Professional Documents

Culture Documents

Short Sale Need To Knows

Uploaded by

James AndrewsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Short Sale Need To Knows

Uploaded by

James AndrewsCopyright:

Available Formats

1.

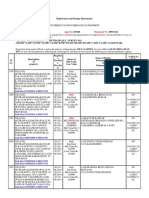

modification, your credit score will decrease and the credit report will reflect this non-payment for up to 7 years. However, the real concern should not be how long will the derogatory information stay on the borrowers credit report, but rather, how long will it affect the borrower? There are many free resources available to improve your credit quickly, even after a significant credit scarring event such as a bankruptcy or foreclosure. 3. 3.How long before I can obtain another mortgage? Currently lenders require that you both rehabilitate your credit score and that you endure a waiting period. The answer depends on how the homeowner lost her home. For a short sale the waiting period is typically 2 years (assuming a rehabilitated credit score). For a foreclosure, the answer depends on the type of loan one is seeking. If its an FHA or VA loan, then the waiting period is currently 3 years. For Fannie Mae/Freddie Mac (conventional) loans, the waiting period is 4 to 5 years. 4. 4.How long is the foreclosure process? The actual foreclosure process is 91 days (from date of the official Notice of Trustee Sale until the auction date). However, most lenders do not start the actual foreclosure process until the homeowner is approximately 4 to 5 months in arrears, onto which they must add the 91 day period, giving the homeowner approximately 7 to 8 months (or longer) before the home is auctioned off by the bank. In some cases, lenders have waited considerably longer than 4 to 5 months to commence the official 91 day foreclosure process. 5. 5.Can I keep my home if I file Bankruptcy? Yes. Under both a Chapter 7 or Chapter 13 bankruptcy, a debtor has the right to keep her home. However, the borrower must continue making timely mortgage payments. 6. 6.What tax consequences will I face if the home is foreclosed or short sold (for less than what I owe)? This will depend on a number of factors, such as whether the Mortgage Forgiveness Debt Relief Act applies, whether the loan is non-recourse, whether the homeowner is insolvent or files bankruptcy, and if a home equity line was obtained, what were the HELOC funds used for? Recommendation: see a CPA. 7. 7.I am a landlord with a tenant, does Arizona law require me to inform my tenant that the home is being foreclosed? No - at least not yet. Indeed, residential tenants now have greater protection after a foreclosure since Congress passed the Protecting Tenants In Foreclosure Act (May, 2009). Tenants now cannot be evicted immediately after a home is foreclosed (caveat: this law does not apply to tenants in short sale homes), and in many circumstances the terms of their lease may be required to be honored by the new owner. 8. 8.What can I take from my property after the foreclosure? Beware: Serious criminal laws may be violated for stripping a property or taking items which are prohibited. Answer: You make take all personal property, provided its not nailed, bolted or affixed in some way to the property itself. For example, your typical washer and dryer may be removed. Turning now to your refrigerator, you make take it provided its the normal roll-in roll-out type. However, if its in a casing or in some way affixed to the property, it may not be removed. 9. 9.HOA fees - must I pay them even though Ive decided to short sell or foreclose? Yes. HOA fees must be paid even if you are planning on short selling or foreclosing. This is because HOA fees and assessments are generally personal debts of the homeowner, meaning that the homeowner is personally liable. Turning now to property taxes, the answer is no because these taxes are debts of the property; thus when the home is foreclosed or short sold, the new owner (bank or a 3rd party buyer) will be required to pay and bring current these unpaid property taxes.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Outline For EssayDocument62 pagesOutline For EssayJames Andrews100% (1)

- Real Estate MortgageDocument3 pagesReal Estate MortgageDianneRioSamsonSanchezNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 559 Big Landlord Tenant OutlineDocument89 pages559 Big Landlord Tenant Outlinemoury227100% (1)

- Margarita DeLoach Eviction NoticeDocument1 pageMargarita DeLoach Eviction NoticeLas Vegas Review-JournalNo ratings yet

- Contract of Lease AgreementDocument3 pagesContract of Lease AgreementRuben Luyon100% (1)

- Mortgage Loan Disclosure Statement - GFEDocument3 pagesMortgage Loan Disclosure Statement - GFEafncorpNo ratings yet

- Davao Sawmill Co Vs CastilloDocument1 pageDavao Sawmill Co Vs CastilloCariss MagallonesNo ratings yet

- Certificate of Redemption2Document2 pagesCertificate of Redemption2cheryl ann100% (1)

- Land Titles and Deeds (Module 1)Document8 pagesLand Titles and Deeds (Module 1)ichu73No ratings yet

- APPLICATION FOR LAND TRANSFER CLEARANCE - DAR.Heirs of Atinyao.6.2022Document2 pagesAPPLICATION FOR LAND TRANSFER CLEARANCE - DAR.Heirs of Atinyao.6.2022deth shot0% (1)

- Respondent'S Position Paper: Facts of The CaseDocument8 pagesRespondent'S Position Paper: Facts of The CaseRothea SimonNo ratings yet

- BLL - Property Management BrochureDocument8 pagesBLL - Property Management BrochureAdedolapo Ademola OdunsiNo ratings yet

- Deed of Sale with Assumption of MortgageDocument3 pagesDeed of Sale with Assumption of MortgageMariefe Garciano VillanuevaNo ratings yet

- Anger Lesson 1Document10 pagesAnger Lesson 1James AndrewsNo ratings yet

- Client Retainer Agreement For Alan MillerDocument3 pagesClient Retainer Agreement For Alan MillerJames AndrewsNo ratings yet

- BANK RUPTCYRetainer AgreementDocument5 pagesBANK RUPTCYRetainer AgreementJames AndrewsNo ratings yet

- Mortgage Loan Excel SheetDocument4 pagesMortgage Loan Excel Sheetsumbul imranNo ratings yet

- Pre Trial Brief (Contemplacion) Edited NewDocument5 pagesPre Trial Brief (Contemplacion) Edited NewD BermudezNo ratings yet

- Missouri Quit Claim Deed FormDocument2 pagesMissouri Quit Claim Deed FormHiNo ratings yet

- Guide to CMBS Securitization: How Commercial Property Loans Are Pooled and SoldDocument4 pagesGuide to CMBS Securitization: How Commercial Property Loans Are Pooled and SoldEric MNo ratings yet

- Cover Letter For Rental ApplicationDocument8 pagesCover Letter For Rental Applicationafjwdbaekycbaa100% (2)

- Contract of LeaseDocument3 pagesContract of LeaseAstralDropNo ratings yet

- Federal Housing Finance Agency: Foreclosure Prevention & Refinance Report Fourth Quarter 2011Document54 pagesFederal Housing Finance Agency: Foreclosure Prevention & Refinance Report Fourth Quarter 2011Foreclosure FraudNo ratings yet

- Contract of Lease - Active LifeDocument3 pagesContract of Lease - Active LifeQand A BookkeepingNo ratings yet

- Real Estate White PaperDocument14 pagesReal Estate White PaperAryaman SharmaNo ratings yet

- Deed of Sale With MortgageDocument2 pagesDeed of Sale With MortgageJomel Arzadon BarrozoNo ratings yet

- Leases and EasementsDocument41 pagesLeases and EasementsNicholas James100% (2)

- 328ECDocument18 pages328ECakshayNo ratings yet

- Section 17. Registration. All Contracts To Sell, Deeds of Sale and Other Similar Instruments Relative ToDocument2 pagesSection 17. Registration. All Contracts To Sell, Deeds of Sale and Other Similar Instruments Relative ToShem Anton ViloroNo ratings yet

- Legal and Institutional Frameworks in KenyaDocument8 pagesLegal and Institutional Frameworks in KenyamugiyanjorogeNo ratings yet

- Greenwich 2009 Tax, Parcel and Property RecordsDocument475 pagesGreenwich 2009 Tax, Parcel and Property RecordsSam TanejaNo ratings yet

- BFS Property Listing For Posting NOV 1Document11 pagesBFS Property Listing For Posting NOV 1April Alimboyoguen Macalintal100% (1)

- Property Law Outline - Concepts of PossessionDocument18 pagesProperty Law Outline - Concepts of Possessionanar beheheheNo ratings yet

- Closing Costs and Loan Terms SummaryDocument6 pagesClosing Costs and Loan Terms SummaryMeagan W.No ratings yet