Professional Documents

Culture Documents

Full Convertibility If

Uploaded by

Prakash IyerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Full Convertibility If

Uploaded by

Prakash IyerCopyright:

Available Formats

Indian government adopted the present form of current account convertibility accepting the IMF agreements..

that decision was an indicator to the world that India is getting ready for the free trade as current account convertibility allows free flow of investments and trade related payments,receipts.it heralded a new era as we opened up the markets through liberalization. Yes you are right the rupee is not fully convertible,there are valid reasons for not making it fully convertible at this moment. Full capital account convertibility is like an exclusive badge to the developed economies....and India is still a developing country.It can be too risky if we allow full capital account convertibility.But i think right now there are some concessions to the NRIs... risks involved if rupee is made fully convertible---full convertibility may lead to massive inflows --->that may lead to excessive liquidity problem in the economy.The result would be 'inflation' . --To suck the excess liquidity RBI will have to issue debt papers,bonds,etc. along with increasing repo and CRR rates. This will put heavy burden on the RBI ,because it has to pay interest rates for huge amounts and this may lead to more problems if inflows don't stop (the value of the debt paper the RBI sells to the banks decreases as its market supply increases) --excessive capital inflow will lead to currency appreciation.This will have negative effect on the exports and jobs .(affects balance of trade--because imports will exceed exports) --full capital account convertibility increases short term FIIs more than long term FDIs, thus leading to volatility in the system. --Now excessive out flows --there can be excessive out flows also....excessive outflow of capital will affect the economic growth . so the effects are extreme . --unrestricted capital flows constrains the countrys ability to manage the exchange rate,now we are not meddling with the exchange rates but in future we may not have the chance to manage exchange rates when it is necessary. --The instability in the international markets (for ex: like the sub prime crisis and fears of a recession, oil crisis )and speculations will lead to flight of capital at large scale. These are some reasons that made RBI and Government to think about full convertibility.Government has accepted and is implementing most of the recommendations made by 2nd tarapore committee. Edit -- Good analysis . Yes there are pros and cons . In this decade we can expect few more steps towards full convertibility.i agree full convertibility could make rupee one of the premier currencies in the world. for a currency to gain premier status, there must be strong demand for the currency as a medium of exchange, a unit of account and a store value. In addition, the size of the economy, its trade volume, currency stability along with convertibility are vital pre-requisites.

So whats the big deal about Indias move towards fuller capital account convertibility (CAC)? Youre right. For most practical things in life, you dont need CAC. You can buy most things foreign with rupees when they are imported. You can travel abroad and buy whatever dollars you need - well almost - over the counter. You can also incur expenses abroad on your credit card and pay for the dollars (or pounds, or euros) expended in rupees. You can invest in specified foreign shares and mutual funds up to $25,000 every year thats more than Rs11 lakh, enough for anybody but the super-rich. So why would the Reserve Bank of India bring former deputy governor SS Tarapore out of retirement to work out yet another roadmap for capital account convertibility? Why wont the old one, which Tarapore submitted in the late nineties, do? Well, much has changed since then. The most important thing that has changed is that India is awash with foreign currency reserves today ($137 billion, excluding gold, at last count).

Equally, India Inc is getting impatient with all the permissions it requires to buy companies and assets abroad. Fuller CAC will help them do that in a jiffy. An economy is said to have CAC when there is complete freedom to convert local currency into foreign currency and vice versa - without the permission of the RBI, and without limits. As of now, India has current account convertibility.This allows residents to receive and make payments in foreign currency for all purposes other than investments and loans. It also allows trade-related payments and receipts by importers and exporters in dollars and any other foreign currency. A capital account transaction, on the other hand, consists of foreign direct investment (both by foreigners in India and by Indians abroad), investment in financial securities (both ways), giving and receiving of foreign loans and short-term investments by foreigners in India and vice-versa. So what does this mean for India and the Indians? As of now there are limits to the amount of foreign exchange one can take abroad depending on the purpose at hand. Individuals can freely remit up to $25,000 per calendar year for any permissible current or capital account transaction or a combination of both. But with Lets say, an individual wants to invest in stock markets abroad. He can do that up to $25,000 annually. With CAC coming in, there will be no limit on this. Similarly for a person wanting to go abroad for a holiday, the current limits are $10,000 per calendar year; with CAC coming in, there will be no upper limit. The current limit for business travel, which stands at $25,000, will also go. Under full CAC, there are just no limits on the money you can take abroad. There will also be greater freedom for money to come in. NRIs and persons of Indian origin can, as of now, repatriate up to $10 million a year from their non-resident rupee accounts. Once full CAC comes in, there will be no upper limit on this as well. The same rules apply to foreign firms also, which can invest at their own discretion without RBI permission. Indian companies also benefit in that they can access more money faster.

http://www.dnaindia.com/money/report_so-what-does-rupee-convertibilitymean_1019154

Reserve Bank of India (RBI) on Tuesday said despite the high global crude oil prices, Budget proposals and moderating economic growth would help lower inflation. RBI deputy governor Subir Gokarn said full rupee convertibility could not be an immediate goal; it would be a gradual process. On internationalisation of the rupee, I dont really see it at this point of time an explicit, strategic objective.... I think the focus, at least in the short- to medium-term policy on capital account management, is gradual liberalisation, though with cognisance and action to mitigate the risks. Speaking on the sidelines of an IMF-Icrier event, he said, "Food prices are going to play a role, as we have some stabilisation and even softening, either because of monsoon in the short term or because of government initiatives that were made quite explicit in the Budget. These would also help contain inflation." The Budget had raised the foodgrain productivity allocation for eastern India in the next financial year by Rs 600 crore. It had also announced tax breaks for farm extension activities. Owing to rising food inflation, wholesale price inflation rose from 6.55 per cent in January to 6.93 per cent in February. The high food inflation also affected retail inflation consumer price inflation rose to 8.83 per cent in February from 7.65 per cent in the previous month. Gokarn said RBI policies could not be based on the nascent consumer price inflation index. He added high oil prices play a prominent role, as does the currency movement. However, the moderation in growth may help contain inflation from the demand side.

Asked if RBI had enough monetary headroom in the light of hardening global crude oil prices, Gokarn said, Space is the question of how prices itself evolve. I think it's not a meaningful thing in terms of the global crisis, in which commodity prices remain so firm and so rigid. If these prices come down, inflation dynamics change completely and this creates space, he said. Citing the example of the global meltdown in 2008, the deputy governor said, "When we saw the Lehman collapse, inflation was 12.5 per cent and the interest rate was nine per cent. The fiscal situation was much better, but oil prices were $147 (a barrel)." Within weeks of the Lehman collapse, oil prices fell very sharply, he said. This allowed the monetary stance to respond quite aggressively." He said the free-float of exchange rates act as a shock absorber. The rupee is, more or less, convertible on trade account, but not on capital account. With India's current account deficit estimated at 3.6 per cent of the GDP this financial year and inflation at around seven per cent, capital account convertibility could not be resorted to, analysts said. RBI's Tarapore Committee had earlier said for India to go for capital account convertibility, CAD had to be less than three per cent, inflation below five per cent and fiscal deficit at 4.1 per cent of GDP. On the diversification of foreign exchange reserves, Gokarn said RBI was looking at Chinese currency RMB in the monetary system. "I don't think we are, at this point, looking at strategic currency diversification. But it is something that would happen as a matter of routine, as the global currency dynamic changes." Growth in India's gross domestic product (GDP) is estimated to fall to 6.9 per cent this financial year from 8.4 per cent in the previous two financial years. Many analysts attributed the decline in growth to RBI's monetary tightening. Crude oil prices have surged to $125 a barrel and the government is expected to raise petrol prices, exerting more pressure on inflation.

http://business-standard.com/india/news/no-immediate-steps-for-rupeeconvertibilitycapital-account/468494/

What is full convertibility of rupee on capital account? Is the Indian economy ready to switch over to such full convertibility? Convertibility of the domestic currency is one of the prerequisite for complete globalisation of any economy. Along with de-controls, freer movement of goods and services, removal of tariff and non-tariff restrictions and easier mobility of the workforce, convertibility is one of the important cornerstones of the process of globalisation and economic reforms. Current account convertibility is already there and the stringent controls of pre-nineties over the foreign exchange have also been relaxed to a great extent. The stringent Foreign Exchange Regulation Act (FERA) was replaced by a relaxed Act called Foreign Exchange Management Act (FEMA), making the movement of foreign exchange easier. Resident Indians and companies now have access to foreign exchange for various purposes, including education and travel. They can also receive and make payments in foreign currencies on trade account. Full convertibility implies that the existing restrictions on the capital account would also be withdrawn. Corollary of this step would be that the domestic assets, including the real estate and stocks, could be sold to the foreigners and the payments in foreign currency could be received in the country without prior regulatory clearances. Some steps have already been taken to facilitate the full capital account convertibility in the country. Foreign exchange has been allowed to flow into Indian stock markets through registered institutional investors. In addition, many categories of the resident Indians have been allowed to open foreign

currency accounts abroad. Indian companies have also been making overseas acquisitions for which they have been given access to foreign currency resources. It would, however, be wrong to presume that full convertibility on the capital account would result in lifting of all the restrictions. Even the developed countries like the USA block foreign investment in some of the sectors. Despite the government decision in this regard, it has not been easy for the non-resident Indians to acquire property and real estate in the country. The government of India, though has allowed Direct Foreign Investment (FDI) in most of the fields, yet certain caps have been put by the government on the FDI in some of the sectors. Most of these restrictions may continue even after the capital account convertibility is introduced. Benefits would be in terms of more flow of foreign capital into the economy, resulting in higher investment and the resultant growth rate. Further, the financial and capital markets would bring more profits to the domestic investors. There are certain prerequisites for introduction of capital account full convertibility. The economy must be nearer to the global standards in the matter of fiscal deficit, inflation rate, interest rates, foreign exchange reserves, etc. It is said that the economy can be said to be ripe for capital account convertibility only if interest rates are low and de-regulated and the inflation rate in the three consecutive years had been around three per cent. In addition, fiscal deficit should be low at around 3 per cent and foreign exchange reserves should be reasonably high. Further, the economy has to be in good shape, as full convertibility would result in bringing in the instabilities and fluctuations of the outside world into the economy, as it gets more connected to the outside world. Further, imperfections in the economy, like the urban-rural dichotomy and difference in the growth rates in various sectors like agriculture and industries, as well as services, must be removed. Considering the above prerequisites it appears that the Indian economy is not yet prepared for switching over to the capital account convertibility. The only requisites which have been met are reasonably high level of foreign exchange reserves, mostly deregulated interest rates and relatively good condition of the economy as a whole. In most of the other areas there is lot more to be done. Interest rates as well as the inflation rate are higher than the required levels. Further, the imperfections of the economy are glaring as the services and industrial sectors are booming, but the agricultural sector which employs over 65 per cent of the total work force, is growing at a much lower rate of 2 to 3 per cent per annum.

http://www.competitionmaster.com/category.aspx?ID=b1a10e19-7d4d-4638-bc83138458e2b63a

Full converted of the currency means the local currency can be exchanged to foreign currency without any governmental control. Presently, the issue of capital account convertibility is in the discussion stage. Capital Account convertibility means the freedom to convert domestic financial assets at market determined rates. It can also imply conversion of overseas financial assets into domestic financial assets. Broadly stage it would mean freedom to firms and residents to freely by overseas assets such as equity, bonds property and acquire ownership of overseas firms besides free repatriation of proceeds by foreign investory. The committee on capital account convertibility appointed in 1997 with Dr. Tarpoor as chairman. The committee had provided a roadmap for the economy to whereas most mental health programmes are move towards full convertibility, step by step, and the time frame was 19972000.

The committee had also laid down certain pre-conditions for implementing the reforms. But nothing much happened during that phase. One of the main problems an economy which has opted for a free float has to contend with is, the prospects of outflow of what is termed as speculative short term flows.

http://www.preservearticles.com/2012032528882/short-notes-on-full-convertibilityof-indian-rupee.html

Home Current Affairs 2012 Current Affairs Quiz Bank PO Quiz IAS Quiz Career News

Full convertibility of Rupee

May 15th, 2011

Last Updated: January 31, 2012

3

The Government when introduced the Partial convertibility of Rupee in 1992, had announced its intention to introduce the full convertibility on the current account in 3-5 years. The full convertibility means unified market determined exchange rate regime. Encouraged with the success of the LERMS, the government introduced the full convertibility of Rupee in Trade account from March 1993 onwards. With this the dual exchange rate system was abolished and LERMS was now based upon the open market exchange. The full convertibility of Rupee was followed by stability in the Rupee Rate in the next many months coming up. The above full convertibility was introduced on Trade account. The Government wanted to introduce the Full convertibility of Rupee on Current account (means invisible also included). In August 1994, the Government of India declared full convertibility of Rupee on Current account with announcing some relaxations as per requirements of the Article VIII of the IMF.

These were: 1. Repatriation of the income earned by the NRIs and overseas corporate bodies of NRIs in a Phased manner in 3 years period.

2. The ceiling for providing foreign exchange for foreign tours, education, medical treatment, gifts and services was made just an indicative. Above this ceiling, foreign exchange could be obtained for payments, while making a reference to RBI. 3. While the Principal amount on the NRNR (Non Resident Non Repatriable) Accounts was non repatriable, the interest was made repatriable

http://www.gktoday.in/full-convertibility-of-rupee/

The dramatic (37.5 per cent) growth in exports in 2010-11 confirms my long-standing belief that the exchange rate is not a major determinant of Indias export competitiveness. Despite the rupee strengthening by four per cent on an average in 2010-11 5.5 per cent, if we use the average rate three months in advance, when most exports were likely priced exports surged like never before. Indeed, since 2003-04, there has been virtually zero correlation between the average value of the rupee (with or without a three month lead) and exports and, for that matter, imports in any particular year.

Also Read

Related Stories News Now

- IMF sees 'more pressing' need

for tightening in Asia prices from May unlikely

- Mercedes-Benz India to hike - Yuan at record high, revaluation - The Fund recants - New trade winds - Global economy recovering but

downside risks remain: G20 The most important factor for export growth is, obviously, the state of global markets. In 2009-10, when the global economy was reeling from the fallout of the global debt crisis, exports fell by 3.5 per cent despite the rupee being more than 10 per cent weaker than in the previous year. If people arent buying, a weaker currency has all the impact of pushing on a string. More specific to, and much more significantly for, India, our exports growth has benefited from the more or less continuous rise in our productivity. Each year, Indias productivity jumps as a result of improvements in telecommunications, transportation, business skills, financial markets, government finances and even bureaucratic friction. To be sure, these improvements are uneven and piecemeal, but, from time to time, and differently for different industries and companies, the cumulative change results in a bolus of increased competitiveness. Most exciting, of course, is the fact that we still have a long way to go before our productivity is even close to plateauing out, as it has in developed economies like Japan, Germany and the US. In other words, export growth is likely to remain largely independent of the exchange rate for some more years. This suggests that making the rupee fully (or substantially more) convertible will have little impact on export competitiveness or export growth. And, given that the world is very loudly looking for a wider array of reasonably stable convertible currencies, it is definitely an excellent time to push the rupee forward. The benefits to the economy would be multifold, from dramatically increasing foreign investment to further adding to business productivity to making life much simpler for citizens.

Of course, greater convertibility would likely lead to higher rupee volatility. However, our reserves are more than adequate to prevent any dramatic macro consequences we had to draw down only about $30 bn of our reserves (around 10 per cent) to combat the 2008-09 crisis, and we are back at around $300 bn and counting. To address the impact of this higher volatility on a micro-level, the Reserve Bank of India (RBI) should license selected NBFCs as super-AD2s who could provide substantially improved service in the FX arena to small and medium enterprises, which are very poorly served by the current banking establishment. RBI has indirectly acknowledged this need by launching currency futures to provide small FX users an alternative window; however, as is well-known by now, this hasnt worked for hedgers. Indeed, full convertibility would also make the futures market more attractive for hedgers since physical settlement would automatically be permissible. However, before RBI can throw the switch, we need hold your breath a meaningful debt market. You cant have a convertible currency till there is sufficient liquidity in the debt market to where the FX forwards reflect interest rate differentials at different tenors. RBI has acknowledged privately that the ONLY way we can get there is if nationalised banks become much more aggressive in trading their interest-sensitive assets. RBI could push banks to do this by, say, eliminating the held-to-maturity segment, which would require banks to mark their entire bond portfolios to market every day. But the risk is that most nationalised banks may well back completely away from risk and stop holding government securities, which could result in dramatic problems for the governments borrowing programme. However, since the finance minister announced in the last budget that the Office of Debt Management would be set up and operational shortly, RBI will soon be free to focus on monetary policy and market development. The transition will certainly have glitches some having to do with RBI being unable to stop mother-henning; some, more seriously, with our politicians having to learn that the market will severely punish fiscal indiscipline. But you cant make an omelette without breaking eggs. The good news, though, is that the increasing activity of all sections of society, abetted by the media, has already started the process of demanding discipline from our political servants. The energy and continuity of these efforts confirm that theres no turning back. The new India is, indeed, in play! Aa jaon maidan mein! As for the rupee my guess is that we will see full convertibility in not much more than two years.

http://www.business-standard.com/india/news/jamal-mecklai-time-to-fast-trackfull-convertibility/434478/

What is full convertibility of rupees?and what impact does it have on our ecomomy?

5 years ago Report Abuse

sb

Best Answer - Chosen by Voters

The full convertibility of the Indian currency means that the rupee would be made freely exchangeable into other currencies and vice versa. This would also mean that international investors can buy and sell Indian assets at will. "The issue was first examined by the Tarapore Committee. Much water was flown down the Ganga since then. Our own position, internally and externally, has become far more comfortable" the Prime Minister said. Ever since India's foreign exchange reserves crossed the $50-billion mark, the issue of full capital convertibility has been keenly debated. India's forex kitty has been steadily growing during the past few years; it stood at $143.92 billion for the week ended March 10, 2006. The Indian rupee has been ruling below Rs 45 a dollar for the last six

months. According to RBI's latest report on Currency and Finance, released by the Finance Minister, Mr P. Chidambaram, today at the same venue, the monthly average Real Effective Exchange Rate of rupee appreciated by 0.5 per cent and the Net Effective Exchange Rate has appreciated by 0.6 per cent, in the financial year. Bankers, corporates welcome move Bankers and corporates welcomed the Prime Minister's move towards the full float of the rupee. Mr Cherian Verghese, Chairman, Union Bank India, said it is the right time to go in for full convertibility as the economy is doing well and the country's forex reserves are at a comfortable position. It would attract much more capital to the country, he said. Mr Anil Singhvi, Managing Director, Gujarat Ambuja Cement Company, said the move is in the right direction. But the road map for the capital account convertibility should be transparent and, given the current environment, convertibility can be achieved in the next two-three years. The Tarapore Committee had suggested a road map for full convertibility in 1997. However, the Asian currency crisis had put the issue on the back-burner. "Mumbai, with all its inherent advantages in terms of human capital and commercial acumen, can be positioned as a viable Regional Financial Centre," said the Prime Minister. Full capital account convertibility will facilitate the transformation of Mumbai into not only a regional but also a global finance centre, Dr Singh said. "There are multiple options that are possible for such a centre, including as an SEZ (special economic zone), and I am confident that we can make steady but firm progress in that direction. "The State Government will have to ensure an appropriate enabling environment, in particular the physical infrastructure." Full convertibility of the rupee should give companies more access to foreign debt markets, cut delays in foreign exchange trades, and enhance foreign investor access to India's banks and debt market, while potentially allowing the rupee exchange rate greater freedom of movement. Allowing freer flows between companies and investors, domestically and abroad, would promote desired foreign investment in the growing Indian economy. And it would remove a major remaining obstacle to India's integration with the global economy, a reflection of the nation's increased selfconfidence.

http://in.answers.yahoo.com/question/index?qid=20070821210323AANjGCP

Since 1991 Manmohan Singh has formulated economic policy for India under the instructions of the IMF (International Monetary Fund), World Bank and later WTO (World Trade Organization), disregarding the interest of the 90 percent of the population of India who are either of lower middle class or poor. The recent decision of the government to have full convertibility of Rupee which will affect everyone in the country but remotely understandable by a few, is one such important decision, which is designed to please the international financial institutions and the 10 percent of the population of India who are either rich or of upper middle class. It is essential to judge a policy by examining the costs and benefits of it. The government is talking about the illusory benefits of this convertibility, which will basically remove all obstacle to the free flow of money and as a result goods and services also can move freely. The government, in a fully convertible

regime, will not be able to control these flows directly. Indirectly controls will be implemented by changing interest rates and taxes but the effectiveness of this control according to the international experiences are uncertain. The benefits of free flows of money in a fully convertible regime means foreigners would be able to invest in the Indian stock markets, buy up companies and property including land (unless there are restrictions). Indian people and companies can import anything they would like, buy shares of foreign companies and property in foreign lands and can transfer money as they please without going through the Hawala business. Indians those who have not paid their taxes or repaid their loans taken from the Indian banks will be free to transfer their money to foreign countries outside the jurisdiction of the Indian authority. Implications are very serious indeed. The expected benefits for India would depend on the attractiveness of the country as a safe destination for short-term investments. Long-term investments do not depend on convertibility. China has no convertibility, instead a fixed exchange rate for the last 12 years. Yet, China is the most important destination for long-term foreign investments. Thus, discussions about the full convertibility should be about the desirability of short-term investments and their implications. Short term investments i.e., foreign investments in shares and bonds of the Indian companies and India government depend on the demonstration of profit of the Indian companies and the continuous good health of the Indian economy in terms of low budget deficits, low balance of payments deficits, low level of government borrowings, low level of non-performing loan in the Indian banking system. From these points of view India cannot be a very attractive destination as the health of the economy despite of the propaganda of the Indian government is very weak with huge government debt, revenue deficits, Rs.150,000 Crores of uncollected taxes and Rs.120,000 Crores of unpaid loans in the banks. Increasing price of petroleum also increasing the balance of payments deficits of the country. With 80 percent of people live on less than 2 dollars a day, and 70 percent of the people live on less than 1 dollar a day, profitable market in India is also very small. If the Indian companies working under these constraints cannot demonstrate good and continuous profit, short-term investments will fly out very easily if there is any sign of economic downturn when there is a fully convertible Rupee. The results will be further increase in the balance of payments deficits and fall of the exchange rate of Rupee, which will provoke Indians to take their money out of India. Another advantage of full convertibility of Rupee for the Indian rich is that they can import as they like and buy properties abroad as they were allowed to do so during the days of British Raj. It has certain advantages for the Indian companies who will be able to import both raw materials and machineries or set up foreign establishments at will. This also has the adverse consequences for the Indias domestic producers of these raw materials and machineries, as they have to compete against foreign suppliers who like Chinese may have deliberate low rate of exchange for their currencies thus making their goods low in price. Foreign suppliers also can be supported by all kinds of subsidies by their government so as to make their prices very low. Agricultural exports from Europe, USA, Thailand, and Australia can ruin Indias own agriculture. There are many such historical examples in India. Within 20 years between 1860 and 1880, Indias domestic manufacturing industries were wiped out by free trade and convertible Rupee during the days of British Raj. Indian farmers during those days could not cultivate their lands, as the imported food products were cheaper than whatever they could produce. Demonstration of wealth by the Nawabs and Maharajas of India in Paris and London during the days of British Raj has not done any good for starving millions of India but was responsible for massive misuse of Indias foreign currency reserve created by the sweat and blood of the Indias poor in those days. Full convertibility of Rupee and free trade may bring back those dark days. The freedom for Indias rich to buy companies and property abroad may lead to massive diversion of funds from investments in the home economy of India to investments abroad. These amount to exports of jobs to foreign countries creating more and more unemployment at home. Japan in recent years suffers from this phenomenon, where increasingly Japanese companies are transferring funds to China for investments, taking advantage of the very low wage rate and low exchange rate of Yuan, thus creating unemployment at home. Although China has massive surplus in the balance of payments, huge reserve of dollars and gigantic flows of foreign investments, a non-convertible Yuan and controls on

transfer of money have kept Chinas exchange rate low enough so that Chinese goods can capture the markets of every important country of the world. The most dangerous consequence of convertibility is that Rupee will be under the control of currency speculators. A fully convertible regime for the Rupee will certainly include participation of Rupee in the international currency market and in the future market of Rupee, the playground for the international speculators. It is very much possible for the speculators to buy massive amount of Rupee to drive up its exchange rate and then they can suddenly sell all to gain enormous profit. That will drive down Rupee to a very low depth suddenly. If the Reserve Bank of India wants to protect Rupee in such a situation, within a few days India will have no foreign exchange left in reserve and the country will go bankrupt. Similar situation took place in 1998 for South Korea, Thailand, and Indonesia, all with then convertible currency. Malaysia has survived by imposing fixed exchange rate, exchange control, and making Malaysian dollar nonconvertible. Both India and China were unaffected because their economies at that time was closed and their currencies were non-convertible. Similar situation took place for the British pound in 1992 when the British government lost its entire dollar holding to save pound, which was under attack from the speculators. However, Britain with 400 tons of gold in the Bank of England could not go bankrupt. There is no guarantee that a similar situation will not occur for India. India has no massive gold reserve; in 1991 it had to submit its gold reserve to the Bank of England to get loan from the I.M.F. Thus, it will certainly go bankrupt if there is any speculative attack on Rupee. Convertibility also implies that the government of India will lose all controls over the economy. In a regime with convertible currency and as a result a flexible exchange rate, fiscal policy of the government, i.e., various taxes and public expenditure to stimulate the economy, will be neutralized by adverse monetary flows out of the country. Only monetary policy i.e., interest rate and money supply by the Reserve Bank of India, may work to some extent. Money supply as experience suggests can work only on the negative direction; i.e., if the country reduces the money supply inflation can be controlled at the cost of reduced investments and increased unemployment. If the country, instead, increases the money supply to stimulate the economy it can cause inflation and eventually unemployment will go up as well because of possible bankruptcy of the private companies as a result of high inflation. The argument of Keynes that if there are underemployed resources in the economy increased money supply resultant from increased government spending cannot cause inflation is not valid for a dual economy like India where the 10 percent of the population live in a different planet from the other 90 percent of the population. Interest rate is a dangerous instrument. If the government reduces it, there will be inflation, speculative movements in the market and disincentives for the savers, which would reduce future investments. Reduced interest rate for a convertible Rupee will reduce the exchange rate of the Rupee. The currency speculators will start selling Rupee and short-term investments will fly out of the country. There would be a free fall of the Rupee in the international currency market. As a result the economy may go bankrupt without any foreign exchange. The result can be collapse of the private companies leaving millions of people unemployed. If the government increases the interest rate exchange rate of Rupee will go up. Short-term investment will flood the market, speculators will buy more Rupee, but the exporters will be unable to sell their products abroad because of higher price of Indian exports as a result of higher exchange rate of Rupee. High exchange rate of Rupee also mean lower price of imported products. As a result both manufacturers and farmers will suffer from enhanced competitions from the manufactured products from the East and South East Asia and farm products from USA, Europe, Australia and Thailand. Thus, interest rate is a dangerous weapon to depend upon. If a country wants to use it extensively the economy will go up and down creating havoc for the people. In 1988 Nigel Lawson, the then Chancellor of Exchequer of Britain used lower interest rate to stimulate the economy creating speculative bubble for a few years until 1991, then he had to increase the interest rate to a very high level to protect the British pound from the speculators causing serious depression of the economy and high unemployment. The policy of the Federal Reserve of the U.S during the presidency of Carter had the same experience. Recently Thailand, South Korea, Argentina, and Chile have suffered in the same way.

If the interest rate is determined by the market, as it should be in a convertible currency regime with unrestricted flows of money, India government will not have any control over the economy to give it a direction. The only instrument that may be available is the public expenditure policy. The government can stimulate the economy by increasing public expenditure, which may have uncertain consequences for the fate of Indian Rupee. Due to increased public expenditure, rate of growth of the economy and employment may go up, but at the same time there will be increased deficits in the balance of payments. Increased rate of growth may invite short-term investments and international speculators will buy more Rupee. However, increased budget deficit will cause increased deficits in the balance of payments, which will soon drive out short-term investments and speculators will start selling Rupee. The exact consequence will depend upon how fast the economy can grow and whether the reduced exchange rate will stimulate the export earnings strong enough to keep the growth growing. The experience of South Korea with a convertible currency from 1996 to 1998 showed that convertibility leads to bankruptcy due to speculative attacks against the currency in the international currency market. Argentina and Chile have similar experiences recently. USA during the days of Reagan and Clinton has avoided the consequences because USA is immune from effects of balance of payments deficits. Value of the U.S dollar does not depend on the balance of payments deficits of USA but on the value of international trade in petroleum, as dollar is the sole currency for petroleum trading in the world. Also, dollar is the currency in which other countries keep their reserve of foreign exchange. As India not USA, the experience of USA cannot give any guide for the Indian policy makers. India should learn from China. China has no convertibility of Yuan, instead there are extensive controls on financial, and commodity flows in or out of the country. Foreign companies cannot have 100 percent ownership; they must have partnership with Chinese state owned companies. Foreign companies cannot repatriate profit, as they like; they must bring new technology, they must export most of their products. China imports what it needs, although theoretically it is a member of the World Trade Organization. China does not allow short-term investments, but it is the most attractive destination for the long-term foreign investments. Chinese Yuan does not take part in the international foreign exchange market and thus, protected from the currency speculators. China has reduced the exchange rate of Yuan by 40 percent in 1984 and kept it fixed only to increase it by only 2 percent in 2005 when it has gigantic reserve of US dollars and massive trade surplus with the rest of the world. Very low exchange rate of Yuan is one of the most important reasons why China has managed to capture the markets of every important countries of the world. Convertibility of Rupee will give pleasure to the 10 percent of Indian people who are either rich or upper middle class, traders in the stock market, speculators, bankers, and accountants. The rest 90 percent of the people will be adversely affected with loss of employments in the manufacturing sector and bankruptcy in the agricultural sector and total economic uncertainly. During the days of the British Raj, Rupee was convertible, India had very large surplus in the balance of payments. Indias share in the world trade was much higher than what it is today. However, millions of Indians used to starve to death from time to time; millions of acres of land were left uncultivated by the bankrupt farmers; there were hardly any industry except for a few textile mills, only 15 percent of the population had any education at all. Yet at the same time, one could buy Rolls Royce and Scotch whisky in Bombay and Calcutta; Jinnah could buy his apartment in Bond Street of London; Maharaja of Patiala could build palace in Paris. We are returning back to those days through the acts of an unelected (only selected for the upper hose of the parliament) Prime Minister Man Mohan Singh whose loyalty is not to the people of India but to the international financial institutions. In any democratic country for any serious matter like turning the Rupee into a convertible currency there must be referendums. There were referendums in each and every European country when they wanted to create the European monetary system whereby each European currency would be aligned to each other to create a common currency Euro. Although India claims to be a democracy, Indian policy makers try their best to avoid the public opinion, even the parliament. Major issues like Indias membership of the World Trade Organization, abolition of the planned economy and privatization of public assets, free trade, and now the convertibility of Rupee should be debated in the parliament and people of India should be allowed to give their verdict in referendums if India wants to be a true democracy.

http://www.ivarta.com/columns/OL_060501.htm

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- International Finance Assn 02Document10 pagesInternational Finance Assn 02Prakash IyerNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- 98roibyabm 120401195725 Phpapp02Document42 pages98roibyabm 120401195725 Phpapp02Prakash IyerNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Training Feedback Form - Level 1Document1 pageTraining Feedback Form - Level 1Prakash IyerNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- EffectivenessofTrainingArthur Etal PDFDocument12 pagesEffectivenessofTrainingArthur Etal PDFIrene KangNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Film Industry in China: Past and Present: Ainhoa Marzol AranburuDocument28 pagesThe Film Industry in China: Past and Present: Ainhoa Marzol AranburuAndrés RodríguezNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Beijing Review - May 30, 2019Document54 pagesBeijing Review - May 30, 2019stupearlNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Top 100 Automotive SuppliersDocument114 pagesTop 100 Automotive Suppliersashish1985167% (3)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Introduction To New Product Data Migration TemplateDocument15 pagesIntroduction To New Product Data Migration TemplateCharu VyasNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Article 1: (Sept 16 2020) US Broke Rules by Imposing Tariffs On ChinaDocument9 pagesArticle 1: (Sept 16 2020) US Broke Rules by Imposing Tariffs On ChinaPranave NellikattilNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- MyNotesOnCNBCSoFar 2016Document38 pagesMyNotesOnCNBCSoFar 2016Tony C.No ratings yet

- Construction Cost Handbook CNHK 2023Document63 pagesConstruction Cost Handbook CNHK 2023wlv hugoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Great Wall of Numbers: Business Opportunities & Challenges in ChinaDocument222 pagesGreat Wall of Numbers: Business Opportunities & Challenges in ChinaTim Swanson0% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Correspondent Banking UpdateDocument2 pagesCorrespondent Banking UpdateHonNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CH 11 HW SolutionsDocument9 pagesCH 11 HW SolutionsAriefka Sari DewiNo ratings yet

- Erdu Lighting-2 0-L20 Magnetic Light Quotation-Aimer2021Document3 pagesErdu Lighting-2 0-L20 Magnetic Light Quotation-Aimer2021Waleed AllafeyNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Soft Power Made in China The Dilemmas of Online and Offline Media and Transnational Audiences (Claire Seungeun Lee)Document245 pagesSoft Power Made in China The Dilemmas of Online and Offline Media and Transnational Audiences (Claire Seungeun Lee)Fadhlil WafiNo ratings yet

- BRICS - No Longer EmergingDocument3 pagesBRICS - No Longer EmergingEduardo RossiNo ratings yet

- E 017 Ccthotelmanagementagreementdated 16 Apr 12Document12 pagesE 017 Ccthotelmanagementagreementdated 16 Apr 12selvi novita (Selvi)No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Find Any Example of A Real Project With A Real Project ManagerDocument2 pagesFind Any Example of A Real Project With A Real Project Manageralum jacobNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hailan Holdings Limited 海 藍 控 股 有 限 公 司: Announcement Of Interim Results For The Six Months Ended 30 June 2020Document40 pagesHailan Holdings Limited 海 藍 控 股 有 限 公 司: Announcement Of Interim Results For The Six Months Ended 30 June 2020in resNo ratings yet

- The Chinese Dream - A Society Under ConstructionDocument395 pagesThe Chinese Dream - A Society Under ConstructionNeville Mars67% (3)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- 25.99 Euro To Indonesia Rupiah, 25.99 EUR To IDR Currency Converter PDFDocument1 page25.99 Euro To Indonesia Rupiah, 25.99 EUR To IDR Currency Converter PDFNoviaNo ratings yet

- Earning Response Coefficients and The Financial Risks of China Commercial BanksDocument11 pagesEarning Response Coefficients and The Financial Risks of China Commercial BanksShelly ImoNo ratings yet

- Group 3 WilmarDocument20 pagesGroup 3 WilmarTrlz AlNo ratings yet

- Compulsary Mathematics - Class 10Document348 pagesCompulsary Mathematics - Class 10Rüpësh ẞhäñdårîNo ratings yet

- Chapter SevenDocument8 pagesChapter SevenAsif HossainNo ratings yet

- Caso China OutsourcingDocument1 pageCaso China OutsourcingLuxury CompanyNo ratings yet

- Jim Rickards On Inflation and Currency WarsDocument8 pagesJim Rickards On Inflation and Currency WarsRon HeraNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Target ChinaDocument170 pagesTarget Chinadantevantes50% (2)

- The Asian Financial Crisis of 1997Document53 pagesThe Asian Financial Crisis of 1997shalwNo ratings yet

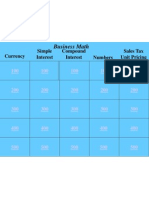

- Business Math - JeopardyDocument51 pagesBusiness Math - Jeopardyapi-173610472No ratings yet

- Solventswire 310718Document10 pagesSolventswire 310718Mohammed BabatinNo ratings yet

- Shanghai Welcome GuideDocument92 pagesShanghai Welcome GuideRamesh BadriNo ratings yet

- IMF Report On China 2011Document83 pagesIMF Report On China 2011Douglas FunkNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)