Professional Documents

Culture Documents

Currency Daily Report September 14

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Currency Daily Report September 14

Uploaded by

Angel BrokingCopyright:

Available Formats

Currencies Daily Report

Friday| September 14, 2012

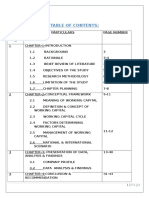

Content

Overview US Dollar Euro GBP JPY Economic Indicators

Overview:

Research Team

Fundamental Team Nalini Rao - Sr. Research Analyst Nalini.rao@angelbroking.com (022) 2921 2000 Extn. 6135 Anish Vyas - Research Associate anish.vyas@angelbroking.com (022) 2921 2000 Extn. 6104

Angel Broking Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Broking Ltd. Your feedback is appreciated on currencies@angelbroking.com

www.angelbroking.com

Currencies Daily Report

Friday| September 14, 2012

Highlights

US Producer Price Index (PPI) increased by 1.7 percent in August. US Unemployment Claims rose to 382,000 for w/e on 7th September.

Market Highlights (% change)

Last NIFTY SENSEX DJIA S&P FTSE KOSPI BOVESPA NIKKEI Nymex Crude (Oct'12) -$/bbl Comex Gold (Dec12) - $/oz Comex Silver(Dec12) $/oz LME Copper (3 month) -$/tonne CRB Index (Industrial) G-Sec -10 yr @7.8% - Yield 5435.4 18021.2 13539.86 1460.0 16244.3 1950.7 61958.1 8995.2 98.31 1769.10 3471.60 8184.00 477.11 99.8 Prev. day 0.1 0.1 1.5 1.6 -1.1 0.0 3.4 0.4 1.3 2.2 4.5 1.3 0.0 0.2

as on September 13, 2012 WoW 3.8 3.9 1.9 1.9 2.9 3.7 6.2 -0.1 2.9 3.9 6.4 6.2 0.6 -0.1 MoM 1.4 2.1 2.2 4.0 8.8 -0.4 4.2 -1.1 2.8 9.5 23.1 9.6 5.0 0.6 YoY 8.4 7.8 20.4 24.5 14.9 11.5 10.1 5.6 10.6 -3.0 -14.2 -5.0 -21.1 3.5

Asian markets are trading on a firm note taking cues from positive global market sentiments caused by US Federal Reserve plan to conduct the third round of quantitative easing. US Producer Price Index (PPI) increased by 1.7 percent in August as against a previous rise of 0.3 percent in July. Unemployment Claims rose by 17,000 to 382,000 for the week ending on 7th September from previous rise of 365,000 in prior week. Core PPI was at 0.2 percent in the last month as compared to rise of 0.4 percent in earlier month. Federal Funds Rate remained unchanged at 0.25 percent in the month of September. Federal Budget Balance was at a deficit of $190.5 billion in August with respect to previous deficit of $69.6 billion in July.

US Dollar Index

US dollar Index (DX) declined 0.6 percent on account of rise in risk appetite amongst market participants after US Federal Reserve Chairman Ben S. Bernanke announced plan to conduct the third round of quantitative easing. It announced that Fed will expand its holdings of long term securities with open ended purchases of $40 billion a month of mortgaged backed securities (MBS) in the QE3. The FOMC also said it would probably hold the federal funds rate near zero at least through mid-2015. This led to decline in the demand for the low yielding currency that is DX. US equities also gained after announcement by the US Federal Reserve Chairman Ben S. Bernanke its third round of QE to boost the economic health of the nation and reduce unemployment. The currency touched a low of 79.15 and closed at 79.25 in yesterdays session.

Source: Reuters

US Dollar (% change)

Last Dollar Index US $ / INR (Spot) US $ / INR Sep12 Futures (NSE) US $ / INR Sep12 Futures (MCX-SX) 79.24 55.34 55.46 55.46 Prev. day -0.6 -0.2 0.28 0.29

as on September 13, 2012 WoW -2.2 0.6 -0.75 -0.75 MoM -3.9 0.5 0.03 0.01 YoY 3.1 -13.9 16.32 16.26

Dollar/INR

The Indian Rupee depreciated by 0.3 percent in the yesterdays trading session. The currency depreciated taking cues from mixed global market sentiments. Additionally, domestic equities also ended on a flat note in yesterdays trade. However, weakness in the DX along with expectations of stimulus measure from the US cushioned sharp fall in the currency. It touched an intra-day low of 55.48 in yesterdays trade and closed at 55.41 on Thursday. For the current month, FII inflows totaled at Rs 2,477.10 crores till 13 September 2012. While year to date basis, net capital inflows stood at Rs 65,546.80 crores till 13th September 2012.

th

Source: Reuters

Technical Chart USD/INR

Source: Telequote

Outlook We expect Indian rupee to appreciate on the back of upbeat global market sentiments triggered by announcement of QE3 by the Federal Reserve policy makers in FOMC meeting held yesterday. However, inflation data from the nation is expected to rise for the month of August which might cap sharp appreciation in currency.

Technical Outlook

Trend US Dollar/INR Sep12 (NSE/MCX-SX) Down

valid for September 14, 2012 Support 55.20/55.0 Resistance 55.56/55.8

www.angelbroking.com

Currencies Daily Report

Friday| September 14, 2012

Euro/INR

Euro gained 0.7 percent taking cues from the announcement of the US Federal Reserve Chairman Ben S. Bernanke plan to conduct QE3. Weakness in the DX also acted as a supportive factor for the currency appreciation. The currency touched an intraday high of 1.3001 and closed at 1.2986 on Thursday. Outlook In todays session, we expect Euro to appreciate taking cues from positive global market sentiments along with weakness in the DX. Additionally, favouarable economic data from the region might support for the currency to appreciate. Technical Outlook

Trend Euro/INR Sep12 (NSE/MCX-SX) Up 71.28/71.1 71.7/71.9 valid for September 14, 2012 Support Resistance

Euro (% change)

Last Euro /$ (Spot) Euro / INR (Spot) Euro / INR Sep12 Futures (NSE) Euro / INR Sep12 Futures (MCX-SX) 1.2988 71.85 71.51 71.5 Prev. day 0.7 -0.9 0.27 0.25

as on September 13, 2012 WoW 2.9 -2.2 1.55 1.55 MoM 5.1 -4.6 4.39 4.31 YoY -5.5 -8.9 9.61 9.79

Source: Reuters

Technical Chart Euro

GBP/INR

The Pound appreciated by 0.3 percent yesterday taking cues from weakness in the DX. Additionally, upbeat global market sentiments also supported upside in the currency. It touched an intra-day high of 1.6174 and closed at 1.6152 on Thursday. GBP (% change) Outlook In the intra-day, we expect Pound to trade on a bullish note on account of upbeat global market sentiments triggered by the announcement of US Federal Reserve its plan to expand its holdings of long term securities with open ended purchases of $40 billion a month of mortgaged backed securities (MBS). Technical Outlook

Trend GBP/INR Sep 12 (NSE/MCX-SX) Up valid for September 14, 2012 Support 88.95/88.75 Resistance 89.4/89.7 Last $ / GBP (Spot) GBP / INR (Spot) GBP / INR Sep12 Futures (NSE) GBP / INR Sep12 Futures (MCX-SX) 1.6152 89.35 89.26 Prev. day 0.3 -0.5 0.34 WoW 1.4 -0.8 0.52 MoM 2.7 -2.1 2.70 YoY 2.5 -19.0 18.41

Source: Telequote

as on September 13, 2012

89.27

0.35

0.55

2.70

18.41

Source: Reuters

www.angelbroking.com

Currencies Daily Report

Friday| September 14, 2012

JPY/INR

The Japanese Yen appreciated by 0.4 percent yesterday on the back of rise in risk aversion in the global markets in the early part of the trade which led to increase in demand for the low yielding currency. It touched an intra-day high of 77.11 and closed at 77.48 in yesterdays trading session. Outlook In todays trade, we expect Yen to depreciate on the back of rise in risk appetite in the global markets which will lead to fall in demand for the low yielding currency. Technical Outlook

Trend JPY/INR Sep 12 (NSE/MCX-SX) Up valid for September 14, 2012 Support 71.05/70.85 Resistance 71.48/71.70

JPY (% change)

Last 77.48 0.7139 71.35 71.34 Prev day -0.4 -0.7 0.56 0.52

as on September 13, 2012 WoW -1.7 -1.2 0.28 0.30 MoM -2.3 -1.9 0.81 0.81 YoY 1.1 -14.9 15.07 15.09

JPY / $ (Spot) JPY / INR (Spot) JPY 100 / INR Sep12 Futures (NSE) JPY 100 / INR Sep12 Futures (MCX-SX)

Source: Reuters

Technical Chart JPY

Source: Telequote

Economic Indicators to be released on September 14, 2012

Indicator CPI y/y Core CPI y/y ECOFIN Meetings Core CPI m/m Core Retail Sales m/m Retail Sales m/m CPI m/m Capacity Utilization Rate Industrial Production m/m Prelim UoM Consumer Sentiment Business Inventories m/m Country Euro Euro Euro US US US US US US US US Time (IST) 2:30pm 2:30pm Tentative 6:00pm 6:00pm 6:00pm 6:00pm 6:45pm 6:45pm 7:25pm 7:30pm Actual Forecast 2.6% 1.7% 0.2% 0.6% 0.7% 0.5% 79.4% 0.2% 74.1 0.3% Previous 2.6% 1.7% 0.1% 0.8% 0.8% 0.0% 79.3% 0.6% 74.3 0.1% Impact Medium Medium Medium High High High Medium Medium Medium High Medium

www.angelbroking.com

You might also like

- Currency Daily Report September 17Document4 pagesCurrency Daily Report September 17Angel BrokingNo ratings yet

- Currency Daily Report September 11Document4 pagesCurrency Daily Report September 11Angel BrokingNo ratings yet

- Currency Daily Report September 21Document4 pagesCurrency Daily Report September 21Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 20Document4 pagesCurrency Daily Report September 20Angel BrokingNo ratings yet

- Currency Daily Report September 13Document4 pagesCurrency Daily Report September 13Angel BrokingNo ratings yet

- Currency Daily Report July 25 2013Document4 pagesCurrency Daily Report July 25 2013Angel BrokingNo ratings yet

- Currency Daily Report August 17Document4 pagesCurrency Daily Report August 17Angel BrokingNo ratings yet

- Currency Daily Report September 12Document4 pagesCurrency Daily Report September 12Angel BrokingNo ratings yet

- Currency Daily Report August 23Document4 pagesCurrency Daily Report August 23Angel BrokingNo ratings yet

- Currency Daily Report November 9Document4 pagesCurrency Daily Report November 9Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report August 27Document4 pagesCurrency Daily Report August 27Angel BrokingNo ratings yet

- Currency Daily Report, July 18 2013Document4 pagesCurrency Daily Report, July 18 2013Angel BrokingNo ratings yet

- Currency Daily Report August 29Document4 pagesCurrency Daily Report August 29Angel BrokingNo ratings yet

- Currency Daily Report, June 20 2013Document4 pagesCurrency Daily Report, June 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 11 2013Document4 pagesCurrency Daily Report, July 11 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 07 2013Document4 pagesCurrency Daily Report, June 07 2013Angel BrokingNo ratings yet

- Currency Daily Report September 27Document4 pagesCurrency Daily Report September 27Angel BrokingNo ratings yet

- Currency Daily Report August 13Document4 pagesCurrency Daily Report August 13Angel BrokingNo ratings yet

- Currency Daily Report October 10Document4 pagesCurrency Daily Report October 10Angel BrokingNo ratings yet

- Currency Daily Report, July 23 2013Document4 pagesCurrency Daily Report, July 23 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 13 2013Document4 pagesCurrency Daily Report, June 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 21Document4 pagesCurrency Daily Report, February 21Angel BrokingNo ratings yet

- Currency Daily Report September 24Document4 pagesCurrency Daily Report September 24Angel BrokingNo ratings yet

- Currency Daily Report, May 10 2013Document4 pagesCurrency Daily Report, May 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 8 2013Document4 pagesCurrency Daily Report, August 8 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 24 2013Document4 pagesCurrency Daily Report, June 24 2013Angel BrokingNo ratings yet

- Currency Daily Report November 8Document4 pagesCurrency Daily Report November 8Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, June 17 2013Document4 pagesCurrency Daily Report, June 17 2013Angel BrokingNo ratings yet

- Currency Daily Report August 16Document4 pagesCurrency Daily Report August 16Angel BrokingNo ratings yet

- Currency Daily Report October 15Document4 pagesCurrency Daily Report October 15Angel BrokingNo ratings yet

- Currency Daily Report November 7Document4 pagesCurrency Daily Report November 7Angel BrokingNo ratings yet

- Currency Daily Report, June 25 2013Document4 pagesCurrency Daily Report, June 25 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 21Document4 pagesCurrency Daily Report, March 21Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report September 10Document4 pagesCurrency Daily Report September 10Angel BrokingNo ratings yet

- Currency Daily Report November 16Document4 pagesCurrency Daily Report November 16Angel BrokingNo ratings yet

- Currency Daily Report, August 7 2013Document4 pagesCurrency Daily Report, August 7 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 01 2013Document4 pagesCurrency Daily Report, July 01 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 28 2013Document4 pagesCurrency Daily Report, June 28 2013Angel BrokingNo ratings yet

- Currency Daily Report November 19Document4 pagesCurrency Daily Report November 19Angel BrokingNo ratings yet

- Currency Daily Report, July 15 2013Document4 pagesCurrency Daily Report, July 15 2013Angel BrokingNo ratings yet

- Currency Daily Report August 21Document4 pagesCurrency Daily Report August 21Angel BrokingNo ratings yet

- Currency Daily Report November 6Document4 pagesCurrency Daily Report November 6Angel BrokingNo ratings yet

- Currency Daily Report, May 13 2013Document4 pagesCurrency Daily Report, May 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 27 2013Document4 pagesCurrency Daily Report, May 27 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 12Document4 pagesCurrency Daily Report, March 12Angel BrokingNo ratings yet

- Currency Daily Report August 31Document4 pagesCurrency Daily Report August 31Angel BrokingNo ratings yet

- Currency Daily Report, June 18 2013Document4 pagesCurrency Daily Report, June 18 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 22Document4 pagesCurrency Daily Report, February 22Angel BrokingNo ratings yet

- Currency Daily Report August 14Document4 pagesCurrency Daily Report August 14Angel BrokingNo ratings yet

- Currency Daily Report, March 11Document4 pagesCurrency Daily Report, March 11Angel BrokingNo ratings yet

- Currency Daily Report 07 March 2013Document4 pagesCurrency Daily Report 07 March 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 14 2013Document4 pagesCurrency Daily Report, June 14 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Skew GuideDocument18 pagesSkew Guidezippolo100% (2)

- Dhaka Stock Exchange General Index 2001-2013Document36 pagesDhaka Stock Exchange General Index 2001-2013Maruf HassanNo ratings yet

- How To Prevent Failure of Financial InstitutionsDocument55 pagesHow To Prevent Failure of Financial InstitutionsBijoy SalahuddinNo ratings yet

- MCQs of AccountingDocument29 pagesMCQs of AccountingImran Arshad33% (3)

- Prediction CompanyDocument16 pagesPrediction CompanylowtarhkNo ratings yet

- 20 Basic Accounting Terms List For Preparation of PPSC, FPSC & NTS Tests - Government Jobs & Private Jobs in Pakistan 2018Document3 pages20 Basic Accounting Terms List For Preparation of PPSC, FPSC & NTS Tests - Government Jobs & Private Jobs in Pakistan 2018Dustar Ali HaideriNo ratings yet

- Riot Blockchain SEC Ends Investigation Letter 1.29.20Document5 pagesRiot Blockchain SEC Ends Investigation Letter 1.29.20Teri BuhlNo ratings yet

- TBChap 009Document50 pagesTBChap 009Kanav GuptaNo ratings yet

- Audit of Ultratech Cement LimitedDocument43 pagesAudit of Ultratech Cement Limitedpallavi21_1992No ratings yet

- Bard NoteDocument20 pagesBard NoteAmulya Kumar SahuNo ratings yet

- Case Study 2 Excel Jackson AutomobileDocument15 pagesCase Study 2 Excel Jackson AutomobileSayantani NandyNo ratings yet

- Starbuck PPT by Pershing SquareDocument44 pagesStarbuck PPT by Pershing SquareJainam VoraNo ratings yet

- CH005Document52 pagesCH005Lana LoaiNo ratings yet

- Valuation TablesDocument29 pagesValuation TablesAniqy Marshall100% (2)

- Business Accounting Question PaperDocument3 pagesBusiness Accounting Question PaperGajendra GargNo ratings yet

- FM Theory NotesDocument31 pagesFM Theory NotesHosea KanyangaNo ratings yet

- 1598156714-Prasenjit Paul Screener Excel - Alkyl AminesDocument15 pages1598156714-Prasenjit Paul Screener Excel - Alkyl AminesANIRU ZZAMANNo ratings yet

- Partnership Fulltext of Cases June 2019 SPSPSDocument288 pagesPartnership Fulltext of Cases June 2019 SPSPSPJFilm-ElijahNo ratings yet

- Dealing Room OperationDocument43 pagesDealing Room Operationkaashifhassan100% (2)

- CHAPTER 15 - TranspoDocument6 pagesCHAPTER 15 - TranspoRenz AmonNo ratings yet

- Working Capital On WIPRO ITCDocument50 pagesWorking Capital On WIPRO ITCB Swaraj100% (1)

- Bank Management Koch 8th Edition Solutions ManualDocument17 pagesBank Management Koch 8th Edition Solutions ManualKristinGreenewgdmNo ratings yet

- AnnualReport2016 17Document244 pagesAnnualReport2016 17RiteshRajputNo ratings yet

- Brochure Internacional Ene2018 (v.2)Document27 pagesBrochure Internacional Ene2018 (v.2)Darío Guiñez ArenasNo ratings yet

- Llamado - Income Taxation - ExpandedDocument14 pagesLlamado - Income Taxation - ExpandedTtlrpq0% (1)

- LICOA Quarterly Statement Q3 2021Document36 pagesLICOA Quarterly Statement Q3 2021Nate TobikNo ratings yet

- Board Committee Roles and ResponsibilitiesDocument31 pagesBoard Committee Roles and ResponsibilitiesIbrahim DafaNo ratings yet

- FACTS: Petitioner Claims That The MCIT Is Unconstitutional Because It Is Highly Oppressive, Arbitrary and ConfiscatoryDocument4 pagesFACTS: Petitioner Claims That The MCIT Is Unconstitutional Because It Is Highly Oppressive, Arbitrary and ConfiscatorychinchayNo ratings yet

- JLL Research ReportDocument10 pagesJLL Research Reportkrishnachaitanya_888No ratings yet

- Financial Accounting and Reporting by Fayieee Prelim To MidtermDocument31 pagesFinancial Accounting and Reporting by Fayieee Prelim To MidtermEnalyn AldeNo ratings yet