Professional Documents

Culture Documents

F6UK 2012 Jun A

Uploaded by

Hasan Ali BokhariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

F6UK 2012 Jun A

Uploaded by

Hasan Ali BokhariCopyright:

Available Formats

Answers

Fundamentals Level Skills Module, Paper F6 (UK) Taxation (United Kingdom) 1 (a) Flick Pick Taxable income 201112 Employment income Salary Living accommodation Annual value Additional benefit (working 1) Furniture (9,400 x 20%) Trading profit (working 2) Property business profit (working 3) Personal allowance Taxable income Working 1 Living accommodation additional benefit (1) The benefit is based on the market value when first provided. Market value Limit 144,000 (75,000) 69,000 23,700 4,600 2,760 1,880 32,940 8,220 5,940 47,100 (7,475) 39,625

June 2012 Answers

(2) The additional benefit is therefore 2,760 (69,000 at 4%). Tutorial note: The property was purchased more than six years before first being provided, so the benefit is based on the market value when first provided. Working 2 Trading profit (1) Flicks share of the partnerships trading profit for the period ended 30 April 2012 is 10,960 calculated as follows: Trading profit Capital allowances Salary paid to Art (6,000 x 4/12) 29,700 (300) 29,400 (2,000) 27,400 10,960

Profit share 27,400 x 40% (2) Flicks trading income assessment for 201112 is 8,220 (10,960 x 3/4).

(3) The partnerships period of account is four months long so the capital allowances in respect of the motor car are 300 calculated as follows: Special rate pool 15,000 (500) x 60% 14,500 Allowances

Addition WDA 10% x 4/12 WDV carried forward Tutorial notes:

300

(1) Flicks assessment for 201112 is for the period 1 January 2012 to 5 April 2012. (2) The partnerships motor car has CO2 emissions over 160 grams per kilometre and therefore qualifies for writing down allowances at the rate of 10%.

15

Working 3 Property business profit (1) The property business profit is calculated as follows: Rent receivable (660 x 12) Council tax Wear and tear allowance Furniture 1,320 660 0 (1,980) 5,940 7,920

Property business profit

(2) The wear and tear allowance is 660 (7,920 1,320 = 6,600 x 10%) as the rent receivable is reduced by the council tax paid by Flick. Tutorial note: No deduction is available for replacement furniture where the wear and tear allowance is claimed. (b) (1) 3D Ltd will be responsible for paying class 1 NIC (both primary and secondary contributions) in respect of Flicks salary. (2) 3D Ltd will be responsible for paying class 1A NIC in respect of Flicks taxable benefits. (3) Flick will be responsible for paying class 2 NIC in respect of her trading income. (4) Flick will be responsible for paying class 4 NIC in respect of her trading income. (c) Advantages (1) The interval between earning profits and paying the related tax liability will be 11 months longer. This can be particularly beneficial where profits are rising. (2) It will be possible to calculate taxable profits well in advance of the end of the tax year, making it much easier to implement tax planning and make pension contributions. Disadvantages (1) The application of the basis period rules is more complicated. (2) The amount of profit assessed in the year of cessation could potentially be quite high as the basis period will be up to 23 months in length. Although overlap profits are deductible, these might be insignificant if the opening years profits are low. (d) (i) (1) Using the flat rate scheme to calculate its VAT liability the partnership will have paid VAT of 7,164 (59,700 x 12%) for the quarter ended 31 March 2012. (2) If the partnership had used the normal basis it would have paid VAT of 5,400 (59,700 27,300 = 32,400 x 20/120). (3) It was therefore not beneficial to use the flat rate scheme as the additional cost of 1,764 (7,164 5,400) for the quarter would appear to outweigh the advantage of simplified VAT administration. (ii) (1) The partnerships sales are all to members of the general public, who cannot recover the input VAT. (2) It may not therefore be possible to pass the output VAT on to customers in the prices charged. To the extent this is not possible the partnership would have had to absorb all or some of this amount itself as a cost. (3) It was therefore not beneficial for the partnership to have voluntarily registered for VAT from 1 January 2012. For the quarter ended 31 March 2012 voluntary registration reduced the partnerships profits by a maximum of 7,164 (5,400 if the normal basis had been used). (iii) (1) Output VAT must be accounted for according to the VAT period in which the supply is treated as being made. This is determined by the tax point. (2) The basic tax point is the date when the service is completed, which will be the date that a film is screened. (3) Where payment is received before the basic tax point, then this date becomes the actual tax point. The tax point for each 25% deposit is therefore the date that it is received. (4) Invoices are issued on the same day as the basic tax point, so this is the tax point for the balance of 75%.

16

(a)

Heavy Ltd Corporation tax computation for the year ended 31 December 2011 Operating profit Depreciation Amortisation Deduction for lease premium (working 1) Capital allowances (working 2) Trading profit Chargeable gain Taxable total profits Franked investment income Augmented profits Corporation tax FY 2010 420,000 x 3/12 = 105,000 at 28% Marginal relief 7/400 (750,000 450,000) x 420,000/450,000 x 3/12 FY 2011 420,000 x 9/12 = 315,000 at 26% Marginal relief 3/200 (750,000 450,000) x 420,000/450,000 x 9/12 433,100 12,880 9,000 (7,380) (27,600) 420,000 0 420,000 30,000 450,000 29,400 (1,225) 81,900 (3,150) 106,925

(1) Franked investment income is 30,000 (18,000 + 9,000 = 27,000 x 100/90). The dividend from Soft Ltd is not franked investment income as it is a group dividend. (2) Heavy Ltd has one associated company, so the upper limit is reduced to 750,000 (1,500,000/2). Tutorial notes: (1) The sale of the office building does not give rise to a chargeable gain as Soft Ltd is a 75% group company. (2) As far as Paper F6 (UK) is concerned all overseas dividends are exempt from UK corporation tax. They are included as franked investment income when calculating a companys augmented profits in exactly the same way as UK dividends. (3) The taxable total profits must be apportioned between the financial years 2010 and 2011 because of the change in the main rate of corporation tax. Working 1 Deduction for lease premium (1) The amount assessed on the landlord is 73,800 calculated as follows: Premium received Less: 90,000 x 2% x (10 1) 90,000 (16,200) 73,800

(2) This is deductible over the life of the lease, so the deduction for the year ended 31 December 2011 is 7,380 (73,800/10). Tutorial note: The office building has been used for business purposes, and so the proportion of the lease premium assessed as income on the landlord can be deducted, spread over the life of the lease.

17

Working 2 Capital allowances Main pool WDV brought forward Addition qualifying for AIA Office equipment AIA 100% Proceeds Balancing charge WDA WDA WDA WDA 100% Restricted 20% 10% (900) (3,000) (1,760) 0 12,100 7,040 (940) 8,460 900 Motor car [1] 15,100 Motor car [2] 8,800 Motor car [3] 13,200 Special rate pool 21,700 Allowances

22,400 (22,400) (14,600) 1,400 (12,300) 9,400

22,400

(1,400) 900 3,000 1,760 940 27,600

WDV carried forward Total allowances Tutorial notes:

(1) The balance on the main pool is less than 1,000 so a writing down allowance equal to the unrelieved expenditure can be claimed. (2) Motor cars [1] and [2] were owned at 1 April 2009 and therefore qualify for writing down allowance at the rate of 20% subject to a maximum of 3,000. The private use of motor car [2] is irrelevant, since such usage will be assessed on the managing director as a benefit. (3) Although all of the items included in the special rate pool have been sold, there is no balancing allowance as the business has not ceased. (b) Soft Ltd Corporation tax liabilities for the 16-month period ended 31 December 2011 Year ended 31 August 2011 90,150 (4,800) 85,350 16,650 102,000 12,495 8,500 20,995 5,806 5,806 Period ended 31 December 2011 30,050 (1,020) 29,030 0 29,030

Trading profit Capital allowances Chargeable gain Taxable total profits Corporation tax FY 2010 102,000 x 7/12 = 59,500 at 21% FY 2011 102,000 x 5/12 = 42,500 at 20% FY 2011 29,030 at 20%

(1) Trading profits are allocated on a time basis: 90,150 (120,200 x 12/16) to the year ended 31 August 2011 and 30,050 (120,200 x 4/16) to the period ended 31 December 2011. (2) Separate capital allowance computations are prepared for each accounting period as follows: Pool Year ended 31 August 2011 WDV brought forward WDA 20% WDV carried forward Period ended 31 December 2011 Proceeds WDA 20% x 4/12 WDV carried forward 24,000 (4,800) 19,200 (3,900) 15,300 (1,020) 14,280 Allowances

4,800

1,020

18

(3) The capital loss of 2,900 for the period ended 31 December 2011 is carried forward. (4) Soft Ltd has one associated company, so the lower limit for the year ended 31 August 2011 is 150,000 (300,000/2) and for the period ended 31 December 2011 it is 50,000 (300,000/2 = 150,000 x 4/12). The small profits rate of corporation tax is therefore applicable to both periods. Tutorial note: The taxable total profits for the year ended 31 August 2011 must be apportioned between the financial years 2010 and 2011 because of the change in the small profits rate of corporation tax.

(a)

(i) (ii)

An individual is subject to capital gains tax (CGT) on the disposal of chargeable assets during any tax year in which they are either resident or ordinarily resident in the UK. A company is subject to corporation tax on gains from the disposal of chargeable assets if it is resident in the UK. Winston King CGT liability 201112 Chargeable gain on painting Annual exempt amount 45,860 (10,600) 35,260 2,268 6,345 8,613

(b)

(i)

CGT liability: 12,600 at 18% 22,660 at 28%

(1) Winston has 12,600 (35,000 22,400) of his basic rate tax band unused. (ii) Winston King Revised CGT liability 201112 Gain qualifying for entrepreneurs relief Freehold shop (140,000 80,000) Other gains Painting Capital loss on freehold warehouse (102,000 88,000) Annual exempt amount 60,000 45,860 (14,000) 31,860 (10,600) 21,260 6,000 5,953 11,953

CGT liability: 60,000 at 10% 21,260 at 28%

Tutorial notes: (1) The capital loss on the sale of the freehold warehouse and the annual exempt amount are set against the chargeable gain from the sale of the painting as this saves CGT at the higher rate of 28%. (2) The unused basic rate tax band of 12,600 is set against the gain qualifying for entrepreneurs relief of 60,000 even though this has no effect on the 10% tax rate. (c) (i) Wiki Ltd Chargeable gain on disposal of warehouse Disposal proceeds Incidental costs of disposal Cost Incidental costs of acquisition 171,000 2,200 (173,200) 135,400 (54,212) 81,188 312,000 (3,400) 308,600

Indexation allowance (173,200 x 0313) Chargeable gain (1) The indexation factor is 0313 (2280 1736)/1736.

19

(ii)

Freehold factory (1) No rollover relief is available as the amount not reinvested of 142,600 (308,600 166,000) exceeds the chargeable gain. (2) The base cost of the factory will be 166,000. Freehold office building (1) The net sale proceeds are not fully reinvested, and so 12,600 (308,600 296,000) of the chargeable gain cannot be rolled over. (2) The base cost of the office building will be 227,412 (296,000 (81,188 12,600)). Tutorial note: Equivalent marks will be awarded if the gross proceeds of 312,000 are used instead of the net proceeds of 308,600.

(a)

(i) (ii)

Saving is encouraged by offering individuals tax incentives such as tax-free individual savings accounts and tax relief on pension contributions. Charitable support is encouraged by giving individuals tax relief on donations made through the gift aid scheme or by payroll deduction.

(iii) Entrepreneurs are encouraged to build their own businesses through various capital gains tax reliefs such as entrepreneurs relief. Investment in plant and machinery is encouraged through capital allowances. (b) Michael (1) The loss of 24,600 for 201011 can be claimed against total income for the three preceding years (under s.72 ITA 2007), earliest first, since it is incurred in the first four years of trading. (2) The loss relief claim will therefore be 16,800 in 200708 and 7,800 (24,600 16,800) in 200809. (3) For 200708 this will waste Michaels personal allowance, with the balance of the claim of 9,325 (16,800 7,475) saving income tax at the basic rate of 20%. (4) For 200809 Michael has income of 8,125 (50,600 7,475 35,000) subject to income tax at the higher rate of 40%, so the claim of 7,800 will save tax at the higher rate. (5) Alternatively, Michael could have carried the trading loss forward against future trading profits (under s.83 ITA 2007), but the trading profit of 7,100 for 201112 is less than the personal allowance, and there is no information regarding future trading profits. Tutorial note: A claim against total income (under s.64 ITA 2007) for 201011 and/or 200910 is not possible since Michael does not have any income for either of these years. Sean (1) The unused overlap profits brought forward are added to the loss for the year ended 31 December 2011, so the total loss for 201112 is 26,700 (23,100 + 3,600). (2) The whole of the loss can be claimed as a terminal loss (under s.89 ITA 2007) since it is for the final 12 months of trading. The claim is against trading income for the year of the loss and the three preceding years, latest first. (3) The terminal loss claim will therefore be 3,700 in 201011, 18,900 in 200910 and 4,100 (26,700 3,700 18,900) in 200809. (4) The property business profits are sufficient to utilise Seans personal allowance for each year, so the loss relief claims will save income tax at the basic rate of 20%. (5) Alternatively, Sean could have initially claimed loss relief against his total income (under s.64 ITA 2007) for 201112 and/or 201011, but this would have wasted his personal allowance for either or both of those years.

(a)

(1) Nings personal representatives could claim her deceased husbands unused nil rate band of 227,500 (325,000 x 70%). (2) The total amount of nil rate band is therefore 552,500 (325,000 + 227,500). (3) The potentially exempt transfer on 7 November 2011 will utilise 220,000 of the nil rate band, so only 332,500 (552,500 220,000) is available against the death estate. (4) The potentially exempt transfer on 14 August 2001 is exempt from inheritance tax as it was made more than seven years before 20 March 2012.

20

(b)

(i)

Ning Gao Inheritance tax (IHT) on death estate Property (674,000 + 442,000) Repayment mortgage Endowment mortgage Motor cars Investments (47,000 + 36,000 + 69,000) Bank loan Legal fees 22,400 0 (22,400) 1,257,600 0 370,040 370,040 160,000 0 1,116,000 (160,000) 956,000 172,000 152,000 1,280,000

Chargeable estate IHT liability 332,500 at nil% 925,100 at 40%

(1) The personal representatives of Nings estate will be responsible for paying the inheritance tax. Tutorial notes: (1) There is no deduction in respect of the endowment mortgage as this will be repaid upon death by the life assurance element of the mortgage. (2) The promise to pay the nephews legal fee is not deductible as it is purely gratuitous (not made for valuable consideration). (ii) (1) If Ning were to live for another six years until 20 March 2018 then the inheritance tax payable in respect of her estate would not alter, as the potentially exempt transfer on 7 November 2011 will still be made within the previous seven years. (2) If Ning were to live for another seven years until 20 March 2019 then the potentially exempt transfer will become exempt, and the inheritance tax payable in respect of her estate would therefore decrease by 88,000 (220,000 at 40%). (c) (1) Gifts of income will be exempt if they are made as part of Nings normal expenditure out of income. (2) This is provided the gifts do not affect her standard of living. (3) To count as normal, gifts must be habitual.

21

Fundamentals Level Skills Module, Paper F6 (UK) Taxation (United Kingdom)

June 2012 Marking Scheme Marks 2 1 2 1 2 1 12 1 1 1 1 4

(a)

Salary Living accommodation Annual value Additional benefit Furniture Trading profit Profit share Assessment Capital allowances Property business profit Rent receivable Council tax Wear and tear allowance Furniture Personal allowance

(b)

Class Class Class Class

1 NIC 1A NIC 2 NIC 4 NIC

(c)

Interval Tax planning Basis period rules more complicated Profit assessed in year of cessation

1 1 1 1 4

(d)

(i)

Flat rate scheme Normal basis Conclusion

1 1 1 3 1 1 1 3 1 1 1 1 4 30

(ii)

No recovery of VAT by customers Possible need to absorb output VAT Conclusion

(iii) VAT period Basic tax point Deposit Balance

23

(a)

Operating profit Depreciation Amortisation Lease premium Assessable amount Deduction Capital allowances AIA Main pool Motor car [1] Motor car [2] Motor car [3] Special rate pool Chargeable gain Franked investment income Corporation tax Upper limit Apportionment to tax years Main rates Marginal reliefs

Marks 1 1 1 1 1 1 1 1 1 2 1 2 18 1 1 1 1 1 1 7 25

(b)

Trading profits Capital allowances Year ended 31 August 2011 Period ended 31 December 2011 Chargeable gains Corporation tax Year ended 31 August 2011 Period ended 31 December 2011

(a)

(i)

Resident in the UK Ordinarily resident in the UK

1 1 1

(ii)

Resident in the UK

(b)

(i)

Annual exempt amount Unused basic rate tax band Capital gains tax

1 1 3 1 1 4

(ii)

Freehold shop Painting Capital loss Annual exempt amount Capital gains tax

(c)

(i)

Proceeds Costs of disposal Cost Costs of acquisition Indexation allowance

1 3 1 1 3 15

(ii)

Freehold factory Freehold office building

24

Marks 4 (a) (i) (ii) Saving Charitable support 1 1 2 (b) Michael Relief against total income Claims Rate of tax saved 200708 200809 Carry forward Sean Available loss Terminal loss relief Claims Rate of tax saved Relief against total income 1 1

(iii) Businesses Plant and machinery

1 1 1 1 1 1 1 1 1 1 11 15

(a)

Husbands nil rate band Total nil rate band PET on 7 November 2011 PET on 14 August 2001

1 1 1 1 4

(b)

(i)

Property Repayment mortgage Endowment mortgage Motor cars Investments Bank loan Legal fees IHT liability Payment responsibility

1 1 1 1 1 7 1 1 2

(ii)

Live for six more years Live for seven more years

(c)

Exemption Standard of living Habitual

1 2 15

25

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Accounting Concepts and ConventionsDocument22 pagesAccounting Concepts and ConventionsMishal SiddiqueNo ratings yet

- Solution To Case 32 by Jim DemelloDocument7 pagesSolution To Case 32 by Jim DemelloRefi Reyhandi Mahardhika100% (2)

- Ias 19 Employee BenefitsDocument43 pagesIas 19 Employee BenefitsHasan Ali BokhariNo ratings yet

- Local Content Law: A Critical and Comparative AnalysisDocument27 pagesLocal Content Law: A Critical and Comparative AnalysisAfrican Centre for Media Excellence100% (2)

- Colgate PalmoliveDocument2 pagesColgate PalmoliveVaswee Dubey100% (1)

- JLL Asia Pacific Property Digest 4q 2015Document76 pagesJLL Asia Pacific Property Digest 4q 2015limpuppyNo ratings yet

- Banks Tanzania2Document11 pagesBanks Tanzania2RaulNo ratings yet

- Energy Security and Energy Union Perspectives For Azerbaijan CESD Policy PaperDocument18 pagesEnergy Security and Energy Union Perspectives For Azerbaijan CESD Policy PaperJack HuseynliNo ratings yet

- Running Head: A Financial Forecast For New World Chemicals IncDocument9 pagesRunning Head: A Financial Forecast For New World Chemicals IncTimNo ratings yet

- Aea Training Centre: 1 Floor, Devi House 2, Dr. A Perdreau Street, Port Louis, 2080272Document3 pagesAea Training Centre: 1 Floor, Devi House 2, Dr. A Perdreau Street, Port Louis, 2080272Hasan Ali BokhariNo ratings yet

- Core Topics Review-Ctr: Days & Date Papers Timings BreaksDocument2 pagesCore Topics Review-Ctr: Days & Date Papers Timings BreaksHasan Ali BokhariNo ratings yet

- Taxation (UK) : Aim of The CourseDocument2 pagesTaxation (UK) : Aim of The CourseHasan Ali BokhariNo ratings yet

- Ifrs 15Document1 pageIfrs 15Hasan Ali Bokhari100% (1)

- A Key Focus at EIILM University Life Skills Good Internships University Branding FeesDocument3 pagesA Key Focus at EIILM University Life Skills Good Internships University Branding FeesHasan Ali BokhariNo ratings yet

- Aea Training Centre: 1 Floor, Devi House 2, Dr. A Perdreau Street, Port Louis, 2080272Document2 pagesAea Training Centre: 1 Floor, Devi House 2, Dr. A Perdreau Street, Port Louis, 2080272Hasan Ali BokhariNo ratings yet

- National College of Business Administration & EconomicsDocument10 pagesNational College of Business Administration & EconomicsHasan Ali BokhariNo ratings yet

- Full Time Timetable Second Semester Oct 2014Document2 pagesFull Time Timetable Second Semester Oct 2014Hasan Ali BokhariNo ratings yet

- Paper Header TemplateDocument1 pagePaper Header TemplateHasan Ali BokhariNo ratings yet

- CPD Intake ListDocument8 pagesCPD Intake ListHasan Ali BokhariNo ratings yet

- BBA 2nd and 3rdDocument20 pagesBBA 2nd and 3rdHasan Ali BokhariNo ratings yet

- Class: Date: Subject: Term: Max Marks: 10 Total Time Allowed: 15 Min Name: - Roll #Document3 pagesClass: Date: Subject: Term: Max Marks: 10 Total Time Allowed: 15 Min Name: - Roll #Hasan Ali BokhariNo ratings yet

- Notification: National College of Business Administration & Economics BUC Campus, Bahawalpur - Exam BranchDocument1 pageNotification: National College of Business Administration & Economics BUC Campus, Bahawalpur - Exam BranchHasan Ali BokhariNo ratings yet

- National College of Business Administration & Economics Sub Campus, BahawalpurDocument1 pageNational College of Business Administration & Economics Sub Campus, BahawalpurHasan Ali BokhariNo ratings yet

- National College of Business Administration & Economics: NCBA&E-BUC Campus BahawalpurDocument14 pagesNational College of Business Administration & Economics: NCBA&E-BUC Campus BahawalpurHasan Ali BokhariNo ratings yet

- HES Proforma Part IDocument6 pagesHES Proforma Part IHasan Ali BokhariNo ratings yet

- Performance MGT Ms Aliya No DateDocument2 pagesPerformance MGT Ms Aliya No DateHasan Ali BokhariNo ratings yet

- NCBA&E-BUC Bahawalpur: MBA (1.5, Exe) Paper: Training & Development/ Human Resource DevelopmentDocument4 pagesNCBA&E-BUC Bahawalpur: MBA (1.5, Exe) Paper: Training & Development/ Human Resource DevelopmentHasan Ali BokhariNo ratings yet

- (MS & MBA Executive) Instructor: Miss Aliya Ahmad Shaikh Total Marks: 10 Subject: Performance Management (Finals) Time Allowed: 15min Name: - Roll #Document2 pages(MS & MBA Executive) Instructor: Miss Aliya Ahmad Shaikh Total Marks: 10 Subject: Performance Management (Finals) Time Allowed: 15min Name: - Roll #Hasan Ali BokhariNo ratings yet

- List of Computers Availability: S. No# NameDocument1 pageList of Computers Availability: S. No# NameHasan Ali BokhariNo ratings yet

- Block 1 Millat Colony Block 2 One Unit Colony Block 3 Dilawar Colony Block 4 Block 5 Block 6 Block 7Document4 pagesBlock 1 Millat Colony Block 2 One Unit Colony Block 3 Dilawar Colony Block 4 Block 5 Block 6 Block 7Hasan Ali BokhariNo ratings yet

- Audit Paper MBA EXEDocument3 pagesAudit Paper MBA EXEHasan Ali BokhariNo ratings yet

- Total No of Admission of Summer 2016Document6 pagesTotal No of Admission of Summer 2016Hasan Ali BokhariNo ratings yet

- Audit Paper MBA Exe - FinalDocument3 pagesAudit Paper MBA Exe - FinalHasan Ali BokhariNo ratings yet

- Janoobi 13 Basti Talavan Choti 13 Basti Gadran 12 BCDocument4 pagesJanoobi 13 Basti Talavan Choti 13 Basti Gadran 12 BCHasan Ali BokhariNo ratings yet

- Audit Paper Bcom - FinalDocument3 pagesAudit Paper Bcom - FinalHasan Ali BokhariNo ratings yet

- Token NoDocument1 pageToken NoHasan Ali BokhariNo ratings yet

- Subject: Urgent Piece of WorkDocument1 pageSubject: Urgent Piece of WorkHasan Ali BokhariNo ratings yet

- Notification: National College of Business Administration & Economics BUC Campus, Bahawalpur - Exam BranchDocument1 pageNotification: National College of Business Administration & Economics BUC Campus, Bahawalpur - Exam BranchHasan Ali BokhariNo ratings yet

- DYNAcerts Hydrogen Generator For TrucksDocument25 pagesDYNAcerts Hydrogen Generator For TrucksHabiburRahmanNo ratings yet

- Analyzing and Improving Management PerformanceDocument25 pagesAnalyzing and Improving Management PerformanceSerena Van Der Woodsen100% (1)

- EouDocument12 pagesEouRuby SinghNo ratings yet

- Jaya Holdings Annual Report 2010Document112 pagesJaya Holdings Annual Report 2010wctimNo ratings yet

- CaseDocument11 pagesCaseshobhity2jNo ratings yet

- External Financing Needed QuestionDocument1 pageExternal Financing Needed QuestionShaolin105No ratings yet

- PS1SFinal PDFDocument3 pagesPS1SFinal PDFAnonymous lIMsLJNSNo ratings yet

- 10.cap+budgeting Cash Flows-1Document20 pages10.cap+budgeting Cash Flows-1Navid GodilNo ratings yet

- Topic 1Document17 pagesTopic 1Trịnh Tuấn HiềnNo ratings yet

- Solved Assignment For Annamalai University MBA SECOND YEAR 2019Document30 pagesSolved Assignment For Annamalai University MBA SECOND YEAR 2019palaniappann25% (4)

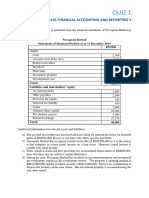

- QUIZ 1 Deferred Taxes SolutionDocument3 pagesQUIZ 1 Deferred Taxes SolutionMohd NuuranNo ratings yet

- Vrindavan Organic Farms PVT LTDDocument14 pagesVrindavan Organic Farms PVT LTDanwar shaikhNo ratings yet

- Sample Paper Accountant (BPS-14)Document8 pagesSample Paper Accountant (BPS-14)Babar Ali MahotoNo ratings yet

- Agm ChecklistDocument3 pagesAgm ChecklistMohd MohdNo ratings yet

- 223 Executive Borad Meeting of NHADocument61 pages223 Executive Borad Meeting of NHAHamid NaveedNo ratings yet

- Final Exam - Part IDocument2 pagesFinal Exam - Part IPriyanka PatelNo ratings yet

- Shareholders' Equity - : Measure of The Consideration ReceivedDocument3 pagesShareholders' Equity - : Measure of The Consideration ReceivedChinchin Ilagan DatayloNo ratings yet

- Balance SheetDocument4 pagesBalance SheetPFENo ratings yet

- Manage Work Priorities and Professional LevelDocument6 pagesManage Work Priorities and Professional Levelparul sharmaNo ratings yet

- Corporate Accounting IMP QuestionsDocument6 pagesCorporate Accounting IMP QuestionsMayank RajeNo ratings yet

- Sample Investment Manager AgreementDocument19 pagesSample Investment Manager Agreementamy alvaroNo ratings yet

- TcoDocument18 pagesTcoshashankgowda100% (1)