Professional Documents

Culture Documents

31 33

Uploaded by

Krishan Bir SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

31 33

Uploaded by

Krishan Bir SinghCopyright:

Available Formats

International Indexed & Refferred Research Journal, October 2012, ISSN 0975-3486, RNI- RAJBAL 2009/30097: VoL IV *ISSUE- 37

Research PaperPhilosophy

Sartorial Risk analysis of Nifty Junior in respect of Systematic Risk Beta

* Vaibhav Vishal October,2012 * Scholar Doctor of Philosophy in the faculty of Management, CMJ University ,Meghalaya

A B S T R A C T

The Indian capital market has changed dramatically over the last few years, especially since 1990. Changes have also been taking place in government regulations and technology. The expectations of the investors are also changing. The only inherent feature of the capital market, which has not changed is the 'risk' involved in investing in corporate securities. Managing the risk is emerging as an important function of both large scale and small-scale investors. The individual and incremental information content of different economic determinants of common stock systematic risk is determined in the Finnish stock market. Based on previous theoretical articles, four financial characteristics of a firm are investigated: profitability, financial leverage, operating leverage, and corporate growth, measured as growth in earnings and dividends .Irrespective of the Four above mentioned factors Indian stock market has sown fluctuations in last decade . In my study I have tried to analyzed the companies on the basis of sector wise risk and have segmented the industries according to choice of investor for their risk taking ability , so that they can prepare there own portfolio. Keywords: CAPM, Industrial Sector, Capital market, systematic risk

Introduction In the fast growing Indian financial market, there are 23 stock exchanges trading securities. The National Stock Exchange of India (NSE) situated in Mumbai - is the largest and most advanced exchange with 1016 companies listed and 726 trading members. The capital market is an interface, where investors can buy and sell stocks and other selected financial instruments. In India the growth of technology brought indefinite opportunities and opened an arena for investors particularly in the capital market. The NSE is owned by the group of leading financial institutions such as Indian Bank or Life Insurance Corporation of India. However, in the totally demutualised Exchange, the ownership as well as the management does not have a right to trade on the Exchange. Only qualified traders can be involved in the securities trading. It is well known that riskiness of an investments is related to uncertainty, which is associated with the expected outcomes from that investment. Furthermore, the total risk of investing in a stock is composed of two distinct risks. Capital asset pricing model (CAPM) explains one of them, particularly, the risk of being in the market. Malkiel and Xu (2006) identified this type of risk as the systematic risk. Such kind of risk is undevirsifiable. The other type - unsystematic risk is specific to a company's fortune. Since uncertainty can be mitigated through appropriate diversification, Sharpe figured out that a portfolio's expected return hinges solely on its beta, that is, its relationship to the overall market.

Litrature Review Number of factors will affect the risk return relation and the various factors which are external that affects large number of securities simultaneously are known as systematic risk and is denoted as beta () .These types of risks are mostly uncontrollable and One can examine the individual stock return to the overall market return by comparing how an individual company stock reacts to overall market fluctuation. CAPM is one of the models widely used throughout the world to explain the risk return relationship and the theory postulate that there is a linear relationship between beta and return. But the literature shows that the model gives different results for different market and thereby it is crucial to test the validity of this before applying to the field concerned. There are some researchers who studied the impact of macroeconomic factors on international beta values, like, DilipPatro, John K. Wald and Yangru Wu (2000), they found that several variables including imports, exports, inflation, market capitalization, significantly affect Beta. Grewal S.S and Navjot Grewall (1984) revealed some basic investment rules and rules for selling shares. They warned the investors not to buy unlisted shares, as Stock Exchanges do not permit trading in unlisted shares. Another rule that they specify is not to buy inactive shares, ie, shares in which transactions take place rarely. The main reason why shares are inactive is because there are no buyers for them. They are mostly shares of companies, which are not doing well.

RESEARCH ANALYSIS AND EVALUATION

31

International Indexed & Refferred Research Journal, October 2012, ISSN 0975-3486, RNI- RAJBAL 2009/30097: VoL IV *ISSUE- 37

Jack Clark Francis (1986) revealed the importance of the rate of return in investments and reviewed the possibility of default and bankruptcy risk. He opined that in an uncertain world, investors cannot predict exactly what rate of return an investment will yield. However he suggested that the investors can formulate a probability distribution of the possible rates of return. Preethi Singh (1986) disclosed the basic rules for selecting the company to invest in. She opined that understanding and measuring return md risk is fundamental to the investment process. According to her, most investors are 'risk averse'. To have a higher return the investor has to face greater risks. She concludes that risk is fundamental to the process of investment. Every investor should have an understanding of the various pitfalls of investments. The investor should carefully analyse the financial statements with special reference to solvency, profitability, EPS, and efficiency of the company. David.L.Scott and William Edward (1990) reviewed the important risks of owning common stocks and the ways to minimize these risks. They commented that the severity of financial risk depends on how heavily a business relies on debt. Financial risk is relatively easy to minimise if an investor sticks to the common stocks of companies that employ small amounts of debt. Nabhi Kumar Jain (1992) specified certain tips for buying shares for holding and also for selling shares. He advised the investors to buy shares of a growing company of a growing industry. Buy shares by diversifying in a number of growth companies operating in a different but equally fast growing sector of the economy. He suggested selling the shares the moment company has or almost reached the peak of its growth. Also, sell the shares the moment you realise you have made a mistake in the initial selection of the shares. The only option to decide when to buy and sell high priced shares is to identify the individual merit or demerit of each of the shares in the portfolio and arrive at a decision. L.C.Gupta (1992) revealed the findings of his study that there is existence of wild speculation in the Indian stock market. The over speculative character of the Indian stock market is reflected in extremely high concentration of the market activity in a handful of shares to the neglect of the remaining shares and absolutely high trading velocities of the speculative counters. Donald E Fischer and Ronald J. Jordan (1994) analysed the relation between risk, investor preferences and investor behaviour. The risk return measures on portfolios are the main determinants of an investor's attitude towards them. Most investors seek more return for additional risk assumed. The conservative investor requires large increase in return for as-

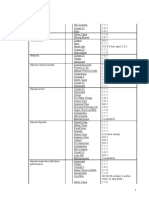

suming small increases in risk. The more aggressive investor will accept smaller increases in return for large increases in risk. They concluded that the psychology of the stock market is based on how investors form judgements about uncertain future events and how they react to these judgments Data and Methodology :This study attempts to find out sectorwise analysis of Ststemetic risk Beta in National Stock Exchange of India. The basic data for the study has been collected from Prowess, a corporate database of Centre for Monitoring Indian Economy (CMIE). To analyse the determinants of market risk for the firms belonging to the Indian Industries listed in National Stock Exchange of India, a time period of eleven yearsn on from Janruary 1999 to June 2010 has been chosen. The sample has covered 282 firms belonging to listed Group companies of National Stock Exchange of India. AGroup companies of National Stock Exchange have been chosen for the study since the stocks of these companies are actively traded in the Indian stock market. Beta has been calculated on slope between return of sensex and return on National Stock Exchange of India . Beta scaled so that the market as a whole has a beta of 1.0. A beta greater than 1 means the price of the investment is expected to move up more than the market when the market goes up and drop more when the market declines. Imperical Results Data of 282 Companies of BSE( Nigty Junior) has been taken and beta of each company has been calculated on the basis of their previous returns . we have segregated the sector wise data based on the range of beta .The industry wise data has been arranged where beta is between 0 to 0.25 , 0. 25 to 0.5 , 0.5 to 0.75, 0.75 to 1.00 ,1.00 to 1.25,1.25 to 1.5 , 1.5 to1.75and 1.75 to 2 & more than 2. Beta ranging between 0 to 0.25 If we arrange the data of companies on the basis of beta ranging between 0 to .25 . we do not find data of any particular company .However in nutshell we can say that none of the sector represents in this range. Beta ranging between 0.25 to 0.50 If we arrange the data of companies on the

Alternatively

Where

32

RESEARCH ANALYSIS AND EVALUATION

International Indexed & Refferred Research Journal, October 2012, ISSN 0975-3486, RNI- RAJBAL 2009/30097: VoL IV *ISSUE- 37

basis of beta ranging between 0.25 to 0.50 . we find that most of the companies representing in this category are from Paints/Varnish ,Abrasives, Lubricants, Cigrattes - Manufacturers , compressors manufacturers ,Food Processing & Personal Care Industries. However 1/3 companies of Investments & Hotel Industry also falls in this category. Which can be defined as a most Defensive stock as its beta is less than 0.5. Beta ranging between 0.50 to 0.75 :- If we arrange the data of companies on the basis of beta ranging between .5 to .75 , we find that most of the companies representing in this category are Auto Ancillaries, Telecom- service, Automobile ,Chemicals, FinanceLeasing ,Glass & Glass Products ,Paper, Pharmaceuticals ,Pump,Refineries, Shipping Industries. However 1/3 companies of Shipping & Finance leasing Industry also falls in this category. These can be defined as a defensive stock as its beta is less than 0.75. Beta ranging between 0.750 to less than 1.00 If we arrange the data of companies on the basis of beta ranging between .75 to 1.00 , we find that most of the companies representing in this category are from the industries like, Agro Chemicals Telecommunication Equipment, Aluminium ,textile-mechinary, Auto Textiles, Banking Tyres, Cables, Casting & Forgings, Consumer Goods, Diversified, Edible Oil, Electric Equipment, Electrodes, Graphites, Engiens,Engineering,Fastners,Fertilisers ,FinanceHousing ,Hospitals ,Information Technology, Jewellary, Leather Products, NonFerrous Metals ,Miscellanious, Oil Drilling & Expolaration, Pacakeging, Plastic, Power, Genration/Distribution, Printing & Stationary ,SteelTyre/Tubes ,Sugar, Tea & Coffee Industries falls in this range. .However 1/2 companies of Investments and Hotel Industry also falls in this category. This can be defined as riskey stock as its beta is more than 0.75. Beta ranging between 1.00 to 1.25 If we arrange the data of companies on the basis of beta ranging between 1.00 to 1.25 , we find that most of the companies representing in this category are from the industries Auto Tractors, Cement,Civil

Construction ,Computer Hardware ,Computer Software ,Computer Software Traning, Finance- Investments ,Finance -Term Lending ,Media & Entertainment , Mining/Minerals , Petro Chemicals ,Power Transmission Equipment ,Realestate ,Retail ,Steel Industries falls in this range. However 1/3 companies of Investments also falls in this category. We can be defined as a stock having moderate risk as its beta is more than 1.00. Beta ranging between 1.25 to less than 1.50 If we arrange the data of companies on the basis of beta ranging between 1.25 to 1.50 , we find that none of the companies representing any industry in this category is available.However in this category We can define stocks as risky as there beta is more than 1.25. Beta ranging between 1.50 to less than 1.75 If we arrange the data of companies on the basis of beta ranging between 1.50 to 1.75 , we find that most of the companies representing in this category are from the industries like Telecom Equipment ,Trading and Transport Industries falls in this range We can define these stocks as most risky stocks as there beta is more than 1.50. Summary and Conclusions: From the above results we can conclude that some sectors such as Paints/Varnish ,Abrasives, Cigrattes, Manifacturers, Food Processing, Personal Care, Pump , Compressors ,Glass & Glass Products , Lubricants ,Paper industry can be defined as defensive sectors their shares will vary less than variation in stock exchange as their beta value is less than 1. whereas Civil Construction,Computer Software, Computer Software Traning, Term Lending Finance, , Non Ferrous Metals ,Mining & Minerals ,Petro Chemicals, Power Transmission Equipment, Realestate sectors , Telecom Equipment ,Trading and Transport Industries can be defined as risky sectors as their shares will vary more than variation in stock exchange as their beta value is more than 1. So as Indian invester according to their risk taking ability can prefer to invest in a particular industry on the basis of above mentioned results.

R E F E R E N C E

1 Ben-Zion, U. and Shalit, S., 1975, 'ize, Leverage, and Dividend Record as Determinants of Systematic Risk' Journal of Finance, Vol. 30, 2 Bildersee, J., 1975, The Association Between a Market Measure of Risk and Alternative 3 Measures of Risk' Accounting Review, Vol. 50, 4 Bowman, R., 1979, The Theoretical Relationship Between Systematic Risk and Financial (Accounting) Variables, Journal of Finance,Vol. 34 5 Breaver, W., Kettler, P. and Scholes, M., 1970, The Association Between Market- Determined and Accounting-Determined Risk Measures,Accounting Review ,vol. 45 6 Breaver, W. and Manegold, J., 1975, The Association Between Market-Determined and Accounting-Determined Measures of Systematic Risk : Some Further Evidence, Journal of Financial and Quantitative Analysis, Vol. 10, No. 2, 7Chance, D., 1982, Evidence on a Simplified Model of Systematic Risk, Financial Management, Vol. 11, No. 3.8 Chiou, C. C. and Su, R. K., 2007, On the Relation of Systematic Risk and Accounting Variables, Managerial Finance, Vol. 33, No. 8. 9 Chung, K. H., 1989, The Impact of the Demand Volatility and Leverages on the Systematic Risk of the Common Stocks, Journal of Business Finance and Accounting, Vol. 13, No. 3. 10 Grewal and Navjot Grewal, Profitable lnvestment- in shares, Vision Books Pvt. Ltd. 36 Connaught Place, New Delhi 1984.11 Preethi Singh, Investment Management , Himalaya Publishing House, Bombay Nagpur and Delhi, 1986. 12 David. L. Scott and William Edward, Understanding and Managing Investment risk and return, MC. Graw Hill Book Co. (U.K.) Ltd.,London 1990. 13 Lewis Mandell, Investment, Macmillan Publishing Company,New York, 1992. 14 Carter Randall Non-stop winning on t he stock Market Vision Books,New Delhi, Bombay(1992.)

RESEARCH ANALYSIS AND EVALUATION

33

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- GR) B) An (Asminti (Nsvid) Til&Kini P (RP/ (Èymi ) : P/I. Kin) Yi P/V) Nbie A (MDocument2 pagesGR) B) An (Asminti (Nsvid) Til&Kini P (RP/ (Èymi ) : P/I. Kin) Yi P/V) Nbie A (MKrishan Bir SinghNo ratings yet

- 'KKS/K Leh (KK VKSJ Ewy KaduDocument2 pages'KKS/K Leh (KK VKSJ Ewy KaduKrishan Bir SinghNo ratings yet

- International Indexed & Referred Research Journal, October, 2012. Issn 0974-2832, Rni-Rajbil 2009/29954 Vol. Iv Issue - 45Document2 pagesInternational Indexed & Referred Research Journal, October, 2012. Issn 0974-2832, Rni-Rajbil 2009/29954 Vol. Iv Issue - 45Krishan Bir SinghNo ratings yet

- 94-95 RaeDocument2 pages94-95 RaeKrishan Bir SinghNo ratings yet

- October, 2012Document3 pagesOctober, 2012Krishan Bir SinghNo ratings yet

- International Indexed & Referred Research Journal, October, 2012. Issn 0974-2832, Rni-Rajbil 2009/29954 Vol. Iv Issue - 45Document2 pagesInternational Indexed & Referred Research Journal, October, 2012. Issn 0974-2832, Rni-Rajbil 2009/29954 Vol. Iv Issue - 45Krishan Bir SinghNo ratings yet

- Language Policy of Assam Government in Sixties and Tribal QuestionDocument2 pagesLanguage Policy of Assam Government in Sixties and Tribal QuestionKrishan Bir SinghNo ratings yet

- 68 69Document2 pages68 69Krishan Bir SinghNo ratings yet

- Management Abilities and Skill Set Required For The Hospitality Professionals in IndiaDocument4 pagesManagement Abilities and Skill Set Required For The Hospitality Professionals in IndiaKrishan Bir SinghNo ratings yet

- 64 65Document2 pages64 65Krishan Bir SinghNo ratings yet

- Protection of Minority Rights Under Company's Affairs:: Aparajita BhargavaDocument2 pagesProtection of Minority Rights Under Company's Affairs:: Aparajita BhargavaKrishan Bir SinghNo ratings yet

- Separation of Judiciary From Executive: Mrs - Deepika BhatnagarDocument2 pagesSeparation of Judiciary From Executive: Mrs - Deepika BhatnagarKrishan Bir SinghNo ratings yet

- 70 71Document2 pages70 71Krishan Bir SinghNo ratings yet

- 'KKS/K Leh (KK VKSJ Ewy KaduDocument2 pages'KKS/K Leh (KK VKSJ Ewy KaduKrishan Bir SinghNo ratings yet

- E-Communication Technology The Chain of Development ProcessDocument2 pagesE-Communication Technology The Chain of Development ProcessKrishan Bir SinghNo ratings yet

- 58 59Document2 pages58 59Krishan Bir SinghNo ratings yet

- 60 61Document2 pages60 61Krishan Bir SinghNo ratings yet

- Peer Pressure Among Adolescents: A Study With Reference To Perceived Parenting StyleDocument2 pagesPeer Pressure Among Adolescents: A Study With Reference To Perceived Parenting StyleKrishan Bir SinghNo ratings yet

- Basics of Research: Mrs. Kiran Prabha Jain Mrs. Anjali A. JainDocument2 pagesBasics of Research: Mrs. Kiran Prabha Jain Mrs. Anjali A. JainKrishan Bir SinghNo ratings yet

- 51 53Document3 pages51 53Krishan Bir SinghNo ratings yet

- Average Cross-Section ModelsDocument4 pagesAverage Cross-Section ModelsKrishan Bir SinghNo ratings yet

- Mass Transport of Visco-Elastic Electrodes: Hardeep Singh TejaDocument3 pagesMass Transport of Visco-Elastic Electrodes: Hardeep Singh TejaKrishan Bir SinghNo ratings yet

- 43 45Document3 pages43 45Krishan Bir SinghNo ratings yet

- 55 57Document3 pages55 57Krishan Bir SinghNo ratings yet

- 45 46Document2 pages45 46Krishan Bir SinghNo ratings yet

- 38 39Document2 pages38 39Krishan Bir SinghNo ratings yet

- 39 40Document2 pages39 40Krishan Bir SinghNo ratings yet

- 36 37Document2 pages36 37Krishan Bir SinghNo ratings yet

- 37 38Document2 pages37 38Krishan Bir SinghNo ratings yet

- ASSAM Movement and Its Impact On Tribal: Dulen BassumataryDocument2 pagesASSAM Movement and Its Impact On Tribal: Dulen BassumataryKrishan Bir SinghNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 5 Years High and Low PointsDocument7 pages5 Years High and Low PointsNaresh Kumar VishwakarmaNo ratings yet

- Glacial Lakes of Himachal PradeshDocument4 pagesGlacial Lakes of Himachal PradeshMonidipa DeyNo ratings yet

- Extrahepatic Biliary Tract Pathology - Cholidolithiasis, Cholidocholithiasis, Cholecystitis and CholangitisDocument60 pagesExtrahepatic Biliary Tract Pathology - Cholidolithiasis, Cholidocholithiasis, Cholecystitis and CholangitisDarien LiewNo ratings yet

- Art1 2Document24 pagesArt1 2Peter Paul Rebucan PerudaNo ratings yet

- Mid-Year Examination, 2023 Science Year 7 1 HourDocument23 pagesMid-Year Examination, 2023 Science Year 7 1 HourAl-Hafiz Bin SajahanNo ratings yet

- DHT, VGOHT - Catloading Diagram - Oct2005Document3 pagesDHT, VGOHT - Catloading Diagram - Oct2005Bikas SahaNo ratings yet

- Vibrations - NptelDocument3 pagesVibrations - NptelMSK65No ratings yet

- +chapter 6 Binomial CoefficientsDocument34 pages+chapter 6 Binomial CoefficientsArash RastiNo ratings yet

- Tempera 2018 AbstractsDocument45 pagesTempera 2018 AbstractsGerard Emmanuel KamdemNo ratings yet

- Study of Mosquito Larvicidal Effects of (Bitter Gourd) Extracts As NanopowderDocument3 pagesStudy of Mosquito Larvicidal Effects of (Bitter Gourd) Extracts As NanopowderAnonymous AkoNo ratings yet

- Amc 20-21Document33 pagesAmc 20-21Vasco M C SantosNo ratings yet

- Nammiaca 000032Document5,323 pagesNammiaca 000032gangadhark196No ratings yet

- Complicaciones Postoperatorias en Esofagectomía Por Cáncer. Evaluación de 215 Casos Según Definiciones Del Grupo de Consenso InternacionalDocument7 pagesComplicaciones Postoperatorias en Esofagectomía Por Cáncer. Evaluación de 215 Casos Según Definiciones Del Grupo de Consenso InternacionalPaulo RoseroNo ratings yet

- RE2S PE LPG CNG SPC Part 1Document32 pagesRE2S PE LPG CNG SPC Part 1Inversiones RinocellNo ratings yet

- Infrastructure Definition:: Economic Infrastructure Includes BroadlyDocument3 pagesInfrastructure Definition:: Economic Infrastructure Includes Broadlyabraha gebruNo ratings yet

- Diablo Watch Newsletter, FALL 2009 Save Mount DiabloDocument16 pagesDiablo Watch Newsletter, FALL 2009 Save Mount DiabloIoannqisHatzopoulosNo ratings yet

- Primary Three Exam Question.Document17 pagesPrimary Three Exam Question.ogidan preciousNo ratings yet

- Feature Writing EnglishDocument2 pagesFeature Writing EnglishAldren BababooeyNo ratings yet

- The Immediate Effect of Ischemic Compression Technique and Transverse Friction Massage On Tenderness of Active and Latent Myofascial Trigger Points - A Pilot StudyDocument7 pagesThe Immediate Effect of Ischemic Compression Technique and Transverse Friction Massage On Tenderness of Active and Latent Myofascial Trigger Points - A Pilot StudyJörgen Puis0% (1)

- Additive Manufacturing Objective QuestionsDocument7 pagesAdditive Manufacturing Objective Questionsmohammad shaqib100% (4)

- TA1515VDocument4 pagesTA1515VLeo LeiNo ratings yet

- Afectiuni Si SimptomeDocument22 pagesAfectiuni Si SimptomeIOANA_ROX_DRNo ratings yet

- Diels-Alder Reaction: MechanismDocument5 pagesDiels-Alder Reaction: MechanismJavier RamirezNo ratings yet

- Module 12. Big Issues Lesson 12a. Reading. Pages 140-141: No Words TranslationDocument4 pagesModule 12. Big Issues Lesson 12a. Reading. Pages 140-141: No Words TranslationLeonardo Perez AlegriaNo ratings yet

- Komatsu Technical BrochurDocument7 pagesKomatsu Technical BrochurBenjamin MossoNo ratings yet

- FPAL Product Code GuideDocument53 pagesFPAL Product Code GuideSRARNo ratings yet

- Food Poisoning: VocabularyDocument9 pagesFood Poisoning: VocabularyHANG WEI MENG MoeNo ratings yet

- Timer Relay ERV-09Document1 pageTimer Relay ERV-09wal idNo ratings yet

- The Finite Element Method Applied To Agricultural Engineering - A Review - Current Agriculture Research JournalDocument19 pagesThe Finite Element Method Applied To Agricultural Engineering - A Review - Current Agriculture Research Journalsubhamgupta7495No ratings yet

- Deld12070 CC18 GT 371 C CDocument1 pageDeld12070 CC18 GT 371 C CDEBASIS BARMANNo ratings yet