Professional Documents

Culture Documents

International Journals Call For Paper HTTP://WWW - Iiste.org/journals

Uploaded by

Alexander DeckerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Journals Call For Paper HTTP://WWW - Iiste.org/journals

Uploaded by

Alexander DeckerCopyright:

Available Formats

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.3, No.

11, 2012

www.iiste.org

INFLATION-HEDGING POTENTIAL OF NIGERIAN BREWERY STOCKS

E. Chuke Nwude Department of Banking and Finance, Faculty of Business Administration, University of Nigeria Nsukka, Enugu Campus. e-mail:chukwunekenwude@yahoo.com, 08034738615. Abstract Inflation is an ill-wind that blows no one any good. It is an important variable in investment decision. In inflationary period, investors are usually jittery because not only that their invested capital and expected income are at risk of extinction, the possibility of maintaining the value of the investment to command the expected purchasing power is heavily threatened. To combat this monster called inflation and protect the purchasing power of investment income, the investor should properly examine his potential investment assets to make sure such can offer him the security of his capital and income in real terms. Against this background, this study sets to examine the inflation-hedging potentials of investment in equity stocks of quoted brewers in Nigeria between 2000 and 2011. The study applied real rate of return on equity and regression analysis to find the stocks that provide positive real return and offer inflation-hedging potentials respectively. The findings revealed that in terms of real return based on shareholders funds and total return to equity, all the firms were not susceptible to adverse effect of inflation but when based on dividend yield all the firms offered no significant hedge against inflation. 1.0 Introduction The influence of inflation is one of the major problems encountered in investment decision especially in high inflationary economies where purchasing power degenerates fastly. In most advanced economies, the rate of inflation is moderated to a single digit level but in developing economies like Nigeria it is mostly in 2-digit state. Because of the negative effects of inflation, any nation with good government always makes efforts to postpone the emergence of inflationary tendency on the economy. This is because once inflation takes on the way, a chain of reactions is set in motion as there will be rising prices of any conceivable goods and services, real profits or earnings from investments dwindle and the urge to differ present consumption to future for investment purpose will wane, prices of real and financial assets will shoot up to the roof top. The purchasing power of the income of the citizens and residents will be messed up as it cannot command enough respect in every free-market economy. Here in Nigeria inflationary pressure is dense and persistent and the nation is yet to break out from this vicious circle. The rate of inflation in Nigeria on a year-on-year basis was 13% as at December 1991, rose to 46% by December 1992, 72.8% as at December 1995 and progressively declined to 6.9% in 2000 but rose to 10.8% as at December 2011(CBN Statistical Bulletin, 2011). Griffith(1976) spotted raging inflationary pressure as at 1974 on some industrialized economies like Britain, France, Italy, Holland, Belgium, Japan, and the United States of America to the level of 20, 14, 20, 10, 13, 24, 12 percent respectively. Bello (2000) traced the cause of inflation in Nigeria economy to low output, rapid growth of liquidity, rising cost of funds, continued depreciation of the local currency Naira and rising cost of transportation brought about by higher adjustments to fuel pump price and related tariff. This economic scenario has being exerting adverse effect on the quantity and quality of real returns on most investment assets. In spite of this, equity investment in banking stocks continues to attract large chunk of investors in the Nigerian stock market. The main reason for this attraction is the belief that stock market investment acts as a better inflation-hedge than most other investment assets. This constitute the research questions which are, Is this belief right or wrong? Is there any evidence to support this assertion from the Nigerian Stock Market? In providing answers to these questions, the remainder of this paper is structured as follows: the next section provides a summary of the previous work and the section that follows deals with the methodology employed in the empirical analysis. The penultimate section takes care of the empirical results and its discussion, while the last section provides the summary of findings, concluding remarks and recommendation. 2.0 Literature Review It is a common belief that investment in common stocks is a good hedge against inflation. The empirical evidence for this belief originated from the work of Irving Fisher (1930) which proposes that expected nominal interest rates should move in tandem with expected inflation. Fama and Schwert (1977) exemplified how the Fisher (1930) proposal could be used to test the inflation hedging characteristics of investment assets. Thereafter, many studies have towed the line of Fama and Schwert (1977) in determining the inflation hedging characteristics of some investment assets. With a quarterly data set covering the period 1976 and 1986 at the

64

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.3, No.11, 2012

www.iiste.org

property sector level and treasury bill rate as a measure of expected inflation, Limmack and Ward(1988) used the Fama and Schwert (1977) framework and found that all commercial property sectors hedge against inflation and that only the industrial sector hedge against unexpected inflation. Brown(1991) used monthly Investment property databank returns from 1987 to 1990 to give evidence that property provides a hedge against both expected and unexpected inflation. Hoesli and Matysiaic (1996) and Tarbert (1996) used cointegration approach on the examination of the inflation hedging capacity of UK commercial property and found that the UK commercial property does not exhibit short term hedging characteristics but in the long run show a positive correspondence between property return and expected/unexpected inflation. Miles (1996) compared real returns on various types of investment in United Kingdom over a period of fifty years and found that most tangible asset-commodities(with the exception of gold), houses, land and equitiesgenerated real returns above the average for all the assets classes with the highest return generated on equities. The assets whose returns are set in nominal terms such as bonds, bank and building society deposits had the least performance over the period. Hoesli et al (1995) show that real estate has poorer short term hedging characteristics than shares but better hedging characteristics than bonds. Newell (1996) examined the inflation hedging characteristics of Australian commercial property between 1984 and 1995 and found that both office and retail property provided a good hedge against actual, expected and unexpected inflation in Ten Australian cities studied. Hoesli (1994) used monthly, quarterly, annual and five- year data on common stocks and real estate in Switzerland for the period between 1943 and 1991 and discovered that Swiss real estate provides a better hedge against inflation than common stocks. Hamerlink and Hoesli (1996) employed hedonic and autoregressive models to show that Swiss stocks, bonds, real estate and real estate mutual funds are positively related to expected inflation and negatively related to unexpected inflation. Hartzell et al (1987) carried out study on inflation hedging potential of residential property, commercial property, farmland, REITs, commingled real estate funds and stock exchange listed property firms and report significantly positive coefficients for expected and unexpected components of inflation. Park et al (1990) study on United States of America equity REITs report significantly negative coefficients to both expected and unexpected inflation. Fogler (1984) reports positive impact of including real estate in portfolios of United States of America stocks and bonds. With causality and cointegration analysis on the relationship between inflation and property returns Barkham et al (1996) observe that in the short run, changes in expected and actual inflation affects returns from investments in property. Bello (2005) splitting inflation into actual, expected, and unexpected and applying the Fisher (1930) model and static regression analysis in assessing inflation hedging attributes of ordinary shares, real estate, and Naira-denominated time deposits between 1996 and 2002 discovered that the extent of hedging against actual inflation was highest in ordinary shares, very weak in Nairadenominated time deposits, and non-existent in real estate. However, hedging against expected inflation was seen only in real estate and Naira-denominated time deposits. From the works of Fisher and Webb(1992) and Newell (1996), the consensus from the results of these studies is that while property is likely to be a hedge against inflation, definitive details concerning whether property is an inflation-hedge are still unclear. Moreover none of these studies has handled a sectoral analysis of the brewery sector. 3.0 Methodology Like most of these previous studies, this study followed the methodology of Fama and Schwert (1977). The form of regression equation typically used in this regard is Rit = it + It + eit, where Rit represents nominal return on the ith asset during period t, it is a constant, is inflation hedging coefficient, It is the inflation rate during period t, while eit is a random disturbance. The decision rule for is as follows: An asset is a complete hedge against inflation if the value of is not significantly less than 1. An asset is a partial hedge against inflation if the value of is between 0 and 1. An asset has zero hedge against inflation if the value of is not significantly different from zero. An asset has a perverse hedge against inflation if the value of is negative. The inflationhedging potential of each brewery stock was assessed against actual inflation. In previous studies, measures of actual inflation have generally been derived from the consumer price index (CPI) percentage change, while proxies available to estimate the level of expected inflation include economic variables at the time such as short term interest rate, for instance 90-day Treasury Bill rates as in Fama (1995), Fama and Schwert (1977), Hoesli(1994), Limmack and Ward (1988). Others include survey-based inflation forecast as in Newell (1995a, 1995b), Newell and Boyd (1995) and Park et al (1990); autoregressive integrated moving average(ARIMA)based inflation estimates as in Brown(1991), Fama and Gibons (1982), Hartzell et al (1987), Limmack and Ward (1988). The unexpected inflation is usually computed as the difference between the actual inflation and the estimates of the expected inflation. In this study, the actual inflation proxy that was used is CPI percentage change. The study period covers 2000-2011. The returns on equity were compiled from the ordinary shares of the three active quoted breweries on the Nigerian Stock Exchange(NSE) using their annual reports and accounts from

65

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.3, No.11, 2012

www.iiste.org

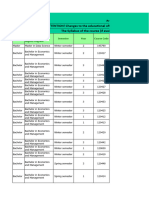

2000-2011. The return on equity was computed under four models namely; 1) return on equity based on PAT/Shareholders funds, 2) return on equity based on sum of dividend yield and capital gain yield, 3) return on equity based on dividend yield before tax, and 4) return on equity based on dividend yield after tax. This segregation becomes necessary in order to capture the inflation potential of the stocks in terms of return on equity based on 1) what the enterprise earns on shareholders funds at its disposal, 2) sum of earnings of dividend yield and capital gain yield, 3) return that enters into the pocket of the shareholders before tax, 4) net return that enters into the pocket of the shareholders after tax. 4.0 Results and Discussions Tables 4.1 to 4.4 show the four categories of nominal return on equity of the subject firms from 2000 to 2011. Table 4.1 : Actual Inflation Rates(%)and Nominal Return on Equity based on shareholdersfunds(%) Year Inflation Rates GUINNESS BREW INTERNATIONAL BREW NIGERIAN BREW 2000 6.90 28.97 171.14 17.11 2001 18.9 32.42 55.32 18.00 2002 12.9 29.31 -125.06 34.89 2003 14.0 43.69 228.35 28.08 2004 15.0 46.80 79.52 18.00 2005 17.9 26.66 63.21 28.79 2006 8.2 35.52 30.37 30.07 2007 5.4 33.79 9.04 43.87 2008 11.6 32.18 2897.94 79.74 2009 12.5 42.95 100.77 59.93 2010 13.7 40.17 -236.44 60.46 2011 10.8 44.50 11.31 48.97 AVE 12.32 36.41 273.79 38.99 STD 4.087 6.91 835.36 19.92 Source: Inflation rates from CBN statistical Bulletin 2011 and ROE computed from Annual Reports of the Breweries Table 4.2 : Actual Inflation Rates(%)and Nominal Return on Equity based on Dividend and Capital gain Yields(%) Year Inflation Rates GUINNESS BREW INTERNATIONAL BREW NIGERIAN BREW 2000 6.90 75.46 -24.24 33.08 2001 18.9 42.01 96.00 32.34 2002 12.9 29.25 43.88 24.98 2003 14.0 69.06 -41.13 19.39 2004 15.0 78.11 -3.61 64.55 2005 17.9 -19.74 10.00 -45.80 2006 8.2 24.92 -1.14 9.40 2007 5.4 11.94 14.94 14.50 2008 11.6 -0.11 661.00 24.50 2009 12.5 6.95 -60.45 3.80 2010 13.7 42.54 79.73 48.45 2011 10.8 40.63 13.49 30.37 AVE 12.32 33.42 65.71 21.63 STD 4.087 30.82 192.84 26.92 Source: Inflation rates from CBN statistical Bulletin 2011 and ROE computed from Annual Reports of the Breweries Table 4.3 : Actual Inflation Rates(%)and Nominal Return on Equity based on Dividend Yield before Tax(%) Year Inflation Rates GUINNESS BREW INTERNATIONAL BREW NIGERIAN BREW 2000 6.90 8.96 0 6.66 2001 18.9 8.38 0 7.60 2002 12.9 8.69 0 5.96 2003 14.0 6.78 0 2.68 2004 15.0 4.31 0 0.59 2005 17.9 3.20 0 1.84 2006 8.2 3.51 0 3.20

66

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.3, No.11, 2012

www.iiste.org

2007 5.4 2.78 0 3.83 2008 11.6 3.77 0 10.23 2009 12.5 11.18 0 3.80 2010 13.7 4.76 0 5.21 2011 10.8 3.82 0 3.48 AVE 12.32 5.85 0 4.59 STD 4.087 2.82 0 2.68 Source: Inflation rates from CBN statistical Bulletin 2011 and ROE computed from Annual Reports of the Breweries Table 4.4 : Actual Inflation Rates(%)and Nominal Return on Equity based on Dividend Yield afterTax(%) Year Inflation Rates GUINNESS BREW INTERNATIONAL BREW NIGERIAN BREW 2000 6.90 8.06 0 5.99 2001 18.9 7.54 0 6.84 2002 12.9 7.82 0 5.36 2003 14.0 6.10 0 2.41 2004 15.0 3.88 0 0.53 2005 17.9 2.88 0 1.66 2006 8.2 3.16 0 2.88 2007 5.4 2.50 0 3.45 2008 11.6 3.39 0 9.21 2009 12.5 10.07 0 3.42 2010 13.7 4.28 0 4.69 2011 10.8 3.44 0 3.13 AVE 12.32 5.26 0 4.13 STD 4.087 2.54 0 2.41 Source: Inflation rates from CBN statistical Bulletin 2011 and ROE computed from Annual Reports of the Breweries A test was carried out to find out if these brewery stocks provide positive real return on equity over the period. Using the Fisher model, the return on equity in real term is given by the model, R = (1+NR)/(1+IR) 1, where NR represents nominal rate of return on equity, IR represents inflation rate, and R represents real rate of return on equity. Applying the Model, the real rate of return on each of the stocks has been computed and displayed in Table 4.5 to Table 4.8 showing the four classes of return on equity. Table 4.5 : Real Return on Equity based on Shareholders funds(%) Year GUINNESS BREW INTERNATIONAL BREW NIGERIAN BREW 2000 20.65 153.64 9.55 2001 11.37 30.63 -0.76 2002 14.53 -122.20 19.48 2003 26.04 188.03 12.35 2004 27.65 56.10 2.61 2005 8.26 39.50 10.08 2006 25.25 20.49 20.21 2007 26.94 3.45 36.50 2008 18.44 2586.33 61.06 2009 27.07 78.46 42.16 2010 23.28 -220.00 41.13 2011 30.42 0.46 34.45 AVE 21.66 234.57 24.07 Source: computed from Annual Reports of the Breweries Based on enterprise return on shareholders funds Guinness generated positive real return on equity over the 12year period which range between 30.42% in 2011to 8.26% in 2005, and this resulted into an average positive real return of 21.66 percent over the period. Similarly, International Breweries exhibited series of real rate of return on equity between 2586.33 and 0.46 percent and an average positive real return of 234.57 percent over a 12-year period, with negative real returns in years 2002 and 2010. Except in year 2001 when Nigerian Breweries recorded -0.76 percent real return, it provided positive real returns in other 11 years which ranged between 61.06 and 2.61 percent, giving an average of 24.07 percent for the period. Table 4.6 : Real Return on Equity based on Dividend and Capital Gain Yields (%)

67

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.3, No.11, 2012

www.iiste.org

Year GUINNESS BREW INTERNATIONAL BREW NIGERIAN BREW 2000 64.13 -29.13 24.49 2001 19.44 64.84 11.30 2002 14.48 27.44 10.70 2003 48.30 -48.36 4.73 2004 54.88 -16.18 43.09 2005 -31.40 -5.98 -53.68 2006 15.45 -8.63 1.11 2007 6.20 9.05 8.63 2008 -10.49 581.90 11.56 2009 -4.93 -64.84 -7.73 2010 25.36 58.07 30.56 2011 26.92 2.43 17.66 AVE 19.03 47.55 8.54 Source: computed from Annual Reports of the Breweries From the perspective of dividend and capital gain yields Guinness has an average of 19.03 percent for the period and provided reasonable positive real returns in all the years except in 2005, 2008, and 2009 when the global financial meltdown was rampaging Nigerian capital market. Nigerian Breweries towed the same line of Guinness with an average of 8.54 percent and positive real returns in all years excerpt in 2005 and 2009. International Breweries exhibited series of positive and negative real rate of return on equity as can be seen in table 4.6 above with an average of 47.55 percent for the 12-year period. Table 4.7 : Real Return on Equity based on Dividend Yield beforeTax(%) Year GUINNESS BREW INTERNATIONAL BREW NIGERIAN BREW 2000 1.93 -6.45 -0.22 2001 -8.85 -15.90 -9.50 2002 -3.73 -11.43 -6.15 2003 -6.33 -12.28 -9.93 2004 -9.30 -13.04 -12.53 2005 -11.79 -14.53 -12.96 2006 -4.33 -7.58 -4.62 2007 -2.49 -5.12 -1.49 2008 -7.02 -10.39 -1.23 2009 -1.17 -11.11 -7.73 2010 -7.86 -12.05 -7.47 2011 -6.30 -9.75 -6.61 AVE -5.60 -10.80 -6.70 Source: computed from Annual Reports of the Breweries Assessment based on dividend yields both before and after tax shows that the return on equity in terms of cash reward to equity holders yielded negative real returns. This shows that dividends received are not good hedge against inflation in the real sense of it and this may be the reason why people try to sell off when price appreciates. Table 4.8 : Real Return on Equity based on Dividend Yield afterTax(%) Year GUINNESS BREW INTERNATIONAL BREW NIGERIAN BREW 2000 1.09 -6.45 -0.85 2001 -9.55 -15.90 -10.14 2002 -4.50 -11.43 -6.67 2003 -6.93 -12.28 -10.17 2004 -9.67 -13.04 -12.58 2005 -12.07 -14.53 -13.11 2006 -4.66 -7.58 -4.92 2007 -2.75 -5.12 -1.85 2008 -7.36 -10.39 -2.14 2009 -2.16 -11.11 -8.07 2010 -8.28 -12.05 -7.92

68

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.3, No.11, 2012

www.iiste.org

2011 -6.64 -9.75 -6.92 AVE -6.12 -10.80 -7.11 Source: computed from Annual Reports of the Breweries The positive average returns exhibited by these breweries from the tables 4.5 and 4.6 above indicate some degree of protection against actual inflation. However, Brown(1991) and Newell(1996) opine that the above basis of analysis is insufficient to conclude that each of these firms is an effective hedge against inflation. Consequently methods such as regression analysis and cointegration approach have been variously suggested in the literature to determine the degree of protection against inflation offered by investment assets. Regression Analysis The regression equation used to determine the degree of protection against inflation is R = + CPI + e, where R represents Real return in time t, CPI represents percentage change in consumer price index in time t (i.e actual inflation estimate), is the inflation coefficient which determines the inflation attributes of each of the banks, while is a constant. The regression equation, R = + CPI + e was used to assess the inflation-hedging performance of these firms against the actual inflation. The analysis is presented in Tables 4.9 to 4.12 below. Table 4.9: Inflation-hedging performance of the Stocks based on return on Shareholders funds Asset Class E R R2 F t DW Mean Constant 1. Guinness .079 0.534 .047 .002 .022 .148 1.686 36.41 6.91 35.439 2. International -12.380 64.510 .061 .004 .037 -.192 2.217 273.79 835.36 426.275 3. Nigerian brew -.879 1.515 .180 .033 .336 -.580 .714 38.99 19.92 49.818 Source: Regressed from table 4.1 above While Guinness returns moved slightly in the same direction with inflation, International and Nigerian Breweries returns moved in opposite direction as can be depicted from the beta coefficients in table 4.9 above. One can infer that Guinness offered small hedge against actual inflation while International and Nigerian Breweries have perverse hedge against actual inflation. The extent of perverse inflation hedging was highest in the ordinary shares of International Breweries with = -12.38. Table 4.10: Inflation-hedging performance of the Stocks based on dividend and Capital Gain Asset Class E R R2 F t DW Mean Constant 1. Guinness -.468 2.379 .062 .004 .039 -.197 1.472 33.42 30.82 39.187 2. International 1.481 14.912 .031 .001 .010 .099 2.380 65.71 192.84 47.463 3. Nigerian brew -.743 2.070 .113 .013 .129 -.359 2.471 21.63 26.92 30.776 Source: Regressed from table 4.2 above From table 4.10, the strength of inflation hedging was highest in the ordinary shares of International Breweries with = 1.481 and lowest though perverse in the ordinary shares of Guinness with = -0.468. Nigerian Breweries and Guinness have perverse partial hedge against inflation as the -coefficients are not up to 1. Hence two of the three firms namely Nigerian Breweries and Guinness which constitute 67 percent of the population provided perverse partial hedge against inflation over the period while one, that is, International Breweries making up 33 percent of the population offered strong positive hedge against inflation. Table 4.11: Inflation-hedging performance of the Stocks based on Dividend Yield before Tax Asset Class E R R2 F t DW Mean Constant 1. Guinness .103 .216 .150 .023 .230 .480 1.355 5.85 2.82 4.571 2. International 3. Nigerian brew -.057 .207 .088 .008 .078 -.278 1.481 4.59 2.68 5.298 Source: Regressed from table 4.3 above From the angle of dividend yield before tax, Guinness stood the best of the three in terms of hedge against actual inflation. International Breweries had nothing to show in terms inflation hedge based on dividend yield before tax, while Nigerian Breweries had perverse hedge. Table 4.12: Inflation-hedging performance of the Stocks based on Dividend Yield after Tax Asset Class E R R2 F t DW Mean Constant 1. Guinness .093 .194 .150 .023 .230 .480 1.358 5.26 2.54 4.113 2. International 3. Nigerian brew -.052 .186 .088 .008 .077 -.278 1.482 4.13 2.41 4.767 Source: Regressed from table 4.4 above From the angle of dividend yield after tax, Guinness stood the best of the three in terms of hedge against actual inflation, though with very weak index. International Breweries had nothing to show in terms inflation hedge based on dividend yield after tax, while Nigerian Breweries had very weak perverse hedge. 5.0 Summary of Findings, Conclusions, and Recommendations

69

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.3, No.11, 2012

www.iiste.org

In this study, attempt had been made to discover the inflation potential of the equities of the active stocks quoted in the Breweries sub-sector of the Nigerian Stock Exchange. The Fischers model and regression analysis were employed as tools to capture the wanted potentials of the subject firms. In terms of real return using Fischers model, and based on enterprise return on shareholders funds Guinness generated positive real return on equity over the 12-year period which range between 30.42% in 2011to 8.26% in 2005, International Breweries had the highest average positive real return of 234.57 percent and Nigerian Breweries recorded an average of 24.07 percent over the 12-year period. From the perspective of dividend and capital gain yields Guinness and Nigerian Breweries towed the same line of persistent generation of positive real return while International Breweries exhibited series of positive and negative real rate of return on equity in this regard. However International Breweries provided the highest average real rate of return on equity of 47.55 percent followed by Guinness with 19.03 percent and Nigerian Breweries with 8.54 percent for the 12-year period. Assessment of inflation hedging based on dividend paid using before and after tax bases provided perverse hedge against inflation. Earlier studies conducted by Wurtzbach et al(1991) and Brueggeman et al (1992) indicated that the extent of inflation hedging is a function of the degree of the inflation, that is, whether high or low. However, in this study, one point that has been established is that from the stocks examined, in terms of return on shareholders funds, Guinness offered small hedge against actual inflation while International and Nigerian Breweries have perverse hedge against actual inflation. In terms of total return on equity, two of the three firms namely Nigerian Breweries and Guinness which constitute 67 percent of the population provided perverse partial hedge against inflation over the period while one, that is, International Breweries making up 33 percent of the population offered strong positive hedge against inflation. From the perspectives of dividend yield before and after tax, Guinness stood the best of the three in terms of hedge against actual inflation, though with very weak index while Nigerian Breweries had perverse hedge. References Barkham, R. J.; Ward, C. W. R. And Henry, O. T. (1996) The Inflation-Hedging Characteristics of U.K Property Journal of Property Finance, Vol.7 No.1, 62-76. Bello, O. M.(2000) Risk Management in the Process of Property Development Construction in Nigeria Journal of the Federation of Construction Industry, Vol.15 No.3, 15-23. Bello, O. M.(2005) The Inflation-Hedging Attributes of Investments in Real Estate, Ordinary Shares and Naira Denominated Deposits Between 1996 and 2002 Journal of Banking, Vol.1 No.1, 1-28. Brown, P. (1990) United Kingdom Residential Price Expectations and Inflation Land Development Studies, Vol.7, 57-67. Brown, G. (1991) Property Investment and the Capital Markets London, E&FN Spon. Brueggeman, W.; Chen, A.; Thibodean, T. (1984) Real Estate Investment Funds: Performance and Portfolio considerations AREUEA Journal, Vol.12 Brueggeman, W.; Chen, A.; Thibodean, T. (1992) Some Additional Evidence on the Performance of Commingled Real Estate Investment Funds: 1972-1991 Journal of Real Estate Research, Vol.7, 433-448. Central Bank of Nigeria(2010) Central Bank of Nigeria Statistical Bulletin 2010 Abuja, Federal Government of Nigeria Press. Fama, E. F.(1975) Short Term Interest Rates as Predictors of Inflation American Economic Review, Vol.65 No.3, 269-282. Fama, E. F. and Gibbons, M. (1982) Inflation Real returns and Investment Journal of Monetary Economics, Vol.8, 279-323. Fama, E. F. And Schwert, G. (1977) Asset Returns and Inflation Journal of Financial Economics, Vol.8, 115146. Fisher Irving (1930) The Theory of Interest Rates Macmillan. Fisher, J. And Webb, B. (1992) Current Issues in the Analysis of Commercial Real Estate AREUEA Journal, Vol.20, 211-228. Fogler, H. R. (1984) 20% in Real Estate: Can theory Justify it? Journal of Portfolio Management, Vol.10 no.2, 6-13. Griffiths, B. (1976) Inflation: The Price of Prosperity London, Wendenfeld and Nicolean. Hamerlinks, F. And Hoesli, M. (1996) Swiss Real Estate as Hedge against Inflation: Evidence using Hedonic and Autoregressive Models Journal of Property Finance, Vol.7 No.1, 33-49. Hartzell, D. J.; Shulman, D. G. And Wurtzebach, C. H. (1987) Refining the Analysis of Regional Diversification for Income-Producing Real Estate Journal of Real Estate Research, Vol.2 No.2, 85-95. Hoesli, M. (1994) Real Estate as a Hedge against Inflation: Learning from the Swiss Case Journal of Property Valuation and Management, Vol.12 No.3, 51-59.

70

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.3, No.11, 2012

www.iiste.org

Hoesli, M.; Matysiak, B.; MacGregor, B. And Nanthakumaran, N. (1995) The Short Term Inflation Hedging Characteristics of UK Real Estate A paper presented at Cutting Edge Conference, Aberdeen, Scotland. Hoesli, M.; Matysiak, B.; MacGregor, B. And Nanthakumaran, N. (1996) The Long-term Inflation Hedging Characteristics of UK Commercial Property Journal of Property Finance, Vol.7 No.1, 50-61. Limmack, R. And Ward, C. (1988) Property Returns and Inflation Land Development Studies, Vol.5, 47-55. Mengden, A. And Hartzell, D. J. (1988) Real Estate Investment Trust- Are They Stocks or Real Estate? Stocks Research-Real Estate, Salmon Brothers Inc. New York. Miles, D. (1996) Property and Inflation Journal of Property Finance, Vol.7 No.1, 21-32. Newell, G. (1995a) Inflation-Hedging Attributes of Australian Commercial Property Australian Land Economic Review, Vol.1, 31-37. Newell, G. (1995b) Is Canadian Real Estate A Hedge Against Inflation The Canadian Appraiser, Vol.39, 2527. Newell, G. (1996) The Inflation-Hedging Characteristics of Australian Commercial Property: 1984-1995 Journal of Property Finance, Vol.7, 6-20. Newell, G. And Boyd, T. (1995) Inflation-Hedging Attributes of New Zealand Commercial Property in Newell, G. (1996) The Inflation-Hedging Characteristics of Australian Commercial Property: 1984-1995 Journal of Property Finance, Vol.7, 6-20. Park, J.; Mullineaux, D. J. And Chew, I. K. (1990) Are REITs Inflation Hedges? Journal of Real Estate Finance and Economics, Vol.3 No.3, 5-23. Wurtzebach, C. et al (1991) The impact of Inflation on Real Estate Returns Journal of Real Estate Research, Vol.6, 153-163.

71

This academic article was published by The International Institute for Science, Technology and Education (IISTE). The IISTE is a pioneer in the Open Access Publishing service based in the U.S. and Europe. The aim of the institute is Accelerating Global Knowledge Sharing. More information about the publisher can be found in the IISTEs homepage: http://www.iiste.org CALL FOR PAPERS The IISTE is currently hosting more than 30 peer-reviewed academic journals and collaborating with academic institutions around the world. Theres no deadline for submission. Prospective authors of IISTE journals can find the submission instruction on the following page: http://www.iiste.org/Journals/ The IISTE editorial team promises to the review and publish all the qualified submissions in a fast manner. All the journals articles are available online to the readers all over the world without financial, legal, or technical barriers other than those inseparable from gaining access to the internet itself. Printed version of the journals is also available upon request of readers and authors. IISTE Knowledge Sharing Partners EBSCO, Index Copernicus, Ulrich's Periodicals Directory, JournalTOCS, PKP Open Archives Harvester, Bielefeld Academic Search Engine, Elektronische Zeitschriftenbibliothek EZB, Open J-Gate, OCLC WorldCat, Universe Digtial Library , NewJour, Google Scholar

You might also like

- Market Structure and Powerful Setups - Wade FX SetupsDocument153 pagesMarket Structure and Powerful Setups - Wade FX Setupspg_hardikar97% (38)

- Cluster Analysis On The Effect of Dollar Increment On The Economy of Nigeria RealDocument58 pagesCluster Analysis On The Effect of Dollar Increment On The Economy of Nigeria RealVictor Hopeson Eweh100% (1)

- Summary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionFrom EverandSummary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionNo ratings yet

- Temitope Chapter 1-5Document50 pagesTemitope Chapter 1-5Adeniyi Oluwaseyi IsaacNo ratings yet

- Does Stock Returns Protect Investors Against Inflation in NigeriaDocument10 pagesDoes Stock Returns Protect Investors Against Inflation in NigeriaAlexander DeckerNo ratings yet

- Report-Inflation HedgesDocument15 pagesReport-Inflation HedgesSidNo ratings yet

- Predictability of Equity Reit Returns: Implications For Property Tactical Asset AllocationDocument24 pagesPredictability of Equity Reit Returns: Implications For Property Tactical Asset AllocationKarburatorNo ratings yet

- Rexr PdiDocument9 pagesRexr PdiKapeel LeemaniNo ratings yet

- Inflation and Real Estate InvestmentDocument22 pagesInflation and Real Estate InvestmentShamsheer Ali TurkNo ratings yet

- (9781451864724 - IMF Working Papers) Volume 2006 (2006) - Issue 212 (Sep 2006) - Political Instability and Inflation VolatilityDocument11 pages(9781451864724 - IMF Working Papers) Volume 2006 (2006) - Issue 212 (Sep 2006) - Political Instability and Inflation Volatilityzola1976No ratings yet

- Inflation and Nigeria's Economic Growth, An Auto Regressive Distributed Lag (ARDL) Model Approach (1981-2018)Document15 pagesInflation and Nigeria's Economic Growth, An Auto Regressive Distributed Lag (ARDL) Model Approach (1981-2018)aijbmNo ratings yet

- The Best Strategies For Inflationary TimesDocument32 pagesThe Best Strategies For Inflationary TimesAlvaro Neto TarcilioNo ratings yet

- Re-Examining The Relationship Between Inflation, Exchange Rate and Economic Growth in NigeriaDocument7 pagesRe-Examining The Relationship Between Inflation, Exchange Rate and Economic Growth in NigeriaShanza KhalidNo ratings yet

- Presented By:: (Jon Faust, John H. Rogers, Shing-Yi B. Wang and Jonathan H. Wright)Document24 pagesPresented By:: (Jon Faust, John H. Rogers, Shing-Yi B. Wang and Jonathan H. Wright)Wicky AkhtarNo ratings yet

- Final Lit ZaryabDocument7 pagesFinal Lit ZaryabZaryab KhanNo ratings yet

- Effect of Government Policies On Price Stability in NigeriaDocument14 pagesEffect of Government Policies On Price Stability in NigeriaResearch ParkNo ratings yet

- .Chapter One - 1692008942000Document7 pages.Chapter One - 1692008942000eranyigiNo ratings yet

- Am I Hud 2020 Il LiquidityDocument19 pagesAm I Hud 2020 Il LiquidityjamilkhannNo ratings yet

- Capital Market Development and Economic Growth in Nigeria: Dr. Preye E. G. Angaye, Bingilar Paymaster Frank PHDDocument6 pagesCapital Market Development and Economic Growth in Nigeria: Dr. Preye E. G. Angaye, Bingilar Paymaster Frank PHDaijbmNo ratings yet

- Domestic Debt and Real Sector GrowthDocument13 pagesDomestic Debt and Real Sector GrowthfunsoarenaNo ratings yet

- A Predictive Model For In?ation in NigeriaDocument28 pagesA Predictive Model For In?ation in NigeriagghNo ratings yet

- Journal of Economics and Management: Katarzyna NiewińskaDocument17 pagesJournal of Economics and Management: Katarzyna NiewińskaUmer ArifNo ratings yet

- Inflation-Hedging Portfolios in Different Inflation Regimes: M. Brière and O. SignoriDocument9 pagesInflation-Hedging Portfolios in Different Inflation Regimes: M. Brière and O. Signorihershie5252No ratings yet

- Capital Market Development and Economic Growth: Evidence From NigeriaDocument13 pagesCapital Market Development and Economic Growth: Evidence From NigeriainventionjournalsNo ratings yet

- Exchange Rate Fluctuation and Sectorial Output in NigeriaDocument20 pagesExchange Rate Fluctuation and Sectorial Output in NigeriaemmanuelNo ratings yet

- Information Uncertainty and Behavioral eDocument23 pagesInformation Uncertainty and Behavioral esv03No ratings yet

- Reseach BRM Hazara UniversityDocument13 pagesReseach BRM Hazara UniversitySadia ShahzadiNo ratings yet

- Financial UncertaintyDocument21 pagesFinancial UncertaintyClaraNo ratings yet

- The Impact of Inflation On Farmers and AgricultureDocument43 pagesThe Impact of Inflation On Farmers and AgricultureSharif BalouchNo ratings yet

- Macro Economic Variables On Stocck PricesDocument15 pagesMacro Economic Variables On Stocck Pricesothmane lamzihriNo ratings yet

- An Examination On The Determinants of Inflation: Yen Chee Lim and Siok Kun Sek, Member, IEDRCDocument5 pagesAn Examination On The Determinants of Inflation: Yen Chee Lim and Siok Kun Sek, Member, IEDRCusjaamNo ratings yet

- Macro Chap 01Document4 pagesMacro Chap 01saurabhsaurs100% (2)

- The Rate of Return On Everything - 1870-2015 PDFDocument174 pagesThe Rate of Return On Everything - 1870-2015 PDFLuiz Paulo DinizNo ratings yet

- Thrift SavingDocument34 pagesThrift SavingDumebi IfeanyiNo ratings yet

- Hedging Inflation by Selecting Stock IndustriesDocument31 pagesHedging Inflation by Selecting Stock IndustriesOENo ratings yet

- Analysis of Savings and Private Capital Formation in NigeriaDocument7 pagesAnalysis of Savings and Private Capital Formation in NigeriaDr. Ezeanyeji ClementNo ratings yet

- Aizenman y Marion - 1999Document23 pagesAizenman y Marion - 1999Esteban LeguizamónNo ratings yet

- 2016 - 1 Inflation and InvestmentDocument38 pages2016 - 1 Inflation and InvestmentSerigne Modou NDIAYENo ratings yet

- W 13177Document30 pagesW 13177Juani QueirelNo ratings yet

- Thesis On Exchange Rate VolatilityDocument8 pagesThesis On Exchange Rate Volatilitydwhchpga100% (2)

- Inflation and Small and Medium Enterprises Growth in Ogbomoso Area, Oyo State, NigeriaDocument5 pagesInflation and Small and Medium Enterprises Growth in Ogbomoso Area, Oyo State, NigeriaAnonymous ed8Y8fCxkSNo ratings yet

- In Ation and Growth in Developing Countries: The Nigerian ExperienceDocument16 pagesIn Ation and Growth in Developing Countries: The Nigerian ExperienceArshita PattanaikNo ratings yet

- Sidranje 2Document22 pagesSidranje 2miha.petrov1998No ratings yet

- Responsiveness of Foreign Exchange Rate To Foreign Debt: Evidence From NigeriaDocument10 pagesResponsiveness of Foreign Exchange Rate To Foreign Debt: Evidence From NigeriaIjahss JournalNo ratings yet

- Work 726Document29 pagesWork 726TBP_Think_Tank100% (1)

- Inflation, Financial Markets and Long-Run Real Activity: Elisabeth Huybens, Bruce D. SmithDocument33 pagesInflation, Financial Markets and Long-Run Real Activity: Elisabeth Huybens, Bruce D. SmithSamuel Mulu SahileNo ratings yet

- RFLR v7 n1 1 PDFDocument23 pagesRFLR v7 n1 1 PDFkudzailaura87No ratings yet

- Project ProposalDocument7 pagesProject Proposalrehmaniaaa100% (3)

- The Role of Macroeconomic Variables On Stock Market Index in China and IndiaDocument11 pagesThe Role of Macroeconomic Variables On Stock Market Index in China and IndiaMoinuddin BaigNo ratings yet

- C& W Asia Pacific Economic Pulse Oct09Document8 pagesC& W Asia Pacific Economic Pulse Oct09viethungd2cvaNo ratings yet

- D I E P ': Eterminants of Nflation and Conomic Growth in AkistanDocument23 pagesD I E P ': Eterminants of Nflation and Conomic Growth in AkistanMALL OF ATTOCKNo ratings yet

- Con 043248Document24 pagesCon 043248Ari CorciaNo ratings yet

- The Impact of Macroeconomic Indicator On Share Pricing in Nigeria Capital Market by Adekoya AdeniyiDocument7 pagesThe Impact of Macroeconomic Indicator On Share Pricing in Nigeria Capital Market by Adekoya AdeniyiAdekoya AdeniyiNo ratings yet

- The Feed and Stock MarketDocument17 pagesThe Feed and Stock Market1911102431318No ratings yet

- Inflation and Nigerian EconomyDocument60 pagesInflation and Nigerian EconomyOgechukwu JulianaNo ratings yet

- Determinants of Non-Performing Loans in NigeriaDocument8 pagesDeterminants of Non-Performing Loans in NigeriaEdlamu AlemieNo ratings yet

- An Analytical Study of The Effect of InfDocument17 pagesAn Analytical Study of The Effect of Infpatrick MuyayaNo ratings yet

- Naik SynopsisDocument7 pagesNaik SynopsisHarshaVardhanNo ratings yet

- Index Investment and Financialization of Commodities: Ke Tang and Wei XiongDocument46 pagesIndex Investment and Financialization of Commodities: Ke Tang and Wei Xiongmylife123No ratings yet

- Inflation-Conscious Investments: Avoid the most common investment pitfallsFrom EverandInflation-Conscious Investments: Avoid the most common investment pitfallsNo ratings yet

- Quantum Strategy II: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNo ratings yet

- Asymptotic Properties of Bayes Factor in One - Way Repeated Measurements ModelDocument17 pagesAsymptotic Properties of Bayes Factor in One - Way Repeated Measurements ModelAlexander DeckerNo ratings yet

- Availability and Use of Instructional Materials and FacilitiesDocument8 pagesAvailability and Use of Instructional Materials and FacilitiesAlexander DeckerNo ratings yet

- Availability, Accessibility and Use of Information Resources and Services Among Information Seekers of Lafia Public Library in Nasarawa StateDocument13 pagesAvailability, Accessibility and Use of Information Resources and Services Among Information Seekers of Lafia Public Library in Nasarawa StateAlexander DeckerNo ratings yet

- Assessment of Relationships Between Students' Counselling NeedsDocument17 pagesAssessment of Relationships Between Students' Counselling NeedsAlexander DeckerNo ratings yet

- Assessment of Some Micronutrient (ZN and Cu) Status of Fadama Soils Under Cultivation in Bauchi, NigeriaDocument7 pagesAssessment of Some Micronutrient (ZN and Cu) Status of Fadama Soils Under Cultivation in Bauchi, NigeriaAlexander DeckerNo ratings yet

- Assessment of Housing Conditions For A Developing Urban Slum Using Geospatial AnalysisDocument17 pagesAssessment of Housing Conditions For A Developing Urban Slum Using Geospatial AnalysisAlexander DeckerNo ratings yet

- Assessment of Knowledge, Attitude and Practices Concerning Food Safety Among Restaurant Workers in Putrajaya, MalaysiaDocument10 pagesAssessment of Knowledge, Attitude and Practices Concerning Food Safety Among Restaurant Workers in Putrajaya, MalaysiaAlexander DeckerNo ratings yet

- Assessment of The Practicum Training Program of B.S. Tourism in Selected UniversitiesDocument9 pagesAssessment of The Practicum Training Program of B.S. Tourism in Selected UniversitiesAlexander DeckerNo ratings yet

- Assessment of Survivors' Perceptions of Crises and Retrenchments in The Nigeria Banking SectorDocument12 pagesAssessment of Survivors' Perceptions of Crises and Retrenchments in The Nigeria Banking SectorAlexander DeckerNo ratings yet

- Barriers To Meeting The Primary Health Care Information NeedsDocument8 pagesBarriers To Meeting The Primary Health Care Information NeedsAlexander DeckerNo ratings yet

- Attitude of Muslim Female Students Towards Entrepreneurship - A Study On University Students in BangladeshDocument12 pagesAttitude of Muslim Female Students Towards Entrepreneurship - A Study On University Students in BangladeshAlexander DeckerNo ratings yet

- Assessment of Teachers' and Principals' Opinion On Causes of LowDocument15 pagesAssessment of Teachers' and Principals' Opinion On Causes of LowAlexander DeckerNo ratings yet

- Assessment of Productive and Reproductive Performances of CrossDocument5 pagesAssessment of Productive and Reproductive Performances of CrossAlexander DeckerNo ratings yet

- Assessment of The Skills Possessed by The Teachers of Metalwork in The Use of Computer Numerically Controlled Machine Tools in Technical Colleges in Oyo StateDocument8 pagesAssessment of The Skills Possessed by The Teachers of Metalwork in The Use of Computer Numerically Controlled Machine Tools in Technical Colleges in Oyo StateAlexander Decker100% (1)

- Antibiotic Resistance and Molecular CharacterizationDocument12 pagesAntibiotic Resistance and Molecular CharacterizationAlexander DeckerNo ratings yet

- Applying Multiple Streams Theoretical Framework To College Matriculation Policy Reform For Children of Migrant Workers in ChinaDocument13 pagesApplying Multiple Streams Theoretical Framework To College Matriculation Policy Reform For Children of Migrant Workers in ChinaAlexander DeckerNo ratings yet

- Application of The Diagnostic Capability of SERVQUAL Model To An Estimation of Service Quality Gaps in Nigeria GSM IndustryDocument14 pagesApplication of The Diagnostic Capability of SERVQUAL Model To An Estimation of Service Quality Gaps in Nigeria GSM IndustryAlexander DeckerNo ratings yet

- Are Graduates From The Public Authority For Applied Education and Training in Kuwaiti Meeting Industrial RequirementsDocument10 pagesAre Graduates From The Public Authority For Applied Education and Training in Kuwaiti Meeting Industrial RequirementsAlexander DeckerNo ratings yet

- Assessing The Effect of Liquidity On Profitability of Commercial Banks in KenyaDocument10 pagesAssessing The Effect of Liquidity On Profitability of Commercial Banks in KenyaAlexander DeckerNo ratings yet

- Assessment in Primary School Mathematics Classrooms in NigeriaDocument8 pagesAssessment in Primary School Mathematics Classrooms in NigeriaAlexander DeckerNo ratings yet

- Assessment For The Improvement of Teaching and Learning of Christian Religious Knowledge in Secondary Schools in Awgu Education Zone, Enugu State, NigeriaDocument11 pagesAssessment For The Improvement of Teaching and Learning of Christian Religious Knowledge in Secondary Schools in Awgu Education Zone, Enugu State, NigeriaAlexander DeckerNo ratings yet

- Assessment of Factors Responsible For Organizational PoliticsDocument7 pagesAssessment of Factors Responsible For Organizational PoliticsAlexander DeckerNo ratings yet

- Application of Panel Data To The Effect of Five (5) World Development Indicators (WDI) On GDP Per Capita of Twenty (20) African Union (AU) Countries (1981-2011)Document10 pagesApplication of Panel Data To The Effect of Five (5) World Development Indicators (WDI) On GDP Per Capita of Twenty (20) African Union (AU) Countries (1981-2011)Alexander DeckerNo ratings yet

- Analysis of Teachers Motivation On The Overall Performance ofDocument16 pagesAnalysis of Teachers Motivation On The Overall Performance ofAlexander DeckerNo ratings yet

- Antioxidant Properties of Phenolic Extracts of African Mistletoes (Loranthus Begwensis L.) From Kolanut and Breadfruit TreesDocument8 pagesAntioxidant Properties of Phenolic Extracts of African Mistletoes (Loranthus Begwensis L.) From Kolanut and Breadfruit TreesAlexander DeckerNo ratings yet

- Analysis The Performance of Life Insurance in Private InsuranceDocument10 pagesAnalysis The Performance of Life Insurance in Private InsuranceAlexander DeckerNo ratings yet

- An Investigation of The Impact of Emotional Intelligence On Job Performance Through The Mediating Effect of Organizational Commitment-An Empirical Study of Banking Sector of PakistanDocument10 pagesAn Investigation of The Impact of Emotional Intelligence On Job Performance Through The Mediating Effect of Organizational Commitment-An Empirical Study of Banking Sector of PakistanAlexander DeckerNo ratings yet

- Analyzing The Economic Consequences of An Epidemic Outbreak-Experience From The 2014 Ebola Outbreak in West AfricaDocument9 pagesAnalyzing The Economic Consequences of An Epidemic Outbreak-Experience From The 2014 Ebola Outbreak in West AfricaAlexander DeckerNo ratings yet

- An Overview of The Environmental Policies To Ensure SafeDocument9 pagesAn Overview of The Environmental Policies To Ensure SafeAlexander DeckerNo ratings yet

- HCI Economics Prelim 2009 (H2 Economics P1-CS) ANSDocument11 pagesHCI Economics Prelim 2009 (H2 Economics P1-CS) ANSpappadutNo ratings yet

- Business Environment NotesDocument48 pagesBusiness Environment NotesPriyanka Gharat AcharekarNo ratings yet

- Microeconomics Test 3Document26 pagesMicroeconomics Test 3a24dkNo ratings yet

- Depreciation AccountingDocument3 pagesDepreciation AccountingBalamanichalaBmcNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource Wasanon_954124867No ratings yet

- Financial Market Problems and FormulasDocument3 pagesFinancial Market Problems and FormulasNufayl KatoNo ratings yet

- Forex - Fundamentals Make Currency Pairs Move (1.3)Document8 pagesForex - Fundamentals Make Currency Pairs Move (1.3)Trading Floor100% (2)

- Rms Policy DocumentDocument6 pagesRms Policy DocumentAshish TripathiNo ratings yet

- Cost IndicesDocument12 pagesCost IndicesKavyaNo ratings yet

- Portfolio Management ServiceDocument75 pagesPortfolio Management ServiceBharti BolwaniNo ratings yet

- Busx 301 FinalDocument4 pagesBusx 301 Finalapi-313685921No ratings yet

- Inflation PresentationDocument12 pagesInflation PresentationVivek SinghNo ratings yet

- Mankiw ch.14Document17 pagesMankiw ch.14Georgina TasshaNo ratings yet

- A Conceptual Model of The Household's Housing Decision-Making ProcessDocument18 pagesA Conceptual Model of The Household's Housing Decision-Making ProcessembestateNo ratings yet

- Offshore WindDocument18 pagesOffshore WindHimanshu BhandariNo ratings yet

- Motivation - An Economic and Social Analysis: Rushil Anand - 20151219 Joseph Moses Parambi - 20151273Document8 pagesMotivation - An Economic and Social Analysis: Rushil Anand - 20151219 Joseph Moses Parambi - 20151273Rushil AnandNo ratings yet

- Marxist Approach PPT (NOPASS)Document12 pagesMarxist Approach PPT (NOPASS)France Nathaniel Canale100% (1)

- Venture Capital & Ventre Capitalist: Made By: Gagan Vats Priyanka Tuteja Achal Jain Akshat DhallDocument24 pagesVenture Capital & Ventre Capitalist: Made By: Gagan Vats Priyanka Tuteja Achal Jain Akshat DhalltarunshridharNo ratings yet

- Assignment Ishan SharmaDocument8 pagesAssignment Ishan SharmaIshan SharmaNo ratings yet

- Aan Qureshi IC-2100 Namra Saeed IC-2099 Saad Ahmed Malik IC-2106 Sajeel Abbas Zaidi IC-2107 Sir Malik Mazhar Hussain Business Research MethodDocument25 pagesAan Qureshi IC-2100 Namra Saeed IC-2099 Saad Ahmed Malik IC-2106 Sajeel Abbas Zaidi IC-2107 Sir Malik Mazhar Hussain Business Research MethodNamra SaeedNo ratings yet

- Fina6000 Module 5 - Capital Structure BDocument32 pagesFina6000 Module 5 - Capital Structure BMar SGNo ratings yet

- Organic Vs Inorganic GrowthDocument12 pagesOrganic Vs Inorganic GrowthSaurabh Chauhan100% (1)

- HBS Case MicrosoftDocument28 pagesHBS Case MicrosoftYitchell ChowNo ratings yet

- Sample QuiestionsDocument169 pagesSample QuiestionsmayankNo ratings yet

- Aumann - 1962 - Utility Theory Without The Completeness AxiomDocument6 pagesAumann - 1962 - Utility Theory Without The Completeness Axiomapi-256525507No ratings yet

- Unit 7 - Lesson 3 - Profit Maximization by The Rational ProducerDocument19 pagesUnit 7 - Lesson 3 - Profit Maximization by The Rational Producerapi-260512563No ratings yet

- BFMDocument28 pagesBFMPratik RambhiaNo ratings yet

- Educational Offer Social Sciences and Humanities Area 2023-2024Document192 pagesEducational Offer Social Sciences and Humanities Area 2023-2024WASIM LAGHARINo ratings yet

- Decision Theory and The Normal Distribution: Eaching Uggestions M3-5Document3 pagesDecision Theory and The Normal Distribution: Eaching Uggestions M3-5José Manuel Orduño VillaNo ratings yet