Professional Documents

Culture Documents

Ratios of Tata Teleservices

Uploaded by

moneybhasin31Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratios of Tata Teleservices

Uploaded by

moneybhasin31Copyright:

Available Formats

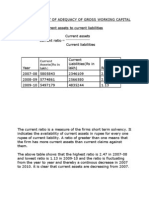

1. Liquidity Ratios of Tata TeleservicesTable: 1 CURRENT ASSET At March31. 2011 Rs.

Inventory Sundry Debtors Loans and advances Cash in hand Cash at bank Total 353981303.44 85516779.40 1279541364.24 943530.07 1916215508.11 3636197482.26

Table: 2 CURRENT LIABILITIES At March31. 2011 Rs. Sundry Creditors Other Liabilities Provision for taxation Proposed dividend Dividend tax Total 138784778.42 108686563.39 1063000000.39 634300.00 107768.00 1311213409.81

Computation of Current and Quick Ratio is as follow:a.) Current Ratio. Current assets Current ratio= Current Liabilities

Table: 3 Particulars As on March31.2011 Current assets Current liabilities Current ratio 3636197482.26 1311213409.81 2.78

x 100000000

40 35 30 25 20 15 10 5 0 Current asset Current Liabilities

InterpretationStandard ratio is 2:1 and Tata Teleservices ltd.s ratio is 2.78:1. It is better than the standard ratio.

b.) Quick ratio/Acid test ratio Liquid asset Quick ratio/Acid test ratio = Current Liabilities Table: 4 Particulars At March31. 2011 Rs. Liquid assets Current liabilities Quick/Acid Test Ratio 3282216179 1311213410 2.50

x 100000000

35 30 25 20 15 10 5 0 Liquid assets Current liabilities

InterpretationTata Teleservices ltd.s Quick ratio/ acid test ratio at March 31.2011 is 2.50.

2. Solvency Ratios: a) Debt Equity Ratio Long term loans Debt equity ratio= Shareholders funds or Net worth Long term loans= Debentures, mortgage loan, bank loan, loans from financial institutions and public deposits etc. Shareholders Fund= Equity share capital, preference share capital, share premium, general reserves, capital reserves credit balance of profit & loss account fictitious assets. Table: 5 Particulars At March31. 2011 Rs. Long term loan Equity share capital Reserves & surplus Shareholders fund Debt equity ratio 426398140.72 634300 2284393451.33 2285027751.33 0.187

x 100000000

40 20 0 Long term fundsShareholder's fund

InterpretationThis ratio expresses the relationship between debt and equity and Tata Teleservices ltd.s Debt equity ratio is 0.187.

b) Debt ratioLong term loans Debt ratio = Capital Employed Table: 6 Particulars At March31. 2011 Rs. Long term debt Capital employed Debt ratio 426398140.72 2285027751.33 .187

x 100000000

25 20 15 10 5 0 Long term Debt. Capital employed

InterpretationThis ratio refers to Tata Teleservices ltd.s ratio of long term debt to total of external and internal funds, and Tata Teleservices ltd.s Debt. Ratio at March 31.2011 is 0.187.

c) Proprietary ratioShareholder Fund Proprietary = Capital Employed Table: 7 Particulars At March31. 2011 Rs. Shareholder fund Capital employed Proprietary ratio 2285027751.33 2285027751.33 1:1

x 100000000

25 20 15 10 5 0 Shareholders Fund Capital employed

InterpretationProprietary ratio refers the proportion proprietors funds to net, and after calculation of Tata Teleservices ltd.s Proprietary Ratio at March 31.2011 is 1:1.

d) Total assets to Debts ratioTotal assets Total asset to debts ratio= Long term Loans Table: 8 Particulars At March31. 2011 Rs. Total assets Long term loans Total asset to debt ratio 4027822953.23 426398140.72 9.45

x 100000000

45 40 35 30 25 20 15 10 5 0 Total asset Long term debts

InterpretationAccording to above statement we can say that Tata Teleservices ltd.s has total asset is greater than long term debts, and its total asset to debt ratio is 9.45.

e) Interest coverage ratio-

Net profit before interest and tax Interest coverage ratio = Fixed interest Charges Particulars At March31. 2011 Rs. Net profit before interest & tax Fixed interest charges Interest coverage ratio 730831826.17 0.00

x 100000000

8 7 6 5 4 3 2 1 0 Net profit before interest & tax Fixed interest charges

InterpretationThis ratio is also termed as Debt services ratio. After the calculation there is found that TTSL has do not fixed interest charges in this year, so the Interest coverage ratio of this year is Infinity.

3. Turnover Ratioa) Stock turnover ratioCost of goods sold Stock turnover ratio = Average stock Where average stock refers to arithmetic average of opening and closing stock and cost of goods sold is the difference between net sales and gross profit. Table: 10 Particulars At March31. 2011 Rs. Cost of goods sold Average stock Stock turnover ratio 1599614352.18 82585520.03 19.36 times

x 100000000

20 15 10 5 0 Cost of goods sold Average stock

InterpretationAccording to above statement we can say that stock turnover ratio of Tata Teleservices Ltd. is 19.36 times in March 2011.

b) Debtors turnover ratioNet Credit sales Debtors turnover ratio = Average accounts receivables Where average accounts receivable = (opening debtors and B/R + closing debtors and B/R)/2 Note- debtors have been taken before making any provision for bad and doubtful debts. Table: 11 Particulars At March31. 2011 Rs. Net credit sales Average debtors Debtors turnover ratio 0 0 0 times

1 0.8 0.6 0.4 0.2 0 Net credit sales Average debtors

InterpretationHigher the debtors turnover ratio, the better it is for the organization but Tata Teleservices ltd.s Debtor turnover ratio is zero.

C) Average collection period12 months or 365 days Average collection period = Debtor turnover ratio Table: 12 Particulars At March31. 2011 Rs. Days in year Debtors turnover ratio Average collection period 365 0 0

400 350 300 250 200 150 100 50 0 Days in year Debtors turnover ratio

InterpretationThis ratio indicates the time with in which the amount is collected from debtors and bills receivable. After our research we calculated that at March 2011 Tata Teleservices ltd.s Average collection period is Zero

D) Creditors turnover ratio Net credit purchases Creditors Turnover ratio = Average Account Payable Where average accounts payable = (Opening creditors and opening bills payable + closing creditors and closing bills payable)/2 Table: 13 Particulars At March31. 2011 Rs. Net credit purchases Average creditors Creditors turnover ratio 34390129.25 14723315.65 7.28 Times

35000000 30000000 25000000 20000000 15000000 10000000 5000000 0 Net credit purchases Average creditors

InterpretationThe creditors turnover ratio of Tata Teleservices ltd.s at March 2011 is 7.28 times.

E) Average payment period12 months or 365 days Average payment period = Creditors turnover ratio Table: 14 Particulars At March31. 2011 Rs. Days in year Creditors turnover ratio Average payment period 365 7.28 50.13 days

400 350 300 250 200 150 100 50 0 Days in year Creditors turnover ratio

InterpretationThe Tata Teleservices ltd.s Average payment period is aprox. 50 days.

F) Working capital turnover ratioCost of goods sold Working capital turnover ratio = Working Capital Table: 15 Particulars At March31. 2011 Rs. Cost of goods sold Working capital Working capital turnover ratio 1599614352.18 2109184779.39 0.76 times

x 100000000

25

20

15

10

0 Cost of goods sold Working capital

InterpretationThe working capital turnover ratio of Tata Teleservices ltd.s is 0.76 times.

4.) Profitability RatiosA.) Gross profit ratioGross Profit Gross profit ratio = Net Sales Table: 16 Particulars At March31. 2011 Rs. Gross profit Net sales Gross profit ratio 905212031.58 2504826383.76 36.14% * 100

x 100000000

30 25 20 15 10 5 0 Gross profit Net sales

InterpretationGross profit ratio as a percentage of sales is compounded to have an idea about gross margin. And Tata Teleservices ltd.s Gross profit ratio of this year is 36.14%.

B) Operating RatioCost of sales + operating expenses Operating ratio = Net Sales Table: 17 Particulars At March31. 2011 Rs. Cost of operation Net sales Operating ratio 1934971265.38 2504826383.76 77.29% * 100

x 100000000

30 25 20 15 10 5 0 Cost of operation Net sales

You might also like

- Financial Management Solved ProblemsDocument50 pagesFinancial Management Solved ProblemsAnonymous RaQiBV75% (4)

- Test Your Knowledge - Ratio AnalysisDocument29 pagesTest Your Knowledge - Ratio AnalysisMukta JainNo ratings yet

- Excel Advanced Excel For Finance - EXERCISEDocument106 pagesExcel Advanced Excel For Finance - EXERCISEghodghod123100% (1)

- Chapter 4 - Analysis of Financial StatementsDocument50 pagesChapter 4 - Analysis of Financial Statementsnoor_maalik100% (1)

- Financial Analysis ProtonDocument9 pagesFinancial Analysis Protonmoonernest100% (2)

- Ratio Analysis HyundaiDocument12 pagesRatio Analysis HyundaiAnkit MistryNo ratings yet

- Financial RatiosDocument4 pagesFinancial Ratiossarahbabe94No ratings yet

- Strategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Document40 pagesStrategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Rupesh KadamNo ratings yet

- A. Liquidity Ratio: Current Assets Include Cash and Bank Balances, Marketable Securities, Debtors andDocument28 pagesA. Liquidity Ratio: Current Assets Include Cash and Bank Balances, Marketable Securities, Debtors andYugendra Babu KNo ratings yet

- Profitibilty RatioDocument50 pagesProfitibilty RatioAshish NayanNo ratings yet

- Hindustan Lever Chemicals Balance Sheet - in Rs. Cr.Document28 pagesHindustan Lever Chemicals Balance Sheet - in Rs. Cr.Lochan ReddyNo ratings yet

- Financial AccountingDocument11 pagesFinancial AccountingAzwani SuhaimiNo ratings yet

- Balance Sheet As at 31st March 2012 (Rs in Lakhs)Document20 pagesBalance Sheet As at 31st March 2012 (Rs in Lakhs)Ranu SinghNo ratings yet

- assignment 1 đầy đủDocument3 pagesassignment 1 đầy đủbaongan23062003No ratings yet

- ProjectDocument34 pagesProjectAkhil NairNo ratings yet

- Financial Statement Analysis - HulDocument15 pagesFinancial Statement Analysis - HulNupur SinghalNo ratings yet

- Ratio Analysis (Group 5-Glc - Ib)Document53 pagesRatio Analysis (Group 5-Glc - Ib)Nikam PranitNo ratings yet

- Ratio Analysis of Tata SteelDocument11 pagesRatio Analysis of Tata SteelUtkarsh GuptaNo ratings yet

- Current Ratio Year LiabilitiesDocument14 pagesCurrent Ratio Year LiabilitiesVaibhavSonawaneNo ratings yet

- Lecture 7 Adjusted Present ValueDocument19 pagesLecture 7 Adjusted Present ValuePraneet Singavarapu100% (1)

- Du PontDocument8 pagesDu PontTên Hay ThếNo ratings yet

- Huyen Bui Asm1Document10 pagesHuyen Bui Asm1Helen Joan BuiNo ratings yet

- Financial Statement Analysis - Pantaloon Retail IndiaDocument7 pagesFinancial Statement Analysis - Pantaloon Retail IndiaSupriyaThengdiNo ratings yet

- Series 1: 1. Profit Margin RatioDocument10 pagesSeries 1: 1. Profit Margin RatioPooja WadhwaniNo ratings yet

- Chapter 5 ExercisesDocument7 pagesChapter 5 ExercisesTrang TranNo ratings yet

- Corp Fin AssignDocument9 pagesCorp Fin AssignTwafik MoNo ratings yet

- Expected Questions of FIN 515Document8 pagesExpected Questions of FIN 515Mian SbNo ratings yet

- Ratio AnalysisDocument17 pagesRatio AnalysisPGNo ratings yet

- Current Assets (Rs in Lakh)Document35 pagesCurrent Assets (Rs in Lakh)Jagadeesh MuthikiNo ratings yet

- Working Capital AnalysisDocument8 pagesWorking Capital AnalysisShravana ChakravartyNo ratings yet

- Business Finance: Submitted byDocument16 pagesBusiness Finance: Submitted byAyesha MalikNo ratings yet

- UntitledDocument197 pagesUntitledMillsRINo ratings yet

- Reference Form (Free Translation of Formulário de Referência)Document197 pagesReference Form (Free Translation of Formulário de Referência)MillsRINo ratings yet

- Balance Sheet - in Rs. Cr.Document9 pagesBalance Sheet - in Rs. Cr.Ashwin KumarNo ratings yet

- Ratio FinanceDocument15 pagesRatio FinanceHaniff RezNo ratings yet

- Profitability AnalysisDocument9 pagesProfitability AnalysisAnkit TyagiNo ratings yet

- Analysis of Financial StatementsDocument54 pagesAnalysis of Financial StatementsBabasab Patil (Karrisatte)No ratings yet

- AXIS Bank AnalysisDocument44 pagesAXIS Bank AnalysisArup SarkarNo ratings yet

- ITC Annual ReportDocument19 pagesITC Annual Reportanks0909No ratings yet

- Ratio Analysis of Shinepukur Ceremics Ltd.Document0 pagesRatio Analysis of Shinepukur Ceremics Ltd.Saddam HossainNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument7 pagesRatio Analysis: Liquidity RatiosAneeka NiazNo ratings yet

- St-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsDocument13 pagesSt-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsGianfranco SpatolaNo ratings yet

- G1 - CIMA Management Accountant Gateway Assessment 20 November 2012 - Tuesday Afternoon SessionDocument20 pagesG1 - CIMA Management Accountant Gateway Assessment 20 November 2012 - Tuesday Afternoon Sessionsalmanahmedkhi1No ratings yet

- Sandip Voltas ReportDocument43 pagesSandip Voltas ReportsandipNo ratings yet

- Principles of Accounting Chapter 14Document43 pagesPrinciples of Accounting Chapter 14myrentistoodamnhighNo ratings yet

- AuditedStandaloneFinancialresults 31stmarch, 201111121123230510Document2 pagesAuditedStandaloneFinancialresults 31stmarch, 201111121123230510Kruti PawarNo ratings yet

- Chapter 4 C2 Beximco MariamDocument5 pagesChapter 4 C2 Beximco MariamHafiz KhanNo ratings yet

- MSF 506-Final DocumentDocument22 pagesMSF 506-Final Documentrdixit2No ratings yet

- Financial Statement Analysis (ch-6)Document38 pagesFinancial Statement Analysis (ch-6)Wares KhanNo ratings yet

- Welcome To My PresentationDocument35 pagesWelcome To My PresentationAl Mahbub RiyadNo ratings yet

- Financial Management and Control - AssignmentDocument7 pagesFinancial Management and Control - AssignmentSabahat BashirNo ratings yet

- Assignment Next PLCDocument16 pagesAssignment Next PLCJames Jane50% (2)

- Financial Analysis of L&TDocument7 pagesFinancial Analysis of L&TPallavi ChoudharyNo ratings yet

- Unit - 2 - Financial Statement and RatioDocument37 pagesUnit - 2 - Financial Statement and Ratiodangthanhhd7967% (6)

- Analysis of Financial StatementsDocument6 pagesAnalysis of Financial StatementsMandeep SharmaNo ratings yet

- Afm PDF 26,28Document12 pagesAfm PDF 26,28jankhanatdNo ratings yet

- Accounting For RevenuesDocument7 pagesAccounting For Revenuesvijayranjan1983No ratings yet

- Ratio Analysis - TMDocument14 pagesRatio Analysis - TMsathishKumarNo ratings yet

- Data Interpretation Guide For All Competitive and Admission ExamsFrom EverandData Interpretation Guide For All Competitive and Admission ExamsRating: 2.5 out of 5 stars2.5/5 (6)

- Seminar: "Scams & Scandals in Indian Security Market"Document4 pagesSeminar: "Scams & Scandals in Indian Security Market"moneybhasin31No ratings yet

- "Scams & Scandals in Indian Security Market": Presented By-Ajay Kumar Roll No.-1638 Mba (P) AIMT Ambala CityDocument13 pages"Scams & Scandals in Indian Security Market": Presented By-Ajay Kumar Roll No.-1638 Mba (P) AIMT Ambala Citymoneybhasin31No ratings yet

- Seminar: "Scams & Scandals in Indian Security Market"Document4 pagesSeminar: "Scams & Scandals in Indian Security Market"moneybhasin31No ratings yet

- AcknowledgementDocument1 pageAcknowledgementAjay BhasinNo ratings yet

- 1st Pages of AjayDocument3 pages1st Pages of Ajaymoneybhasin31No ratings yet

- Objective of The Study 1 2. Industry Overview 2-4Document2 pagesObjective of The Study 1 2. Industry Overview 2-4moneybhasin31No ratings yet

- 1st Pages of AjayDocument3 pages1st Pages of Ajaymoneybhasin31No ratings yet

- IFIs Rate Low On Access by Publish What Your FundDocument1 pageIFIs Rate Low On Access by Publish What Your Fundmoneybhasin31No ratings yet

- Project Employee Training DevelopmentDocument16 pagesProject Employee Training Developmentmoneybhasin31No ratings yet

- IFIs Rate Low On Access by Publish What Your FundDocument1 pageIFIs Rate Low On Access by Publish What Your Fundmoneybhasin31No ratings yet

- IFIs Rate Low On Access by Publish What Your FundDocument1 pageIFIs Rate Low On Access by Publish What Your Fundmoneybhasin31No ratings yet

- Mba Traning ReportDocument71 pagesMba Traning Reportmoneybhasin31No ratings yet

- DOCOCMODocument63 pagesDOCOCMOmoneybhasin31No ratings yet

- TrainingDocument17 pagesTrainingmoneybhasin31No ratings yet

- About NokiaDocument45 pagesAbout Nokiamoneybhasin31No ratings yet

- Batangas Polytechnic College: The Morning After Case 7Document4 pagesBatangas Polytechnic College: The Morning After Case 7Jonard Marco RomeroNo ratings yet

- Real Estate in IndiaDocument6 pagesReal Estate in IndiaVikrant KarhadkarNo ratings yet

- Elec Final OutputDocument3 pagesElec Final Outputluebert kunNo ratings yet

- Essentials or Legal Rules As To ProposalDocument7 pagesEssentials or Legal Rules As To ProposalmasoodNo ratings yet

- 16 Leases (Lessee) s19 FinalDocument35 pages16 Leases (Lessee) s19 FinalNosipho NyathiNo ratings yet

- Anandita Bhargava Smita Gupta: Name of AuthorsDocument11 pagesAnandita Bhargava Smita Gupta: Name of AuthorsSuvedhya ReddyNo ratings yet

- Time To Kill PagesDocument24 pagesTime To Kill PagesFrancisco FerreiraNo ratings yet

- Former UM Soccer Coach Sues University For DefamationDocument12 pagesFormer UM Soccer Coach Sues University For DefamationNBC MontanaNo ratings yet

- Image Saving, Processing and Name Tagging Over SDTP Using Java ScriptDocument21 pagesImage Saving, Processing and Name Tagging Over SDTP Using Java Scriptsomnath banerjeeNo ratings yet

- Greetings From Freehold: How Bruce Springsteen's Hometown Shaped His Life and WorkDocument57 pagesGreetings From Freehold: How Bruce Springsteen's Hometown Shaped His Life and WorkDavid WilsonNo ratings yet

- Using APpropriate LanguageDocument25 pagesUsing APpropriate LanguageVerna Dell CorpuzNo ratings yet

- Gartner Magic Quadrant Report For SFA - Aug 2016Document31 pagesGartner Magic Quadrant Report For SFA - Aug 2016Francisco LSNo ratings yet

- Digital Marketing - Scope Opportunities and Challenges - IntechOpen PDFDocument31 pagesDigital Marketing - Scope Opportunities and Challenges - IntechOpen PDFPratsNo ratings yet

- Name Caliber Base Penalties DMG Rate Clip Conceal Range CostDocument23 pagesName Caliber Base Penalties DMG Rate Clip Conceal Range CostLars Pedersen100% (1)

- Engineering Economics & Financial Accounting Two Mark Questions and AnswersDocument15 pagesEngineering Economics & Financial Accounting Two Mark Questions and AnswerspothigaiselvansNo ratings yet

- Chraj 1Document6 pagesChraj 1The Independent GhanaNo ratings yet

- Bus 685 Final ReportDocument25 pagesBus 685 Final Reportabu.sakibNo ratings yet

- GSPL Annual ReportDocument190 pagesGSPL Annual Reportjai chaudhariNo ratings yet

- Excuse Letter For Grade 7 ElectionsDocument4 pagesExcuse Letter For Grade 7 ElectionsRaymund ArcosNo ratings yet

- 50 Questions and Answers About Tasawwuf (English) - by Ameer Maulana Akram Awan (MZA)Document26 pages50 Questions and Answers About Tasawwuf (English) - by Ameer Maulana Akram Awan (MZA)Azim KhanNo ratings yet

- Quality TranslationDocument33 pagesQuality TranslationCarolina ContrerasNo ratings yet

- c238 Service ManualDocument2,304 pagesc238 Service Manualcody100% (1)

- Kapil Choudhary: Personal ProfileDocument2 pagesKapil Choudhary: Personal ProfileAishwarya GoelNo ratings yet

- Guideline Reading Diagnosis and Management of Pericardial DiseaseDocument87 pagesGuideline Reading Diagnosis and Management of Pericardial DiseaseMirza AlfiansyahNo ratings yet

- KWPL07 RankinDocument28 pagesKWPL07 RankinBoogy GrimNo ratings yet

- Article 21Document17 pagesArticle 21shanikaNo ratings yet

- Rebrand and Relaunch Hydrox CookiesDocument9 pagesRebrand and Relaunch Hydrox CookiesAruba KhanNo ratings yet

- Reviewer in Gen 001 (P2)Document2 pagesReviewer in Gen 001 (P2)bonellyeyeNo ratings yet

- Advanced Space Propulsion Based On VacuumDocument17 pagesAdvanced Space Propulsion Based On VacuumMystery Wire100% (1)

- DEll PMSDocument64 pagesDEll PMSDipak ThakurNo ratings yet