Professional Documents

Culture Documents

Law On Free Economic Zones

Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Law On Free Economic Zones

Copyright:

Available Formats

Law on Free Economic Zones

No. 440-XV from 27 July, 2001

*** Table of contents: Article 1. General Provisions Article 3. The Applicable Law Article 4. Creation of Free Zones Article 5. The Administration of Free Zones Article 6. The Residents of Free Zones Article 7. Customs Regime Article 8. Tax System Article 9. Currency Regime Article 10. Visa and Registration Regime Article 11. Working Relations and Social Protection Article 12. Dispute Settlement Article 13. State Guarantees Article 14. Cessation of the Free Zones Activity Article 15. Transitory and Final Provisions The Parliament adopts the present Organic Law. ARTICLE 1. General Provisions (1) The free economic zones (free enterprise zones), hereinafter named as free zones are parts of the customs territory of the Republic of Moldova, separated from the economic point of view, strictly delimited on their whole perimeter, and where some types of entrepreneurial activity are permitted, in a preferential regime, for the domestic and foreign investors, according to the law. (Par. 1 of article 1 redacted by the Law No.594-XV from 01.11.2001) (Par. 1 of article 1 redacted by the Law No.280-XVI from 14.12.2007) (2) The territory of the free zones must be isolated from the rest of the country by a secure fencing. The guard of the free zones borders shall be ensured by the State safeguard authorities of the Republic of Moldova, based on the contracts concluded by them with the Administration of the respective zone. The system of authorized passing of the free zones borders, of which manner of functioning is set by a decision of the Government, shall be applied for physical persons and transport means. (Par. 2 of art.1 redacted by Law No.175. from 09.07.201, since in force 30.07.2010) (Par. 2 of article 1 redacted by the Law No. 594-XV from 01.11.2001) (3) The free zones shall be created aiming the acceleration of the social and economic development of certain territories and of the country as a whole by: a) attracting domestic and foreign investments; b) implementing the modern technique and technology;

c) developing the export-oriented production; e) creating work places. (4) Preferential regimes of stimulating the entrepreneurial activity shall be accorded to the free zones, aiming

(5) The free zone can be comprised from several subzones. The regimes and the manner of implementation of the entrepreneurial activity and the management are identical in all subzones.

ARTICLE 2. subzone a part, territorially isolated from the rest of the free zone; authorization for carrying out a certain type of activity written permission, issued by the Administration permitted in the respective zone and provided into the contract concluded between the Administration and the resident; development of free zones infrastructure construction and reparation of buildings and installations, construction of roads, installation and organization of water, electricity, gas supply, installation of telecommunication networks and organization of telephonic communications and other such works (services) on the territory of the free zone, which the Administration of the free zone considers to be favorable for the zones development and functioning; production buildings and constructions, warehouses, land plots, technical installations, equipment, including stationery items and machines, except for the means of passengers transport, utilized in process of implementation of the entrepreneurial activity in the free zone. external trade activity wholesale trade of goods imported into the free zone from the territory of Republic of Moldova and outside the boarders of Republic of Moldova; and delivered for export. (appended to art. 2 by the Law No.175 from 09.07.2010, since in force 30.07.2010) (appended to Article 2 by the Law No. 34-XVI from 28.02.2008) transportation activity transportation of imported or exported goods through the free zone by air or naval means of transportation. (appended to Article 2 by the Law No. 34-XVI from 28.02.2008)

ARTICLE 3. The Applicable Law (1) On the territory of the free zone shall act the: a) international agreements to which the Republic of Moldova is a party; b) legislation of the Republic of Moldova; c) normative acts of the Government; d) normative acts of the Administration of the free zone, adopted within the limits of its competence, which do not contravene with the present Law. (2) The drafts of normative acts of the public administration authorities that will regulate the activity of free zones shall be subject to an obligatory expertise at the Ministry of Economy and at the National Agency for Competition Protection.

The regime of investment and entrepreneurial activity in the free zone cannot be less favorable than the regime set for the economic agents carrying out their activity on the other side of the customs territory of the Republic of Moldova.

except by the decision of court only. (5) After settling the taxes, fees and other payments stipulated in Laws, the foreign investors shall be guaranteed with the right to transfer outside the Republic of Moldova the sums in foreign currency, obtained package of shares (share of stock) of the resident-enterprise, as well as from the liquidation or reorganization of the enterprise as provided by law. (Par. 5 of article 3 redacted by the Law No.280-XVI from 14.12.2007) (6) The free zones are demilitarized territories. The production, transportation and keeping weapons, as well as dislocation of military units shall be prohibited in such zones. (7) The activities prohibited by the legislation of the Republic of Moldova or by the international agreements to which the Republic of Moldova is a party shall not be admitted in free zones. (8) The State shall not bear responsibility for the commitments of the Administration of the free zone and of the residents of such zone, and the Administration and residents for the commitments of the State.

ARTICLE 4. Creation of Free Zones (1) The free zone shall be created, at the proposal of the Government, by a Law, adopted by the Parliament in accordance with the present Law, which will delimit in this purpose a part or several parts of the territory in the Law. (2) The Government shall elaborate the general conception of the free zones creation and development. (3) Initiators of the free zones creation can be the central and local public administration authorities, the economic agents and various organizations that will submit the corresponding proposals. (4) The proposals on the creation of the free zones shall comprise: a) the creation purposes, the types of entrepreneurial activity and functional orientation of the free zone; b) feasibility study regarding the opportunity of the free zones creation; c) draft of the layout of the free zone, coordinated with the corresponding authorities of the central and local public administration. (5) The feasibility study regarding the opportunity of free zones creation shall comprise the: a) delimitation of the zones borders; b) complex characteristic of the social and economic potential of the territory, including of the production, commercial and social infrastructures, as well as of the economic relations with international markets; c) reasoning the possibility of realization of the permitted types of activity; d) indication of the degree of load with specialists; e) draft of the economic mechanism of operation; f ) reasoning the stages and terms of the free zones creation;

(6) The free zones can be created on territories not occupied with buildings, as well as on the base of enterprises, institutions and organizations. (Par. 6 of article 4 redacted by the Law No.280-XVI from 14.12.2007) (7) The free zones cannot be created on the base of enterprises of strategic importance or which carry out

(8) Until the decision on the proposal of a free zone creation is adopted, the expertise on the opportunity of such zone creation shall be implemented, being ensured by the Ministry of Economy, together with the National Agency for Competition Protection. (9) When implementing the expertise, the following factors shall be taken into consideration: a) approximate cost of creation and maintenance of the free zone; b) advantage for the national economy from a such zones functioning; c) social and economic situation and the utilization degree of the workforce in the region where the creation of the free zone is planned; d) closeness of the given free zone to other free zones; e) number of free zones already existing in the country. (10) The proposal on creating a free zone can be approved in case if the expertise sets that the creation thereof will substantially improve the situation in national economy and that the respective improvement can be obtained in this way only. (11) In case when the proposal on creating a free zone is accepted, the Ministry of Economy will submit for approval to the Government the corresponding draft law. (12) The free zone shall be considered as created after the entering into force of the corresponding Law.

ARTICLE 5. The Administration of Free Zones (1) For the administration of the free zone, within 30 days from entering into force of the Law on the creation thereof, the Government shall form a State authority the Administration of free zone, hereinafter named as The premises of the Administration shall be situated on the territory of the free zone. (2) The Administration shall comprise a principal administrator, appointed into his position by the bear responsibility for the Administrations activity, for ensuring the guard of the free zones borders and the observance of the system of authorized passing. The functions, rights and obligations of the principal administrator shall be set in the contract concluded between the latter and the Ministry of Economy. (Par. 2 art. 5 redacted by Law. 444-XV from 07.11.2003) (3) The coordination and control of the activity of the free zones shall enter into the Governments attribution, being carried out through the State authorities authorized by it. The activity of the Administration shall be subject to an annual audit.

(4) The main sources of revenues of the Administration shall be the: a) payments and fees collected for the participation in the contests for obtaining the right to be resident of the free zone and for the registration as their residents, as well as for the issuance of authorizations for the corresponding types of activity in the respective zone; b) zonal payments and fees set by the Administration; c) revenues from renting assets and land plots; d) voluntary contributions of the free zones residents for the development of the infrastructure thereof; e) donations; f ) other revenues connected with the implementation of its functions, according to the law. (Item f) of paragraph 4 redacted by the Law No.280-XVI from 14.12.2007) (5) The structure and the amount of authorizations accorded to the Administration shall be set by laws and normative acts of the Government. (Par. 5 of article 5 redacted by the Law No.280-XVI from 14.12.2007)

a) coordinate the activity of creation of the productive and non-productive infrastructure of the free zone; b) maintain in working condition the systems of electricity, water and thermal energy supply on the territory of the free zone; c) organize tenders for obtaining the right to be resident of the free zone and register the residents, issue them the authorizations for carrying out concrete types of entrepreneurial activity in the respective zone, according to laws; (Item c) of paragraph 6 redacted by the Law No.280-XVI from 14.12.2007) d) ensure the maintenance in proper condition of the enclosures and constructions along the perimeter of e) elaborate and ensure the implementation of the complex development program of the free zone and environmental protection; f ) set, with the agreement of the Ministry of Economy, zonal payments and fees; g) collect from the residents of the free zone the renting payment and other payments provided by the present Law; h) control the manner in which the residents of the free zone observe the contracts concluded with it, as well as the legislation, sanitary and hygienic norms and rules; i) cooperate with the Customs Service aiming to ensure the observance of the customs legislation. (7) The Administration shall coordinate its activity with the local public administration authorities regarding answering the social and ecological issues and the issues referring to the development of the free zones infrastructure. (8) The Administrations decisions, adopted within the limits of its competence, shall be obligatory to be executed for all the residents of the free zone. (9) The Administration shall determine, in accordance with the laws and normative acts of the Government, the manner of renting land plots, the manner of granting the rights to use the natural resources, as well as the

normative acts of the Government. (Par. 9 of article 5 redacted by the Law No.280-XVI from 14.12.2007) (10) The Administration shall not have the right to interfere with the economic activity of the free zones

residents, if such activity does not contravene with the legislation and the contract concluded between the Administration and the resident. (11) The Administration of the free zone, the principal administrator and other workers of the Administration shall not have the right to carry out entrepreneurial activity on the territory of the free zone, as well as to participate directly or indirectly at the formation of equity capital of the legal persons carrying out their activity on the territory of the respective zone. (12) The labor remuneration of the Administrations workers shall be implemented in accordance with the legislation. (13) The Administration shall implement according to the law, the accounting and statistic management of its activity. The principal administrator shall systematically submit the Ministry of Economy with reports on the activity carried out in the free zone. The Ministry of Economy shall set the form and terms of submission of the reports. (Par. 13 of article 5 redacted by the Law No.280-XVI from 14.12.2007)

ARTICLE 6. The Residents of Free Zones (1) Any physical or legal person registered, according to the law, as a subject of entrepreneurial activity of the Republic of Moldova shall be considered resident of the free zone, hereinafter named as resident. (2) The selection of residents shall be implemented by the Administration on a contest basis, taking into consideration the amount and character of foreseen investments, the necessity of creation of a zones productive and non-productive infrastructure, the maintenance of the free zone oriented to fabrication of the industrial production for export, the free territory and land plots, the ensuring with workforce, water, energetic resources and other criteria. (3) The enterprises, on which base the free zone is created, shall be obliged, within one month, to register as residents. (4) The manner of implementation of contests in free zones shall be set by the regulation on contests, approved by the Government. (5) The selection conditions for residents, as well as the determination criteria for winners of contests shall be set by the principal administrator together with the Ministry of Economy. (6) The physical or legal person, who obtained the right to be registered as a resident, shall conclude with the Administration a contract for carrying out entrepreneurial activity in the free zone. The contract shall be concluded for all the activity period in the respective zone. (7) In the contract there shall be indicated: a) the authorized type of activity; b) the rights and obligations of the resident and of the Administration; c) the economic project to be implemented in the free zone and the foreseen parameters thereof; d) the size of zonal payments and of renting payments and fees; e) the facilities accorded to the resident by the Administration; f ) the types of reports submitted by the resident; g) the responsibilities of the parties, in case of infringement of contractual requirements;

h) other aspects, in accordance with the agreement between the parties. (8) A fee in the size set by the Administration with the agreement of the Ministry of Economy shall be collected for the registration as a resident. (9) Within 15 days from the registration of the resident, the Administration shall submit copies of the customs authorities. (10) The following types of activity can be carried out in the free zone: concentration higher than 80% vol., ethyl alcohol with concentration lower than 80% vol., technical ethanol, denatured alcohol, distillate from crude wine and aged distillates, including aged distillates, other ethanol derivates) and alcoholic production; (Item a) of paragraph 10 redacted by the Law No. 594-XV from 01.11.2001) (Item a) of paragraph 10 redacted by Law No. 1313-XV from 26.07.2002) b) sorting, packaging, labeling and other similar operations with goods transited through the customs territory of the Republic of Moldova; (Item b) of paragraph 10 redacted by the Law No. 594-XV from 01.11.2001) b1) external trade activity; (Item b1) of paragraph 10 appended by the Law No. 34-XVI from 28.02.2008) b2) transportation activity; (Item b2) of paragraph 10 appended by the Law No. 34-XVI from 28.02.2008) c) auxiliary types of activity, as public service, warehousing activity, constructions, catering etc., necessary for carrying out the activities indicated in items a) and b). (Item c) of paragraph 10 redacted by the Law No. 594-XV from 01.11.2001) (Item c) of paragraph. 10 redacted by the Law No.280-XVI from 14.12.2007) (101) Notwithstanding the provisions of par. (10) a), residents who, on the implementation of those provisions implemented investment projects related to the production of ethyl alcohol and alcoholic products time of implementation of the provisions hereof. [Par. 10 of article 6 amended by Law nr.175 of 09.07.2010, in force since 30.07.2010] (11) The industrial production shall be the priority type of activity. [Par.12 repealed by the Law nr.175 of 09.07.2010, from 30.07.2010]

(13) The drawing out of alcoholic production from the free zone to the rest of the customs territory of the Republic of Moldova is allowed only for exhibitions, contests, and tasting, with the accompanying documents. The record and labeling of the alcoholic production shall be implemented in accordance with the laws and normative acts of the Government. The import of tobacco and tobacco items into the free zone and the fabrication of such products in the free zone shall be prohibited. (Par. 13 of article 6 redacted by the Law No. 594-XV from 01.11.2001) (Par. 13 of article 6 redacted by the Law No. 444-XV from 07.11.2003) (Par. 13 of article 6 redacted by the Law No.280-XVI from 14.12.2007) (14) The residents shall carry out the activities stipulated in paragraph (10) on the basis of the separate authorization for every type of activity, issued by the Administration on the basis of the contract concluded by

them in accordance with the regulation approved by the principal administrator together with the Ministry of Economy. (15) The authorization for carrying out the activity in the free zone shall not exempt the resident from the obligation to obtain also other licenses (authorizations) provided by the laws. (Par. 15 of article 6 redacted by the Law No.280-XVI from 14.12.2007) (16) The authorization, provided by paragraph (14), shall be issued, as usual, for the validity term of the contract concluded between the resident and the Administration. The authorization issued for the resident contract or the requirements of the legislation. (17) The carrying out of entrepreneurial activity in the free zone by physical or legal persons which are not registered as residents or which do not have the authorization necessary for such an activity shall be prohibited and shall entail the responsibility provided by the legislation.

of the free zones infrastructure on its territory. (19) The residents shall be obliged to declare the goods only at the customs service supervising the activity of the respective free zone. (20) The residents can be divested from their statute of resident, by nullifying the registration, in case of: b) infringement by them of the legislation or of the requirements set by the Administration within the limits of its competence, established by laws and normative acts of the Government; (Item b) of paragraph 20 redacted by the Law No.280-XVI from 14.12.2007) d) non-settlement of the debts to the obligatory zonal payments and fees; e) carrying out the entrepreneurial activity without the respective authorizations (Par. 20 of article 6 redacted by the Law No. 594-XV from 01.11.2001) (21) The residents, in conditions of the law, can appeal in Economic Court of Appeal the actions of the Administration, including the ones regarding the withdrawal of the authorization or suspension of the activity, as well as regarding the withdrawal of the resident statute. (Par. 21 of article 6 redacted by the Law No. 240-XV from 13.06.2003) (Par. 21 of article 6 redacted by the Law No.280-XVI from 14.12.2007) (22) The sizes of fees for issuance of authorizations shall be set by the Administration with the agreement of the Ministry of Economy. (23) The resident shall keep, in the set manner, the accounting and statistic record of his activity, systematically submit the Administration with the reports on the activity carried out in the zone. The form and terms of reports submission shall be set by the Administration. (24) The record of the entrepreneurial activity carried out by the resident within the free zone must be kept separately from the record of the activity carried out by him outside the respective zone.

(25) The control of the residents activity shall be implemented through: a) planned controls not frequenter than once during one calendar year, by all control authorities concomitantly; b) non-planned controls if there is at least one from the following circumstances: comprised in such reports; registration of complaints or other written petitions regarding the infringement by the resident of the legislation; by them or the legislation on the free zones. (26) All the controls on the territory of the respective free zone shall be implemented with the agreement of the Administration and in presence of its representatives and of the resident, on behalf of which the complaint was submitted or of which activity constitutes the ground for control implementation. (27) The provisions of paragraph (26) shall not be extended on the controls implemented by the customs service. (28) The National Bank of Moldova shall implement, within the limits of its competence, the control of the residents activity in accordance with the Law on the National Bank of Moldova.

ARTICLE 7. Customs Regime (1) The customs regime on the territory of free zones shall be ensured by the customs service of the Customs Service, of which activity, under the organizational aspect, is coordinated with the Administration. (2) Within one month from the date of entering into force of the Law on creation of a free zone, the Customs Services shall elaborate the regulation of the customs service in the respective zone, the mechanism and mode of technical ensuring of its operation, shall submit proposals to the Government on the number of

(3) The regime of obligatory customs declaration of goods (services) imported into and exported from the territory of free zones shall be set in the free zones territory. Daily introduction into the free zone of local merchandise for non-commercial purposes with a cumulative value of 300 Euros and under, according to the total amount shown in the accompanying documents, is done without the completion of declaration of goods. (Par.3 art. 7 redacted by Law No.175 from 09.07.2010, since in force 30.07.2010) (Par. 3 art. 7 appended with by Law. 34-XVI from 28.02.2008) (4) The regime of contingency and licensing the import and export of goods (services) shall not be applied on the territory of the free zones. (Par. 5 art. 7 excluded by Law. 268-XVI from 28.07.2006) (6) The goods integrally produced or integrally processed in the free zone shall be considered as originating from such zone, if:

b) the cost of declared goods being exported exceeds the cost of goods introduced into the free zone

because of the increase with 35 percent of the amount of own expenditures. (7) The provisions of customs legislation, in the part referring to the content of the import compound shall export from the zone into the rest of customs territory of the Republic of Moldova. (8) The motor cars imported on the territory of the free zone for the necessities of the Administration and of residents shall be taxed in accordance with the law on taxation. (9) The introduction on the territory of the free zone of goods and other objects shall be prohibited in case when their commercialization is prohibited by the laws of the Republic of Moldova and by the international agreements to which the Republic of Moldova is a party, as well as in case they: a) are dangerous for other goods and objects of the free zone; b) endanger the public moral state and security; c) do not correspond with the ecological and sanitary and hygienic norms and rules, provided by the legislation; d) do not correspond with the quality requirements set by the laws. (Par. 9 of article 7 redacted by the Law No.280-XVI from 14.12.2007) (10) The deliveries of goods (services) into free zones from the rest of customs territory of the Republic of Moldova shall be assimilated to export, and the delivery of goods (services) from the free zone to the rest of customs territory of the Republic of Moldova shall be assimilated to import and shall be regulated in accordance with the legislation. (Par. 11, 12 of article 7 transferred to article 8 by the Law No. 594-XV from 01.11.2001) (Par. 13 renumbered into par. 11) (11) The goods (services) from the free zone until the moment of passing across their borders shall have free circulation regime and shall be transmitted from one resident to another without drawing up the customs declaration. (12) Upon the closing of the activity of a free zone (subzone), as well as upon the recalling of resident statute before the closing of the free zone (subzone), the resident or the former resident places the goods, formerly introduced under free zone customs regime, under new customs regime according to the legal framework. The inventory in storage are placed at their initial value and the used merchandise are placed at their residual value. (Par. 12, art.7 appended by Law No. 73-XVI from 22.03.2007)

ARTICLE 8. Tax Regime (1) The tax authorities of the Republic of Moldova shall exercise the control on observance of the tax legislation within the framework of the free zones. (2) The tax on the residents income, obtained from the delivery of goods (services) from the free zone to the rest of the customs territory of the Republic of Moldova, shall be collected in accordance with the legislation. (3) The Administration shall have the right to set zonal payments and fees. The size of zonal payments and fees collected from the residents by the Administration shall be set in the contract concluded by them with the Administration.

(4) Except for the reserves provided by the present article, the tax legislation of the Republic of Moldova shall be applied to the activity of free zones. (Par. 2-6, 8-12 and 14 art. 7deleted and par. 7, 13, and 15 renamed into 2, 3 and 4 appended with by Law. 34-XVI from 28.02.2008) ARTICLE 9. Currency Regime (1) The cash settlements on the territory of free zones shall be implemented in national currency. (11) On the territory of free zones, clearing settlements between residents and foreign currency can be made in accordance with rules established by the National Bank of Moldova. (2) The clearing settlements between the Administration, the residents and the economic agents of the Republic of Moldova shall be implemented in accordance with the laws and normative acts of the Government. (Par. 2 of article 9 redacted by the Law No.280-XVI from 14.12.2007) (3) The requirements of the legislation on currency repatriation shall not be extended on the transactions between the residents and the economic agents. (4) The requirements stipulated in the legislation on currency repatriation shall be extended on the exportimport transactions implemented by the residents with foreign subjects. (5) The labor remuneration of persons operating in the free zone shall be implemented in national currency.

ARTICLE 10. Visa and Registration Regime (1) In case of foreign investors and of the workers of the residents, as well as in case of persons invited by not be collected. (2) The solicitation of the principal administrator of the free zone shall constitute a ground for the issuance of the residence permit and the authorization for employment to the foreign investor or the worker of the free zones resident.

ARTICLE 11. Working Relations and Social Protection (1) At the resident enterprises, the working relations and the social guarantees shall be regulated in accordance with the legislation, by collective and individual contracts. The contracts can not comprise provisions limiting the rights set by the legislation. (2) The issues concerning the creation and the activity of trade unions at resident enterprises of the free zone shall be solved in accordance with the Law on trade unions No. 1129-XIV from July 7, 2000.

ARTICLE 12. Solving Disputes (1) The disputes between the residents, between the residents and other legal persons of the Republic of Moldova or the Administration shall be solved by the competent courts of the Republic of Moldova in accordance with the legislation. (2) The disputes between the foreign physical or legal persons and the residents, between the resident enterprises with foreign capital and other legal persons of the Republic of Moldova can be solved through the mediation of the international arbitrage, provided the legislation of the Republic of Moldova does not say

otherwise. (Par. 2 of article 12 redacted by the Law No. 594-XV from 01.11.2001)

ARTICLE 13. State Guarantees (1) The free zones shall be created for a period of at least 20 years. The Law on the respective free zone shall set the operation period of a free zone. (2) In case new legislative acts are adopted, worsening the conditions of residents activity regarding the customs, tax and other regimes provided by the present Law, the residents shall have the right to apply, within the period of 10 years from the date of entering into force of the said legislative acts, but not exceeding the functioning period of the free zone, to comply with the provisions of the present Law. This norm is applicable solely to the activities within the investment projects registered before the new law is adopted. (Par. 2, art. 13 redacted by the Law No. 34-XVI din 28.02.2008)

infrastructure capital equivalent to at least USD 200 million, state guarantees provided in paragraph (2) extend over the entire period activity of the resident in the free zone, but not more than 20 years. (Par. 3, art. 13 appended by the Law No. 14-XVI din 03.02.2009) ARTICLE 14. Termination of the Free Zones Activity (1) The activity of the free zone shall cease: a) at the expiration of the term of free zones functioning, provided by the Law on the concrete free zone; b) before the expiration of the term of free zones functioning, if its activity contradicts the objectives of the present Law or the economic interests of the Republic of Moldova. (2) The decision on the termination ahead of time of the free zones activity shall be adopted by the Parliament, at the proposal of the Government. The procedure of termination of the free zones activity and the manner of ensuring the State guarantees provided for the residents of free zones by paragraph (2) of article 13 shall be set by the Government. (Article 14 amended by the Law No. 594-XV from 01.11.2001)

ARTICLE 15. Transitory and Final Provisions Note: See Law for the interpretation of legislative acts no.245-XVI of 10.20.2005 (1) The laws on free enterprise zones, in force at the date of entering into force of the present Law, shall continue to function in the part in which they do not contravene with the present Law. (2) Within one month from the date of entering into force of the present Law, the Customs Service shall elaborate the regulations of the customs service in the free zone, the mechanism and manner of technical supply of its functioning, submit the Government with proposals on the number of personnel and the

(3) The Government, within 3 months, shall: bring its normative acts in accordance with the present Law; submit to the Parliament proposals for bringing the in force legislation in accordance with the present Law;

adopt the normative acts necessary for the execution of the present Law. (4) The resident of the free zone, registered before the present Law entered into force, shall have the right, within 10 years from its entering into force, to act on the basis of the provisions of the Laws on concrete free zones, referring to the tax and customs regime, in force at the date of its registration. The resident, within 3 months from the entry into force of the present Law, shall communicate his decision in this sense to the (Par. 4 of article 14 redacted by the Law No. 594-XV from 01.11.2001) (5) The Law on free enterprise zones No. 1451-XII from May 25, 1993 shall be abrogated.

THE PRESIDENT OF THE PARLIAMENT Chisinau, July 27, 2001. No. 440-XV.

Eugenia OSTAPCIUC

EXTRACT FROM THE LAW on Giurgiulesti International Free Port

No. 8-XV from 17 February, 2005

Article 1. General Provisions (1) Giurgiulesti International Free Port is established with the purpose to accelerate the economic development of the south area of the Republic of Moldova, to ensure countrys energy and transport security and to develop international trade. (2) The International Port is a separated area, from the economic point of view, and is operating according to the legislation of the Republic of Moldova, as well as related amendments and supplements. (3) The International Port is established for a period of 25 years. (4) The land lot located within the border of the International Port is owned by the state. (5) The International Port land area is not exceeding 120 hectares. (6) The International Port land lot is given priority as part of the development process of the Republic of Moldova. (8) The state is responsible for the protection of the International Port border, while the General Investor for ensuring security within the territory of the International Port. (9) The access to the International Port territory is granted in conformity with the regulation approved by the Government. (10) The International Port is a demilitarized zone. Any production, transit and storage of weapon, as well as any deployment of military units on the International Port territory are forbidden. (11) The General Investor shall be responsible for the development and maintenance of the infrastructure within the territory of the International Port. (12) The provisions of the legislation on competition and activity of natural monopolies shall not be applied to the activity of General Investor residing on the territory of the International Port, except for the actions that (13) The state shall not be liable for the obligations of the International Port residents, and the International Port residents shall not be liable for the state obligations. Article 2. Applicable Law Internationally, shall require the Ministry of Economys coordination. (3) Investments made within the International Port shall be protectedby the state, as per legislation. The regime of investment and entrepreneurial activity established for the International Port shall not be less favorable than the regime established for the agents on the rest of the customs territory of the Republic of Moldova. Article 3. General investor and other residents (1) The resident of the International Port, hereinafter resident, shall be any individual or legal entity of the Republic of Moldova or of another state, registered in the Republic of Moldova as a subject of entrepreneurial activity that leases property or land lots on the International Port territory, and which is registered by the Government Representative at the International Port. (2) For a complex development of the International Port, the Government will identify the General Investor, which shall be a party to the Investment Agreement and shall sign a lease agreement for the entire territory of the International Port. (4) On the territory of the International Port, the residents are entitled to:

a) provide port and transport services; b) manufacture industrial products, including oil products; d) carry out wholesale trade; e) provide paid services; f ) perform other types of activity, as provided by the legislation of the Republic of Moldova. (5) Any entrepreneurial activity on the territory of the International Port prior to its registration as resident is forbidden. (6) Residents may invite non-resident individuals or legal entities to provide specialized services, but only upon agreement with the Government Representative. (8) Residents shall keep separate accounting and statistics records on their activities inside and outside the International Port territory. (9) State inspection authorities shall perform not more than one complete inspection per year of resident activities. This restriction does not apply to the operational inspections carried out by customs bodies on the territory of the International Port or inspections carried out within criminal investigations by relevant state bodies of the Republic of Moldova or by prosecution bodies, as well as within investigations of industrial accidents. All inspections and investigations shall be carried out in the presence of the Government Representative. (10) The National Bank of Moldova shall exercise control over residents activity under the Law on the National Bank of Moldova. Article 4. Exemption from fees and charges for the operation and use of the port and port facilities For the entire period of law validity, the General Investor and its customers are exempt from the payment of fees and taxes under the Moldovan legislation for the operation and use of port and port facilities, except for the shipping payments that shall be calculated and paid on the basis of rate 0.0062 USD per 1 m3 of ship volume. Article 5. International Port Management The International Port Management and the coordination of land development works shall be carried out by the General Investor. Article 7. Customs Regime (1) The customs regime within the International Port is ensured by the customs service. The activity of the customs service of the International Port is coordinated in terms of organization with the Government Representative and General Investor. (2) The procedure of mandatory customs declaration of goods (services) imported and exported from the territory shall be established by the International Port. (3) No quota and licensing procedures for the import and export of goods (services) shall be applied on the territory of the International Port. Foreign trade activity of residents and their activity on the territory of the International Port shall not be subject to foreign trade limitations, including banning or limiting the import or export of goods (services), except for limitations approved by the competent bodies of the Republic of Moldova based on the related decisions or resolutions of the United Nations or World Trade Organization. (4) SHall be exempt from customs duties, except for the customs processing fees: a) goods imported to the International Port from the rest of the customs territory of the Republic of Moldova; b) goods imported to the International Port from outside the customs territory of the Republic of Moldova, from the territory of free economic zones of the Republic of Moldova; c) goods originating from the International Port, exported to the rest of the customs territory of the Republic of Moldova; d) goods, including those originating from the International Port, exported outside the customs territory of

the Republic of Moldova, as well as to the territory of free economic zones of the Republic of Moldova. within its territory, if as a result of such fact:

b) the cost of declared goods exported under customs regime exceeds the cost of goods imported to the International Port, due to tthe expense growth rate more than 35%. the rest of the customs territory of the Republic of Moldova, fall under the provisions of the customs legislation regarding the content of imports. (8) The delivery of goods (services) to the International Port from the rest of the customs territory of the Republic of Moldova shall be considered export activities, and the delivery of goods (services) from the International Port to the rest of the customs territory of the Republic of Moldova shall be considered import activities and fall under the provisions of the legislation in force. (9) Goods located on the territory of the International Port, before export is carried out, fall under the free circulation regime and are transferred from one resident to another without any customs declaration. Article 8. Tax Regime (1) The control over the compliance with tax legislation on the territory of the International Port shall be carried out by the tax bodies of the Republic of Moldova. (2) The tax on the income earned from the activities carried out at the International Port is imposed as follows: was registered - 25% of the established income tax rate; b) thereafter and until the expiry of the present law - 50% of the established income tax rate. (3) The income earned by a resident from the sale of goods (services) originating from the International Port on the rest of the customs territory of the Republic shall be taxed in accordance with the law. (4) The goods (services) imported to the International Port from outside the customs territory of the Republic of Moldova, as well as goods (services) exported from the International Port outside the customs territory of the Republic of Moldova shall be exempted from value added tax. (5) The delivery of goods (services) within the International Port and deliveries of goods (services) between residents of the International Port and those of free economic zones of the Republic of Moldova shall be exempted from value added and excise tax. (6) The goods (services) imported to the International Port from the rest of the customs territory of the Republic of Moldova shall be imposed with 0% value added tax. (7) The delivery of goods (services) from the International Port to the rest of the customs territory of the Republic of Moldova shall be imposed with VAT in accordance with the legislation in force. (9) Excisable goods imported to the International Port from outside the customs territory of the Republic of Moldova, from the FEZs of Moldova, and goods originating from the International Port and exported outside the customs territory of the Republic of Moldova shall not be imposed with excise duty. (10) Excisable goods exported from the International Port to the rest of the customs territory of the Republic of Moldova shall be imposed with excise duty, as per the law. Article 9. Other Regimes (1) Cash payments on the territory of the International Port shall be made in national currency of the Republic of Moldova. (5) The payment of work of persons engaged in activities within the International Port shall be made in the currency of the Republic of Moldova. (6) Residents are entitled to:

a) transfer abroad, in accordance with the Moldovan legislation, funds derived from investments, including income and funds obtained from the liquidation or sale of investments; b) open, in accordance with the procedures established by the Moldovan legislation, bank accounts in local and foreign currency at any commercial bank of the Republic of Moldova and abroad. Accounts opening abroad shall conform to the requirements of the Moldovan legislation. c) make payments and transfers related to international capital transactions, without any restrictions, except for restrictions existing on the date of their registration as residents; d) make payments and transfers related to current international transactions, including payments to foreign contractors and payments of salaries to foreign workers, without any restrictions in forceor that could arise in the future; e) buy, sell or convert foreign currency into another foreign currency and / or the currency of the Republic of Moldova at the market exchange rate on the date of transaction, excluding charges other than bank fees; f ) avoid the requirements on mandatory sale of foreign currency collected from exports, when such actions are adopted in the Republic of Moldova. (7) Foreign investors and residents employees, as well as persons invited by the Government Representative, shall not pay any consular fees for business visa processing. (8) The Government Representatives application shall serve as a basis for the resident permit and work permit issue to the foreign investor or residents employee. Article 10. Labor relations and social security (2) Residents employees - foreign and stateless persons are not obliged to pay mandatory social security contributions to the state social insurance budget and mandatory health insurance contributions. (3) Residents are not obliged to pay mandatory social security contributions to the state social insurance budget and mandatory health insurance contributions for their employed foreign and stateless persons. Article 12. State Guarantees If new legal acts are adopted, including amendments or supplements to the present law, aggravating the operational conditions of residents in terms of customs and tax regimes, residents registered before the entrance into force of the new legal act, are entitled, up to 17 February 2030 to apply the provisions of the rpesent law, which shall be considered valid until the new legal act is put into force.

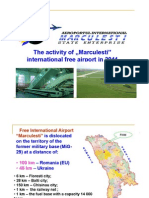

EXTRACT FROM THE LAW on Marculesti International Free Airport

No. 178-XVI from 10 July, 2008

Article 1. General provisions (1) The Marculesti Free International Airport is founded with the purpose to accelerate the development of air transport, aviation services, export-oriented industrial production and foreign trade activities. (2) The Free Airport is a part of the customs territory of the Republic of Moldova, subject to the legislation of the Republic of Moldova, unless otherwise stipulated by the present law.

defense, security and international commitments of the Republic of Moldova. (4) The International Airport is established for a period of 25 years. (5) The land lot located within the limits of the International Airport is owned by the state. (6) The land is managed by the State Enterprise Marculesti International Airport as a general investor. the development region and is surrounded by secure fencing. (9) The control over the Free Airport activities falls under Governments responsibilities and is carried out by state bodies authorized by the Government. (10) The state is responsible for the protection of the Free Airport limits, while the general investor for the security within the Free Airport limits. Article 2. Residents of the Free Airport (1) Resident of the Free Airport (hereinafter referred to as resident) can be represented by an individual or legal entity of the Republic of Moldova or of other origin, registered in the Republic of Moldova as a subject of entrepreneurial activity, which owns or leases property or land lots located on the territory of the Free Airport and is registered by the Government Representative as a resident, in accordance with the Regulation on the registration of residents of Marculesti Free International Airport approved by the Government. (2) The general investor, as resident, carries out production and aircraft, equipment and special installations repair works, provision of ground services and air transportation services, as well as additional activities required by the Free Airport.

according to the operation and safety requirements in force. (4) The general investor develops and approves the Complex Development Plan of the Free Airport, which provides for the priorities in aeronautic activity types, as well as in additional related activities, the establishment of an international logistics hub, attraction of domestic and foreign investments, the application of modern equipment and technology, application of advanced management experience, job vacancies announcement, ensuring the implementation of such. (5) The general investor has the following functions: a) to develop the infrastructure and manage the Free Airport; b) to select residents according to the procedure established by the Government, taking into account the complex development plan of the Free Airport; c) to lease residents a part of the Free Airport land, for a term not longer than the term of airport operation; d) to keep operational the electric power, water and thermal energy supply systems within the Free Airport; e) to coordinate activities with local government authorities under as provided by the legislation. (6) The activity provided by the article 1 par. (3) is carried out exclusively by the general investor.

(7) Residents of the Free Airport are entitled: a) to provide ground service and air transportation services; b) to perform wholesale sales, except for the goods excluded from the civil use; c) to produce industrial goods; d) to process agricultural and food products; e) to perform sorting, packing, marking and other similar operations with regard to the goods in transit through the Free Airport; f ) to provide paid services to residents of the Free Airport and foreign companies; g) to carry out other additional activities, such as utilities, warehouse, construction, lease and / or rental, (8) The goods imported into the Free Airport cannot be sold on the rest of the customs territory of the Republic of Moldova. The volume of goods (services) produced at the Free Airport and sold by a resident on the rest of the customs territory of the Republic of Moldova cannot exceed 30 percent of the total sales of goods (services) per one year. (9) The transportation of spirits, tobacco and tobacco products from the Free Airport to the rest of the customs territory of the Republic of Moldova and manufacture of within the Free Airport space of spirits, tobacco and tobacco products are strictly forbidden. (10) Any entrepreneurial activity developed at the Free Airport without registration as resident is forbidden, except for the purpose of aviation security and exceptional circumstances, when non-residents get free access to the Free Airport, as stipulated by the Regulation on the authorized system of crossing the territory of the Free Airport. (12) The residents shall keep separate accounting and statistics records on its activities within and outside the Free Airport territory. Article 4. Customs Regime (1) The customs regime within the Free Airport is ensured by the Customs Service, whose activity is coordinated in terms of organization with the general investor and the Government Representative. (2) The procedure of mandatory customs declaration of goods (services) imported and exported from the territory shall be established by the Free Airport. The import by residents of local goods for non-trade purpose of a total limit value of 50 EUR, as per the documents attached, is carried out without any customs declaration. (3) No quota and licensing procedures for the import and export of goods (services) shall be applied on the territory of the Free Airport. Foreign trade activity of residents and their activity on the territory of the Free Airport shall not be subject to foreign trade limitations, including banning or limiting the import or export of goods (services), except for limitations approved by the competent bodies of the Republic of Moldova based on the related decisions or resolutions of the United Nations or World Trade Organization, as well as the restrictions stipulated by the international acts and treaties to which the Republic of Moldova is a party. (4) The following are exempted from customs duties: a) goods imported to the Free Airport from the rest of the customs territory of the Republic of Moldova; b) goods imported to the Free Airport from outside the customs territory of the Republic of Moldova, from the territory of free economic zones of the Republic of Moldova and the Giurgiulesti International Free Port; c) goods originating from the Free Airport, exported to the rest of the customs territory of the Republic of Moldova, except for foreign goods to be taxed under the general rule; d) goods, including those originating from the Free Airport, exported to the customs territory of the Republic of Moldova, on the territory of free economic zones of the Republic of Moldova and the Giurgiulesti International Free Port. within its territory, if as a result of this:

b) the cost of declared goods exported under customs regime exceeds the cost of goods imported to the Free Airport because of the increase by over 35% of own expenditure ratio.

rest of the customs territory of the Republic of Moldova, fall under the provisions of the customs legislation regarding the structure of imported goods. (8) The delivery of goods (services) to the Free Airport from the rest of the customs territory of the Republic of Moldova shall be considered as export, and the delivery of goods (services) from the Free Airport to the rest of the customs territory of the Republic of Moldova shall be considered as import and fall under the provisions of the legislation in force. (9) Goods located on the territory of the Free Airport up to the border crossing moment fall under the free

Article 5. Tax regime (1) The control over the compliance with tax legislation on the territory of the Free Airport shall be carried out by the tax bodies of the Republic of Moldova. (2) The income earned from the sale of goods (services) originating from the Free Airport is subject to taxation according to the law. (3) The goods and services delivered to the Free Airport from outside the customs territory of the Republic of Moldova, delivered from the Free Airport outside the customs territory of the Republic of Moldova, delivered to the Free Airport from the rest of the customs territory of the Republic of Moldova, as well as those delivered from the Free Airport to the Giurgiulesti International Free Port and free economic zones of the Republic of Moldova shall be imposed with 0 value added tax. (4) The delivery of goods and services within the Free Airport shall be exempted from VAT. (5) Shall be exempted from excise tax the goods imported to the Free Airport from outside the customs territory of the Republic of Moldova, from the free economic zones and the rest of the customs territory of the Republic of Moldova, as well as the goods originating from the Free Airport and exported outside the customs territory of the Republic of Moldova. (6) Shall be exempted from excise tax the goods delivery carried out within the Free Airport, as well as those between the Free Airport residents and residents of the Giurgiulesti International Free Port and free economic zones of the Republic of Moldova. (7) shall be considered excisable the goods exported from the Free Airport to the rest of the customs territory of the Republic of Moldova. legislation of the Republic of Moldova. Article 6. Other regimes (1) Cash payment on the territory of the Free Airport shall be made in national currency of the Republic of Moldova. (5) Residents are entitled: a) to transfer abroad, in accordance with the Moldovan legislation, funds derived from investments, including income and funds obtained from the liquidation or sale of investments; b) to open, in accordance with the procedures established by the Moldovan legislation, bank accounts in local and foreign currency at any commercial bank of the Republic of Moldova and abroad. Accounts opening abroad shall be subject to the requirements of the Moldovan legislation. Article 9. State guarantees If new laws are adopted, aggravating the operational conditions of residents in terms of customs, tax and other regimes provided by the legal acts on the activity of the Free Airport, residents are entitled, within a period of 10 years, but not exceeding the term of operation of the Free Airport, to act according to the legislation in force until the date of new legislation put into force. This norm will apply to the activities of residents acting within the investment projects registered before the adoption of the new law.

You might also like

- 17 Checked Law On Free Zones Ed CDocument7 pages17 Checked Law On Free Zones Ed CBulgantamir TuvshinjargalNo ratings yet

- Cambodia's Special Economic Zones FrameworkDocument5 pagesCambodia's Special Economic Zones FrameworkmamillapallisriNo ratings yet

- Myanmar Ministry Issues Foreign Investment RulesDocument28 pagesMyanmar Ministry Issues Foreign Investment Ruleszayarmyint_uNo ratings yet

- G.R. No. 127410 - Tiu vs. CADocument8 pagesG.R. No. 127410 - Tiu vs. CAseanNo ratings yet

- The Case: Custom SearchDocument5 pagesThe Case: Custom SearchKim Laurente-AlibNo ratings yet

- The CaseDocument7 pagesThe Casekim zeus ga-anNo ratings yet

- Tiu Vs CADocument6 pagesTiu Vs CARodney Cho TimbolNo ratings yet

- The Law of The Free Zones Corporation No. (32) For 1984 and Its AmendmentsDocument9 pagesThe Law of The Free Zones Corporation No. (32) For 1984 and Its AmendmentsGjuetar BalonashNo ratings yet

- Tiu V CADocument5 pagesTiu V CAAgnes FranciscoNo ratings yet

- Organized Industrial Zones LawDocument13 pagesOrganized Industrial Zones LawsirreadsalotNo ratings yet

- PAL ActDocument8 pagesPAL ActsudumalliNo ratings yet

- Investment Contract 02Document45 pagesInvestment Contract 02ahadi abdullahNo ratings yet

- Law On Free ZonesDocument14 pagesLaw On Free ZonesVladan StojanovicNo ratings yet

- Exec V SouthwingDocument2 pagesExec V SouthwingRomeo Dator Sucaldito Jr.No ratings yet

- Oyu Tolgoi Investment AgreementDocument45 pagesOyu Tolgoi Investment AgreementOdbayar GurragchaaNo ratings yet

- Free Zone Law 2002Document9 pagesFree Zone Law 2002kkmcNo ratings yet

- KOURDISTAN InvestmentLaw enDocument12 pagesKOURDISTAN InvestmentLaw enkerateaNo ratings yet

- The Special Economic Zone Act, 2005Document5 pagesThe Special Economic Zone Act, 2005SreejithNo ratings yet

- Oyu Tolgoi IA EN PDFDocument45 pagesOyu Tolgoi IA EN PDFts bulganNo ratings yet

- SEZ ActDocument2 pagesSEZ ActD Attitude KidNo ratings yet

- Law No.8 of 1997 For Investment - EnglishDocument32 pagesLaw No.8 of 1997 For Investment - EnglishkyahiaNo ratings yet

- Tiu Montelibano Et Al Vs CA Hon Guingona Subic 301 SCRA 278Document6 pagesTiu Montelibano Et Al Vs CA Hon Guingona Subic 301 SCRA 278Jarvin David ResusNo ratings yet

- Law571 Fiscal CodeDocument281 pagesLaw571 Fiscal CodeMihaela SatmariNo ratings yet

- Ra 7916Document3 pagesRa 7916Anonymous Ig5kBjDmwQ100% (1)

- Free ZoneDocument22 pagesFree ZoneNadine ShaheenNo ratings yet

- Concession Law Completed VersionDocument19 pagesConcession Law Completed VersionmimiNo ratings yet

- Leyes de ZEDE en HondurasDocument27 pagesLeyes de ZEDE en HondurasfjroviraNo ratings yet

- Subic Special Economic Zone tax incentives caseDocument8 pagesSubic Special Economic Zone tax incentives caseLemuel Lagasca Razalan IVNo ratings yet

- Zákon o DPH V Anglickom Jazyku 222-2004 PDFDocument53 pagesZákon o DPH V Anglickom Jazyku 222-2004 PDFtreskajNo ratings yet

- Objectives of SezDocument48 pagesObjectives of Sezasandilya100% (1)

- The Government - The Socialist Republic of Vietnam Independence - Freedom - HappinessDocument136 pagesThe Government - The Socialist Republic of Vietnam Independence - Freedom - HappinessVan khuongNo ratings yet

- 05-Clark Investors and Locators Association, Inc. v. Secretary of Finance GR No 200670Document10 pages05-Clark Investors and Locators Association, Inc. v. Secretary of Finance GR No 200670ryanmeinNo ratings yet

- The Petitioners Filed A Petition For CertiorariDocument17 pagesThe Petitioners Filed A Petition For CertiorariRyan Jhay YangNo ratings yet

- Indian Special Economic ZoneDocument7 pagesIndian Special Economic Zoneadwitiya1No ratings yet

- FIL English Version - 29-1-2013Document43 pagesFIL English Version - 29-1-2013Apoel SumbaYakNo ratings yet

- The Foreign Trade (Development and Regulation) Act, 1992Document12 pagesThe Foreign Trade (Development and Regulation) Act, 1992Mishail BakshiNo ratings yet

- Nd87 2004Document10 pagesNd87 2004Hong NganNo ratings yet

- Republic V. CaguioaDocument18 pagesRepublic V. CaguioaMae SampangNo ratings yet

- There Is No Vested Right in A Tax Exemption. Being Mere Statutory Privilege, A Tax Exemption May Be Modified or Withdrawn at Will by The Granting AuthorityDocument13 pagesThere Is No Vested Right in A Tax Exemption. Being Mere Statutory Privilege, A Tax Exemption May Be Modified or Withdrawn at Will by The Granting AuthorityJeremiah Jawaharlal Ii NaluptaNo ratings yet

- Export Processing Zones Authority Ordinance Iv of 1980Document10 pagesExport Processing Zones Authority Ordinance Iv of 1980Fa Adi Ahm EdNo ratings yet

- EAC AssignmentDocument7 pagesEAC AssignmentShazzyNo ratings yet

- Philippine Supreme Court Decision on VAT and Excise Tax in FreeportsDocument12 pagesPhilippine Supreme Court Decision on VAT and Excise Tax in FreeportsTrishia Fernandez GarciaNo ratings yet

- Sro 327-2008Document22 pagesSro 327-2008abid205No ratings yet

- Omani Commercial LawDocument8 pagesOmani Commercial LawDorian BallNo ratings yet

- Sro 327 PDFDocument20 pagesSro 327 PDFOmer ToqirNo ratings yet

- Republic vs. CaguioaDocument23 pagesRepublic vs. CaguioaVictoria aytonaNo ratings yet

- Oman Issues Executive Regulations for Income Tax LawDocument44 pagesOman Issues Executive Regulations for Income Tax LawavineroNo ratings yet

- 4Document32 pages4Audrin Agapito de AsisNo ratings yet

- This Research Guide Summarizes The Sources of Philippine Tax LawDocument6 pagesThis Research Guide Summarizes The Sources of Philippine Tax LawMeanne Estaño CaraganNo ratings yet

- Foreign TradeDocument12 pagesForeign TradeSoumyajit Das MahapatraNo ratings yet

- Double Tax Agreement Indonesia - NorwayDocument19 pagesDouble Tax Agreement Indonesia - NorwayMang CoyNo ratings yet

- Republic vs. CaguioaDocument10 pagesRepublic vs. CaguioaMichelle Jude TinioNo ratings yet

- Regulation of The Investment LawDocument33 pagesRegulation of The Investment LawArcénio R WassoteNo ratings yet

- Quipo ReportDocument24 pagesQuipo ReportNaiju MathewNo ratings yet

- TURNOVER TAX PROCLAMATION No 308 2002Document22 pagesTURNOVER TAX PROCLAMATION No 308 2002Murti DhugasaNo ratings yet

- Basic Law of the Macao Special Administrative Region of the People' s Republic of ChinaFrom EverandBasic Law of the Macao Special Administrative Region of the People' s Republic of ChinaNo ratings yet

- Studiu Agricultura Ecologica - EngDocument44 pagesStudiu Agricultura Ecologica - EngOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Romanian Apparel Market 1Document30 pagesRomanian Apparel Market 1Organizația de Atragere a Investițiilor și Promovarea Exportului din Moldova100% (1)

- Investment - Project - Miepo 02 11 12 FinalDocument24 pagesInvestment - Project - Miepo 02 11 12 FinalOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- 4.MIFA Activity 2011Document11 pages4.MIFA Activity 2011Organizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- 5.presentation GIFP Activity 2011-2012Document23 pages5.presentation GIFP Activity 2011-2012Organizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Presentation Industrial Complex Ciocana BIS 13.07.2012Document19 pagesPresentation Industrial Complex Ciocana BIS 13.07.2012Organizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- ReportRomanian Market Study-Eng (Final)Document85 pagesReportRomanian Market Study-Eng (Final)Organizația de Atragere a Investițiilor și Promovarea Exportului din Moldova100% (1)

- 2.FEZ Activity 2011Document14 pages2.FEZ Activity 2011Organizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- FEZ Chisinau OfferDocument8 pagesFEZ Chisinau OfferOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- FEZ Balti OfferDocument5 pagesFEZ Balti OfferOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- 3.the Population Around FEZ and The Average Monthly WageDocument1 page3.the Population Around FEZ and The Average Monthly WageOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- FEZ Tvardita OferDocument8 pagesFEZ Tvardita OferOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Marculesti IFA OfferDocument25 pagesMarculesti IFA OfferOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- FEZ Otaci OfferDocument12 pagesFEZ Otaci OfferOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- FEZ Valkanes OfferDocument7 pagesFEZ Valkanes OfferOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Doing Bussines2011Document40 pagesDoing Bussines2011Organizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- FEZ Ungheni OferDocument15 pagesFEZ Ungheni OferOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- FEZ Taraclia OferDocument10 pagesFEZ Taraclia OferOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Feasability Study IP Tracom - EnglishDocument118 pagesFeasability Study IP Tracom - EnglishOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Catalog ICTDocument19 pagesCatalog ICTOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- PI 2011 EngDocument21 pagesPI 2011 EngOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Feasability Study Falesti - EnglishDocument171 pagesFeasability Study Falesti - EnglishOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Feasibility Study Cantemir - EnglishDocument130 pagesFeasibility Study Cantemir - EnglishOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Investment Guide - 2010Document70 pagesInvestment Guide - 2010Organizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Info MoldovaDocument20 pagesInfo MoldovaOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Feasibility Study ZEL Balti - EnglishDocument90 pagesFeasibility Study ZEL Balti - EnglishOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Feasibility Study Cainari - EnglishDocument65 pagesFeasibility Study Cainari - EnglishOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Feasability Study Edinet - EnglishDocument134 pagesFeasability Study Edinet - EnglishOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- Feasability Study Hincesti - EnglishDocument120 pagesFeasability Study Hincesti - EnglishOrganizația de Atragere a Investițiilor și Promovarea Exportului din MoldovaNo ratings yet

- CMTA SummaryDocument36 pagesCMTA SummaryAngie Douglas100% (2)

- Customs & Excise ActDocument85 pagesCustoms & Excise ActAndrew JoriNo ratings yet

- Trade India BangladeshDocument127 pagesTrade India BangladeshSunil KumarNo ratings yet

- Comparative Analysis of VAT and GSTDocument39 pagesComparative Analysis of VAT and GSTsaahilp_10% (5)

- Is A F Container ScamDocument91 pagesIs A F Container ScamM Munir QureishiNo ratings yet

- Flow Chart Importation To PaymentDocument1 pageFlow Chart Importation To Paymentjulandmic9No ratings yet

- Unlicensed Customs Broker - LegresDocument2 pagesUnlicensed Customs Broker - LegresRegine LangrioNo ratings yet

- KuwaitDocument2 pagesKuwaitKelz YouknowmynameNo ratings yet

- Tax Remedies under NIRCDocument32 pagesTax Remedies under NIRCCire GeeNo ratings yet

- Enrile Vs VinuyaDocument4 pagesEnrile Vs VinuyapyulovincentNo ratings yet

- Mountaineering Rules & RegulationsDocument13 pagesMountaineering Rules & Regulationstayyab_mir_467% (6)

- Macondary Co. v Commissioner of CustomsDocument4 pagesMacondary Co. v Commissioner of CustomsPipoy AmyNo ratings yet

- Chapter I - Imposition of Tax: Title Iv Value-Added TaxDocument8 pagesChapter I - Imposition of Tax: Title Iv Value-Added TaxCher TantiadoNo ratings yet

- Form 12 Registration For VAT Deferment Blank App P1-P5Document5 pagesForm 12 Registration For VAT Deferment Blank App P1-P5samaanNo ratings yet

- New Provisional BillDocument55 pagesNew Provisional Billrafi ud dinNo ratings yet

- Customs Clearance IssuesDocument5 pagesCustoms Clearance IssuesAbhijeet Srivastava100% (1)

- Psychedelic Art, Music and Culture at Ozora FestivalDocument7 pagesPsychedelic Art, Music and Culture at Ozora FestivalAndra IvănușNo ratings yet

- Custom Law - ManualDocument100 pagesCustom Law - Manualmiteshpatel.judicialNo ratings yet

- TAX CASE MV Don Martin vs. Secretary of FinanceDocument1 pageTAX CASE MV Don Martin vs. Secretary of FinanceDiane UyNo ratings yet

- A Tax Incentives Guide For Investors in UgandaDocument37 pagesA Tax Incentives Guide For Investors in UgandaNtumwa IbrahimNo ratings yet

- E-Library - Information At Your Fingertips: Printer FriendlyDocument15 pagesE-Library - Information At Your Fingertips: Printer FriendlyJonNo ratings yet

- Streifeneder Catalogue ProstheticsDocument264 pagesStreifeneder Catalogue Prostheticsmohd shuib abd rahmanNo ratings yet

- EY-Kazakhstan Oil and Gas Tax Guide 2014Document24 pagesEY-Kazakhstan Oil and Gas Tax Guide 2014shankar_embaNo ratings yet

- Preferential Quizers From ULDocument21 pagesPreferential Quizers From ULFrie NdshipMaeNo ratings yet

- Specific Instuctions To BiddersDocument37 pagesSpecific Instuctions To BiddersShahed Hussain100% (1)

- @canotes - Final Customs Question Bank May, Nov 20 by ICAI PDFDocument111 pages@canotes - Final Customs Question Bank May, Nov 20 by ICAI PDFPraneelNo ratings yet

- Cao No. 7-2002Document6 pagesCao No. 7-2002Sam RafzNo ratings yet

- List of Cases:: YEAR 2019 10 April 2019 No. 25Document113 pagesList of Cases:: YEAR 2019 10 April 2019 No. 25HidayatmuhtarNo ratings yet

- Customs Valuation SystemDocument3 pagesCustoms Valuation SystemJehiel CastilloNo ratings yet

- Title Iv Import Clearance and Formalities Goods DeclarationDocument42 pagesTitle Iv Import Clearance and Formalities Goods Declarationdennilyn recaldeNo ratings yet