Professional Documents

Culture Documents

Mortgage Observer September 2012

Uploaded by

NewYorkObserverOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mortgage Observer September 2012

Uploaded by

NewYorkObserverCopyright:

Available Formats

The Insiders Monthly Guide to New Yorks Commercial Mortgage Industry September 2012

Q&A

The M.O. talks motivation

with HKS Capital Partners

Jerry Swartz

CMBS:

Where Were

Headed

POWER PROFILE

STEVE

KENNY

BANK OF AMERICA

RACES AHEAD

Newport Tower

Prudential Mortgage

Capitals $200 Million

Renance

325 Hudson Street

Acquisition

Loan in Place for

Jamestown

Massey

Knakal Capital

Follows Client to

Sunshine State

Blackstone

$575 Million

Loan for Industrial

Portfolio Buy

TMO.0912.CS3.COVER.indd 1 8/30/12 3:18:45 PM

Relationship Driven.

Execution Focused.

Only Meridian Capital Groups powerful

nancing relationships can consistently

achieve the unparalleled results our

clients require.

Meridian Capital Group, LLC

proudly advised on fnancing for the

following transaction:

B&L Management

25-Building Multifamily Portfolio

New York, NY

$160,000,000

This transaction was negotiated by:

Moshe Majeski, Managing Director

Abe Hirsch, Managing Director

1 Battery Park Plaza New York, NY 10004 | 212 972 3600 | www.meridiancapital.com

Commercial Mortgage Observer - Sept. 2012 Final.indd 1 8/30/12 1:14 PM

Untitled-41 1 8/30/12 1:33:44 PM

321 West 44th Street, New York, NY 10036

212.755.2400

Carl Gaines

Editor

Jotham Sederstrom

Editorial Director

Daniel Geiger

Daniel Edward Rosen

Staf Writers

Sam Chandan

Joshua Stein

Columnists

Michael Stoler

Contributor

Noam S. Cohen

Copy Editor

Barbara Ginsburg Shapiro

Associate Publisher

Robyn Weiss

Director of Real Estate

Ed Johnson

Production and Creative Director

Peter Lettre

Photo Editor

Lauren Draper

Designer

Lisa Medchill

Advertising Production

OBSERVER MEDIA GROUP

Jared Kushner

Publisher

Elizabeth Spiers

Editorial Director

Christopher Barnes

President

Barry Lewis

Executive Vice President

Jamie Forrest

Associate Publisher, Senior Vice President

Michael Woodsmall

Editorial Manager

Zarah Burstein

Marketing Manager

Mark Pasquerella

Controller

Tracy Roberts

Accounts Payable Manager

Accounts Receivable

Ian McCormick

September 2012 / Contents

Editors Leter 02

News Exchange 04-10

Mortgage originations, note sales,

investments, industry research

Prudential Refnances Newport Tower for $200 M.

Thor Equities 590 Fifth Gets $100 Million

Funding for Nazarian Hotel Revealed

Steiner Equities Takes $25 M. Loan for Multifamily

M&T Bank Set to Acquire Hudson City Bancorp

for $3.7 Billion

In-Depth Look 11

Competition Hot in Multifamily

by Michael Stoler

Q&A 12

Jerry Swartz of HKS Capital Partners

by Carl Gaines

Scheme of Things 14

Monthly charts of commercial real estate

fnancings in the boroughs

Steins Law 16

How New York State Shoots Itself in the

Foot on Revolving Mortgage Loans

by Joshua Stein

The Basis Point 17

Lenders Press Forward, but Outlook

for CMBS Remains Reserved

by Sam Chandan

Workforce 18

Hirings, promotions, defections and appointments

Power Profle 20-23

Bank of America: Of to the Races

by Carl Gaines

CMBS 24-27

Keep Calm and Carry On

by Carl Gaines

Culture 28

What made your summer reading lists and work wear

The Sked: September 30

Our picks for the months must-attend events

Of Interest 32

An index of all the people, places, addresses and

companies mentioned in this issue

Cover Photo by Beowulf Sheehan

20

24 04

06

1

TMO.0912.ContentsCS3.indd 1 8/30/12 3:41:09 PM

2

Editors Letter /September 2012

For our September issue, I was lucky

enough to profle Steve Kenny, Bank of

Americas banking executive for New York

and New Jersey. In addition to the obvious

deals like Extell Developments One57 and

Edward Minskofs 51 Astor PlaceI was

able to confrm another important piece of

information: running would not be for me.

See, Steves currently training to run in the

ING New York City Marathon November 4,

the early morning training for which he fts

in to a work schedule that includes eforts to

diversify the banks commercial real estate

portfolio.

I also spoke to industry experts about the

CMBS market, in relation to the massive

amount of loans coming due the rest of the

year. I was curious to learn, with the CMBS

market not nearly where it was before the

fnancial crisis, if there was any concern

about being able to refnance whats coming

due. The general consensus was, well, that its

a complicated issue. Experts like Prudential

Mortgage Capital Companys Melissa Farrell,

who Im happy to say well soon profle, said

that the disposition of these loans depends

on many factors. They explain why in the

piece I wrote.

Even more ambitious, though, than any

piece on the CMBS market and where it

might head was working on our new Culture

page. Were really trying to get more of a

sense of who our readers arethe folks who

work in commercial real estate fnanceand

what it is that drives you. As summer draws

to a close, a look at what made your summer

reading lists proved really insightful.

Carl Gaines, Editor

Running on

All Cylinders

TMO.0912.EditorsLetterCS3.indd 2 8/30/12 3:03:22 PM

Credit is subject to approval. Rates and programs are subject to change; certain restrictions apply.

Products and services provided by JPMorgan Chase Bank, N.A. #1 claim based on 2011 FDIC data.

2012 JPMorgan Chase & Co. Member FDIC. All rights reserved.

How did Chase become the nations leader in multifamily lending? With great rates, low fees and a deep

understanding of the local marketin communities just like yours. If you have an apartment building to

purchase or renance, call us today to learn how we can put our resources to work for you.

Bringing you low fees, great rates and local market expertise.

LOW F E ES | GREAT RAT ES | S T R E AML I NED P ROCESS

Call 866-310-2490 or visit www.chase.com/MFL

The nations #1 multifamily lender

is lending in your backyard.

11CCB0005_CTL Print_Prod.indd 1 3/28/12 11:00 AM

Untitled-5 1 8/28/12 11:32:34 AM

4

OriginatiOns

news Exchange /September 2012

Prudential refnances newport

tower for $200 Million

$575 Million Loan to

Blackstone for Industrial

GE Capital Real Estate has provided a $575

million loan to afliates of a Blackstone real es-

tate fund for its purchase of 66 U.S. industrial

properties. The properties are located across 10

states in the South, mid-Atlantic and Midwest

and were bought from Australias Dexus Prop-

erty Group.

Frank Cohen, a senior managing director at

Blackstone, said that several factors put GE ahead

in the race to fund the acquisition.

There was signifcant interest in fnancing

this transaction, but GEs creative balance sheet

approach and fexible deal structure was a per-

fect match for our business plan, Mr. Cohen said.

Theyve been a responsive, experienced lender

who can deliver on transactions like this.

To his point, GECRE underwrote and closed

the loan in under 45 days, according to an an-

nouncement it released about the transaction,

which allowed Blackstone Real Estate Part-

ners VII to pick up 129 buildings and a total of

16.4 million square feet.

A spokeswoman for GECRE told The Mortgage

Observer that executives were traveling and un-

available for comment. However, in a prepared

statement, Alec Burger, president of the North

America division, said that it had a previous

working relationship with Blackstone. Our team

focused their expertise and eforts on this port-

folio and delivered a structure that met Black-

stones needs, Mr. Burger added.

Blackstone has said that it will sell its U.S. ofce

holdings, valued at $22 billion. Concurrently, as

The Mortgage Observer previously reported, the

frm leased 31,000 square feet of spacethe en-

tire 48th foorat Citadel Groups 601 Lexing-

ton Avenue.

CWCapital Arranges $46

Million Principal Loan

CWCapitals life company platform has ar-

ranged a $46 million loan for a mixed-use build-

ing on Manhattans Upper West Side. The loan

was provided by Principal Real Estate Inves-

tors, which said through a spokesman that it has

been targeting such attractive opportunities,

investing in multifamily throughout the New

York City boroughs.

Todd Trehubenko, a CWCapital managing

director, arranged the fnancing. The compa-

ny declined to comment beyond a release about

the deal, citing requested anonymity on the part

of the borrower. However, Mr. Trehubenko said

P

h

o

t

o

C

o

u

r

t

e

s

y

H

F

F

Newport Tower, a 1.1 million-square-foot of-

fce tower in Jersey City, N.J., has been refnanced,

thanks to a $200 million frst mortgage provided

by Prudential Mortgage Capital Co. The loan is

for seven-years, at a 3.5 percent fxed rate.

Owner Bentall Kennedy bought the building at

525 Washington Boulevard in October 2011 from

Brookfeld Ofce Properties for $377.5 million.

Marty Standiford, a vice president of acqui-

sitions at Toronto-based Bentall Kennedy who

worked on the original acquisition, told The Mort-

gage Observer that the building was the companys

entry to the New York City-area market and that

the Jersey City location was attractive on several

fronts.

The basic reasoning was that we wanted expo-

sure to metropolitan New York ofce, and we saw

this as an opportunity to do that in a way that, in

our view, gave us a tremendous rent role of blue-

chip tenants in the building with long-term dura-

tion leases, Mr. Standiford said. The Newport,

Exchange Place submarket has great supply and

demand fundamentals.

Tenants include BNP Paribas and AXA Equi-

table. Competition, he add-

ed, is limited in the area, due

to market rents that make

new construction difcult to

justify.

Mr. Standiford estimated

that the buildings current oc-

cupancy rate, taking into ac-

count pending leases, is about

93 percent.

HFF arranged the loan for

the borrower, led by manag-

ing director Cary Abod and

senior managing directors

Whit Wilcox, Mike Tepedi-

no and Tom Didio. The team

worked on behalf of a sub-

sidiary of Multi-Employer

Property Trust called MEPT

Newport Tower LLC. Bentall

Kennedy in turn advised the

subsidiary.

In June it was announced

that the California Pub-

lic Employees Retirement

System had bought a one-

third stake in Bentall Kenne-

dy, investing $100 million in

the real estate adviser. CalP-

ERS said in a statement at the

time that it was a move de-

signed to engage the pension

fund and its staf with an expe-

rienced real estate investment

and management team.

TMO.0912.NewsExchangeCS3_CG.indd 4 8/30/12 12:29:46 PM

5

September 2012 / News Exchange

CWCapital was very pleased to be able to com-

plete this transaction for the borrower. He added

that it is a top-quality asset in a terrifc location,

with dedicated, long-term ownership.

We reviewed numerous options for the client

and ultimately determined a life company execu-

tion best met their goals for long-term, low-le-

verage fnancing, Mr. Trehubenko continued.

The refnancing generated a great deal of inter-

est from our fnancing partners, which resulted

in very attractive terms for our client.

CWCapital, which Bethesda, Md.-based Walk-

er & Dunlop announced plans to acquire in June,

worked with CW Financial Services afliate

Rockwood Real Estate Advisors on the deal.

Andre Dobrowsky represented Rockwood.

Michael Berman, president and CEO of CW-

Capital, weighed in on the deal in a prepared

statement as well, pointing out that it boded well

for the frms new life insurance platform.

Since launching our life company platform

last year, we have established a strong network

of relationships, including the very capable team

at Principal, he said, which has allowed us to

assure our borrowers have access to the most

competitive and fexible fnancing options.

Meanwhile, a Principal Real Estate Investors

spokesman said in an email to The Mortgage Ob-

server that it was attracted by the conservative

nature of the loan request and that the bor-

rower liked our terms and aggressive pricing.

He hinted that there would likely be more invest-

ments to come.

In the last three years, Principal Real Estate

Investors has seen attractive opportunities and

made a signifcant number of new investments

in fnancing apartment properties in Manhattan,

Brooklyn, Queens and Staten Island, the email

read. That appetite for investment continues to-

day, not only for apartments, but for ofce prop-

erties as well.

Capital One Provides

325 Hudson Street Loan

The Mortgage Observer has learned exclu-

sively that Capital One Bank has provided a

$60 million loan to Jamestown Properties to

fnance its recent acquisition of 325 Hudson

Street, which it bought in April for $110 million

from a joint venture of Young Woo & Associates

and San Franciscos Bristol Group.

The loan closed in late July, and although

Jamestown declined to comment, Ben Stacks,

Capital Ones market manager for greater New

York commercial real estate banking, said it put

the permanent fnancing on the building follow-

ing Jamestowns all-cash purchase of it in April.

It was an approximately $60 million loan, Mr.

Stacks said, adding that the loan is for a fve-year

term. It represents another in a line of deals that

weve done with Jamestown. Were very excited

about our relationship with them. We view them

as one of our top-tier clients and we anticipate

doing more business with them in the future.

Jamestown added the 240,000-square-foot

Hudson Square property to a New York portfolio

that includes Chelsea Market, 530 Fifth Ave-

nue and 1 Times Square. Tenants at the tech-

friendly building include Empire State College,

Verizon and Level 3 Communications.

2012 CIT Group Inc. CIT and the CIT logo are regi stered service marks of CIT Group Inc.

ACQUISITION AND CONSTRUCTION FINANCING: OFFICE RETAIL INDUSTRIAL MULTI-FAMILY

Propertunistic

TM

[pro-per-too-nis-tic]

Denition: Growth opportunities afforded property owners

by customized nancing from CIT.

CIT Real Estate Finance combines deep industry relationships,

underwriting experience and market expertise to help real estate

organizations grow. We originate and underwrite senior secured

real estate transactions, emphasizing moderate leverage, a visible

repayment strategy and market competitive terms and pricing.

Visit cit.com/realestatenance

Matt Galligan, EVP/Group Head, 212-461-7740

TMO.0912.NewsExchangeCS3_CG.indd 5 8/30/12 12:30:06 PM

6

News Exchange /September 2012

Thor Equities 590 Fifth

Gets $100 Million

Cushman & Wakefelds Equity, Debt &

Structured Finance team has arranged $100 mil-

lion in foating rate fnancing for Thor Equities

590 Fifth Avenue.

Thor Equities, headed by CEO Joseph Sitt,

bought the 19-story, 100,000-square-foot ofce

and retail building in 2007 from the Feil Orga-

nization for $90 million, according to data from

Real Capital Analytics. Tenants there include

AT&T and the NBA Store.

Dave Karson, executive managing director

of Cushman & Wakefeld Equity, Debt & Struc-

tured Finance, told The Mortgage Observer that

the loans terms exemplify the interest not only in

New York property in general, but in retail on low-

er Fifth Avenue in particular.

I think that Fifth Avenue in the 50s has al-

ways been the best retail corridor probably in the

country, Mr. Karson said. As of the last few years,

Fifth Avenue in the 40s is starting to catch up. He

attributes this, he said, to a hard line that used to

exist at Saks and Rockefeller Center that retailers

didnt want to cross.

Folks have realized that south of Rock Center

and Saks is also a very, very attractive market, and

the rents are half of what they are a block north,

he pointed out. So ... from 49th Street down to

40th Street youre seeing a lot of high-end, high-

rent-paying retailers moving onto that strip.

Mr. Karson said that the $100 million loan

a blend of mortgage and mezzaninewas a low

fve debt yield, which is a terrifc level of proceeds,

and it was done at a very favorable interest rate,

which I just think illustrates the demand for New

York City property right now. He declined to say

what the rate provided by the lender was, but said

that the bulk of the loan was the senior mortgage

component.

Other team members at Cushman on the deal

included Steve Kohn, Alex Hernandez, Kate Pe-

let and John Spreitzer.

A spokesman for Thor Equities didnt return

phone calls seeking comment.

Brookfeld Slaps New $270

Million Loan on 4 WFC

Brookfeld Ofce Properties has complet-

ed a $270 million refnancing of 4 World Finan-

cial Center, the 1.9-million-square-foot ofce

tower it owns as part of the World Financial Cen-

ter complex in Lower Manhattan.

The deal was done by a group of banks, a source

said, including Deutsche Bank, which is listed in

city records as providing the loan but was part of

a syndicate, according to the source. The source

said Deutsche Bank provided a quarter of the

debt, about $68 million.

Late last year, Brookfeld reached an agreement

to consolidate its ownership of 4 World Financial

Center, buying a 49 percent interest that was held

by Bank of America and its subsidiary Merrill

Lynch, which is also a tenant in the building. In

that deal, Brookfeld agreed to pay $264 million

for the banks stake and assume debt so that it

could gain full control of the tower, whose base it

is renovating as part of a sweeping makeover of

the complexs retail and public space.

A representative at Brookfeld did not return

calls seeking comment. The mortgage accounts

for less than half the roughly $634 million valu-

ation for the building that was set in last years

purchase of the minority interest, a conservative

level of leverage that is typical of real estate in-

vestment trusts.

Its not clear what Brookfeld will do with any

proceeds it generates from the new loan, but the

funds could be used to help fnance the over-$200

million retail renovation, which the company is

just beginning work on.

Brookfeld is also planning to break ground

this summer on a $300 million deck over work-

ing train tracks that lead into Penn Station. The

platform will allow for the construction of an up

to fve-million-square-foot, mixed-use develop-

mentwhich it is calling Manhattan Weston

the Far West Side. Daniel Geiger

Funding for Nazarian

Hotel Revealed

L.A. nightclub and hotel guru Sam Nazarian

has set his sights on the Midtown South submarket.

As the Wall Street Journal reported recently, Mr.

Nazarian will develop a boutique hotel at 444 Park

Avenue South, along with his partner, New York-

based Moin Development Corp.

The Mortgage Observer has learned that the f-

nancing for the project was arranged by HKS Capi-

tal Partners, in a mix of two types of fnancingone

of which, an EB-5, was a frst for the frm.

We actually secured the fnancing, which was a

blend of a frst mortgage from a conventional local

bank in a construction facility, and we paired it with

an EB-5 fnancing structure, said Ayush Kapahi, a

partner at HKS who worked on the deal. The inves-

tors behind the EB-5 are Chinese, Mr. Kapahi said.

It just so happens that the Chinese are heavily,

heavily the ones jumping onboard at this point be-

cause it does require for a family to be able to invest

$500,000 at a given time, so you need to have some-

what of a deep pocket in order to be able to pull of

the investment.

HKS provided close to $50 million for the project,

which will allow for the redevelopment of the site

and the start of construction on the planned 190-

key hotel. Mr. Nazarian and Moin Development

bought the site in August 2011 for $45 million.

They already acquired it, Mr. Kapahi point-

ed out. This is the refnancing, restructuring and

the construction component to get to a fnished

product.

Mr. Kapahi declined to reveal the name of the

lender involved in the transaction.

Asked about a time frame for the construction,

David Shenfeld, a vice president at Moin Develop-

ment, said that it is already underway.

Weve been doing demo and asbestos removal,

Mr. Shenfeld said. But we are starting to gut it next

week.

Steiner Equities Takes

$25 Million Loan for

Multifamily

Meridian Capital Group recently wrapped

up $25 million in acquisition fnancing for Steiner

Equities purchase of the Jardin, a 44-unit multi-

family building with retail space in the Williams-

burg section of Brooklyn.

The four- and fve-story buildings making up the

Jardin are located at 142 North 6th Street and

comprise 45,521 square feet of space in all. Read

Properties Inc. sold the building to Steiner Equi-

ties in June 2012 for $38 million, according to data

from Real Capital Analytics, which also indicated

that the lender is Sovereign Bank.

Meridian managing director Aaron Appel and

vice president Jonathan Schwartz negotiated

the 10-year, fxed-rate balance sheet loan.

The sponsors deep knowledge of the market,

TMO.0912.NewsExchangeCS3_CG.indd 6 8/30/12 12:30:28 PM

Relationship lending

wellsfargo.com/realestate

CMBSloansPortlolioloansWarcLousclincs

FannicMacFrcddicMacFHA

We focus on maintaining strong relationships with our clients, and using

the breadth of our platform to deliver capital solutions in every market cycle.

Working with you, project after project, has made us the largest commercial

real estate lender in the U.S.

Wells Fargo Bank, N.A. All rights reserved. MC-

Untitled-34 1 8/30/12 12:28:49 PM

8

News Exchange /September 2012

ElsEwhErE...

paired with the spectacular location of the prop-

erty, was extremely benefcial in working to quick-

ly close this fnancing in under three weeks, Mr.

Schwartz said about the deal.

For his part, Mr. Appel added that the transac-

tion highlights how Meridians strong relationships

and market expertise allow us to quickly obtain f-

nancing that is tailored to the clients needs.

The Jardin, which includes two retail spaces,

was originally slated to be developed as condos but

was changed to rentals before all the units sold. It

has since been fully leased at an average rent of

$53 per square foot.

Meridian was able to arrange the loan within a

tight 18-day time frame, the frm said.

Loan Forthcoming for

Carlton House Condo

Conversion

The Mortgage Ob-

server has learned that a

$200 million refnanc-

ing of the Carlton House

condominium conver-

sion is in the works. Bank

of America is in talks

with partners Angelo,

Gordon & Co. and Extell

Development to provide

the fnancing, though the

loan hasnt closed and terms werent available.

The refnance coincides with the JVs agreement

to sell the 33,389-square-foot retail condominium

at the site, located at 680 Madison Avenue, to Vor-

nado Realty Trust. The REIT will pay $280 mil-

lion for the retail there, according to reports.

The estate of Leona Helmsley sold its leasehold

interest in the Carlton Housea former hotelto

Extell Development and Angelo, Gordon & Co. in

2010, setting the ball rolling.

Adam Schwartz, a managing director and head

of Real Estate at Angelo, Gordon confrmed that

talks were underway about refnancing the condo

conversion, which is expected to result in upwards

of 70 luxury apartments.

Were working with them on potentially re-

fnancing the Carlton House transaction, Mr.

Schwartz confrmed, adding that the fnancing

would either refnance Carlton House as a whole

or infuse the condominium conversion project

with money to fund construction.

This fnancing would come on the heels of an ac-

quisition loan that Bank of America provided for

Angelo, Gordon & Co. for a Gramercy Park ofce

and retail project.

Massey Knakal Capital services

Arranges $21 Million loan for

New York Clients Miami retail

The Mortgage Observer has learned exclusively

that Massey Knakal Capital Services has followed

a New York-based clients needs to the Sunshine

State, arranging a $21 million loan for a retail prop-

erty on Miami Beachs Lincoln Road. Wells Fargo

provided the 10-year, 4.5 percent loan to the spon-

sor, Aurora Capital Associates. The loan-to-value

ratio is 70 percent.

Garrett Thelander, managing director at MKCS,

and director Morris Betesh worked on the trans-

action. Joseph Tufariello, a managing director at

Wells Fargo, worked on the banks end, the duo said.

This was actually a loan that I had originated at

Anglo Irish Bank, Mr. Thelander told The Mort-

gage Observer. So I had an existing relationship

with Aurora Capital. Mr. Thelander joined Massey

Knakal Capital Services in 2011 after working as an

executive vice president at Anglo Irish Bank, where

he helped set up the New York ofce.

The original loan was a $17 million acquisition

loan that was coming due in 2012.

The sponsor, Aurora Capital Associates, had done

a great job repositioning the retail by upgrading the

tenancy and increasing the rents to market rate,

Mr. Betesh explained. The high debt per square foot

is a testament to the strength of the Lincoln Road re-

tail corridor and the sponsors proven track record

of managing high-end, urban retail assets. The debt

per square foot Mr. Betesh mentioned was $1,400.

Though Messrs. Thelander and Betesh declined

to reveal the address of the Aurora Capital Asso-

ciates building, Lincoln Road as a whole is a major

shopping destination in the city and it has been the

site of much interest lately on behalf of New York-

area real estate frms. In early July, for instance,

REIT Vornado Realty Trust announced that its

Vornado Capital Partners fund had bought 1100

Lincoln Road, which is 97 percent leased to retail

tenants like Regal Cinemas and Anthropologie.

The fund bought the 167,000-square-foot property

for $132 million.

Because of the value inherent in such a retail area,

Mr. Thelander noted that MKCS had found a lender

here that was very familiar with Lincoln Road. Mr.

Betesh, meanwhile, emphasized the importance of

the lenders familiarity with the area as well, saying

that others were maybe not able to get their arms

around the high value per square foot.

Adam Schwartz

P

h

o

t

o

: F

l

i

c

k

r

U

s

e

r

d

i

g

i

t

a

l

k

u

n

d

e

TMO.0912.NewsExchangeCS3_CG.indd 8 8/31/12 2:29:37 PM

140 W 57th St. NYC, NY 10019 T +1 212 867 1234 Contact Eli Braha

(ebraha@berkleyacq.com)

BerkleyAcq.com

BERKLEY ADDS...

BERKLEY | ACQUISITIONS

INTERNATIONAL CONSULTING

ANALYTICAL UNDERWRITING

ADVISORY SERVICES

Untitled-4 1 8/31/12 2:38:30 PM

10

News Exchange /September 2012

MiscEllaNy

Prudential Mortgage

Capital Kicks Of New Arm

with $108M Loan

Newark, N.J.-based Prudential Mortgage

Capital Co.s European business arm has completed

its frst piece of fnancing since launching in January

2012. The company said in June that it had provided

a $108 million commercial real estate loan, secured

by a portfolio of four Central London ofce proper-

ties and grocery-anchored retail in the town of Bath,

which is just over 100 miles west of London.

Its a signifcant frst step on the road to the com-

panys targeted $500 million in long-term, fxed-rate

senior debt transactions for 2012, it said. The debt in

these transactions will be denominated in local cur-

rency, bringing this frst one in at 69.5 million.

The diversifcation we can achieve by investing a

portion of our portfolio outside of the U.S., whether

its Europe, Japan or Mexico, is very valuable, said

Thor Orndahl, a managing director at the company

who oversees its non-U.S. mortgage platform. The

current market dislocation has provided the opening

we have been looking for, and our plan is to be active

in Europe for many years to come.

The company will sidestep the most troubled re-

gions of Europe, focusing instead on ofce, logistics,

multifamily and retail in large German cities as well

as London and Paris. Local banks may collaborate on

structuring the loans.

Greystone Servicing

Corp. Arranges $21M

Afordable Housing Loan

New Yorks Greystone Servicing Corp. said

recently that it has arranged a $21 million loan f-

nanced by the Freddie Mac Targeted Afordable

Housing Mortgage Program for 350 units of af-

fordable housing in Willimantic, Conn.

The complex, Windham Heights, located at 202

Scott Road, is owned and managed by Vesta Cor-

poration, which manages roughly 4,000 total units

in Connecticut, Ohio, New Jersey, Indiana and D.C.

Sources indicated it was renovated as recently as

2005 and that the refnancing is for about 10 years.

Working with Freddie Mac allows us to further

reach customers through a multitude of high-qual-

ity products, said Jef Englund, who led Grey-

stones afordable housing team on the deal. As

Greystone works closely with a number of mort-

gage-purchasing enterprises, we are able to ofer

the best programs for our clients, and we are excited

to continue working closely with Freddie Mac and

our other partners to serve the multifamily mort-

gage needs of the country.

M&T Bank said Monday that it had entered

into a defnitive agreement to acquire Hudson

City Bancorp for $3.7 billion in stock and cash.

The acquisition will see Hudson City merge into

an M&T subsidiarygiving M&T access to 135

new branch locations in New Jersey, New York

and Fairfeld County, Conn. The deal would make

for the largest bank

merger of 2012 so far.

The boards of di-

rectors of each bank

have approved the

merger, which is now

pending regulatory ap-

proval and approval

by the shareholders of

each company.

According to an in-

vestor presentation

about the merger available online, the merger

will greatly diversify Hudson Citys monoline res-

idential mortgage focus99 percent of its portfo-

lio as of June 30, 2012. It will create a pro forma

commercial real estate platform of $17.9 billion,

providing the biggest boost for M&T, however, in

the area of residential mortgages.

M&T, which was established in 1856, and

Hudson City, founded in 1868, have been serv-

ing their customers and communities for gener-

ations, and we look forward to building on that

long history and tradition together in the future,

M&T Chairman and CEO Robert Wilmers said

in a prepared statement about the merger.

As a thrift, Hudson City focused primarily on

deposits and mortgages, Wilmers continued.

M&T will build on Hudson Citys loyal custom-

er base to create a comprehensive community

banking franchise that provides a full range of

checking and savings accounts, debit and cred-

it cards, home equity loans and other lending

options, plus small business and commercial

banking services and our premier wealth man-

agement and corporate trust solutions through

Wilmington Trust.

M&T acquired Wilmington Trust in late

2010.

Hudson City Chairman and CEO Ronald

Hermance, Jr. said that the merger creates

tremendous opportunities to build on the suc-

cesses that each company has achieved individ-

ually in its own markets.

M&T is headquartered in Buffalo, N.Y. and has

$80.8 billion in assets. Post merger, the banks

pro forma balance sheet is anticipated to in-

crease by roughly $28 billion, it said.

Trepp: CMBS Delinquencies

at Record High

Another month, another all-time high

CMBS delinquency rate, according to data from

Trepp. The companys July 2012 U.S. CMBS De-

linquency Report showed $59.5 billion in CMBS

loans are now delinquentclassified as 30 days

or more in arrears. This figure doesnt include

loans past the balloon date but current on inter-

est payments.

The rate for July moved up 18 basis points to

10.36 percent, from Junes 10.16 percent, leav-

ing $75.4 billion in loansnearly 4,000 in allin

special servicing.

The July results seem to go against what Trepp

predicted a month earlier, when senior manag-

ing director Manus Clancy said that, with most

of the 2007-vintage loans already past their ma-

turity dates, the worst might be behind us.

Just as the heat should break by September,

investors should see some relief, too, Mr. Clan-

cy predicted. Now that most of the 2007 loans

coming due in 2012 have passed their maturity

date, the delinquency rate should start to level

off soon.

In light of the July numbers, Mr. Clancy said

that Trepp doesnt expect much improvement

over the next few months. We dont anticipate

many more increases in the rate over the next six

months, he said. The loans that were unable to

refinance over the last year will continue to lin-

ger with the special servicers.

Retail was the only asset type to see improve-

ment in July, its delinquency rate dropping to

8.03 percent for the month from 8.17 percent the

month previous.

Robert Wilmers

M&T Bank set to acquire Hudson

city Bancorp for $3.7 Billion

TMO.0912.NewsExchangeCS3_CG.indd 10 8/31/12 2:30:00 PM

11

September 2012 / In-Depth Look A comprehensive look at CRE finance trends

R

ecord-low mortgage rates have helped to

fuel renancing activity for residential

homes. In July, the number of mortgage

applications led hit a three-year high. Freddie Mac

also reported that 30-year, xed-rate mortgages

averaged 3.49 percent for the week ending July 26.

Likewise, attractive rates are fueling nancing in

the multifamily market, where nancing for low-

leveraged rental buildings has reached its lowest

levels in decades. The result? Fierce competition

among lenders looking to provide nancing for the

asset class, particularly in the Big Apple.

Interest rates as low as 3 percent for ve-year

nancing, 30 to 35 year amortization at par, non-

recourse are being oered. And borrowers are taking

advantage of seven- and 10-year xed-rate nancing,

which is being oered below 4 percent.

Commercial/multifamily mortgage origination

volumes during the second quarter of 2012 were up

25 percent compared with second-quarter 2011 levels

as well, according to a Mortgage Bankers Association

survey that also charted a 39 percent increase from

the rst quarter of 2012.

Commercial and multifamily mortgage lending

and borrowing continued to pick up in the second

quarter, said Jamie Woodwell, MBAs vice president

of commercial real estate research. Every major

investor group increased their lending.

In fact, each and every day, lenders from around

the region are knocking on the doors of owners of

rental properties oering low-cost nancing. Some

of the newest for this asset class include Connecticut-

based Peoples United Bank and Montebello, N.Y.s

Provident Bank.

We are focused on growing our commercial

real estate business, particularly in the multifamily

segment, across the metro New York market, said

John Costa, executive vice president, commercial

banking for Peoples United Bank.

Competition is, and will remain, keen for these

new entrants who will have to oer exceptionally low

rates to compete with leaders like Investors Bank.

We were fortunate to begin nancing multifamily

apartment buildings back in 2008 before it became

the lending choice for many banks, said Domenick

Cama, senior executive vice president and COO of

Investors Bank. While its true the combination of

lower rates and more competitors has driven down

spreads, we remain committed to this business.

One of the most active lenders to this asset class is

the commercial term lending division of JPMorgan

Chase. The head of East for CTL, Jason Pendergist,

said, Our Chase commercial term lending business

provides the greater New York-area, Boston, D.C. and

Philadelphia markets with term nancing to owners

and investors of income producing buildings with

ve or more units.

Astoria Financial, the holding

company for Astoria Federal

Savings and Loan Association,

joined the ranks of lenders for

this asset class in 2011. It reported

in its latest earnings report that

from March 31 to June 30, 2012, its

combined multifamily commercial

real estate loan portfolio increased

by $361.2 million, or 58 percent

annualized, to $2.8 billion.

New York Community Bank

continues to be number one

in the New York City region

for multifamily. The company

reported as of June 30, 2012 that

multifamily loans were up $417.1

million from March 31 and $753.5

million from December 31. And it

had approximately $1.8 billion in

the pipeline.

James Carpenter, senior executive vice president

and chief lending o cer at New York Community

Bank, said that the bank has been a leading

multifamily lender in the area for decades. While

there have been many market participants over

the years, no one has remained as consistently

committed to multifamily nance, he said.

Multifamily properties are a preferred asset class

for Mercantil Commercebank because of their low

risk prole and acceptable risk-adjusted returns,

said Paulo Garcia, vice president of commercial

real estate at the bank. This is particularly true for

New York City, where the multifamily market held

up and, in fact, continues to climb to new record

highs.

Loans on commercial real estate, especially for

multifamily residential properties, helped Signature

Bank log a record $45.3 million in net income for the

second quarter of 2012. Loans at the bank increased

$664.9 million, or 9 percent, to $8.03 billion for the

second quarter. Over the rst half of the year, they

grew $1.8 billion, or 17.2 percent. Not surprisingly,

the increase in loans was primarily driven by growth

in commercial real estate and multifamily loans, as

well as by the launch of the banks specialty nance

business.

The banks are also in constant

competition with the GSEs.

One of the most active players

in the GSE arena is Beech Street

Capital. Its interesting how

strong it is, despite persisting

unemployment and at income

growth, said Mike Edelman,

senior vice president, production

management at the rm. A lot

has to do with demographics.

You also have the disruption

associated with the housing

crisis, so theres a lot more renters

by choice.

Also a factor is the resurgence of

nancing from Wall Street CMBS

and conduit lenders. Competition

is keen from Deutsche Bank,

Cantor Commercial Real Estate,

JPMorgan and Ladder Capital, as

well as Goldman Sachs.

Record-low nancing is fueling the investment

sales market, too. This is the best investment sales

market we have seen in ve years, said Robert

Knakal, chairman of Massey Knakal Realty Services.

Nonetheless, while rates fell to record lowseven

below 3 percent in Julythere are clouds on the

horizon. During the rst 15 days of August, pricing

of the 10-year Treasury note rose 30 basis points.

And higher yields on these notes will result in higher

costs for long-term nancing and impact investment

sales.

But for now, as rates continue to be at all-time

record lows, prudent borrowers should, and will,

lock in long-term permanent nancing for all asset

classes.

Record-low rates are keeping area lenders busy.

Competition Hot in Multifamily

by Michael Stoler

I

L

L

U

S

T

R

A

T

I

O

N

B

Y

E

D

J

O

H

N

S

O

N

TMO.0912.CS3.InDepthLook.indd 11 8/30/12 12:25:49 PM

12

Q&A /September 2012

by Carl Gaines

Jerry Swartz

HKS Capital Partners

The Mortgage Observer recently spoke to Jerry Swartz, who last year

struck out on his own to found HKS Capital Partners after almost 40 years

at Pergolis Swartz Associates. He shared what motivated him to wind

something up, at an age when most might be focused on winding down.

The Mortgage Observer: You were a founding

partner at Pergolis Swartz. How did you get

your start in the business before that?

I was in the manufacturing business and in 1970,

I think it was, there was a credit crunch and the

entire industry did not do well and we closed that

business up and I was looking for something. At

the time I was in contract on a house. I had my frst

wife and two young kids and when I closed that

business up, I had no means of closing on the house,

I had no means of income and I needed something

that was going to generate income for me quickly.

A friend of mine was in the real estate business

and I spoke to him about it and he told me that I

should get into brokerage because, once you learn

the business, youre generating fee income and as

soon as you can close its faster. I was nave enough

to go with that and I went to Sonnenblick Goldman

and I got a job there on straight commission.

It was very enlightening because I really didnt

knowother than the mortgage I was going to get

on the house I was in contract onI didnt know

what a mortgage was. But it was a great shop. I

listened. I learned. I remember in the beginning

when I would make a cold phone call and someone

would ask me a question, I remember specifcally

someone asking me what the current prepayment

penalty is on a mortgage. And I said, You know

what, Ive got another call coming in. Let me call

you right back. And I went and asked one of the

other brokers what a prepayment penalty was.

Thats how basic. I really did not know anything.

But anyhow I learned, and within six months I had

some closings and made some nice money, and the

next year I doubled that income and so on and so

on and so on and it was great. I was there for four

or fve years and then I met Richard Pergolis there.

In 74 or 75 we formed Pergolis Swartz, and 40

years later, or whatever it was, in 2011, we started

this company, on April 1 of 2011.

What was it about the market that made you

think it was a good time to start something

new in 2011, and how long had you been

thinking about doing that?

The market was beginning to get a little better.

I wouldnt say it was good enough to launch a new

business. However, what happened at the other

frm was a philosophical diference between my

partner and mejust in the way that the business

was done and in the approach that each of us took.

Even geographically within the ofce. We had

5,000 square feet of space; I was literally in the

back, he was all the way in the front. And a lot of

the young brokerswe didnt have a lot of brokers,

but the ones we had, Ayush [Kapahi], for example,

and John [Harrington], the two who came with

mewere in the back. And I kind of morphed into

deals with them because they were there and they

were in my ofce a lot and we talked about deals.

How competitive is the environment now? Has

it gotten more competitive over the years?

It has. What happens is that the direction of the

market dictates the competitiveness. When the

market heats up and more and more transactions

are getting done, like any other business, excess

profts breed ruinous competition. I dont know.

I didnt make up the statement. I dont know

whether it was Baruch or somebody, but thats

what happens. And as the market heats up and

more and more deals get done, well, attorneys

who may not be too busy in their legal business

say, Hey, Im a broker. I can do deals. So in that

respect, yeah, it does get busier and well all of a

sudden be competing against somebody who Ill

say, Geez, Ive been in business a long time and

Ive never heard of them. It might be a startup

business or not even a brokerage business per se.

But someone like Massey KnakalI know they

have opened up a fnance business. And Eastern

Consolidated, I believe they have their own. Its

obviously an additional source of income, a new

proft center, so, yes, as the market gets better I

think the competition heats up. Of course.

Are you seeing more construction deals? Are

they picking up?

A lot. The construction loans, not as many

ground-up construction loans. A number of

conversions, renovations, a number of bridge

loans, obviously, where there may be a value-

added scenario or a structured-fnance scenario

to the transaction. You know, someone might

be adding a new tenant or renovating existing

apartments or enlarging certain apartments. A

lot of those. We have not seen as many note sales

as we did two years ago, which doesnt necessarily

mean that that particular segment of the market

has evaporated. Im sure that there are still

plenty of toxic loans that need to be worked out.

Certainly CMBS is going to have a lot of loans

coming up very soon, but in terms of the number

of loans that we saw to fnance acquisition of

loans, we havent seen that many of those lately.

Do you see doing this for the immediate

future? Any plans to slow down?

I see doing it until I fall down on the desk and

they carry me out, feet frst. As I said before, its

something I can do from anywhere with emails

and the computer and the iPad.

You just need to stay busy?

I do. I get bored quickly. I guess Im a Type-A.

Interestingly enough, pretty much all the brokers

are the same way. You kind of have to be in this

businesshave that kind of personality. Well, it

works if you do have. Thats what it is. At times I

will sit on the deck overlooking the ocean and its

just incredible. But I cant do it for a long time

Ill get bored. Or Ill be planning in my mind what

Im going to do next.

Jerry Swartz

TMO.0912.CS3.Q+A.indd 12 8/30/12 12:32:03 PM

has acquired

Fannie Mae | Freddie Mac | FHA | Life Co | CMBS | Bridge

We are pleased to announce that Walker & Dunlop has closed

CWC LLC 1

th

u

S W CWC

&

Donald King Lv C C

Michelle Warner Sv C P lPA l

J. Tyler Blue | Lv C M

www.walkerdunlop.com

&>>>

Untitled-5 1 8/28/12 11:37:51 AM

1095

224

344

192

351

228

1115

14

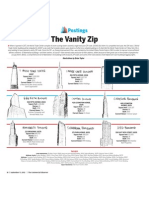

Scheme of Things /September 2012 Monthly charts of commercial real estate financings in the boroughs

The Mortgage Observer has compiled a

monthly snapshot of top commercial real es-

tate fnancings in New York City. This month

we take a look at refnances versus purchases,

top recent lenders, total sales by borough and

the six ZIP codes that saw the most action,

though several tied in July. Data are drawn

from Actovia, which tracks mortgage informa-

tion and streamlines leads from city records.

Mortgage Charts

310

85

Refnances were up in June from Mays 736 to a high of

1,095. They then dropped sharply in July, down to just 310.

Purchases were down in July as well.

JUNE JULY

REFINANCES

JUNE JULY

PURCHASES

10003 36 11211 13

10009 32 11215 12

10002 30 11218 9

11201 29 10457 8

11211 29 11219 8

10458 26 10031 8

11101 8

ZIP CODE JUNE 2012 ZIP CODE JULY 2012

The 11211 ZIP code, comprising much of Williamsburg,

regained the top spot for fnancing activity in July.

According to Actovias data, however, fnancings were

down across all the top ZIP codes for the month..

JUNE JULY

BRONX

JUNE JULY

ALL

JUNE JULY

MANHATTAN

JUNE JULY

BROOKLYN

JUNE JULY

QUEENS

Total sales dropped precipitously in July in all the boroughs. June saw 1,115 sales in Manhatan, the Bronx,

Brooklyn and Queens, yet this fgure dropped all the way to 394 for July. The Bronx registered the fewest

sales in the month of July, with just 52.

394

116

52

154

72

New York Community Bank maintained the top spot for lenders in the New York area for both June and July. See

this months In-Depth Look (page 11) for insight into how lenders are vying for chunks of the regions multifamily

fnancing. It details how several of the lenders on this list are making inroads.

New York Community Bank 93 New York Community Bank 45

Astoria Federal Savings Bank 84 JPMorgan Chase 39

JPMorgan Chase 73 M&T 35

Signature Bank 60 Capital One 24

Capital One 55 Signature Bank 21

Dime Savings Bank of Williamsburgh 46 Astoria Federal Savings Bank 13

M&T 28 Dime Savings Bank of Williamsburgh 12

Investors Bank 26 Wells Fargo 10

Flushing Savings Bank 24 Sovereign Bank 7

Apple Bank 20 Flushing Savings Bank 6

BANK JUNE 2012 BANK JULY 2012

Refnances vs. Purchases

Most Active ZIP CodesFinancing

Top 10 Lenders

Total Sales by Borough

TMO.0912.CS3.SchemeOfThings.indd 14 8/30/12 3:06:07 PM

Community lending expertise with a personal touch.

Flushing Bank is a trade name of Flushing Savings Bank, FSB.

At Flushing Bank were focused on exceeding your goals. Comprised of experienced lenders with deep market knowledge,

Flushing Banks Real Estate Lending team is ready to help you with the perfect real estate mortgage solution. As a well-

established community lender, weve provided credit to a diverse group of customers helping them to quickly and efciently

achieve their goals. Call us today and let us make your real estate dream a reality.

144-51 Northern Boulevard

Flushing, NY 11354

800.581.2889

www.FlushingBank.com

Bronx, NY

48-Unit Multifamily

$4,000,000

Brooklyn, NY

120-Unit Multifamily

$5,750,000

Brooklyn, NY

36-Unit Multifamily

$2,000,000

New York, NY

Mixed-Use

$4,000,000

New York, NY

52-Unit Multifamily

$6,500,000

Brooklyn, NY

36-Unit Multifamily

$2,100,000

FB Real Estate Ad Mort Observer5.indd 1 8/30/12 10:31 AM

Untitled-32 1 8/30/12 12:12:10 PM

16

The M.O. Columnists /September 2012

Steins Law

Joshua Stein

A

multistate developer wanted to set up a

credit line secured by mortgages on a few

available properties, one in New York City.

Knowing from experience that New York State had

a mortgage recording tax, the developer resigned

itself to paying that tax as the price of

using New York property as collateral.

The developer reluctantly prepared to

write a fve-digit check to support New

Yorks various governments.

Then the developer started to move

toward a closing. Someone saw the word

revolving in the developers credit

line agreement. The loan documents

allowed the developer to borrow on the

credit line, repay and then borrow again

to meet the developers cash needs. The

developer soon learned that this meant

it would, in theory, owe a mortgage recording

tax both for the initial closing and borrowing of

the loan, and then again every time it repaid and

borrowed. The state tax ofcials take the position

that once any mortgage loan has been repaid, even

temporarily, any additional borrowing of that loan

incurs another tax.

How New York State

Shoots Itself in the Foot on

Revolving Mortgage Loans

Unfortunately, the developer contemplated

using its secured credit line just like any other

revolving credit line. The developer would borrow

and repay multiple times over the course of a year. If

this required the developer to pay a tax every time,

then payment of the tax would dwarf all

other borrowing costs. The tax amounts

to 2.8 percent of each borrowing. The

tax would simply make it impossible for

the developer to use the credit line.

Given the business deal with the

developers lender, someone suggested

that the developer could limit the New

York piece of the revolving loan so it

falls within a $3 million safe harbor

in the New York tax law. Thats a special

provision that says revolving loans

below $3 million dont incur multiple

taxes with each repayment followed by another

borrowing.

If a revolving loan as a whole amounts to $3

million or more, though, then the safe harbor wont

apply even if the New York mortgage secures only

some smaller piece of the loan. The New York

collateral needs to secure the entire loan, which

must be less than $3 million. Moreover, as a price of

qualifying for the safe harbor, the borrower must, in

practice, pay of and release the mortgage when the

borrower sells the property, losing the opportunity

to deliver to the buyer a tax-paid mortgage, for

which the buyer may pay a little extra at closing.

Other technical restrictions on availability of the

safe harbor also made it difcult for the developer

to use.

Before long, the developer threw up its hands,

and decided not to record a New York mortgage

at all. It just cost too much and created too many

problems to have New York real property secure

a revolving loan. So, instead of writing a fve-digit

check to pay mortgage recording tax, the developer

saved some money. And the New York taxing

authorities received zero instead of the check

for mortgage recording tax the developer would

have reluctantly paid if New York accommodated

revolving mortgage loans.

This all happened because New York law and tax

ofcials cling to a hyper-technical interpretation

of the mortgage recording tax. They insist that any

repayment and additional borrowing of a mortgage

loan incurs a new tax. In practice, that means New

York real property cant secure revolving loans,

because no sane borrower will pay another 2.8

percent tax every time it borrows again. And, as a

result, New York efectively turns down whatever

mortgage recording tax payments the state could

collect if the mortgage recording tax accommodated

revolving loans.

As the easiest way to accommodate revolving

loansi.e., to make it practical to use New York

real estate to secure themthe state could expand

the safe harbor so it applies to all revolving loans.

Ideally the state could also cut away some of the

technical issues that limit the practical usefulness

of the safe harbor. The state could, in efect, say that

if a loan is in fact a revolving loan, then it only incurs

mortgage recording tax once, not multiple times.

New York State must think that todays

interpretations of the mortgage recording tax

will somehow allow the state to collect multiple

iterations of mortgage recording tax on any

revolving loan. In practice, what really happens is

New York real property doesnt secure revolving

loans, so no one pays any mortgage recording tax at

all on them.

If the state fxed its treatment of revolving loans,

this would not only raise a bit of money, it would also

encourage at least one type of commercial real estate

fnancing that is commonplace outside New York.

What does New York have against revolving

mortgage loans?

Joshua Stein is the sole principal of Joshua Stein

PLLC. The views expressed here are his own. He can

be reached at joshua@joshuastein.com.

TMO.0912.CS3.Columnists.indd 16 8/30/12 12:21:51 PM

17

September 2012 / The M.O. Columnists

The Basis Point

Sam Chandan

Lenders Press Forward,

but Outlook for CMBS

Remains Reserved

C

ommercial real estate lenders are growing

more confdent, or at least more inclined

to resume risk-taking. Bucking head

winds from the weaker economy and job market,

underwriting standards for loans on well-positioned

assets eased in the second quarter and through

the summer. Competition to fund high-quality

borrowers showed increasing spillovers from the

febrile apartment sector, with a small but growing

number of development projects and cash-out

refnancings registering alongside new ofce, retail

and hotel mortgages.

From the vantage points of operating,

investment and lending, apartments

continue to set the high bar. Long-

term fxed-rate fnancing for stabilized

apartments fell to a national average of 4

percent in the second quarter, the lowest

on record. For larger and higher-quality

assets, rates are lower. In New York

and Washington, D.C., in particular, the

prevailing notion that lending spreads

are in line with historically supportable

levels is being tested. As risk-free rates

skirt bottom, we should expect a far-

sighted market to ofset with wider cushions. For

some lenders, competitive pressures from peers and

from the sector-dominant agencies are clouding the

long view and limiting risk-based pricing power.

Short-term risk metrics refect the apartment

sectors strong cash fow momentum. Even as debt

yields inched lower, the combination of cash fow

gains and lower rates allowed debt service coverage

to improve slightly in the second quarter. But more

comfortable measures of term risk belie the elevated

maturity risk embedded in the most aggressively

priced loans. Too many loans in the second quarter

assumed a new normal in the interest rate

environment while also afording a healthy uptick in

cash fow growth.

Baseline projections for interest rates anticipate

10-year Treasury yields in the vicinity of 4.5 to 5

percent when todays new permanent fnancings

mature. In a moderate economic growth scenario

in which the economy expands below its potential

rate, that is a reasonable working assumption. Even

though Treasury yields have generally been falling

for more than three decades, they were fairly steady

at just below 5 percent in the years leading up to the

fnancial crisis. However difcult to imagine today,

higher rates will be even more difcult to digest

at refnancing, in particular for the rising count of

apartment loans with up-front interest-only periods.

The lender landscape is not as sparsely populated

as it was a few years ago. Banks with

healthy balance sheets and even

healthier regulatory relationships are

continuing to support their legacy

borrowers needs and are slowly

engaging new business. Underwriting

standards suggest that banks are betting

the economy will strengthen, though

bets are being hedged on the rising tide

lifting value-add assets. Life companies

are dominating opportunities to fund

large loans for public REITs and other

liquid borrowers. The agencies are

ceding some share of apartment lending but have

seen the absolute volume of their apartment lending

programs hold steady or increase.

The CMBS outlook is less sanguine, principally

as a result of bond investors shifting tastes and

tolerances. Securitization volume inched up just

6 percent in the frst half of 2012, though the pace

has improved, with third-quarter deals through

mid-August pushing volume closer to $25 billion.

There are currently eight deals on track to price in

September and October, with a projected average

pool balance in the range of $1.2 billion. On its

current trajectory, issuance will fall short of $40

billion in 2012, up from last year but still just a

fraction of the markets potential.

Even as some master servicers struggled with

excess capacity, limited CMBS volume is supporting

a rally in bond prices. After widening unremittingly

over the course of the second quarter, spreads

have narrowed in the weeks following the most

fretful moments of the sovereign bond crisis, when

corporate spreads opened up. For the time being, the

more recent improvement in CMBS trends is being

read as a signal of the markets appetite for more.

It remains unclear how much spreads will widen if

volume picks up or the European dilemma reasserts

itself in force, requiring higher yields from all risky

investments. Europes current dtente has come too

late to stave of recession in the United Kingdom and

on the Continent. The semblance of a return to order

will give way yet again if German ordoliberalism and

demands for austerity do not bend for its restive and

increasingly unemployed neighbors.

Current assumptions could also be upset if

conditions in Europe improve substantially. Rock-

bottom treasury yields refect global risks and are

not a vote of confdence in American fscal policy

under either presidential-election scenario. The

Feds readiness to accommodate is not in question,

but monetary policy will strain to hold long-term

rates anywhere near current levels if investors

perceptions of global risk improve.

The vagaries of the bond market and the ever-

present potential for disruptive reforms are not the

only qualifers to the CMBS outlook. For investors in

search of diversifcation, the overweighting of pools

to anchored and unanchored retail properties is

also a consideration. If conduit lenders had perfect

foresight into the long-term performance of their

originations and if the ratings models were equally

prescient, the underwriting standards would adjust

in kind to refect the risks of each retail loan.

In practice, investors that have been active in

buying recent CMBS may become wary of the

idiosyncratic risks associated with overexposure to

the retail sector. By dollar volume, almost 40 percent

of second- and third-quarter CMBS was in the retail

sector. Diversifcation into apartment loans might

enhance the investment attractiveness of new deals,

but conduit lenders are not typically positioned to

compete with agency lending and the advantage

conferred by the guarantee.

Pricing in early August, a $1.3 billion Deutsche

Bank and Cantor Fitzgerald deal ofered investors

an opportunity to diversify their new issuance

holdings toward ofce exposures. Less than one in

four dollars was backed by retail property income,

one of the smallest shares of any deal this year. If

the conduit is to reassert itself in force, it will have

to follow that lead and stave of its recent niche

persona.

Sam Chandan, Ph.D., is president and chief

economist of Chandan Economics and an adjunct

professor at the Wharton School. The views expressed

here are his own. He can be reached at dsc@chandan.

TMO.0912.CS3.Columnists.indd 17 8/30/12 12:22:11 PM

Prior to his new position, Mr. Gluck was a free-

lance consultant for high-net-worth real estate

investors.

Eastern Union Commercial, the privately

owned commercial mortgage company, has hired

Avi Pilchick as the frms chief operating ofcer,

a new position within the frm.

Mr. Pilchick, who most recently served as a se-

nior executive at a Pennsylvania real estate ven-

dor, will be assuming a corporate role within the

company, allowing company president Ira Zlo-

towitz, managing partner Abe Bergman and

other brokers to focus on deal-making.

As COO, Avi Pilchick will strengthen our cor-

porate infrastructure, policies and procedures to

ensure that brokers have the information, tools

and staf support they need to fulfll our core mis-

sion: providing clients with the best customized

loans and terms on every transaction, said Mr.

Zlotowitz.

With Avi concentrating on Eastern Unions

internal mechanisms, our brokers can focus with

even greater efciency on every detail of every

loan and arrange creative fnancing solutions

ideally structured to address the many nuances

of each individual loan.

Studley has hired

Heidi Learner as

chief economist, it was

announced last week.

Ms. Learner, an 18-

year Wall Street veter-

an who most recently

served as a vice presi-

dent of State Street

Corp., will now be re-

sponsible for develop-

ing real-time measures of supply and demand for

commercial space to assist Studleys clients in un-

derstanding the continually evolving economics

of the real estate markets.

Heidis arrival elevates our service capabili-

ties, said Studley president Michael Colacino.

Her proven ability to measure real-time eco-

nomic variables and assess their impact on mar-

kets will help our clients make better real estate

decisions. She will enhance Studleys reputation

for having the best analytics in our industry.

Before her position at State Street, where she

created quantitatively based global fxed-in-

come trading strategies, Ms. Learner worked as

a bond portfolio manager at MEAG New York

Corp., where she directed interest rate trading

for Munich Res $38 billion portfolio of assets.

Prior to those positions, she worked at both

Barclays Bank and Salomon Brothers.

Heidi Learner

United Realty Part-

ners has named Dov

Shimanowitz as exec-

utive vice president of

operations for its advi-

sory division, United

Realty Advisors LP.

[Mr. Shimaowitz]

not only brings an ex-

tensive real estate background to United Realty,

but he also has a unique combination of strate-

gic business planning and execution experience

as well as expertise in sales and marketing, said

Jacob Frydman, chief executive ofcer. He is a

valuable addition to our team as we look to make

strategic real estate investments on behalf of our

clients.

Mr. Shimanowitz will oversee United Realtys

strategic plan, business development, compli-

ance and client relations. His responsibilities also

include coordinating investment-ofering docu-

ments and flings across all of the frms afliates.

Walker & Dunlop announced Michael

Vaughn as the senior vice president of the com-

panys FHA fnance health care division. Mr.

Vaughn will serve as the head of the department

and manage origination, underwriting and qual-

ity control of health care loans.

We are excited to welcome Michael to our

FHA fnance team, which has grown signifcant-

ly over the past year. Michael is a seasoned and

highly respected professional in the health care

fnance sector and bringing him onboard is a sig-

nifcant opportunity due to the knowledge and

experience he developed as director of the LEAN

health care division at HUD, said Michelle

Warner, senior vice president of FHA fnance at

Walker & Dunlop.

Prior to his new position, Mr. Vaughn was

worked as a director of the Ofce of Residen-

tial Care Facilities for the U.S. Department of

Housing and Urban Development.

One of Americas largest privately owned

mortgage companies, Eastern Union Commer-

cial, has welcomed Jake Gluck to assume the

role of director of lender relations.

Jake Gluck will devote his time and attention

to understanding how each lender operates, the

details and nuance of how they structure their

loans and how their policies, decisions and per-

sonnel change, no matter how small, said Ira

Zlotowitz, president of Eastern Union Com-

mercial. All of these factors can impact the fnal

loan.

Jonathan Horn has

joined the Besen Group

as executive managing

director of the special

assets group. Mr. Horn,

who previously founded

Helios Capital Advi-

sors and was directly re-

sponsible for over $500

million UPB of small-

balance residential and commercial mortgage

loans, will now oversee day-to-day operations in the

Besen Groups new ofce in Red Bank, N.J.

We are pleased to have such an experienced

industry leader at Besen heading this specialized

segment of the market and to further expand our

team, stated Michael Besen, chief executive of-

cer of the Besen Group. Jonathan has a noteworthy

track record and is well-regarded in the mortgage

loan and investment community.

The Besen Group specializes in the disposition of

small-balance residential and commercial loans in

the secondary market and will operate a full-service

advisory and brokerage ofce in the new location.

The nonproft afordable housing advocacy group

National Housing Conference has named a new

president and CEO, Chris Estes.

I am honored with this extraordinary opportu-

nity to lead NHC during this critical period, Mr.

Estes said. There is a new urgency around hous-

ing issuesa level focus we have not seen for many

years. I aim to make NHC a stronger leader on

housing issues, bringing my own experience to ex-

pand on a strong tradition.

Before NHC, Mr. Estes worked for nine years as

an executive director at the North Carolina Hous-

ing Coalition.

Marcus & Millichap Real Estate Investment

Services has promoted Glen Kunofsky to execu-

tive vice president, investments. The position is the

highest level for investment professionals at Mar-

cus & Millichap.

Mr. Kunofsky joined the frm in the summer of

2001 and was promoted to senior vice president in

the summer of 2008.

Glens promotion to executive vice president

investments is a testament to his extensive knowl-

edge of the net-lease market, his superior transac-

tion expertise and his unwavering commitment to

client service, said president and CEO John Ker-

in. His thorough understanding of sale-leaseback

transactions and the depth of his net-leased asset

disposition experience make him a tremendous re-

source for our retail investment clients.

18

Work Force /September 2012 Hirings, promotions, defections and appointments

Dov Shimanowitz

Jonathan Horn

TMO.0912.WorkForceCS3.indd 18 8/30/12 1:22:30 PM

NYSERDAs Multifamily Performance Program still offers cash, low-interest nancing, and expertise to help you stop

energy waste in your buildingsexisting or new. Whats different? The pathway you take to get there.

Get started with energy benchmarking (and earn your rst cash incentive). Then tailor a plan to improve your building,

save energy and take advantage of benets that can easily surpass $1 million.

An expert Multifamily Performance Partner will help you at every step. Funding is limited. Your energy-saving options

are not. Contact a Partner today to get started. Call 1-866-NYSERDA or visit nyserda.ny.gov/multifamily.

Get thousands. Save thousands.

And do it your way.

NYSERDAs improved Multifamily Performance Program

makes it easier for you to slash your energy costs.

New choices let you customize a package

of cash incentives and affordable loans

with help from energy efciency experts.

M

P

P

-

O

W

N

-

c

o

m

m

o

b

s

v

r

-

a

d

-

1

-

v

1

Untitled-20 1 8/30/12 9:59:00 AM

20

Power Profile /September 2012

STEVE KENNY

Bank of America:

Of to the Races

Training for a marathon while working a

full-time job would be a challenge for anyone.

But working up to that 26.2-mile mark while

simultaneously doing your part to contribute to a

nationwide book of transactions that over the last

18 to 20 months included the origination of more

than $20 billion in commercial real estate loans

might pose its own set of challenges.

Steve Kenny, Bank of Americas commercial real

estate banking executive for New York and New

Jersey, is doing just that, though. And when he

takes to the starting line for the ING New York City

Marathon on November 4 to set out on a course

that will take him through all fve boroughs, the

challenges hell face will in many ways be business

as usual.

Mr. Kenny joined Bank of America in June 2000

from a legacy company, FleetBoston Financial, as a

client manager, and held this position for a decade.

Fleet was acquired by Bank of America on April 1,

2004, for approximately $47 billion in stock.

Then in May of 2010, there were some changes