Professional Documents

Culture Documents

2011 ITR2 r9

Uploaded by

N.PalaniappanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2011 ITR2 r9

Uploaded by

N.PalaniappanCopyright:

Available Formats

Select applicable sheets below by choosing Y/N and Click on Apply Click on the sheets below PART A - GENERAL

PARTB - TI - TTI HOUSE_PROPERTY CG-OS CYLA-BFLA CFL VIA SPI - SI EI IT TDS Schedules for filing Income Tax Return Personal Info., Filing Status PartB-TI,PartB-TTI,Verification,Schedule S Schedule HP Schedule CG, Schedule OS Schedule CYLA, Schedule BFLA ScheduleCFL Schedule VIA Schedule SPI, Schedule SI Schedule EI Schedule AIR, Schedule IT Schedule TDS1,Schedule TDS2

1 2 3 4 5 6 7 8 9 10 11

Y Y Y Y Y Y Y Y Y Y Y

Select sheets to print and click apply

Y Y Y Y Y Y Y Y Y Y Y

ScheduleName

GENERAL PART_B PART_B HOUSE_PROPERTY CG_OS CG_OS CYLA BFLA CYLA BFLA CFL VIA SPI - SI SPI - SI EI IT TDS TDS

PartA_Gen1 PartB-TI PartB-TTI ScheduleHP ScheduleCG ScheduleOS ScheduleCYLA ScheduleBFLA ScheduleCFL ScheduleVIA ScheduleSPI ScheduleSI ScheduleEI ScheduleIT ScheduleTDS1 ScheduleTDS2

Appli cable YN Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y

Description Click on applicable links to navigate to the respective sheet / schedule. Click on any of the links on this page to navigate to the respective schedules. Computation of total income Computation of tax liability on total income Details of Income from House Property Capital Gains Income from other sources Details of Income after set-off of current years losses Details of Income after Set off of Brought Forward Losses of earlier years Details of Losses to be carried forward to future Years Deductions under Chapter VI-A Income chargeable to Income tax at special rates IB [Please see instruction Number-9(iii) for section code and rate of tax] Income chargeable to Income tax at special rates IB [Please see instruction Number-9(iii) for section code and rate of tax] Details of Exempt Income (Income not to be included in Total Income) Details of Advance Tax and Self Assessment Tax Payments of Income-tax Details of Tax Deducted at Source on Income [As per Form 16 A issued by Deductor(s)] Details of Tax Collected at Source [As per Form 27D issued by the Collector(s)]

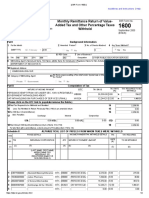

FORM

INDIAN INCOME TAX RETURN

Assessment Year 2011-12

ITR-2

First Name

[For Individuals and HUFs not having Income from Business or Profession] (Please see Rule 12 of the Income Tax-Rules,1962) (Also see attached Instructions) Middle Name Last Name PAN

PERSONAL INFORMATION

Flat / Door / Block No

Name of Premises / Building / Village

Status (I-Individual,H-HUF) I - Individual Date of birth (in case of individual) 00/00/0000

Road / Street / Post Office

Area / Locality

Town/City/District

State

Pin Code

Sex (Select) M-Male

Email Address

Mobile No

(Std code) Phone No

Designation of Assessing Officer (Ward / Circle) FILING STATUS Whether original or revised return? O-Original

Employer Category (if in employment) OTH Return filed under section (Refer 11 - u/s 139(1) Instruction 9(ii)

If revised, enter Receipt no and Date of Date filing original return (DD/MM/YYYY) (DD/MM/YYYY RES - Resident Residential Status Whether this return is being filed by a representative assessee? If yes, please furnish following information a Name of the representative b Address of the representative c Permanent Account Number (PAN) of the representative For Office Use Only For Office Use Only Receipt No Date

N-No

Seal and signature of receiving official

Computation of total income . PLEASE NOTE THAT CALCULATED FIELDS (IN WHITE) ARE PICKED UP FROM OTHER SCHEDULES AND ARE NOT TO BE ENTERED. For ex : The income figures below will get filled up when the Schedules Part B - TI linked to the Income are filled. 1 Salaries (6 of Schedule S) 1 2 Income from house property (C of Schedule-HP) (Enter nil if loss) 2 3 Capital gains a Short term 0 i Short-term (under section 111A) (A5 of Schedule - 3ai CG) 0 ii Short-term (others) (A6 of Schedule-CG) 3aii iii Total short-term (3ai + 3aii) (A4 of Schedule CG) 3aii i b Long-term (B5 of Schedule-CG) 3b c Total capital gains (3aiii + 3b) Income from other sources a from sources other than from owning race horses (3 4a of Schedule OS) b from owning race horses (4c of Schedule OS) 4b c Total (a + b) Total (1 + 2 + 3 c+ 4c) Losses of current year set off against 5 (total of 2vi and 3vi of Schedule CYLA) Balance after set off current year losses (5-6) (also total of column 4 of Schedule CYLA) Brought forward losses set off against 7 (2vi of Schedule BFLA) Gross Total income (7-8) (also 3vii of Schedule BFLA) Deductions under Chapter VI-A (o of Schedule VIA) Total income (9 - 10) Net agricultural income/ any other income for rate purpose (4 of Schedule EI) Aggregate income (11 + 12) Losses of current year to be carried forward (total of xi of Schedule CFL) 0 0 3c 0 0 4c 5 6 7 8 9 10 11 12 13 14

0 0

TOTAL INCOME

5 6 7 8 9 10 11 12 13 14

0 0 0 0 0 0 0 0 0 0 0

Computation of tax liability on total income Part B - TTI 1 Tax payable on total income a Tax at normal rates 1a b Tax at special rates (11 of Schedule-SI) 1b c Rebate on Agricultural income 1c d Tax Payable on Total Income (1a + 1b-1c) 2 Education Cess, including secondary and higher education cess, on 1d 3 Gross tax liability (1d+ 2) 4 Tax relief a Section 89 4a b Section 90 4b c Section 91 4c d Total (4a + 4b + 4c) 5 Net tax liability (3 4d) 6 Interest payable a For default in furnishing the return (section 234A) 6a b For default in payment of advance tax (section 234B) 6b c For deferment of advance tax (section 234C) 6c d Total Interest Payable (6a+6b+6c) COMPUTATION OF TAX LIABILITY

0 0 0 1d 2 3 0 0 0

4d 5 0 0 0 6d

0 0

COMPUTAT

TAXES PAID

7 8

Aggregate liability (5 + 6d) Taxes Paid a Advance Tax (from Schedule-IT) b TDS (total of Schedule-TDS1 and Schedule-TDS2)

7 8a 8b 0 0

0 c Self Assessment Tax (from Schedule-IT) 8c d Total Taxes Paid (8a+8b+8c) 9 Amount payable (Enter if 7 is greater than 8d, else enter 0) 10 Refund (If 8d is greater than 7, also give Bank Account details below) 11 Enter your bank account number (mandatory ) Select Yes if you want your refund by direct deposit into your bank account, Select 12 No if you want refund by Cheque 13 In case of direct deposit to your bank account give additional details MICR Code Type of Account (Select)

REFUND

8d 9 10 11 12

0 0 0

NO

Date(DD/MM/YYYY) VERIFICATION I, (full name in block letters), son/ daughter of

solemnly declare that to the best of my knowledge and belief, the information given in the return and the schedules thereto is is correct and complete and that the amount of total income/ fringe benefits and other particulars shown therein are truly stated and are in accordance with the the provisions of the Income-tax Act, 1961, in respect of income and fringe benefits chargeable to Income-tax for the previous year relevant to the assessment year 2011-2012 Place (Date) PAN 14 If the return has been prepared by a Tax Return Preparer (TRP) give further details below: Counter Signature Identification No. of of TRP TRP Name of TRP If TRP is entitled for any reimbursement from the Government, 14 amount thereof Schedule S Details of Income from Salary (Fields marked in RED should not be left Blank) Name of Employer PAN of Employer (optional) Address of employer Town/City Pin code State 1 Salary (Excluding all allowances, perquisites & profit in lieu of salary).. 1 2 Allowances exempt under section 10 2 3 Allowances not exempt 3 4 Value of perquisites 4 0 5 Profits in lieu of salary 5 0 6 Income chargeable under the Head Salaries (1+3+4+5) 6 0 Total 0

Schedule HP Details of Income from House Property (Fields marked in RED must not be left Blank) Address of property Town/ City State PIN Code

a b c d e f g

h i

Is the property let out ? Name of Tenant Y Annual letable value/ rent received or receivable The amount of rent which cannot be realized Tax paid to local authorities Total (b + c) Balance (a d) 30% of e Interest payable on borrowed capital Cannot exceed 1.5 lacs if not let out Total (f + g) Income from house property (e h) Address of property Town/ City State

PAN of Tenant (optional) a b c d f g 0 0 0 e 0 0 0

b i PIN Code PAN of Tenant (optional) a b c d f g

0 0

Is the property let out ? a b c d e f g

Name of Tenant

h i

Annual letable value/ rent received or receivable The amount of rent which cannot be realized Tax paid to local authorities Total (b + c) Balance (a d) 30% of e Interest payable on borrowed capital Cannot exceed 1.5 lacs if not let out Total (f + g) Income from house property (e h) Address of property Town/ City State

0 e 0 0

b i PIN Code PAN of Tenant (optional) a

0 0

Is the property let out ? a b c d e f g

Name of Tenant

Annual letable value/ rent received or receivable The amount of rent which cannot be realized b Tax paid to local authorities c Total (b + c) d 0 Balance (a d) 30% of e f 0 Interest payable on borrowed capital Cannot exceed g 1.5 lacs if not let out h Total (f + g) i Income from house property (e h) Income under the head Income from house property A Rent of earlier years realized under section 25A/AA B Arrears of rent received during the year under section 25B after deducting 30% C Total (A + B + Total of (i) for all properties above)

b i A B C

0 0

Schedule CGCapital Gains A Short-term capital gain 1. From assets in case of non-resident to which first proviso to section 48 applicable 2. From other assets 2a a Full value of consideration b Deductions under section 48 i Cost of acquisition bi ii Cost of Improvement bii iii Expenditure on transfer biii iv Total ( i + ii + ii) biv 2c c Balance (2a 2biv) Loss, if any, to be ignored under section 94(7) or 94(8) d 2d (Enter positive values only) Exemption under section 54B/54D e 2e f Short-term capital gain (2c + 2d 2e) Amount deemed to be short term capital gains under sections 3. 54/54B/54D/54EC/54ED/54F 4. Total short term capital gain (1 + 2f +3) 5. Short term capital gain under section 111A included in 4 6. Short term capital gain other than referred to in section 111A (4 5) Long term capital gain 1. Asset in case of non-resident to which first proviso to section 48 applicable 2. Other assets for which option under proviso to section 112(1) not exercised a Full value of consideration 2a b Deductions under section 48 i Cost of acquisition after indexation bi ii Cost of improvement after indexation bii iii Expenditure on transfer biii iv Total (bi + bii +biii) biv c Balance (2a 2biv) 2c d Excemption under sections 54/54B/54D/54EC/54F 2d

1 0 0 0 0 0 0 0 0 2f 3 4 A5 A6 1

0 0 0 0 0

CAPITAL GAINS

0 0 0 0 0 0 2e 0

e Net balance (2c 2d) 3. Other assets for which option under proviso to section 112(1) exercised a Full value of consideration 3a

CAPITAL GAINS

b Deductions under section 48 i Cost of acquisition without indexation ii Cost of improvement without indexation iii Expenditure on transfer iv Total (bi + bii +biii) c Balance (3a biv) d Excemption under sections 54/54B/54D/54EC/54F e Net balance (3c-3d) Amount deemed to be long term capital gains under sections 4. 54/54B/54D/54EC/54ED/54F 5 Total long term capital gain (1 + 2e + 3e + 4) Income chargeable under the head CAPITAL GAINS (A4 + B5)

bi bii biii biv 3c 3d

0 0 0 0 0 0 3e 4 B5 C 0 0 0 0

Date i Up to 15/9 (i) ii 16/9 to 15/12 (ii) iii 16/12 to 15/3 (iii) iv 16/3 to 31/3 (iv) Date i Up to 15/9 (i) ii 16/9 to 15/12 (ii) iii 16/12 to 15/3 (iii) iv 16/3 to 31/3 (iv) Date i Up to 15/9 (i) ii 16/9 to 15/12 (ii) iii 16/12 to 15/3 (iii) iv 16/3 to 31/3 (iv)

STCG 111A 0 0 0 0 LTCG PROVISO 0 0 0 0 Lottery 0 0 0 0

STCG OTH 0 0 0 0 LTCG NO PROVISO 0 0 0 0

Schedule OS Income 1 Income other than from owning race horse(s):a Dividends, Gross 1a b Interest, Gross 1b c Rental income from machinery, plants, buildings, etc., 1c d Others, Gross (excluding income from owning race horses) 1d e Total (1a + 1b + 1c + 1d) f Deductions under section 57:i Expenses fi ii Depreciation fii iii Total fiii g Balance (1e fiii) 2 Winnings from lotteries, crossword puzzles, races, etc. 3 Income from other sources (other than from owning race horses) (1g + 2) 4 Income from owning and maintaining race horses a Receipts 4a b Deductions under section 57 in relation to (4) 4b c Balance (4a 4b) 5 Income chargeable under the head Income from other sources (3 + 4c) OTHER SOURCES

1e

0 0 1g 2 3 0 0

0 4c 5 0 0

NOTE Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head

Schedule CYLA

Sl.No

Head/ Source of Income

Details of Income after set-off of current years losses Other Income of sources loss current year House Current (other (Fill this property years than loss column only loss of the Income from race if income is current year remaining horses) of zero or set off after set off the current positive) year set off

CURRENT YEAR LOSS ADJUSTMENT

Total loss (C of Schedule HP) Loss to be adjusted 1 i Salaries ii House property iii Short-term capital gain iv Long term capital gain Other sources (incl profit from owning v race horses, winnings from lotteries added later) 0 0 0 0 2 0 0

Total loss (3 of ScheduleOS)

0 3 0 0 0 0 4=1-2-3 0 0 0 0

0 0

0 vi Total loss set-off Loss remaining after set-off vii

0 0 0

0 0 0

Schedule BFLA

BROUGHT FORWARD LOSS ADJUSTMENT

Sl. No.

Head/ Source of Income

i Salaries ii House property iii Short-term capital gain iv Long-term capital gain

Details of Income after Set off Brought Forward Losses of earlier years Income after set off, if any, of Current current Brought years years forward loss income losses as per set off remaining 4 of after set off Schedule CYLA) 1 2 3 0 0 0 0 0 0 0 0 0 0 0

BROUGHT FORWARD LO

Other sources v (including profit from owning race horses) 0 vi Total of brought forward loss set off Current years income remaining after set off vii Total (i3 +ii3 + iii3 + iv3+v3)

0 0

Note : Short Term Capital Loss Brought Forward will be adjusted against STCG and LTCG in the sequence of STCG Other than 111A, LTCG Non Proviso, STCG u/s 111A, LTCG Proviso to the extent of loss brought forward available for set off Please click on "Compute Set off" button on top to allow the utility to auto fill the Adjustment of Current Year and Brought Forward Loss in yellow fields .

Schedule CFL Sl. No. i ii iii iv v vi vii viii ix

CARRY FORWARD OF LOSS

Details of Losses to be carried forward to future Years Date of Assessmen House Short-term Long-term Filing t Year property loss capital loss Capital loss (DD/MM/ YYYY) 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 Total of earlier year losses Adjustmen t of above losses in ScheduleB FLA 2011-12 (Current year losses) Total loss Carried Forward to future 0 0 0

Other sources loss (other than loss from race horses)

Other sources loss (from owning race horses)

xi xii

0 0

0 0

0 0

0 0

Schedule VI-A Deductions under Chapter VI-A a 80C b 80CCC c 80CCD d 80CCF e 80D f 80DD g 80DDB h 80E i 80G j 80GG k 80GGA l 80GGC m 80QQB n 80RRB o 80U p Total Deductions :

System Calculated a b c d e f g h i j k l m n o 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 p 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

TOTAL DEDUCTIONS

Schedule SPI Income of specified persons(spouse, minor child etc) includable in income of the assessee Sl No Name of person PAN of person (optional) Relationship Nature of Income Amount (Rs) 1 2 3 0

Please clilck on Recalculate initially, and also subsequently if Gender, Date of Birth , Residential Status or Assessee Status (Indl / HUF etc) is changed Income chargeable to Income tax at special rates IB [Please see instruction Schedule SI Number-9(iii) for section code and rate of tax] Section SPECI System code Sr nos 1 to 4 AL Taxable Income calculated are auto filled RATE Sl Special rate Income after adjusting for tax thereon from Sch CG. No (%) i Min Chargeable to Enter rates for Sl Tax no 5 and 6 manually) 1 21 20 0 0 0 2 1A 15 0 0 0 3 22 10 0 0 0 4 5BB 30 0 0 0 5 1 10 0 0 0 6 DTAA 1 0 0 0 7 4A1 30 0 0 8 5A1b2 20 0 0 0 9 7A 30 0 0 10 7A 30 0 0 11 Total (1ii to 10 ii) 0 0 0

Please Click on Compute Tax button in Part B TI to re calculate Tax at Normal Rate and Tax at Special Rate

Schedule EI Details of Exempt Income (Income not to be included in Total Income) 1 Interest income 2 Dividend income 3 Long-term capital gains on which Securities Transaction Tax is paid Net Agriculture income(other than income to be excluded under rule 7, 7A, 7B 4 or 8) 5 Others, (including exempt income of minor child) 6 Total (1+2+3+4+5)

EXEMPT INCOME

1 2 3 4 5 6

0 0 0 0 0 0

Schedule ITDetails of Advance Tax and Self Assessment Tax Payments TA X PA Sl Date of Deposit Serial Number BSR Code Amount (Rs) YM No (DD/MM/YYYY) of Challan EN TS 1 2 3 4 5 1 2 3 4 5 6 NOTE Enter totals of Advance and Self Assessment tax in Sl No. 8a & 8c of PartB-TTI

Schedule TDS1

Details of Tax Deducted

Sl No 1 1 2 3

Tax Deduction Account Number (TAN) of the Deductor 2

Income Name of Deductor chargeable under Salaries 3 4

Total tax deducted 5

Schedule TDS2 Tax Deduction Account Number (TAN) of the Deductor 1 1 2 3 2

Details of Tax Deducted at Source on Income [As per Form 16 A issued by Deductor(s)] Amount out of (4) claimed for this year 5

Sl No

Name of Deductor

Total tax deducted 4

You might also like

- Bank of Chettinad in Ceylon in 1929 Nagarathar PerumaiDocument2 pagesBank of Chettinad in Ceylon in 1929 Nagarathar PerumaiN.PalaniappanNo ratings yet

- Pneumatics Symbols Din ISO 1219 PDFDocument4 pagesPneumatics Symbols Din ISO 1219 PDFN.Palaniappan100% (1)

- What Is A PPAP?: Frequently Asked Questions RegardingDocument4 pagesWhat Is A PPAP?: Frequently Asked Questions Regardingb_bhoopathyNo ratings yet

- Co-Ordinates HolesDocument1 pageCo-Ordinates HolesN.PalaniappanNo ratings yet

- Technical Information BoltDocument77 pagesTechnical Information BoltLivian TeddyNo ratings yet

- Select The Country Select The Corresponding Country, You Desire To Watch The TimeDocument2 pagesSelect The Country Select The Corresponding Country, You Desire To Watch The TimeN.PalaniappanNo ratings yet

- Hindu Tamil CalanderDocument11 pagesHindu Tamil CalanderN.PalaniappanNo ratings yet

- Screw ThreadsDocument2 pagesScrew ThreadsN.PalaniappanNo ratings yet

- The Current State of Worldwide Standards of Ductile IronDocument8 pagesThe Current State of Worldwide Standards of Ductile IronN.PalaniappanNo ratings yet

- Explanation of Surface RoughnessDocument8 pagesExplanation of Surface RoughnessN.Palaniappan100% (6)

- Material Data BaseDocument22 pagesMaterial Data BaseN.PalaniappanNo ratings yet

- MOLYBDEUM in DUCTILE IRONDocument5 pagesMOLYBDEUM in DUCTILE IRONN.Palaniappan100% (1)

- SQD-025 PPAP ChecklistDocument7 pagesSQD-025 PPAP ChecklistMadhan RajNo ratings yet

- Posters of Hole Diameter For All Type of ThreadsDocument1 pagePosters of Hole Diameter For All Type of ThreadsN.PalaniappanNo ratings yet

- Measurement of Mass and Weight by NPLDocument34 pagesMeasurement of Mass and Weight by NPLN.PalaniappanNo ratings yet

- Parallel Groove ClampsDocument5 pagesParallel Groove ClampsN.PalaniappanNo ratings yet

- GD&T Hierarachy PyramidDocument1 pageGD&T Hierarachy PyramidSunil BaliNo ratings yet

- The Measurement of Surface Texture by NPL LabDocument97 pagesThe Measurement of Surface Texture by NPL LabN.Palaniappan100% (1)

- FITTING HANDBOOK by FORMATYRA INIEZIONE POLIMERIDocument56 pagesFITTING HANDBOOK by FORMATYRA INIEZIONE POLIMERIN.PalaniappanNo ratings yet

- GTEM Cells For EMC Measurement by NPLDocument53 pagesGTEM Cells For EMC Measurement by NPLN.PalaniappanNo ratings yet

- GTEM Cells For EMC Measurement by NPLDocument53 pagesGTEM Cells For EMC Measurement by NPLN.PalaniappanNo ratings yet

- Magic SquareDocument9 pagesMagic SquareN.PalaniappanNo ratings yet

- mgpg11 - A Beginner's Guide To Uncertainty of Measurement by Stephanie BellDocument41 pagesmgpg11 - A Beginner's Guide To Uncertainty of Measurement by Stephanie Bellarylananyla100% (2)

- Data Chart For Threads by MARYLANDDocument71 pagesData Chart For Threads by MARYLANDN.Palaniappan100% (6)

- PPAP ChecklistDocument2 pagesPPAP ChecklistN.Palaniappan50% (2)

- PPAPDocument16 pagesPPAPOsvaldo Da Silva Neto100% (1)

- PIPED GAS - SafetyDocument2 pagesPIPED GAS - SafetyN.PalaniappanNo ratings yet

- Valve Material SpecificationDocument5 pagesValve Material Specificationapi-9572051No ratings yet

- PPAPDocument51 pagesPPAPGuru PrasadNo ratings yet

- Armacoil Catalog HelicoilDocument28 pagesArmacoil Catalog Helicoilmishnator666No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- Business Transfer Tax MidcmuDocument13 pagesBusiness Transfer Tax MidcmuEricaNo ratings yet

- Payslip 2022 2023 9 Inf0047318 ISSINDIADocument1 pagePayslip 2022 2023 9 Inf0047318 ISSINDIAManohar NMNo ratings yet

- Estate Tax Documentary RequirementsDocument4 pagesEstate Tax Documentary RequirementsBINAYAO NAIZA MAENo ratings yet

- Adyen Invoice BR202111001041.Company - Frubana BRDocument2 pagesAdyen Invoice BR202111001041.Company - Frubana BRBruno Tescaro RomaNo ratings yet

- Microsoft Word - eBTax Lab 03Document4 pagesMicrosoft Word - eBTax Lab 03Ur's RangaNo ratings yet

- TAX Quiz 30Document2 pagesTAX Quiz 30LanceNo ratings yet

- Gallantry Awards Income Tax ExemptionDocument2 pagesGallantry Awards Income Tax Exemptionnavdeepsingh.india8849100% (10)

- Taxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxDocument32 pagesTaxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxnikkiNo ratings yet

- Worksheet 5 q2 TaxationDocument15 pagesWorksheet 5 q2 TaxationAllan TaripeNo ratings yet

- Boldfit Shoe BagDocument1 pageBoldfit Shoe BagSundeep ChebroluNo ratings yet

- Indian Oil Corporation Limited: Supplier ConsigneeDocument1 pageIndian Oil Corporation Limited: Supplier ConsigneeMONTUPRONo ratings yet

- Self Employed DocumentDocument11 pagesSelf Employed DocumentapproachdirectNo ratings yet

- Question 1: Ias 8 Policies, Estimates & Errors: Page 1 of 3Document3 pagesQuestion 1: Ias 8 Policies, Estimates & Errors: Page 1 of 3Bagudu Bilal GamboNo ratings yet

- DocumentDocument2 pagesDocumentVikas ENo ratings yet

- CIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Document4 pagesCIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Kath Leen100% (1)

- Invoice PDFDocument1 pageInvoice PDFHaan 7100% (1)

- Cipla Limited Cipla House Lower Parel: Payslip For The Month of NOVEMBER 2021Document2 pagesCipla Limited Cipla House Lower Parel: Payslip For The Month of NOVEMBER 2021Dhruv RanaNo ratings yet

- Ein - Techcyrus, LLC (2414058)Document2 pagesEin - Techcyrus, LLC (2414058)mayajain1No ratings yet

- Web Payslip 332429 202305 PDFDocument3 pagesWeb Payslip 332429 202305 PDFN.SATHYAMOORTHY MoorthyNo ratings yet

- Service Description: Internet Access ServiceDocument1 pageService Description: Internet Access ServiceYatnaNo ratings yet

- ACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertDocument77 pagesACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertTawanda Tatenda Herbert100% (4)

- Chapter 1 of Introduction With Margin 1111-1-2Document33 pagesChapter 1 of Introduction With Margin 1111-1-2YogiNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment SystemJinkieNo ratings yet

- Elisa Zhllima - Microthesis 2022Document40 pagesElisa Zhllima - Microthesis 2022Elisa ZhllimaNo ratings yet

- Employees Compensation DetailsDocument2 pagesEmployees Compensation DetailsS Prem NathNo ratings yet

- Valuation of PerquisitesDocument9 pagesValuation of PerquisitesAbhishek ChandorkarNo ratings yet

- Suggested Answers in Taxation Law Bar Examinations 1994 2006 PDFDocument86 pagesSuggested Answers in Taxation Law Bar Examinations 1994 2006 PDFGregorio AustralNo ratings yet

- PICPA Building, 700 Shaw BLVD., Mandaluyong City: Philippine Institute of Certified Public AccountantsDocument1 pagePICPA Building, 700 Shaw BLVD., Mandaluyong City: Philippine Institute of Certified Public AccountantsAisa CastilloNo ratings yet

- Part III Exam Result 2018, Kumaun University Nainital, UttarakhandDocument1 pagePart III Exam Result 2018, Kumaun University Nainital, UttarakhandShashank SharmaNo ratings yet