Professional Documents

Culture Documents

Non-Linear Stochastic Fractional Programming Model of Financial Derivatives

Uploaded by

Akhil Kumar SomOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Non-Linear Stochastic Fractional Programming Model of Financial Derivatives

Uploaded by

Akhil Kumar SomCopyright:

Available Formats

Non-Linear Stochastic Fractional Programming Model of

Financial Derivatives

V.Charles

Department of Management Science

SDM Institute for Management Development, Mysore

Karanataka, India 570 011. Ph: 9885430036.

D.Dutta

Department of Mathematics & Humanities

National Institute of Technology Warangal

A.P.,India 506 004. Ph: 91-870-2468820.

Email : v_chals@yahoo.com & ddutta@nitw.ernet.in

Abstract

Non-Linear Stochastic Fractional programming models provide numerous insights into a

wide variety of areas such as in financial derivatives. Portfolio optimization has been one

of the important research fields in modern finance. The most important character within

this optimization problem is the uncertainty of the future returns on assets. The objective

of this study is to achieve a maximum profit with minimum investment in the share

market. In this paper, we have discussed about linear and nonlinear stochastic fractional

programming problems with mixed constraints, which is the key aspect of this model.

The application of the model is discussed with an example.

Key words: Stochastic Programming, Fractional Programming, Financial Derivatives.

Introduction

Let us define what are financial derivatives. A derivative is a financial instrument whose

value is derived from the price of a more basic asset called the underlying. The

underlying may not necessarily be a tradable product. Examples of underlying are stock

market indices, shares, commodities, currencies, credits, weather temperatures, sunshine,

results of sport matches, wind speed and so on. Basically, anything that may have a

certain degree of an unpredictable effect on any business activity can be considered as an

underlying of a certain derivative. The most popular derivative is stock option.

Before we discuss about stock option, one should know what is an investment? An

investment is a sacrifice of current money for future benefits, Prasanna (2002). Now a

days number of avenue of investment are available. One can have chances of investing

the money in the following form, deposit money in a bank account or purchase a long-

term government bond or invest in the equity shares of a company or contribute to

provident fund account or buy a stock option or acquire a plot of land.

Very important attributes of any investment are time and risk. The sacrifice takes place

now and is certain. The benefit is expected in the future and tends to be uncertain and

here the stochastic nature is peeping in to picture. One can find the stochastic models in

Robert A. Strong (2003) and Sen et al. (1999). In some investment, the time element is

the vital attribute and in some investment the risk factor is the vital attribute. For

example, in government bonds, time place a vital role whereas in stock option, risk

matters.

In this paper we have designed a model, which helps us to place minimum investment on

the stock market to achieve maximum profit in single period. The model has been derived

from the concepts of stochastic fractional programming (SFP) Charles and Dutta (2004a,

2004b) and Sen et al. (1999). The SFP is having wide spread of applications, some of

them can be found in Jeeva et al. (2002,2004).

This paper has been classified into seven sections. The first and second section deals with

preliminary financial concepts and optimal portfolio. In Section three and four we have

discussed about linear and non-linear stochastic fractional programming with mixed

constraints. The model description has been given in section five and section six deals

with portfolio optimization. The application of the model and the required algorithm with

numerical example are given in section seven.

1. Financial Concepts

In this section we briefly recall a number of fundamental financial concepts, A financial

derivative is a security whose value is derived by an underlying asset. The most popular

financial derivative is the stock option very well known as contingent claim. An

option is a right negotiated between two parties to buy or sell an asset at a later date or a

price agreed now or certain price, called the exercise or strike price.

A call option give the buyer the right to buy a specified number of shares of a certain

stock at any time at or before the expiration date. Once the option has been exercised,

the buyer of the call option profits and the writer loses if the market value of the stock

rises above the exercise price by an amount exceeding the original amount paid for the

option. e.g., if the price of the call is Rs.10 and the exercise price is Rs.80, the buyer

would gain if the price of the stock were above Rs.90 at expiration.

A put option provides the buyer with the right to sell shares at any time within the

option period at the exercise price. The buyer of the put profits if the market value of the

stock when the put is exercised is below the exercise price by more than the original cost

of the put. e.g., if the price of the put is Rs.10 and the exercise price is Rs.80, the put

buyer would gain if the stock price were below Rs.70 at expiration.

An option that can only be exercised at the expiration date is called a European option

whereas an option that can be exercised at or before expiration is referred to as an

American option. in-the-money options - where the exercise price is below the stock

price, i.e., provides a positive payoff for the owner of the contract. out-of-the-money

or underwater options - where the exercise price is above the stock price, i.e., does not

provide a positive payoff. at-the-money options - where the exercise price equal the

stock price, i.e. no payoff. Bermudan option can be exercised prior to maturity but on

certain pre-determined days. Options are also used to manage the risk investment

portfolios, so that wild upward or downward swings are minimized.

2. Optimal Portfolio

Portfolio theory deals with the problem of how to allocate wealth among several assets

(stocks, bounds), many of which have an unknown outcome. Some of the model

portfolios can be found in Sudhir Malik (2003). The optimization problem on portfolio

selection, portfolio optimization problem, has been one of the important research fields in

modern finance. The most important character within this optimization problem is the

uncertainty of the future returns on assets. Generally speaking, an investor always prefers

to have the return on their portfolio as large as possible. At the same time, he also wants

to make the risk as small as possible. However, some investors pursue a high return even

though it is accompanied with a higher risk. Markowitz presented the basic theory of

portfolio optimization in his pioneering article Markowitz (1952). By employing the

standard deviation and expected value of the asset as the representation of return,

Markowitz (1952) introduced the famous mean-variance model, which has been regarded

as a quadratic programming problem.

3. Linear Stochastic Fractional Programming Problem (LSFPP)

Linear Stochastic Fractional programming supports decision making under uncertainty. It

is a methodology for bringing uncertain future scenarios into the traditional decision

making framework of linear programming. Stochastic fractional programming model is

an optimization problem in which the allocation of today's resources will meet

tomorrow's unknown returns in such a way that the user can explore the trade offs with

respect to expected risks and rewards and make informed decisions.

Let us consider LSFPP as defined in Charles and Dutta (2001a, 2001b, 2002),

Min Z(X) =

+

+

) (

) (

X D

X N

(3.1)

Subject to

Pr (

=

n

j 1

tij xj bi

) 1-p

i

(3.2)

Where T

mxn

= || tij

||, X

nx1

= || xj

||, b

mx1

= || bi

||, i =1,2,..,m ; j =1,2,..,n. and are scalars.

In this model, atleast one of T, N(X)=

=

n

j 1

cjxj

, D(X)=

=

n

j 1

djxj

or b is random in nature

and X is deterministic decision variable. Let S = { X Pr (

=

n

j 1

t

ij

x

j

b

i

) 1-p

i

, X 0,

X R

n

} be the non-empty convex set.

4. Non-linear Stochastic Fractional Programming Problem (NLSFPP)

Non-Linear Stochastic fractional programming deals with a class of optimization models

and algorithms in which some of the data may be subject to significant uncertainty with

non-linear fractional objective. Such models are appropriate when data evolve over time

and decisions need to be made prior to observing the entire data stream. For instance,

investment decisions in portfolio planning problems must be implemented before stock

performance can be observed.

Let us consider NLSFPP of the first form

Min Z(X) =

+

+

) (

) (

X D

X N

(4.1)

Subject to

Pr (

=

n

j 1

t

ij

x

j

b

i

) 1-p

i

(4.2)

Where T

mxn

= || t

ij

||, X

nx1

= || x

j

||, b

mx1

= || b

i

||, i =1,2,..,m ; j =1,2,..,n. and are scalars.

In this model, atleast one of T, N(X)=

=

n

j 1

c

j

x

j

2

, D(X)=

=

n

j 1

d

j

x

j

or b is random in nature

and X is deterministic decision variable. Let S = { X Pr (

=

n

j 1

t

ij

x

j

b

i

) 1-p

i

, X 0,

X R

n

} be the non-empty convex set.

4.1. NLSFPP with Mixed Constraints

Let us consider NLSFPP of the form

Min Z(X) =

+

+

) (

) (

X D

X N

(4.3)

Subject to

Pr (

=

n

j 1

t

ij

x

j

b

i

) 1-p

i

(4.4)

along with the deterministic constraints as defined in Charles and Dutta (2002, 2003,

2004b)

=

n

j 1

r

kj

x

j

b

rk

(4.5)

where T

mxn

= || t

ij

||, X

nx1

= || x

j

||, b

mx1

= || b

i

||, b

r

hx1

= || b

rk

||, i =1,2,..,m ; j =1,2,..,n;

k=1,2,..,h. In this model T and b are random in nature and X is deterministic decision

variable. Let S = {X Pr (

=

n

j 1

t

ij

x

j

b

i

) 1-p

i

, X 0, XR

n

} be the non-empty convex

set.

5. Model Description

The model described in Markowitz (1952), assumes a series of steps between a writer and

buyer of an options contract:

1. At the beginning of the period, a contract writer sells an option to the buyer and

receives F

0

.

2. With this F

0,

the writer invests the money into the market which consists of

securities X={x

1

, x

2

, x

3

,,x

n

}, until the end of the period.

3. At the end of the period, if the options are in the money, the writer has to pay

out to the buyer.

5.1. Multi Period Model

In multi period model, F

0

is the value of the stock option and x

1

, x

2

, x

3

,,x

n

are the only

securities in the market. Among the available securities some of them are numeraire i.e

riskless and the other securities are having some sorts of risk. The mathematical

formulation of the prescribed model as follows

Maximize E[C

t

X

t

] (5.1)

Subject to C

o

X

0

F

0

(5.2)

C

t

[X

0

-X

t

] F

t

(5.3)

C

t

X

t

0 (5.4)

where F

0

be the cost of the stock option, F

t

: payouts from buyer because of options, C

0

: the initial value of the securities, C

t

: the value of each stock at the end of the period and

X

0

: the amount held of each security.

The model depicts that C

t

, F

t

are random in nature. One can view the constraint (5.3) as

stochastic constraint with appropriate probability. By eliminating X

t

from the above multi

period model we can get the following one period model.

5.2. One Period Model

The one period model is of the form

Maximize E[C

t

X

t

] (5.5)

Subject to C

o

X

0

F

0

(5.6)

C

t

X

0

F

t

(5.7)

Constraint (5.7) has been obtained by adding constraints (5.3) with (5.4). Note that in this

model X

t

is totally eradicated. Still the stochastic nature is retained in this model. Here

constraint (5.6) is deterministic where as constraint (5.7) is probabilistic. The objective

function can be viewed as the terminal portfolio minus the expected payout. Notational

form: C

t

X

0

E[F

t

].

5.3. Option Valuation

The cost or value of the stock option, F

0

is an unknown variable. One can get the feasible

region in the linear programming by attempting to convert the one period model into

linear programming from and minimize F

0.

Minimize F

0

(5.8)

Subject to C

o

X

0

- F

0

0 (5.6)

C

t

X

0

F

t

(5.7)

Once F

0

is determined then one can obtain the optimal portfolio by substituting F

0

in the

one period model and solving it. This leads us to solve more than one problem.

6. Portfolio Optimization

In this section an attempt has been made to minimize the value of the stock option and

maximize the net profit with help of nonlinear fractional objective function subject to

mixed constraints. Let the model be of the form

Minimize

[ ]

[ ]

0

0

0

v

t

t

F C X

C X

E

+

+

(6.1)

Subject to C

o

X

0

- F

0

0 (6.2)

P[C

t

X

0

F

t

] 1-p

(6.3)

where

(0,1] and here the stochastic constraint (6.3) is designed with help of

constraint (5.7) and the concepts of Charles and Dutta (2001a, 2001b, 2004a). The

technical meaning of the constraint (6.3) is that it should atleast hold with probability not

less than 1-p. Where p (0,1]. We should note that C

t

and F

t

are random variables,

which are assumed to follow normal distribution. The above stochastic constraint can be

converted into deterministic form Charles and Dutta (2001a, 2003, 2004a), which is as

follows:

E[C

t

X

0

- F

t

] - k

1-p

\V|C

t

X

0

- F

t

] 0 (6.4)

Where k

1-p

is the table value of normal distribution at 1-p level. Once we obtain the

solution for the above problem, we can optimize the portfolios by substituting F

0

in the

following portfolio optimization model.

Maximize

[ ]

0 t

C X

E (6.5)

Subject to C

o

X

0

- F

0

0 (6.6)

E[C

t

X

0

- F

t

] - k

1-p

\V|C

t

X

0

- F

t

] 0 (6.7)

The profit of the portfolio model is

[ ]

0 t

C X

E -

[ ]

t F

E .

7. Application of the Model

Let us consider the application of this model for three securities, by creating example

with some hypothetical values for the stock prices.

Let C

0

= [c

0

(1)

,c

0

(2)

,c

0

(3)

] be the initial value of the stock price. Let us assume that the first

security is riskless whereas the second and third securities have high and medium risk.

Let C

t

= [c

0

(1)

,c

t

(2)

,c

t

(3)

] be the stock price at the end of the first period i.e. at time t, which

is usually liable to change with respect to time period. One can note that the first stock

price of C

0

and C

t

are same since it is assumed to be risk free security.

Let us also assume that for the second security, the value can go from c

0

(2)

at the start of

the period to c

1

(2)

, c

2

(2)

,or c

n1

(2)

each value having the probability 1/n

1.

For the third

security, the value can go from c

0

(3)

to c

1

(3)

, c

2

(3)

,or c

n2

(3)

, each with probability 1/n

2

. At

the end of the period the option allows the owner to buy second security at strike price

1

and third security at strike price

2

. One can observe that at the end of the period,

there will be n

1

*n

2

possible outcomes with each out come having probability 1/n

1

n

2

.

7.1. Algorithm to determine C

t

and F

t

Step 1: Read

1

,

2

Step 2: K = 0

Step 3: For i = { c

1

(2)

, c

2

(2)

,c

n1

(2)

}

For j = { c

1

(3)

, c

2

(3)

,c

n2

(3)

}

c

t

(1)

[K] = i

c

t

(2)

[K] = j

If i <

1

F

t1

= 0

Else

F

t1

=

1

- i

End If.

If j <

2

F

t2

= 0

Else

F

t2

=

2

- j

End If.

F

t

[k++] = F

t1

+ F

t2

End For.

End For.

Step 4: Stop.

7.2. Numerical Example

Now we will solve the proposed model numerically by considering the market data for

three securities, which is given in table 1. The initial values of the security in rupees be

C

0

= [591.8,218,25.8]. The values of

1

,

2

and

3

are Rs. 478, Rs.224 and Rs. 25

respectively. Here we should note that the first, second and third securities have high,

medium and low risks. Using the proposed algorithm in section 7.1 the following

expressions has been obtained.

<Place for Table 1 Which is given separately at the end>

E(C

t

X

0

) = 549.7375 x

1

+ 222.6375 x

2

+ 26.7535 x

3

(7.1)

V(C

t

X

0

) = 1356.9290 x

1

2

+ 111.8748 x

2

2

+ 1.6895 x

3

2

(7.2)

E(F

t

) = 77.2536 (7.3)

V(F

t

) = 1371.3870 (7.4)

V(CtX

0

- F

t

) = 1356.9290 x

1

2

+ 111.8748 x

2

2

+ 1.6895 x

3

2

+ 1371.3870 (7.5)

Minimize

[ ]

[ ]

0

0

0

v

t

t

F C X

C X

E

+

+

(7.6)

Subject to 591.8 x

1

+ 218 x

2

+ 25.8 x

3

- F

0

0 (7.7)

549.7375 x

1

+ 222.6375 x

2

+ 26.7535 x

3

1.28 \ (1356.9290 x

1

2

+ 111.8748 x

2

2

+

1.6895 x

3

2

+ 1371.3870) 77.2536

(7.8)

0< 1 (7.9)

Solving the above non-linear stochastic fractional programming problem we obtain the

following result. {

x

1

, x

2

, x

3

, F

0

,

}= {0.02963, 0.2422, 2.0442, 123.0843,1}.

Let us substitute F

0

value in (6.6) and solve (6.5) to (6.7). We find the optimal solution to

be {x

1

, x

2

, x

3

}= {0.02963, 0.2422, 2.0442} or 14.2512 % in first security

,

42.8971% in

second security and 42.8511% in third security. This yields an objective value of

Rs.124.9092, which gives a net profit of Rs.124.9092 - Rs.123.0843 = Rs. 1.8249.

Conclusion

Stochastic fractional programming is a promising technology for handling portfolio

problems in uncertain environments. Unfortunately, due to modeling difficulties this

technology has not yet reached a wide range of audience it deserves. In this paper, non-

linear stochastic fractional programming of financial derivatives has been discussed with

a numerical example to illustrate the proposed model. With the help of this model one

can get a commendable profit with a least amount of investment in the market.

References

1. Charles, V. and Dutta, D., Non-linear stochastic fractional programming models

of financial derivatives- II, Proceedings of International Conference on Business

and Finance, Vol. III, pp 253-263, 2004a.

2. Charles, V. and Dutta, D., A method for solving linear stochastic fractional

programming problem with mixed constraints, Acta Ciencia Indica, Vol. XXX M,

No. 3, pp 497-506, 2004b.

3. Charles, V. and Dutta, D., Bi-weighted multi-objective stochastic fractional

programming problem with mixed constraints, Proceedings of the Second

National Conference on Mathematical and Computational Methods, pp. 29-36,

2003.

4. Charles, V. and Dutta, D., Two level linear stochastic fractional programming

problem with discrepancy vector, Journal of Indian Society of Statistics and

Operations Research, Vol. XXIII, No. 1-4, pp. 59-67, 2002.

5. Charles, V., Dutta, D. and Appal Raju, K., Linear stochastic fractional programming

problem, Proceedings of International Conference on Mathematical Modelling, IIT

Roorkee, 211-217, 2001a.

6. Charles, V. and Dutta, D., Linear stochastic fractional programming with branch-and-

bound technique, Proceedings of National Conference on Mathematical and

Computational Models, PSG College of Technology Coimbator, 131-139, 2001b.

7. Jeeva, M., Rajalakshmi Rajagopal, Charles, V. and Yadavalli, V.S.S., An

application of stochastic programming with weibull distribution-cluster based

optimum allocation of recruitment in manpower planning, International Journal of

Stochastic Analysis and Applications, Vol. 22, No.3, pp 801-812, 2004.

8. Jeeva, M., Rajalakshmi Rajagopal, and Charles, V., Stochastic Programming in

Manpower Planning- Cluster Based Optimum Allocation of Recruitments,

Advances in Stochastic Modelling. Notable Publication, Inc., New Jersey, USA,

147-156, 2002.

9. Markowitz, H., Portfolio selection, Journal of Finance, 7, 77-91, 1952.

10. Prasanna Chandra, Investment analysis and portfolio management, Indian Edition,

CFM-TMH Professional Series in Finance, Tata McGraw-Hill Publication Co.,

2002.

11. Robert A. Strong, Porfolio construction, management, & protection, International

Student Edition, Taxmann Publications Pvt Ltd, 2003.

12. Sen, S. and Higle, J.L., An introductory tutorial on stochastic linear programming

models, Interfaces, 29, 33-61, 1999.

13. Sudhir Malik, plan your investments with investment ready reckoner, India

Edition, Taxmann Allied Service Pvt. Ltd, 2003.

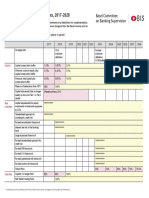

Table 1: Data for example 7.2

Date CMC Bajaj Tempo Amarjothi Special

16/07/2004 474.3 236.9 27.75

17/07/2004 478.9 249.9 29

20/07/2004 514.85 225.75 28.8

21/07/2004 562 223.3 26.85

22/07/2004 565.65 211.05 27.9

23/07/2004 570 224.9 26.95

24/07/2004 564.5 215.7 26.1

27/07/2004 567.1 220.75 25.7

28/07/2004 561.2 214.1 26.1

29/07/2004 571.6 214.7 25.1

30/07/2004 574.95 216.6 25

31/07/2004 591.8 218 25.8

You might also like

- Right and Wrong Model For Callable Muni BondsDocument22 pagesRight and Wrong Model For Callable Muni BondssoumensahilNo ratings yet

- SSRN Id593584Document28 pagesSSRN Id593584Loulou DePanamNo ratings yet

- Development of Algorithmic Volatility Trading Strategies For Equity OptionsDocument18 pagesDevelopment of Algorithmic Volatility Trading Strategies For Equity Optionsc0ldlimit8345No ratings yet

- Full Work. DP by Sule JosephDocument58 pagesFull Work. DP by Sule JosephAdebisiNo ratings yet

- Game Theory To Optimize Stock PortfolioDocument7 pagesGame Theory To Optimize Stock Portfolioashuking2020No ratings yet

- Van Der Post H. Market Master. Trading With Python 2024Document336 pagesVan Der Post H. Market Master. Trading With Python 2024numl-s22-30115No ratings yet

- Empirical Cross-Sectional Asset PricingDocument60 pagesEmpirical Cross-Sectional Asset PricingThomas FlanaganNo ratings yet

- Market Volatility Calculation MethodDocument42 pagesMarket Volatility Calculation MethodMandadapu SwathiNo ratings yet

- Van Der Post H. Power Trader. Options Trading With Python 2024Document346 pagesVan Der Post H. Power Trader. Options Trading With Python 2024IDN3B GADGETSNo ratings yet

- chiminglinAMS5 8 2007Document10 pageschiminglinAMS5 8 2007Heades JulechristNo ratings yet

- Monte Carlo Methods in Finance An Introductory TutDocument10 pagesMonte Carlo Methods in Finance An Introductory TutNicolas LeãoNo ratings yet

- IMP LR PortfolioSelectionunderMaximumMinimumCriterion PDFDocument13 pagesIMP LR PortfolioSelectionunderMaximumMinimumCriterion PDFKrishna JoshiNo ratings yet

- Soa University: Name: Gyanabrata Mohapatra Subject: Financial Derivetives AssignmentDocument10 pagesSoa University: Name: Gyanabrata Mohapatra Subject: Financial Derivetives Assignment87 gunjandasNo ratings yet

- Market Master Trading With Python Van Der Post Full ChapterDocument67 pagesMarket Master Trading With Python Van Der Post Full Chaptersarah.ranta155100% (4)

- Overview of Financial Engineering: Why Are Financial Markets Necessary?Document5 pagesOverview of Financial Engineering: Why Are Financial Markets Necessary?PLS1991No ratings yet

- Fund of Hedge Funds Portfolio Selection: A Multiple-Objective ApproachDocument35 pagesFund of Hedge Funds Portfolio Selection: A Multiple-Objective ApproachgimbrinelNo ratings yet

- Lecture Notes NHH 405Document160 pagesLecture Notes NHH 405Abhik PalNo ratings yet

- Applying Portfolio Selection: A Case of Indonesia Stock ExchangeDocument10 pagesApplying Portfolio Selection: A Case of Indonesia Stock ExchangeShahnaz AflahaNo ratings yet

- SSRN Id3514586Document21 pagesSSRN Id3514586Jakub Wojciech WisniewskiNo ratings yet

- Real Option For Policy AnalysisDocument10 pagesReal Option For Policy AnalysisEduardo FariasNo ratings yet

- Effecient Frontier Stock PortfoliosDocument60 pagesEffecient Frontier Stock Portfoliosee1993No ratings yet

- Modern Portfolio TheoryDocument12 pagesModern Portfolio TheoryruiyizNo ratings yet

- Assignment 1 Complete Markets Questions. Valeria Ruiz Mollinedo.Document4 pagesAssignment 1 Complete Markets Questions. Valeria Ruiz Mollinedo.Valeria MollinedoNo ratings yet

- Some Recent Developments in Futures HedgingDocument40 pagesSome Recent Developments in Futures Hedgingjoni hajriNo ratings yet

- Modern Portfolio Theory (MPT) and What Critics SayDocument6 pagesModern Portfolio Theory (MPT) and What Critics SayEvans MandinyanyaNo ratings yet

- Capital Growth With SecurityDocument18 pagesCapital Growth With SecurityMimumNo ratings yet

- Emotionless Decision A Coin Flip Investment DecisiDocument7 pagesEmotionless Decision A Coin Flip Investment DecisiGONZALO ANDRE RIVERO MALATESTANo ratings yet

- Sound Deposit Insurance Pricing Using A Machine LeDocument18 pagesSound Deposit Insurance Pricing Using A Machine LeHenry OseiNo ratings yet

- The Practice of Portfolio Replication: Algo Research Quarterly Vol. 3, No.2 September 2000Document12 pagesThe Practice of Portfolio Replication: Algo Research Quarterly Vol. 3, No.2 September 2000Gu GraceNo ratings yet

- (BAO, 2014) A Simulation-Based Portfolio Optimization Approach With Least Squares LearningDocument6 pages(BAO, 2014) A Simulation-Based Portfolio Optimization Approach With Least Squares LearningarnaudNo ratings yet

- 3250 NoteDocument186 pages3250 Noterooney_hunterxhunterNo ratings yet

- MS 9 2012Document26 pagesMS 9 2012mahasagarNo ratings yet

- Portfolio Theory and Modern Portfolio Management TechniquesDocument3 pagesPortfolio Theory and Modern Portfolio Management TechniquesJarir ibn ilyusNo ratings yet

- Capital Asset Pricing Model (CAPM) : by Himani GrewalDocument48 pagesCapital Asset Pricing Model (CAPM) : by Himani Grewalshekhar_anand1235807No ratings yet

- Article1379417503 - Omisore Et AlDocument10 pagesArticle1379417503 - Omisore Et AlThanaa LakshimiNo ratings yet

- Modern Portfolio TheoryDocument16 pagesModern Portfolio TheoryBernard OkpeNo ratings yet

- Van Der Post H. Python Fundamentals For Finance... Trading With Python 2024Document231 pagesVan Der Post H. Python Fundamentals For Finance... Trading With Python 2024Aina Horrach AlonsoNo ratings yet

- Traditional Portfolio TheoryDocument5 pagesTraditional Portfolio Theorykritigupta.may1999No ratings yet

- No 76Document44 pagesNo 76eeeeewwwwwwwwNo ratings yet

- SYNOPSIS Foreign ExchangeDocument16 pagesSYNOPSIS Foreign Exchangejain2007gaurav100% (1)

- SSRN Id1906489Document59 pagesSSRN Id1906489pasaitowNo ratings yet

- Python Fundamentals For Finance A Survey of Algorithmic Options Trading With Python Van Der Post All ChapterDocument51 pagesPython Fundamentals For Finance A Survey of Algorithmic Options Trading With Python Van Der Post All Chapterkevin.thompson445100% (4)

- A Poor Man's Guide To Q FinanceDocument17 pagesA Poor Man's Guide To Q FinanceArturo SeijasNo ratings yet

- Literature Review of Black Scholes ModelDocument6 pagesLiterature Review of Black Scholes Modelc5rek9r4100% (1)

- Finance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.CDocument33 pagesFinance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.CPradeep Srivatsava ManikondaNo ratings yet

- Topic 4 BMS LiyaDocument24 pagesTopic 4 BMS LiyaLidia SamuelNo ratings yet

- QF Illusions DynamicDocument4 pagesQF Illusions Dynamicpoojagopalia1162No ratings yet

- Computational FinanceDocument61 pagesComputational Financezeshan khaliqNo ratings yet

- Risk Man Using OptionsDocument21 pagesRisk Man Using OptionserererezizuzuouiNo ratings yet

- On Portfolio Selection Under Extreme Risk Measure: The Heavy-Tailed ICA ModelDocument31 pagesOn Portfolio Selection Under Extreme Risk Measure: The Heavy-Tailed ICA ModelPradeep Srivatsava ManikondaNo ratings yet

- Dynamic Hedging in Incomplete Markets: A Simple SolutionDocument49 pagesDynamic Hedging in Incomplete Markets: A Simple SolutionIBNo ratings yet

- Equity Research (Stock Market)Document8 pagesEquity Research (Stock Market)mohammadhamza563No ratings yet

- A Simple Options Trading Strategy Based On Technical IndicatorsDocument4 pagesA Simple Options Trading Strategy Based On Technical IndicatorsMnvd prasadNo ratings yet

- Volatility ProjectDocument29 pagesVolatility ProjectRatish CdnvNo ratings yet

- Option Chain Analysis Project KKDocument67 pagesOption Chain Analysis Project KKkedar kumbharNo ratings yet

- Constrained Mean-Variance Portfolio Optimization With Alternative Return EstimationDocument18 pagesConstrained Mean-Variance Portfolio Optimization With Alternative Return EstimationMommiza MommizaNo ratings yet

- Options Installment Strategies: Long-Term Spreads for Profiting from Time DecayFrom EverandOptions Installment Strategies: Long-Term Spreads for Profiting from Time DecayNo ratings yet

- 02-Stock Basics-Tutorial PDFDocument14 pages02-Stock Basics-Tutorial PDFbassmastahNo ratings yet

- Security Analysis and PortFolio Management Case StudyDocument4 pagesSecurity Analysis and PortFolio Management Case StudySammir Malhotra0% (1)

- Revision Problem For Final Exam INS3032 2017Document2 pagesRevision Problem For Final Exam INS3032 2017magical_life96100% (1)

- FM 04 Lecture 10Document18 pagesFM 04 Lecture 10Aniket PuriNo ratings yet

- CHPT10Document23 pagesCHPT10chinNo ratings yet

- La Demanda Contra Loma NegraDocument30 pagesLa Demanda Contra Loma NegraGuillermo Pereira PoizónNo ratings yet

- Project Finance: Aditya Agarwal Sandeep KaulDocument96 pagesProject Finance: Aditya Agarwal Sandeep Kaulsguha123No ratings yet

- 50 PipDocument3 pages50 PipSpine StraightenerNo ratings yet

- Basel III Transitional Arrangements, 2017-2028: Basel Committee On Banking SupervisionDocument1 pageBasel III Transitional Arrangements, 2017-2028: Basel Committee On Banking SupervisiongoonNo ratings yet

- State Bank of India (SBI) : SynopsisDocument18 pagesState Bank of India (SBI) : SynopsisAshish KumarNo ratings yet

- Soal 1: Jurnal Penerbitan Satu Lembar Saham BiasaDocument11 pagesSoal 1: Jurnal Penerbitan Satu Lembar Saham Biasakevin phillipsNo ratings yet

- Client Brochure Bloomberg GTI2Document2 pagesClient Brochure Bloomberg GTI2DANIEL ESCOBARNo ratings yet

- Ata Ims (Aib MK) : Regional Morning NotesDocument5 pagesAta Ims (Aib MK) : Regional Morning NotesFong Kah YanNo ratings yet

- Trader Website Fund Details - W - SummaryDocument1,430 pagesTrader Website Fund Details - W - SummaryGtc Diaz CarlosNo ratings yet

- Future Ventures IpoDocument504 pagesFuture Ventures IpomerenjithNo ratings yet

- Transfer ReceiptDocument3 pagesTransfer Receipthaneesh11No ratings yet

- Unit 5 DFA 4212optionsDocument14 pagesUnit 5 DFA 4212optionsne002No ratings yet

- How To Be An Angel InvestorDocument9 pagesHow To Be An Angel Investorcarlyblack2006No ratings yet

- ET Wealth PDFDocument23 pagesET Wealth PDFVijaya KumarNo ratings yet

- Customer Perception Towards Investment in Mutual FundDocument49 pagesCustomer Perception Towards Investment in Mutual FundPaankaj NetamNo ratings yet

- FM - Bond & Stock ValuationDocument10 pagesFM - Bond & Stock ValuationSeneca GonzalesNo ratings yet

- BBS 56Document1 pageBBS 56ENG PTBBSNo ratings yet

- Module 6 Audit of InvestmentsDocument15 pagesModule 6 Audit of InvestmentsKez MaxNo ratings yet

- The DuPont AnalysisDocument3 pagesThe DuPont AnalysisGaurav SinghNo ratings yet

- Tutorial Chapter 13Document7 pagesTutorial Chapter 13Leong Jin XuanNo ratings yet

- Low Delta IC 2022 ResultsDocument6 pagesLow Delta IC 2022 Resultsben44No ratings yet

- Analysis Corfin Kelompok 3Document9 pagesAnalysis Corfin Kelompok 3Denisse Aretha LeeNo ratings yet

- Forward Markets Commission (India) PDFDocument3 pagesForward Markets Commission (India) PDFkinjal_1ymailcomNo ratings yet

- ACCT 1221 Assignment 2Document11 pagesACCT 1221 Assignment 2Ali ShahNo ratings yet

- Syeda Samia Ali - Case Study - National Mayonnaise - CBDocument6 pagesSyeda Samia Ali - Case Study - National Mayonnaise - CBSyédà Sámiá AlìNo ratings yet