Professional Documents

Culture Documents

U.S. Fire Court Bond

Uploaded by

anon_529589942Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

U.S. Fire Court Bond

Uploaded by

anon_529589942Copyright:

Available Formats

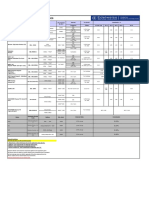

APPLICATION FOR JUDICIAL BOND

Surety One

Email: Underwriting@SuretyOne.org | Facsimile: 919-834-7039 | Mail: P.O. Box 37284, Raleigh, NC 27627

Applying for a bond is like applying for credit, therefore, please provide the following: Application Please make sure this information is complete and legible. Company financial statements (if applicable) Please provide the latest fiscal year end statements and current interim statement if over six months old Personal financial statements (below) All owners must provide a personal financial statement. Similar, current forms are acceptable Court documents Please provide all pertinent court documents to assist in our prompt underwriting

Applicant (Principal) Principal's Address SSN or Tax ID # Owners Home Address Email Applicant's Attorney Attorney Address Type of Bond Requested Plaintiff Bond to be filed in the Court of City Bond Amount $ Defendant County, State of Explain Purpose of Bond Phone If Applicant is a Privately-held company; Owners Full Name City Owner SSN State Owner Home Phone Attorney Phone State Zip Zip City Email Address State Zip

Amount of liability, claim judgment and/or value of property in controversy $ Does the business or any principal involved: if yes, attach an explanation Have any outstanding collection items or liens? Ever failed in business or declared bankruptcy? Yes Yes No No

Had any lawsuits or judgments against them? Ever had a license or bond cancelled or denied?

Yes Yes

No No

Agency Contact

Agency Contact Address Phone Mobile Fax Email

Agency Recommendation

We are not familiar with the applicant Applicant has been referred to us for bond placement The agency writes all Applicants insurance and we highly recommend Other

Indemnification Agreement - Read Carefully and Sign

IN CONSIDERATION of the execution of the bond for which application is made, the undersigned (collectively, Applicant) for themselves, their personal representatives, heirs, successors and assigns, hereby agree with, warrant and represent to, and bind themselves jointly and severally to, United States Fire Insurance Company and its co-sureties, re-insurers, and any other company which may execute a bond or bonds at the request of United States Fire Insurance Company (the surety) as follows: 1. Applicant agrees to pay the surety an advanced premium for the first year or a fractional part thereof that is earned and the amount due annually thereafter in accordance with the suretys then current premium rates or any minimum earned premium until the surety shall be discharged or released from any and all liability and responsibility under said bond, and all matters arising therefrom, and until competent written legal evidence of such discharge or release, satisfactory to the surety, is furnished to the surety. Applicant agrees that the surety may make any credit checks, including consumer and investigative credit checks, it deems necessary. Applicant warrants and represents that the questions answered and information furnished in connection with the application are true and correct. Applicant agrees to indemnify and keep indemnified the surety and its agents and representatives and hold and save it them harmless from and against any and all liability, damage, loss, cost and expense of whatsoever kind or nature, including consul and attorneys fee, which the surety or its agents or representatives may at any time sustain or incur by reason or in consequence of have executed or procured the execution of the bond or enforcing this agreement against any of the undersigned or in procuring or in attempting to procure its release from liability under the bond. If the surety shall set up a reserve to cover any liability, claims, suit or judgment under said bond, the undersigned will, immediately upon demand, deposit with the surety a sum of money, equal to such reserve and any increase thereof, to be held by the surety as collateral security on said bond. Any such collateral shall be available, in the discretion of the surety, as collateral security on any other or all bonds heretofore or hereafter executed for at the requests of any of the undersigned.

2. 3. 4.

5.

6.

If the surety shall procure any other company or companies to execute or join with it in executing, or to reinsure said bonds, this instrument shall insure to the benefit of such other company or companies, its or their successors and assigns, so as to give it or them a direct right of actions against the indemnitors to enforce the provisions of this instrument. An itemized statement of payments made by the surety, sworn to by an officer of the surety, shall be prima facie evidence of the liability of the undersigned to reimburse the surety for such payments with interests. The surety in it sole discretion and without notice to the undersigned, is hereb y authorized but not required from time to: (a ) make or consent to any change in said bond or to issue any substitutes for any renewal thereof, and this instrument shall apply to such substituted or changed bond or renewal; (b) take such act ion as it may deem appropriate to prevent or minimize loss under said bond, including but not limited to steps to procure discharge from liability under said bonds, and (c) adjust, settle or compromise any claim or suit arising under said bond and, with respect to any such claims or suits, to take any action it may deem appropriate and any adjustment, settlement or compromise made or action taken by the surety shall be conclusive against and binding upon the undersigned. Each of the undersigned agrees to pay the full amount of the foregoing regardless of (a) the failure of the principal or any applicant or indemnitor to sign any such bond or (b) any claims that other indemnity, security or collateral was to have been obtained or (c) the release, return or exchange by the surety with or without the consent of the undersigned, of any indemnity, security, or collateral that may have been obtained or (d) the fact that any party signing this instrument is not bound for any reason.

7. 8.

9.

10. The undersigned hereby expressly waive notice from the surety of any claims or demand made against the surety or the principal under the bond or of any information the surety may receive concerning the principal, any contract, or bond. The surety shall have the right to decline any or all bonds herein applied for and shall have the right to withdraw from or cancel the same at any time, all without incurring any liability to the undersigned. 11. Whenever used in this instrument the plural term shall include the singular and the singular shall include the plural, as the circumstances require. If any portion of this agreement be in conflict with any law controlling the construction hereof, such portion of this instrument shall be considered to be deleted and the remainder shall continue in full force and effect. A facsimile of this Agreement shall be considered an original and shall be admissible in a court at law to the same extent as an original copy. 12. All obligations of the principal, applicants, and indemnitors to the surety are due, payable, and performable in Houston, Harris County, Texas, where venue of any action to enforce this agreement may be brought by the surety. The surety shall be entit led to recover all attorneys fees (including those of attorneys employed by the surety), consulting fees, and claims adjustment expenses in defending any claims made against its bonds or in enforcing any of its rights under this Agreement. 13. In consideration of the execution by the surety of the suretyship herein applied for, each of the undersigned, jointly and severally, agree to be bound by all of the terms of the foregoing indemnity agreement executed by the applicant, as fully as though each of the undersigned were the sole applicant named herein, and admit to being financially interested in the performance of the obligation, which the suretyship applied for is given to secure.

Important Signature Instructions If sole owner, applicant must sign as duly authorized representative. Spouse must sign as additional indemnitor below. If a general partnership, an authorized partner must sign as duly authorized representative. All authorized partners and spouses must sign as additional indemnitor below. If a corporation the president must sign as the authorized representative. All stockholders of 10% or more and spouses must sign as additional indemnitor below.

Signed and dated this __________ day of _____________________ , 20 _____ X

Print Applicant Name

(Principals authorized representative)

(Title)

Additional Indemnitors Witness: Witness: Witness: Witness: X X X X (Signature) (Signature) (Signature) (Signature) (Print Name) (Print Name) (Print Name) (Print Name)

-2-

You might also like

- A Guide to District Court Civil Forms in the State of HawaiiFrom EverandA Guide to District Court Civil Forms in the State of HawaiiNo ratings yet

- Constitution of the State of Minnesota — 1876 VersionFrom EverandConstitution of the State of Minnesota — 1876 VersionNo ratings yet

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- Constitution of the State of Minnesota — 1974 VersionFrom EverandConstitution of the State of Minnesota — 1974 VersionNo ratings yet

- Code Breaker; The § 83 Equation: The Tax Code’s Forgotten ParagraphFrom EverandCode Breaker; The § 83 Equation: The Tax Code’s Forgotten ParagraphRating: 3.5 out of 5 stars3.5/5 (2)

- The Artificial Person and the Color of Law: How to Take Back the "Consent"! Social Geometry of LifeFrom EverandThe Artificial Person and the Color of Law: How to Take Back the "Consent"! Social Geometry of LifeRating: 4.5 out of 5 stars4.5/5 (9)

- The Declaration of Independence: A Play for Many ReadersFrom EverandThe Declaration of Independence: A Play for Many ReadersNo ratings yet

- The Constitutional Case for Religious Exemptions from Federal Vaccine MandatesFrom EverandThe Constitutional Case for Religious Exemptions from Federal Vaccine MandatesNo ratings yet

- The Constitution of the United States of America: The Declaration of Independence, The Bill of RightsFrom EverandThe Constitution of the United States of America: The Declaration of Independence, The Bill of RightsNo ratings yet

- Lawfully Yours: The Realm of Business, Government and LawFrom EverandLawfully Yours: The Realm of Business, Government and LawNo ratings yet

- SF86 - 2011 (Short)Document63 pagesSF86 - 2011 (Short)Touba SadatNo ratings yet

- Land of the Free: The Most Important Legal Documents That Built America We Know Today: Key Civil Rights Acts, Constitutional Amendments, Supreme Court Decisions & Acts of Foreign PolicyFrom EverandLand of the Free: The Most Important Legal Documents That Built America We Know Today: Key Civil Rights Acts, Constitutional Amendments, Supreme Court Decisions & Acts of Foreign PolicyNo ratings yet

- To Hell, with the Irs!: To the Kingdom of Christ, It Cannot Come!From EverandTo Hell, with the Irs!: To the Kingdom of Christ, It Cannot Come!No ratings yet

- Indemnity Agreement For Surety Bail BondDocument1 pageIndemnity Agreement For Surety Bail Bondclayborn9100% (1)

- Sav 5188Document3 pagesSav 5188sopor,es painNo ratings yet

- Bid, Payment, and Performance Bonds 091125Document19 pagesBid, Payment, and Performance Bonds 091125JOHNNo ratings yet

- From Slavery to True Freedom: The Story of a so Called African American ManFrom EverandFrom Slavery to True Freedom: The Story of a so Called African American ManNo ratings yet

- Naked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsFrom EverandNaked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsNo ratings yet

- Selling Off Our Freedom The AnswerDocument20 pagesSelling Off Our Freedom The AnswerDan BartoNo ratings yet

- JACK'S HANDY GUIDE TO TRUSTS: Staying Out of CourtFrom EverandJACK'S HANDY GUIDE TO TRUSTS: Staying Out of CourtRating: 5 out of 5 stars5/5 (1)

- BankNOS InstructionsDocument5 pagesBankNOS InstructionsTimWeltingNo ratings yet

- Template With Cover PageDocument5 pagesTemplate With Cover PageChristine Manna100% (1)

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (14)

- Anti-SLAPP Law Modernized: The Uniform Public Expression Protection ActFrom EverandAnti-SLAPP Law Modernized: The Uniform Public Expression Protection ActNo ratings yet

- Fillable SPCDocument38 pagesFillable SPCrutbut100% (3)

- Constitutional Tax Structure: Why Most Americans Pay Too Much Federal Income TaxFrom EverandConstitutional Tax Structure: Why Most Americans Pay Too Much Federal Income TaxNo ratings yet

- The Legacy of Law: The Most Important Legal Documents That Built America We Know TodayFrom EverandThe Legacy of Law: The Most Important Legal Documents That Built America We Know TodayNo ratings yet

- Request Form Office of The OMBDocument1 pageRequest Form Office of The OMBΡομίρ Γιάνκκιλ100% (1)

- Murray Court OrderDocument12 pagesMurray Court OrderKenan FarrellNo ratings yet

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1151From EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1151No ratings yet

- Deed of Registered Mortgage 6.1.05Document25 pagesDeed of Registered Mortgage 6.1.05Satish KumarNo ratings yet

- N:Fal: : Nam-E - Ro (J:L :: PDocument5 pagesN:Fal: : Nam-E - Ro (J:L :: PChapter 11 DocketsNo ratings yet

- Private Reaffirmation of OathDocument1 pagePrivate Reaffirmation of OathSue RhoadesNo ratings yet

- Motion To DismissDocument81 pagesMotion To DismissTodd DeFeo0% (1)

- Navigating Failure: Bankruptcy and Commercial Society in Antebellum AmericaFrom EverandNavigating Failure: Bankruptcy and Commercial Society in Antebellum AmericaRating: 2 out of 5 stars2/5 (3)

- Banking Finance Policies and Procedures Manual ExtractDocument51 pagesBanking Finance Policies and Procedures Manual ExtractLovemore Tshuma100% (1)

- FS Form 1071 (Statement of Ownership)Document2 pagesFS Form 1071 (Statement of Ownership)Benne James100% (3)

- Maturity Claim (Form No.3825)Document3 pagesMaturity Claim (Form No.3825)PrasanthNo ratings yet

- Admiralty Jurisdiction and Amphibious TortsDocument13 pagesAdmiralty Jurisdiction and Amphibious TortsShubhrajit SahaNo ratings yet

- Phil-Am Gen Insurance Co. Vs Ramos GR No. L-20978Document2 pagesPhil-Am Gen Insurance Co. Vs Ramos GR No. L-20978Celver Joy Gaviola TampariaNo ratings yet

- Review Questions and ProblemsDocument6 pagesReview Questions and ProblemsCarlo GaliciaNo ratings yet

- Quiz On Cash and Cash Equivalents - Quiz 1 On Prelim Term PeriodDocument2 pagesQuiz On Cash and Cash Equivalents - Quiz 1 On Prelim Term PeriodMae Jessa67% (6)

- Alkene Reaction GuideDocument41 pagesAlkene Reaction GuideAbhishek Isaac MathewNo ratings yet

- CHEM 1315 Exam 3 Practice BDocument6 pagesCHEM 1315 Exam 3 Practice BmikamundkurNo ratings yet

- Bio-Inorganic ChemistryDocument66 pagesBio-Inorganic ChemistryPhalynxNo ratings yet

- MIT15 401F08 FinalDocument29 pagesMIT15 401F08 FinalfloatingbrainNo ratings yet

- Bao3403 - Tutorial Questions Session 1 - Chapter 1: A. ZeroDocument1 pageBao3403 - Tutorial Questions Session 1 - Chapter 1: A. Zero李佳南No ratings yet

- SCH 4U The Structure of BenzeneDocument21 pagesSCH 4U The Structure of Benzenediego.lopez1870No ratings yet

- Section A: Structured Questions (30 Marks) : Diagram 1Document6 pagesSection A: Structured Questions (30 Marks) : Diagram 1ndianaoNo ratings yet

- 2018 Level III Mock Exam 2 Questions PDFDocument60 pages2018 Level III Mock Exam 2 Questions PDFKeith LoNo ratings yet

- FD & Bond Brokerage July 20Document1 pageFD & Bond Brokerage July 20Yash SoniNo ratings yet

- Thermochemistry With GaussianDocument10 pagesThermochemistry With GaussianHenrique Caldas ChameNo ratings yet

- SBI Mutual FundDocument12 pagesSBI Mutual FundSriram MuthuNo ratings yet

- TRIDHARMA MARKETING CORPORATION Vs COURT OF TAX APPEALSDocument2 pagesTRIDHARMA MARKETING CORPORATION Vs COURT OF TAX APPEALSNFNLNo ratings yet

- Images Ebook Sample - Assessment.questions Ceilli Ceilli - English Ceilli - Set2Document26 pagesImages Ebook Sample - Assessment.questions Ceilli Ceilli - English Ceilli - Set2phyliciayapNo ratings yet

- Report #2 EASDocument5 pagesReport #2 EASVanessa NguyenNo ratings yet

- BiologyDocument6 pagesBiologyJeffrey TjokNo ratings yet

- 9701 s15 QP 13 PDFDocument16 pages9701 s15 QP 13 PDFAl BeruniNo ratings yet

- Effect of Acids N Bases On Tensile Strength of FibreDocument5 pagesEffect of Acids N Bases On Tensile Strength of FibreShubhangi67% (3)

- Indemnity Bond Affidavit DuplicateDocument6 pagesIndemnity Bond Affidavit DuplicateKirti Bhushan KapilNo ratings yet

- Chapter No.08 The Analysis and Valuation of Bonds - STDocument13 pagesChapter No.08 The Analysis and Valuation of Bonds - STBlue StoneNo ratings yet

- Fajan's RuleDocument19 pagesFajan's RuleSaransh GoyalNo ratings yet

- Benzene AnimationsDocument15 pagesBenzene AnimationsNico Agung NugrahaNo ratings yet

- AK Kieso Chapter 13-14Document106 pagesAK Kieso Chapter 13-14Desinta Putri100% (1)

- Mid Year ExaminationDocument25 pagesMid Year ExaminationJue MayaNo ratings yet

- Subprime Crisis: Sandipan Nandi Shamik Roy Uttiya DasDocument61 pagesSubprime Crisis: Sandipan Nandi Shamik Roy Uttiya DasUttiya DasNo ratings yet

- Class Problems Chapter 6 - Haryo IndraDocument3 pagesClass Problems Chapter 6 - Haryo IndraHaryo HartoyoNo ratings yet

- COMMERCIAL SECURITY AGREEMENT: #CPM-05202006-RA 600 756 856 US Debtor: John Philip Doe©Document21 pagesCOMMERCIAL SECURITY AGREEMENT: #CPM-05202006-RA 600 756 856 US Debtor: John Philip Doe©Nadah8100% (1)