Professional Documents

Culture Documents

Setting Up/Using Multi Currency in Quickbooks

Uploaded by

Aamir Shahzad AfridiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Setting Up/Using Multi Currency in Quickbooks

Uploaded by

Aamir Shahzad AfridiCopyright:

Available Formats

Business EEz Procedure

Setting up/Using Multi Currency in QuickBooks

The multi currency feature in Quick Books allows you to deal in currencies other than the Australia dollar. This includes Selling goods and /or services and receiving payment in a foreign currency Purchasing and paying for goods in a foreign currency Holding a bank account in a foreign currency

This paper outlines setting up QuickBooks to enable this feature and recording the relevant transactions in QuickBooks as well as some hints to ensure the data is correct Data is entered in the foreign currency but converted to Australian dollars and recorded as such in the financial statements, however the foreign currency balances are available in lists and registers Note this functionality is only available in QuickBooks Pro or higher (Premier, Enterprise, On-Line)

Initial Set up

1 Setting the Preference

Edit > Preferences > Accounting > Company Preferences Tick the box Use Multicurrency

The following warning message will appear

Copyright Business EEz 2010 1

margaret.carey@businesseez.com.au 0408 210 552

Business EEz Procedure Once multi currency is turned on, it can never be turned off so it is recommended not to turn it on unless you intend to use it Once you have accepted the message the home currency will default in to AUD. This can be changed if necessary

2 Setting Exchange rates Once the preference is turned on there is a new list under the Lists menu for the exchange rates List > Currency List

QuickBooks will bring in default rates so you should change the rate to be as per the current rate for the currencies that will be used. However the rate can be changed on individual transactions The Exchange rate is usually quoted in Australia as 1 AUD = 0.88 USD, however in QuickBooks it is recorded the other way around i.e. 1 USD = 1.13 AUD. You can delete currencies from this list if you will never use them or make them inactive as with other lists in QuickBooks 3 Changes in the chart of accounts QuickBooks also adds a special expense account to the chart of accounts called Exchange Gain/Loss. This is where QuickBooks automatically posts any variation in a transaction due to movements in the exchange rate between for example raising the invoice and receiving payment or receiving the bill and paying it.

Copyright Business EEz 2010 2

margaret.carey@businesseez.com.au 0408 210 552

Business EEz Procedure 4 Setting up Customers & Suppliers Once multi currency is turned on you will need to specify the currency that you use for each customer and supplier

The first time you use a particular currency for a supplier or customer, the following message will appear:

Followed by

Set the account up as follows specifying the relevant currency

Copyright Business EEz 2010 3

margaret.carey@businesseez.com.au 0408 210 552

Business EEz Procedure 5 Foreign Currency Bank account If you have a bank account in a foreign currency that can also be set up as there is now a field to specify the currency

Note the Chart of Accounts and customer/supplier lists will show the balance in the accounts in the local currency but the Balance Sheet and all other reports will show the values in AUD as will any transactions

Copyright Business EEz 2010 4

margaret.carey@businesseez.com.au 0408 210 552

Business EEz Procedure

Recording transactions in a foreign currency

1 Customer Transactions

Invoicing the customer Once you select a customer that has been set up as a foreign currency customer QuickBooks will raise the invoice in the currency of the customer using the exchange rate in the currency list this can be amended if required either on the invoice or in the List

Note generally you should use the tax code EXP to indicate that this is an export sale as this should be recorded in box G2 on the BAS The invoice will print showing the foreign currency amount. Note you can start the process with an Estimate or a Sales Order Customer Inquiries & reports The Accounts Receivable Aging summary will show the amount in Australian dollars In the Customer Centre the customer balance will be in the foreign currency but the transactions will show in Australian dollars

Copyright Business EEz 2010 5

margaret.carey@businesseez.com.au 0408 210 552

Business EEz Procedure The Open Invoices report can be modified to show both the Australian dollar and foreign currency amounts along with the currency

Customer Pays the invoice When the funds are received from the customer in the foreign currency this is again recorded in that currency, however if the money is received in an Australian dollar bank account, you will need to amend the exchange rate to reflect the amount actually received in the bank account

QuickBooks will automatically calculate the difference between the amount in Australian dollars that was invoiced and the amount received and create a gain or loss amount.

Copyright Business EEz 2010 6

margaret.carey@businesseez.com.au 0408 210 552

Business EEz Procedure 2 Supplier Transactions Invoicing the Supplier Once you select a Supplier that has been set up as a foreign currency Supplier QuickBooks will record the bill in the currency of the Supplier using the exchange rate in the currency list this can be amended if required either on the bill or in the List

Supplier Inquiries & reports The Accounts Payable Aging summary will show the amount in Australian dollars In the Supplier Centre the Supplier balance will be in the foreign currency but the transactions will show in Australian dollars

Copyright Business EEz 2010 7

margaret.carey@businesseez.com.au 0408 210 552

Business EEz Procedure The Unpaid Bills Detail report can be modified to show both the Australian dollar and foreign currency amounts

Paying the Bill If you are paying the supplier from a foreign currency bank account, you can simply record the payment. QuickBooks will still calculate a gain or loss in exchange if there is a difference between the exchange rate on the bill and the exchange rate at the time the payment is recorded. If however you are paying the bill out of the Australian dollar account, you will need to calculate the exchange rate as applied by the bank and record this. You can record up to five decimal places.

QuickBooks will again calculate the gain or loss on exchange

Copyright Business EEz 2010 8

margaret.carey@businesseez.com.au 0408 210 552

Business EEz Procedure

Home Currency Adjustments

If you are using a foreign currency bank account, this can be managed in the same way as a normal bank account except that at year end, it will be necessary to adjust the balance in Australian dollars so that it reflects the current value in Australian dollars. This is done via a general journal and ticking the box Home Currency Adjustment. This does not change the foreign currency amount just the Australian dollar equivalent for correct financial reporting

Realised and Unrealised Gains/Losses Reporting

Under the Report menu is an additional heading Multicurrency with two options Realised and Unrealised gains and Losses. The Realised Gains & Losses report will just provide a list of all the exchange rate variation amounts that QuickBooks has calculated

The Unrealised Gain Loss option will first ask if you want to revalue your accounts with foreign currency transactions. You can enter the rate that you want to use and press OK

Copyright Business EEz 2010 9

margaret.carey@businesseez.com.au 0408 210 552

Business EEz Procedure

All accounts in that currency will then be revalued based on the rate entered. This is classified as an unrealised gain or loss as the actual amount has not been crystallised

Hints when using Multi Currency

There are a few traps when using multi currency the following may be of assistance 1. If a credit note is to be applied to an invoice or bill use the same rate as the original Invoice or Bill 2. If you need to apply a credit to multiple Bills/Invoices with different exchange rates then split the credit by entering multiple credit notes at the same exchange rate as the original Bill or Invoice it applies to 3. Never go back and change the exchange rate on Bills/Invoices that have already been paid or have had a partial payment s/receipts made against them as then the matching payment/receipt s will also need to be amended otherwise there will be out of balance issues

Copyright Business EEz 2010 10

margaret.carey@businesseez.com.au 0408 210 552

You might also like

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Short Essay 3: UnrestrictedDocument3 pagesShort Essay 3: UnrestrictedSatesh KalimuthuNo ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- Adjustments: Steps For Recording Adjusting EntriesDocument2 pagesAdjustments: Steps For Recording Adjusting EntriesYahnsea AlfaroNo ratings yet

- Completing The Accounting CycleDocument3 pagesCompleting The Accounting CycleHeeseung LeeNo ratings yet

- Bank ReconciliationDocument4 pagesBank Reconciliationknowledge musendekwaNo ratings yet

- Accounting Cycle GuideDocument18 pagesAccounting Cycle GuideKarysse Arielle Noel JalaoNo ratings yet

- 15 Handle Foreign Currency TransactionsDocument27 pages15 Handle Foreign Currency TransactionsTegene TesfayeNo ratings yet

- The Accounting Process (The Accounting Cycle) : 2. Prepare The Transaction'sDocument3 pagesThe Accounting Process (The Accounting Cycle) : 2. Prepare The Transaction'sGanesh ZopeNo ratings yet

- AccountingDocument14 pagesAccountingKleint Tadem OcialNo ratings yet

- Application Note: Multi-Currency IssuesDocument6 pagesApplication Note: Multi-Currency IssuesLinh NguyễnNo ratings yet

- Accounting Principles - AllDocument104 pagesAccounting Principles - AllAHMED100% (1)

- University of Saint Louis Tuguegarao City School of Accountancy, Business and Hospitality First Semester A.Y. 2020-2021Document8 pagesUniversity of Saint Louis Tuguegarao City School of Accountancy, Business and Hospitality First Semester A.Y. 2020-2021Annie RapanutNo ratings yet

- Accounting Cycle StepsDocument4 pagesAccounting Cycle StepsAntiiasmawatiiNo ratings yet

- What Is Accounting and What Is Its Purpose? What Is Its Role in Decision-Making?Document4 pagesWhat Is Accounting and What Is Its Purpose? What Is Its Role in Decision-Making?Jpoy RiveraNo ratings yet

- Cfas 3Document10 pagesCfas 3Bea charmillecapiliNo ratings yet

- Revenue Recognition ConfigurationDocument5 pagesRevenue Recognition Configurationsheruf_aliNo ratings yet

- Module 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsDocument10 pagesModule 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsWinoah HubaldeNo ratings yet

- Module 6 - Worksheet and Financial Statements Part IDocument12 pagesModule 6 - Worksheet and Financial Statements Part IMJ San Pedro100% (1)

- Account ProcessDocument3 pagesAccount ProcessMae AroganteNo ratings yet

- Review of The Accounting ProcessDocument18 pagesReview of The Accounting ProcessRoyceNo ratings yet

- The Accounting Cycle - Service Business: Rodmarc P. Sanchez, J.DDocument41 pagesThe Accounting Cycle - Service Business: Rodmarc P. Sanchez, J.DDodgeSanchezNo ratings yet

- Accounting CycleDocument30 pagesAccounting CycleJenelle RamosNo ratings yet

- Accounting Cycle MechanicsDocument6 pagesAccounting Cycle MechanicsAnjali BalmikiNo ratings yet

- Accountancy ProjectDocument14 pagesAccountancy ProjectKshitize NigamNo ratings yet

- 01.what Are Different Status in Payment Batch ?: Oracle Financials Test No.10 DT: 4 Feb 2006 Payables - IiDocument8 pages01.what Are Different Status in Payment Batch ?: Oracle Financials Test No.10 DT: 4 Feb 2006 Payables - IiAnonymous 5mSMeP2jNo ratings yet

- Accounting Process 2Document2 pagesAccounting Process 2Lala ArdilaNo ratings yet

- Acc CycleDocument3 pagesAcc CycleJomarie BenedictoNo ratings yet

- The Accounting CycleDocument3 pagesThe Accounting Cycleliesly buticNo ratings yet

- Buffalo Accounting Go-Live ChecklistDocument16 pagesBuffalo Accounting Go-Live ChecklistThach DoanNo ratings yet

- Introduction: The Accounting Process Is A Series of Activities That BeginsDocument20 pagesIntroduction: The Accounting Process Is A Series of Activities That BeginsMiton AlamNo ratings yet

- Accounting CycleDocument4 pagesAccounting Cycleddoc.mimiNo ratings yet

- Chapter-2 Intainship ProjectDocument8 pagesChapter-2 Intainship ProjectAP GREEN ENERGY CORPORATION LIMITEDNo ratings yet

- Intermediate Accounting: Eleventh Canadian EditionDocument62 pagesIntermediate Accounting: Eleventh Canadian EditionthisisfakedNo ratings yet

- The Accounting Cycle: 1. TransactionsDocument2 pagesThe Accounting Cycle: 1. TransactionsJonalyn MontecalvoNo ratings yet

- Acctg 5-8Document5 pagesAcctg 5-8Cristle ServentoNo ratings yet

- Acc201 Su2Document5 pagesAcc201 Su2Gwyneth LimNo ratings yet

- Module 3 CFAS PDFDocument7 pagesModule 3 CFAS PDFErmelyn GayoNo ratings yet

- Accounting Methods: Important: Carefully Consider These Settings at Implementation TimeDocument5 pagesAccounting Methods: Important: Carefully Consider These Settings at Implementation Timekalai01eceNo ratings yet

- Accounting Basics - Quick Guide Accounting - OverviewDocument75 pagesAccounting Basics - Quick Guide Accounting - Overviewdebaditya_hit326634No ratings yet

- What Is Meant by R2R? R2R Plays A Vital Role in The Company, Collecting Data and PostingDocument12 pagesWhat Is Meant by R2R? R2R Plays A Vital Role in The Company, Collecting Data and PostingRAM SUBBAREDDYNo ratings yet

- Introduction To QuickBooks For FarmersDocument93 pagesIntroduction To QuickBooks For Farmerslaraworden100% (4)

- JournalizationDocument36 pagesJournalizationDavid Guerrero Terrado100% (1)

- Completing The Accounting CycleDocument9 pagesCompleting The Accounting CycleTikaNo ratings yet

- Chapter 2Document3 pagesChapter 2Jk DVSNo ratings yet

- Compai QB G1 Bsma3eDocument16 pagesCompai QB G1 Bsma3eHerrie AbaoNo ratings yet

- Accounting ProcessDocument3 pagesAccounting ProcessAngel RosalesNo ratings yet

- Chapter 6 LectureDocument21 pagesChapter 6 LectureDana cheNo ratings yet

- Lesson 13Document10 pagesLesson 13Julianne Bea NotarteNo ratings yet

- Question Answer EMBA505Document9 pagesQuestion Answer EMBA505Md. AsaduzzamanNo ratings yet

- Principle of Accounting Topic Is: Adjusting EntriesDocument11 pagesPrinciple of Accounting Topic Is: Adjusting EntriesAhsan azizNo ratings yet

- Extensive Theory PackageDocument70 pagesExtensive Theory PackageLeon BurresNo ratings yet

- Principles of Accounts Unit TwoDocument12 pagesPrinciples of Accounts Unit Twotamera dellamoreNo ratings yet

- BOE & AR INT CalculationsDocument35 pagesBOE & AR INT CalculationsAman IamtheBestNo ratings yet

- Adjusting EntriesDocument19 pagesAdjusting EntriesMasood Ahmad AadamNo ratings yet

- Understanding The Accounting Cycle in Trading BusinessDocument4 pagesUnderstanding The Accounting Cycle in Trading BusinessHafidzi Derahman100% (1)

- Accounting Cycle StepsDocument3 pagesAccounting Cycle Stepsjewelmir100% (1)

- The Post of Trial Balance (Bing)Document5 pagesThe Post of Trial Balance (Bing)rezarenonnNo ratings yet

- C1 - The Accounting ProcessDocument49 pagesC1 - The Accounting ProcessMae JessaNo ratings yet

- Jaxworks StatementAccount1Document1 pageJaxworks StatementAccount1Aamir Shahzad AfridiNo ratings yet

- Praveen Subramani: EducationDocument3 pagesPraveen Subramani: EducationAamir Shahzad AfridiNo ratings yet

- 1.00 Usd 3.75110 Sar 1 Usd 3.75110 Sar 1 Sar 0.266588 UsdDocument3 pages1.00 Usd 3.75110 Sar 1 Usd 3.75110 Sar 1 Sar 0.266588 UsdAamir Shahzad AfridiNo ratings yet

- Compliance Audit TemplateDocument8 pagesCompliance Audit TemplateAnsarMahmoodNo ratings yet

- 2012 Master StatsDocument9 pages2012 Master StatsArmando Palma RosalesNo ratings yet

- Amir Kamal HEALTHDocument3 pagesAmir Kamal HEALTHAamir Shahzad AfridiNo ratings yet

- Ccna Course ContentDocument5 pagesCcna Course ContentAamir Shahzad AfridiNo ratings yet

- Account StatementDocument1 pageAccount StatementAamir Shahzad AfridiNo ratings yet

- C V of DR Atta Ur Rahman Dept of Geography PDFDocument13 pagesC V of DR Atta Ur Rahman Dept of Geography PDFAamir Shahzad Afridi100% (3)

- CV Chronological 2010Document2 pagesCV Chronological 2010tSk_No ratings yet

- First Name Last Name: Professional ProfileDocument4 pagesFirst Name Last Name: Professional ProfileAamir Shahzad AfridiNo ratings yet

- Nick Sayers CVDocument2 pagesNick Sayers CVTonka TonceNo ratings yet

- CV Format by Naveeddil 1 PDFDocument3 pagesCV Format by Naveeddil 1 PDFAamir Shahzad AfridiNo ratings yet

- Mircea Strugaru - CVDocument3 pagesMircea Strugaru - CVMircea StrugaruNo ratings yet

- 5815578429028updated MCITP OutlineDocument8 pages5815578429028updated MCITP OutlineAamir Shahzad AfridiNo ratings yet

- HABC Level 2 Health & Safety - 12-Oct-2013 in Lahore - PDFDocument1 pageHABC Level 2 Health & Safety - 12-Oct-2013 in Lahore - PDFAamir Shahzad AfridiNo ratings yet

- CIEH Level 2 Award in Fire Safety Principles: Sample Examination QuestionsDocument2 pagesCIEH Level 2 Award in Fire Safety Principles: Sample Examination QuestionsAamir Shahzad AfridiNo ratings yet

- CIEH Level 2 Award in Fire Safety Principles: How To DeliverDocument2 pagesCIEH Level 2 Award in Fire Safety Principles: How To DeliverAamir Shahzad AfridiNo ratings yet

- CIEH Level 2 Award in Fire Safety Principles: SyllabusDocument2 pagesCIEH Level 2 Award in Fire Safety Principles: SyllabusAamir Shahzad AfridiNo ratings yet

- Job DescriptionDocument1 pageJob DescriptionAamir Shahzad AfridiNo ratings yet

- IGC 3 Candidate Report TemplateDocument1 pageIGC 3 Candidate Report TemplateDivya RastogiNo ratings yet

- 5 Steps To Risk AssessmentDocument8 pages5 Steps To Risk AssessmentAnnie HawkinsNo ratings yet

- IGC 3 Candidate Report TemplateDocument1 pageIGC 3 Candidate Report TemplateDivya RastogiNo ratings yet

- How To Open Nfo FilesDocument1 pageHow To Open Nfo Filesjude_abarcaNo ratings yet

- Empty Application FormDocument2 pagesEmpty Application FormAamir Shahzad AfridiNo ratings yet

- Nebosh Igc 3 DocumentsDocument1 pageNebosh Igc 3 DocumentsAbdul RaufNo ratings yet

- Lightroom 5Document57 pagesLightroom 5Ree DexterNo ratings yet

- How To Open Nfo FilesDocument1 pageHow To Open Nfo Filesjude_abarcaNo ratings yet

- Umar Khattak Fresh BiodataDocument6 pagesUmar Khattak Fresh BiodataAamir Shahzad AfridiNo ratings yet

- Sample Formal Resume TemplateDocument2 pagesSample Formal Resume TemplateMark David Abin ValgunaNo ratings yet

- Topic 7Document18 pagesTopic 7Anonymous 0fCNL9T0No ratings yet

- Circuito Eléctrico Bomba de Freno VochoDocument1 pageCircuito Eléctrico Bomba de Freno Vochosvelaib100% (1)

- FPO Policy-1Document96 pagesFPO Policy-1shashanksaranNo ratings yet

- Yashu Internship Report 21Document45 pagesYashu Internship Report 21Lakshmi dayanand DayaNo ratings yet

- C10G - Hardware Installation GD - 3 - 12 - 2014Document126 pagesC10G - Hardware Installation GD - 3 - 12 - 2014Htt Ếch CốmNo ratings yet

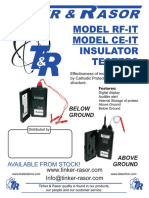

- R R O S A: Model Rf-It Model Ce-It Insulator TestersDocument2 pagesR R O S A: Model Rf-It Model Ce-It Insulator Testersvictor raul sandoval martinezNo ratings yet

- Oil & Grease CatalogDocument4 pagesOil & Grease Catalogmanoj983@gmail.comNo ratings yet

- Rule: Steel Import Monitoring and Analysis SystemDocument8 pagesRule: Steel Import Monitoring and Analysis SystemJustia.comNo ratings yet

- Gcm02-Mt-Ing4 New1 PDFDocument57 pagesGcm02-Mt-Ing4 New1 PDFabdel jabbar67% (3)

- Bearing SettlementDocument4 pagesBearing SettlementBahaismail100% (1)

- One For All Urc-8350 Instruction Manual PDF DownloadDocument5 pagesOne For All Urc-8350 Instruction Manual PDF DownloademinaNo ratings yet

- Bilal CVDocument3 pagesBilal CVShergul KhanNo ratings yet

- As 29 Provisions Contingent Liabilities and Contingent AssetsDocument38 pagesAs 29 Provisions Contingent Liabilities and Contingent AssetsAayushi AroraNo ratings yet

- Assignment 1: Unit 3 - Week 1Document80 pagesAssignment 1: Unit 3 - Week 1sathiyan gsNo ratings yet

- Case Study (3 To 5 Months Test Plan) : Test Deliverable Responsibility Completion TimeDocument1 pageCase Study (3 To 5 Months Test Plan) : Test Deliverable Responsibility Completion Timepry_kumNo ratings yet

- International Journal On Cryptography and Information Security (IJCIS)Document2 pagesInternational Journal On Cryptography and Information Security (IJCIS)ijcisjournalNo ratings yet

- Thermister O Levels Typical QuestionDocument4 pagesThermister O Levels Typical QuestionMohammad Irfan YousufNo ratings yet

- BDA Guide To Successful Brickwor1kDocument259 pagesBDA Guide To Successful Brickwor1kMudassar AhmadNo ratings yet

- Relative Clauses (Who, Which, That) For B LevelDocument16 pagesRelative Clauses (Who, Which, That) For B LevelOğuzhan KarabayNo ratings yet

- Project Execution and Control: Lunar International College July, 2021Document35 pagesProject Execution and Control: Lunar International College July, 2021getahun tesfayeNo ratings yet

- 03 Pezeshki-Ivari2018 Article ApplicationsOfBIMABriefReviewADocument40 pages03 Pezeshki-Ivari2018 Article ApplicationsOfBIMABriefReviewAdanes1800No ratings yet

- Cover LetterDocument2 pagesCover LetterSasi Gangadhar BNo ratings yet

- Pathfinder House RulesDocument2 pagesPathfinder House RulesilililiilililliliI100% (1)

- Designing A 3D Jewelry ModelDocument4 pagesDesigning A 3D Jewelry ModelAbdulrahman JradiNo ratings yet

- Meeting Request LetterDocument2 pagesMeeting Request LetterRagni Tayal100% (1)

- NEBOSH IGC IG1 Course NotesDocument165 pagesNEBOSH IGC IG1 Course NotesShagufta Mallick100% (13)

- Offer LetterDocument8 pagesOffer LetterMadhavi Latha100% (3)

- Lect7 Grinding Advanced ManufacturingDocument33 pagesLect7 Grinding Advanced Manufacturingsirac topcuNo ratings yet

- SLA707xM Series: 2-Phase Unipolar Stepper Motor DriverDocument20 pagesSLA707xM Series: 2-Phase Unipolar Stepper Motor DriverKatherine EsperillaNo ratings yet

- Polymer AbbreviationsDocument9 pagesPolymer AbbreviationsFernando GuerreroNo ratings yet

- You Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherFrom EverandYou Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherNo ratings yet

- The House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedFrom EverandThe House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedRating: 4.5 out of 5 stars4.5/5 (5)

- The Importance of Being Earnest: Classic Tales EditionFrom EverandThe Importance of Being Earnest: Classic Tales EditionRating: 4.5 out of 5 stars4.5/5 (44)

- The Most Forbidden Knowledge: 151 Things NO ONE Should Know How to DoFrom EverandThe Most Forbidden Knowledge: 151 Things NO ONE Should Know How to DoRating: 4.5 out of 5 stars4.5/5 (6)

- Welcome to the United States of Anxiety: Observations from a Reforming NeuroticFrom EverandWelcome to the United States of Anxiety: Observations from a Reforming NeuroticRating: 3.5 out of 5 stars3.5/5 (10)

- Cats On The Run: a wickedly funny animal adventureFrom EverandCats On The Run: a wickedly funny animal adventureRating: 4 out of 5 stars4/5 (8)

- The Comedians in Cars Getting Coffee BookFrom EverandThe Comedians in Cars Getting Coffee BookRating: 4.5 out of 5 stars4.5/5 (8)

- The Inimitable Jeeves [Classic Tales Edition]From EverandThe Inimitable Jeeves [Classic Tales Edition]Rating: 5 out of 5 stars5/5 (3)

- The Book of Bad:: Stuff You Should Know Unless You’re a PussyFrom EverandThe Book of Bad:: Stuff You Should Know Unless You’re a PussyRating: 3.5 out of 5 stars3.5/5 (3)

- The Best Joke Book (Period): Hundreds of the Funniest, Silliest, Most Ridiculous Jokes EverFrom EverandThe Best Joke Book (Period): Hundreds of the Funniest, Silliest, Most Ridiculous Jokes EverRating: 3.5 out of 5 stars3.5/5 (4)

- Pickup Lines: The Ultimate Collection of the World's Best Pickup Lines!From EverandPickup Lines: The Ultimate Collection of the World's Best Pickup Lines!Rating: 5 out of 5 stars5/5 (1)

- 1,001 Facts that Will Scare the S#*t Out of You: The Ultimate Bathroom ReaderFrom Everand1,001 Facts that Will Scare the S#*t Out of You: The Ultimate Bathroom ReaderRating: 3.5 out of 5 stars3.5/5 (48)

- The Smartest Book in the World: A Lexicon of Literacy, A Rancorous Reportage, A Concise Curriculum of CoolFrom EverandThe Smartest Book in the World: A Lexicon of Literacy, A Rancorous Reportage, A Concise Curriculum of CoolRating: 4 out of 5 stars4/5 (14)

![The Inimitable Jeeves [Classic Tales Edition]](https://imgv2-1-f.scribdassets.com/img/audiobook_square_badge/711420909/198x198/ba98be6b93/1712018618?v=1)