Professional Documents

Culture Documents

Acctg 115 - CH 12 Solutions

Uploaded by

Mark Adel FaridOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acctg 115 - CH 12 Solutions

Uploaded by

Mark Adel FaridCopyright:

Available Formats

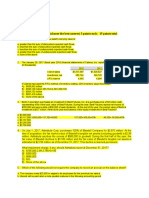

SOLUTIONS TO PROBLEMS SET A PROBLEM 12.

1A ATLANTIC AIRLINES

a.

ATLANTIC AIRLINES Income Statement For the Year Ended December 31, 20__ Net sales Costs and expenses (including income taxes on continuing operations) Income from continuing operations Discontinued operations: Operating income from motels (net of income tax) Gain on sale of motels (net of income tax) Income before extraordinary items Extraordinary loss: destruction of airliner by earthquake (net of income tax benefit) Net income $ 55,120,000 43,320,000 11,800,000

$ $ 864,000 4,956,000 $ $ $

5,820,000 17,620,000 (3,360,000) 14,260,000

Earnings per share of common stock: Earnings from continuing operations ($11,800,000 1,000,000 shares) Income from discontinued operations ($5,820,000 1,000,000 shares) Earnings before extraordinary items ($17,620,000 1,000,000 shares) Extraordinary loss ($3,360,000 1,000,000 shares) Net earnings ($14,260,000 1,000,000 shares)

11.80 5.82

$ $

17.62 (3.36) 14.26

b.

Estimated net earnings per share next year: Earnings per share from continuing operations Estimated decrease ($11.80 x 5%) Estimated net earnings per share next year The profitability of the motels is not relevant, as these motels are no longer are owned by Atlantic Airlines.

$ $

11.80 (0.59) 11.21

PROBLEM 12.2A SLICK SOFTWARE, INC.

a.

SLICK SOFTWARE, INC. Condensed Income Statement For the Year Ended December 31, 2007 Net sales Costs and expenses (including applicable income taxes) Income from continuing operations Discontinued operations: Operating income (net of income tax) Loss on disposal (net of income tax benefit) Income before extraordinary item Extraordinary loss (net of income tax benefit) Net income $ $ $ 140,000 (550,000) $ $ 19,850,000 16,900,000 2,950,000

(410,000) 2,540,000 (900,000) 1,640,000

Earnings per share: Earnings from continuing operations [($2,950,000 - $500,000*) 200,000 shares]

Loss from discontinued operations ($410,000 200,000 shares) Earnings before extraordinary items [($2,540,000 - $500,000 preferred dividends) 200,000 shares

12.25 (2.05) 10.20 (4.50) 5.70

Extraordinary loss ($900,000 200,000 shares) Net earnings [($1,640,000 - $500,000 preferred dividends) 200,000 shares] *Preferred dividends: 80,000 shares x $6.25 =$500,000

PROBLEM 12.2A SLICK SOFTWARE, INC. (concluded)

b.

SLICK SOFTWARE, INC. Statement of Retained Earnings For the Year Ended December 31, 2007 Retained earnings, December 31, 2006 As originally reported Less: prior period adjustment As restated Net income Subtotal Cash dividends Retained earnings, December 31, 2007

$ $ $ $

7,285,000 350,000 6,935,000 1,640,000 8,575,000 (950,000) 7,625,000

c. Total cash dividends declared during 2007 (data given) Less: Preferred stock dividend (80,000 shares x $6.25 per share) Cash dividends to common stockholders Number of common shares outstanding through 2007 Cash dividend per common share ($450,000 200,000 shares)

$ $ $

950,000 500,000 450,000 200,000 2.25

d.

The single 2008 $8.00 figure for EPS is unfavorable in comparison with 2007 performance. Since 2008 has only one EPS figure, it should be compared to the earnings per share from continuing operations in 2007, which amounted to $12.25 per share. Slick Software, Inc.s earnings per share from continuing operations fell $4.25 per share (approximately 35%) from 2007 to 2008.

You might also like

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- The Passage of HJR 192 PDFDocument3 pagesThe Passage of HJR 192 PDFKeith Muhammad: BeyNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- Consolidated Financial Statements of Prather Company and SubsidiaryDocument7 pagesConsolidated Financial Statements of Prather Company and SubsidiaryImelda100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Sol. Man. - Chapter 2 - Statement of Comprehensive IncomeDocument15 pagesSol. Man. - Chapter 2 - Statement of Comprehensive IncomeKATHRYN CLAUDETTE RESENTE100% (1)

- Marketing Summary Chapter 1Document8 pagesMarketing Summary Chapter 1hamanNo ratings yet

- Chapter 17 - Consol. Fs Part 2Document6 pagesChapter 17 - Consol. Fs Part 2PutmehudgJasdNo ratings yet

- 04 Fischer10e SM Ch04 FinalDocument79 pages04 Fischer10e SM Ch04 FinalSoc MontemayorNo ratings yet

- Taxation-for-Development-Narrative-Report Final ReportDocument40 pagesTaxation-for-Development-Narrative-Report Final ReportJackNo ratings yet

- Passive Infrastructure Sharing in TelecommunicationsDocument16 pagesPassive Infrastructure Sharing in Telecommunicationsmib_santosh67% (3)

- Accounting assignment - Income statements and discontinued operationsDocument7 pagesAccounting assignment - Income statements and discontinued operationshananNo ratings yet

- Financial Accounting - Tugas 5 - 30 Oktober 2019Document3 pagesFinancial Accounting - Tugas 5 - 30 Oktober 2019AlfiyanNo ratings yet

- Introduction of Investment BankingDocument18 pagesIntroduction of Investment Bankingshubham100% (2)

- Final Exam Engineering EconomyDocument2 pagesFinal Exam Engineering EconomyGelvie Lagos100% (2)

- Practice Exam Chapters 1-5 (1) Solutions: Problem IDocument5 pagesPractice Exam Chapters 1-5 (1) Solutions: Problem IAtif RehmanNo ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNo ratings yet

- P7-23 Eliminations For Upstream SalesDocument18 pagesP7-23 Eliminations For Upstream SalesMirza Khairul RezaNo ratings yet

- Week 2 Homework (Chap. 4) - PostedDocument4 pagesWeek 2 Homework (Chap. 4) - PostedMs. Nina100% (5)

- Intermediate Accounting Exam 3 SolutionsDocument7 pagesIntermediate Accounting Exam 3 SolutionsAlex SchuldinerNo ratings yet

- ACCT311 Chapter 4 SolutionsDocument10 pagesACCT311 Chapter 4 SolutionsSThomas070884No ratings yet

- Practice Exam Chapters 1-5 (2) Solutions: Problem IDocument4 pagesPractice Exam Chapters 1-5 (2) Solutions: Problem IAtif RehmanNo ratings yet

- Reed Company 2023 Profit or Loss StatementDocument16 pagesReed Company 2023 Profit or Loss StatementSarah Nelle PasaoNo ratings yet

- Chapter 12 ProblemsDocument40 pagesChapter 12 ProblemsInciaNo ratings yet

- Managerial AccountingDocument25 pagesManagerial AccountingBelle SaenyeaNo ratings yet

- Tugas Akl 2Document7 pagesTugas Akl 2Kukuh HariyadiNo ratings yet

- Consolidated financial statements of Pal CorporationDocument5 pagesConsolidated financial statements of Pal CorporationfebbiniaNo ratings yet

- Akl1 Week 6Document2 pagesAkl1 Week 6tolha ramadhaniNo ratings yet

- Division Denver Tacoma: Tacoma Should Be Continued Since, Net Income Losses Decreases by $1,400Document2 pagesDivision Denver Tacoma: Tacoma Should Be Continued Since, Net Income Losses Decreases by $1,400Clarence MenezesNo ratings yet

- FFM 9 Im 12Document31 pagesFFM 9 Im 12Mariel CorderoNo ratings yet

- Equity Method Workpaper Entries and Consolidated Financial Statements for Porter Company and SubsidiaryDocument8 pagesEquity Method Workpaper Entries and Consolidated Financial Statements for Porter Company and SubsidiaryIndra PramanaNo ratings yet

- IA3 AssignmentDocument7 pagesIA3 AssignmentJaeNo ratings yet

- SCM Lec 2Document67 pagesSCM Lec 2Star KerenzaNo ratings yet

- Prepare Single-Step Income StatementDocument4 pagesPrepare Single-Step Income StatementPulkit MahajanNo ratings yet

- Answers To Week 1 HomeworkDocument6 pagesAnswers To Week 1 Homeworkmzvette234No ratings yet

- Assignment1_Profit and loss exercise E financeDocument8 pagesAssignment1_Profit and loss exercise E financees.eldeebNo ratings yet

- Operating Expenses:: Reed CompanyDocument8 pagesOperating Expenses:: Reed CompanySarah Nelle PasaoNo ratings yet

- Soal Kuis 2Document6 pagesSoal Kuis 2Rahajeng SantosoNo ratings yet

- Ia-Problem-Solving PartDocument4 pagesIa-Problem-Solving PartCrystallhyn Joy AntonioNo ratings yet

- Replacement Examples ImportantDocument7 pagesReplacement Examples Importantsalehin1969No ratings yet

- Asdos Jawaban 2Document3 pagesAsdos Jawaban 2mutiaoooNo ratings yet

- Parnevik Corp Income Statement Analysis 2010 Net Income EPSDocument4 pagesParnevik Corp Income Statement Analysis 2010 Net Income EPSkoftaNo ratings yet

- Balucan InAcc 3 Week2 Part 2Document2 pagesBalucan InAcc 3 Week2 Part 2Luigi Enderez BalucanNo ratings yet

- Practice Exam Chapters 1-4 Solutions: Problem IDocument6 pagesPractice Exam Chapters 1-4 Solutions: Problem IJesse NgaliNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Chapter 15 - Bus. Combination Part 3Document8 pagesChapter 15 - Bus. Combination Part 3PutmehudgJasdNo ratings yet

- Solution Aassignments CH 12Document7 pagesSolution Aassignments CH 12RuturajPatilNo ratings yet

- AKL 2 - Tugas 5 Marselinus A H T (A31113316)Document4 pagesAKL 2 - Tugas 5 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- Practice Exam Chapters 1-8 Solutions: Problem 1Document7 pagesPractice Exam Chapters 1-8 Solutions: Problem 1Atif RehmanNo ratings yet

- Assignment 1 Fall 2017Document3 pagesAssignment 1 Fall 2017YaseenTamerNo ratings yet

- ASE 3902 - IAS - Revised Syllabus - Answers To Specimen Paper 2008 16307Document8 pagesASE 3902 - IAS - Revised Syllabus - Answers To Specimen Paper 2008 16307WinnieOngNo ratings yet

- Homework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Document3 pagesHomework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Caroline OktavianiNo ratings yet

- Homework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Document6 pagesHomework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Dawna Lee BerryNo ratings yet

- Tutorial 2Document10 pagesTutorial 2Shah ReenNo ratings yet

- Chaechapter 7 SolutionsDocument16 pagesChaechapter 7 Solutionsmadddy_hydNo ratings yet

- Final Exam Review Income StatementDocument9 pagesFinal Exam Review Income StatementFatima SNo ratings yet

- Sol ch13Document6 pagesSol ch13Kailash KumarNo ratings yet

- Brokaw Corp financial statements 2010Document1 pageBrokaw Corp financial statements 2010Asma HatamNo ratings yet

- ACCCOB3Document10 pagesACCCOB3Jenine YamsonNo ratings yet

- Cash FlowsDocument7 pagesCash FlowsJasmine ActaNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- Analyzing Adjusting Entries and Financial StatementsDocument12 pagesAnalyzing Adjusting Entries and Financial StatementsTuba AkbarNo ratings yet

- Soha Balance SheeDocument7 pagesSoha Balance SheeMohamed ZaitoonNo ratings yet

- CVP Analysis Class Exercise SolutionsDocument4 pagesCVP Analysis Class Exercise Solutionsaryan bhandariNo ratings yet

- Liberty - March 7 2022Document1 pageLiberty - March 7 2022Lisle Daverin BlythNo ratings yet

- Seven Year Water Planning Insights (2014-2020Document110 pagesSeven Year Water Planning Insights (2014-2020reghuNo ratings yet

- Fundamentals of Accountancy Income StatementsDocument22 pagesFundamentals of Accountancy Income Statementskhaizer matias100% (1)

- #4 Assignment Description (Ch. 7-8)Document5 pages#4 Assignment Description (Ch. 7-8)Karan BhavsarNo ratings yet

- Multiple choice and short problems on accounting topicsDocument7 pagesMultiple choice and short problems on accounting topicsKenny BrownNo ratings yet

- Cma 051812Document16 pagesCma 051812Beer0% (1)

- 27 DT Case LawsDocument26 pages27 DT Case LawsVishakha MangtaniNo ratings yet

- Generic Engineering PreesentationDocument50 pagesGeneric Engineering Preesentationshailesh1978kNo ratings yet

- Rakon 2007 Annual ReportDocument64 pagesRakon 2007 Annual Reportjjmaloney100% (3)

- Curriclum Revised 1st DraftDocument73 pagesCurriclum Revised 1st Draftamaruthivaraprasad100% (1)

- Sector 3: Banking and Financial Services: Chapter ContentsDocument20 pagesSector 3: Banking and Financial Services: Chapter ContentsAmartya Bodh TripathiNo ratings yet

- Chapter 10 PPE Accounting ProblemsDocument4 pagesChapter 10 PPE Accounting ProblemsJudithRavelloNo ratings yet

- Trade War Between China and USDocument5 pagesTrade War Between China and USShayan HiraniNo ratings yet

- (Centre For Central Banking Studies Bank of EnglandDocument54 pages(Centre For Central Banking Studies Bank of Englandmalik naeemNo ratings yet

- by Adarsh Mishra Report On Marketing Mix Promotional Strategies at IDBI Federal Lfe Insurance Final Report PDFDocument76 pagesby Adarsh Mishra Report On Marketing Mix Promotional Strategies at IDBI Federal Lfe Insurance Final Report PDFRtr Ebenezar Stanley JNo ratings yet

- Doddaballapura TalukDocument97 pagesDoddaballapura TalukAkhilesh JainNo ratings yet

- Fma CH 1 IntroductionDocument32 pagesFma CH 1 IntroductionHabtamuNo ratings yet

- Selfridges - Company CapsuleDocument14 pagesSelfridges - Company Capsulekidszalor1412No ratings yet

- Accounting For Bonus Issue: By: Ca Parveen JindalDocument10 pagesAccounting For Bonus Issue: By: Ca Parveen Jindalphani chowdaryNo ratings yet

- Kenya Uganda unlock trade barriersDocument32 pagesKenya Uganda unlock trade barriersgangruka0% (1)

- John Adam ST (21) : The Business Exchange Douglas LlambiasDocument1 pageJohn Adam ST (21) : The Business Exchange Douglas LlambiasJohn Adam St Gang: Crown ControlNo ratings yet

- MIF Group 1 AnswersDocument3 pagesMIF Group 1 AnswersEryn GabrielleNo ratings yet

- Standalone Balance Sheet (Tata Motors) : AssetsDocument43 pagesStandalone Balance Sheet (Tata Motors) : AssetsAniketNo ratings yet

- SIDBIDocument14 pagesSIDBIjyotigupta90No ratings yet