Professional Documents

Culture Documents

18 Chapter4 Unit 1 2 Hire Purchase and Instalment Payment

Uploaded by

narasimha_gudiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

18 Chapter4 Unit 1 2 Hire Purchase and Instalment Payment

Uploaded by

narasimha_gudiCopyright:

Available Formats

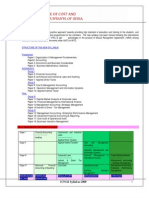

ACCOUNTING FOR SOME SPECIAL TRANSACTIONS

HIRE PURCHASE AND INSTALMENT PAYMENT SYSTEM AND ACCOUNTING FOR LEASES

Question 1 Krishna Agencies started business on 1st April, 1994. During the year ended 31 st March, 1995, they sold under-mentioned durables under two schemes Cash Price Scheme (CPS) and Hire-Purchase Scheme (HPS). Under the CPS they priced the goods at cost plus 25% and collected it on delivery. Under the HPS the buyers were required to sign a Hire-purchase Agreement undertaking to pay for the value of the goods including finance charges in 30 instalments, the value being calculated at Cash Price plus 50%. The following are the details available at the end of 31 st March, 1995 with regard to the products : Product Nos. purchased Nos. sold under CPS Nos. sold under HPS Cost per unit Rs. No. of instalments due during the year 1,080 840 No. of instalments received during the year 1,000 800

TV sets Washing Machines

90 70

20 20

60 40

16,000 12,000

The following were the expenses during the year : Rs. Rent Salaries 1,20,000 1,44,000

4.2

Accounting

Commission to Salesmen Office Expenses

12,000 1,20,000

From the above information, you are required to prepare : (a) Hire-purchase Trading Account, and (b) Trading and Profit & Loss Account. (20 marks) (IntermediateMay 1995) Answer In the books of Krishna Agencies Hire-Purchase Trading Account for the year ended 31st March, 1995

Rs. To Goods sold on H.P. A/c: TVs (60Rs. 30,000) Washing Machines (40 Rs. 22,500) 9,00,000 To H.P. Stock Reserve 87.5 Rs. 9,90,000 187.5 To Profit & Loss A/c (H.P. profit transferred) By Instalment Due A/c: 4,62,000 7,98,000 TVs (80Rs.1,000) Washing Machines (40Rs. 750) By Goods sold on HP A/c: (Cancellation of loading) 87.5 Rs. 27,00,000 187.5 By H.P. Stock (W.N 2) 39,60,000 12,60,000 9,90,000 39,60,000 30,000 1,10,000 80,000 27,00,000 18,00,000 Rs. By Bank A/c cash received TVs (1,000Rs. 1,000) Washing Machines (800 Rs. 750) 6,00,000 16,00,000 10,00,000 Rs. Rs.

Trading and Profit & Loss Account for the year ended 31st March, 1995

Rs. To Purchases: TVs (90Rs. 16,000) 14,40,000 Rs. By Sales: TVs (20Rs. 20,000) 4,00,000 Rs. Rs.

Accounting for Some Special Transactions

4.3

Washing Machines (70 Rs. 12,000) To Gross profit c/d 8,40,000 22,80,000 1,40,000

Washing Machines (20 Rs. 15,000) By Goods sold on H.P. A/c (27,00,00012,60,000) By Shop Stock (W. N 3) 24,20,000 2,80,000 24,20,000 By Gross profit b/d By H.P. Trading a/c (H.P. Profit) 7,98,000 1,40,000 14,40,000 3,00,000 7,00,000

To Salaries To Rent To Commission To Office expenses To Net Profit

1,44,000 1,20,000 12,000 1,20,000 5,42,000 9,38,000

9,38,000

Working Notes: (1) Calculation of per unit cash price, H.P. price and Instalment Amount : Product Cost Rs. Cash Price Rs. (Cost 1.25) TV sets Washing Machines 12,000 15,000 22,500 750 16,000 20,000 H.P. price Rs. (Cash Price1.50) 30,000 Instalment Amount (Rs.) (H.P. price/No. of instalments) 1,000

(2) Calculation of H.P. Stock as on 31st March, 1995 : Product Total No. of Instalments (Nos.) TV sets Washing Machines 1800 1,200 Instalments Due in 1994-95 (Nos.) 1080 840 Instalments not due in 1994-95 (Nos.) 720 360 7,20,000 2,70,000 9,90,000 (3) Calculation of Shop Stock as on 31 st March, 1995 : Product Purchased (Nos.) Sold (Nos.) Balance (Nos.) Amount Rs. Amount Rs.

4.4

Accounting

TV sets Washing Machines

90 70

80 60

10 10

1,60,000 1,20,000 2,80,000

Question 2 ABC Associates entered into a financial lease agreement on 1.4.1995 with Flexible Leasing Ltd. for lease of a car. The price of the car was Rs. 2,00,000 and the quarterly lease rentals were agreed at Rs. 90 per thousand payable at the beginning of every quarter. ABC Associates kept up their payments but by 25.3.1996 they approached and obtained the consent of the leasing company for treating the arrangement as one of Hire-purchase from the beginning on the following terms : Period: 3 years Quarterly hire : Rs. 30,000 payable at the beginning of the quarter. It was agreed that the lease rentals paid will be treated as hire monies and that the balance due upto 31.3.1996 will be settled by ABC Associates on that date with interest at 18% p.a. on various instalments due during the year. The rate of depreciation on the car is 25%. Show the following accounts in the books of ABC Associates for the year 1995-96: Flexible Leasing Ltd.s A/c and Interest Suspense A/c. Calculations are to be rounded off to the nearest rupee (15 Marks)(IntermediateMay 1996) Answer Books of ABC Associates Flexible Leasing Limited Account Dr. Rs. 1996 March 25 March 31 March 31 To Lease rental A/c To Bank To Balance c/d 72,000 53,400 2,40,000 3,65,400 Interest Suspense Account Dr. Rs. 1996 March 25 To Flexible 1,60,000 1996 March, 31 By Interest on Hire Cr. Rs. 72,727 1996 March 25 March 25 By Car on Hire Purchase A/c By Interest Suspense A/c By Interest A/c Cr. Rs. 2,00,000 1,60,000 5,400 3,65,400

Accounting for Some Special Transactions

4.5

Leasing Ltd. A/c March, 31 1,60,000 Working Notes :

purchase A/c By Balance c/d

87,273 1,60,000

(1) Calculation of balance payable on 31st March, 1996 and the Amount of Interest Calculation of Difference Payable on 31.3.1996 and Interest

Date Quarterly Hire Charges (Rs.) 1.4.95 1.7.95 1.10.95 1.1.96 30,000 30,000 30,000 30,000 Quarterly Lease Rentals Paid (Rs.) 18,000 18,000 18,000 18,000 72,000 Difference Payable (Rs.) 12,000 12,000 12,000 12,000 48,000 1.4.95 1.7.95 1.10.95 1.1.96 31.3.96 31.3.96 31.3.96 31.3.96 Interest From (18% p.a.) To Amount of Interest (Rs.) 2,160 1,620 1,080 540 5,400

Amount payable on 31st March, 1996 : Rs. Balance due Interest due 48,000 5,400 53,400 (2) Ascertainment of Total Amount of Interest on Hire Purchase Rs. Hire Purchase Price of the car (Rs. 30,000 12 installments) Less : Cash Price Total Amount of Interest Date 1.4.95 3,60,000 2,00,000 1,60,000 Interest Calculation Interest Rs.

(3) Calculation of Interest on Hire Purchase Attributable to the year 1995-1996.

4.6

Accounting

1.7.95 1.10.95 1.1.96

1,60,000

1,60,000 1,60,000

11 66

10 66 9 66

26,667 24,242 21,818 72,727

Question 3 Omega Corporation sells computers on hire purchase basis at cost plus 25%. Terms of sales are Rs. 10,000 as down payment and 8 monthly instalments of Rs. 5,000 for each computer. From the following particulars prepare Hire Purchase Trading Account for the year 1999. As on 1 st January, 1999 last instalment on 30 computers was outstanding as these were not due up to the end of the previous year. During 1999 the firm sold 240 computers. As on 31 st December, 1999 the position of instalments outstanding were as under : Instalments due but not collected : 2 instalments on 2 computers and last instalment on 6 computers. Instalments not yet due : 8 instalments on 50 computers, 6 instalments on 30 and last instalment on 20 computers. Two computers on which 6 instalments were due and one instalment not yet due on 31.12.99 had to be repossessed. Repossessed stock is valued at 50% of cost. All other instalments have been received. (10 marks) (IntermediateMay 2000) Answer In the books of Omega Corporation Hire Purchase Trading Account for the year ended on 31 st Dec., 1999

Dr. Rs. To Hire Purchase Stock (30Rs. 5,000) To Goods Sold on Hire Purchase (240Rs. 50,000) To Bad Debts To Loss on Re1,20,00,000 12,000 By Goods sold on Hire Purchase (Rs. 1,20,00,000 20%) 24,00,000 1,50,000 Rs. By Hire Purchase Sales (W.N. 2) By Stock Reserve (Rs. 1,50,00020% ) 30,000 91,40,000 Cr Rs.

Accounting for Some Special Transactions

4.7

possession Less : Instalments not yet due To Stock Reserve (30,00,000 20%) To Profit & Loss A/c (Transfer of Profit)

16,000 8,000 8,000 6,00,000

By Hire Purchase Stock [(850+630+120) Rs. 5,000] 30,00,000

18,00,000 1,45,70,000 1,45,70,000

Alternatively, hire purchase trading account can be prepared in the following manner : Hire Purchase Trading Account for the year ended on 31 st Dec., 1999

Rs. To Hire Purchase Stock (30Rs. 5,000) To Goods Sold on Hire Purchase (240Rs. 50,000) To Stock Reserve (Rs. 30,00,000 20%) To Profit & Loss A/c (Transfer of Profit) 18,00,000 6,00,000 1,20,00,000 1,50,000 By Cash (W.N.1) By Stock Reserve (Rs. 1,50,00020%) By Goods Sold on Hire Purchase (Rs. 1,20,00,00020%) By Goods Repossessed (2Rs. 40,00050%) By Instalments Due [(22+16)Rs. 5,000] By Hire Purchase Stock [850+630+120)Rs. 5,000] 1,45,50,000 30,00,000 1,45,50,000 50,000 40,000 24,00,000 30,000 Rs. 90,30,000

Working Notes : Rs. (1) Cash collected: Cash down payment (240 Rs. 10,000) Add : Instalments collected : Last instalments on 30 computers outstanding on 1.4.99 Instalments due and collected on 240 computers sold during the year : 1,50,000 24,00,000

4.8

Accounting

Total instalments on 240 computers (8 240 Rs. 5,000) Less : Instalments due but not collected [(2 2 + 1 6 + 6 2) Rs. 5,000] Instalments not due on 31.12.99 [(8 50 + 6 30 + 1 20 + 1 2) Rs. 5,000] (2) Hire purchase sales: Cash collected Add : Instalments due but not collected [(2 2 + 1 6 + 6 2) Rs. 5,000] (3) Loss on repossessed computers: Cost of instalments due but not collected (6 2 Rs. 4,000) Cost of Instalments not yet due (1 2 Rs. 4,000) Less : Estimated value of repossessed computers (2 Rs. 40,000 50%) Loss (4) Bad debts (in respect of repossessed computers): Instalments due but not collected (6 2 Rs. 5,000) Cost of installments not due on 31.12.99 (1 2 Rs. 5,000 80%) Less : Cost of instalments due but not collected (6 2 Rs. 4,000) Cost of instalments not yet due (1 2 Rs. 4,000) 8,000 56,000 48,000 8,000 68,000 60,000 40,000 16,000 8,000 56,000 48,000 1,10,000 91,40,000 90,30,000 30,10,000 31,20,000 64,80,000 90,30,000 1,10,000 96,00,000

Accounting for Some Special Transactions

4.9

Bad debts Question 4

12,000

Welwash (Pvt.) Ltd. sells washing machines for outright cash as well as on hire-purchase basis. The cost of a washing machine to the company is Rs. 10,500. The company has fixed cash price of the machine at Rs. 12,300 and hire-purchase price, at Rs. 13,500 payable as to Rs. 1,500 down and the balance in 24 equal monthly instalments of Rs. 500 each. On Ist April, 2000 the company had 26 washing machines lying in its showroom. On that date 3 instalments had fallen due, but not yet received and 675 instalments were yet ot fall due in respect of machines lying with the hire purchase customers. During the year ended 31st March, 2001 the company sold 130 machines on cash basis and 80 machines on hire-purchase basis. After paying five monthly instalments, one customer failed to pay subsequent instalments and the company had to repossess the washing machine. After spending Rs. 1,000 on it, the company resold it for Rs. 11,500. On 31st March, 2001 there were 21 washing machines in stock, 810 instalments were yet to fall due and 5 instalments had fallen due, but not yet received in respect of washing machines lying with the hire-purchase customers. Total selling expenses and office expenses including depreciation on fixed assets totalled Rs. 1,60,000 for the year. You are required to prepare for the Accounting Year ended 31 st March, 2001: (i) (ii) Hire purchase Trading Account, and Trading and Profit and Loss Account showing net profit earned by the company after making provision for income-tax @ 35%. (16 marks)(IntermediateNov. 2001) Answer In the books of Welwash (Pvt.) Ltd. Hire Purchase Trading Account for the year ended on 31 st March, 2001

Dr. Rs. To Hire Purchase Stock (Rs. 500 675) To Instalments due Rs. (500 3) To Goods sold on Hire Purchase (Rs. 13,50080) To Stock Reserve 3,000 Rs.4,05,000 13,500 10,80,000 90,000 3,37,500 By Stock Reserve 3 , 000 1,500 Rs . 3 , 37 ,500 13 , 500 By Goods Repossessed (Rs. 13,500Rs. 1,500Rs. 2,500) By Goods sold on Hire Purchase 3,000 Rs.10,80,000 13,500 9,500 2,40,000 75,000 By Cash (W.N. 1) Cr Rs. 10,02,000

4.10

Accounting

To Profit and Loss A/c (Transfer of profit) 2,25,000

By Hire Purchase Stock (Rs. 500 810) By Instalments due (Rs. 500 5) 17,34,000 2,500 17,34,000 4,05,000

Trading and Profit and Loss Account for the year ended on 31 st March, 2001

Rs. To Opening Stock (Rs.10,50026) To Purchases Rs. 10,500(130+80+2126) To Gross Profit 21,52,500 2,34,000 26,59,500 To Sundry Expenses To Provision for Income Tax (35% of Rs. 3,00,000) To Net Profit for the year 1,05,000 1,95,000 4,60,000 1,60,000 By Gross Profit By Hire Purchase Trading A/c By Goods Repossessed (Rs. 11,500Rs.1,000Rs. 9,500) 1,000 4,60,000 By Goods sold on Hire Purchase (Rs. 10,80,000Rs. 2,40,000) By Closing Stock (Rs. 10,50021) 8,40,000 2,20,500 26,59,500 2,34,000 2,25,000 2,73,000 By Sales (Rs. 12,300130) Rs. 15,99,000

Working Notes : Rs. (1) Cash collected during the year Hire purchase stock on 1.4.2000 Instalments due on 1.4.2000 Hire purchase price of goods sold during the year Rs. Less : Repossessed goods Hire purchase stock on 31.3.2001 Instalments due on 31.3.2001 Cash collected during the year 9,500 4,05,000 2,500 4,17,000 10,02,000 3,37,500 1,500 10,80,000 14,19,000

Accounting for Some Special Transactions

4.11

(2) Washing machines purchased during the year No. Closing balance Add : Cash Sales Sales on hire purchase basis Less : Opening stock Purchase during the year Purchases Question 5 A acquired on 1st January, 2003 a machine under a Hire-Purchase agreement which provides for 5 half-yearly instalments of Rs. 6,000 each, the first instalment being due on 1st July, 2003. Assuming that the applicable rate of interest is 10 per cent per annum, calculate the cash value of the machine. All working should form part of the answer. (8 marks) (PE-II May 2003) Answer Statement showing cash value of the machine acquired on hire-purchase basis Instalment Amount Interest @ 5% half yearly (10% p.a.) = 5/105 = 1/21) (in each instalment) Rs. 5th Instalment Less: Interest Add: 4th Instalment Less: Interest Add: 3rd instalment Less: Interest 6,000 286 5,714 6,000 11,714 558 11,156 6,000 17,156 817 16,339 817 5,183 (16,33911,156) 558 5,442 (11,1565,714) Rs. 286 Rs. 5,714 Principal Amount (in each instalment) 21 130 80 231 26 205 205 Rs. 10,500 = Rs. 21,52,500 No.

4.12

Accounting

Add: 2nd instalment Less: Interest Add: 1st instalment Less: Interest

6,000 22,339 1,063 21,276 6,000 27,276 1,299 25,977 4,023 1,299 4,701 (25,97721,276) 25,977 1,063 4,937 (21,27616,339)

The cash purchase price of machinery is Rs. 25,977. Question 6 Sameera Corporation sells Computers on Hire-purchase basis at cost plus 25%. Terms of sales are 5,000/- as Down payment and 10 monthly instalments of Rs. 2,500/- for each Computer. From the following particulars, prepare Hire-purchase Trading A/c for the year 2002-2003: As on 1st April, 2002, last instalment on 20 Computers were outstanding as these were not due upto the end of the previous year. During 200203, the firm sold 120 Computers. As on 31st March, 2003 the position of instalments outstanding were as under: Instalments due but not collected Instalments not yet due 4 Instalments on 4 Computers and Last instalment on 9 Computers 6 Instalments on 50 Computers, 4 Instalments on 20 and Last Instalment on 40 Computers

Two Computers on which 8 Instalments were due and one Instalment not yet due on 31.03.2003, had to be repossessed. Repossessed stock is valued at 50% of cost. All other Instalments have been received. (14 marks) (PE-II May 2004) Answer In the books of Sameera Corporation Hire Purchase Trading Account for the year ended 31st March, 2003 Dr.

To To Hire Purchase Stock (20 Rs. 2,500) Goods sold on Hire Purchase Amount Rs. 50,000 36,00,000 By By Hire Purchase Sales (W.N. 2) Stock Reserve (Rs. 50,000 20%)

Cr.

Amount Rs. 25,95,000 10,000

Accounting for Some Special Transactions

4.13

To To

(120Rs.30,000) Bad Debts (W.N. 4) Loss on Repossession Less: Instalments not yet due Stock Reserve (Rs.10,50,000 20%) Profit and Loss Account (Transfer of Profit)

8,000 12,000

By

Goods sold on Hire Purchase 7,20,000 (Rs. 36,00,000 20%) Hire Purchase Stock [(650+420+ 140) Rs. 2,500]

By 4,000 8,000 2,10,000 4,99,000 43,75,000

10,50,000

To To

________ 43,75,000

Alternatively the Hire Purchase Trading A/c can be prepared in the following manner: Hire Purchase Trading Account for the year ended 31st March, 2003 Amount Rs. 50,000 36,00,000 2,10,000 Amount Rs. 24,92,500 10,000 7,20,000

To To To

Hire Purchase Stock (20 Rs. 2,500) Goods sold on Hire Purchase (120Rs.30,000) Stock Reserve (Rs.10,50,000 20%)

By By By

Cash Account (W.N. 1) Stock Reserve (Rs. 50,000 20%) Goods sold on Hire Purchase

(Rs. 36,00,000 20%)

To Profit and Loss Account (Transfer of Profit) 4,99,000 By By By ________ 43,59,000 Question 7 ABC Ltd. sells goods on Hire-purchase by adding 50% above cost. From the following particulars, prepare Hire-purchase Trading account to reveal the profit for the year ended 31.3.2005: Rs. 1.4.2004 1.4.2004 1.4.2004 Instalments due but not collected Stock at shop (at cost) Instalment not yet due 10,000 36,000 18,000 Goods Repossessed

(2 Rs. 24,000 50%)

24,000 62,500 10,50,000

Instalments due

[(4 4 + 1 9) Rs. 2,500]

Hire Purchase Stock

[(6 50 + 4 20 + 1 40) Rs. 2,500]

43,59,000

4.14

Accounting

31.3.2005 31.3.2005 Other details: Total instalments became due Goods purchased

Stock at shop Instalments due but not collected

40,000 18,000 1,32,000 1,20,000

Cash received from customers 1,21,000 Goods on which due instalments could not be collected were repossessed and valued at 30% below original cost. The vendor spent Rs. 500 on getting goods overhauled and then sold for Rs. 2,800. (16 marks) (PE-II May 2005) Answer In the Books of ABC Ltd. Hire Purchase Trading Account for the year ended 31st March, 2005 Rs. 18,000 Cr. Rs. 1.1.2004 By Stock reserve (1/3 of Rs. 18,000) 1,74,000 1.1.2004 By Hire purchase to By sales 31.3.2005 Goods sold on hire 1,600 purchase (1/3 of Rs. 1,74,000) 20,000 By Profit on sale of repossessed goods (W.N. 4) 6,000 1,32,000 58,000

Dr. 1.1.2004 To Hire purchase stock 1.1.2004 To Goods sold on hire to Purchase 31.3.2005 To Loss on repossession of goods (W.N. 5) 31.3.2005 To Stock reserve To Profit and loss account (Transfer of profit)

900

43,300 31.3.2005 By Hire purchase stock (W.N. 3) 60,000 2,56,900 2,56,900 Alternatively, Hire Purchase Trading Account can be prepared in the following manner: Hire Purchase Trading Account for the year ended 31st March, 2005

Dr. 1.1.2004 1.1.2004 to 31.3.2005 To To To To 31.3.2005 To Hire purchase stock Hire purchase debtors Goods sold on hire purchase Cash (Overhauling charges) Stock reserve Rs. 18,000 10,000 1,74,000 500 20,000 1.1.2004 1.1.2004 to 31.3.2005 By By By Stock reserve (1/3 of Rs. 18,000) Cash (Rs. 1,21,000 + Rs. 2,800) Goods sold on hire purchase (1/3 of Rs. 1,74,000)

Cr. Rs. 6,000

1,23,800 58,000

Accounting for Some Special Transactions

4.15

To

Profit and loss account (Transfer of profit)

31.3.2005 43,300 2,65,800

By By

Hire purchase stock Hire purchase debtors

60,000 18,000 _______ 2,65,800

4.16

Accounting

Working Notes: 1. Memorandum Instalment due but not collected (hire purchase debtors) account Dr. To To Balance b/d Hire purchase sales Rs. 10,000 By Cash By Repossessed stock 1,32,000 (Balancing figure) _______ By Balance c/d 1,42,000 Memorandum shop stock account Rs. To To Balance b/d Purchases 36,000 By 1,20,000 _______ By 1,56,000 3. Dr. To To Balance b/d Goods sold on hire purchase [1,16,000 + (1,16,000 50%)] Rs. 18,000 By By 1,74,000 1,92,000 Goods Repossessed account Dr. To Hire purchase debtors Rs. 3,000 By _____ By 3,000 1,400 By 500 900 2,800 Hire purchase trading account (W.N. 5) Balance c/d (W.N. 5) Cash account Cr. Rs. 1,600 1,400 3,000 2,800 Hire purchase Sales Balance c/d (Balancing figure) Goods sold on hire purchase (Balancing figure) Balance c/d 40,000 1,56,000 Cr. Rs. 1,21,000 3,000 18,000 1,42,000 Cr. Rs. 1,16,000

2. Dr.

Memorandum Instalment not yet due (hire purchase stock) account Cr. Rs. 1,32,000 60,000 _______ 1,92,000

4.

To To To

Balance b/d Cash account (expenses) Profit on sale

_____ 2,800

Accounting for Some Special Transactions

4.17

5.

100 Original cost of goods repossessed Rs. 3,000 150

Rs. 2,000 3,000 1,400 1,600

Instalments due but not received Valuation of repossessed goods (70% of Rs. 2,000) Loss on repossession

You might also like

- Departmental Acc.Document22 pagesDepartmental Acc.Somsindhu Nag100% (2)

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesDocument17 pagesChapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesAyush AcharyaNo ratings yet

- Coc Departmental Accounting Ca/Cma Santosh KumarDocument11 pagesCoc Departmental Accounting Ca/Cma Santosh KumarAyush AcharyaNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Amalgamation Accounting Cp6 3Document28 pagesAmalgamation Accounting Cp6 3Divakara ReddyNo ratings yet

- Partnership Dec 2020 UpdatedDocument46 pagesPartnership Dec 2020 Updatedbinu100% (4)

- Suggested Answer CAP II June 2017rDocument104 pagesSuggested Answer CAP II June 2017rBAZINGANo ratings yet

- 3246accounting - CA IPCCDocument116 pages3246accounting - CA IPCCPrashant Pandey100% (1)

- Chap 12 PDFDocument15 pagesChap 12 PDFTrishna Upadhyay50% (2)

- Hire Purchase Short NotesDocument26 pagesHire Purchase Short NotesULTIMATE FACTS HINDINo ratings yet

- PCC 2008 NPO QuestionDocument10 pagesPCC 2008 NPO QuestionVaibhav MaheshwariNo ratings yet

- Cash ManagementDocument14 pagesCash ManagementSushant MaskeyNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- PartnershipDocument28 pagesPartnershipAdi Murthy100% (2)

- Accounting From Incomplete Records For BookDocument21 pagesAccounting From Incomplete Records For BookbinuNo ratings yet

- Insurance Claim PDFDocument15 pagesInsurance Claim PDFbinuNo ratings yet

- Branch Accounting Examination BankDocument71 pagesBranch Accounting Examination BankNicole TaylorNo ratings yet

- CA Inter Cost Important Questions For CA Nov'22Document93 pagesCA Inter Cost Important Questions For CA Nov'2202 Tapasvee ShahNo ratings yet

- Suggested Answer CAP II June 2018Document128 pagesSuggested Answer CAP II June 2018Pradeep Bhattarai67% (3)

- Scanner CAP II Income Tax VATDocument162 pagesScanner CAP II Income Tax VATEdtech NepalNo ratings yet

- Compiler CAP II Cost AccountingDocument187 pagesCompiler CAP II Cost AccountingEdtech NepalNo ratings yet

- Partnership PDFDocument28 pagesPartnership PDFBasant OjhaNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Home Work Section Working CapitalDocument10 pagesHome Work Section Working CapitalSaloni AgrawalNo ratings yet

- Branch: ? AccountingDocument36 pagesBranch: ? AccountingbinuNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- Unit - 4: Amalgamation and ReconstructionDocument54 pagesUnit - 4: Amalgamation and ReconstructionAzad AboobackerNo ratings yet

- Account Past Questions Compilation (2009june - 2020 Dec.)Document246 pagesAccount Past Questions Compilation (2009june - 2020 Dec.)Prashant Sagar Gautam100% (2)

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (1)

- 11 AmalgmationDocument38 pages11 AmalgmationPranaya Agrawal100% (1)

- 4 Hire Purchase Material9018311258494236503Document15 pages4 Hire Purchase Material9018311258494236503Prabin stha100% (2)

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- DepartmentalDocument17 pagesDepartmentalPapiya DeyNo ratings yet

- Study Note 5.2 (353-378)Document26 pagesStudy Note 5.2 (353-378)s4sahith100% (1)

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- Investment Accounting ProblemsDocument7 pagesInvestment Accounting Problemspritika mishraNo ratings yet

- Chapter # 6 Departmental AccountDocument36 pagesChapter # 6 Departmental AccountRooh Ullah KhanNo ratings yet

- 47 Branch AccountsDocument53 pages47 Branch AccountsShivaram Krishnan70% (10)

- Bos 28432 CP 10Document45 pagesBos 28432 CP 10hiral dattaniNo ratings yet

- Branch AccountsDocument12 pagesBranch AccountsRobert Henson100% (1)

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- 2 Insurance F PDFDocument42 pages2 Insurance F PDFjashveer rekhi17% (6)

- Branch AccountsDocument4 pagesBranch Accountsnavin_raghuNo ratings yet

- Paper 1 Advanced AccountingDocument576 pagesPaper 1 Advanced AccountingExcel Champ60% (5)

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- 15-Mca-Nr-Accounting and Financial ManagementDocument4 pages15-Mca-Nr-Accounting and Financial ManagementSRINIVASA RAO GANTA0% (2)

- Over Heads Additional Sums PDFDocument40 pagesOver Heads Additional Sums PDFShiva AP100% (1)

- Tough LekkaluDocument42 pagesTough Lekkaludeviprasad03No ratings yet

- Not For Profit OrganizationDocument69 pagesNot For Profit OrganizationDristi SaudNo ratings yet

- Practice Accounts Prime PDFDocument56 pagesPractice Accounts Prime PDFShraddha NepalNo ratings yet

- Chapter 9 Accounting For Branches Including Foreign Branches PDFDocument61 pagesChapter 9 Accounting For Branches Including Foreign Branches PDFAkshansh MahajanNo ratings yet

- Labour: (A) (B) (C) (D) (E)Document40 pagesLabour: (A) (B) (C) (D) (E)Sushant MaskeyNo ratings yet

- 5 Debenture Material3619080524732228932Document14 pages5 Debenture Material3619080524732228932Prabin stha100% (1)

- Revision - Test - Paper - CAP - II - June - 2017 9Document181 pagesRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariNo ratings yet

- BudgetingDocument130 pagesBudgetingRevathi AnandNo ratings yet

- BudgetingDocument74 pagesBudgetingRevathi AnandNo ratings yet

- Solved Answer Accounts CA IPCC May. 2010Document13 pagesSolved Answer Accounts CA IPCC May. 2010Akash GuptaNo ratings yet

- Accounting and Finance Numericals Problems and AnsDocument11 pagesAccounting and Finance Numericals Problems and AnsPramodh Kanulla0% (1)

- Topic 6 - Hire Purchase and Instalment Payment Systems: AnswersDocument7 pagesTopic 6 - Hire Purchase and Instalment Payment Systems: AnswersAshish KaushikNo ratings yet

- Unix Linux IntroductionDocument124 pagesUnix Linux Introductionnarasimha_gudiNo ratings yet

- Ipv4 AddressingDocument5 pagesIpv4 Addressingnarasimha_gudiNo ratings yet

- Cryptography & Network Security-Atul KahateDocument480 pagesCryptography & Network Security-Atul KahateAjay GiriNo ratings yet

- Stories From Panchatantra - Sanskrit EnglishDocument105 pagesStories From Panchatantra - Sanskrit Englishmmsingi100% (9)

- IcwaisyllabusDocument26 pagesIcwaisyllabusTanisha FlowersNo ratings yet

- Accounting Treatment of Forfeiture of SharesDocument18 pagesAccounting Treatment of Forfeiture of SharesMandy SinghNo ratings yet

- Announcechs 2009Document4 pagesAnnouncechs 2009narasimha_gudiNo ratings yet

- Sanskrit Derived LanguagesDocument14 pagesSanskrit Derived Languagesnarasimha_gudiNo ratings yet

- Product Life Cycle ManagementDocument26 pagesProduct Life Cycle Managementnarasimha_gudiNo ratings yet

- Arthashastra of Chanakya - EnglishDocument614 pagesArthashastra of Chanakya - EnglishHari Chandana K83% (6)

- Chapter 5: Analysis Financial Statements: Financial Mix RatioDocument22 pagesChapter 5: Analysis Financial Statements: Financial Mix RatioBOSS I4N TVNo ratings yet

- ACC707 Auditing Assurance Services AssignmentDocument2 pagesACC707 Auditing Assurance Services AssignmentHaris AliNo ratings yet

- Exam NoDocument17 pagesExam NoAzzia Morante LopezNo ratings yet

- FIN621 MidTerm 1100MCQsDocument236 pagesFIN621 MidTerm 1100MCQsMohammad AnasNo ratings yet

- What Is The Difference Between Revenues and EarningsDocument4 pagesWhat Is The Difference Between Revenues and EarningsMa. Angela GarciaNo ratings yet

- Guidelines For Investment Proof Submission 2023-2024Document7 pagesGuidelines For Investment Proof Submission 2023-2024rajdelhi000No ratings yet

- Assessment 1 - Assignment 1Document5 pagesAssessment 1 - Assignment 1Ten NineNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Course: Financial Accounting Session: 1Document33 pagesCourse: Financial Accounting Session: 1Nazir AnsariNo ratings yet

- Far Quiz 2 Final W AnswersDocument4 pagesFar Quiz 2 Final W AnswersMarriz Bustaliño Tan78% (9)

- 2021-22 International Accounting MaterialsDocument59 pages2021-22 International Accounting MaterialsLamis ShalabiNo ratings yet

- CH 04Document4 pagesCH 04Nusirwan Mz50% (2)

- Wilmington HA - Audit March 2018Document92 pagesWilmington HA - Audit March 2018Ben SchachtmanNo ratings yet

- Financial Performance of Kerala Gramin Bank Special Reference To Southern AreaDocument81 pagesFinancial Performance of Kerala Gramin Bank Special Reference To Southern AreaPriyanka Ramath100% (1)

- Intermediate Group II Test Papers (Revised July 2009)Document55 pagesIntermediate Group II Test Papers (Revised July 2009)Sumit AroraNo ratings yet

- Mastering Quickbooks - Part 1Document112 pagesMastering Quickbooks - Part 1Shahriar Kabir Khan100% (2)

- Budgetary ControlDocument12 pagesBudgetary ControlAhesan AnsariNo ratings yet

- Customization Operations Cost Information Toperform Each of These Functions. Aparticular PurposeDocument4 pagesCustomization Operations Cost Information Toperform Each of These Functions. Aparticular PurposeNalynCasNo ratings yet

- Performance Task No 2 - Group Work - Planning Concepts and Tools P1Document8 pagesPerformance Task No 2 - Group Work - Planning Concepts and Tools P1Corn SaladNo ratings yet

- ThesisDocument3 pagesThesisKarmela EspinosaNo ratings yet

- NISM Investment Adviser Level 1 PDFDocument190 pagesNISM Investment Adviser Level 1 PDFTrinath SharmaNo ratings yet

- FAMDocument22 pagesFAMMedha SinghNo ratings yet

- Hindu Undivided Family - Save More Tax With HUF AccountDocument42 pagesHindu Undivided Family - Save More Tax With HUF AccountsgrsthNo ratings yet

- Contemporary Mathematics For Business and Consumers, Third EditionDocument4 pagesContemporary Mathematics For Business and Consumers, Third Editionবিষাক্ত মানবNo ratings yet

- CBLM - Bookkeeping NC III (Aporbo, J)Document28 pagesCBLM - Bookkeeping NC III (Aporbo, J)denmark macalisangNo ratings yet

- Payslip SampleDocument1 pagePayslip SampleWayo PhodangNo ratings yet

- Ch04 Plant Assets, Natural Resources, and Intangible Assets EditedDocument70 pagesCh04 Plant Assets, Natural Resources, and Intangible Assets EditedThea Roth100% (1)

- Chapter - 12 - Inventory Accounting For Consumable SuppliesDocument10 pagesChapter - 12 - Inventory Accounting For Consumable SuppliesJa Mi LahNo ratings yet

- KODA LTD 2010 Annual ReportDocument120 pagesKODA LTD 2010 Annual ReportWeR1 Consultants Pte LtdNo ratings yet

- Chapter 10 - Problem 9Document13 pagesChapter 10 - Problem 9Christy HabelNo ratings yet