Professional Documents

Culture Documents

INTB 3351 - Final Exam Review

Uploaded by

Kaga KamamiyaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INTB 3351 - Final Exam Review

Uploaded by

Kaga KamamiyaCopyright:

Available Formats

INTB 3351 Final Exam Review

Week 8 Study Guide Monday, 10/10 On-Line Video: The Prize: Crude Diplomacy (links to streamed clips in Week 8 folder) 1. How did the United States beat out Great Britain in establishing and solidifying the special relationship with Saudi Arabia? What were the key events? - September 14, 1939, Americans suspected that there were British anthropologists disguised as bug hunters. US have been relying on the British to maintain stability in the Middle East and an environment in which private companies could operate. US were afraid that the British would use their political connections with the king of Saudi Arabia to push the US Company out. But the British could have gotten the oil if they really wanted to. Instead, the British told Saudi Arabia to take the American money because they dont have any oil there. Fortunately, the American company SOCAL received the concession because they were not a party to the Red Line agreement. -Washington had a fear of an oil shortage, the security and availability of Saudi oil took on urgent significance. In the middle of WWII American government realized that oil was important for military strategy. - Harold Icke encouraged oil companies to help production grow in Saudi Arabia and the government were to not intervene. Ickes sent Americas leading geologist to Saudi Arabia to assess the potential of the new oil discoveries and he declared that the Middle East would oils new center of gravity. The oil in this region is the single greatest prize in all history. - President Roosevelt arranged to meet the desert ruler to establish a relationship between two countries. At the meeting, oil and Israel were introduced and discussed together for the first time. The King was interested in Roosevelt when he stated the idea of creating the state of Israel in Palestine. The King said it would make more just to create the state in Germany after the war. - New relationship grew Roosevelt had given the King a DC3 airplane. -British heard about this gift and decided to give a customized Rolls Royce to the King. They went through a lot of pain in customizing it but ended up unsatisfying the King by misplacing the steering wheel which meant dishonor. 2. Describe the relationship formed between U.S. major oil firms and American government in the Middle East after World War II. - President Truman created the Marshall Plan, a massive American Aid Program that would help rebuild devastated Europe and contain Communism. This was where the Arabian oil played its part. - Oil companies would deliver and become vehicles of the national interest in foreign oil. National Interest was oil from the Middle East for Europe and Japan for Economic recovery which was crucial to stability, to democracy and to the containment of Communism in Asia.

- A new relationship was emerging between the US and Saudi Arabia. There was a clear policy within the government rapid oil development in the Middle East was a good idea because it would conserve resources in the Western hemisphere so anything to support Saudi Arabia was a good idea. - Access to oil was vital to Saudis economic development and the American relationship to Saudi was very important to security. Saudi Arabia was encircled and the King needed help so he turned to America. - The Middle East took over fueled Europe and Japan. The rest of the world was following US thus leaving the world in more need of oil, shifting from coal to oil. The world needed more Saudi oil. - ARAMCO expanded and the American governments position was to stay out of the oil business but to reinforce things the companies did. Frequently when companies ask for policies to pass. The official response was no objections code word for the government supporting you. - Establishment of State of Israel puts American government in an awkward position. The oil companies take revision over oil and build relations with Saudi - ARAMCO. US government has to take care of its actions. - Companies dealing with the state department were in secret meetings. 3. How was the Iranian Consortium a culmination of thirty years of effort to control world supply by the major oil companies? What were the obstacles to this effort? - Bring Iranian oil to world market in a orderly fashion (by America government). Build viable control of world oil. 8 major and 9 independent oil companies. Americans reluctant to be drawn in to unstable politics in iran. By handling management of iran increasing oil output, hoping to stabilize iran. Obstacles = anti-trust laws. Anti-trust suit against major oil companies by USA dept of justice. In the end govt had to choose increase competition and national security. chose Security and stability in middle east and oil markets over uncertainties created by increased competition 4. What was the effect of the oil system established in the 1950s? Who did it work for, and against? - 20 years of cheap oil prices for the West but 20 years of military dictatorship for the Iranian people. The question of Who did it for and against?- Depends on where one stands. - In economic terms things were getting better for oil producing countries. Revenues were rising rapidly and economies were growing fast. But if you lived in one of those oil countries, the Western companies still looked imperial and impregnable. Nationalism was rising and as the western world was growing more on the dependent of oil. The balance of power was shifting from the companies to the countries. TERMS: IBN Saud - Founder of the Kingdom of Saudi Arabia who, with the help of Wahhabi Islamist warriors, conquered the region of Arabia. 50-50 split - Saudi Arabia, following the actions Venezuela undertook, demanded a 50% share of the profit the oil made. Aramco agreed but wrote the payment off on their taxes as a foreign tax Anglo-Iranian Oil Company - Founded in 1908 and later became BP. Mohammad Mossadegh - Democratically elected Prime Minister of Iran who nationalized the Anglo-Iranian Oil Company and her oil fields

Wednesday, 10/12 Reading: Anthony Sampson, The Seven Sisters, pp. 104-166 (PDF file in Week 8 folder) 1. How and why did the American oil companies, Socal (Chevron) and Texaco, gain the oil concession in Saudi Arabia, as opposed to the other major oil companies? Why was the ruler of Saudi Arabia eager to do business with the Americans? (pp. 104-109) --They were not party to the Red Line Agreement, which prevented other companies from exploring alone in Saudi Arabia. --Acting on behalf of London syndicate speculating in oil concessions in the Middle East, Frank Holmes approached British Petroleum (BP) about oil prospects in Bahrain but turned down the offer due to oil already discovered in Iraq and Iran. Holmes than approached Exxon but Teagle rejected the rights to the oil concessions for $50,000. Holmes then approached Gulf who paid the $50,000 and sent their own geologist to the field. However, due to the Red Line agreement Gulf was unable to go through on their own as the other members of the agreement expressed no interest. Socal, an American company bought the $50,000 option from Gulf and sent in their first geologist to Bahrain and in 1931 struck oil. t. John Philby (who suggested that the King exploit the countrys natural resources), arranged a meeting with philanthropist Charles Crane who than arranged for an American geologist, Karl Twitchell, to prospect for minerals. Twitchell was encouraged by what he saw and approached several American companies regarding oil exploration on the Kings behalf. One by one he was turned down until Socal engaged him as their adviser. Socal also offered Philby a reward if he was able to broker a deal on Socals behalf. At this time, after the discovery of oil in Bahrain which provided sufficient evidence for oil in Arabia, Sir John Cadman of BP insisted on the IPC to prospect together in Arabia. The IPC was more concerned about keeping the Americans out rather than drilling for oil and offered the King only 10,000 not in gold. Socal, advised by Philby, offered a better deal for the King: an immediate loan of 30,000 with another 20,000 eighteen months later and an annual rent of 5,000 all in gold. The King agreed and Philby was given 1,000 as a reward from Socal. As drilling commenced in Arabia and oil came into production in Bahrain, Socal realized it was short on capital and marketing outlets. They found a partner who was not bound by the Red Line agreement in Texaco which bought a half-share in both Bahrain and Arabia. The British were only willing to give the King rupees whereas the Americans were willing to pay more and in gold, which the King desired. 2. What were the two opposite foreign policies of the United States in the Middle East? What was the U.S. State Departments solution? (pp. 119-125)

--The two opposite foreign policies of the US in the Middle East was the support of the state of Israel, which was critical for votes at home and honor, and Arabia, which was critical for oil. The State Departments solution was to delegate their diplomacy in the oil countries as far as possible to the oil companies, and to regard them as an autonomous kind of government. 3. How and why were the major U.S. oil companies able to avoid criminal anti-trust convictions for their join agreements in the Middle East? (pp. 144-150; 158-159) --Due to the nationalization of oil in Iran by Mohammad Mosaddegh, the case against the seven sisters was reduced from a criminal case to a civil one (which was dropped) because of the issue of national security due to the fear of Communism spreading into Iran. 4. How did the major oil companies use their control over the Iranian concession to control the global supply of oil? (pp. 155-159) --They agreed to restrict oil production from Iran to avoid a worldwide glut. --The oil companies followed a formula called Aggregate Programmed Quantity whereby, for example, if Exxon or Texaco wanted less oil in Iran due to their commitments in Saudi Arabia, BP and Shell would have to restrict their production by the same amount. They agreed to restrict oil production from Iran to avoid a worldwide glut. TERMS ( IDENTIFY BY HISTORICAL SIGNIFICANCE, TIME, AND PLACE ) Harold Ickes (P 113-119) - Secretary of the Interior who held the post of Petroleum Administrator for War. Fifty-Fifty Deal (P 129-131) - Perez Alfonsos plan by which the Venezuelan government and oil companies should have a 50-50 share in all oil profits. Golden Gimmick (P 132) - Aramcos scheme to get around the double taxation of its corporate income. The share of the profit given to the King of Saudi Arabia was considered as a foreign income tax which was deducted from the companys tax bill. Posted Price (P 133) - Price at which companies would sell their oil to anyone and on this price would be based the taxes paid to each government. Suez Crisis (P 164-166) - An offensive war fought by France, Britain, and Israel against Egypt after Gamal Abdel Nasser nationalized the Suez Canal. It began as a result of Israeli military action against Egypt in the Sinai and Suez Canal zone. Lecture Outline Please fill out as much information as you can that was discussed in the lecture The Globalization of Oil, 1945-1986 1. Post-WWII Supply System Saudi Arabia Aramco (Arab American Oil Company) Tapline and Truman Doctrine 50-50 Split Iran Anglo-Persian Oil Company (BP) Overthrow of Mossadegh

Suez Crisis (1956) Challenge from Mattei and ENI 2. Rise of OPEC Changes in world oil economy in the 1950s Founding and strengthening of OPEC in 1960s OPEC Embargo (1973) First Oil Shock Rising prices, re-negotiations of oil concessions in the 1970s, NOCs Iranian Revolution (1979) Second Oil Shock 3. OPEC Undermined Growth in non-OPEC production: Alaska, North Sea, Mexico OPEC failed to enforce production quotas Oil price collapse, 1985-1986 TERMS Concession - right to natural resources Aramco - is the state-owned oil company of the Kingdom of Saudi Arabia. It ranks first among oil companies worldwide in terms of crude oil production and exports, and natural gas liquids (NGL) exports, and is among the leading producers of natural gas OPEC - the Organization of the Petroleum Exporting Countries (OPEC) was founded in Baghdad, Iraq, with the signing of an agreement in September 1960 by five countries namely Islamic Republic of Iran, Iraq, Kuwait, Saudi Arabia and Venezuela Ghawar - The Ghawar Oil Field is by far the largest conventional oil field in the world and accounts for more than half of the cumulative oil production of Saudi Arabia. Enrico Mattei - owned the world's sixth largest oil company and to play a leading role in the oil industry Muammar al-Qaddafi - Former Libyan political leader. Week 9 Study Guide Monday, 10/17 On-line Video: The New Age of Wal-Mart, entire (CNBC, streamed at Hulu.com) http://www.hulu.com/watch/103756/cnbc-originals-the-new-age-of-walmart#s-p1-so-i0 *Watch for discussion that opens on Thursday, October 20 1. Why has Wal-Mart become such as divisive force in communities across the United States? How would you describe Wal-Marts relationship with its workers?

--Walmart has become big because they drive out small competition with their low prices. They research the area of a city: traffic flow, location , etc. and they employ many unemployed workers by opening new stores. The relationships with their workers are on rocky terms as there have been many unions lately. Workers feel that due to Walmarts huge success that they should be paid more and have better benefits like health care. 2. How would you describe the companys relationships with overseas suppliers? Is Wal-Mart responsible for the exploitation of foreign workers? Are workers in foreign sweatshops exploited? --Walmarts relationship with overseas suppliers is poor. Its because their international success has put pressure on employees in factories to meet with the demands of Walmart forcing them to work on low wages, poor conditions, and working overtime as long as 24 hours. 3. How did Wal-Mart overhaul its U.S. stores and corporate organization in recent years? Was this just an image makeover, or has it changed more than its image? What hasnt changed? --By promoting that they were becoming environment-friendly through recycling of products. They do have recycling centers to prove their attempt at an image change, but there are still some people that believe it is just at PR stunt. Its desire to drive down costs hasnt changed. Wednesday, 10/19 The End of Bretton Woods and the Long Stagnation Reading: Rodrik, The Globalization Paradox, pp. 76-88, 101-111 1. What were the two developments that undermined the Bretton Woods Consensus? As world trade and finance expanded, the policy space contracted, The IMF proved inadequate. The US fixed exchange rates could no longer be sustained. The two developments that undermined the Bretton Woods Consensus were free capital flows and market demanded exchange rates. (pg 104) What replaced the Bretton Woods system? (pp. 101-104) 2-an agenda of deep integration on free capital mobility wcxould replace the b.w. compromise, floating exchange rates as well as no capital controls. 2. Why did the international economic system become so unstable after 1973? 1. 3 Major cycles of dollar depreciation followed by appreciation. Ups and downs to the pound that were superimposed. Floating currencies became a source of instability rather than a safety valve for the international economic system. 2. Oil shock (1973 first oil shock) and stagflation (pg 101)

Do you agree with Rodriks analysis, or might you think of other factors that contributed to this instability? (pp. 106-111) Please answer in red font color 3. Why did the World Trade Organization (WTO) come to replace GATT? The WTO envisaged both a significant ramping up of ambitions with respect to economic globalization and a dramatic re-balancing of nation states domestic and international responsibilities. Why has the WTO been so controversial? (pp. 76-84) Among many reasons the WTO was accused of discrimination, and lack of enforcement of rules. Developing countries felt cheated by the Uruguay round and the US locked horns with the European union and Japan over the dismantling of agricultural subsidies and barriers. -[P Terms Washington Consensus (p. 77): Belief system that combined excessive optimism about what markets could achieve on their own with a very bleak view of the capacity of governments to act in socially desirable ways. Governments stood in the way of markets and had to be cut down in size. Doha Round (p. 82): Development Round. Agriculture-centered round that focused on the needs of developing countries and helped isolate the European Union. James Tobin (pp. 107-108): a Keynesian economist at Yale. He argued that capital mobility prevented nations from pursing monetary and fiscal policies that differ from those in other economies and therefore undermined the conduct of policies appropriate to the domestic economy. He also argued that large shifts in funds across nations or large movements in exchange rates have serious and painful real internal economic consequences. He proposed two solutions: adopt a single world currency and emulate globally what was true domestically or, the more realistic one, tax international currency transactions-Tobin tax Timeline 1950 Tab: End of Bretton Woods (1968-1971) By late 1960s. the Vietnam War was hurting the US economy and undermined US political and economic power in the world. Rather than raising taxes to finance the war, the gov borrowed and printed money, which pushed pries and interest rates up and fueled a mounting inflationary spiral. Combined with US foreign investment and increasing oil imports, and foreign competition, spending on the VN War created gold crisis in 1968. With the $ fixed in value at $35/ounce and an excess of dollars floating around the world (which meant their market value was probably a lot less than $35/ounce), foreign banks began exchanging their dollars for gold. This put pressure on the BW System of fixed exchange rate and hampered the ability of US to cont prosecuting the VN War. Led to Pres Nixon to respond, removing the surcharge in return for obtaining new world monetary arrangements. The new arrangements terminated the fixed system of monetary exchange rates established by BW. Currencies were no longer fixed by government policy in relation to each other, they were allowed to float. Debt Crisis of the 1980s (1982-1989)

The origins of the debt crisis of the 1980s may be traced back to and through the lurching efforts of the worlds gov to cope with economic instabilities of the 1970s. This story is familiar, even if arguments persist about how much space to give to each cause; the severance of the dollar-gold linkage in 1971, the shift of floating exchange rates in 1973, etc that brought a sharp rise in world interest rates and sustained appreciation of the dollar. By late 1970s, developing countries were able to borrow freely in rapidly growing international private credit markets, at low interest rates that were for a while negative in real terms. Money-center banks had received large deposits from oil-exporting countries and the saw oil-importing developing countries as a prime mkt for increased lending. Many countries took advantage and external debt cont to rise both absolutely and in relation to output. The Brady Plan (1989) Beg in 1989, agreements brokered by Nicholas Brady, US Secretary of the Treasury, turned commercial loans to indebted Third World gov into tradable bonds, which facilitated risk-spreading and trading of emerging market debt, assisted b Plaza Accord (1985) The Plaza Accord was made at Plaza Hotel in NYC by gov of France, West Germany, Japan, US, and UK to devalue US dollar in relation to Jap yen and German Deutsche Mark by intervening in international currency markets. Purpose of devaluation was to reduce US current account deficit and help US reemerge from recession. Higher value of the dollar made US industry less competitive in world market and transmitted inflation to US trading partners. It succeeded in reducing the US trade deficit with W Europe but NOT with Japan due to Jap re-structural restrictions on imports. (Louvre Accord in 1987 successfully reduced USD in relation to Jap yen). End of the Cold War (1989-1991) Cold War began to break down in late 1980s during Soviet leader Gorbachev. He dismantled the totalitarian aspects of the Soviet system and began efforts to democratize the Soviet political system. In late 1991, the Soviet Union collapsed with 15 newly independent nations were born from its corpse, including a Russia with a democratically elected anticommunist leader. Birth of the Internet World Wide Web (1990) WWW is a system of interlinked hypertext docs contained on the Internet. Using concepts from earlier hypertext systems, English physicist Berners-Lee, new the Director of WWW Consortium, wrote a proposal in March 1989 for what would eventually become the WWW. 2000 Tab: World Trade Organization (1995) WTO is the global international organization dealing with the rules of trade between nations. At its heart are the WTO agreemtns and its goal is to help producers of goods and services,, exporters, and importers conduct their business. Previously known as GATT. Seattle WTO Protest (1999) In Nov 1999, at a WTO ministerial meeting in Seattle, estimated 100 000 protesters turned out to denounce corporate led free trade agreemtns brokered by the WTO. It was a significant movement in the history of popular protests, disrupting the meetings of the worlds most influential trade-governing body. Although most activists were protecting the unfairness of the established model of free trade and globalization not international trade and globalization itself, the media portrayed the battle of Seattle as an expression of an antiglobalization movement. Lecture Outline Please fill out as much information as you can that was discussed in the lecture

The Emergence of the Second Global Economy, 1971-1998 Gold crisis Expansion in U.S. government spending and outflow of dollars resulting from: Keynesian, full employment policies. Growing U.S. trade deficits and oil imports. Increasing FDI by U.S. MNCs Massive military spending: Nuclear arms and space races Vietnam War Guns and Butter rather than increasing taxes to pay for military expenditures in 1960s, U.S. government borrowed and printed money This led to a dollar glut in world economy, an overvalued dollar (in relation to gold), and thus a mounting gold crisis. End of Bretton-Woods System (1969-1971) 1961-1968: Foreign central banks and investors cashed in $7 billion in gold, draining 40% of U.S. gold reserves. January 1968: Foreign central banks made a run on U.S. gold (selling overvalued dollars for gold) U.S. business and financial interests moved in opposition to Vietnam War, which undermined presidency of Lyndon B. Johnson. 1969-1970: Efforts to relieve pressure on dollar and halt the run on gold failed. Options: Cut U.S. government spending to prop up dollar. Raise interest rates to prop up dollar. End the dollar-for gold promise. 1971: President Richard Nixon suspended convertibility of dollars into gold and imposed 10% import surcharge (to ease balance of payments deficit), thus terminating the Bretton Woods monetary arrangements. Post Bretton Woods End of Long Boom: Short term: Stagflation(recession and inflation at the same time) Long term: Long Downturn World GDP growth rate: 1950-1973 5% 1973-2002 2.7 o Increased Global Capital Flows: After collapse of BWS, managed and then floating currency rates. Removal of capital controls. Increased international flows of short-term capital. Chronic financial crises in global economy. Recycling of Petrodollars

o Oil state petrodollar deposits (1973-1981: $500 billion) made possible a huge lending spree by U.S. commercial banks to NICS and oil-importing Third World governments, which needed to borrow to finance imports. o Massive arms purchases by Middle East oil states using petrodollars o U.S. arms sales abroad: 1960s - $2 billion/year 1970s - $17 billion/year o In effect, oil shocks resulted in a large transfer of money from U.S. consumers to oil states, oil companies, international banks, and U.S. defense industry. Second Oil Shock o The Iranian Revolution disrupted crude oil exports, sending crude oil prices to $40/barrel. o Soaring oil prices intensified inflation. o Iran and inflation generated domestic and foreign policy crises for incumbent Democratic U.S. president, Jimmy Carter. o Election of Republican Ronald Reagan in 1980. Reagan Revolution o Ronald Reagan (U.S. president, 1980-1988) is usually credited for three things: Free market reforms: tax cuts and deregulation. Supply Side or Trickle Down economics (Reaganomics); belief that cutting taxes and social spending will create investment and jobs; tax cut effect will trickle down from investors to workers. Took deregulation beyond airline industry to savings and loan industry, natural gas industry, and other parts of the economy. Relaxed anti-trust enforcement, thus permitting large mergers and acquisitions movement, restoring profitability in some industries. Anti-union: Reagan favored breaking the power of organized labor, thus serving to limit wage increases. Ending the vicious cycle of inflation. Ending the Cold War. o Credit given to Reagan on items #2 and #3 is debatable, but main point is that all were important in bringing about the Second Global Economy. Emergence of Second Global Economy, 1980-1998 Process 1 o Shift from Keynesianism to Monetarism (1980-1998) Focus on maintaining price stability or a balance between supply and demand for money; getting prices right rather than pursuit of full employment although deficit spending did not go away. Strongly favored financial community and investors; tolerance of higher unemployment, hard line against wage increases. Huge upward redistribution of income. o Growth of international financial markets made deficit financing easier for nations not in serious debt. o However, nations in serious international debt still faced problems . . . Volcker Counter-Shock created Third World debt crisis (interest burden on sovereign debt exploded; base rate for Third World debt increased from 10 to 20%). 1982 Mexico (interest rates soared; petroleum sales declined) defaulted on foreign debt; within weeks, private lending to developing world dried up. As lending ended and governments scrambled to pay debts, Latin America, one of the hardest hit regions, suffered net outflow of capital, resulting in The Lost Decade of the 1980s. Brady Plan (U.S. Secretary of the Treasury Nicholas Brady) of the late 1980s:

Agreements brokered by U.S. Treasury turned commercial loans to Third World governments into tradeable bonds; facilitated risk-spreading and trading of emerging market debt, assisted by new loans from the IMF . . . in exchange for indebted countries undertaking structural adjustment reforms. o Structural adjustment called for reduced trade barriers, restriction of credit, greater openness to foreign investment, elimination of capital controls, privatization, lower taxes, and reduced government regulation as conditions for renegotiating debt. o World Bank began to coordinate with IMF on imposing structural adjustment on indebted Third World countries. o Also known as neo-liberal reform, market fundamentalism, or Washington Consensus. o Free Trade Agreements (i.e. NAFTA, Mercosur, CAFTA) often packaged with structural adjustment. o Together, these developments forced open highly regulated economies. Growth in cross-border trade and investment. Emergence of Second Global Economy, 1980-1998 Process 2 o High interest rates from Volcker Counter-Shock induced economic recession in developed nations. o Energy conservation measures and new oil discoveries (Mexico, North Sea, etc.), combined with recession, reduced demand for oil. o Oil price collapse, 1985-1986, undermined Soviet economy, which had become increasingly dependent on oil exports to pay for imported goods. Cost Russia $20 billion/year. o Collapse of Eastern European communism and Soviet Union in 1989-1991 > End of the Cold War. o Collapse of communism and End of the Cold War eliminated alternative development model and alternative sources of aid for Third World nations. o Third World nations transformed themselves into emerging markets. China accelerated market reforms begun in 1978. o British Prime Minister Margaret Thatcher: There is no alternative (TINA) to the Western capitalist model. Free markets, free trade, and capitalist globalization are the only way for societies to modernize themselves. Francis Fukuyama (neo-conservative policy intellectual): The End of History (1990) o Celebration of market triumph. End to ideological conflict. Liberal (representative) democracy and freemarket capitalism are the final destination of history: o The end of history will be a very sad time. The struggle for recognition, the willingness to risk one's life for a purely abstract goal, the worldwide ideological struggle that called forth daring, courage, imagination, and idealism, will be replaced by economic calculation, the endless solving of technical problems, environmental concerns, and the satisfaction of sophisticated consumer demands. In the post-historical period there will be neither art nor philosophy, just the perpetual care-taking of the museum of human history. Terms Petrodollars - The money that oil exporters receive from selling oil and then deposit into Western banks. Petrodollars are also known as petrocurrency. Reaganomics - called for widespread tax cuts, decreased social spending, increased military spending, and the deregulation of domestic markets. Paul Volcker - From 1969 to 1974, he was Undersecretary of the Treasury for Monetary Affairs. His five-and-ahalf-year tenure covered a period of rapid change in international and domestic financial affairs. Brady Plan - the principles of which were first articulated by U.S. Treasury Secretary Nicholas F. Brady in March 1989, was designed to address the so-called LDC debt crisis of the 1980's. The debt crisis began in 1982, when a number of countries, primarily in Latin America, confronted by high interest rates and low commodities prices, admitted their inability to service hundreds of billions of dollars of their commercial bank loans.

Structural Adjustment - economic policies which countries must follow in order to qualify for new World Bank and International Monetary Fund (IMF) loans and help them make debt repayments on the older debts owed to commercial banks, governments and the World Bank. TINA (There is No Alternative) - This is the mantra chanted by 'dries' during the prime ministerial reign of Margaret Thatcher, by which they demonstrated their belief that free-market capitalism was the only possible economic theory. Week 10 Study Guide Wednesday, 10/26 Reading: Rodrik, The Globalization Paradox, 144-149, 159-170 Lichtenstein, Wal-Mart: A Template for 21st Century Capitalism (PDF in Week 10 folder) 1. How would you compare the performance of nations that followed a model of export-manufacturing vs. those that pursued import-substitution industrialization (ISI)? What lessons should be drawn from this comparison about development strategies for nations in a global economy? (Rodrik, 144-149, 159-170) -Model of export-manufacturing: required an active government to stimulate the creation of new industries. The government began to promote export-processing zone (EPZ) scheme, using tax incentives, import-duty exemptions, and weaker labor rules.=> Producers could overcome the limitations of the small home market by exporting to the world. -Import-substitution industrialization: relying mostly on the domestic market to fuel growth. They had maintained highly restrictive trade. The strategy focused on replacing previously imported goodsinitially simple consumer goods, but eventually more sophisticated capital goods as wellby domestic production. This goal was to be achieved through an array of government interventions, in the form of import protection, credit subsidies, tax incentives, and public investment. The strategy placed little emphasis or confidence in the ability of domestic firms to export and compete on world markets. -Compare: economy wide productivity grew more rapidly in import-substituting Latin America than it did in export-oriented East Asia. Latin America's economies expanded at a slower clip than East Asia's not because they experienced slower technological progress but because they invested a lower share of their national income. -Sachs and Warner divided countries into two groups: those that were open to international trade and those that were closed. Their central result was that countries in the first group grew 2.45 percentage points faster over the longer term (in per capita terms) than those in the second. Lessons: - Lowering barriers to trade alone would spur growth - If you want to catch up with the living standards of the advanced nations, there exists no instrument more potent than reducing your import tariffs and relaxing other restrictions on trade.

2. Why is Wal-Mart so big? What is the source of Wal-Marts market power? (Lichtenstein, pp. 9-13) Why? B/c it has an good emphasis on customer attention, cost controls, and efficiencies in its distribution networks help Wal-mart become the huge retailer What? - Wal-mart innovate a new span of control in supply chain which has been a worldwide logistic revolution -Wal-mart is functionally linked itself to supply firms, making it not simply a huge retailer, but increasingly a manufacturing giant in all but name. -Its purchasing power is so immense; Wal-Mart has transformed its 3 thousand Chinese suppliers into powerless price takers, rather than partners 3. How is Wal-Mart a product of a particular kind of politics and culture? (Lichtenstein pp. 13-22) Politics: -Walmarts success in establish a pervasive low-wage standard in big-box retailing. -The company take advantage of the agricultural revolution of the early postwar ear, depopulating Arkansas farms, and putting 10 thousands losing jobs. When the new highways build, it brought a far larger group of potential consumers within the reach on the small, but growing, commercial centers. And, these same highways enabled non-metropolitan retailers to build and service the large, efficient warehouses necessary for discount operations. -The failure of labor law reform in 1978, followed by the PATCO debacle in 1981, meant that unionism would not be much of a threat in discount retailing. -The failure of the Cliton health insurance give Wal-Mart advantage to continue to externalize these labor costs. -Free trade legislation (WTO) give Wal-Mart advantage of global market in Sweatshop labor. Culture: -Wal-Mart has proven remarkably successful in propagating a distinctive brand of Christian entrepreneurialism and faux egalitarianism -Wal-Mart executives have played a systematic role in translating a Reagan-era conservative populism into a set of ideological tropes that work effectively to legitimize Wal-Marts hierarchical structure and insulate most employees from other calls upon their loyalty 4. Where and why has Wal-Marts expansion not always gone smoothly? (Lichtenstein, pp. 22-24) Where? europe Why? -The companys business model is largely dependent upon the strength or weakness of the regulatory employment regime that it encounters. -different political and cultural Ex: +UK: enforce zoning ange green belt laws to protect farmers and other domestic producers from getting hurt by Wal-Marts squeeze on its supply chain

+Germany: Wal-mart fial to achieve a competitive advantage b/c stringent planning and zoning regulations have hindered green field expansion or urban remolding of existing store. Restrictive shopping-hour regulations, and Antitrust regulationshave restricted price competition and eviscerated Wal-Mart efforts to squeeze German suppliers. 5. What are some of the key differences between General Motors (GM), the leading American company in the mid-twentieth century, and Wal-Mart, the leading American company in the early 21st century? (Lichtenstein, pp. 24-28) Answer 1: Wal-mart has a radical transformation of reward, incentives and values than GM. -Wal-mart pay over time, GM not -Wal-mart not afraid to hire thousand of new workers each year. -Wal-mart pay more for their store managers that GM Answer 2: But these differences are less apparent than real. GM did manufacture lots of cars, but its franchised dealer system, which was always kept on a tight leash, sold them by the millions, and its wholly owned GMAC subsidiary financed them, and sometimes made as much profit as did the production side of the corporation. WalMart started off as a retailer, but as this essay has tried to demonstrate, the increasingly intimate relationship between the discounter and its suppliers is transforming Wal-Mart into a defacto manufacturing company. ANswer 3: While Walmart is a Protestant firm, GM is a unionized firm. Walmart employs retirees, youth-aged workers, who dont need a stabel income to support a households, discriminate against women workers, all in an efforts to squeeze prize. GM, while also squeezing prices, but also give in to wage increase request from employees, e.g. Treaty of Detroit. Terms: East Asian Miracle (Rodrik, p. 144-146) - Not only Japan but the seven other East and SouthEast Asian economies that had grown rapidly since the 1960s. South Korea, Taiwan, Honk Kong, Singapore, Malaysia, Thailand and Indonesia. None except Honk Kong were free Market Economies, all had state coordination. Export-processing zone (EPZ) (Rodrik, p. 162) - Starting in 1970, the government began to promote export oriented firms under a Scheme using tax incentives, import-duty exemptions, and weaker labour rules. Pull System (Lichtenstein, pp. 11-12) - Manufacturing system in which production is based on actual daily demand (sales), and where information flows from market to management in a direction opposite to that in traditional (push) systems. Shenzhen (Lichtenstein, p. 12) - Chinas first and most successful Special Economic Zones Students in Free Enterprise (SIFE)- is an ideological formation that propagandizes on behalf of free market capitalism within the conservative Christian world. It prepare students for entry-level management posts by linking the collegiate quest for self-esteem and humanitarian good works to an ideology of market capitalism and career advancement, Timeline: 1900 Tab: Toyota Production System, ECLA (1948-1975)

Orignially called JIT Production the Toyota Prod Sys (TPS) built on the approach created by the founders of Toyota and engineer Ohno to reorganize the manufacturing and logistics of automobiles. 1950 Tab: McDonalds (1955) The first McDonalds restaurant was started in 1948 by broterhs Maurixe and Richard McDonald in California. The number of McDonald outlets would top 1000 before the end of the decade. Boosted by steady growth, the companys stock began trading publicly in 1965. East Asian Tigers (1960s 1990s) East Asian Tigers refer to HK, Taiwan, Singapore, and South Korea, nations that rapidly developed in 1960s and susustained high growth rates until late 1990s. Following Japans successful example, the Asian Tigers developed an export-driven model of development, focusing on selling manufactured goods to highly industrialized nations. These countries became increasingly important to global economic system. Wal-Mart (1962) An emphasis on customer attention, cost ctrls, and efficiencies in its distribution networks helped WM become the largest retailer in the US in 1990. It moved into internation markets one yr later with opening a store in Mexico. Immigration and Nationality Act (1965) The Immigration and Nationality Act of 1965 was a turning point in US policy regarding immigration. Pres LBJ made a point of signing the legislation near the base of the Statue of Liberty. The act gave preference to refugees and families, removed quotas from countries in the w Hemisphere and based entry to US on levels of skill. The new act also provide for quick admittance of immigrants with needed/vital skills, such as doctors and scientists. Sweatshops (1992) Workers in Indonesia assembling nearly 14 pairs of Nike tennis shoes everyday and earning 14 cents per hr. The high level of attention to global sweatshop condition reflected more than a rise in the level of awareness. From 1980 to 1998, manufactured exports as a percentage share of total exports from less developed countries rose on average from under 20% to > 70%. NAFTA (1994) NAFTA is a trade agreement among the US, Canada, and Mexico that liberalized restrictions on trade among the 3 countries. Some of the agreements objectives include the elimination of tariff or duty rates (all qualifying products to Canada are now duty-free, and Mexico as well), the promotion of conditions of free competition, and increasing market access and investment opportunities with the free trade area. Betwe 1994-2002, trade between the 3 countries increased > 200%, and FDI in both Mexico and Canada quadrupled. However the agreement contributed to losses in US manufacturing jobs and undercut subsistence agriculture in Mexico. 2000 Tab: China Joins WTO (12/11/2001) After 15 yrs of negotiations, China became a full member of the WTO on 12/11/2001. China agreed to lower tariffs and abolish market impediments. Chinese and foreign businessmen, would gain the right to import and export on their own and to sell their products without going thru a gov middleman. Lecture Outline Please fill out as much information as you can that was discussed in the lecture The Globalization of Manufacturing Key Trendsin the last 25 years o Shift from Fordism to Lean Manufacturing or Flexible Mass Production o Revolutionized manufacturing Interchangeable parts Interchangeable workers

o Gathered all elements of production in one place o Visible Hand of corporate management Fordism o System of political economy based on mass production and mass consumption (economies of scale); linked to Keynesian policies of demand management and full employment o $5/day wage for his workers compared to other companies at that time ($1 to $1.50 per day) workers could afford to buy what they made motor car for the great multitudes In return for high wage, workers accepted highly repetitive and regimented work conditions. o General Motors developed multi-divisional form (regional and product divisions) that provided more flexibility; but still command-and-control management. o Late 1930s, labor-capital accommodation; unionization (United Auto Workers), but union demands focused on wages, not control over work. Unions became junior partner in prosperity. Lean Manufacturing or Flexible Mass Production o Companies increasingly adopted process management derived from Toyota Production System (TPS). o Cost reduction by increasing efficiency and decreasing waste in the process of manufacturing. o Focus on flow or smoothness of work. Just-in-time inventory management (if production flows perfectly, then there is no inventory). Smart automation (designing machines not to replace humans, but to aid humans in what they do best). o Greater attention to quality control. o Greater worker input and teamwork. o More value with less work. Import-Substitution Industrialization (ISI) vs. Export Manufacturing o ISI Dominant model in larger countries of Latin America, Middle East, Africa, and parts of Asia during 1950s-1970s Strategy focused on replacing previously imported goods with domestic production. Geared toward heavy industrialization for the domestic market. Use of an array government interventions: import protection, credit subsidies, tax incentives, public investment. Little emphasis on ability of domestic firms to export and compete in world markets. o Export Manufacturing Dominant model in East and Southeast Asian economies (South Korea, Taiwan, Singapore, Malaysia, Thailand, Indonesia) since early 1960s. Adopted by China in the 1990s. Domestic markets not large enough to use ISI to pursue high growth strategy in manufacturing. Often associated with free trade and comparative advantage. Removed obstacles to private investment, but used government intervention to provide cheap inputs, subsidized loans, export incentives, and gradual removal of import restrictions, which were maintained for some time to protect infant industries. Growing Competition in Global Manufacturing

o o o o o

Late 1960s: Increased competition, overcapacity, downward pressure on prices. Entry of lower-cost producers from Japan, Western Europe, and East Asia. High-interest rate policy of early 1980s strong dollar, cheaper imports hurt U.S. manufacturers. Third World debt crisis of 1980s hurt many ISI nations (especially in Latin America). 1980s-1990s: Major restructuring and downsizing in steel, autos, and old-line manufacturing industries.

Lean Manufacturing to Globalized Production o Neo-liberal reforms allowed for greater global mobility of business and capital. Pressured many developing nations to convert from ISI to export manufacturing. Asian financial crisis of 1997-1998 reinforced this trend. o Increasing, relentless pressures to compete. Development of new competitive strategies: Lean manufacturing. Outsourcing of functions offshoring. Move to non-union labor in regions without strong labor protections, especially in laborintensive industries (i.e. textiles, footwear, sporting goods, appliances, electronics). Fragmentation (smaller companies multiple foreign suppliers) as well as concentration (large conglomerates). Supply chain management; economies of speed in addition to economies of scale. o Debt-driven consumer demand in United States and other developed nations absorbed output from globalized manufacturing. o Pull production instead of push production. Shift in market-making power from manufacturers to merchants, retailers, traders, and financiers. Wal-Mart Discussion o Employs 2.1 million workers worldwide. Largest private business employer in the world. 3rd largest employing organization in the world. o Employs 1.4 million in the United States (UPS #2 and McDonalds #3, both with about 400,000). o 9,759 retail units worldwide (4,447 retail units in the US and 5,312 units outside the US, in 28 countries). o 140 million customers per week o Walton family is the richest in the world. Net worth: $93 billion. o First Wal-Mart opened in 1962 o 1960s-1970s: Regional discounter with modest buying power. Went public in 1972. o Mid-1970s to mid-1980s: balance of market making shifted in favor of big discounters like Wal-Mart. The Wal-Mart Juggernaut o Bulk buying power o High sales volumes, low profit margins, and rapid turnover. o Requires suppliers to accept Wal-Marts business strategy. o Increasingly, Wal-Mart dictates how products are packaged, shipped, and marketed. o Leader of the logistics revolution in modern age of globalization. Engineered global supply chains to be more responsive to customer demand. Wal-Mart in Perspective o REVENUE (2010): Wal-Mart #1 in Global Fortune 500 rankings: $421 billion in revenues for the fiscal year ending January 2011, up from $220 billion in 2001.

Royal Dutch Shell, Exxon, and BP 2nd, 3rd, and 4th, respectively ($300+ billion each). Nine of top 12 are oil/energy companies. General Motors #20 ($135 billion). Home Depot (#101), Target (#106), Costco (#85), each with approx. $65-70 billion. o EARNINGS or PROFITABILITY (2010): Wal-Mart #14 in list of most profitable (return on assets) global companies: $16.4 billion (Nestle #1, $32.8 billion). Almost all of the top 50 are banking, petroleum/energy, pharmaceuticals, telecoms/ infotech. Wal-Mart the only retailer in top 50. Money, oil, drugs, and digits, or MODD, are where you find the really big profits. Not retail. Wal-Mart Global Expansion o Early 1990s: Wal-Mart became a major force in restructuring large sectors of the U.S. and global economies. o Discount stores -> Supercenters -> Groceries -> International. o After 1999: bold global expansion, especially sourcing products from China. o Early 2000s: Shenzhen office established as global purchasing headquarters; global expansion of big-box stores. Global Assembly Line o Relocation of production and assembly facilities to low-wage emerging markets. o What matters is not just how effectively finished goods are produced, but how effectively global-scale production networks are built and managed. o Outsourcing: rise of global suppliers (components and semi-finished parts) who shoulder more of the risks. o Countries specialize not so much in final products, but in steps in the process of production. o Shift in source of competition from globalization of markets to globalization of production. In other words, companies compete less for markets than for access to low-cost production Sweatshop Working Conditions o Export-processing zones (Mexican maquiladoras, Chinas Special Economic Zones) typically an area of minimal or non-existent regulation. o Foreign companies, or contractors to foreign companies, with little social or political stake in the region. o Aggressive prevention of unionization. o Tolerance of child labor. o Little regulation, or enforcement of regulation, over air pollution, industrial and household waste, groundwater contamination, etc. o Poor or non-existent social services: education, public health, infrastructure. o Can create zones for social predators, organized crime, culture of violence, and devaluation of human life. Femicides (systematic killing of women) in border town of Ciudad Juarez: Since 1994, by various estimates, hundreds of women missing and more than 500 brutally murdered. Domestic violence and targeted violence surrounding narcotics trafficking. o Pressure from labor, student, and human rights organizations has forced many companies to monitor, voluntarily, the factories of their contractors. o Nicholas Kristof, NYT columnist: the challenge is not that sweatshops exploit too many people, but that they dont exploit enough. Do you agree? o Relatively high wages. Possibility for social and economic advancement. o Diminishing opportunities to earn a living in agriculture. Massive pools of surplus rural workers with no fallback options. o Thus, chance to escape rural poverty and achieve wage-earning independence.

o Or, forced by family to supplement household income. o Deceived by labor recruiters about wages and working conditions workers will find upon arriving at their job (e.g. high wages offset by high rent on company housing or extortionist prices on company goods and services). o High turnover. Increasing use of foreign guest workers. o Robert Pollin, Justine Burns, James Heintz Global Apparel Production and Sweatshop Labor: Can Raising Retail Prices Finance Living Wages, Cambridge Journal of Economics (2004) A one-time, 100 percent wage increase for Mexican apparel production workers would force apparel retail prices in the U.S. clothing market to rise by only 1.8 percent to cover the 100 percent wage increase. $100 sports jacket -> $101.80 (wages in maquila sector constitute 10% of final value; 80% of final value from imported inputs). National Bureau of Economic Research poll found that U.S. consumers would pay $115 for this jacket if they could be assured it had not been made under sweatshop conditions. Why not give Mexican apparel workers a raise? Terms Henry Ford - Henry Ford installed first moving assembly line. In the last 25 years there has been a shift from Fordism to Lean Manufacturing or Flexible Mass Production Revolutionized manufacturing interchangeable parts interchangeable workers Gathered all elements of production in one place Visible Hand of corporate management Interchangeable parts - Using interchangeable parts meant making the individual pieces of the car the same every time. That way any valve would fit any engine, any steering wheel would fit any chassis. This meant improving the machinery and cutting tools used to make the parts. Toyota Production Systems (TPS) - The Toyota Production System (TPS) empowers team members to optimise quality by constantly improving processes and eliminating unnecessary waste in natural, human, and corporate resources. It entrusts employees with well-defined responsibilities in each production step and encourages each staff member to strive for overall improvement. Pull production - Producing a particular product according to the client's demands in order to reduce wasting and eliminate inventory. (Goods are demanded first, then produced accordingly) Kathy Lee Gifford - In the video, they show a case of a foreign manufacturing company in Honduras where young girls are employed for much less than a dollar (not enough to support their families) and the irony is that the tag of the item by Kathy Lee Giffords product line and sold in Wal-Mart says that part will be donated for various childrens charities, the problem was that girls as young as 13 years old are making these clothes. Week 11

Study Guide Monday 10/31 Online Video: The Ascent of Money (PBS Online, http://www.pbs.org/wnet/ascentofmoney/) Episode 4: Planet Finance (entire, 54 minutes) 1. When and how did the idea of a property owning democracy emerge in the United States? During and after the great depression many American workers lost their homes. The Roosevelt admin created the new deal to combat against red revolution. It allowed the government to rig the housing market to give incentivize Americans to become prop owners. govt would guarantee savings and loans even if they busted. When and how did the risks of promoting democratic property ownership come about? (The Ascent of Money) The Risks came about when Ethnic Minorities were discriminated against when it came to interest rates for burrowing to buy a home. Subprime for low credit blacks. Blacks in Detroit rioted to protest economic discrimination. Nearly 3000 bldgs luted or burned. 2. Explain the idea of Chimerica. (The Ascent of Money) An economy that accounts for 33% of worlds economic output and more than half of global growth in the past 8 years. East Chimericans do saving, west did spending. The cause of subprime mortgages being lent to people who were not qualified for the loans. The concept of Chinese lending money to the US. Wednesday Reading: Joseph Stiglitz, The Making of a Crisis, pp. 1-26, from Freefall: America, Free Markets, and the Sinking of the World Economy (PDF in Week 11 folder). 1. Who or what is to blame for the massive financial crisis that began in 2008? (pp. 6-12) In short, Americas financial markets had failed to perform their essential societal functions of managing risk, allocating capitol, and mobilizing savings, while keeping transaction costs low. Instead, they had created risk, misallocated capitol and encouraged excessive indebtedness while imposing high transaction costs. At their peak in 2007, the bloated financial markets absorbed 41 percent of profits in the corporate sector (p.7). ------------------------------------------------------------------------------------------additional answer: Mortgage companies pushed exotic mortgages on to millions of people, many of whom did not know what they were getting into. The bank bought these mortgages, repackaged them and sold them to unwary investors. The rating agencies failed to check the growth of these deadly instruments, and went ahead giving them the seal of approval. This encouraged othersincluding those in the USA and other countries to invest pension funds into these safely. In other words, Americas financial markets failed to perform their societal function of managing risk, allocating capital, and mobilizing savings while keeping transaction costs low. Risk was poorly managed because of wrong pricing and misjudgment (risk of default on subprime mortgages and trusting rating agencies).

The Federal Reserve was also to blame for not regulating interest rates properly. They claim to not have been able to foresee this bubble and if they did, they wouldnt be able to do anything. Both claims have been proven false. Overall, the bubble was created and burst due to lack of regulation and people not fulfilling their jobs adequately for the interest of the country. 2. Explain how the classic examples of market failure agency problems, externalities, and moral hazard factored into the financial crisis and its aftermath? (pp. 12-17) When there are important agency problems and externalities, markets typically fail to produce efficient outcomescontrary to the widespread belief in the efficiency of markets. This is one of the rationales for financial market regulation. The regulatory agencies were the last line of defense against both excessively risky and unscrupulous behavior from the banks, but after years of concentrated lobbying efforts the government had not only stripped away existing regulations but also failed to adopt new ones in response to the changing financial landscape. People who didnt understand why regulation was necessary-and accordingly belived it was unnecessary became regulators. The repeal in the 1999 of the glass-Steagall Act, which had separated and commercial banks, created ever larger banks that were too big to fial. Knowing they were too big to fail provided incentives for excessive risk-taking. In the end, the banks got hoisted by their own pretard:The financial instruments that they used to exploit the poor turned against the financial markets and brought them down. When the the bubble broke, most of the banks were left holding enough of the risky securities to threaten their very survivalevidently they hadnt done as good a job in passing the risk along to others as they had thought. This is but one of the many ironies that have marked the crisis: in Greenspan and Bushs attempt to minimize the role of government in the economy, the government has assumed an unprecedented role across a wide swathbecoming the owner of the worlds largest automobile company, the worlds largest insurance company, and (had it received in return for what it had givento the banks some of the largest banks. A country in which socialism is often treated as an anathema has socialized risk and intervened in markets in unprecedented ways. -----------------------------------------------------------------------------------------------------------additional answer: Agency Problems: when the agent made investment decisions, they were mainly focused on the short-term returns. Short-term focus is reinforced by the demand for high quarterly returns from stock market analysis. This drive for high short-term returns led banks to create more fees and wall street to create new product to drum up more income for their firms. This also caused agents to be more careless in their duty (such as emphasizing or noting inherent risks in new financial instruments/products) and passing the responsibility to the next person in line to check (the banks). Externalities: this is a situation in which market exchange imposes cost or benefits to an unrelated party. Today the financial system is so intertwined that the economy will fall to ruin with any large institution. In this case, millions of homeowners were affected, communities were devastated, taxpayers had to pay for bank losses, and workers lost their jobs. When there are agency and externality problems, the markets are no longer able to produce efficient outcomes. Plus, people who didnt understand why regulation was necessary became the REGULATORS. They thought them to be unnecessary, along with the Glass-Steagall Act, so there was excessive risk-taking.

3. What does Stiglitz believe was the macro problem in the U.S. and world economies under globalization? (pp. 19-20). Indeed, anyone looking closely at the American economy could easily have seen that there were major macro problems as well as micro problems. As I noted earlier, our economy had been sustained by an unsustainable bubble, aggregate demandthe sum total of the goods and services demanded by households, firms government, and foreignerswould have been weak, partly because of the growing inequality in the United States and elsewhere around the world, which shifted money from those would have spent it to those who didnt. ----------------------------------------------------------------------------------------------------additional answer: There was no aggregate demandthe sum total of the goods and services demanded by household firms, government, and foreignerswithout the bubble. There was a growing inequality in the USA and around the world, which shifted money from those who would have spent it to people who didnt. There is a problem when people across the globe create products no one wants to buy. One of the reasons for weak global aggregate demand is countries didnt spend enough which led to growth in the level of reserves. 4. How and why did the U.S. financial crisis spread to become a global financial crisis? (pp. 21-24) This crisis quickly became globaland not surprisingly, as nearly a quarter of U.S. mortgages had gone abroad. Unintentionally, this helped the U.S. had foreign institutions not bought as many of of its toxic instruments and debt, the situation here might have been far worse. But first, the US had exported its recession. This was of course, one of only several channels deregulatory philosophy--without that exported its recession. This was, of course, only one of several channels through which the American crisis became global. The US economy is still the largest,, and it is hard for a down turn of this magnitude not to have a global impact. Moreover, global financial markets have become closely interlinkedevidenced by the fact that two of the three beneficiaries of the US Government bailout of AIG were foreign banks. --------------------------------------------------------------------------------additional answer: (1) about a quarter of the mortgages had gone abroad. (2) US economy is too big to not affect the world with this big of a downturn (3) Global financial markets have been closely interlinked Terms Subprime mortgages (The Ascent of Money) - Home loans with high interest rates for borrowers with low credit scores. Redlining (The Ascent of Money) - whole neighborhoods given poor credit rating due to race. Savings & Loan Crisis (The Ascent of Money) - The government removed regulations on money market accounts so the masses removed their deposits from S&L institutions and invested in money market accounts for better returns on their dollar. The S&L institutions went bankrupt and it cost the tax payer 50 Billion to bail out. Alan Greenspan (Stiglitz, p. 4) - Chairman of federal reserve 87-2006 Repeal of Glass-Steagall (Stiglitz, p. 15) - repeal of the law that which allowed banks to merge with insurance companies and investment houses.

Securitization (Stiglitz, p. 14) - Higher yields for higher risks-- the originator pools many, many mortgages together to form a security, which it sells to another financial institution. This security is structured to behave very similarly to a bond; the owner of the security is entitled to interest payments (which are simply the payments home buyers are making on) Timeline Tequila Crisis 1950: Refers to the economic and financial crisis that began in late 1994 when the Mexican peso devalued, causing disruption in the Mexican economy that then spread through other countries of Latin America. Asian Financial Crisis 1950: Started out as a speculative attack on Asian currencies (originated with the Thai Baht), which resulted in capital flight, currency devaluation, and bankruptcies. This crisis eventually spread to the other BRIC countries (except India), including Argentina. Russian default brought down Long-term capital management (see The Ascent of Money) for further information. Asian Financial Crisis o Occurred during 1997-1998 o Capital market liberalization; huge capital in-flows o Speculative attack on Asian currencies o Capital flight, currency devaluation, bankruptcies o Started in Thailand and then to other Southeast Asian countries o Crisis eventually spread to Russia, Brazil, Argentina o Russian default brought down Long Term Capital Management o IMF stepped in and initiated a $40 billion program to stabilize the currencies of the countries hit hardest by the crisis, mainly South Korea, Thailand, and Indonesia Global Financial Crisis 2000: -Capital flight, currency devaluation, bankruptcies in Asia -Crisis spread over Eastern Europe and Latin American country like Brazil and Argentina Lecture Outline Age of Financial Turbulence Eurodollar Market Dollar funds deposited in European banks. Diversification of currency denomination of bond issues. Eurocurrency markets became convenient for raising large loans. Not subject to national regulations or capital controls. Responsible for initial expansion of private international finance in the 1960s. Helped force collapse of BWS

Increased Global Capital Flows After collapse of BWS, value of currencies determined by global market, rather than fixed by national governments. Drop in value of the dollar, but it remained the worlds reserve currency. Steady growth in short-term capital flows into all kinds of financial assets from mid-1970s forward. Petrodollars invested in international money markets; increased liquidity for international banks. Following 1973 shock, direct, private lending to non-OECD countries rose from below 5 percent of total to between 25 and 33 percent. 1975 elimination of minimum commissions on stock trades in United States. Financial innovation: late 1970s, growth in currency and stock index futures, and bond derivatives (e.g. mortgage-backed securities). Unlike commodity futures, stock index futures traded without price limits, which cushion volatility. The Big Bang (1986) sudden deregulation of financial markets in London. Elimination of fixed stock commissions and removal of barriers to foreign entry into London Stock Exchange. Reestablished City of London as international financial center. Creation of the Euro (1999) European monetary union. Deeper integration of European banking and financial markets. Upward Redistribution of Income, 1979-2007 Economic Recovery Act of 1981 and Tax Reform Act of 1986: Huge marginal tax cuts, especially for upper income groups; top bracket reduced from 70% to 28%. Capital gains tax slashed from 49% to 20%. Social Security Tax, which falls disproportionately on working-class families, increased by 25% during the 1980s. Wealthy and capital-owning class plowed money into stocks, options, and other financial instruments. 1986: stock funds grew by $42 billion, 33% increase. Unleashing of Debt Upward redistribution of income in U.S. forced people took on more debt to maintain standard of living. National personal debt: 1960 55% of national income 2007 133% of national income Financial deregulation made debt creation easier: 1978, U.S. Supreme Court decision, Marquette National Bank vs. First of Omaha Service Corp. Held that state anti-usury laws regulating interest rates could not be enforced against nationally chartered banks. Eliminated effective caps on what big national banks could charge credit-card holders. Old, state-mandated top rates of 9-10% gone.

Consequence: vast increase in issuance of credit cards, some bearing interest rates of 35, 40, 45% or more. With uncapping of interest rates, huge shift of capital (and talent) into the financial sector (new money plowed into bonds) and away from manufacturing sector. Banking no longer a boring industry.

Financial Bubbles, 1981-2001 Third World Debt Crisis (1981-1989 ) U.S. Stock Market Crash (1987) result of financial innovation and rapid upward income redistribution. Savings and Loan Crisis (1986-1989) Deregulation led to speculative and reckless lending and failure of 750 S&L banks by late 1980s; ultimately cost taxpayers $125 billion ($300 billion in 2010 $). Japanese banking crisis (1995) result of deregulated financial sector and real estate bubble. Bursting of Dot-Com Bubble (2000). 1970-2007: 124 financial crises in developing countries. Mexican Tequila Crisis (1994) outflow of short-term capital; devaluation of peso; loss of investor confidence in other Latin American emerging markets. Asian Financial Crises (1997) another financial contagion effect in East Asian emerging markets; increasing volatility and systemic risk. Large impact on Russia and Brazil. Collapse of Argentine economy (2001) Financial Crisis of 2008 - Inside Job (2010) Larry Summers Treasure Secretary (1999-2001) Larry Summers, who as Treasury secretary played a critical role in the deregulation of derivatives, became president of Harvard in 2001. While at Harvard, he made millions consulting to hedge funds, and millions more in speaking fees, much of it from investment banks. According to his federal disclosure report, Summers's net worth is between 16.5 million and 39.5 million dollars. Securitization Food Chain A new system, which connected trillions of dollars in mortgages and other loans with investors all over the world. Collateralized Debt Obligation (CDO) Investment banks combined thousands of mortgages and other loans including car loans, student loans, and credit-card debt to create complex derivatives Commodity Futures Modernization Act (2000)

Banned the regulation of derivatives Goldman Sachs Investment bank

Terms EurodollarsDollar funds deposited in European banks. The Big Bang (1986)sudden deregulation of financial markets in London. Elimination of fixed stock commissions and removal of barriers to foreign entry into London Stock Exchange. Reestablished City of London as international financial center. Marquette National Bank vs. First of Omaha (1978)Held that state anti-usury laws regulating interest rates could not be enforced against nationally chartered banks. Eliminated effective caps on what big national banks could charge credit-card holders. Terms Eurodollars - deposits denominated in US dollars in foreign banks(europe) or us banks in europe The Big Bang (1986) - The "Big Bang" introduced a more U.S.-style business culture, abolished fixed commissions at the London Stock Exchange, which at the time was an exclusive association of small financial houses that dominated the U.K. trade in stocks and bonds. Marquette National Bank vs. First of Omaha (1978) - determined national banks only have to obey the interestrate caps of the state they are chartered in, not that of the state where a banks customer lives.

Week 12 Study Guide Globalization, Poverty, and Inequality On-line: Website: World Bank, Poverty Reduction & Equity, Statistics and Indicators http://web.worldbank.org/WBSITE/EXTERNAL/TOPICS/EXTPOVERTY/0,,contentMDK:22569498~pagePK:1 48956~piPK:216618~theSitePK:336992,00.html Reading: Rodrik, The Globalization Paradox, pp. 144-183 1. Explore the World Banks Poverty Reduction and Equity website. Familiarize yourself with the basic concepts dealing with measuring and understanding poverty and inequality on a global scale. Here is another useful website: http://uk.oneworld.net/guides/poverty that more directly explains how poverty is measured and understood. We will go into more detail on this in lecture.

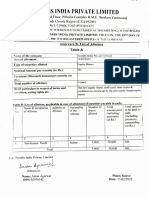

Poverty estimates are derived from the National Sample Survey (NSS), which measures monthly per capita consumer expense (MPCE) every five years. The Planning Commission's estimates are significant since they are used to determine the official national and state level below poverty line (BPL) population. Calorie intake and requirements are used to estimate poverty as well. (See http://www.prb.org/Articles/2010/indiapoverty.aspx) Poor countries typically determine their national poverty line as the value of a basket of basic food and essential non-food items. Some governments work with separate urban and rural poverty lines, recognising that costs are higher in cities. Some even insist on the most stringent measure, the food poverty line, which reduces the basket to food items only. Household surveys analyse consumption as well as income, recognising that goods may be exchanged by barter and that many families grow their own food. Statistics will highlight the incidence of households whose income is just above or below the poverty line. (see http://uk.oneworld.net/guides/poverty, Measuring World Poverty) 2. China is often considered to be a poster child for how globalization can bring huge growth and benefits to a nation. Do you agree with this characterization, or is there something wrong with this picture? Explain. (pp. 149-156) --Not really. They resisted international disciplines, and submitted to them only once their economy has become sufficiently strong. They decided to shield their markets for as long as they can, somewhat not following the rules of international nations. While other countrys opened their markets to foreign competition, many of them failed or had difficulties. So for china to bend the rules and hold off on exposing markets to foreign markets, they managed to have successful markets. In my opinion I dont believe bending the rules makes you the poster child, so I would disagree to this statement. NOTE: This question is opinionated so if someone else can post something that disagrees with me, that would be great for the study guide 3. According to Rodrik, what is the ulitimate paradox of globalization? According to Rodrik, the ultimate paradox of globalization is that reaping the gains of globalization may require an increase rather than a decrease in international transaction costs but paradox is more apparent than real. What is the key for nations to succeed under globalization? (pp. 156-158) According to Rodrik, the ultimate paradox of globalization is that reaping the gains of globalization may require an increase rather than a decrease in international transaction costs but paradox is more apparent than real. The key for nations to succeed under globalization is for the countrys government to have more interest in real development through politics and understanding of the economics of globalization. Terms

Gini Coefficient (website) - The Gini Coefficient measures the income inequality among the entire population of the country. The higher the number, the more income is being taken in by a small group. This number, which ranges between 0 and 1 and is based on residents' net income, helps define the gap between the rich and the poor, with 0 representing perfect equality and 1 representing perfect inequality. Township and Village Enterprises (TVEs) (p. 151) effectively stimulated domestic private investment. Owned not by private entities or central government, but by local governments (townships and villages); TVEs produced consumer goods to capital goods and spearheaded Chinese economic growth from mid 1980s-mid 1990s; key to TVEs success was due to local governments ensuring their prosperity because TVEs equity stake generated substantial income for the local governments. Special Economic Zones (SEZs) (pp. 152-153) The Chinese relied on this mechanism that would not create too much pressure on existing economic industrial structures. They relied on SEZs to generate exports and attract foreign investment. Enterprises that operated in these zones had access to better infrastructure and could import duty-free. SEZs created incentives for export-oriented investments without pulling the rug from under state enterprises. Timeline 1950 Tab: Deng Xiaoping - After the death in 1976 of Chinese Communist Chairman Mao Zedong, who had led the country since the communist revolution in 1949, Deng Xiaoping rose to power and initiated a series of economic reforms beginning in 1978 that placed China on a path toward a market economy and high-levels of economic growth. His first step, implemented initially in the province of Fengyang, was to abolish the rural agricultural communes set up by Mao and allow peasants to work family plots. Under this household responsibility system, individual farmers were entitled to produce food for a state-mandated quota, but any foods they grew beyond that could be sold on a free market at unregulated prices. As a result, agricultural harvests grew, and other reforms followed. Lecture Outline Please fill out as much information as you can that was discussed in the lecture Globalization, Poverty, and Inequality Globalization and Poverty o Estimating World Poverty Levels International Poverty Line (IPL) calculated by converting the purchasing power (Purchasing Power Parity: adjustment based on how much it costs to buy the same basket of goods in two or more different countries) of an average of the official national poverty lines of a set of low-income countries into U.S. dollars. From household surveys, the World Bank (International Comparison Program) then estimates the number of people in countries living on less than this figure. Money metric approach: international poverty line defined in relation to money rather than an explicit conception of well-being. Extreme Levels of World Poverty World Bank figures for people living in extreme poverty on an income of less than $1.25/day PPP (2005 Purchasing Power Parity): 1981 1.9 billion people 2005 1.4 billion people