Professional Documents

Culture Documents

Income From Other Sources

Uploaded by

Kiran UpadhyayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income From Other Sources

Uploaded by

Kiran UpadhyayCopyright:

Available Formats

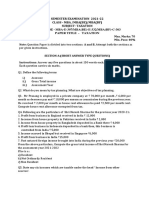

INCOME FROM OTHER SOURCES Q.1. Mr. Richards is a non resident.

He has earned following amounts during the previous year ended 31st March, 2011. 1. Income from agricultural land in Sri Lanka Rs.1,50,000/- received in Sri Lanka. 2. Dividend from Indian companies received Rs.5000/- received in India. 3. Dividend from Indian companies received: a) Final dividend from pace construction Ltd. Rs 15,000/b) Interim dividend from Glindia Ltd. Rs 12,400/- was actually paid by the company on 30th June, 11. 4. Winnings from lotteries Rs. 1,00,000/-(T.D.S. Rs.35,000/-) 5. As on 1st April, 2010 his investment was as follows: a) 10% Mumbai Municipal Debentures Rs. 50,000/b) 15% Debentures in Telco Ltd of Rs 1,00,000/c) 8% Port Trust Bonds of Rs. 30,000/d) 9% Maharashtra Govt. Loan of Rs.40,000/Compute the Gross Total Income of Mr. Richards for the assessment year 2011-2012. Q.2. Professor Godbole of Bombay University has received following receipt during the year ended 31st March 2011. 1. Salary Income Rs.1,42,000. (Gross) 2. Interest on National Saving Certificates VIIIth issues Rs.770. 3. Rs.3,185/- as interest on Post Officer Saving Bank. 4. Received Rs.30,000 from L.I.C. on maturity of policy. 5. Examinership fees Rs.3,350 received from the Institute of Chartered Accountancy of India, New Delhi. 6. Income by way of Dividend from Indian Companies: National Rayon Ltd Rs.750/Reliance Industries Ltd. Rs.685/Oswal Agro Ltd. Rs.315/7. Winning from crossword puzzles Rs. 8,880/Q.3. Mrs. Priti is a social worker. She owns a house property at Vashi, New Mumbai which is let out at an annual rent of Rs. 25,000. She incurred following expenses in respect of house property: Ground Rent Rs.600. Repairs Rs.2,000. Insurance Rs.400. Municipal Taxes paid Rs.1,000. Her other income is as follows: 1. Interest on Bank deposits Rs.12,500. 2. Dividend on Shares of Indian Companies :

Rs. 500 from L&T Ltd. Rs. 750 from Amarnath Textiles Ltd. Rs. 1,500 from Bindal Agro Ltd. She paid Rs.25 for collection charges and Rs.2,000 as interest on loan borrowed for purchase of above shares. 3. Dividend from UTI Rs.47,000. 4. Accrued Interest on NSC Rs.17,800. 5. Dividend from foreign companies Rs.14,500. 6. Family Pension of Rs.12,000 on the death of her husband from his Employer. Compute Mrs. Pritis Gross Total Income for the assessment year 201112. Q.4. Mr. Sunil is the owner of M/s. Hotel Trupti. He informs you that: 1. Income for business Rs.1,15,000/2. Income by way of interest on debentures amounted to Rs.12,000. He paid Rs.6,000 as interest on amount borrowed for purchase of Debenture to Mr. Reagan, an American resident. No tax has been deducted at source nor there is any representative assessee in India. 3. Received Rs.35,000 royalty from Deepak Prakashan for writing a book on Hotel Management. He incurred the expenses for preparing manuscript and purchases of certain books for reference Rs.12,000/-. These expenses are bonafide and reasonable. 4. Mr. Sunil took Anand Bhavan on rent of Rs.2,000 p.m. He sub-letted this property to Mr. Sanjay at Rs.2,500 per month w.e.f. 1st April,2010. 5. Accrued interest on Indira Vikas Patra Amounts Rs.15,000. 6. Directorship fees from Impex Associates Pvt. Ltd. received Rs.12,000/7. Interest on deposits with ACC Ltd Rs.12,000. Calculate his total income for the assessment year 2011-2012.

Q.5. Following is the Receipt and Payment A/c. of Mrs.Ujwala who is a professor in Arts & Commerce College of Vidya Prasarak Mandal, Thane, for the year ending on 31.03.2011. PARTICULARS Rs. PARTICULARS Rs. Salary from college 1,51,000 Household Expenses 41,500 Interest on Bank Deposits 1,500 Investments in U.T.I. in Dividend from U.T.I. 3,000 monthly Income Unit scheme

Examinership Fees (M.U.) Award for Best article written On Export Management Gift from father Dividend from : Thane Janata Sahakari Bank VPMs Teacher Co-op. Credit Society LIC Policy matured : Principal Amount 17,000 Bonus 5,000

4,000 on 31-3-2011 Expenses on House property (self occupied) 10,000 Land Revenue 800 65,000 Insurance 1,200 Repairs 8,000 3,000 Donation to: Sant Gadge Maharaj 2,000 Dharmashala Trust Purchase of land Interest on loan borrowed for 22,000 The purpose of investment in Shares of Thane Janta Sahakari Bank

1,20,000

10,000 10,000 37,500

2,500

2,61,500 2,61,500 Compute Gross Total Income of Mrs. Ujwala for the assessment year 2011-12. Q.6. Mr.Arjun owns three residential units. Units No.1 is self occupied whereas unit Nos.2 and 3 are let out. Unit No.2 is let out on a monthly rent of Rs.500 p.m. Municipal taxes are to be borne by tenant. Expenses incurred for this unit are : Insurance 200 Collection charges 150 Ground rent 100 Unit No.3 is fully furnished with furniture and electrical appliances (including refrigerator, television etc).This unit is let out on a monthly rent of Rs.10,000. All expenses including municipal tax are to be borne by tenant ( Income of building and appliances is inseparable). Annual interest due on 31st march, 2011 on the investment in10 % Maharashtra State Loan of Rs.15,000/- which was received in April,2011. Interest of Rs. 1,000/- is credited to the Public Provident Fund Account With State Bank of India. He received Rs. 4,500/- as dividend from Unit Trust of India. You are required to compute the gross total income of Mr.Arjun for the assessment year 2011-2012. Q.7. Mr.Ramakant provides you the following information for the financial year 2011 1. Salary @Rs.6,000 p.m. 2. Bonus for the year Rs.2,000 was declared. 3. Honorarium for playing cricket from Mulund Gymkhana Rs. 5,000/4. Received an award of Man of the Match of Rs.5,000/-

5.

Arjun Award of Rs.10,000 instituted in the public interest by Govt. of Maharashtra for showing proficiency in sports. 6. He owns the following securities on 1-4-2007: 15% Mumbai Port Trust Bonds Rs. 15000/(Interest payable annually) 10% Bonds of Narmada Cement Ltd Rs. 7,500/7. Interest on: Fixed Deposit with State Bank of India 12,800/Interest Accrued on Indira Vikas Patra Rs. 11,200/Compute Mr. Ramakants total income for the assessment year 20112012. Q.8. Mr. Jayantrao provides you the following information for the year ended 31st March,2011. 1. Received Rs. 12,000 from H.U.F. as a member of H.U.F. 2. Salary @ Rs.12,000 p. m. from Marathwada Krishi Mahavidyalaya being a lecturer in the college. 3. Examinership fees received from Pune university Rs.13,750. 4. Royalty from Anmol Prakashan Rs.32,250/- for writing a book on Progress & Problems of agriculture in India. 5. Received an award of Rs.25,000/- from Krishi VikasMahamandal instituted in public interest by government of Maharashtra in respect of Scientific Study of Krishi Udyog. Compute the gross total income of Mr.Jayantrao for the assessment year 2011-2012.

You might also like

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- Calculating Income Tax for Individuals and BusinessesDocument36 pagesCalculating Income Tax for Individuals and BusinessesVelayudham ThiyagarajanNo ratings yet

- Salary QuestionsDocument3 pagesSalary QuestionsgixNo ratings yet

- Problems On Income From Other SourcesDocument3 pagesProblems On Income From Other Sourcesgoli pandeyNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- Income From Salary Chapter QuestionsDocument5 pagesIncome From Salary Chapter Questionsanon_595315274100% (1)

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- Problems On Tax ManagementDocument44 pagesProblems On Tax ManagementBalaji Elangovan25% (4)

- Single SystemDocument7 pagesSingle SystemRobert HensonNo ratings yet

- Business Taxation MBA III 566324802Document5 pagesBusiness Taxation MBA III 566324802mohanraokp2279No ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Tax Planning & Financial Reporting 2nd Mid TermDocument6 pagesTax Planning & Financial Reporting 2nd Mid TermKrishan Kant PartiharNo ratings yet

- Income Tax - I Subj - Code:113020 Section-ADocument3 pagesIncome Tax - I Subj - Code:113020 Section-AThiru VenkatNo ratings yet

- Correct AnswerDocument20 pagesCorrect AnswerToji ThomasNo ratings yet

- SRI NITHYANANDA SWAMY EDUCATIONAL TRUST DEGREE COLLEGE TAX PROBLEMSDocument2 pagesSRI NITHYANANDA SWAMY EDUCATIONAL TRUST DEGREE COLLEGE TAX PROBLEMSHarish NaikNo ratings yet

- Income from Salaries: Calculating Exempted Allowances, Taxable Gratuity & PensionDocument53 pagesIncome from Salaries: Calculating Exempted Allowances, Taxable Gratuity & PensionSiva SankariNo ratings yet

- Business TaxationDocument3 pagesBusiness TaxationatvishalNo ratings yet

- Mba E307 - Mbe E332 - MBF C303Document4 pagesMba E307 - Mbe E332 - MBF C303Shashank TripathiNo ratings yet

- Calculate Simple Interest Rates and Amounts InvestedDocument5 pagesCalculate Simple Interest Rates and Amounts InvestedArvind SrivastavaNo ratings yet

- Tax NumericalsDocument11 pagesTax NumericalsRohit PanpatilNo ratings yet

- Tax Management ModelDocument17 pagesTax Management ModelZacharia VincentNo ratings yet

- Income Tax Model PaperDocument5 pagesIncome Tax Model PaperSrinivas YerrawarNo ratings yet

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbNo ratings yet

- Corporate AccountingDocument7 pagesCorporate AccountingSuraksha SaharanNo ratings yet

- Salaries 3Document2 pagesSalaries 3soumyajeetkundu123No ratings yet

- Other Sources Numerical SheetDocument5 pagesOther Sources Numerical SheetDisha GuptaNo ratings yet

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

- Calculating tax exemptions for HRA, gratuity, and other allowancesDocument1 pageCalculating tax exemptions for HRA, gratuity, and other allowancesSiva SankariNo ratings yet

- The Income Tax ActDocument32 pagesThe Income Tax Actapi-3832224No ratings yet

- 1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDDocument3 pages1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDadhishree bhattacharyaNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- +++C$C, CCC$ CDocument7 pages+++C$C, CCC$ CKomal Damani ParekhNo ratings yet

- Numericals of SalaryDocument7 pagesNumericals of SalaryAnas ShaikhNo ratings yet

- Mba 3 Sem Tax Planning and Management Jan 2019Document3 pagesMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhNo ratings yet

- Sum On Salary 27.08.2022Document3 pagesSum On Salary 27.08.2022Nilay ShethNo ratings yet

- Practice Problems On Incidence of TaxDocument3 pagesPractice Problems On Incidence of TaxPratik DesaiNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- CA Inter Taxation Mock Test - 02.08.2018 - Only QuestionDocument7 pagesCA Inter Taxation Mock Test - 02.08.2018 - Only QuestionKaustubhNo ratings yet

- Order in The Matter of M/s Sheen Agro & Plantations Ltd.Document12 pagesOrder in The Matter of M/s Sheen Agro & Plantations Ltd.Shyam Sunder100% (1)

- Logistics AccountsDocument2 pagesLogistics AccountsDavid Raju GollapudiNo ratings yet

- QP 1Document7 pagesQP 1Shankar ReddyNo ratings yet

- MTP 1Document7 pagesMTP 1Aman VithlaniNo ratings yet

- 4) TaxationDocument21 pages4) TaxationKrushna MateNo ratings yet

- Time Value of Money: Year 2008 2009 2010 2011 2012 2013Document1 pageTime Value of Money: Year 2008 2009 2010 2011 2012 2013Alissa BarnesNo ratings yet

- TVM QuestionsDocument4 pagesTVM QuestionsSultan AwateNo ratings yet

- IT OS Part 5Document4 pagesIT OS Part 5Business RecoveryNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- 4.1 Questions On Income From SalaryDocument4 pages4.1 Questions On Income From SalaryAashi GuptaNo ratings yet

- BC 501 Income Tax Law 740766763 PDFDocument15 pagesBC 501 Income Tax Law 740766763 PDFSakshi JainNo ratings yet

- Nirmal Multiple CampusDocument2 pagesNirmal Multiple CampusSabitaNo ratings yet

- Tut Q Extra TrustDocument3 pagesTut Q Extra Trustchunlun87No ratings yet

- Journalizes transactions and prepares ledger and trial balanceDocument7 pagesJournalizes transactions and prepares ledger and trial balanceLowzil AJIMNo ratings yet

- PFTP - Unit II - Income From Salary - Short SumsDocument3 pagesPFTP - Unit II - Income From Salary - Short Sumsgeetagupta2974No ratings yet

- CA Inter Group 1 Accounts MarathonDocument33 pagesCA Inter Group 1 Accounts MarathonNikitaa SanghviNo ratings yet

- FM TVM Practice Questions G5jmfcwesn PDFDocument2 pagesFM TVM Practice Questions G5jmfcwesn PDFValiant MixtapesNo ratings yet

- 2015 12 SP Accountancy Unsolved 07Document6 pages2015 12 SP Accountancy Unsolved 07BhumitVashishtNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- FINAL 2021 Financial Performance Analysis For MICROSOFT INC Company - R3Document20 pagesFINAL 2021 Financial Performance Analysis For MICROSOFT INC Company - R3Nicole BabatundeNo ratings yet

- Annual Report 2018 PDFDocument288 pagesAnnual Report 2018 PDFАндрей СилаевNo ratings yet

- Financial Management 2E: Solutions To Numerical Problems Rajiv Srivastava - Dr. Anil MisraDocument8 pagesFinancial Management 2E: Solutions To Numerical Problems Rajiv Srivastava - Dr. Anil Misramanisha sonawaneNo ratings yet

- Sinergi dan Transformasi untuk Pertumbuhan BerkelanjutanDocument447 pagesSinergi dan Transformasi untuk Pertumbuhan BerkelanjutanNimas PandanwangiNo ratings yet

- Investment in AssociateDocument2 pagesInvestment in AssociateChiChi0% (1)

- Metro Manila College: College of Business and AccountancyDocument8 pagesMetro Manila College: College of Business and AccountancyJeric TorionNo ratings yet

- 2004-Lewis and Pendrill - Current Cost Accounting Developed-Chapter - 17Document31 pages2004-Lewis and Pendrill - Current Cost Accounting Developed-Chapter - 17EkralcdNo ratings yet

- Chevron Annual Report SupplementDocument64 pagesChevron Annual Report SupplementVictor RattanavongNo ratings yet

- Cost of CapitalDocument4 pagesCost of Capitalkomal mishraNo ratings yet

- Capital ManagementDocument61 pagesCapital Managementra2002ma2002931No ratings yet

- 2 AssignmentDocument14 pages2 AssignmentHira NazNo ratings yet

- Executive Summary HarleyDocument25 pagesExecutive Summary HarleyYusra Iqbal100% (1)

- LQ 1 Sec C Solution PDFDocument14 pagesLQ 1 Sec C Solution PDFmaria evangelistaNo ratings yet

- Financial Planning and Forecasting Brigham SolutionDocument29 pagesFinancial Planning and Forecasting Brigham SolutionShahid Mehmood100% (6)

- Glorious 44 YearsDocument349 pagesGlorious 44 YearsKhushboo MehtaNo ratings yet

- Form 2306 Witn Computation Electric BillDocument5 pagesForm 2306 Witn Computation Electric BillLean IsidroNo ratings yet

- Corporation Law Before Midterms ReviewerDocument219 pagesCorporation Law Before Midterms Reviewertit2pNo ratings yet

- Full Download Fundamentals of Investments Valuation and Management 8th Edition Jordan Solutions ManualDocument36 pagesFull Download Fundamentals of Investments Valuation and Management 8th Edition Jordan Solutions Manualtapergodildqvfd100% (39)

- Sealed Air Corporation's Leveraged Recapitalization (A)Document10 pagesSealed Air Corporation's Leveraged Recapitalization (A)Ramji100% (1)

- Cpareviewschoolofthephilippines ChanchanDocument8 pagesCpareviewschoolofthephilippines ChanchanDavid David100% (1)

- Zaas Ventures Ltd Memorandum of AssociationDocument20 pagesZaas Ventures Ltd Memorandum of AssociationAtiqur SobhanNo ratings yet

- Alliance Concrete Case QuestionsDocument1 pageAlliance Concrete Case QuestionsS r kNo ratings yet

- FAR Dry Run ReviewerDocument5 pagesFAR Dry Run ReviewerJohn Ace MadriagaNo ratings yet

- Assignment - Karla Company Provided The Following Information For 2016Document1 pageAssignment - Karla Company Provided The Following Information For 2016April Boreres33% (3)

- Netherlands IntlestateDocument18 pagesNetherlands IntlestateAnonymous OuFPXbCNo ratings yet

- Quiz 2Document10 pagesQuiz 2simcity23No ratings yet

- Internship Project at NTPC KanihaDocument73 pagesInternship Project at NTPC KanihaRABI KUMAR SAHUNo ratings yet

- Financial Management Chapter ReviewDocument11 pagesFinancial Management Chapter ReviewkarynNo ratings yet

- Below Are Balance Sheet, Income Statement, Statement of Cash Flows, and Selected Notes To The Financial StatementsDocument14 pagesBelow Are Balance Sheet, Income Statement, Statement of Cash Flows, and Selected Notes To The Financial StatementsQueen ValleNo ratings yet

- NJ Mutual Fund Project On Wealth CreationDocument62 pagesNJ Mutual Fund Project On Wealth CreationSandeepMishra100% (1)