Professional Documents

Culture Documents

Role of Human Resources in Mergers and Acquisitions

Uploaded by

Harmeet SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Role of Human Resources in Mergers and Acquisitions

Uploaded by

Harmeet SinghCopyright:

Available Formats

ROLE OF HUMAN RESOURCES IN MERGERS AND ACQUISITIONS

Jun 07, 2009 0 7,954

13

AdChoices

Indias economy Read more from The Economist. Uncompromising global perspective. www.economist.com Investment Banking Europe Corporate Finance Advisory for Companies & Targets in Europe www.ieg-banking.com MBA: For Best Placements Ranked 1st in Global Exposure & CSR Register Now for free prospectus. www.iipm.info/Admissions_2012 NMAT 2013 MBA from NMIMS. Apply Online ! Test starts from 11 Oct. 2012 www.nmat.org.in ROLE OF HUMAN RESOURCES IN MERGERS AND ACQUISITIONS

Related Articles The Im Advantage Review By An Insider Am I a criminal if im caught speeding? IM Tool Reviews MDI & FSM start application process for 2011-13 admissions Introduction: A merger is a combination of two companies to form a new company, while an acquisition is the purchase of one company by another with no new company being formed. A merger occurs when one firm assumes all the assets and all the liabilities of another. The acquiring firm retains its identity, while the acquired firm ceases to exist. A

majority vote of shareholders is generally required to approve a merger. A merger is just one type of acquisition. One company can acquire another in several other ways, including purchasing some or all of the company's assets or buying up its outstanding shares of stock. The term "acquisition" is typically used when one company takes control of another. This can occur through a merger or a number of other methods, such as purchasing the majority of a company's stock or all of its assets. Reasons for Mergers and Acquisitions: The management of an acquiring company may be motivated more by the desire to manage ever-larger companies than by any possible gains in efficiency. There are a number of reasons why a corporation will merge with, acquire, or be acquired by another corporation. Sometimes, corporations can produce goods or services more efficiently if they combine their efforts and facilities. Collaborating or sharing expertise may achieve gains in efficiency, or a company might have underutilized assets, the other company can better use. Also, a change in management may make the company more profitable. Other reasons for acquisitions have to do more with hubris and power. Regulation of Mergers and Acquisitions: Mergers and acquisitions are governed by both state and federal laws. State law sets the procedures for the approval of mergers and establishes judicial oversight for the terms of mergers to ensure shareholders of the target company, receive fair value. Generally, state law tends to be deferential to defences as long as the target company is not acting primarily to preserve its own positions. Courts tend to be sceptical of defences if the management of a target company has already decided to sell the company or to bring about a change of control. Because of the fear that mergers will negatively affect employees or other company stakeholders, most states allow directors at target companies to defend against acquisitions. Because of the number of state defences now available, the vast majority of mergers and acquisitions are friendly, negotiated transactions.

Motives behind M&A

i) The following motives are considered to add shareholder value: Economies of scale, increased revenue / increased market share, cross selling, synergy, taxes, geographical or other diversification and resource transfer. ii) The following motives are considered to not add shareholder value: Diversification, overextension, manager's hubris, empire building, manager's compensation, bootstrapping and vertical integration Mergers and Acquisitions: Doing the deal Start with an Offer When the CEO and top managers of a company decide that they want to do a merger or acquisition, they start with a tender offer. The process typically begins with the acquiring company carefully and discreetly buying up shares in the target company, or building a position. The Target's Response Once the tender offer has been made, the target company can do one of several things Accept the Terms of the Offer, Attempt to Negotiate, Execute a Poison Pill or Some Other Hostile Takeover Defence. Closing the Deal Finally, once the target company agrees to the tender offer and regulatory requirements are met, the merger deal will be executed by means of some transaction. In a merger in which one company buys another, the acquiring company will pay for the target company's shares with cash, stock or both. When the deal is closed, investors usually receive a new stock in their portfolios - the acquiring company's expanded stock. Sometimes investors will get new stock identifying a new corporate entity that is created by the M&A deal.

AdChoices

The Human Side of M&A Activity Plenty of attention is paid to the legal, financial, and operational elements of mergers and acquisitions. But executives who have been through the merger process now recognize that in today's economy, the management of the human side of change is the real key to maximizing the value of a deal. The management of the human side of M&A activity, however, based upon the failure rates of M&As, appears to be a somewhat neglected focus of the top management's attention. People issues occur at several phases or stages of M&A activity. More specifically, people issues in just the integration phase of mergers and acquisitions include: (1) Retention of key talent; (2) Communications; (3) Retention of key managers; and (4) Integration of corporate cultures. HR issues in three Stage Models of Mergers and Acquisitions The three stages: (1) Pre-combination; (2) Combination and integration of the partners; and (3) Solidification and advancement.

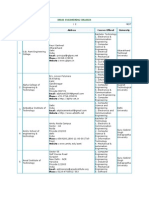

Selected HR Issues in the three Stages of M&A Stage 1: Pre-Combination

Identifying reasons for the IM & A Forming IM & A team/leader Searching for potential partners Selecting a partner Planning for managing the process of the IM and/or A Planning to learn from the process

Stage 2-Combination and Integration

Selecting the integration manager Designing/implementing teams Creating the new structure/strategies/ leadership Retaining key employees Motivating the employees Managing the change process Communicating to and involving stakeholders Deciding on the HR policies and practice

Stage 3: Solidification and Assessment

Solidifying leadership and staffing Assessing the new strategies and structures Assessing the new culture Assessing the new HRM policies and practices Assessing the concerns of stakeholders Revising as needed Learning from the process

Role of the HR Department in M&A activity

1. 2. 3. 4. 5. 6. 7. 8. 9.

Developing key strategies for a company's M&A activities Managing the soft due diligence activity Providing input into managing the process of change Advising top management on the merged company's new organizational structure Overseeing the communications Managing the learning processes Re-casting the HR department itself Identifying and embracing new roles for the HR leader Identifying and developing new competencies

The strategic contribution of HR as consisting of the "Five P's": Philosophy, Policies, Programs, Practices, and Processes. Conclusion Merger and Acquisitions success entirely depends on the people who drive the Business, their ability to Execute, Creativity, and Innovation. It is of utmost importance to involve HR Professionals in Mergers and Acquisitions discussions as it has an impact on key people issues. As Mergers and Acquisitions activity continues to step up globally, Companies involved in these transactions have the opportunity to adopt a different approach including the increased involvement of HR professionals. By doing so they will achieve a much better outcome and increase the chance that the overall deal is a total success.

You might also like

- Literature ReviewDocument2 pagesLiterature ReviewHarmeet SinghNo ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewHarmeet SinghNo ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewHarmeet SinghNo ratings yet

- Xie - Yuanyuan and Hu - WeiDocument55 pagesXie - Yuanyuan and Hu - WeiVinoliaEdwinNo ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewHarmeet SinghNo ratings yet

- Wiki Sewing MachineDocument7 pagesWiki Sewing MachineHarmeet Singh100% (1)

- List of Colleges in DelhiDocument63 pagesList of Colleges in DelhiHarmeet SinghNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- St. Louis ChemicalDocument8 pagesSt. Louis ChemicalNaomi Alberg-BlijdNo ratings yet

- Intrinsic Resistance and Unusual Phenotypes Tables v3.2 20200225Document12 pagesIntrinsic Resistance and Unusual Phenotypes Tables v3.2 20200225Roy MontoyaNo ratings yet

- Umair Mazher ThesisDocument44 pagesUmair Mazher Thesisumair_mazherNo ratings yet

- 7 Years - Lukas Graham SBJDocument2 pages7 Years - Lukas Graham SBJScowshNo ratings yet

- 1022-Article Text-2961-1-10-20200120Document10 pages1022-Article Text-2961-1-10-20200120Zuber RokhmanNo ratings yet

- Introduction To Vitamin C, (Chemistry STPM)Document2 pagesIntroduction To Vitamin C, (Chemistry STPM)NarmeenNirmaNo ratings yet

- A Study On Inventory Management Towards Organizational Performance of Manufacturing Company in MelakaDocument12 pagesA Study On Inventory Management Towards Organizational Performance of Manufacturing Company in MelakaOsama MazharNo ratings yet

- MF 04Document21 pagesMF 04Carlos De la CruzNo ratings yet

- Origin and Development of Law of Sea PDFDocument135 pagesOrigin and Development of Law of Sea PDFkimmiahujaNo ratings yet

- The Ontological Argument.: A Basic IntroductionDocument12 pagesThe Ontological Argument.: A Basic IntroductionJas PalNo ratings yet

- Debt Recovery Management of SBIDocument128 pagesDebt Recovery Management of SBIpranjalamishra100% (6)

- Combined RubricsDocument3 pagesCombined Rubricsapi-446053878No ratings yet

- ASSIGNMENTDocument5 pagesASSIGNMENTPanchdev KumarNo ratings yet

- Telesure Mock 8Document13 pagesTelesure Mock 8Letlhogonolo RatselaneNo ratings yet

- Vinzenz Hediger, Patrick Vonderau - Films That Work - Industrial Film and The Productivity of Media (Film Culture in Transition) (2009)Document496 pagesVinzenz Hediger, Patrick Vonderau - Films That Work - Industrial Film and The Productivity of Media (Film Culture in Transition) (2009)Arlindo Rebechi JuniorNo ratings yet

- New Democracy June-August 2017Document32 pagesNew Democracy June-August 2017Communist Party of India - Marxist Leninist - New DemocracyNo ratings yet

- Psychology - A Separate PeaceDocument2 pagesPsychology - A Separate PeacevasudhaaaaaNo ratings yet

- Perkin Elmer Singapore Distribution CaseDocument3 pagesPerkin Elmer Singapore Distribution CaseJackie Canlas100% (1)

- Fusion Tech ActDocument74 pagesFusion Tech ActrahulrsinghNo ratings yet

- Simple Past Tense The Elves and The Shoemaker Short-Story-Learnenglishteam - ComDocument1 pageSimple Past Tense The Elves and The Shoemaker Short-Story-Learnenglishteam - ComgokagokaNo ratings yet

- Progress Test 5 (Units 13-15) : Complete All Seven Sections. There Are Seventy Marks in TotalDocument7 pagesProgress Test 5 (Units 13-15) : Complete All Seven Sections. There Are Seventy Marks in TotalIlia GviniashviliNo ratings yet

- LumsDocument52 pagesLumsUmar AliNo ratings yet

- What's The Line Between Middle Class, Upper Middle Class, and Upper Class in Britain - QuoraDocument11 pagesWhat's The Line Between Middle Class, Upper Middle Class, and Upper Class in Britain - QuoraFaizan ButtNo ratings yet

- Homework WatergateDocument8 pagesHomework Watergateaapsujtif100% (1)

- Comparative Ethnographies: State and Its MarginsDocument31 pagesComparative Ethnographies: State and Its MarginsJuan ManuelNo ratings yet

- DRR Module 4 Detailed Lesson PlanDocument8 pagesDRR Module 4 Detailed Lesson PlanFe Annalie Sacal100% (2)

- Richard CuretonDocument24 pagesRichard CuretonHayk HambardzumyanNo ratings yet

- APCHG 2019 ProceedingsDocument69 pagesAPCHG 2019 ProceedingsEnrico SocoNo ratings yet

- EY The Cfo Perspective at A Glance Profit or LoseDocument2 pagesEY The Cfo Perspective at A Glance Profit or LoseAayushi AroraNo ratings yet

- The City - Populus' As A Self-Governing CorporationDocument24 pagesThe City - Populus' As A Self-Governing Corporation马寅秋No ratings yet