Professional Documents

Culture Documents

University of Mauritius: Faculty of Law and Management

Uploaded by

Ayush GowriahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

University of Mauritius: Faculty of Law and Management

Uploaded by

Ayush GowriahCopyright:

Available Formats

UNIVERSITY OF MAURITIUS

FACULTY OF LAW AND MANAGEMENT

SECOND SEMESTER EXAMINATIONS MAY 2010 PROGRAMME BSc (Hons) Finance with Law Level II, III BSc (Hons) Finance Level II, III BSc (Hons) Management Minor Finance Level II

MODULE NAME DATE

Portfolio Theory and Fixed Income Securities Saturday 8 May 2010 MODULE CODE

DFA2012Y(3) 3 Hours

TIME

9.30 - 12.30

DURATION

NO. OF QUESTIONS SET

NO. OF QUESTIONS TO BE ATTEMPTED

INSTRUCTIONS TO CANDIDATES There are 2 Sections in this paper: Section A AND Section B. Section A consists of TWO (2) Questions which are compulsory. Section B consists of THREE (3) questions. Answer ANY TWO (2) questions from Section B. Candidates are required to answer FOUR (4) Questions in ALL. Section A : 30 Marks Section B : Each question carries 15 Marks

PORTFOLIO THEORY AND FIXED INCOME SECURITIES - DFA2012Y(3)

SECTION A

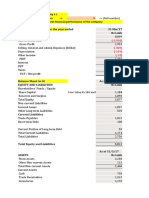

Question 1 (Compulsory) Mr Park has invested Rs 1 000 000 on the first of January 2010 in the following units managed by the Ferdinand Investment Associates: Table 1 :Mr Parks portfolio Growth Fund Benchmarks All Equities Local Index 0.55 Income Fund Fixed Income Index 0.70

Correlation of the investment with its respective benchmark Value of portfolio at 1January 2010 Number of Units in the portfolio at 1 January 2010

350 000 25 000

650 000 15 000

Mr Wayne, the financial analyst of Ferdinand Investment Associates, reports the following movement in the selected benchmarks of the respective investments: Table 2 : Movements of selected benchmarks Jan 1 15 January 15January 2010 31January 2010 All Equities Local +5% +39% Index Fixed Income +4% +19% Index

Feb 1 15 February 2010 + 3% +2%

Table 3 reports transactions carried out by Ferdinand Investment Associates on behalf of Mr Park. Table 3 : Transactions carried out Jan 1 15 January 2010 Growth Fund Buy 1500 Units Income Fund Buy 1600 Units

15January 31January 2010 Buy 2000 units Sell 2200 Units

Feb 1 15 February 2010 Sell 2300 Units Buy 750 Units

Page 1 of 3

PORTFOLIO THEORY AND FIXED INCOME SECURITIES - DFA2012Y(3)

Required : (a) Calculate the value of each unit as at 15 February 2010. [6 marks] (b) Hence, calculate the value of Mr Parks portfolio as at that date, clearly indicating the proportion of each investment in his global portfolio. Comment on the reported proportion. [4 marks]

Question 2 (Compulsory) You are given the following information: Corporate US bonds 8%, payable annually and maturing in 3 years. Quoted price is $104. Yield to maturity is at 6.49%. The bonds credit rating is CCC. (a) Calculate the followings: (i) Maculay Duration (ii) Modified Duration [4 marks] [2 marks]

(b) (c)

Find the PRICE VALUE OF A BASIS POINT(PVBP).

[2 marks]

What will be the theoretical price if the yield to maturity falls by 100 basis points ? [2 marks] Calculate the actual price of the bond if yield to maturity effectively falls by 100 basis points. [2 marks] Assume now, that the bond is callable in 2 years. Assess the main possible types risks associated with the purchase of this bond. [8 marks] [Total: 30 marks]

Page 2 of 3

(d)

e)

PORTFOLIO THEORY AND FIXED INCOME SECURITIES - DFA2012Y(3)

SECTION B

Answer Any Two Questions

Question 3 There are essentially two ways of analyzing investments: fundamental analysis and technical analysis. Discuss. [15 marks]

Question 4 An individual undoubtedly derives some advantages and drawbacks whether he invests in index funds, growth funds or mutual funds. Discuss. [15 marks] Question 5 For very small change in the yield, duration can be a good approximation of the actual change in the bond price . Discuss. [15 marks]

END OF QUESTION PAPER

Page 3 of 3

You might also like

- Investments Notes (Lecture 1)Document33 pagesInvestments Notes (Lecture 1)JoelNo ratings yet

- Technician Pilot Papers PDFDocument133 pagesTechnician Pilot Papers PDFCasius Mubamba100% (4)

- Chapters 6-7 and DerivativesDocument68 pagesChapters 6-7 and DerivativesLouise0% (1)

- Functions of Ecgc and Exim BankDocument12 pagesFunctions of Ecgc and Exim BankbhumishahNo ratings yet

- Foreign Exchange ArithmeticDocument9 pagesForeign Exchange Arithmeticmeghaparekh11No ratings yet

- PP Invt&sec 2018Document5 pagesPP Invt&sec 2018Revatee HurilNo ratings yet

- Corporate FinanceDocument2 pagesCorporate FinanceMuhammad Atif SheikhNo ratings yet

- Mid Term PaperDocument9 pagesMid Term Paperthorat82No ratings yet

- Building Planning and DrawingDocument47 pagesBuilding Planning and DrawingkornesureshNo ratings yet

- AccountingDocument8 pagesAccountingHaniyaAngelNo ratings yet

- Mms Mbs Apr2012Document32 pagesMms Mbs Apr2012Fernandes RudolfNo ratings yet

- Paper14 SolutionDocument20 pagesPaper14 Solutionp11No ratings yet

- MF0003Document2 pagesMF0003Tenzin KunchokNo ratings yet

- SDE 3MBA SecondDocument9 pagesSDE 3MBA SecondgirijaNo ratings yet

- Actuarial Society of India: ExaminationsDocument9 pagesActuarial Society of India: ExaminationsAmitNo ratings yet

- 4103 Project ManagementDocument9 pages4103 Project ManagementMuhammad Shahadat HossainNo ratings yet

- TCF Sample Assessment Unit 3Document37 pagesTCF Sample Assessment Unit 3zafarghauri14No ratings yet

- University of Rajasthan: B.B.A (II Sem.) 205 BBA-205 B.B.A. (Second Semester) Exam.,2013Document3 pagesUniversity of Rajasthan: B.B.A (II Sem.) 205 BBA-205 B.B.A. (Second Semester) Exam.,2013GuruKPO0% (1)

- Mba Programme (3 Year) Ii Year Assignment Question Papers 2010-2011 201: Human Resource ManagementDocument9 pagesMba Programme (3 Year) Ii Year Assignment Question Papers 2010-2011 201: Human Resource ManagementDeep Narayan RamNo ratings yet

- QP March2012 f2Document16 pagesQP March2012 f2g296469No ratings yet

- F2 March 2011Document20 pagesF2 March 2011Dhanushka SamNo ratings yet

- Bba 304Document4 pagesBba 304hodmbaalpineNo ratings yet

- NovelDocument3 pagesNovelNosamkele MpululaNo ratings yet

- IMC Unit 2 Mock Exam 2 V18 March 2021Document33 pagesIMC Unit 2 Mock Exam 2 V18 March 2021SATHISH SNo ratings yet

- Microsoft Word Sta 2190 Introduction To Actuarial ScienceDocument3 pagesMicrosoft Word Sta 2190 Introduction To Actuarial ScienceAnuoluwapo PalmerNo ratings yet

- AssignmentsDocument5 pagesAssignmentsshikha mittalNo ratings yet

- CBSE Sample Papers For Class 12 Economics Set 2 WDocument4 pagesCBSE Sample Papers For Class 12 Economics Set 2 Wxpert shikshaNo ratings yet

- Preliminary Exam 2021 - 2022 Milind Night Junior CollegeDocument3 pagesPreliminary Exam 2021 - 2022 Milind Night Junior CollegeDevendra JoilNo ratings yet

- Bsc. (Hons) Banking and International Finance: Examinations For 2008 - 2009 Semester 1 / 2008 Semester 2Document4 pagesBsc. (Hons) Banking and International Finance: Examinations For 2008 - 2009 Semester 1 / 2008 Semester 2Mevika MerchantNo ratings yet

- Book-Keeping and Accounts/Series-4-2011 (Code2007)Document16 pagesBook-Keeping and Accounts/Series-4-2011 (Code2007)Hein Linn Kyaw100% (1)

- 0102 Managerial Economics and Financial AnalysisDocument7 pages0102 Managerial Economics and Financial AnalysisFozia PanhwerNo ratings yet

- Assignment 2Document2 pagesAssignment 2MiorSyadiNo ratings yet

- MBA Assignment TopicsDocument40 pagesMBA Assignment TopicstdhinakaranNo ratings yet

- New 3rd Semester English (MCO-03,07,15, IBO-02) PDFDocument6 pagesNew 3rd Semester English (MCO-03,07,15, IBO-02) PDFAkash Peter MishraNo ratings yet

- International Finance 2021-22Document3 pagesInternational Finance 2021-22NAITIK SHAHNo ratings yet

- Dec 2009 IcwaDocument8 pagesDec 2009 Icwamknatoo1963No ratings yet

- 2nd Year English (MCO)Document9 pages2nd Year English (MCO)Kksia AroraNo ratings yet

- CF MTQPDocument2 pagesCF MTQPNeha H GNo ratings yet

- Bahagian B: 25 MarkahDocument5 pagesBahagian B: 25 MarkahJohanan KwekNo ratings yet

- Ceg Set 31 Mba I Sem AssigimentDocument7 pagesCeg Set 31 Mba I Sem AssigimentRohith KumarNo ratings yet

- MP 505Document2 pagesMP 505ptgoNo ratings yet

- Second Paper: Elements of Financial ManagementDocument5 pagesSecond Paper: Elements of Financial ManagementGuruKPONo ratings yet

- 2nd Year EnglishDocument8 pages2nd Year EnglishKAJAL YADAVNo ratings yet

- BF PP 2017Document4 pagesBF PP 2017Revatee HurilNo ratings yet

- BAO3309 2015SAMPLEBv2Document6 pagesBAO3309 2015SAMPLEBv2zakskt1No ratings yet

- Esp3 - Practice Test - TCNHDocument2 pagesEsp3 - Practice Test - TCNHĐăng HuyNo ratings yet

- MBA I Semeste Model Question Papers W.E.F (2011-13) StudentsDocument8 pagesMBA I Semeste Model Question Papers W.E.F (2011-13) Studentsvikramvsu100% (2)

- International Finance - Past Year June 2022Document5 pagesInternational Finance - Past Year June 2022Yin Hao WongNo ratings yet

- Hsoe 13 Ed Sem QP May 2021Document2 pagesHsoe 13 Ed Sem QP May 2021mehul jindalNo ratings yet

- Financial Accounting II: 2 Year ExaminationDocument34 pagesFinancial Accounting II: 2 Year ExaminationRobin SicatNo ratings yet

- ECON252 Final ExamDocument12 pagesECON252 Final ExamTu ShirotaNo ratings yet

- Fin 103 CDocument1 pageFin 103 CPeaceful WarriorNo ratings yet

- FNDNFFBDocument4 pagesFNDNFFBGALIĆ AntonioNo ratings yet

- Managerial Economics and Financial AnalysisDocument4 pagesManagerial Economics and Financial Analysissrihari100% (1)

- Test Papers: FoundationDocument23 pagesTest Papers: FoundationUmesh TurankarNo ratings yet

- Assignment 1Document2 pagesAssignment 1MiorSyadi0% (1)

- Ceg Set 29 Mba I Sem AssigimentDocument8 pagesCeg Set 29 Mba I Sem AssigimentrakeshparthasarathyNo ratings yet

- MP 505Document3 pagesMP 505ao slr1No ratings yet

- Assignment and Seminar TopicsDocument13 pagesAssignment and Seminar TopicsSeenaNo ratings yet

- Project CriteriaDocument2 pagesProject CriteriaLe DungNo ratings yet

- Bcss & Faa Que - PaperDocument3 pagesBcss & Faa Que - PaperNaresh GuduruNo ratings yet

- (23 24) S5E1AccPpDocument10 pages(23 24) S5E1AccPpczm19008No ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- 2011-2012 Quebec BudgetDocument524 pages2011-2012 Quebec BudgetGlobal_Montreal100% (1)

- Vardhan Consulting Finance Internship Task 1Document6 pagesVardhan Consulting Finance Internship Task 1Ravi KapoorNo ratings yet

- The Factors That Affects The Investment Behavior (PPT c1)Document24 pagesThe Factors That Affects The Investment Behavior (PPT c1)Jiezle JavierNo ratings yet

- DoccDocument25 pagesDoccSagarNo ratings yet

- Introduction To BioArbitrageDocument31 pagesIntroduction To BioArbitrageHarrison HayesNo ratings yet

- Template Receive Dan Payment Voucher BankDocument7 pagesTemplate Receive Dan Payment Voucher BankSATISFACTORY PLACENo ratings yet

- OpbyccDocument1 pageOpbyccUNo ratings yet

- Microsoft For Startups Deck 19Document20 pagesMicrosoft For Startups Deck 19Rajni Kant Sinha100% (1)

- Question and AnswersDocument13 pagesQuestion and AnswersBeebee ZainabNo ratings yet

- Budget Process in ZanzibarDocument50 pagesBudget Process in ZanzibarOthman OmarNo ratings yet

- User Manual Learning Phase V2206Document40 pagesUser Manual Learning Phase V2206Harsh DedhiaNo ratings yet

- Homework - Week 1 AnswersDocument9 pagesHomework - Week 1 AnswersDamalie IzaulaNo ratings yet

- Semi Detailed Lesson Plan in Applied Economics Quarter 1Document5 pagesSemi Detailed Lesson Plan in Applied Economics Quarter 1Lyka Curammeng CarvajalNo ratings yet

- Gokarna Forest Resort: Salary SlipDocument7 pagesGokarna Forest Resort: Salary SlipPradip ShahiNo ratings yet

- Elite Events Corporation Has Provided Event Planning Services For SeveralDocument1 pageElite Events Corporation Has Provided Event Planning Services For SeveralFreelance WorkerNo ratings yet

- Role of A BMDocument2 pagesRole of A BMraj singhNo ratings yet

- Taxation Auditing Problems: (Monday) (Wednesday)Document2 pagesTaxation Auditing Problems: (Monday) (Wednesday)Carmen TabundaNo ratings yet

- Capital Budgeting - Homework-2 AnswersDocument3 pagesCapital Budgeting - Homework-2 AnswersYasmine GouyNo ratings yet

- TraderEdge - Backtesting BlueprintDocument12 pagesTraderEdge - Backtesting BlueprintPaulo TuppyNo ratings yet

- Advanced Accounting Chapter 10 2021Document126 pagesAdvanced Accounting Chapter 10 2021Uzzaam HaiderNo ratings yet

- ENCANTADIA Company Worksheet For Year Ended Dec. 31, 2018Document8 pagesENCANTADIA Company Worksheet For Year Ended Dec. 31, 2018kent starkNo ratings yet

- Inflation Definition, WPI, CPI, Measurement and CausesDocument2 pagesInflation Definition, WPI, CPI, Measurement and Causesatikbarbhuiya1432No ratings yet

- OFFICIAL RATES 2020 PRINCESS GOLDEN BEACH INDpdfDocument3 pagesOFFICIAL RATES 2020 PRINCESS GOLDEN BEACH INDpdfMocanu AdrianNo ratings yet

- MeetFounders NYC May 2021 Handout FINAL v2Document13 pagesMeetFounders NYC May 2021 Handout FINAL v2Andrew BottNo ratings yet

- APM Assignment 2 - by SameeraDocument18 pagesAPM Assignment 2 - by SameeraRahull GurnaniNo ratings yet

- 2019 Syllabus For MAS and AUDITINGDocument10 pages2019 Syllabus For MAS and AUDITINGChristopher NogotNo ratings yet

- Fa 3 Chapter 15 Error CorrectionDocument5 pagesFa 3 Chapter 15 Error CorrectionKristine Florence Tolentino100% (1)