Professional Documents

Culture Documents

Double Entry Cash Book

Uploaded by

Gyanish JhaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Double Entry Cash Book

Uploaded by

Gyanish JhaCopyright:

Available Formats

Two/Double Column Cash Book:

Definition and Explanation:

Cash A/c and Bank A/c are two busiest accounts in ledger and they are removed from the ledger to reduce its volume and size. Cash A/c is removed from the ledger and instead of it the Single Column Cash Book is kept to record cash transactions. In the same way no Bank A/c is opened in ledger for recording bank transactions, rather an additional amount column is provided on each side of 'Single Column Cash Book' for recording bank transactions. One more column for amount is provided on the debit side and one on credit side of Single Column Cash Book. These two amount columns on debit side and credit side will serve as Bank A/c and so it will not be necessary to open a Bank A/c in the ledger. The Cash Book having two Amount Columns on both sides is called 'Double Column Cash Book'.

Advantages:

The following advantages are derived from Double Column Cash Book:

1. All entries made in "Bank" Column of Double Column Cash Book form a part of 2.

double entry system and hence a separate Bank A/C need not be opened in ledger. It saves time, labour and cost. Both cash transactions and bank transactions are recorded in the same book. So both cash balance and bank balance are easily available from the same book.

Thus it is said that the Double Column Cash Book has two accounts in it, the Cash A/C and the Bank A/C.

Contra Entry

In any account we can only have one half of a double entry. An account cannot be debited and credited at the same time. For example, when we sell goods for cash, cash received will be recorded on the debit side of Cash Book and the goods sold will be posted on the credit side of Sales Account. But in Double Column Cash Book, we have two accounts, Cash A/c and the Bank A/c, so it is possible to have both a debit entry and a credit entry at the same time. For example, cash of $5,000 is deposited into the bank. In this transaction both Bank A/c and Cash A/c are involved and they will be recorded on both sides of Double Column Cash Book i.e. on the debit side in bank column and on the credit side in cash column. Thus a transaction in which Cash A/c and Bank A/c are involved, is recorded on both the sides of Double Column Cash Book, it is called "contra entry", from the Latin prefix contra meaning 'opposite to or against'. In recording such a transaction the letter "C", is written in 'L.F' column because both aspects of the transactions are recorded and there is no need to post them into the ledger. In this connection, the difference between contra entry and other entries in Cash Book may be noted. ''The Double entry work of contra entry is completed in Cash Book. They need not be posted to ledger". But the double entry work of other entries in Cash Book is not

completed, one aspect (i.e. cash aspect) of the transaction is, however, completed in Cash Book, but the other aspect is not completed, which is to be posted to the concerned account in ledger.

Contra entry will be passed in the following cases:

When cash is deposited into the Bank: Bank column - debit -- Cash column-credit. When cash is drawn from the bank for business purposes: Cash Column - debit -- Bank column - credit. When a cheque received from a debtor on a date subsequent to its receipt is deposited into the bank: Bank column - debit -- Cash column - credit.

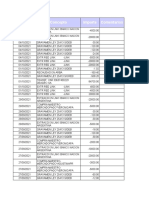

Example 1:

Enter the following transactions in a double column cash book/two column cash book.

2005 March 1 March 1 March 3 March 4 March 8 March 10 March 15 March 18 March 20 March 30 March 31 March 31 Cash in hand Bank Balance Received a cheque from Osman Deposited Osman's cheque with bank Withdrawn from bank for business use Goods sold for cash Goods bought for cash Goods sold for cash Paid Rahim by cheque Deposited into bank Paid salary in cash Paid rent by cheque $ 80,000 120,000 24,000 -20,000 30,000 80,000 60,000 26,000 16,000 10,000 6,000

Solution: Double Column Cash Book

Dat Particula e rs 200 5 Mar. Balance 1 b/d 80,000 120,000 V/ N L/ F Cash $ Bank $ Dat Particula e rs 200 5 Mar. Bank A/c 4 (Being cheque deposited ) C 24,000 V/ N L/ F Cash $ Bank $

Osman A/c (Being cheque received) Cash A/c (Cheque deposited with bank) Bank A/c (Being cash drawn from bank) C

24,000

Cash A/c (Being cash withdrawn from bank) Purchase A/c (Being goods bought) Cash A/c

20,000

24,000

15

80,000

20,000

18

16,000

10 Sales A/c (Being goods sold 'for cash) 18 Sales A/c (Being goods sold for cash) 30 Cash A/c (Being cash deposited ) C

30,000

20

Rahim A/c (Cheque issued)

26,000

60,000

31

Salary A/c (Being salary paid) Rent A/c (Being rent paid by cheque)

10,000

16,000

31

6,000

31 Balances c/d

84,000

108,000

214,000

160,000

214,000

160,000

April Balance . 1 b/d

84,000

108,000

You might also like

- Gamification in Consumer Research A Clear and Concise ReferenceFrom EverandGamification in Consumer Research A Clear and Concise ReferenceNo ratings yet

- The Handbook of Employee Benefits: Health and Group Benefits 7/EFrom EverandThe Handbook of Employee Benefits: Health and Group Benefits 7/ERating: 1 out of 5 stars1/5 (1)

- Double Column Cash BookDocument2 pagesDouble Column Cash BookAneeza Anwar0% (1)

- Income Statement & Balance SheetDocument23 pagesIncome Statement & Balance SheetSAURABH PATELNo ratings yet

- Corporate Taxation - Module I: Basic Concepts of Income Tax A. HistoryDocument15 pagesCorporate Taxation - Module I: Basic Concepts of Income Tax A. HistoryDr Linda Mary SimonNo ratings yet

- Akash 123Document44 pagesAkash 123praveshNo ratings yet

- Mutual Fund AssignmentDocument7 pagesMutual Fund AssignmentBhargav PathakNo ratings yet

- CadburyDocument37 pagesCadburyjdh_apsNo ratings yet

- Recruitment & Selection Process of SQUARE Toiletries LTD PDFDocument41 pagesRecruitment & Selection Process of SQUARE Toiletries LTD PDFswastika bhagowatiNo ratings yet

- MF OrganisationDocument9 pagesMF Organisationsaratchandra123No ratings yet

- Indian Accounting StandardsDocument9 pagesIndian Accounting StandardsAman Singh0% (1)

- Study On Investor Behaviour in Systematic Investment Plan of Mutual FundDocument7 pagesStudy On Investor Behaviour in Systematic Investment Plan of Mutual FundSurajNo ratings yet

- Effect of Stock Market On Indian EconomyDocument28 pagesEffect of Stock Market On Indian Economyanshu009767% (3)

- Capital Structure TheoriesDocument31 pagesCapital Structure Theoriestannu2114No ratings yet

- Impact of Fee Based and Fund Based Services On Profitability of BanksDocument55 pagesImpact of Fee Based and Fund Based Services On Profitability of BanksNeeluSuthar100% (7)

- Fund Flow Statement AnalysisDocument16 pagesFund Flow Statement AnalysisgopinathNo ratings yet

- File DBMS FINALDocument28 pagesFile DBMS FINALShubham TyagiNo ratings yet

- Abs Journal RankingDocument52 pagesAbs Journal Rankingrizwan1001No ratings yet

- New Microsoft Word DocumentDocument7 pagesNew Microsoft Word DocumentGideesh Padinjakara100% (1)

- External Reconstruction DefinitionDocument3 pagesExternal Reconstruction DefinitionTushar All Rounder67% (3)

- MGT 25 Challenges For Social Entrepreneurship PDFDocument9 pagesMGT 25 Challenges For Social Entrepreneurship PDFAneesh MalhotraNo ratings yet

- Operations ManagementDocument11 pagesOperations ManagementMd. Shadman AminNo ratings yet

- Fund Flow Statement - Nature, Preparation, AnalysisDocument22 pagesFund Flow Statement - Nature, Preparation, AnalysisNikita 07No ratings yet

- 3 Golden Rules of AccountancyDocument6 pages3 Golden Rules of Accountancynishu_0001No ratings yet

- Solved - United Technologies Corporation (UTC), Based in Hartfor...Document4 pagesSolved - United Technologies Corporation (UTC), Based in Hartfor...Saad ShafiqNo ratings yet

- Sugar IndustryDocument44 pagesSugar IndustryRuishabh RunwalNo ratings yet

- Project Report ON Working Capital Management IN Bharti Airtel LTDDocument84 pagesProject Report ON Working Capital Management IN Bharti Airtel LTDRam LalNo ratings yet

- Amalgamation of Firms ProjectDocument5 pagesAmalgamation of Firms ProjectkalaswamiNo ratings yet

- Reliance Mutual FundDocument32 pagesReliance Mutual Fundshiva_kuttimma100% (1)

- Meaning and Nature of ProfitDocument2 pagesMeaning and Nature of ProfitkigenNo ratings yet

- Audit Expectation Gap in AuditorDocument3 pagesAudit Expectation Gap in AuditorTantanLeNo ratings yet

- Minimum Acceptable Rate of ReturnDocument3 pagesMinimum Acceptable Rate of ReturnRalph GalvezNo ratings yet

- Institute of Business ManagementDocument18 pagesInstitute of Business ManagementMehwish LadhaniNo ratings yet

- Shahjalal Islami Bank LTDDocument25 pagesShahjalal Islami Bank LTDShanu Uddin RubelNo ratings yet

- Ratio Analysis On Optcl, BBSRDocument47 pagesRatio Analysis On Optcl, BBSRSusmita Nayak100% (1)

- RM Units 1 2 NOTES PDFDocument9 pagesRM Units 1 2 NOTES PDFKishore RamNo ratings yet

- Presentation On Mncs in IndiaDocument4 pagesPresentation On Mncs in IndiaJugal ShahNo ratings yet

- Importance of Mutual FundsDocument14 pagesImportance of Mutual FundsMukesh Kumar SinghNo ratings yet

- Manipal University Jaipur: A Dissertation ON "Financial Planning and Comparison of Various Instruments"Document44 pagesManipal University Jaipur: A Dissertation ON "Financial Planning and Comparison of Various Instruments"Saksham JainNo ratings yet

- Valuation of Shares PDFDocument62 pagesValuation of Shares PDFGarima100% (1)

- Article On Financial PlanningDocument16 pagesArticle On Financial PlanningShyam KumarNo ratings yet

- Assesement of Working Capital RequirementsDocument11 pagesAssesement of Working Capital RequirementsBibin JoyNo ratings yet

- Part ADocument41 pagesPart AAmar G PatilNo ratings yet

- Insurance SlideDocument17 pagesInsurance Sliderzannat94No ratings yet

- Introduction of Cash BudgetDocument4 pagesIntroduction of Cash BudgetLaxman Zagge100% (2)

- WORKING CAPITAL - Meaning of Working CapitalDocument23 pagesWORKING CAPITAL - Meaning of Working Capitalzubair100% (1)

- 1-Introduction-to-StatisticsDocument6 pages1-Introduction-to-StatisticsMD TausifNo ratings yet

- Debt Analysis and ManagementDocument47 pagesDebt Analysis and ManagementRahul AtodariaNo ratings yet

- Difference Between Entrepreneur and ManagerDocument7 pagesDifference Between Entrepreneur and ManagerSantosh ChaudharyNo ratings yet

- Is MNCs Superior To Indian CompaniesDocument3 pagesIs MNCs Superior To Indian CompaniesTanvi SethiaNo ratings yet

- BUS 505.assignmentDocument16 pagesBUS 505.assignmentRashìd RanaNo ratings yet

- Shape of The MEC CurveDocument3 pagesShape of The MEC CurveYashas Mp100% (2)

- Synopsis Working CapitalDocument27 pagesSynopsis Working CapitalManish DwivediNo ratings yet

- Working Capital Management of SectrixDocument50 pagesWorking Capital Management of SectrixsectrixNo ratings yet

- Cash Flow Accounts Final Project (2Document21 pagesCash Flow Accounts Final Project (2KandaroliNo ratings yet

- Performance Appraisal: Presented By:-Nisha Goyal Rakesh SinghDocument29 pagesPerformance Appraisal: Presented By:-Nisha Goyal Rakesh SinghSreemoyee SahaNo ratings yet

- Research PaperDocument28 pagesResearch PaperSudarshan RavichandranNo ratings yet

- BancassuranceDocument15 pagesBancassuranceRakesh BhanjNo ratings yet

- The Four Walls: Live Like the Wind, Free, Without HindrancesFrom EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesRating: 5 out of 5 stars5/5 (1)

- Advertising ManagementDocument45 pagesAdvertising Managementtripathi_indramani5185No ratings yet

- The Contract Labour (Regulation and Abolition) ACT, 1970Document38 pagesThe Contract Labour (Regulation and Abolition) ACT, 1970Gyanish JhaNo ratings yet

- Consumer Preferences of Frooti by ManmathDocument47 pagesConsumer Preferences of Frooti by Manmathmanusahu200492% (13)

- Company ProfileDocument36 pagesCompany ProfileGyanish JhaNo ratings yet

- Summer Training Project Report: Prabath Financial Services LimitedDocument66 pagesSummer Training Project Report: Prabath Financial Services Limitedrahuljajoo100% (1)

- Contract FarmingDocument8 pagesContract FarmingRavi KaruppusamyNo ratings yet

- Lease Accounting: Professor, I.M TiwariDocument20 pagesLease Accounting: Professor, I.M TiwariEr Swati NagalNo ratings yet

- Financial Statement Analysis of Habib BankDocument87 pagesFinancial Statement Analysis of Habib Bankhelperforeu56% (9)

- Universak BankingDocument33 pagesUniversak BankingprashantgoruleNo ratings yet

- 1 2015 Year in Review (Colum 2015)Document135 pages1 2015 Year in Review (Colum 2015)LurzizareNo ratings yet

- Bank Reconciliation: Prepared By: Rezel A. Funtila R, LPTDocument19 pagesBank Reconciliation: Prepared By: Rezel A. Funtila R, LPTRezel FuntilarNo ratings yet

- Mathews Vs TaylorDocument4 pagesMathews Vs TaylorStephen JacoboNo ratings yet

- Agency Banking and Accessibility To Financial Services of Commercial Banks in The Northern Province of RwandaDocument20 pagesAgency Banking and Accessibility To Financial Services of Commercial Banks in The Northern Province of RwandaKIU PUBLICATION AND EXTENSIONNo ratings yet

- The Round Table GroupDocument18 pagesThe Round Table GroupAnonymous BvkmZHm50% (2)

- Example Impfa NKD Euro 24-20Document7 pagesExample Impfa NKD Euro 24-20ucervantesNo ratings yet

- BPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988Document2 pagesBPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988Jolet Paulo Dela CruzNo ratings yet

- Hold and ParkingDocument2 pagesHold and Parkingjoy_dipdasNo ratings yet

- Detailed StatementDocument2 pagesDetailed Statementnisha.yusuf.infNo ratings yet

- 017517-Proforma Invoices FY 2019-20 PDFDocument1 page017517-Proforma Invoices FY 2019-20 PDFMEDICAL SUPERINTENDENTNo ratings yet

- HSE Lesson17Document20 pagesHSE Lesson17SteeeeeeeephNo ratings yet

- Tuhin StakeholdersDocument3 pagesTuhin StakeholdersTauhidulIslamTuhin100% (1)

- Movimientos HistoricosDocument22 pagesMovimientos HistoricosVerónica RodNo ratings yet

- KPMG Banking On Technology-India BFSIDocument24 pagesKPMG Banking On Technology-India BFSInitin_garg_35No ratings yet

- The Study On Women EmpowermentDocument5 pagesThe Study On Women EmpowermentEldhose Jose100% (1)

- Master Employee Data BaseDocument132 pagesMaster Employee Data BaseVinodhNo ratings yet

- Challan PDFDocument1 pageChallan PDFRAJESH KUMAR YADAVNo ratings yet

- Resolutions SAC 2ndeditionDocument193 pagesResolutions SAC 2ndeditionWan Ruschdey100% (1)

- Analysis of Australian Financial SystemDocument20 pagesAnalysis of Australian Financial SystemSUMAN BERANo ratings yet

- Impact of Internet Banking System and Technology On Indian BanksDocument6 pagesImpact of Internet Banking System and Technology On Indian BanksBhanu BasnalNo ratings yet

- Proforma 1EDocument3 pagesProforma 1EEric HernandezNo ratings yet

- International Bank For Reconstruction and DevelopmentDocument14 pagesInternational Bank For Reconstruction and DevelopmentBhavesh JoliyaNo ratings yet

- Credit Card BOA DuyDocument4 pagesCredit Card BOA Duynghia leNo ratings yet

- Questions and Answers About Direct PLUS Loans For Graduate and Professional StudentsDocument2 pagesQuestions and Answers About Direct PLUS Loans For Graduate and Professional Studentsistuff28No ratings yet

- Project Presentation: Token Sale ProposalDocument18 pagesProject Presentation: Token Sale ProposalyogiNo ratings yet

- 123-Online Shopping System - SynopsisDocument6 pages123-Online Shopping System - SynopsismcaprojectsNo ratings yet