Professional Documents

Culture Documents

FM 1 Insurance Management BBA V

Uploaded by

varunkaushik1630Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM 1 Insurance Management BBA V

Uploaded by

varunkaushik1630Copyright:

Available Formats

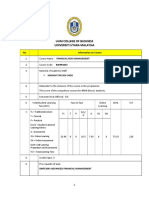

Module Descriptor Module Title Programme Term Credits : Insurance Management ( FM1) : BBA :V :4

Time required in terms of Student Learning: Learning Contact Guided study Assessment Total Hours 40 35 25 100

Aim and Objectives The course is designed to offer a theoretical framework for the analysis of financial intermediation, the Insurance firm and trends in Insurance Sector. Provide students with broad perspective of risk management and to acquaint with essential details of insurance contracts and markets On completion of this module the student will be able to: o To explain how Risk and Risk mitigation is managed To know about the theoretical aspects relating to risk management & insurance management Teaching/Learning Approach Teaching/ learning approach will include following methods: Lectures supported with overhead transparencies or power point slides and handouts Group Discussions Case Studies Individual and Group Presentations Text book readings and Articles. Quiz Guided Study Guided study will include text readings, articles on contemporary issues in organization, assignments, case analysis and power point presentations. Assessment Assessment of the student will be based on mid-term and end term examination and continuous assessment subject to class participation, assignments and presentations.

Indicative Content Topic UNIT 1 Coverage

The Concept of Risk Risk Vs. Uncertainty types of Risks: Market Risk, Credit Risk, Operational Risk, interest risk, business risk, systematic risk Classifying pure risks methods of handling pure risks risk management process Risk financing techniques Risk management objectives Risk Management by Individuals: Factors effecting individual demands for insurance Risk Management by Corporations: Corporate Risk Management Process Types of Risk Managing firms Growth & Development of Indian Insurance Industry Regulations of Insurance Business and The Emerging Scenario Introduction to Life & General Insurance Life Insurance: Features of Life Insurance Essentials of Life Insurance Contract Kinds of Insurance Policies Premium determination Life Policy Conditions Fire Insurance: Fire Insurance Contracts Fire Insurance Coverage Policies for stocks Rate Fixation in Fire Insurance Settlement of Claims. Marine Insurance: Marine Insurance Contract Types of Marine Insurance Marine Cargo Losses and Frauds Settlement of claims Miscellaneous Insurance: Motor Insurance ,Employers Liability Insurance, Personal Accident and sickness Insurance ,Aviation Insurance , Burglary Insurance

No. of lectures 9

Presentations Presentation

Case study

UNIT 2

Case Study

UNIT 3

Presentation

UNIT 4

Case Study

UNIT 5

Case Study

Suggested Readings: Only 5 books

1. Dr. P.K. Gupta: Insurance and Risk Management, 1st edition,Himalaya Publishing House. 2. Dr.P.K. Gupta: Fundamental of Insurance, 1st edition, Himalaya Publishing House. 3. C. Gopala Krishnan: Insurance Principles & Practice, Sterling Publishers Pvt. Ltd., New Delhi. 4. Prof. K.S. N. Murthy and K.V.S. Sarma: Modern Law of Insurance in India, N.M. Tripathi Pvt. Ltd., Bombay. 5. P.S. Palande, R.S. Shah, M.L. Lunawat: Insurance in India, Sage Publications, New Delhi.

You might also like

- Rim399 (0110)Document3 pagesRim399 (0110)Mariam MindiashviliNo ratings yet

- Rim 3351Document5 pagesRim 3351edwin perdanaNo ratings yet

- Lal Bahadur Shastri Institute of Management, New Delhi: Course ObjectiveDocument4 pagesLal Bahadur Shastri Institute of Management, New Delhi: Course ObjectiveParshant GuptaNo ratings yet

- Insurance Law SyllabusDocument3 pagesInsurance Law Syllabusrmbj94_scribdNo ratings yet

- FRMDocument2 pagesFRMManjunath BVNo ratings yet

- Syllabus PDFDocument81 pagesSyllabus PDFC RajkumarNo ratings yet

- RM & I Detailed PDFDocument187 pagesRM & I Detailed PDFDevikaNo ratings yet

- 18MBAFM402 RM & I Notes 26.4.21Document77 pages18MBAFM402 RM & I Notes 26.4.21Hy SomachariNo ratings yet

- Risk Management Insurance - NotesDocument187 pagesRisk Management Insurance - NotesTejas100% (1)

- Ifce Eng v4 March 2012Document184 pagesIfce Eng v4 March 2012Serhan ParappilNo ratings yet

- BWRR1013 - Risk InsuranceDocument9 pagesBWRR1013 - Risk Insurancetrevorsum123No ratings yet

- Complete Unit Plan2Document18 pagesComplete Unit Plan2Allison HoodNo ratings yet

- (H) IrmDocument2 pages(H) IrmArchana XDNo ratings yet

- Af 323Document2 pagesAf 323gregory georgeNo ratings yet

- RimDocument3 pagesRim29_ramesh170No ratings yet

- FINA2342 Insurance Course Outline FallDocument6 pagesFINA2342 Insurance Course Outline FallTsz Mei WongNo ratings yet

- Insurance Course OutlineDocument2 pagesInsurance Course OutlineSheikh Miftahul HasibNo ratings yet

- CO Derivative ManagementDocument8 pagesCO Derivative ManagementAbhinav MahajanNo ratings yet

- Modul 3 Risk ManagementDocument5 pagesModul 3 Risk ManagementLuca PappalardoNo ratings yet

- RSK4803 Topic 4Document61 pagesRSK4803 Topic 4RonZembeNo ratings yet

- Insurance Law 2020Document3 pagesInsurance Law 2020Apoorva DewanNo ratings yet

- Insurance and Risk ManagementDocument4 pagesInsurance and Risk Managementhussainmba300% (1)

- 715 - BCom General Computer Applications Semester IVDocument1 page715 - BCom General Computer Applications Semester IVshaiksufiyan9999No ratings yet

- Mini Course On InsuranceDocument20 pagesMini Course On Insurancemegapowerstar1111No ratings yet

- Subject Outline Financial Risk ManagementDocument6 pagesSubject Outline Financial Risk ManagementDamien KohNo ratings yet

- New SyllabusDocument81 pagesNew SyllabuspranavyesNo ratings yet

- Course Outlines BbaDocument151 pagesCourse Outlines Bbazahid khanNo ratings yet

- SYLLABUS of Health InsuranceDocument10 pagesSYLLABUS of Health InsuranceSuchetana SenNo ratings yet

- Daf 1211 Principles of Risk Management and Insurance 2Document84 pagesDaf 1211 Principles of Risk Management and Insurance 2MAYENDE ALBERTNo ratings yet

- CPAIM Couse SyllabusDocument48 pagesCPAIM Couse SyllabussajidtoshibaNo ratings yet

- CFP Certification Education Program SyllabusDocument24 pagesCFP Certification Education Program SyllabusSanchu DhingraNo ratings yet

- Welcome To The CourseDocument5 pagesWelcome To The Coursetiaramaulinazhi1700No ratings yet

- PCIL (E) Summary Handbook V1.feb2020Document145 pagesPCIL (E) Summary Handbook V1.feb2020Ezam Ezam50% (2)

- Cource Out Line Risk Final AAUDocument4 pagesCource Out Line Risk Final AAUEbsa AdemeNo ratings yet

- Risk Management and Insurance (LSCM 2092)Document140 pagesRisk Management and Insurance (LSCM 2092)Sagni Belachew DukNo ratings yet

- Risk Management Specialization OutlineDocument4 pagesRisk Management Specialization OutlineNadine ShaheenNo ratings yet

- Uum College of Business Universiti Utara MalaysiaDocument7 pagesUum College of Business Universiti Utara MalaysiaSyai GenjNo ratings yet

- Ent 121Document121 pagesEnt 121Thompson E IghaloNo ratings yet

- MBA (Insurance & Banking) and (Insurance & Financial Planning) Course Title: Servicing of Insurance ProductsDocument4 pagesMBA (Insurance & Banking) and (Insurance & Financial Planning) Course Title: Servicing of Insurance ProductsApurva JhaNo ratings yet

- DerivativesDocument3 pagesDerivativesAditya SukhijaNo ratings yet

- Notes BMGT 211 Introduction To Risk and Insurance May 2020-1Document94 pagesNotes BMGT 211 Introduction To Risk and Insurance May 2020-1jeremieNo ratings yet

- Health InsuranceDocument28 pagesHealth Insuranceप्रविण सराफNo ratings yet

- Course Outline 2015Document3 pagesCourse Outline 2015KumarVelivelaNo ratings yet

- FIN 238 Risk and Insurance Management (BBA-BI: 4 Semester)Document2 pagesFIN 238 Risk and Insurance Management (BBA-BI: 4 Semester)Sakshi Adhikary0% (1)

- Cource Out Line Risk Management and Insurance AAUDocument3 pagesCource Out Line Risk Management and Insurance AAUEdenNo ratings yet

- Syllabus MBA (IB) 2010 3rd SemDocument29 pagesSyllabus MBA (IB) 2010 3rd SemVipul AroraNo ratings yet

- MBA Insurance RiskDocument17 pagesMBA Insurance RiskEnd EndNo ratings yet

- Fire Specialised DiplomaDocument10 pagesFire Specialised DiplomaNeetu Deepak NagalNo ratings yet

- IPPDocument77 pagesIPPshanifNo ratings yet

- Insurance & Risk Management SyllabusDocument1 pageInsurance & Risk Management SyllabuskunkumabalaNo ratings yet

- SyllabusDocument76 pagesSyllabusamattirkeyNo ratings yet

- Annexure CD - 01'Document3 pagesAnnexure CD - 01'Bharat MahajanNo ratings yet

- MBA (Insurance & Banking) : Course Title: Regulation of Insurance Business Course Code: Credit Units: 3Document4 pagesMBA (Insurance & Banking) : Course Title: Regulation of Insurance Business Course Code: Credit Units: 3Bharat MahajanNo ratings yet

- mc314Document248 pagesmc314simranNo ratings yet

- Bshm55 Module 1Document12 pagesBshm55 Module 1Yisu HimaaNo ratings yet

- FRM Syllabus of AUDocument9 pagesFRM Syllabus of AUMeer Mazhar AliNo ratings yet

- Security Leader Insights for Risk Management: Lessons and Strategies from Leading Security ProfessionalsFrom EverandSecurity Leader Insights for Risk Management: Lessons and Strategies from Leading Security ProfessionalsNo ratings yet

- A. Traditional Approach: Scope of Financial MGTDocument79 pagesA. Traditional Approach: Scope of Financial MGTbindhujohnNo ratings yet

- Maf620 - Corporate Finance Test 1 4 MAY 2013 - 1 HOURS Answer All Questions. Good LuckDocument6 pagesMaf620 - Corporate Finance Test 1 4 MAY 2013 - 1 HOURS Answer All Questions. Good LuckAsraf HadzwanNo ratings yet

- Punjab Chemicals - Apr 2014Document20 pagesPunjab Chemicals - Apr 2014Duby Rex100% (1)

- Chapter 4 EnterpriseDocument5 pagesChapter 4 Enterpriseapi-207606282No ratings yet

- MSC PSCM Changalima, I.A 2016Document91 pagesMSC PSCM Changalima, I.A 2016Samuel Bruce RocksonNo ratings yet

- Oberoi Realty Annual Report 2018-19Document220 pagesOberoi Realty Annual Report 2018-19yashneet kaurNo ratings yet

- (Outstanding) (DDI) 9 Talent Management Best Practices - DDIDocument12 pages(Outstanding) (DDI) 9 Talent Management Best Practices - DDINguyen Thanh-LoanNo ratings yet

- 2013 Deutsche Bank Operational Due Diligence SurveyDocument48 pages2013 Deutsche Bank Operational Due Diligence SurveyRajat CNo ratings yet

- The Unbanked and Underbanked by StateDocument11 pagesThe Unbanked and Underbanked by StatecaitlynharveyNo ratings yet

- Topic 4 Planning and Strategic ManagementDocument44 pagesTopic 4 Planning and Strategic ManagementkimiNo ratings yet

- Amazon VA Lecture 1Document20 pagesAmazon VA Lecture 1Moazzan MughalNo ratings yet

- Financial Accounting Theory: Sixth William R. ScottDocument32 pagesFinancial Accounting Theory: Sixth William R. Scottanon_757820301No ratings yet

- Cashinfinity EuroDocument2 pagesCashinfinity EuroAna CarvalhoNo ratings yet

- Ducati Valuation - LPDocument11 pagesDucati Valuation - LPuygh gNo ratings yet

- DayTrade Gaps SignalsDocument30 pagesDayTrade Gaps SignalsJay SagarNo ratings yet

- Detergent Powder Manufacturing Unit Rs. 28.83 Million Jun-2021Document23 pagesDetergent Powder Manufacturing Unit Rs. 28.83 Million Jun-2021Syed Fawad AhmadNo ratings yet

- Curriculum Grade 7 ELA - 2016Document19 pagesCurriculum Grade 7 ELA - 2016blagaiaNo ratings yet

- Dcom307 - DMGT405 - Dcom406 - Financial Management PDFDocument318 pagesDcom307 - DMGT405 - Dcom406 - Financial Management PDFBaltej singhNo ratings yet

- Pavilion-cum-Convention Centre DesignDocument5 pagesPavilion-cum-Convention Centre DesignHarman VirdiNo ratings yet

- Chapter 7 The Balanced Scorecard A Tool To Implement Strategy SoftDocument20 pagesChapter 7 The Balanced Scorecard A Tool To Implement Strategy SoftDjunah ArellanoNo ratings yet

- Accounting FinalsDocument10 pagesAccounting FinalsrixaNo ratings yet

- Practice Questions # 4 Internal Control and Cash With AnswersDocument9 pagesPractice Questions # 4 Internal Control and Cash With AnswersIzzahIkramIllahiNo ratings yet

- BSBSUS211 - Assessment Task 1Document7 pagesBSBSUS211 - Assessment Task 1Anzel Anzel100% (1)

- HR Analytics - Assignment 7Document4 pagesHR Analytics - Assignment 7Bismah AhmedNo ratings yet

- Industry Analysis FinalDocument18 pagesIndustry Analysis FinalManaf BasheerNo ratings yet

- BCG MatrixDocument42 pagesBCG MatrixArun RanaNo ratings yet

- Chapter - 6 Findings, Suggestions Andconclusion Findings From Financial AnalysisDocument2 pagesChapter - 6 Findings, Suggestions Andconclusion Findings From Financial AnalysisTinku KumarNo ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential AC/JULY 2021/ACC416Document8 pagesUniversiti Teknologi Mara Final Assessment: Confidential AC/JULY 2021/ACC416Abdul HakimNo ratings yet

- Sample Business Article CritiqueDocument5 pagesSample Business Article CritiqueGlaize FulgencioNo ratings yet

- Profitability RatiosDocument4 pagesProfitability RatiosDorcas YanoNo ratings yet