Professional Documents

Culture Documents

Internal Audit Report Format

Uploaded by

Saket TibrewalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internal Audit Report Format

Uploaded by

Saket TibrewalCopyright:

Available Formats

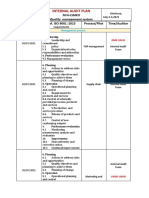

INTERNAL AUDIT REPORT

Client Name: M/s Vineet Oils P. Ltd. Report Date: 19/12/2011 Period: 01st April to 30th Sept., 2011 Auditee: Mr. Vishal & Kushal Surekha Accountant: Mr. Kamal

Strictly Private & Confidential

Page 1 of 3

S. No. 1.

Audit Observation (Point; annexure) Co. is not maintaining any detailed information register for Fixed Assets amounting Rs. 70 Lacs. (Point 1.a)

2.

It seems deposit of almost Rs. 8.12 Lacs have given parties in Cash, instead of FDR.(Point 1.b;1)

Risk Criteria / Recommendation Risk: Very High Recommendation: i) Model Fixed Assets register format will be given, to extract and fill up the information. Efforts are needed to incorporate the same in routine accounting process. Risk: Moderate Recommendation: i) Options should be explored to convert the same in FDR format to save interest cost. Risk: High Recommendation: i) Communications need to be done to restart relationship with those parties to boost sales and assure recoverability option also. Risk :Moderate Recommendation: should be avoided Risk: Very High Recommendation: validity have been elapsed, efforts for re-issuance needs to be done. Risk: High Recommendation: i) Above practice bears revenue implication in form of interest and penalty, hence should be avoided. Risk: High Recommendation: Proper care needs to be taken, return may be revised to claim above revenue implication.

Management Action Plan

Management Action Plan:

3.

Debtors of Rs. 4.62 Cr. have not done transactions during the financial period. (1.c;2)

Management Action Plan:

4.

Cash Book: - Seven days of July month have negative cash balance cash, indicating there is unaccounted cash lying in the organization. Cheque in Hand: Cheque of Rs. 10.44 Lacs of M/s PRT petrochemicals P. Ltd. have not been realized by the Co. since April. TDS: a. TDS liability have not been paid during the period (Rs. 1.1 lacs) b. A case of non-deduction of TDS is also found in case of Dibakar Dutta.(2.1;3) Sales Tax: a. Liability amounting Rs. 28.36 has been paid late in the month of Oct. b. In case of Balmer Lawrie Co. Ltd, discount has been allowed after charging of VAT, causing revenue implication of Rs. 1.29 Lacs. c. In some cases, input have not been taken causing revenue implication of approx. Rs. 2,000/- (2.ii;4)

Management Action Plan:

Management Action Plan:

5.

Management Action Plan:

6.

7.

Strictly Private & Confidential

Page 2 of 3

S. No. 8.

Audit Observation (Point; annexure)

9. 10.

11.

Service Tax:a. Some cases were found where input of service tax have not been taken causing revenue implication of Approx. Rs. 35,000/(2.iii) Difference in Opening Balance:- Opening balances is not tallied with amount of Rs. 3287/- (2.c) Documentation: a. Almost 250 transactions amounting Rs. 40 Lacs have been found of improper documentation. (3.a,b,e; 7,8,11) b. In some case of Rs. 6.7 lacs voucher date is earlier than invoice date (3.d;11) c. 6 transaction have been booked with a amount different than management approved, causing revenue implication of Rs. 14,611/- (3.d;10) d. Some cases of improper classification or double booking were found, which needs to be checked (3.f,g;12,13) E- documentation: - some function of Tally like control function, e- Risk: High statutory compliance, e-library may be used to establish proper Recommendation: i) We may assist the accounting staff to establish harmony between soft and hard records. (4) the above function in accounting software.

Risk Criteria / Recommendation Risk: Very High Recommendation: i) Proper care need to be taken to avoid these transactions. Risk: Very High Recommendation: should be tallied Risk: very high Recommendation: i) SOP for proper documentation needs to be formed and followed.

Management Action Plan Management Action Plan:

Management Action Plan: Management Action Plan:

Management Action Plan:

Strictly Private & Confidential

Page 3 of 3

You might also like

- Internal Audit NC ReportDocument1 pageInternal Audit NC Reportmorshed_mahamud7055No ratings yet

- Risk Based Internal Auditing in Taiwanese Banking Industry Yung MingDocument40 pagesRisk Based Internal Auditing in Taiwanese Banking Industry Yung MingGaguk M. GupronNo ratings yet

- Internal Audit Summary by DeptDocument1 pageInternal Audit Summary by Depttahaalkibsi100% (1)

- Audit Plan 2018 lbc1Document23 pagesAudit Plan 2018 lbc1r0wanNo ratings yet

- Form - Internal Audit Report (BLANK)Document5 pagesForm - Internal Audit Report (BLANK)arajamani78No ratings yet

- ISO 9001 Internal AuditDocument9 pagesISO 9001 Internal AuditLim Kim YookNo ratings yet

- Internal Audit Annual Report and 2017 Audit Plan (PDFDrive)Document29 pagesInternal Audit Annual Report and 2017 Audit Plan (PDFDrive)samirNo ratings yet

- Internal Audit ChecklistDocument80 pagesInternal Audit ChecklistdinuindiaNo ratings yet

- Annual Audit Plan Template - Revised Version 2011Document36 pagesAnnual Audit Plan Template - Revised Version 2011Jasim BalochNo ratings yet

- Performance Goals For Audit Senior & Assistant MGRDocument1 pagePerformance Goals For Audit Senior & Assistant MGRSiganteng Bonar0% (1)

- BDP Department Periodic Audit Report .2Document30 pagesBDP Department Periodic Audit Report .2Arefayne WodajoNo ratings yet

- Audit checklist templates for quality, EMS and OH&S management systemsDocument4 pagesAudit checklist templates for quality, EMS and OH&S management systemssrsureshrajanNo ratings yet

- Audit Client SurveyDocument1 pageAudit Client Surveytaufik_ahmad_4No ratings yet

- AUdit ReportDocument95 pagesAUdit ReportSASIKUMAR100% (1)

- Internal Audit Planning and Scheduling Sample FormatDocument3 pagesInternal Audit Planning and Scheduling Sample Formatsameh100% (2)

- The Biggest Internal Audit Challenges in The Next Five YearsDocument3 pagesThe Biggest Internal Audit Challenges in The Next Five YearsBagusNo ratings yet

- AUDIT EQUITY CHANGESDocument3 pagesAUDIT EQUITY CHANGESzahrahassan78No ratings yet

- 5259-C3-V1-S2R-9001 Audit Summary ReportDocument5 pages5259-C3-V1-S2R-9001 Audit Summary ReportHanhan Jaya MahendraNo ratings yet

- Internal Audit ReportsDocument1 pageInternal Audit ReportsCQMS 5S DivisionNo ratings yet

- Thane Division 0Document2 pagesThane Division 0SurajPandey100% (1)

- Revision and audit schedulesDocument9 pagesRevision and audit scheduleszamanbdNo ratings yet

- FINAL - Audit Report - Shailesh DongareDocument7 pagesFINAL - Audit Report - Shailesh DongareRajeev KumarNo ratings yet

- Internal Audit Plan: Day Ref. ISO 9001:2015 Process/Pilot Time/AuditorDocument3 pagesInternal Audit Plan: Day Ref. ISO 9001:2015 Process/Pilot Time/AuditorPFENo ratings yet

- ID JKT 3402 Audit 2018 Audit Plan Issue 1Document2 pagesID JKT 3402 Audit 2018 Audit Plan Issue 1sofyanclickNo ratings yet

- Internal Audit ManualDocument127 pagesInternal Audit Manualsaidmsaid100% (1)

- Internal AuditChecklistDocument7 pagesInternal AuditChecklistAdsa100% (1)

- Internal Audit Process ScheduleDocument2 pagesInternal Audit Process Schedule25900solon50% (2)

- Internal Quality Audit Rev 00Document26 pagesInternal Quality Audit Rev 00Keith AmorNo ratings yet

- 03 (SQ) - Process Product Audit ReportDocument2 pages03 (SQ) - Process Product Audit ReportDEVENDERNo ratings yet

- Internal Process Audit Toolbox - WHITE PAPERDocument5 pagesInternal Process Audit Toolbox - WHITE PAPERR JNo ratings yet

- I General: Internal Audit ChecklistDocument33 pagesI General: Internal Audit ChecklistHimanshu GaurNo ratings yet

- Workpaper GuidelinesDocument4 pagesWorkpaper GuidelinesAltynay IlyassovaNo ratings yet

- SM - ChecklistDocument17 pagesSM - ChecklistAdeline MokNo ratings yet

- Internal Audit Check ListDocument17 pagesInternal Audit Check ListAnkur Dhir0% (1)

- Pentair Noida ARG-407503 WI-820614 Audit ReportDocument13 pagesPentair Noida ARG-407503 WI-820614 Audit ReportHolly SmithNo ratings yet

- Handbook On Internal AuditingDocument1 pageHandbook On Internal AuditingAshutosh100% (1)

- IS Audit ChecklistDocument13 pagesIS Audit ChecklistSurbhiNo ratings yet

- Combined EHS Management System Audit ChecklistDocument26 pagesCombined EHS Management System Audit ChecklistOjo OgboadayegbeNo ratings yet

- Audit Schedule - Department WiseDocument10 pagesAudit Schedule - Department WiseashishvaidNo ratings yet

- 46 - Internal Audit Report FormatDocument9 pages46 - Internal Audit Report FormatGurvinder Mann Singh PradhanNo ratings yet

- P018 Internal Audit Procedure: ISO 9001:2008 Clause 8.2.2Document9 pagesP018 Internal Audit Procedure: ISO 9001:2008 Clause 8.2.2Álvaro Martínez Fernández100% (1)

- INTERNAL AUDITS ENSURE QMS COMPLIANCEDocument2 pagesINTERNAL AUDITS ENSURE QMS COMPLIANCELuke J LandryNo ratings yet

- Internal Audit ChecklistDocument26 pagesInternal Audit Checklistjimmydomingojr100% (1)

- INTERNAL AUDIT PROGRAMMEDocument7 pagesINTERNAL AUDIT PROGRAMMERiya XavierNo ratings yet

- Internal Audit ChecklistDocument6 pagesInternal Audit Checklistkarlkristoff9950100% (5)

- Sop (Internal Audit)Document6 pagesSop (Internal Audit)Arijit Pattanayak100% (1)

- Vcare Burglar Alarm: Terms and ConditionsDocument1 pageVcare Burglar Alarm: Terms and ConditionsJoranne Gregorio100% (1)

- CPA Compliance ChecklistDocument25 pagesCPA Compliance ChecklistFizz FirdausNo ratings yet

- Audit FindingsDocument2 pagesAudit FindingsIsmailNo ratings yet

- Interim IT SOX 2018 Preliminary FindingDocument2 pagesInterim IT SOX 2018 Preliminary FindingT. LyNo ratings yet

- MIS Audit ChecklistDocument19 pagesMIS Audit ChecklistAhmad Tariq BhattiNo ratings yet

- Internal Audit ProcedureDocument4 pagesInternal Audit Procedureelisma fitriNo ratings yet

- Internal Audit Progress Report and Quarter 2 PlanDocument10 pagesInternal Audit Progress Report and Quarter 2 PlanPitt Si EndutNo ratings yet

- Preview - Iso9001-2015.checklist For ISO 9001-2015Document6 pagesPreview - Iso9001-2015.checklist For ISO 9001-2015Jones RNo ratings yet

- Auditing ObjectivesDocument12 pagesAuditing ObjectivesAjay KaundalNo ratings yet

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Currency ConversionDocument33 pagesCurrency ConversionSruthi NairNo ratings yet

- JournalDocument3 pagesJournalAnonymous RPGElS100% (1)

- Topic 1 Introduction To Financial Environment and Financial ManagementDocument69 pagesTopic 1 Introduction To Financial Environment and Financial ManagementNajwa Alyaa binti Abd WakilNo ratings yet

- Cost of New Investment-OS 3,250k: Undervalued Equipment P100k X 40% Ownership P40k/5 P8kDocument1 pageCost of New Investment-OS 3,250k: Undervalued Equipment P100k X 40% Ownership P40k/5 P8kQueenie ValleNo ratings yet

- Indian Restaurant Industry Growth OpportunityDocument4 pagesIndian Restaurant Industry Growth OpportunityJuBeeNo ratings yet

- Introduction To Income TaxDocument7 pagesIntroduction To Income Taxsipabow760No ratings yet

- Cpale Syllabus 2022Document27 pagesCpale Syllabus 2022BlueBladeNo ratings yet

- Acknowledge Men 1Document3 pagesAcknowledge Men 1shamimasaubNo ratings yet

- ESIC New Inspection Policy 2008Document3 pagesESIC New Inspection Policy 2008smindustryNo ratings yet

- Composition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxDocument6 pagesComposition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxKatie PxNo ratings yet

- Study On Organization and Digital Banking Awareness Programme in State Bank of IndiaDocument41 pagesStudy On Organization and Digital Banking Awareness Programme in State Bank of IndiaShobiga VNo ratings yet

- University of Cebu senior high school department compilation notesDocument8 pagesUniversity of Cebu senior high school department compilation notesAndra FleurNo ratings yet

- Travel Agency Marketing PlanDocument20 pagesTravel Agency Marketing PlanGregsyNo ratings yet

- UST GN 2011 - Taxation Law IndexDocument2 pagesUST GN 2011 - Taxation Law IndexGhost100% (1)

- Brigham Chapter 21 Solution ManualDocument12 pagesBrigham Chapter 21 Solution Manualprimadonna03100% (3)

- Testbanks FADocument7 pagesTestbanks FAStela Marie CarandangNo ratings yet

- Slutsky vs. HicksDocument7 pagesSlutsky vs. HicksJohn ScNo ratings yet

- Guidelines For Investment Proof SubmissionDocument6 pagesGuidelines For Investment Proof Submissionzaheer KaziNo ratings yet

- Financial Analysis and Valuation of Masan GroupDocument17 pagesFinancial Analysis and Valuation of Masan GroupDoan Tu100% (1)

- Fr. Emmanuel Lemelson Letter To Congress Regarding LigandDocument9 pagesFr. Emmanuel Lemelson Letter To Congress Regarding LigandamvonaNo ratings yet

- Commercial Kitchen EquipmentDocument9 pagesCommercial Kitchen EquipmentVinayak OletiNo ratings yet

- Chapter-21 Cash Flow AnalysisDocument38 pagesChapter-21 Cash Flow AnalysisSimran KaurNo ratings yet

- AIATSL Payslip for August 2021Document1 pageAIATSL Payslip for August 2021Ashna anilkumar pNo ratings yet

- 2000 Annual Report (Figures) EngDocument16 pages2000 Annual Report (Figures) EngLorena TudorascuNo ratings yet

- Statement of Financial PositionDocument30 pagesStatement of Financial Positionyulina eviNo ratings yet

- Making A BudgetDocument22 pagesMaking A BudgetbuddysmbdNo ratings yet

- BIR Ruling DA - (C-257) 658-09Document2 pagesBIR Ruling DA - (C-257) 658-09Aris Basco DuroyNo ratings yet

- Startup Costs WorksheetDocument1 pageStartup Costs WorksheetBushra Zakir100% (1)

- John R. Tuttle and Louise B. Tuttle v. United States, 436 F.2d 69, 2d Cir. (1970)Document6 pagesJohn R. Tuttle and Louise B. Tuttle v. United States, 436 F.2d 69, 2d Cir. (1970)Scribd Government DocsNo ratings yet

- London Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelDocument16 pagesLondon Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelFarbeen Satira MirzaNo ratings yet