Professional Documents

Culture Documents

Consumer Credit Marketing System in Bangladesh-A Case Study On Dhaka Bank

Uploaded by

Ali Haider MohammadullahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consumer Credit Marketing System in Bangladesh-A Case Study On Dhaka Bank

Uploaded by

Ali Haider MohammadullahCopyright:

Available Formats

Consumer Credit Marketing System in Bangladesh: A Case Study on Dhaka Bank Ltd.

By Ali Haider Mohammadullah

1.

Introduction

A commercial bank provides financial services, including debit or credit cards, receiving deposits of money, lending money and processing transactions. A commercial bank accepts deposits from customers and in turn makes loans based on those deposits. Some banks (called Banks of issue) issue banknotes as legal tender. Many banks offer ancillary financial services to make additional profit; for example, most banks also rent safe deposit boxes in their branches. The primary purpose of a bank was to provide loans to trading companies. Banks provide funds to allow businesses to purchase inventory, and collected those funds back with interest when the goods were sold. For centuries, the banking industry only dealt with businesses, not consumers. Commercial lending today is a very intense activity, with banks carefully analyzing the financial condition of its business clients to determine the level of risk in each loan transaction. Banking services have expanded to include services directed at individuals and risks in these much smaller transactions are pooled. In the recent time, commercial banks are more concerned about the consumer credit. They provide various types of credit to the consumer to fulfill their personal needs. This is very important for a country to develop the life standard of people. Consumer credit is the best way to develop the living standard. In this assignment we try to discuss about consumer credit marketing system and thats why we have done a survey. With the basis of survey we prepared our finding part and try to clear the consumer credit borrowers view. We also try to discuss about role of bank, role of credit and role of consumer credit in Bangladesh economy.

1.1 Role of Bank in Bangladesh Economy

Bangladesh pursues a liberal market economy. Bangladesh Bank is the apex bank of the country responsible for promoting healthy growth and development of the banking system. Banks and insurance companies, both in the private and public sectors, are operating freely and contributing to the economy. Foreign banks like American Express Bank, Standard Chartered Bank, Grindlays Bank, Indosuez Bank, etc. function in Bangladesh through their branches. There are other specialized financial institutions like the Bangladesh Shilpa Bank (Industrial Bank), Bangladesh Shilpa Rin Sangstha (Industrial credit organization), Krishi (Agriculture) Bank, House Building Finance Corporation, Grameen (Rural) Bank and several cooperative banks. The Industrial Promotion and Development Corporation (IPDC) of Bangladesh and the Investment Corporation of Bangladesh (ICB) provide equity support

Page 1 of 13

to public limited companies in the private sector. The government has recently replaced the Controller of Capital Issues by establishing a full fledged Securities and Exchange Commission with enhanced power for the growth and development of the Securities market in Bangladesh. Liberal fiscal policy has resulted in the highest forex reserve. During the last three years a number of steps have been taken to strengthen the country's banking system. These include improvement of the regulatory environment. Enforcement of loan classification guidelines and recapitalization of nationalized commercial banks. Over the past two years, there has been a massive infusion of taka 32,000 million in the NCBs in the shape of government bonds to make up for capital and provisioning shortfalls. (Bashar) The countrys economic performance in the four quarter (April-June of FY06) indicated a marginally slower growth in Gross Domestic Product (GDP) compared to the encouraging GDP growth and control on inflation in the third quarter of the fiscal year 2006-07. The major growth area was industry, particularly manufacturing and construction, which recorded notable expansion in the quarter under review. The performance of the agriculture sector was relatively weaker compared to that of the previous year. A favorable aspect of the countrys macro economy during the review period was the return of stability in the foreign exchange market, and an improvement in the countrys foreign exchange reserve. Increased inflows of remittances and better performance of the export sector together helped raise Bangladesh Banks foreign exchange reserve by US$ 430 million in the review quarter to US$ 3,340 million at end June 2006 compared to a decline of US$ 10 million in the corresponding quarter of the last year. The generally stable domestic and external macro economic environment benefited all the real sectors of the economy. In particular, the industry sector benefited from increased investment and the creation of additional production capacity in textile and leather sub-sectors, which boosted manufacturing production in the quarter under review. In the monetary sector, the Central Bank continued its restrictive monetary policy stance by increasing interest rates in the review quarter. While the Central Bank pursued a restrictive monetary policy, reserve money growth in Q4 of F06 was unusually high, at 19.8% compared to 9.7% in the last fiscal year. This resulted in a larger volume of currency issue than anticipated. (Dhaka Bank, 2006) 1.2 Role of Credit in Bangladesh Economy

The new banking system succeeded in establishing reasonably efficient procedures for managing credit and foreign exchange. The primary function of the credit system throughout the 1970s was to finance trade and the public sector, which together absorbed 75 percent of total advances.

Page 2 of 13

The government's encouragement during the late 1970s and early 1980s of agricultural development and private industry brought changes in lending strategies. Managed by the Bangladesh Krishi Bank, a specialized agricultural banking institution, lending to farmers and fishermen dramatically expanded. The number of rural bank branches doubled between 1977 and 1985, to more than 3,330. Denationalization and private industrial growth led the Bangladesh Bank and the World Bank to focus their lending on the emerging private manufacturing sector. Scheduled bank advances to private agriculture, as a percentage of sectoral GDP, rose from 2 percent in FY 1979 to 11 percent in FY 1987, while advances to private manufacturing rose from 13 percent to 53 percent. The transformation of finance priorities has brought with it problems in administration. No sound project-appraisal system was in place to identify viable borrowers and projects. Lending institutions did not have adequate autonomy to choose borrowers and projects and were often instructed by the political authorities. In addition, the incentive system for the banks stressed disbursements rather than recoveries, and the accounting and debt collection systems were inadequate to deal with the problems of loan recovery. It became more common for borrowers to default on loans than to repay them; the lending system was simply disbursing grant assistance to private individuals who qualified for loans more for political than for economic reasons. The rate of recovery on agricultural loans was only 27 percent in FY 1986, and the rate on industrial loans was even worse. As a result of this poor showing, major donors applied pressure to induce the government and banks to take firmer action to strengthen internal bank management and credit discipline. As a consequence, recovery rates began to improve in 1987. The National Commission on Money, Credit, and Banking recommended broad structural changes in Bangladesh's system of financial intermediation early in 1987, many of which were built into a three-year compensatory financing facility signed by Bangladesh with the IMF in February 1987. One major exception to the management problems of Bangladeshi banks was the Grameen Bank, begun as a government project in 1976 and established in 1983 as an independent bank. In the late 1980s, the bank continued to provide financial resources to the poor on reasonable terms and to generate productive self-employment without external assistance. Its customers were landless persons who took small loans for all types of economic activities, including housing. About 70 percent of the borrowers were women, who were otherwise not much represented in institutional finance. Collective rural enterprises also could borrow from the Grameen Bank for investments in tube wells, rice and oil mills, and power looms and for leasing land for joint cultivation. The average loan by the Grameen Bank in the mid-1980s was around Tk2,000 (US$65), and the maximum was just Tk18,000 (for construction of a tin-roof house). Repayment terms were 4 percent for rural housing and 8.5 percent for normal lending operations.

Page 3 of 13

1.3

Role of Consumer Credit in Bangladesh Economy

Commercial banks play an important role in the financial system and the economy. As a key component of the financial system, banks allocate funds from savers to borrowers in an efficient manner. They provide specialized financial services, which reduce the cost of obtaining information about both savings and borrowing opportunities. These financial services help to make the overall economy more efficient. One of the important financial services is consumer credit. In recent years, there has been a rapid increase in consumer credit. At the same time, despite high average annual growth rates in this segment for the past three years, the market is set to expand further. In our country, commercial banks introduce many types of consumer credit, like, house loan, car loan, personal loan, education loan, teacher loan, any purpose loan, marriage loan, vacation loan etc.

1.4

History of the Bank

Bangladesh economy has been experiencing a rapid growth since the '90s. Industrial and agricultural development, international trade, inflow of expatriate Bangladeshi workers' remittance, local and foreign investments in construction, communication, power, food processing and service enterprises ushered in an era of economic activities. Urbanization and lifestyle changes concurrent with the economic development created a demand for banking products and services to support the new initiatives as well as to channelize consumer investments in a profitable manner. A group of highly acclaimed businessmen of the country grouped together to responded to this need and established Dhaka Bank Limited in the year 1995. The Bank was incorporated as a public limited company under the Companies Act. 1994. The Bank started its commercial operation on July 05, 1995 with an authorized capital of Tk. 1,000 million and paid up capital of Tk. 100 million. The paid up capital of the Bank stood at Tk 1,289,501,900 as on June 30, 2006. The total equity (capital and reserves) of the Bank as on June 30, 2006 stood at Tk 2,188,529,224. The Bank has 37 branches across the country and a wide network of correspondents all over the world. The Bank has plans to open more branches in the current fiscal year to expand the network. The Bank offers the full range of banking and investment services for personal and corporate customers, backed by the latest technology and a team of highly motivated officers and staff.

Page 4 of 13

In our effort to provide Excellence in Banking services, the Bank has launched Online Banking service, joined a countrywide shared ATM network and has introduced a co-branded credit card. A process is also underway to provide e-business facility to the bank's clientele through Online and Home banking solutions. Dhaka Bank Ltd. is the preferred choice in banking for friendly and personalized services, cutting edge technology, tailored solutions for business needs, global reach in trade and commerce and high yield on investments. (Dhaka Bank, 2006) The main activity of the Bank is banking related business. The activity includes deposit collection, extending credit facilities to different corporate organizations and small & medium enterprises. The Bank issue ATM Cards to the accountholders and it issues Credit cards to the customers through its Personal Banking wing. Moreover, it has different types of loan products such as Personal Loans, Car Loans, Any Purpose Loan, Vacation Loans etc. Being the member of Dhaka and Chittagong Stock Exchanges Dhaka Bank helps people to perform share trading. The accountholders of the bank can enjoy the SMS banking and Internet banking facilities, which is a part of modern technology. Besides conventional banking Dhaka Bank Limited offers Shariah-based Islamic Banking Services to its clients. The Bank opened its first Islamic Banking Branch on July 02, 2003 at Motijheel Commercial Area, Dhaka. The second Islamic Banking Branch of the Bank commenced its operation at Agrabad Commercial Are, Chittagong on May 22, 2004. Dhaka Bank Limited is a provider of online banking services and any of its clients may avail Islamic Banking Limited services through any of its branches across the country. (Dhaka Bank Ltd.)

Objective of the Research

2.1 2.2 2.3 To understand how to prepare a research work To understand consumer credit To understand consumer credit marketing system

Literature Review

3.1 Nonprofit credit counseling organizations have been helping consumers manage debt for more than 50 years. Credit counseling concerns about conflicts of interest and the emergence of a new type of credit counseling agency have triggered significant legislative and regulatory activity. The older counseling organizations rely primarily on credit-factors for their revenues, and this may create the appearance of a conflict of interest. These concerns and others have triggered significant legislative and

Page 5 of 13

regulatory activity. The credit counseling industry is an important one, but its activities and effects are not widely understood. Still the available research does give us some insight into the effects of consumer credit counseling and debt management plans on borrower behavior and the implications for the industry and regulation. (Hunt, 2005) 3.2 By using consumer testing systematically, the Federal Reserve is taking an innovative approach to revising its regulations and improving the effectiveness of disclosures. Consumers who do not have accurate information and an understanding of what that information means will have difficulty choosing among competing products and making decisions that are in their best interest. We are finding about consumers, how they use information and how we can simplify disclosures and enhance consumers understanding. Better-informed consumers will strengthen market competition. Consumer testing for credit cards will also help us improve mortgage disclosures and contribute to a more robust, competitive, and responsible subprime market. (Kroszner, 2007) As credit management professionals everybody have a clear responsibility to identify and report frauds to the police. If we all treat fraud more seriously, the losses need not continue rising. There are also direct benefits to the businesses we represent. In credit, collections, risk management and now fraud prevention, main thing is that it is much less costly and less effort to prevent a fraud than to attempt to collect a difficult debt or a debt that has arisen as a result of deception. (Hurst, 2003) Little is known about TANF recipients and leavers use of consumer credit. TANF families are 70% less likely than other low-income families to have a bank account and much more likely to have participated in a credit counseling program. Race also matters when it comes to accessing mainstream banking and credit systems. Targeted programs help TANF families gain greater access to the financial mainstream. When it comes to specialization programs, however, those involved in the welfare system are not very different from other poor families. However, by virtue of their formal involvement with TANF, this population can be more efficiently served than other low-income populations. (Stegman & Faris, 2005) The act of seeking counseling is a valuable early warning indicator of financial trouble. Telephone and face-to-face delivery appear to generate equivalent outcomes. Creditworthiness improved for debt management plan participants. (Plunkett, 2006)

3.3

3.4

3.5

Methodology of the study

Page 6 of 13

Secondary and primary data were collected for the study. Male and female were selected as sample unit. 20 male and 10 female were interviewed for this study. No statistical tools were used for this study.

5 Findings

5.1 Introduction

The main activity of the Bank is banking related business. The activity includes deposit collection, extending credit facilities to different corporate organizations and small & medium enterprises. The Bank issue ATM Cards to the accountholders and it issues Credit cards to the customers through its Personal Banking wing. Moreover, it has different types of consumer credit products such as Personal Loans, Car Loans, Any Purpose Loan, Vacation Loans etc. 5.2 Analysis

Money is any good or token that functions as a medium of exchange that is socially and legally accepted in payment for goods and services and in settlement of debts. Money also serves as a standard of value for measuring the relative worth of different goods and services and as a store of value. Money is essential to everybody and its make the life simple and smooth. Its also facilitating our life standard. Credit is denominated by a unit of account. Unlike money, credit itself cannot act as a unit of account. However, many forms of credit can readily act as a medium of exchange. As such, various forms of credit are frequently referred to as money and are included in estimates of the money supply. Peoples use credit for fulfill their needs. They use it to buy required items or execute their usual demand. The credit can be Personal loan (Motor Cycle, Air Conditioner), Computer loan, and Car loan etc. They use their credit as their emergency needs. Some peoples think that with the credit they have enabled to buy their necessary items, somebody thinks that the extra amount will help them to meet the expense.

From the survey which we have done before, we can see that from the Figure 1, 40% people think that consumer credit meets enjoying their life, 20% think that consumer credit does not meets enjoying their life and rest of the people does not have clear concept about that.

Page 7 of 13

Figure 1 : Consumer credit meets enjoying your life.

In Figure 2 we can see 60% people said that consumer credit increase their standard of living, 20% people said No and rest of the people said some times consumer credit increase their living standard.

Figure 2 : Consumer credit increase your standard of living.

From Figure 3 we can able to understand that, 40% people agree with, consumer credit relieves their distress, 20% people does not agree, 20% people said some times consumer credit relieves their distress and 20% said bit off.

Page 8 of 13

Figure 3 : Consumer credit relieves your distress.

Some people thinks that consumer credit developed and promoted mass prroduction for durables goods. Consumer credit promoted high employent and in the result of survey we can see from the Figure 4, that is 40% people agreed with the statement and rest of the respondent gave mixed answers. In sour country consumer credit create more wealth and employment. Sometimes its preseve our sevings and the bank offered us convenience credit. We took credit for our pressure of necessary and sometimes for early consumption.

Figure 4 : Consumer credit create employment.

Page 9 of 13

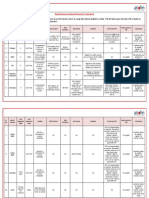

In our questionnaire we found that, most of the family has the monthly expenditure of minimum Tk. 14,500/= to maximum Tk. 38,700/= and we assume their household income should be higher than their expenditure and that is acceptable as their borrowed amount. From the response of question about adjustments because of financial need. We found some mixed answers because of the respondents were mixed credit borrowers. We are showing the answers in the Table 1 as follows: Table 1 : Response from the borrower about the Adjustment of financial needs for borrowing credit Statement Strong ly agree Agre e 40% 20% 20% 20% 20% 40% 40% 60% 40% 40% 60% 20% 60% 40% 100% 40% 40% 60% 60% 100% 100% 40% 60% Neutr al 40% 40% 40% 40% 40% 60% 40% 40% 60% 60% Disagr ee 20% 40% 40% 40% Strong ly disagr ee

Borrowed or used credit more than you used to Changed food shopping or eating habits to save money Reduced households utility use Cut back on social activities and entertainment expense Cut back on entertainment expense Postponed medical or dental care Fallon behind in paying bills Not registered for classes of your children Cannot afford holiday Cannot afford night out Cannot afford friends or family for meals Cannot afford special meals Cannot afford other than second hand clothes Cannot afford leisure or hobby activities Economic pressure can impact of your mental health Create tensions in marital relationships Create conflict between siblings Affect the quality of the parentchild relationship Impact the school performance of children

40% 40%

40% 60%

Page 10 of 13

In the view of Table 1 we can see that, the respondents have not faced any problems to maintain their family and they dont need to make enough adjustment for borrowing credits. In our survey we found different kinds of borrower. The purposes of credits are car loan, personal loan, computer loan. They respond some questions in their credit category. For taking car loan the borrower gave some answers about their changes in lifestyle activities, interest as lifestyle variables, opinion attitudes as lifestyle variables, etc. They strongly agree with the consumer credit increased their security & comfort ability to go to office or working center. They though its increased enjoyment and comfortability by visiting enjoyable place. Consumer credit increased their family members facility to go to a function, working center, relative house, school, college, shopping malls etc. but they have neutral view for using durable products differ their lifestyle from other of their society and tour. In personal loan, same kinds of questions were asked to the respondents. They gave almost same answer for their questions. The borrowers used their personal credit for using purchasing air conditioner, motor cycle, etc. Another credit borrower was take computer loan. She thinks its help to find, store, organize and disseminate information and improve her ability to maintained account quickly & correctly. Its also helps to save time because of getting information. 5.3 Problems

In this assignment no such problem found. The borrowers also have not enough problems to take the credit and repay the borrowing amount. 5.4 Recommendation

As we mentioned the borrowers have not enough problems, so we dont have any comments or recommendation on that. In the overview we think, the bank should make easy the procedure of consumer credit system and generalize that to the mass people. There are some restrictions for consumer credit, which is not so easy to fulfill for everybody. So the restrictions for consumer credit should be simpler.

6.

Conclusion

In conclusion, the rights of Consumers have to be treated fairly and to have more control over their financial affairs. They need to be in a position to make more informed borrowing decisions and to have clear and regular information on the state of their financial affairs. Consumers need to be able to challenge unfair conduct by lenders and, where disputes do arise, have access to a quick and effective means of resolving them.

Page 11 of 13

Nothing damages consumer confidence quite like being treated unfairly or simply ripped off. This affects not only the credit industry, but also the health of the economy as a whole. Responsible lenders have the right to operate in a healthy and competitive credit market, where business success is based on sound investment decisions and good customer service. We have to build in the Bangladesh a consumer credit market that is fair, open and competitive: one that protects the interests of consumers and allows lenders to compete on a fair and equal footing.

Page 12 of 13

7.

References

Bashar, Shabbir A, Bangladesh : Economy, Finance and Banking, Business and Investment in Bangladesh, http://www.betelco.com/bd/bdsbus/economy.html Dhaka Bank Ltd. www.dhakabankltd.com Dr. Econ (2001), What Is the Economic Function of a Bank, Educational Resources, http://www.frbsf.org/education/activities/drecon/2001/0107.html Hunt, Robert M, (2005), Whither Consumer Credit Counseling?, Business Review - Federal Reserve Bank of Philadelphia, Fourth Quarter 2005 Hurst, Peter, (2003), Organised fraud - the consumer credit industry's response, Credit Management, 2003 Kroszner, Randall S, Creating more effective consumer credit disclosures, Financial Services Research Program Policy Forum, 23 May, 2007 Plunkett, Travis (2006), CFA and American Express Report on First Phase of Research on Consumer Credit Counseling Effectiveness, American Express, June 12, 2006 Stegman, A. Michael & Faris, Robert (2005), Welfare, Work And Banking: The Use Of Consumer Credit By Current And Former TANF Recipients In Charlotte, North Carolina, Journal of Urban Affairs, Volume 27, Number 4, pages 379402

Page 13 of 13

You might also like

- Lecturer Department of Accounting & Finance School of Business & Economics (SBE)Document11 pagesLecturer Department of Accounting & Finance School of Business & Economics (SBE)Imrul Farhan Pritom 1620326630No ratings yet

- Contribution of Financial Market in BDDocument8 pagesContribution of Financial Market in BDAmeen IslamNo ratings yet

- Role of Commercial Bank in The Economic Development of INDIADocument5 pagesRole of Commercial Bank in The Economic Development of INDIAVaibhavRanjankar0% (1)

- 2.Md. Shamim Hossain & Abdul Alim Basher - Final PaperDocument9 pages2.Md. Shamim Hossain & Abdul Alim Basher - Final PaperiisteNo ratings yet

- Banking SectorDocument16 pagesBanking Sectorathul jobyNo ratings yet

- Iop HDFC LTDDocument72 pagesIop HDFC LTDSimreen HuddaNo ratings yet

- Role of Banks in The Development of Indian Economy: Prof. Jagdeep KumariDocument4 pagesRole of Banks in The Development of Indian Economy: Prof. Jagdeep KumariJOEL JOHNNo ratings yet

- FatemaTuzZohra, Role of Commercial Banking in The Economic Development of BengladeshDocument12 pagesFatemaTuzZohra, Role of Commercial Banking in The Economic Development of BengladeshsilveR staRNo ratings yet

- Chapter 3 To LastDocument126 pagesChapter 3 To LastASHU KNo ratings yet

- Bank ManagenentDocument7 pagesBank ManagenentsfarhanemonNo ratings yet

- SodaPDF Merged Merging Result NewDocument134 pagesSodaPDF Merged Merging Result NewASHU KNo ratings yet

- Data Provided in Annexure 1-ADocument11 pagesData Provided in Annexure 1-Avijay ancNo ratings yet

- Indian Banking Industry AnalysisDocument10 pagesIndian Banking Industry AnalysisSrinivas NandikantiNo ratings yet

- Commercial Banks and Industrial Finance GÇô Evolving RoleDocument26 pagesCommercial Banks and Industrial Finance GÇô Evolving RoletarunNo ratings yet

- Finance in India: Bank of Bengal Bank of Bombay Bank of MadrasDocument14 pagesFinance in India: Bank of Bengal Bank of Bombay Bank of MadrasRohan KhattarNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- A Study On Comparative AnalysisDocument11 pagesA Study On Comparative AnalysisSai RamyaNo ratings yet

- Role of Financial Institutions in Economic Development of Pakistan Essay Sample - Papers and Articles On Bla Bla WritingDocument5 pagesRole of Financial Institutions in Economic Development of Pakistan Essay Sample - Papers and Articles On Bla Bla WritingMuhammad Shahid Saddique33% (3)

- FIN603 Assignment 19164056Document10 pagesFIN603 Assignment 19164056KAZI THASMIA KABIRNo ratings yet

- Thesis Report of 5 BankDocument180 pagesThesis Report of 5 BankMd KamruzzamanNo ratings yet

- Growth of Commercial Bank in IndiaDocument2 pagesGrowth of Commercial Bank in Indiavinayak_874580% (5)

- BANKING INDUSTRY-Fundamental AnalysisDocument19 pagesBANKING INDUSTRY-Fundamental AnalysisGopi Krishnan.nNo ratings yet

- BANKING INDUSTRY-Fundamental AnalysisDocument19 pagesBANKING INDUSTRY-Fundamental AnalysisGopi Krishnan.nNo ratings yet

- Chapter 1,2,3 PDFDocument36 pagesChapter 1,2,3 PDFprapoorna chintaNo ratings yet

- Banking and ItDocument3 pagesBanking and ItAkhil DelhiNo ratings yet

- BankingDocument10 pagesBankingShikha MehtaNo ratings yet

- Banking: Last Updated: July 2011Document4 pagesBanking: Last Updated: July 2011shalini26No ratings yet

- Role of Commercial Banks in Economic Development: Indian PerspectiveDocument6 pagesRole of Commercial Banks in Economic Development: Indian PerspectivekapuNo ratings yet

- Industry Profile: Excellence in Indian Banking', India's Gross Domestic Product (GDP) Growth Will Make TheDocument27 pagesIndustry Profile: Excellence in Indian Banking', India's Gross Domestic Product (GDP) Growth Will Make TheNekta PinchaNo ratings yet

- Bank in PakistanDocument125 pagesBank in PakistanmustabeenasadNo ratings yet

- Future of Indian Banking IndustryDocument8 pagesFuture of Indian Banking IndustrymbashriksNo ratings yet

- Banking Sector - Backing On Demographic DividendDocument13 pagesBanking Sector - Backing On Demographic DividendJanardhan Rao NeelamNo ratings yet

- STP ShrutiDocument68 pagesSTP ShrutiShikha TrehanNo ratings yet

- Banking Sector ReformsDocument15 pagesBanking Sector ReformsKIRANMAI CHENNURUNo ratings yet

- An Analysis of Employee Job Satisfaction: A Study On United Commercial Bank LimitedDocument15 pagesAn Analysis of Employee Job Satisfaction: A Study On United Commercial Bank LimitedJunaidNo ratings yet

- Indian Banking SectorDocument4 pagesIndian Banking SectorAshok SharmaNo ratings yet

- Issues and Challenges in Indian Banking SectorDocument7 pagesIssues and Challenges in Indian Banking Sectorbhattcomputer3015No ratings yet

- Banking SectorDocument10 pagesBanking SectorMichael ChawiyaNo ratings yet

- Recent Trends in BankingDocument16 pagesRecent Trends in BankingManisha S. BhattNo ratings yet

- A Study On Credit Appraisal Process On Lotak Mahindra Bank (Draft)Document54 pagesA Study On Credit Appraisal Process On Lotak Mahindra Bank (Draft)Rhea SrivastavaNo ratings yet

- Road Map For NBFC To Banking: A Finance Case StudyDocument13 pagesRoad Map For NBFC To Banking: A Finance Case StudySohini BanerjeeNo ratings yet

- New Microsoft Office Word DocumentDocument9 pagesNew Microsoft Office Word DocumentgauravgorkhaNo ratings yet

- Untitled DocumentDocument44 pagesUntitled Documentjamwalvarun58No ratings yet

- Report On Banking IndustryDocument91 pagesReport On Banking IndustrySachin MittalNo ratings yet

- South East BankDocument36 pagesSouth East BankMamun KabirNo ratings yet

- IDBI ProjectDocument58 pagesIDBI ProjectBHARATNo ratings yet

- The Banking Industry of Bangladesh PDFDocument12 pagesThe Banking Industry of Bangladesh PDFrased62100% (1)

- Fin 301Document6 pagesFin 301Mostafa ZubaerNo ratings yet

- Comparative Analysis Between Private Sector VS Nationalised Banks - NetworthDocument81 pagesComparative Analysis Between Private Sector VS Nationalised Banks - NetworthRajesh BathulaNo ratings yet

- Bangladesh University of Business and Technology: Assignment On Overview of Banking Sector of BangladeshDocument27 pagesBangladesh University of Business and Technology: Assignment On Overview of Banking Sector of BangladeshRahat KhanNo ratings yet

- Bank Focus Writing All Important in One PDFDocument84 pagesBank Focus Writing All Important in One PDFFerdausNo ratings yet

- Banking IndustryDocument55 pagesBanking IndustryShikha TrehanNo ratings yet

- Indian Banking SectorDocument5 pagesIndian Banking Sector2612010No ratings yet

- Topic: Role of Commercial Banks in India: Name: Megha Singh Class: FYBSC Roll - No: 26 Semester - 1Document16 pagesTopic: Role of Commercial Banks in India: Name: Megha Singh Class: FYBSC Roll - No: 26 Semester - 1026 Megha SinghNo ratings yet

- Topic: Role of Commercial Banks in India: Name: Megha Singh Class: FYBSC Roll - No: 26 Semester - 1Document16 pagesTopic: Role of Commercial Banks in India: Name: Megha Singh Class: FYBSC Roll - No: 26 Semester - 1026 Megha SinghNo ratings yet

- Bajaj FinanceDocument65 pagesBajaj FinanceAshutoshSharmaNo ratings yet

- Project Report 4th Sem 1Document51 pagesProject Report 4th Sem 1Neha SachdevaNo ratings yet

- Axis Bank Project On CreditDocument136 pagesAxis Bank Project On CreditRishi SinghNo ratings yet

- Consolidation & Mergers in BankingDocument7 pagesConsolidation & Mergers in BankingISHAN CHAUDHARYNo ratings yet

- TimisaoraDocument8 pagesTimisaoraPride Tutorials Manikbagh RoadNo ratings yet

- Consumer Credit Marketing System in Bangladesh-A Case Study On Dhaka BankDocument11 pagesConsumer Credit Marketing System in Bangladesh-A Case Study On Dhaka BankAli Haider MohammadullahNo ratings yet

- Mis FaoDocument21 pagesMis FaoAli Haider MohammadullahNo ratings yet

- Operation Process of "Nabisco Biscuit & Bread Factory LTD": MethodologyDocument6 pagesOperation Process of "Nabisco Biscuit & Bread Factory LTD": MethodologyAli Haider MohammadullahNo ratings yet

- FDI in SingaporeDocument6 pagesFDI in SingaporeAli Haider MohammadullahNo ratings yet

- Fusion Fin GLDocument7 pagesFusion Fin GLjaleelmohamedfNo ratings yet

- Viray and Viola Viray For Petitioner. First Assistant Solicitor General Roberto A. Gianzon and Solicitor Manuel Tomacruz For RespondentDocument13 pagesViray and Viola Viray For Petitioner. First Assistant Solicitor General Roberto A. Gianzon and Solicitor Manuel Tomacruz For RespondentCarren Paulet Villar CuyosNo ratings yet

- Buying Homes in ForeclosureDocument182 pagesBuying Homes in Foreclosurermendgle100% (1)

- Addendum - As Is Where IsDocument8 pagesAddendum - As Is Where Issteveterrell68No ratings yet

- Statutory Audit PresentationDocument43 pagesStatutory Audit Presentationmanishnangalia0% (1)

- Chase CCDocument4 pagesChase CCapi-285771275No ratings yet

- Bangkanai 098YKW10 05 SPA-BPLBDocument21 pagesBangkanai 098YKW10 05 SPA-BPLBsulistyo rachmad wibowoNo ratings yet

- CommRev - Villanueva-Castro CaseZ Doctrines (Securities) (Malabad)Document10 pagesCommRev - Villanueva-Castro CaseZ Doctrines (Securities) (Malabad)Naethan Jhoe L. CiprianoNo ratings yet

- ALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXDocument37 pagesALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXjohn apostolNo ratings yet

- Methods of Payment in Export ImportDocument10 pagesMethods of Payment in Export Importkaran singlaNo ratings yet

- IFRS 15 Revenue From Contract With CustomersDocument64 pagesIFRS 15 Revenue From Contract With CustomersImtiaz Mohammed Arafeen0% (1)

- Electronic Bank Statement-MT940 FormatDocument21 pagesElectronic Bank Statement-MT940 FormatNuno AndradeNo ratings yet

- MEMORANDUM D17-1-5: in BriefDocument39 pagesMEMORANDUM D17-1-5: in Briefbiharris22No ratings yet

- Implementing Guidelines On Electronic Registration of Land Titles and DeedsDocument18 pagesImplementing Guidelines On Electronic Registration of Land Titles and DeedsSybil Salazar Vios100% (1)

- Client Manual Consumer Banking - CitibankDocument29 pagesClient Manual Consumer Banking - CitibankNGUYEN HUU THUNo ratings yet

- Bank Process To Obtain PasscodeDocument4 pagesBank Process To Obtain Passcodenakul19a_007No ratings yet

- TilaDocument83 pagesTilafisherre2000100% (1)

- Chapter 3 ExerciseDocument14 pagesChapter 3 ExerciseLy Chanraksmey100% (1)

- Account Number Account Type Branch Amount (INR)Document1 pageAccount Number Account Type Branch Amount (INR)palla gopalNo ratings yet

- Letter of Placing An OrderDocument10 pagesLetter of Placing An OrderArnav SinghalNo ratings yet

- Soneri Bank LTDDocument42 pagesSoneri Bank LTDKomal AbbasiNo ratings yet

- 2Document406 pages2m_a_1993No ratings yet

- StatementDocument7 pagesStatementnasreshNo ratings yet

- Accounts PayableDocument4 pagesAccounts PayablenorthepirNo ratings yet

- CH 07 - Intercompany Inventory TransactionsDocument23 pagesCH 07 - Intercompany Inventory TransactionsRodolfo SayangNo ratings yet

- Contracts PP 1 and 2Document6 pagesContracts PP 1 and 2Issa HawatmehNo ratings yet

- 14th October by Prof Harkirat SinghDocument17 pages14th October by Prof Harkirat SinghadhinayakgoharNo ratings yet

- AucDocument15 pagesAucJyotiraditya BanerjeeNo ratings yet

- LOIDocument1 pageLOImzlwinNo ratings yet

- Share Based NotesDocument5 pagesShare Based NotesJP MJNo ratings yet