Professional Documents

Culture Documents

Bps

Uploaded by

Maharjan AmitOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bps

Uploaded by

Maharjan AmitCopyright:

Available Formats

Nepal Bangladesh Bank Case Study

In the given case, Nepal Bangladesh Bank Ltd was established in the year 1994 with IFIC Bank Ltd of Bangladesh with the goal to become The Bank for Everyone. Nepal Bangladesh Bank (NBB) is back with a bang. Also, it further states NBB, had a 3 billion profit in past years but now it is struggling to recover its bad loans and make reasonable profit. In order to meet the objective and goal, NBB implemented various structural and operational changes in the wake of banks bitter experience. Moreover, it has quite diversified investment portfolio. It has around 25% of its total portfolio in the construction sector while its investment in manufacturing sector hovers 17%. NBB is currently working hard to achieve the position what they were in past. Therefore, in order to identify the status of NBB, lets do PEST Analysis which clearly shows political, economical, social and technological factor affecting.

FACTORS Political

PEST ANALYSIS OF NBB Environmental regulation and protection. Nepal Rastra Banks limitations regarding interest rates, ratios like cash reserve, capital adequacy, Nonperforming Assets etc. Merger between NBB and Nepal Srilanka Merchant Bank Limited. Threat given by government to NBB to punish, if appropriate information is not provided regarding NPA and loan statement.

POSITION 1) Reduced NPA from 19% to 10% 2) Banks capital been raised to 14% above central banks requirement 3) Merged Lanka Limited with Nepal Sri Merchant Bank

4) 25%of its portfolio construction sector

in

5) Planning to invest in productive sector as per NRB 6) CRR = 14.16%

7) CCAR = 11.07%

Anit Maharjan

Nepal Bangladesh Bank Case Study

8) CAR= 11.9% 9) CCD ratio = 67.77%

10) NPL = 10.32% 11) Net liquidity = 50.35% Economical NBB had 3 billion profits but it is 1) NBB had 3 billion profits but it is struggling still to recover its bad loans. Loss made by merger company 2) Loss made by merger (NSMBL) was recovered by NBB. company (NSMBL) was Foreign Investor is focused to invest recovered by NBB. 3) Foreign Investor is focused on its portfolio in large volume. to invest on its portfolio in Non-performing assets are down to large volume. 10% from 19% 4) Non-performing assets are down to 10% from 19% 5) Capital is more than 2.009 billion 6) Planning to strengthen financial health to distribute dividends of 15% 7) Invested 25%of portfolio in construction company loans. 8) Planning to invest in productive sector 9) Offers 9-15% interest rate on loan and 8-11.5%on deposit 10) Total deposit million Social = 15477 struggling still to recover its bad

customer and They had donated computers and 1) Good employee relationship wheelchairs to orphanage in past 2) donated computers and wheelchairs to orphanage days.

Anit Maharjan

Nepal Bangladesh Bank Case Study

In future they are planning to 3) planning to separate budget from profit for CSR activities separate budget from profit. 4) 19 branches to serve people 5) Planning to expand its network to reach 65%of the population of the country Technological Trying banking to make by computerized eliminating 1) 16 ATMs throughout country 2) Access to NTC bill payment 3) Access to SMS and Ebanking 4) Planning to expand products based on technology

system

traditional banking structure.

From the PEST analysis, NBB is trying to improve its status by overcoming the threats and weakness with the help of proper utilization of opportunities they have got. Further, NBB is struggling at present and trying to recover its NPA and bad loans. Thus, after analyzing the PEST, see for SWOT analysis. SWOT ANALYSIS Strength Over 18 years in the banking industry Customer Loyalty Customer friendly and experience staff Synergy between local business and joint venture partners Good quality and non Weakness Challenge to receive public business. Opportunity Prospectus of economic development. Prospectus to foreign direct investment Increasing economic activities. Threats Stiff competitions Possibility of economic recession Fluid political environment

Anit Maharjan

Nepal Bangladesh Bank Case Study

funded business.

However, NBB is passing through recession because of its bad loans and NPA, they are projecting something new with best strategy in near future. Thus, they are processing internally and they are back with a bang at current scenario. The new strategies they are following are: 1. They have developed criteria to manage risk and liquidity from past experience. 2. Various structural and operational changes made to wake of bitter experience. 3. NBB planning to sell its share to foreign company to diversify its portfolio. 4. NBB is trying finding new product in market instead of traditional deposits and lending. 5. NBB is planning to expand technology based products, specialized and standardize products with structural reforms. 6. Investment in energy and agriculture by around 15% also looking to enter in newer sector like medical and education, tourism for diversification investment portfolio. All in all, the strategies that NBB using is suitable to boost up its economic growth. Except NBB, Nepal standard Charted Bank also have been focusing in foreign investment and manufacturing portfolio. Moreover, the commercial banks are coming up with new ideas and merger strategies to penetrate the market through integration process. Likewise, tough competition and regulations offered by NRB enhance the commercial bank to bring new strategies as followed by Nepal Bangladesh Bank. Despite of fact, most of the banks are passing through recession and searching for alternative strategy to sustain in market. Thus, same case of recession and competitive market encouraged NBB to follow new strategies. In such kind of situation, apart from NBB other bank would have done same.

Anit Maharjan

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Disclosure Ulip Feb-2020Document60 pagesDisclosure Ulip Feb-2020pankarvi6No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Boom in Global Fintech InvestmentDocument16 pagesBoom in Global Fintech Investmentscrdbsr100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- FAC About Loans PDFDocument5 pagesFAC About Loans PDFDenzel BrownNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- ST Hannah's High-School-Fees-Structure-2020Document1 pageST Hannah's High-School-Fees-Structure-2020RUTIYOMBA EustacheNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Star-Digi Productwise Contact DetailsDocument6 pagesStar-Digi Productwise Contact Detailsmadirajunaveen100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Robert HuebnerDocument13 pagesRobert HuebnerjtnylsonNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Steve BurnsDocument12 pagesSteve Burnsscarnose33% (3)

- Format Purchase Order - 7Document4 pagesFormat Purchase Order - 7shovit singh100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- E-Commerce: Slide 1-1Document12 pagesE-Commerce: Slide 1-1haleemNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

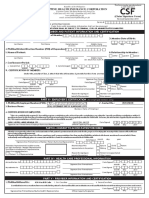

- CSFDocument1 pageCSFChristopher Garrata Galano Jr.50% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Lessons From 1 000 Corporate Defaults 2011-11-30Document7 pagesLessons From 1 000 Corporate Defaults 2011-11-30louislu87No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Difference Pledge MortgageDocument6 pagesDifference Pledge MortgageJeffrey Constantino Patacsil100% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Co Operative Banking ProjectDocument55 pagesCo Operative Banking Projectamit9_prince91% (11)

- Pilgrim Bank - ADocument7 pagesPilgrim Bank - ASaurabhNo ratings yet

- Capstone ProjectDocument48 pagesCapstone ProjectTulika Agrawal Rawool0% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Gsis LawDocument17 pagesGsis LawJohn Ree Esquivel DoctorNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Depository System and Its Role in Stock MarketDocument9 pagesDepository System and Its Role in Stock Marketlokesh chandra ranjanNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The IB League Case StudyDocument6 pagesThe IB League Case StudyNidhi KumarNo ratings yet

- Iiw-Aws 2015Document2 pagesIiw-Aws 2015fishy18No ratings yet

- Terms and Conditions: Æ ON Credit Service (M) BerhadDocument19 pagesTerms and Conditions: Æ ON Credit Service (M) BerhadKhazwan AriffNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- (In Case of Joint Accounts, Part-I (CIF) To Be Taken For Each Customer)Document20 pages(In Case of Joint Accounts, Part-I (CIF) To Be Taken For Each Customer)Jignesh V. KhimsuriyaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Starting A Spa BusinessDocument2 pagesStarting A Spa BusinessBessie GoNo ratings yet

- Final PL FormDocument5 pagesFinal PL FormMarvin BonaobraNo ratings yet

- Non-Current Asset PoliciesDocument16 pagesNon-Current Asset PoliciesPaul ChangNo ratings yet

- Report On NABARDDocument15 pagesReport On NABARDAnkit TiwariNo ratings yet

- Concurrent Audit ProcessDocument7 pagesConcurrent Audit Processsukumar basuNo ratings yet

- RoyalBritishBank V TurquanDocument3 pagesRoyalBritishBank V TurquanAlbukhari AliasNo ratings yet

- Report On Non Performing Assets of BankDocument53 pagesReport On Non Performing Assets of Bankhemali chovatiya75% (4)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Research Report On HDFC Bank - An Investor's Perspective.Document19 pagesResearch Report On HDFC Bank - An Investor's Perspective.benoypNo ratings yet

- Fire InsuranceDocument5 pagesFire Insurancerahulhaldankar0% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)