Professional Documents

Culture Documents

Financial Inclusion Issue Brief

Uploaded by

Christine PrefontaineOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Inclusion Issue Brief

Uploaded by

Christine PrefontaineCopyright:

Available Formats

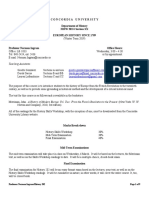

Issue Brief, August 2012

Knowledge is Power: The Role of Libraries in Financial Inclusion

Many government- and donor-funded initiatives aim to increase financial inclusion, but could strengthen programs by carefully considering how historically marginalized populations will access and apply financial information resources.

Introductory Summary

Governments and international donors have increasingly invested in financial inclusion policy initiatives and development programs over the last decade. Private businesses have developed new products, such as branchless banking on mobile phones, to increase access to their services for those previously excluded. In June 2012, the G20 held sessions dedicated to financial inclusion and asked all countries to once again make public financial inclusion commitments.

Recent Financial Inclusion Initiatives:

Financial Inclusion for Rural Microenterprises (2011-2013) A USAID/Government of Kenya program is working with the private sector to develop products that address the financial needs of microenterprises in Kenya. The program supports loans to entrepreneurs, initiates policy reforms at a government level, and provides capacity building support to the Central Bank of Kenya. Central Bank of Brazils National Partnership for Financial Inclusion (NPIF) (since November 2011) This is a government-sponsored venture to promote financial inclusion in line with G20 principles for innovative financial inclusion, and to raise awareness with other public and private partners. On May 9, NPIF committed to an action plan meant to strengthen the institutional environment. Alliance for Financial Inclusion Global Policy Forum, Capetown, South Africa (September 2012) Senior representatives from developing countries regulatory institutions will gather with financial inclusion policy experts and practitioners to discuss the quality of financial access and usage and the potential and the real impact of financial inclusion on the lives of the worlds unbanked.

Disparities in financial service coverage are significant, and the absence around the world of nearly half of all adults from the banking system presents a challenging obstacle to economic development and participation.1 Many people lack the information and skills they need to access, understand and apply relevant laws and services. At least 35 percent of adults report barriers to account use that might be addressed by public policy.2 Without access to financial information and lacking the ability to use or know about available services, many will continue to be left out of the opportunities offered by their countrys economy. How can governments provide marginalized people with the financial know-how necessary to improve their economic situation in a sustainable and cost-effective way?

www.beyondaccess.net

Page 1

Governments seeking to provide marginalized citizens with the financial know-how and access to services necessary to improve their economic situation must consider the following questions: How will people learn about new banking tools, laws, and financial management skills? How will they access and learn to use them? How will they contact and interact with the government, banks and other service providers? Who will help those new to the process? How will governments meet their G20 commitments to provide financial education to those in need? Today, there are more than 320,000 public libraries around the worldand 73 percent of them are located in developing and transitioning countries. Those libraries could be used as a conduit of information and services that enable financial inclusion. A community hub, research center, and internet access point, they are a natural place for people to go for financial information and training. They are a centralized place for service providers, banks and governments to easily reach potential beneficiaries, often accessible in areas where even bank branches are not. Already committed to providing access to information, librarians are equipped to serve as information guides. They are able to disseminate information, identify community members needs, and to refer them to relevant services. Existing libraries and librarians provide a ready platform for sharing information at local, regional and international levels. Through these institutions, information dissemination efforts can be scaled up quickly and easily, in a cost-effective way that reaches the most people. These public access points offer the potential of one-on-one support from librarians, enabling the marginalized to take steps away from financial exclusion.

Gaps in Existing Provision, and the Potential Role of Libraries Consumer protection agencies, citizens advice bureaus, and financial legislation are meant to ensure that consumers have the information needed to make informed decisions. New private sector products, sometimes governmentsubsidized, also are intended to provide financially excluded populations with ways to more actively participate in the economy. Unfortunately, these initiatives often fall short because their reach is not wide enough, or because they do not have longterm funding. For example, where consumer protection agencies exist, they often lack relevant mechanisms to get their information out to the public. The agency may have a website, but many particularly those who are marginalizedmay not know about it or how best to use it. Laws meant to enable financial inclusion, such as banking regulations that protect consumers from arbitrary fees, may not be enough for uninformed citizens to shield themselves from financial predators or scams. With the added support of knowledge brokers like public library staff, those at the bottom rung of the financial ladder will be better equipped to navigate public banking information resources and regulations. In addition to government agencies, private companies are also marketing new products at lower income groups, such as mobile phone banking and appropriately designed loans. However, not all companies provide citizens with the background knowledge they need to benefit from these products. Like government initiatives aimed at reducing financial service coverage disparities, many of these productsincluding mobile phone bankingdo not reach the most marginalized.3

www.beyondaccess.net

Page 2

Development experts have suggested that low literacy rates and information disparities pose significant barriers to widespread use of private banking services.4 Here, too, libraries can be of considerable use in supporting people in taking advantage of public and private banking resources. Librarians can help prepare those currently lacking access to financial services to learn how to use the tools that banks, microfinance lenders, and mobile services offer, as well as their related risks. As trusted, publically-funded community institutions, libraries are a natural place for people to seek information. Where librarians have the right training, customized librarian guidance supports those missing out on financial opportunities. Government agencies and banks can support this process by establishing formal linkages with public libraries. Ultimately, all public and private stakeholders stand to profit from the presence of a larger banked, information-literate population. Library Case Studies: Increasing Financial Literacy and Inclusion Serbia: Financial Education5 At the Belgrade City Library, visitors were repeatedly expressing a need for financial education. The library responded by conceiving the Novcici family and its online financial tutorial (www.novcici.rs) was born. To demonstrate basic personal financial management and provide information about certain financial products, the Novcici family takes the visitor on a tour of these topics. The website, with tailored sections for teenagers, students, employed youth, families, and pensioners, serves as a resource for workshops conducted regularly by librarians. Training covers tools to calculate, for example, deposits, loan installments, and credit card payments. Financial training is now available in 14 branches, ensuring that their financial education efforts reach the widest possible audience.

Ukraine: Personal Money Management6 With more than 15 percent of the Ukrainian population over the age of 65,7 financial literacy in a tech-driven world is a survival skill. The library in rural Rivne, Ukraine recognized this need and partnered with a local foundation and private business to offer older patrons on a fixed income the financial and computer skills they needed to save money in their everyday finances. At the Stryi City Library, youth can benefit from its personal money management classes, co-hosted with a local bank. Both libraries, and others throughout Ukraine, are providing sound information and guidance that supports all citizens to make better financial decisions. Chile: Small Business Start-up Advice8 The Chilean government has already realized the valuable role that libraries can play in reaching out to impoverished communities to improve their standard of living. The Tolten Library in the historically marginalized Araucana region, where poverty is higher than the Chilean national average,9 offers a variety of training for those seeking financial independence and those who want to open a small business. Thanks to these opportunities and librarian support, community members have successfully launched their own tourism and craft businesses. Recommendations To ensure that all citizens can access, learn about, and use available financial information and services to become financially included, Beyond Access recommends: To governments and donors: 1. Explore partnerships with libraries that will enable them to serve as hubs for information on financial opportunities and training. For example, community training and information dissemination could be based at libraries throughout a country, targeting locations that will reach those currently excluded.

www.beyondaccess.net

Page 3

2. Support librarian-led training to connect communities to financial services and information or include librarians in existing financial-related training initiatives. Librarians equipped with financial information knowledge will have a multiplier effect, as each librarian will be able to reach many people in the community and patrons will know to keep coming back to him/her for reliable information.

Librarians can request training on those services for librarians, and offer libraries as a central location for training and information. Financial institutions might not even know that libraries could play this role. It is up to libraries to reach out and establish themselves as a conduit of financial information that is valuable to these institutions. 2. Compile resources both online and on paper for those seeking financial information. Financial information useful to library patrons already exists in most places, but is often hard to find. Even before other programs are implemented, libraries can begin assembling the information that will be relevant to their visitors right now.

To libraries: 1. Reach out to financial institutions to explore what services they offer to the marginalized.

References

1. World Bank. Financial Inclusion Data. <http://datatopics.worldbank.org/financialinclusion/> 2. Demirguc-Kunt, Asli, and Leora Klapper. Measuring Financial Inclusion: The Global Findex Database. Policy Research Working Paper 6025, World Bank Development Research Group, Finance and Private Sector Development Team, April 2012. <http://www-wds.worldbank.org/servlet/WDSContentServer/WDSP/IB/2 012/04/19/000158349_20120419083611/Rendered/PDF/WPS6025.pdf> 3. Jack, William, and Tavneet Suri. The Economics of MPESA: An Update. Short Paper, Georgetown University, October 2012. <http://www9.georgetown.edu/ faculty/wgj/papers/M-PESA_Update.pdf> 4. Murphy, Tom. Mobile Money is Failing and Expanding. Go Figure. Blog: A View From The Cave. June 13, 2012. <http://www.aviewfromthecave.com/2012/06/ mobile-money-is-failing-and-expanding.html> 5. EIFL. Novcici Public library website to promote financial literacy. Economic wellbeing: EIFL-PLIP innovation award: Award 1: Meet the winners! 2012. <http://www.eifl.net/eifl-plip-innovation-award/award-1-economic-wellbeing#europe> 6. Bibliomist. Libraries Offer Financial Literacy Classes. Biblionews, March 2012. <http://www.bibliomist.org/documents/Biblionews/March_2012_Bibliomist_ newsletter_ENG.pdf> 7. CIA World Factbook. Ukraine - CIA - The World Factbook. July 17, 2012. <https://www.cia.gov/library/publications/the-world-factbook/geos/up.html> 8. Beyond Access. Empowering Disenfranchised Communities: A Look at the Tolten Library, Chile. Blog: Beyond Access. April 3, 2012. <http://www. beyondaccess.net/2012/04/03/tolten-library-a-potential-catalyst-for-social-and-economic-change/> 9. Tonioni , Andrs Roldn. Communitarian development practices: A perspective from handcraft skills and work. Polis Magazine of Universidad Bolivariana 24 (2009). <http://www.revistapolis.cl/english/24e/roldan.htm> About Beyond Access: Beyond Access is an initiative of IREX, EIFL, IFLA, Makaia, Civic Regeneration, TASCHA, The Riecken Foundation, and READ Global, with support from the Bill & Melinda Gates Foundation.

www.beyondaccess.net

Page 4

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Amit M Agarwal Integral Calculus IIT JEE Main Advanced Fully Revised Edition For IITJEE Arihant Meerut PDFDocument313 pagesAmit M Agarwal Integral Calculus IIT JEE Main Advanced Fully Revised Edition For IITJEE Arihant Meerut PDFNikhilsai KasireddyNo ratings yet

- Writing As A Learning Tool Integrating Theory and Practice PDFDocument220 pagesWriting As A Learning Tool Integrating Theory and Practice PDFq234234234No ratings yet

- Government Information Systems Plan of The PhilippinesDocument116 pagesGovernment Information Systems Plan of The PhilippinesJack Nicole Tabirao75% (4)

- Assignment FP002 ORC Casanova GuadalupeDocument11 pagesAssignment FP002 ORC Casanova GuadalupeGuadalupe Elizabeth Casanova PérezNo ratings yet

- Territorial Innovation MarshCatRDocument16 pagesTerritorial Innovation MarshCatRChristine PrefontaineNo ratings yet

- Twitter BookDocument191 pagesTwitter BookChristine PrefontaineNo ratings yet

- Karavanov Brown Strategic PlanDocument5 pagesKaravanov Brown Strategic PlanChristine PrefontaineNo ratings yet

- TASCHA Chile Disaster Brief 20120224Document2 pagesTASCHA Chile Disaster Brief 20120224Christine PrefontaineNo ratings yet

- 07 ScienceinterimreportDocument4 pages07 ScienceinterimreportAlyssa ColeNo ratings yet

- Simulated and Standardized Patients in Osces: Achievements and Challenges 1992-2003Document9 pagesSimulated and Standardized Patients in Osces: Achievements and Challenges 1992-2003Anonymous wGAc8DYl3VNo ratings yet

- Bschons Statistics and Data Science (02240193) : University of Pretoria Yearbook 2020Document6 pagesBschons Statistics and Data Science (02240193) : University of Pretoria Yearbook 2020Liberty JoachimNo ratings yet

- December 2013 NLE Room Assignments - Davao CityDocument150 pagesDecember 2013 NLE Room Assignments - Davao CityjamieboyRNNo ratings yet

- Physics Core 2017 With SolutionDocument62 pagesPhysics Core 2017 With Solutional_helu260% (1)

- Ragilliya Royana, S.T.: Fresh Graduate, Environmental EngineeringDocument1 pageRagilliya Royana, S.T.: Fresh Graduate, Environmental EngineeringRagiliyaRNo ratings yet

- How To Teach Prepositions of Time - LessonDocument3 pagesHow To Teach Prepositions of Time - LessonrosariosilvaNo ratings yet

- Promotion Policy 11 January WAPDADocument28 pagesPromotion Policy 11 January WAPDANigah Hussain100% (1)

- 04chapter3 PDFDocument38 pages04chapter3 PDFMegz OkadaNo ratings yet

- Policy Changes: Offered in The Morning or Is Clashing With Another Core Course Then They May Take Core Course in TheDocument1 pagePolicy Changes: Offered in The Morning or Is Clashing With Another Core Course Then They May Take Core Course in ThesirfanalizaidiNo ratings yet

- Y1S1 2020-21 - TIMETABLE - Njoro Campus - BDocument3 pagesY1S1 2020-21 - TIMETABLE - Njoro Campus - BBONVIN BUKACHINo ratings yet

- Energetika, Elektronika I Telekomunikacije (Master Akademske Studije)Document309 pagesEnergetika, Elektronika I Telekomunikacije (Master Akademske Studije)Antoni JakovleskiNo ratings yet

- P9.2 Acceleration Worksheet STUDENTDocument3 pagesP9.2 Acceleration Worksheet STUDENTBenjamin WatsonNo ratings yet

- Week2 Day1Document9 pagesWeek2 Day1Hassen Zabala100% (1)

- Rti 10 Adv SchemeDocument35 pagesRti 10 Adv SchemeNasir AhmedNo ratings yet

- Derrig Udl Lesson AnnotationsDocument13 pagesDerrig Udl Lesson Annotationsapi-528337063No ratings yet

- HISW 202 SyllabusDocument9 pagesHISW 202 SyllabusIqbal SanduNo ratings yet

- 0402 Internal and External Eventssss 1Document175 pages0402 Internal and External Eventssss 1Let it beNo ratings yet

- Online Railway PassesDocument23 pagesOnline Railway PassesSenthil KumarNo ratings yet

- Assignment Purposive CommunicationDocument4 pagesAssignment Purposive CommunicationGonowon Jojimar KennethNo ratings yet

- Event Report Tnwaa 2021Document32 pagesEvent Report Tnwaa 2021Aditya PaluriNo ratings yet

- Final Thesis Assesment in Tecnical Drawing Skills2.0Document61 pagesFinal Thesis Assesment in Tecnical Drawing Skills2.0john kingNo ratings yet

- Inovasi 2Document17 pagesInovasi 2SalsabilaNo ratings yet

- U3m2 Lesson Internalization GuideDocument4 pagesU3m2 Lesson Internalization Guideapi-426305688No ratings yet

- Nairobi - Fulltime - 3rd Trimester 2022 Common Teaching Timetables - 08.09.2022Document5 pagesNairobi - Fulltime - 3rd Trimester 2022 Common Teaching Timetables - 08.09.2022Chann AngelNo ratings yet

- Chapter 1 12humss CDocument11 pagesChapter 1 12humss CBea Aizelle Adelantar Porras100% (1)