Professional Documents

Culture Documents

Hkas 1

Uploaded by

Edvan HervianOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hkas 1

Uploaded by

Edvan HervianCopyright:

Available Formats

Hong Kong Accounting Standard 1 (Revised)

Presentation of Financial Statements

(Relevant to ATE Paper 1 Financial Accounting & Paper 7 Advanced Accounting)

Lisa Wong, City University of Hong Kong (SCOPE)

Introduction This article will not go into the details of the overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content. The emphasis here is instead on the main features of the revised version of the accounting standard and changes from the previous version. Illustrative examples on the format of the financial statements are also provided. HKAS 1 (Revised) was issued in December 2007 to replace HKAS 1 Presentation of Financial Statements which was issued in 2004 and amended in 2005. The revised statement is effective for annual periods beginning on or after 1 January 2009. The revised HKAS 1 aims to maintain international convergence arising from the revision of IAS 1, the objective of which was to aggregate information in the financial statements on the basis of shared characteristics. Main features HKAS 1 (Revised) affects the presentation of owner changes in equity and of comprehensive income. It does not change the recognition, measurement or disclosure of specific transactions and other events required by other HKFRSs. It requires an entity to present or disclose the following information: (a) All owner changes in equity in a statement of changes in equity (b) All non-owner changes in equity (i.e. comprehensive income): (i) in one statement of comprehensive income; or (ii) in two statements (a separate income statement and a statement of comprehensive income) (c) A statement of financial position as at the beginning of the earliest comparative period in a complete set of financial statements: (i) when the entity applies an accounting policy retrospectively or makes a retrospective restatement, as defined in HKAS 8 Accounting Policies, Changes in Accounting Estimates and Errors; or (ii) when the entity reclassifies items in the financial statements This means that three statements of financial position, as a minimum, have to be presented as at: the end of the current period

the end of the previous period (which is the same as the beginning of the current period) the beginning of the earliest comparative period (d) Reclassification adjustments and income tax relating to each component of other comprehensive income. Reclassification adjustments are the amounts reclassified to profit or loss in the current period that were previously recognized in other comprehensive income. Changes from previous version 1. HKAS 1 (Revised) uses new titles to describe the balance sheet and cash flow statement. However, these titles are not mandatory, which means that entities are not required to use them in their financial statements. The reason is that making use of the titles non-mandatory will allow time for entities to implement changes gradually as the new titles become more familiar. The new titles are: (a) Statement of financial position (balance sheet) (b) Statement of cash flows (cash flow statement) 2. The presentation of the income statement is changed. (a) Statement of comprehensive income is now used in HKAS 1 (Revised). (b) The statement presents all income and expense items

passing through the profit or loss during a period; other income and expenses not passing through profit and loss are shown under the term other comprehensive income; finally the total comprehensive income is given. (Refer to note for the explanation of comprehensive income and other comprehensive income) 3. HKAS 1 (Revised) requires an entity to disclose: (a) Income tax relating to each component of other comprehensive income (b) Reclassification adjustments relating to components of other comprehensive income. For example, reclassification adjustments arise on derecognition of availablefor-sale financial assets (This is beyond the scope of the syllabus of Papers 1 & 7). 4. All changes in equity arising from transactions with owners in their capacity as owners (i.e. owner changes in equity) have to be presented separately from non-owner changes in equity. This means that components of comprehensive income are not permitted to be presented in the statement of changes in equity. For example, a gain on property revaluation is allowed to be presented in the statement of changes in equity under the previous version but not in the revised version.

5. The presentation of dividends allowed to be disclosed under previous version in the income statement, in the statement of changes in equity or in the notes has now been changed. (a)The revised standard requires that dividends recognized as distributions to owners and related amounts per share to be presented in the statement of changes in equity or in the notes. (b) Such disclosure as set out in (a) above can no longer be presented in the statement of comprehensive income. Illustrative financial statement structure The following examples illustrate only the presentation of a statement of financial position, a statement of comprehensive income and a statement of changes in equity. These examples have been simplified to exclude comparative figures and items outside the scope of the Paper 1 or Paper 7 syllabus. Thus, they are not intended to illustrate all aspects of HKFRSs, nor do they constitute a complete set of financial statements. Higher level students can refer to the Guidance on implementing which is attached to HKAS 1 for information on the presentation of other statements or the disclosure of items such as reclassification adjustments for available-for-sale financial assets.

Example 1 Statement of financial position (No change to the content and structure but note the change to the title of the statement) ABC Company Statement of financial position as at 31 December 20X8 Assets Non-current assets Property, plant and equipment Goodwill Other intangible assets Investments in associates Current assets Inventories Trade receivables Other current assets Cash at bank Total assets Equity and liabilities Equity attributable to owners of the parent Share capital Retained earnings Other components of equity Minority interest Total equity Non-current liabilities Long-term borrowings Bank loan Current liabilities Trade and other payables Current portion of long-term borrowings Tax payable Provisions Total equity and liabilities $000 x x x x X x x x x X 1,416

650 244 102 996 99 1,095

120 28 148 115 10 35 13 173 1,416

Example 2 Statement of comprehensive income in one statement (Note the change in the title, content and structure of the statement) ABC Company Statement of comprehensive income for the year ended 31 December 20X8 $000 390 (245) 145 21 (9) (20) (4) (8) 35 160 (40) 120

Revenue Cost of sales Gross profit Other income Distribution costs Administrative expenses Other expenses Finance costs Share of profit of associates (a) Profit before tax Income tax expense Profit for the year

Other comprehensive income: Gains on property revaluation 93 Share of other comprehensive income of associates (a) 40 Income tax relating to components of other comprehensive income (b) (3) Other comprehensive income for the year, net of tax 130 Total comprehensive income for the year 250 Profit attributable to: Owners of the parent Minority interest

96 24 120

Total comprehensive income attributable to: Owners of the parent Minority interest

200 50 250 46

Earnings per share (Basic and Diluted)

Example 3 Statement of comprehensive income in two statements If the two-statement format is used, the first part is an income statement which presents the items from revenue to profit for the year, profit attributable to owners of the parent and minority interest and earnings per share. ABC Company Income statement for the year ended 31 December 20X8 $000 390 : : : 120

Revenue : : : Profit for the year Profit attributable to: Owners of the parent Minority interest

96 24 120 46

Earnings per share (Basic and Diluted)

The second part is the statement of comprehensive income which continues from profit for the year of the first part, then presents items under other comprehensive income and ends with the final figure of total comprehensive income for the year. It also shows at the end the total comprehensive income amounts attributable to owners of the parent and to the minority interest. ABC Company Statement of comprehensive income for the year ended 31 December 20X8 $000 Profit for the year 120 Other comprehensive income: Gains on property revaluation 93 Share of other comprehensive income of associates (a) 40 Income tax relating to components of other comprehensive income (b) (3) Other comprehensive income for the year, net of tax 130 Total comprehensive income for the year 250 Total comprehensive income attributable to: Owners of the parent Minority interest

200 50 250

Example 4 Disclosure of components of other comprehensive income (Note that this disclosure is not new but it was included in the statement of changes in equity under the previous version of HKAS 1) If the components of other comprehensive income are not as simple as those in Example 2 above, notes to show the movements during the year have to be prepared separately for each item. For example, a separate statement would be needed to disclose the gains arising during the year and reclassification adjustments for gains included in profit or loss relating to Available-for-sale financial assets.(This is also beyond the scope of Papers 1 & 7.)

Example 5 Disclosure of tax effects relating to each component of other comprehensive income (This note is a new requirement) Notes Year ended 31 December 20X8

Gains on property revaluation Share of other comprehensive income of associates

Before-tax amount $000

Tax Net-of-tax expense amount $000 $000

Example 6 Statement of changes in equity for the year ended 31 December 20X8 (Note that non-owner changes in equity, e.g., gains on property revaluation, are not shown in this statement anymore)

ABC Company Statement of changes in equity for the year ended 31 December 20X8 Share capital $000 Balance at 1 January 20X7 Changes in accounting policy Restated balance Changes in equity for 20X7 Dividends Total comprehensive income for the year Balance at 31 December 20X7 Changes in equity for 20X8 Issue of share capital Dividends Total comprehensive income for the year Transfer to retained earnings Balance at 31 December 20X8 x x x Retained earnings $000 x x x Revaluation surplus $000 x x x Total $000 x x x Minority interest $000 x x x Total equity $000 x x x

x x

x x

x x

x x

x x

x x

600

161

761

49

810

50 650

(15) 96 2 244

104 (2) 102

50 (15) 200 996

50 99

50 (15) 250 1,095

Notes: (a) It is after tax and minority interests in the associates. (b) Alternatively, components of other comprehensive income could be presented net of tax. In this case, the gain on property revaluation could be presented as $90,000 and income tax not shown. (c) The amount included in the revaluation surplus of $104,000 represents the share of other comprehensive income of associates of $40,000 plus gains on property revaluation of

$64,000($93,000 less tax of $3,000 and less minority interest of $26,000). Other comprehensive income of associates relates solely to gains or losses on property revaluation. Comprehensive income The term comprehensive income is not defined in the Framework but is used in IAS 1 to describe the change in equity of an entity during a period from transactions, events and circumstance other than those resulting from transactions with owners in their capacity as owners.

Other comprehensive income Although the term comprehensive income is used to describe the aggregate of all components of comprehensive income, including profit or loss, the term other comprehensive income refers to income and expenses that, under IFRSs, are included in comprehensive income but excluded from profit or loss. References:

Hong Kong Accounting Standard 1 (Revised) Presentation of Financial Statements A Plus, July 2008, page 44

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Nascent Indian MFI Fund RaisingDocument2 pagesNascent Indian MFI Fund RaisingSanjeev ChaudharyNo ratings yet

- Cint 2016 Ar PDFDocument162 pagesCint 2016 Ar PDFAkun GloryNo ratings yet

- Risk Return Analysis of InvestmentDocument3 pagesRisk Return Analysis of InvestmentAnju PrakashNo ratings yet

- Dividend Policy and Retained EarningDocument28 pagesDividend Policy and Retained EarningMd Abusaied AsikNo ratings yet

- CH 16Document11 pagesCH 16Fahad Javaid50% (2)

- Exchange Traded Funds: There Are Safer Ways To Invest in Stocks Rebounding Up From LowsDocument1 pageExchange Traded Funds: There Are Safer Ways To Invest in Stocks Rebounding Up From LowsRajeshbhai vaghaniNo ratings yet

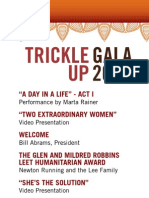

- Gala 2012 Program FinalDocument2 pagesGala 2012 Program FinalaryairanpourNo ratings yet

- Midterm Project Portfolio OptimizationDocument3 pagesMidterm Project Portfolio OptimizationAllan ZhangNo ratings yet

- Asset management company business modelDocument9 pagesAsset management company business modelJAINAM SHAHNo ratings yet

- Cagayan National High School Fundamentals of Accountancy, Business and Management 2 Table of SpecificationsDocument2 pagesCagayan National High School Fundamentals of Accountancy, Business and Management 2 Table of SpecificationsFrancez Anne Guanzon100% (2)

- Research Paper 1Document30 pagesResearch Paper 1Drpushparaj KulkarniNo ratings yet

- Financial Decision Making - Sample Suggested AnswersDocument14 pagesFinancial Decision Making - Sample Suggested AnswersRaymond RayNo ratings yet

- Brand Valuation - DamodaranDocument39 pagesBrand Valuation - Damodaranmystique2s100% (2)

- Derivatives Interview QuestionsDocument14 pagesDerivatives Interview Questionsanil100% (3)

- Investment StartegyDocument87 pagesInvestment StartegySudhir NahakNo ratings yet

- Dividend Discount Model - Commercial Bank Valuation (FIG)Document2 pagesDividend Discount Model - Commercial Bank Valuation (FIG)Sanjay RathiNo ratings yet

- Insider Strategies for Profiting With OptionsDocument13 pagesInsider Strategies for Profiting With OptionsbelewjoNo ratings yet

- Loma 357 C6Document17 pagesLoma 357 C6May ThirteenthNo ratings yet

- 8 Functions of A Financial Manager (Management) PDFDocument3 pages8 Functions of A Financial Manager (Management) PDFPalash BairagiNo ratings yet

- A Study of Awareness About Forex Market at DharwadDocument17 pagesA Study of Awareness About Forex Market at DharwadSanjay KaradiNo ratings yet

- Dna CalendarDocument7 pagesDna CalendarDan Santos100% (1)

- Part 1, Future InterestsDocument16 pagesPart 1, Future InterestsMike StokesNo ratings yet

- Working Capital ReportDocument60 pagesWorking Capital ReportRavi JoshiNo ratings yet

- Swedish MatchDocument4 pagesSwedish MatchCamielHamstra100% (2)

- 2008-12-16 033910 newFinExmnewDocument5 pages2008-12-16 033910 newFinExmnewIslam FarhanaNo ratings yet

- ICB's Role in Capital MarketsDocument22 pagesICB's Role in Capital MarketsHabibur RahmanNo ratings yet

- Real Estate in IndiaDocument6 pagesReal Estate in IndiaVikrant KarhadkarNo ratings yet

- Quiz - Chapter 4 - Partnership Liquidation - 2020 EditionDocument4 pagesQuiz - Chapter 4 - Partnership Liquidation - 2020 EditionHell LuciNo ratings yet