Professional Documents

Culture Documents

Questionnaire Revised 2

Uploaded by

Anish MarwahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questionnaire Revised 2

Uploaded by

Anish MarwahCopyright:

Available Formats

QUESTIONNAIRE DEMOGRAPHIC DETAILS 1. AGE 1. 20-30 2. 30-40 3. 40-50 4. 50AND ABOVE 2. GENDER 1. Male 2. Female 3. EDUCATION AL QUALIFICATIONS 1.

Under graduate 2. Graduate 3. Post graduate 4. Doctorate 4. INCOME LEVEL 1. Below 15000 2. 15000-30000 3. 30000-50000 4. 50,000-75000 5. Above 75000 5. Occupation a. b. c. d. e. Student Working Professional Housewife Retired Self-employed

SECTION-1

Level of financial literacy

1. Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, would you be able to buy: a. More than today? b. Exactly the same? c. Less than today?

2. Suppose you put Rs 100 in a savings account with a guaranteed interest rate of 2% per year. You dont make any further payments into this account and you dont withdraw any money. How much would be in the account at the end of the first year, once the interest payment is made? Answer ----------------a. Answered correctly b. Dont know c. Irrelevant answer 3. If you lost your main source of income, how long could you continue to cover living expenses, without borrowing a. Less than a month b. One to three months c. Three to six months d. More than six months 4. Tick if you are aware of /invested in the following financial product Have you Do you In the last two years, heard of currently which of the following any of hold any of types of financial these these products have you types of types of chosen (Personally or financial products jointly) whether or not products (personally you still hold or jointly)? themPlease do not include products that were renewed automatically. a. A pension fund b. An investment account such as unit trust c. A mortgage d. A bank loan secured on property e. An unsecured bank loan f. A microfinance loan g. Insurance h. Stocks and shares i. Bonds j. Mutual funds

5. Label the following statements appropriate True False Dont know An investment with a high return is likely to be high risk High inflation means that the cost of living is increasing rapidly It is usually possible to reduce the risk of investing in the stock market by buying a wide range of stocks and shares.

Section II Rate Your Financial Behavior on a Scale of 1 to 5 1=Never 2=Rarely 3=Sometimes 4=Usually 5=Always 1 a. I keep track of my expenses on a regular basis. b. I put money aside for future purchases or emergencies. c. I prepare a budget every month. d. I make goals about how to spend money and I discuss them with my family. e. I earn more money than I spend (I am not in debt). f. I feel secure in my current financial situation. g. I feel confident about my financial future. h. I pay my monthly bills on time . i. Before I buy something I carefully consider whether I can afford it j. I tend to live for today and let tomorrow take care of itself k. I keep a close personal watch on my financial affairs l. I am prepared to risk some of my own money when saving or making an investment m. I set long term financial goals and strive to achieve them n. I find it more satisfying to spend money than to save it for the long term o. Money is there to be spent 2 3 4 5

Section-3 Effectiveness of financial literacy programs by RBI 1. Are you aware of Financial education website of RBI a. YES b. NO 2. Have you visited the website of RBI ? a. YES b. NO 3. How useful is the website of RBI for a common man. a. Very useful b. Somewhat useful c. Not useful 4. Rate the financial education website of RBI on a scale of 1 to5 1 a. Language /easily understandable b. Ease of access c. Information provided /content d. Appeal/look e. User friendly f. Response section 5. Have you ever attended a workshop on financial education by RBI? a. Yes b. no 6. Which type of Bank are you Banking with (a.) Nationalised (b.) Commercial (or Private) 2 3 4 5

7. Does your Bank provide you with awareness with respect to financial education by RBI (a.) Yes (b.) No

8. How frequently do you read a press release by RBI? (a.) Often (b.) Sometimes (c.) Rarely (d.) Never

9 . To what extent, does the information given in press releases /website/workshops meet the following parameters ?(rate in terms of your satisfaction level ) 1= highly satisfied 2= satisfied 3= neither satisfied nor dissatisfied 4= dissatisfied 5= highly dissatisfied website 1 2 3 Increased your general financial awareness Helps you in financial planning for the future Saves you from fraud Helps you in overcoming a financial crisis Increased awareness about central banking functions Increased knowledge about financial markets and products Helped in making better investment decisions press release 1 2 3 4 Workshop 1 2 3

Any other(please specify)

10. How would you like to gather information or receive information from RBI? a. b. c. d. Through their website Through publications in reputed magazines and newspapers Through personally attending financial literacy workshops and seminars Through television and radio programmes

11. Would you welcome the following initiatives from RBI .if yes rate them following on a scale of 1-3. 1 =most desirable 2= moderately desirable 3= least desirable YES/NO a. Making financial education a part of school curriculum b. Financial literacy centers in colleges c. Workshops in colleges and universities d. Inviting or holding weekly workshops for the common man at central and regional offices e. Weekly column of financial education in major newspapers f. Targeted outreach camps for women and retired persons g. Short term Refresher course on basics of financial management Score

You might also like

- IR Globalisation& IRDocument10 pagesIR Globalisation& IRSujit SekharNo ratings yet

- Malaysian Saving BehaviorDocument4 pagesMalaysian Saving BehaviorRied-Zall HasanNo ratings yet

- Price Attention and MemoryDocument14 pagesPrice Attention and MemoryMohamed LisaamNo ratings yet

- E-Banking Customer QuestionnaireDocument4 pagesE-Banking Customer QuestionnaireAjit Pal Singh HarnalNo ratings yet

- Presentation On Dividend PolicyDocument26 pagesPresentation On Dividend PolicygeoffmaneNo ratings yet

- Questionnaire - For Agents: Personal DataDocument8 pagesQuestionnaire - For Agents: Personal DataRachi JainNo ratings yet

- Factors Influencing Investor Decisions in Nepalese Stock MarketsDocument3 pagesFactors Influencing Investor Decisions in Nepalese Stock MarketsShresthaNo ratings yet

- EMI CalculatorDocument6 pagesEMI CalculatorPhanindra Sarma100% (1)

- Digitalization Survey ResultsDocument3 pagesDigitalization Survey ResultsMANIKA PURINo ratings yet

- Promotion Mix of LicDocument5 pagesPromotion Mix of LicRohitBhatiaNo ratings yet

- CAD and BoP trendsDocument10 pagesCAD and BoP trendsPalak MehtaNo ratings yet

- Value Chain in E-Commerce (M5)Document3 pagesValue Chain in E-Commerce (M5)SagarNo ratings yet

- Law of DemandDocument20 pagesLaw of Demandaman27jaiswalNo ratings yet

- Financial Management Mcqs With Answers: Eguardian India Banking and Finance McqsDocument27 pagesFinancial Management Mcqs With Answers: Eguardian India Banking and Finance McqsDeeparsh SinghalNo ratings yet

- Preethi QuestionnaireDocument5 pagesPreethi Questionnairetamil selviNo ratings yet

- ADocument46 pagesAalfiyaNo ratings yet

- NJ India Invest Summer Placement PresentationDocument16 pagesNJ India Invest Summer Placement Presentationdeepanshu lakhyaniNo ratings yet

- National Saving CertificatesDocument11 pagesNational Saving Certificatesaabc12345No ratings yet

- Calculating financial metrics and terminal value from corporate dataDocument5 pagesCalculating financial metrics and terminal value from corporate datapachpind jayeshNo ratings yet

- Empowering Women Through Financial Inclusion - A Study of Urban Slum - Shivangi Bhatia, Seema Singh, 2019Document29 pagesEmpowering Women Through Financial Inclusion - A Study of Urban Slum - Shivangi Bhatia, Seema Singh, 2019Sagar Chowdhury100% (1)

- Azeem Complete Thesis Imran AzeemDocument68 pagesAzeem Complete Thesis Imran AzeemImran Hassan100% (1)

- Evolutions of Mega Stores in PakistanDocument42 pagesEvolutions of Mega Stores in PakistanAraib KhanNo ratings yet

- 11 - Chapter 03 Review of LiteratureDocument66 pages11 - Chapter 03 Review of LiteratureAman GuptaNo ratings yet

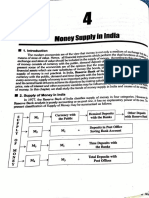

- Money Supply in India 1Document9 pagesMoney Supply in India 1Chaitanya ChoudharyNo ratings yet

- Make in India – Minimalist Approach to GrowthDocument6 pagesMake in India – Minimalist Approach to GrowthAvik K DuttaNo ratings yet

- PDFDocument4 pagesPDFJanvi MandaliyaNo ratings yet

- Microfinancial Analysis of J&K Grameen Bank2Document99 pagesMicrofinancial Analysis of J&K Grameen Bank2Ayan NazirNo ratings yet

- Boro - Effect of Mobile Banking On Financial Inclusion in KenyaDocument61 pagesBoro - Effect of Mobile Banking On Financial Inclusion in Kenyaedu mainaNo ratings yet

- Corporate Finance Paper MidDocument2 pagesCorporate Finance Paper MidAjmal KhanNo ratings yet

- Final BRMDocument59 pagesFinal BRMabhilasha_babbarNo ratings yet

- Customer Behavior and Preferences Regarding Reliance Mutual FundDocument50 pagesCustomer Behavior and Preferences Regarding Reliance Mutual FundAlisha SharmaNo ratings yet

- Money Back PolicyDocument58 pagesMoney Back PolicyUppal Patel83% (6)

- Project Report On Mutual FundDocument79 pagesProject Report On Mutual FundNikita Bhatt100% (1)

- Understanding Importance of Insurance and Marketing in IndiaDocument85 pagesUnderstanding Importance of Insurance and Marketing in IndiaRadhikaWadhwaNo ratings yet

- Study of Dividend Policy Adopted by Companies: Master of Business AdministrationDocument125 pagesStudy of Dividend Policy Adopted by Companies: Master of Business AdministrationtechcaresystemNo ratings yet

- Parative Analysis On The Performance of Mutual Funds Between Private & PublicDocument3 pagesParative Analysis On The Performance of Mutual Funds Between Private & PublicN.MUTHUKUMARANNo ratings yet

- Case Analysis On Schmitten - : Strategic ManagementDocument5 pagesCase Analysis On Schmitten - : Strategic ManagementPriyanshi GandhiNo ratings yet

- Data Analysis Reveals Investor PreferencesDocument23 pagesData Analysis Reveals Investor PreferencesBharat MahajanNo ratings yet

- SIFD 1st UnitDocument6 pagesSIFD 1st UnitRaaji BujjiNo ratings yet

- Quesionnaire PDFDocument6 pagesQuesionnaire PDFNiwron SarmientoNo ratings yet

- B. Ed. Prospectus 2011Document16 pagesB. Ed. Prospectus 2011deepak4uNo ratings yet

- Internship Report-India InfolineDocument61 pagesInternship Report-India Infolinevir13jan100% (2)

- Investment Opportunities in Mutual FundsDocument70 pagesInvestment Opportunities in Mutual Fundsrahulsogani123No ratings yet

- Financial Literacy: Challenges For Indian EconomyDocument14 pagesFinancial Literacy: Challenges For Indian EconomyJediGodNo ratings yet

- 6 BondDocument18 pages6 Bondßïshñü PhüyãlNo ratings yet

- Exhibit - I - Investing Habits-QuestionnaireDocument3 pagesExhibit - I - Investing Habits-Questionnairemba009No ratings yet

- Portfolio Management Banking SectorDocument133 pagesPortfolio Management Banking SectorNitinAgnihotri100% (1)

- Swot Analysis of Indian Banking IndustryDocument13 pagesSwot Analysis of Indian Banking Industrydrastishah9100% (1)

- CP Damini Jyoti PDFDocument90 pagesCP Damini Jyoti PDFjyoti dabhi100% (1)

- Project Report. FinalDocument32 pagesProject Report. FinalashutoshicbmNo ratings yet

- Project Report: Topic of The StudyDocument11 pagesProject Report: Topic of The StudySAGAR KHATUA100% (1)

- Financial Statement Analysis of TCS and INFOSYSDocument43 pagesFinancial Statement Analysis of TCS and INFOSYSRitwik Subudhi100% (1)

- Life Insurance Industry of IndiaDocument8 pagesLife Insurance Industry of Indiaanupma.mehta86236750% (4)

- A Synopsis ON: Investment Pattern of Salaried People'Document5 pagesA Synopsis ON: Investment Pattern of Salaried People'Abhishek SharmaNo ratings yet

- Mutual FundsDocument16 pagesMutual Fundsvirenshah_9846No ratings yet

- Exercise 2Document2 pagesExercise 2Mir Ziaul Hoda0% (2)

- Repo Rate and Its Effect On GDP: An Empirical Indian ExperienceDocument11 pagesRepo Rate and Its Effect On GDP: An Empirical Indian ExperienceAnonymous CwJeBCAXpNo ratings yet

- Ecommerce Consumer Behaviour Survey - Google FormsDocument5 pagesEcommerce Consumer Behaviour Survey - Google FormsRadhaNo ratings yet

- Gamification in Consumer Research A Clear and Concise ReferenceFrom EverandGamification in Consumer Research A Clear and Concise ReferenceNo ratings yet

- BCCL - Review of Transactions With OPSDocument18 pagesBCCL - Review of Transactions With OPSAnish MarwahNo ratings yet

- Airtel Final QuestionnaireDocument3 pagesAirtel Final QuestionnaireShamsjaved80% (5)

- IptvDocument10 pagesIptvAnish MarwahNo ratings yet

- CCM NotesDocument87 pagesCCM NotesAnish MarwahNo ratings yet

- What Is E-LearningDocument3 pagesWhat Is E-LearningAnish MarwahNo ratings yet

- First Metro Investment vs. Estate of Del SolDocument3 pagesFirst Metro Investment vs. Estate of Del SolEmir MendozaNo ratings yet

- Speculation Demon BankDocument3 pagesSpeculation Demon BankFreya RenataNo ratings yet

- TAXATION 1 - Hopewell Power V CommissionerDocument3 pagesTAXATION 1 - Hopewell Power V CommissionerSuiNo ratings yet

- GR 130722 LINTONJUA Vs L & R CORPORATIONDocument14 pagesGR 130722 LINTONJUA Vs L & R CORPORATIONRuel FernandezNo ratings yet

- General Power of AttorneyDocument2 pagesGeneral Power of AttorneyDred OpleNo ratings yet

- Guaranty SuretyDocument108 pagesGuaranty SuretyAlarm GuardiansNo ratings yet

- Popular Culture Galore Part 7Document79 pagesPopular Culture Galore Part 7Timothy100% (1)

- Valuation of Real PDocument5 pagesValuation of Real PKowsalyaNo ratings yet

- Eleanor Erica Strong vs. Francisco Gutierrez Repide 6 Phil. 680 Agents Power To Sell Property of Principal. - Under Article 1713 ofDocument6 pagesEleanor Erica Strong vs. Francisco Gutierrez Repide 6 Phil. 680 Agents Power To Sell Property of Principal. - Under Article 1713 ofFrancess Mae AlonzoNo ratings yet

- Jamie Gorelick, Mistress of DisasterDocument6 pagesJamie Gorelick, Mistress of DisasterrsarlinNo ratings yet

- Ecc Gen MathDocument26 pagesEcc Gen MathloidaNo ratings yet

- 6 Finance Interview Qs Test Market KnowledgeDocument2 pages6 Finance Interview Qs Test Market KnowledgeJack JacintoNo ratings yet

- Legal Aspects of SaleDocument7 pagesLegal Aspects of SaleShine Revilla - MontefalconNo ratings yet

- Canadian INSURANCE CourseDocument509 pagesCanadian INSURANCE CourseDeralianNo ratings yet

- Family Budget Tracker Shows $41 DifferenceDocument1 pageFamily Budget Tracker Shows $41 DifferenceYen NguyenNo ratings yet

- Order 83, Rules of Court 2012 - Charge ActionsDocument4 pagesOrder 83, Rules of Court 2012 - Charge ActionsemyliaatanNo ratings yet

- Opportunities For A New New York (Spring 2014)Document41 pagesOpportunities For A New New York (Spring 2014)qaidprojectsNo ratings yet

- TAXATION OF INCOME UNDER THE MALAYSIAN INCOME TAX ACTDocument7 pagesTAXATION OF INCOME UNDER THE MALAYSIAN INCOME TAX ACTVincent ChenNo ratings yet

- PGDmF10 - Research Methodology in Micro FinanceDocument2 pagesPGDmF10 - Research Methodology in Micro FinanceJammy MaNo ratings yet

- Mortgage Servicing Fraud ForumDocument125 pagesMortgage Servicing Fraud Forumautumngrace100% (1)

- M-09-05 Actuarial Mathematics ExamDocument223 pagesM-09-05 Actuarial Mathematics ExamStelios VafeasNo ratings yet

- Tax EvasionDocument4 pagesTax EvasionPavithra MurugesanNo ratings yet

- Commercial Law - Printable (Posted) PDFDocument124 pagesCommercial Law - Printable (Posted) PDFKimberlyAgravante100% (1)

- ALM Project ReportDocument18 pagesALM Project ReportAISHWARYA CHAUHANNo ratings yet

- 130642-1991-BA Finance Corp. v. Court of AppealsDocument6 pages130642-1991-BA Finance Corp. v. Court of AppealsTopher BalagtasNo ratings yet

- Fundamentals of Property OwnershipDocument4 pagesFundamentals of Property OwnershipMichelleOgatis83% (6)

- Discharge of ContractDocument29 pagesDischarge of ContractRahul SahuNo ratings yet

- Cooperative BankingDocument8 pagesCooperative BankingvmktptNo ratings yet

- 8 BPI Investment Vs Court of Appeals GR 133632Document2 pages8 BPI Investment Vs Court of Appeals GR 133632Hector Mayel MacapagalNo ratings yet

- Banking DigestDocument7 pagesBanking DigestMLeeNo ratings yet