CMC Other than Mate Receipt, Forwarder Cargo Receipt, Deliver Challan and etc Insurance documents : Insurance policy, or Certificate but not a cover note

Procedure Procedure for Administration of Standby Letters of Credit: Step 1 : The Sales and Credit Departments agree that a standby letter of credit is necessary prior to communicating financial terms to the customer. Step 2 : The Credit Department will communicate the standby letter of credit terms to the customer. If a domestic letter of credit, an advising bank is not necessary; if an international letter of credit, an advising bank is necessary and thus, Credit will request that it be (name) Bank. Step 3 : Should the issuing bank's financial viability be unknown, the Credit Department will contact (name) Bank for a credit inquiry. Step 4 : Once the advising bank confirms the adequacy of the standby letter of credit and the financial viability of the issuing bank, the Credit Department will inform Sales and Traffic.

Step 5 : Sales may ship the goods. However, prior to each shipment, Sales must inform the Credit Department of the total value of the goods to ensure that it does not exceed the protection allotted by the standby letter of credit. Credit and Sales should pay close attention to multiple shipments so that at no time does the credit exposure exceed the amount stated on the standby letter of credit.

Procedure for Administration of Irrevocable Documentary Letters of Credit Step 1 : The Sales and Credit Departments agree that a irrevocable letter of credit is necessary prior to communicating financial terms to the customer. Sales and Credit must also agree whether to require an irrevocable confirmed or unconfirmed letter of credit. Step 2 : The Credit Department will communicate the letter of credit terms to the customer, forward a letter of credit checklist to the customer and try to select the issuing bank. Selecting the issuing bank is not always possible. The Credit Department will also request that the customer forward a copy of the letter of credit on receipt. The customer generally receives its copy before our advising bank. Getting an early copy allows all parties at (your company) to begin the review process. Step 3 : The customer arranges with its bank for the issuance of the letter of credit. Step 4 : The issuing bank sends copies of the letter of credit to the customer and to our advising bank. Both, the customer and our advising bank will send a copy to the Credit Department. Step 5 : Once the Credit Department receives a copy of the letter of credit, it will send copies to Customer Service Representatives, Sales, and Traffic within one business day of receipt. Traffic personnel will forward the letter of credit to the forwarder. In addition, the Credit Department will log the letter of credit in the Letter of Credit Database. Step 6 : Credit, Sales, and Traffic will review the letter of credit looking for necessary amendments within one day of receipt. Reviewing parties will forward all amendments to the Credit Department via Fax or Email. A Fax or E-mail is still necessary should Sales or Traffic require no amendments. Step 7 : If amendments are necessary, the Credit Department will forward all required changes to the customer. Should the necessary amendments lie outside Credit's realm of expertise, it will seek the needed assistance from other areas within the Company. If the customer agrees, it will forward requests to its issuing bank, whom in turn will forward an amended letter of credit to our advising bank. Our advising bank will fax a copy of the amended letter of credit to Credit, who in turn will

send it to Sales and Traffic. Credit, Sales, and Traffic will review the amended letter of credit to ensure no additional changes are necessary. When making amendments and reviewing an amended letter of credit, it is important to keep the letter of credit's expiration date in mind. Credit should approximate the number of days taken up by the amendment process and amend the expiration date by the same number of days. Step 8 : If no changes are necessary, all the affected parties approve the amended letter of credit by notifying the Credit Department of the approval via Fax or E-mail within one day of receiving the amended letter of credit. If changes are necessary, go back to Step 6. Once the Credit Department receives the approval notifications from all parties, it will immediately advise all parties affected that the letter of credit has been approved. Step 9 : Sales sends a copy of the amended letter of credit to the plant with instructions to ship the product to the customer. Sales will do this on the same day it receives the notification from the Credit Department confirming that the amended letter of credit is acceptable. Step 10 : The Freight forwarder and Traffic Department ship the material and send all the documentation required in the letter of credit along with a draft for payment to our advising bank via overnight express courier. Step 11 : Our advising bank reviews all documentation to ensure that it complies with the letter of credit's requirements. If there are any correctable discrepancies, the advising bank will correct them. It is important to note that your advising bank may charge you for each discrepancy found and corrected. If there are non-correctable discrepancies, our advising bank will try to get the customer to waive them. However, getting the customer to waive non-correctable discrepancies is no guarantee that the issuing bank will agree to the changes. This is especially true if the financial condition of the customer deteriorates. The advising bank's review process should take three days or less. Step 12 : Our advising bank forwards all the documents to the location specified in the letter of credit, which is usually the address of the issuing bank. Step 13 : The issuing bank honors the letter of credit and forwards the funds to our advising bank. Should the issuing bank not honor the letter of credit, it must tell our advising bank why. Step 14 : Our advising bank will credit our account minus applicable fees. All advising fees are absorbed by the division making the sale. The advising bank will contact the Credit Department stating whether or not payment has been received. Should the issuing bank refuse to honor the letter of credit, we (seller

company) are still responsible for associated fees. The issue of who will pay for the associated fees should be resolved prior to accepting the letter of credit. The Buyer and the Seller should all be in accord. Although the seller typically pays for advising fees, all fees are negotiable.

Web References : http://en.wikipedia.org/wiki/Letter_of_credit http://www.teachmefinance.com/Financial_Terms/letter_of_credit.html http://www.crfonline.org/orc/ca/ca-10.html http://www.ec-finance.com/site/about_lcs/letter_of_credit_process.htm http://www.sovereignfunding.com/Letter-of-Credit.html

You might also like

- Letters of Credit and Documentary Collections: An Export and Import GuideFrom EverandLetters of Credit and Documentary Collections: An Export and Import GuideRating: 1 out of 5 stars1/5 (1)

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- Letter of Credit (Defination)Document34 pagesLetter of Credit (Defination)M NageshNo ratings yet

- Import Export: A Guide To Letters of CreditDocument48 pagesImport Export: A Guide To Letters of CreditAmit RaiNo ratings yet

- Letter of Credit Case StudyDocument9 pagesLetter of Credit Case StudyLiz KallistaNo ratings yet

- Method of International PaymentsDocument12 pagesMethod of International PaymentsananyaNo ratings yet

- Letter of Credit (LC) - Meaning, Process & Role in International TradeDocument8 pagesLetter of Credit (LC) - Meaning, Process & Role in International TradeAmirNo ratings yet

- Letter of CreditDocument35 pagesLetter of Credithunt_pgNo ratings yet

- IBT - Letter of Credit PaperDocument4 pagesIBT - Letter of Credit PaperrizkiaevnNo ratings yet

- Trade Finance ManualDocument8 pagesTrade Finance ManualgautamnarulaNo ratings yet

- Letter of CreditDocument17 pagesLetter of CreditKunal GuptaNo ratings yet

- Roll No-D018, SAP ID - 80101190221Document9 pagesRoll No-D018, SAP ID - 80101190221Harsh GandhiNo ratings yet

- Letter of Credit ArticleDocument8 pagesLetter of Credit ArticleAlbert Moses OlleroNo ratings yet

- Notes On Letter of CreditDocument6 pagesNotes On Letter of Creditsandeepgawade100% (1)

- 8 Payment Terms - Bill of Freight 05052021 100239pm 20112021 074035pm 01072022 121539pmDocument29 pages8 Payment Terms - Bill of Freight 05052021 100239pm 20112021 074035pm 01072022 121539pmJahanzeb KhokharNo ratings yet

- A Guide ToDocument27 pagesA Guide Toneelamd456No ratings yet

- Letters of CreditDocument25 pagesLetters of Creditshamim1102100% (1)

- Dealing With LC DiscrepanciesDocument6 pagesDealing With LC Discrepanciesmahmudratul85No ratings yet

- Letter of CreditDocument8 pagesLetter of CredithardikNo ratings yet

- Ishha Nagrath Ishita Gupta Manish Kalra Manish SharmaDocument31 pagesIshha Nagrath Ishita Gupta Manish Kalra Manish SharmaAjay AhujaNo ratings yet

- Letter of CreditDocument6 pagesLetter of CreditbhumishahNo ratings yet

- Letter of CreditDocument17 pagesLetter of Creditpratik_singh_11No ratings yet

- Letter of Credit - Process: Step 1 - Issuance of LCDocument8 pagesLetter of Credit - Process: Step 1 - Issuance of LCRuchitha PrakashNo ratings yet

- Itab RevieweerDocument13 pagesItab RevieweerAra PanganibanNo ratings yet

- Letters of CreditDocument12 pagesLetters of CreditPrince McGershonNo ratings yet

- Inland TradeDocument32 pagesInland Tradepattabhi_reddy_1No ratings yet

- Methods of Payment in Export ImportDocument10 pagesMethods of Payment in Export Importkaran singlaNo ratings yet

- Letter of CreditDocument15 pagesLetter of CreditAnonymous yxc3NX6mXNo ratings yet

- 55 Kaushan NimeshDocument12 pages55 Kaushan NimeshKaushan NimeshNo ratings yet

- This Is The Department Which The Customers Approach When They Are in Need of Loans. The Department IsDocument12 pagesThis Is The Department Which The Customers Approach When They Are in Need of Loans. The Department Israahul7No ratings yet

- Fee Based Services11Document14 pagesFee Based Services11nikhild77No ratings yet

- Letter of Credit ReportDocument22 pagesLetter of Credit ReportMuhammad Waseem100% (4)

- Letter of Credit - Concept & ProcedureDocument4 pagesLetter of Credit - Concept & ProcedureAnand VermaNo ratings yet

- Letter of CreditDocument14 pagesLetter of CreditAltaf SuryaNo ratings yet

- LocDocument49 pagesLocmahmudratul85No ratings yet

- Understanding and Using Letters of Credit: PurposeDocument7 pagesUnderstanding and Using Letters of Credit: PurposePhani KumarNo ratings yet

- Traveler's Letters of CreditDocument15 pagesTraveler's Letters of CreditAnonymous qEeH6SlNo ratings yet

- Lectur Notes: International Trade Law B.A.LL.B. (HONS), VIII Semester Unit-IiDocument4 pagesLectur Notes: International Trade Law B.A.LL.B. (HONS), VIII Semester Unit-IiKumar KalyanNo ratings yet

- Letter of CreditDocument32 pagesLetter of CreditPeter DjkmNo ratings yet

- LC SRS-2Document20 pagesLC SRS-2puku90No ratings yet

- Chapter 4-1Document18 pagesChapter 4-1syahiir syauqiiNo ratings yet

- Chapter-6 Foreign Exchange and Financing of Foreign TradeDocument7 pagesChapter-6 Foreign Exchange and Financing of Foreign TradeFardin KhanNo ratings yet

- Group No. 05 (BC18-05) (BC18-12)Document31 pagesGroup No. 05 (BC18-05) (BC18-12)Fiza GulzarNo ratings yet

- Letter of Credit HardDocument35 pagesLetter of Credit HardReHopNo ratings yet

- Tahir KhanDocument10 pagesTahir KhantahirkkkNo ratings yet

- Letter of CreditDocument13 pagesLetter of Creditvinayjoshi99No ratings yet

- Payment MethodsDocument4 pagesPayment MethodsAnonymous qEeH6SlNo ratings yet

- DocumentationDocument13 pagesDocumentationAnonymous GcxSvKrtwaNo ratings yet

- Assignment 4 MBDocument6 pagesAssignment 4 MBQueen CancerianNo ratings yet

- Trade - Intermediate LevelDocument202 pagesTrade - Intermediate Levelsnigdha biswasNo ratings yet

- Rest of ThingDocument58 pagesRest of ThingAvinash RbNo ratings yet

- 11 Letter of CreditDocument266 pages11 Letter of Creditحسيب مرتضي100% (24)

- Yeasin LawDocument10 pagesYeasin LawSifatShoaebNo ratings yet

- Assignment On Writing A Letter of CreditDocument13 pagesAssignment On Writing A Letter of CreditZim-Ud -Daula0% (2)

- Streetwise Credit And Collections: Maximize Your Collections Process to Improve Your ProfitabilityFrom EverandStreetwise Credit And Collections: Maximize Your Collections Process to Improve Your ProfitabilityRating: 5 out of 5 stars5/5 (1)

- Somany Final PRJCTDocument91 pagesSomany Final PRJCTKuldeep RathoreNo ratings yet

- CH 06Document72 pagesCH 06api-307892902No ratings yet

- ABC Advanced MethodsDocument6 pagesABC Advanced MethodsMicaiah MasangoNo ratings yet

- CroswellDocument2 pagesCroswellHarry Rock100% (1)

- Sales Management Dissertation TopicsDocument4 pagesSales Management Dissertation TopicsPaperWritingServicesReviewsSingapore100% (1)

- Aggregate Planning PDFDocument13 pagesAggregate Planning PDFShimanta EasinNo ratings yet

- Unit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Document23 pagesUnit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Bizu AtnafuNo ratings yet

- PRELIMDocument2 pagesPRELIMlatte aeriNo ratings yet

- JanMar Case AnalysisDocument6 pagesJanMar Case AnalysisSbeaupre12100% (1)

- Microsoft Dynamics 365 Business Central Capability GuideDocument28 pagesMicrosoft Dynamics 365 Business Central Capability GuideMatarNo ratings yet

- Retail ManagementDocument15 pagesRetail ManagementMa. Katrina MoraNo ratings yet

- AmazonDocument1 pageAmazonAAYUSHI VERMA 7ANo ratings yet

- Synopsis GangaDocument3 pagesSynopsis GangaPrabhu Offset Printers MishrikotiNo ratings yet

- AkuntansiDocument26 pagesAkuntansiDesy SekarNo ratings yet

- LAS FUNDA2 WK2-editedDocument2 pagesLAS FUNDA2 WK2-editedronald bantuganNo ratings yet

- Week 12Document1 pageWeek 12PrateekNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Candy AvinashNo ratings yet

- Sales and Distribution Management Assignment-I: Submitted To: Prof. Joydeep BiswasDocument6 pagesSales and Distribution Management Assignment-I: Submitted To: Prof. Joydeep BiswasArun Kumar SatapathyNo ratings yet

- Potential Risks For McDonaldDocument1 pagePotential Risks For McDonaldDianne CantiverosNo ratings yet

- Principles: Percentage TaxesDocument40 pagesPrinciples: Percentage TaxesMarcky24 GuitarNo ratings yet

- BMC Module 5 Revenue Streams and Key Resources - CompressedDocument5 pagesBMC Module 5 Revenue Streams and Key Resources - CompressedOlaiya EphraimNo ratings yet

- Customer Relationship Management: Finding Value DriversDocument12 pagesCustomer Relationship Management: Finding Value DriversSpas PisovNo ratings yet

- What Is Business Letter?: Oldest Form of Official CorrespondenceDocument9 pagesWhat Is Business Letter?: Oldest Form of Official CorrespondenceAnil Bhard WajNo ratings yet

- Hotel Accounting Policies and Procedures ManualDocument19 pagesHotel Accounting Policies and Procedures ManualNatasha Azlan83% (23)

- Class1 Introduction Updated 2Document37 pagesClass1 Introduction Updated 2hiuyeehilaryNo ratings yet

- Case Study On Eveready: Group AssignmentDocument9 pagesCase Study On Eveready: Group AssignmentSwikriti SethNo ratings yet

- Steenkamp - Retail Brand Disrupters PDFDocument58 pagesSteenkamp - Retail Brand Disrupters PDFChad IvieNo ratings yet

- Consumer PromotionDocument25 pagesConsumer PromotionRavi JaiswalNo ratings yet

- Quiz - Chapter 9 - Consignment Sales - 2021 EditionDocument4 pagesQuiz - Chapter 9 - Consignment Sales - 2021 EditionYam SondayNo ratings yet

- Group 7 - Ikea Invades AmericaDocument25 pagesGroup 7 - Ikea Invades AmericaSwetapadma MishraNo ratings yet