Professional Documents

Culture Documents

Terry Mellers

Uploaded by

Ahmed AyadOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Terry Mellers

Uploaded by

Ahmed AyadCopyright:

Available Formats

Application of risk management in construction of underground urban transportation projects

Dr Terry W Mellors Principal, Mellors & Associates, UK

Abstract Codes of Practice for Risk Management in Tunnel Works were prepared in response to concerns expressed by insurers and re-insurers on the London-based insurance market arising from losses associated with tunnelling and underground works generally in the UK and overseas. A Code for the UK was published in 2003 and an international version in 2006. The Codes set out deemed good practice in terms of principles and a framework for project and risk management for the design and construction of projects involving underground works. Since 2003, the principles of the Codes have been applied directly or indirectly by insurers/reinsurers on urban transit projects ranging from the west coast of America through Europe and Africa to Australasia. The application of the Code is now regarded by insurers as de rigeur on projects involving tunnelling or underground works in whatever form. However, it has to be appreciated and acknowledged that the principles of the Codes are now expected to be applied on projects which do not necessarily involve underground/below ground construction eg on bridges and/or viaducts for overhead road or rail systems. Clients/Owners now appreciate the benefit of risk management and pro-actively require this in contracts. However, more significantly, the matter of demonstration of the management of identified risks remains vague. Lessons learned in the application of the principles of the Codes over the last 8 years are seen to be worthy of reflection for the benefit of going forward.

BACKGROUND

1.1 Insurance market concerns The Association of British Insurers (ABI), representing insurers and re-insurers on the Londonbased Insurance Market, contacted the British Tunnelling Society (BTS) in October 2001 to express their growing concerns in relation to insurance losses associated with tunnelling works in the United Kingdom (UK) and overseas. Their concerns included an increased frequency of claims; the magnitudes of losses against premium volumes; the magnitudes of losses against Contract Values; comparisons of reinstatement costs against original construction costs; the magnitudes of Insured Claims against Insurers Possible Maximum Losses. Over the preceding 10 years or so, the loss ratio (ie sums paid out in relation to sums received via premiums etc) in the construction/engineering sector, had been typically in excess of 110%. However, for tunnelling works, the loss ratio had been typically in excess of 500%. Clearly, this situation was unsustainable and the perception was that the tunnelling industry had had an inconsistent approach to risk management which the

insurance industry had not previously queried. This was reflected by a number of withdrawals of major insurance companies from providing insurance cover for construction projects and/or tunnelling works in particular. 12 Options open to the insurers The ABI advised they were actively considering various options open to them in relation to insurance for tunnelling works which included a) stop offering insurance cover all together. It was acknowledged that this would necessitate selfinsurance by Clients/Employers or Contractors for projects to proceed but potentially seriously influencing the nature, scale and extent of tunnelling works carried out in the future.

b)

increase the terms (premiums), excesses (deductibles) and/or restrict cover. Such actions could cause projects to become cost prohibitive in the event that insurance was required and again influence the nature, scale and extent of tunnelling works carried out in the future.

work with industry to develop a code of practice for tunnelling works which set out deemed best practice. The precedent for this approach had been set by the preparation and publication of a Joint Code of Practice on the

c)

Protection from Fire of Construction Sites and Buildings Undergoing Renovation (first published 1992 by the Construction Confederation/Fire Protection Association fifth edition published 2000). This publication was prompted by the occurrence of major fires on construction sites which led to significant losses to the insurance market. The Joint Code was prepared with the cooperation of insurers, contractors, developers, the fire service and health and safety specialists. The Joint Code is generally perceived by the insurance market as having made a significant contribution to the reduction in the number of fires on construction sites and also in the number of claims made against insurance policies. Rather than adopt options a) and b) above at the outset with the attendant potential consequences on worldwide tunnelling works, the ABI sought to work with industry through the BTS to develop a Joint Code of Practice for Risk Management for use worldwide.

renovation of existing underground structures. Tunnel Works were defined as tunnels, caverns, shafts and associated underground structures howsoever constructed. This was to be achieved by providing a recognisable framework (and guidance) for deemed best practice project and risk management procedures to reduce the probability of a loss happening; reduce the size of a claim when it happened; provide Insurers with a better understanding of the risks during underwriting process and hence increased certainty on financial exposure in the provision of insurance cover.

It was acknowledged at the outset that strict implementation of and compliance with the Codes would not necessarily prevent insurance claims occurring. Implementation of the contents of the Codes was intended to provide an auditable trail. This was not only for the benefit of insurers, to ensure compliance with the Code and to ensure that deemed best practice had been followed in the event that a claim against project insurance arose, but also for the benefit of a project. In addition, the Code was intended to enable insurers to have the confidence to recommend to their management that insurance should continue to be provided to the tunnelling sector of the construction industry.

DEVELOPMENT OF THE CODES

A Working Group was formed in November 2001 comprising representatives from the ABI and the BTS. The author was a Joint Chairmen of the Working Group, representing the BTS and the primary author of the ensuing Codes of Practice. The ABIs intent was to have a Code prepared which could be applied for tunnelling works in the UK and overseas. However, the BTS considered that the preparation of a Code to satisfy the insurance market could be more readily prepared for application initially in the UK in view of familiarity with UK legislative and statutory requirements and British and European Standards, which a Code had to acknowledge. Such a Code (ie for application in the UK), once accepted by the insurance market, could then form the framework for a Code for use internationally by appropriate and suitable amendment and revision. The ABI agreed to this approach and so, as a first step, a Code was prepared for use in the UK. This was published by the BTS in September 2003. The Code was revised for international application and published in January 2006 by the International Tunnelling Insurance Group (ITIG) with the support of the International Tunnelling Association (ITA).

4 SOME FUNDAMENTAL OF THE CODES

PRINCIPLES

Fundamental principles running through the Codes include a) the Codes are intended to operate in parallel with and not derogate from existing local national Standards and statutory legislative duties and responsibilities relating to, for example, regulations and requirements associated with design, health and safety, environment; b) the Codes set out a framework for project and risk management procedures and systems for the stages of project development, contract procurement, design and construction activities; c) risk management as a process is defined and risk is defined as the combination of the consequence (or severity) of a hazard and its likelihood;

3 OBJECTIVES AND BASES FOR THE CODES

A jointly agreed objective of the Codes was to promote and secure best practice for the minimisation and management of risks associated with the design and construction of Tunnel Works including the

d) hazard identification is required during each stage of a project on a project-specific basis ie the cradle to grave approach; e) risks associated with identified hazards at each stage are to be evaluated through formalised risk assessment procedures;

f)

risks are to be reduced through appropriate design and construction procedures;

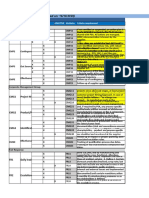

project and risk management procedures and processes against the intent of the Codes. The results of these exercises have been made available to insurers for their consideration in writing the insurance. At the post-underwriting stage, survey visits to projects have then been commissioned by insurers to confirm that the intentions in relation to the implementation of the Codes from a pre-underwriting benchmarking exercise are being adhered to. Secondly and alternatively in the absence of preunderwriting benchmarking exercises, survey visits have been commissioned by insurers to confirm that project and risk management practices being adopted are consistent with underwriting information and to compare them with the requirement/recommendations of the Codes. The first of such survey visits invariably establishes a benchmark against the Codes. Follow-up visits confirm continuing adherence to the accepted and established practices. The Codes are now invariably quoted at the time of underwriting. Through personal involvement, it is known that monitoring of project and risk management procedures against the Codes has been instigated by Brokers or Insurers on urban rail transit projects which include Beacon Hill Tunnels, LRT Project, Seattle, USA East Side Access Project, New York, USA 2nd Avenue Subway Project, New York, USA Terminal 5 Project, Heathrow Airport, London Crossrail, London , UK Citylink Project, Stockholm Sweden Copenhagen Metro, Copenhagen Denmark Gautrain Project, Johannesburg, South Africa Budapest Metro, Budapest, Hungary Marmaray Crossing, Istanbul, Turkey Dubai Metro Project, Dubai, UAE Circle Line Stages 1-5, Singapore Downtown Line Projects 1 and 2, Singapore.

g) since the ground (and groundwater) is the primary construction material in tunnel works, the concept of ground reference conditions/geotechnical baseline conditions is incorporated in the Codes. These are defined in the Codes as Definitive statements about the nature, form, composition and structure of the ground (both artificial and natural) and groundwater together with geotechnical properties of the ground which serve as a basis for construction Contract tendering purposes and for the subsequent application of the contract with respect to conditions actually encountered during Tunnel Works. The Geotechnical Baseline Conditions and/or Ground Reference Conditions represent a contractual definition of what is assumed will be encountered. However, the provision of such Conditions in the Contract is not a warranty that the Conditions will be encountered. The Client/Owner is expected to prepare the Conditions (or have them prepared on their behalf). Failing this, the Codes make provision for Tenderers to prepare the Conditions and submit them with their tenders for use by the client/Owner in tender evaluation; h) risks are to be managed to ensure their reduction to a level as low as reasonably practicable; i) risk assessments together with mitigation/control measures are to be recorded and summarised in risk registers at each stage of a project which include the identification of the party responsible for the control and management of an identified risk; assessments/registers of residual risks should cascade throughout a project (ie throughout each stage) to ensure that parties, at any time during a project, are made familiar with previously identified hazards and associated risks which are still live for transparency;

j)

k) risk registers are to be live documents which are continuously reviewed and revised as appropriate and available for scrutiny at any time; l) insurance is not to be considered as a contingency or mitigation measure in risk management.

Such exercises have also been carried out on urban road transportation projects including North-South Bypass Tunnel, Brisbane, Australia Marina Coastal Expressway, Singapore SMART Project, Kuala Lumpur, Malaysia.

APPLICATION OF THE CODES

as well as numerous hydroelectric projects and water supply schemes. It should be recognized that experience has shown that insurers expect the principles and frameworks of the Codes to be applied across a whole project and not just to the tunnelling aspects. Hence the project and risk management matters raised in the Codes are expected to

Since their introduction, the Codes have been used in two basic ways, based on the experience of the author. Firstly, at the pre-underwriting stage, benchmarking exercises have been commissioned by Brokers of

apply to above ground as well as below ground construction on a project and so for, example, would be expected to apply to elevated urban transit structures on projects involving underground works.

underwriting benchmarking exercise takes on a greater importance; b) in the absence of a requirement for risk management in the project contract documents, the impression has been gained that it is generally assumed/presumed by Clients/Owners that risk management will be implemented in any event. However, this has proven not to be the case and has demonstrated that if it is not asked for specifically and explicitly in contract documentation, risk management may not be practised during a project; c) when specific requirements for risk management are not set out in contract documents, it has been found that there can be a lack of understanding about risk management generally and its benefits overall for a project;

6 OBSERVATIONS ON THE APPLICATION OF THE PRINCIPLES OF THE CODES

6.1 General The involvement on over 30 projects on behalf of Insurers since 2002 in relation to the application of the Codes has provided the opportunity to view and review the approach taken in relation to project and risk management matters on projects since then. In the absence of the international version of the Code (as it was not published until January 2006), the UK version of the Code was generally quoted at time of underwriting. 6.2 Project management considerations Project management processes and procedures presented in the Codes are generally followed. This has not always been immediately evident because of differences in approach to those set out in the Codes. It can be appreciated that it was difficult preparing a code for international use which recognized all Contract Forms and all international, national and local contract requirements. Indeed, it was recognized that this was not practicable. It is for this reason that simply going through the Codes, clause by clause, seeking compliance as a benchmarking exercise is totally inappropriate. A holistic approach in relation to compliance for benchmarking purposes must be implemented. Although accepted and utilized in North America, the relatively innovative concept of ground reference conditions/geotechnical baseline conditions introduced in the Codes has been increasingly accepted and it is reassuring to find that there is a greater awareness of risk sharing on ground and groundwater conditions between the Client/Owner and the appointed constructor through their adoption. 6.3 Risk management considerations a) construction related insurance is often placed after project inception and when project contract requirements are already established. Whilst project contracts invariably require management plans relating to health and safety, quality, the environment etc, it is still common to find that Clients/Owners do not require a structured approach to risk management including provision of a risk management plan. In this respect, the project contract requirements are in default of the Codes. A pre-underwriting benchmarking exercise, as referred to above, is therefore of significance to insurers and in the absence of such, the post-

d) a consequence of the non-implementation of a risk management procedure is invariably the lack of risk registers formalising the results of hazard identification and risk assessment. The simple point is made that if risks cannot be readily identified then it is difficult to demonstrate that risks are being managed. This is not just for the benefit of insurers but for the project including all stakeholders; e) although Clients/Owners may have carried out risk assessments, some have been reluctant to pass the outcome on to bidders/tenderers. This results in lack of transparency of identified risks which is seen not to be beneficial to a project; when risk management is set out as a requirement in contract documentation, Clients/Owners or their representatives do not always participate in the process. It is considered that Clients/Owners should participate, even as observers, to provide them with the assurance that the process is active and working for the benefit of the project;

f)

g) even where a structured approach to risk management is required in the project contract documentation, there appears to be a difficulty in differentiating between risk management and management of risk. This latter aspect is seen as being fundamental for the development of an auditable trail for stakeholders. Risk management is seen as a top-down process, driven by the overall project management team demanding commitment from all involved personnel to participate. Management of risk is seen as a bottom-up process where the control of identified hazards (and associated risks) is very much in the domain of the workforce ie the muddy boots brigade. The production of a risk register is seen to be part of the risk management process. The questions of i) what is done with the register and ii) how can it be

demonstrated that an identified risk is being managed frequently remain unanswered. h) when appropriately formatted, risk registers can be a relatively powerful project management tool which has been recognised on some projects.

SUMMARY COMMENTS

The existence, intent and contents of the Codes appear to have been recognized internationally and appear to be gaining even more widespread acceptance. The distinct impression has been gained that the Codes have had, and are having, an impact on project and risk management considerations for urban rail transit projects involving underground works as well as other underground projects relating to roads, water supply and power generation. The benefits of a structured approach to risk management, when implemented, have been appreciated by Clients/Owners as well as designers and constructors. It is perceived that there is a growing awareness of such benefits not only in Client/Owner organisations but also in constructor/contractor organisations. However, the approach to risk management is still variable. It is considered that the optimum way forward is for Clients/Owners to require risk management as a fundamental part of the overall project management procedure and stipulate as such at the outset of a project by developing a Risk Management Plan to ensure that all parties to a project are aware of the Clients/Owners requirements in relation to risk management and how they are to be achieved. The Plan could identify mechanisms for the reporting of risks up through management chains in terms of risk status and in a format compatible with management reporting principles/requirements; to develop a risk management procedure to which all parties to the project will be required to adhere. This will provide the basis for uniformity in approach through the design and delivery stages of a project; the procedure should set out mechanisms for the risk management (including hazard identification, risk assessment, identification of mitigation/control measures etc) and the management of risk processes; the procedure should include an appropriately formatted pro-forma risk register which will be beneficial as a project management tool.

You might also like

- Code of Practice Tunnel Works 2006 PDFDocument28 pagesCode of Practice Tunnel Works 2006 PDFMariappan LetchumananNo ratings yet

- Tunnel Code of PracticeDocument20 pagesTunnel Code of PracticeChin Keong ChengNo ratings yet

- SP04-2008-Update-on-Tunnelling-CoP-2Document6 pagesSP04-2008-Update-on-Tunnelling-CoP-2Rajat DeshmukhNo ratings yet

- Ita Imia 2023 BDDocument28 pagesIta Imia 2023 BDKishor YenepalliNo ratings yet

- Code of Practice for Risk Management of Tunnel WorksDocument28 pagesCode of Practice for Risk Management of Tunnel WorksTiago ConeglianNo ratings yet

- ENGINEERING AND CONSTRUCTION CONTRACTSDocument16 pagesENGINEERING AND CONSTRUCTION CONTRACTSLevanNo ratings yet

- Construction and Infrastructure Projects - Risk Management Through Insurance 50Document50 pagesConstruction and Infrastructure Projects - Risk Management Through Insurance 50Carl Williams100% (1)

- Richard Calver - The ABIC Suite of Contracts Principles and PracticeDocument13 pagesRichard Calver - The ABIC Suite of Contracts Principles and PracticeCPittmanNo ratings yet

- Contractorsrisk Paras 0003 File PDFDocument57 pagesContractorsrisk Paras 0003 File PDFRiyasNo ratings yet

- Construction Law International - June 2021 - DAAB Update - International Bar AssociationDocument6 pagesConstruction Law International - June 2021 - DAAB Update - International Bar AssociationIbrahim MohdNo ratings yet

- Factors Influencing Contractors' Adoption of Insurance for Construction RiskDocument10 pagesFactors Influencing Contractors' Adoption of Insurance for Construction RiskArun Kumar PrajapatiNo ratings yet

- 25 News EPC Cliff 2010 04 26 UsDocument8 pages25 News EPC Cliff 2010 04 26 UsSagar MhetreNo ratings yet

- 2523-03 enDocument10 pages2523-03 enalamrizwan03No ratings yet

- 0005 - 20230209 - Contracting Principles - at A Glance - Jan2023 - IMCADocument3 pages0005 - 20230209 - Contracting Principles - at A Glance - Jan2023 - IMCAMaciej MzykNo ratings yet

- FIDIC & Recent Infrastructure Developments - BOTDocument3 pagesFIDIC & Recent Infrastructure Developments - BOTIvan FrancNo ratings yet

- Defect LiabilitiesDocument8 pagesDefect LiabilitiesAshoke RoyNo ratings yet

- Management of Construction Risk Through Contractor'S All Risk Insurance Policy - A South Africa Case StudyDocument8 pagesManagement of Construction Risk Through Contractor'S All Risk Insurance Policy - A South Africa Case StudyBimal PrajapatiNo ratings yet

- Doubts Raised On The Validity of Construction and Payment GuaranteesDocument26 pagesDoubts Raised On The Validity of Construction and Payment Guaranteesanon_b186No ratings yet

- Recommendations to Improve UK Construction Safety RegulationsDocument9 pagesRecommendations to Improve UK Construction Safety RegulationswordssmithNo ratings yet

- Limitations of LiabilityDocument6 pagesLimitations of LiabilityMeeraTharaMaayaNo ratings yet

- FIDIC (Silver Book)Document15 pagesFIDIC (Silver Book)a74engNo ratings yet

- An Approach To Quantify The Current Level of Safety Achieved by The BuildingDocument14 pagesAn Approach To Quantify The Current Level of Safety Achieved by The BuildingjessqiuNo ratings yet

- Case Project FinanceDocument9 pagesCase Project FinanceaamritaaNo ratings yet

- Contractorsrisk Paras 0003 File PDFDocument57 pagesContractorsrisk Paras 0003 File PDFMauro MLRNo ratings yet

- Webpdf Part35Document2 pagesWebpdf Part35Imalka KariyawasamNo ratings yet

- The Faulty Workmanship Exclusion - MXSDocument7 pagesThe Faulty Workmanship Exclusion - MXSKinoLodaNo ratings yet

- Insurance and SecuritiesDocument50 pagesInsurance and Securitiesobengloloision2022No ratings yet

- Procurement Contract 2Document13 pagesProcurement Contract 2Damilola AkinsanyaNo ratings yet

- A Report Recommending The Best Project Procurement Strategy For A Client - EditedDocument25 pagesA Report Recommending The Best Project Procurement Strategy For A Client - Editedngolodedan2No ratings yet

- Research Proposal EPC FinalDocument6 pagesResearch Proposal EPC FinalMohd Syafei AhmadNo ratings yet

- Risk Management in Construction - JKMDocument2 pagesRisk Management in Construction - JKMJogendra KumarNo ratings yet

- Ewsletter O Pril: Eports N This SsueDocument6 pagesEwsletter O Pril: Eports N This SsueShijo AntonyNo ratings yet

- Procurement Contract Assignment 2 CorrectedDocument14 pagesProcurement Contract Assignment 2 CorrectedDamilola AkinsanyaNo ratings yet

- The Effects of Arbitration On The Building IndustryDocument83 pagesThe Effects of Arbitration On The Building IndustryChristopher Amasor AdokuruNo ratings yet

- Delay and Disruption Claims March 2014 PDFDocument31 pagesDelay and Disruption Claims March 2014 PDFNuruddin CuevaNo ratings yet

- Kuwait Issues Problems KartamDocument22 pagesKuwait Issues Problems KartamSyeda Fatima aliNo ratings yet

- Guidance On Collaborative Procurement - An OverviewDocument15 pagesGuidance On Collaborative Procurement - An Overviewfirooziahmad1986No ratings yet

- Contractor All Risks InsuranceDocument6 pagesContractor All Risks InsuranceAbdul Rahman Sabra67% (3)

- How Valuable Is The FIDIC Suite For Construction of Project FinancedDocument63 pagesHow Valuable Is The FIDIC Suite For Construction of Project FinancedMdms PayoeNo ratings yet

- Construction InsuranceDocument9 pagesConstruction InsuranceBritton WhitakerNo ratings yet

- A Comparison of NEC and FIDIC by Rob GerrardDocument4 pagesA Comparison of NEC and FIDIC by Rob GerrardbappanaduNo ratings yet

- NEC and CLC Guidance For Dealing With Retention Payments Under NEC3 and NEC4 Contracts 15.11.22Document5 pagesNEC and CLC Guidance For Dealing With Retention Payments Under NEC3 and NEC4 Contracts 15.11.22George ParsonsNo ratings yet

- IS Projects in KEnya PDFDocument6 pagesIS Projects in KEnya PDFGkou DojkuNo ratings yet

- Construction Claims Contracting StrategiesDocument10 pagesConstruction Claims Contracting StrategiesKen WongNo ratings yet

- Code of Practice Cyber Security For ShipsDocument75 pagesCode of Practice Cyber Security For Shipshemadri ray100% (1)

- FIDIC or IChemE Which Is BestDocument1 pageFIDIC or IChemE Which Is BestfalnaimiNo ratings yet

- Differences in JC T ConditionsDocument4 pagesDifferences in JC T ConditionsShawkat AbbasNo ratings yet

- Xxii Paper 03Document8 pagesXxii Paper 03Nitesh KirnakeNo ratings yet

- Comparison of Generic Procurement CategoriesDocument8 pagesComparison of Generic Procurement CategoriesDavisNo ratings yet

- Construction Insurance TypesDocument10 pagesConstruction Insurance TypesHoussam ZeinNo ratings yet

- CDR509 Assignement-21001340-April.2023Document12 pagesCDR509 Assignement-21001340-April.2023Mem Nabil RamadanNo ratings yet

- Risks Analysis Under Construction and Engineering Contracts.Document6 pagesRisks Analysis Under Construction and Engineering Contracts.sarathirv6No ratings yet

- Contracts, Biddings and Tender:Rule of ThumbFrom EverandContracts, Biddings and Tender:Rule of ThumbRating: 5 out of 5 stars5/5 (1)

- Project Management For Procurement Management ModuleFrom EverandProject Management For Procurement Management ModuleNo ratings yet

- Member States’ Experiences and Insights from Maintaining Safety, Security and Reliable Nuclear Industry Operations During the Covid-19 PandemicFrom EverandMember States’ Experiences and Insights from Maintaining Safety, Security and Reliable Nuclear Industry Operations During the Covid-19 PandemicNo ratings yet

- Carbon Offsetting in International Aviation in Asia and the Pacific: Challenges and OpportunitiesFrom EverandCarbon Offsetting in International Aviation in Asia and the Pacific: Challenges and OpportunitiesNo ratings yet

- The Nuclear Safety and Nuclear Security Interface: Approaches and National ExperiencesFrom EverandThe Nuclear Safety and Nuclear Security Interface: Approaches and National ExperiencesNo ratings yet

- Fugro Technical Services (Guangzhou) Limited: Registration No. HOKLAS 170 Page 1 of 11 28 March 2014 Ref: 170-24Document11 pagesFugro Technical Services (Guangzhou) Limited: Registration No. HOKLAS 170 Page 1 of 11 28 March 2014 Ref: 170-24Ahmed AyadNo ratings yet

- Scopus Smart Search WebinarDocument27 pagesScopus Smart Search WebinarAhmed AyadNo ratings yet

- Outside Air Brick Air Gap Block Inside AirDocument1 pageOutside Air Brick Air Gap Block Inside AirAhmed AyadNo ratings yet

- DSBB Chapter 1 Straw and Bales (Complete)Document23 pagesDSBB Chapter 1 Straw and Bales (Complete)antonioNo ratings yet

- Chapter 2aDocument64 pagesChapter 2aMohamed ElbazNo ratings yet

- Scientists As CommunicatorsDocument25 pagesScientists As CommunicatorsAhmed AyadNo ratings yet

- Special ALT Characters ListDocument4 pagesSpecial ALT Characters ListAhmed AyadNo ratings yet

- Engineering Structure &materialsDocument18 pagesEngineering Structure &materialsnitishk25No ratings yet

- مقدمة عن المنشآت المحددة إستاتيكياًDocument25 pagesمقدمة عن المنشآت المحددة إستاتيكياًAhmed Ayad0% (1)

- ACI 214-77 Errata Concrete Strength Test EvaluationDocument1 pageACI 214-77 Errata Concrete Strength Test EvaluationAhmed AyadNo ratings yet

- # An - Je - 100k - 2-0 - 3-29-19 - v2Document5 pages# An - Je - 100k - 2-0 - 3-29-19 - v2Collblanc Seatours Srl Jose LahozNo ratings yet

- Go-to-Market & Scale - 2020-01-09 - Emin, Patrick, TessaDocument58 pagesGo-to-Market & Scale - 2020-01-09 - Emin, Patrick, TessaFounderinstituteNo ratings yet

- BlackRock 2023-2024 Portfolio Management Job DescriptionDocument8 pagesBlackRock 2023-2024 Portfolio Management Job Descriptionharikevadiya4No ratings yet

- Checklist For DSA - DOADocument2 pagesChecklist For DSA - DOAkhriskammNo ratings yet

- Capital Market, Consumption and Investment RelationshipsDocument22 pagesCapital Market, Consumption and Investment RelationshipsKamran Kamran100% (1)

- Case Study BookDocument106 pagesCase Study BookshubhaomNo ratings yet

- Case Study - Circuit City CaseDocument4 pagesCase Study - Circuit City CaseMohammedNo ratings yet

- HrumDocument3 pagesHrumDenny SiswajaNo ratings yet

- Apparel Merchandising - Types of BuyersDocument24 pagesApparel Merchandising - Types of BuyersNithyaprakashNo ratings yet

- Demantra and ASCP Presentation PDFDocument54 pagesDemantra and ASCP Presentation PDFvenvimal1No ratings yet

- HCL ProposalDocument2 pagesHCL Proposalrishabh21No ratings yet

- Risks of Material Misstatement at Financial Statement and Assertion LevelsDocument5 pagesRisks of Material Misstatement at Financial Statement and Assertion Levelskris mNo ratings yet

- Accenture - Five Ways To Win With Digital PlatformsDocument14 pagesAccenture - Five Ways To Win With Digital PlatformsSGNo ratings yet

- Higher Education Financing Agency BrochureDocument6 pagesHigher Education Financing Agency BrochuremidhunnobleNo ratings yet

- Lean Leadership PowerPoint PresentationDocument83 pagesLean Leadership PowerPoint PresentationchrmerzNo ratings yet

- Study Guide 7 Entrepreneurship 1Document43 pagesStudy Guide 7 Entrepreneurship 1Cathlyne Mejia NatnatNo ratings yet

- Develop Business in Rural Areas With The Help of Digital PlatformsDocument30 pagesDevelop Business in Rural Areas With The Help of Digital PlatformsMd Tasnim FerdousNo ratings yet

- Empathy and Experience (Coursera)Document3 pagesEmpathy and Experience (Coursera)008Akshat BedekarNo ratings yet

- Qip QSB v4.2 - Trad P Anotaçôes Rev02Document17 pagesQip QSB v4.2 - Trad P Anotaçôes Rev02Yasmin BatistaNo ratings yet

- Comparative Study of Operating Cycle Wih Reference To Manufacturing CompaniesDocument18 pagesComparative Study of Operating Cycle Wih Reference To Manufacturing Companies1921 Kanu ChauhanNo ratings yet

- Avon-Strategic Management CaseDocument56 pagesAvon-Strategic Management Casebrownshuga100% (2)

- Problem Solving: 1. Relay Corp. Manufactures Batons. Relay Can Manufacture 300,000 Batons A Year at ADocument2 pagesProblem Solving: 1. Relay Corp. Manufactures Batons. Relay Can Manufacture 300,000 Batons A Year at AMa Teresa B. CerezoNo ratings yet

- RPT Life Basic XDocument9 pagesRPT Life Basic XKhryz CallëjaNo ratings yet

- Mgt-302 (Final Project Report)Document22 pagesMgt-302 (Final Project Report)ShihabAkhandNo ratings yet

- Asli Köseoğlu Billur Yümlü Onur Erdoğan Sibel Temürlenk Sarah UnterburgerDocument26 pagesAsli Köseoğlu Billur Yümlü Onur Erdoğan Sibel Temürlenk Sarah UnterburgerAslı Akkaş100% (1)

- Parivarthane - Campus 2 Corporate Modules - IntroDocument5 pagesParivarthane - Campus 2 Corporate Modules - IntrocbooklenNo ratings yet

- Chloe's ClosetDocument17 pagesChloe's ClosetCheeze cake100% (1)

- The early days of risk management and derivatives marketsDocument8 pagesThe early days of risk management and derivatives marketstuzemec19No ratings yet

- SCDL Solved International Finance AssignmentsDocument19 pagesSCDL Solved International Finance AssignmentsShipra GoyalNo ratings yet

- Ra 7042 Foreign Investment ActDocument2 pagesRa 7042 Foreign Investment ActMark Hiro NakagawaNo ratings yet