Professional Documents

Culture Documents

Power To The People: City Blasts Euro Boss Over Growth Claims

Uploaded by

City A.M.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Power To The People: City Blasts Euro Boss Over Growth Claims

Uploaded by

City A.M.Copyright:

Available Formats

ON THE DAY THAT YOUTH UNEMPLOYMENT IN GREECE REACHED A SHOCKING 58 PER CENT HIGH

BUSINESS WITH PERSONALITY

In the wake of the nancial crisis, the global fund industry nds itself in a

changed environment. Is it time for a new portfolio investment rulebook?

Stephen Schaefer, Professor of Finance

Investment Management Evening Programmes

Fixed Income Markets and Bond Portfolio Management programme starts 15 January 2013

Visit www.london.edu/imp/ | Email nance@london.edu | Call +44 (0)20 7000 7397 Leading Financial Thinking

I th

h k f th

i l i i th l

b l f d i d t

d it lf i

Steph

chan

In th

, Professor of F hen Schaefer

nged environment.

he wake of the na

Finance

Is it time for a new

ancial crisis, the glo

w portfolio investm

obal fund industry

ment rulebook?

nds itself in a

www.london.edu/imp/

Leading Financial

Thinking

EUROPEAN Central Bank boss Mario

Draghi was under fire yesterday for

claiming the Eurozone economies are

back on track for growth just a day

after the European Commission

slashed its own forecasts for the single

currency area.

Draghi said the troubled currency

areas governments have made great

strides in reforming their economies,

meaning they are poised for recov-

ery but economists disagreed with

his optimistic forecast.

New figures in Greece show more

than a quarter of the labour force are

unemployed, and an astonishing 58

per cent of those aged between 16 and

24 are jobless, showing the countrys

crisis worsening.

I wouldnt have said it a year ago,

but both the Eurozone as a whole and

individual countries have a fundamen-

tal position which is way more bal-

anced than the US, Japan and the UK,

Draghi said, pointing to falling private

debt levels, a better trade position and

falling labour costs although he

noted poor survey data.

This poises the Eurozone for a recov-

ery. It will probably be slow, but it will

be solid, he concluded.

City economists disagreed.

If anything the Eurozone is poised

to remain in the doldrums for even

longer, said Investecs Philip Shaw.

Despite noble attempts by Draghi to

defend the Eurozones prospects, the

outlook is really very different.

Brussels this week slashed growth

forecasts and now expects the econo-

my to grow by just 0.1 per cent in 2013

while unemployment will rise to 11.8

per cent. But the ECB president even

claimed government debt positions

are getting better.

Fiscal consolidation has been amaz-

ing and when we look at other parts

of the world, they have not been so

amazing. Debt to GDP is on the way

down, even in countries with the high-

est ratios, he claimed.

But the ECs studies show that debt

will climb to 94.5 per cent of GDP next

year, and continue to run a solid

deficit into 2014.

And economists said even the ECs

gloomy forecasts may be overly opti-

mistic. The economy is getting worse,

not better a 0.4 per cent contraction

in GDP next year is looking more like-

ly, said BNP Paribas Ken Wattret.

It does sound odd for Draghi to talk

about an improvement when uncer-

tainty is so high and business confi-

dence is falling. Draghis view of

rebalancing and growth is very much

a long-term one.

ALAN BENNETTS NEW PLAY IS A TRIUMPH

BY TIM WALLACE

AMERICAS

FISCAL CLIFF

Mark Littlewood in The Forum Page 26

See Page 28

MORE EUROZONE: Pages 14, 27

L L

Certified Distribution

27/08/12 til 30/09/12 is 128,785

Head of the European Central Bank Mario Draghi celebrated the Eurozones economic promise yesterday but Greek unrest looked set to continue

FTSE 100 n5,776.05 -15.58 DOWn12,811.32 -121.41 NASDAQn2,895.58 -41.71 /$ 1.60 unc / 1.25 unc /$ 1.27 unc

www.cityam.com FREE ISSUE 1,757 FRIDAY 9 NOVEMBER 2012

Bank turns

off the taps

THE BANK of England

yesterday agreed a halt to

quantitative easing (QE) for

November, with economists

warning the policy is close to

running its course.

The Banks monetary policy

committee (MPC) rejected

both a change in rates and

QE stopping asset purchases

for only the third time since

the policy began.

While some analysts threw

cold water on the effectiveness

of QE, many believed the

decision was close-run and

poor data would bring the

Bank back to the policy again.

QE is not a very powerful

tool to boost growth, said

Michael Saunders at Citi. But

he nevertheless expected: The

MPC will resume QE quite

soon, prompted by

disappointing data.

BY BEN SOUTHWOOD

MORE: THE DEBATE, Page 27

L L

POWER TO THE PEOPLE

CITY BLASTS EURO BOSS

OVER GROWTH CLAIMS

nDebt to GDP is

down even in the

countries with

the worst ratios

nEurozone is

poised for

solid recovery

Draghis delusions

allister.heath@cityam.com

Follow me on Twitter: @allisterheath

G4S loses out as coalition

rows back on prison deals

OUTSOURCING giant G4S has lost its

contract to run Wolds prison and

failed to make the shortlist to over-

see several other jails, as the govern-

ment backtracked on plans for more

competitive justice operations.

The Ministry of Justice revealed

yesterday that G4S will hand over

the category C jail in Hull in July

2013 after 21 years in charge, after

failing to convince the government

it could offer a better service than

the state.

Justice minister Chris Grayling

said three other prisons will remain

under state control for the foresee-

able future, despite his department

spending over a year fielding private

sector bids to take them over.

The MoJ has even rejected a bid

from HM Prison Service, in partner-

ship with FTSE 250-listed Mitie, to

operate all six of the jail groups that

were put out to tender. Mitie

declined to comment.

The ministry said that Wolds,

Durham, Coldingley and Onley pris-

ons will be more cost-effective if

they remain run by the state sector.

Andrew Haldenby, director of the

Reform think-tank, said this U-turn

calls into question the govern-

ments whole approach to improv-

ing public services.

The CBI said the decision was real-

Panmure hires team from Matrix

Panmure Gordon has returned to the

investment fund business by hiring a team

from Matrix Corporate Capital, as the

broker seeks to build on its return to

profitability without inflating its cost

base. Most of Matrixs existing investment

funds team, which includes market

makers, specialist analysts and sales

people, will join Panmure next week.

Phillip Wale, Panmures chief executive,

said he would continue to focus on fixing

broken parts of the business.

Qualcomm vies with Intel

Intel, the chipmaker that was once a stock

market champion for the technology

sector, was overtaken briefly in market

value by rival Qualcomm in a sign of the

rapidly changing fortunes of the

smartphone and personal computer

industries.

Ghana selling triggers cocoa slide

Cocoa prices fell to their lowest level in

three-and-a-half months as unexpected

selling by a west African producer

prompted selling by investment funds.

Traders said Ghana was seen locking in

profits for the new seasons crop.

Pension promises sinks AEA

An unmanageable pension fund deficit

and disastrous overseas foray have

finished off the ailing privatised arm of

the UK Atomic Energy Agency. AEA

Technology went into a pre-pack

administration yesterday.

Adoboli fabricated defence

The UBS rogue trader falsely claimed

that colleagues knew what he was doing

in an attempt to save himself, a court was

told.

Comet firesale disappoints

Comet has launched its widely anticipated

firesale as administrators move to wind

down the failed retailer ahead of store

closures as early as next week.

IAG makes 113m Vueling offer

International Airlines Group, owner of

British Airways and Iberia, has mounted a

113m (90m) offer to take full control of

Spanish low-cost carrier, Vueling, as it

looks to restructure its loss-making

business in Spain.

Money Funds Plan Falls Flat

A proposal by money funds to safeguard

their industry during times of financial

stressand head off substantial new

regulationsis receiving a chilly

reception from federal regulators.

Orient-Express Rejects Offer

Orient-Express Hotels yesterday rejected

a takeover offer from a rival chain owned

by Tata Group, calling the $1.2 billion offer

deeply unattractive.

ONLINE travel agency

Priceline.com said yesterday it will

buy Kayak Software Corp in a

friendly deal that values the

company at $1.8bn (1.13bn).

Priceline is offering $40 a share

for Kayak, a 29 per cent premium

on the companys closing price of

$31.04 yesterday.

Kayak shares jumped 27 per

cent to more than $39 in extended

trading, while Priceline.com

moved lower.

Daniel Kurnos, an analyst at

Benchmark Company, said the

purchase would let Priceline.com

participate more in the travel

advertising space.

Priceline had previously

addressed that it was having issues

in terms of marketing

efficiencies, he said.

This certainly represents an

investment for them in the paid-

search, or the advertising channel,

which is not an area where they've

historically had a lot of exposure.

But Kurnos added the move also

exposes Priceline.com more

significantly to the volatile air

travel market.

Kayak, which uses a website and

a mobile site to help consumers

compare prices for airlines and

hotels, went public in July with

shares priced at $26. The deal is

expected to close early next year.

Priceline to buy

Kayak Software

in $1.8bn deal

Nick Buckles, chief executive of G4S. The firm is waiting for feedback on what went wrong

2

NEWS

BY HARRY BANKS

BY MARION DAKERS

To contact the newsdesk email news@cityam.com

I

T is time for George Osborne to

start worrying. The Chancellor

will be the biggest loser from the

Bank of Englands right and

proper decision to halt quantitative

easing, at least for the time being.

The biggest problem with QE apart

from its increasing lack of impact

and the pain inflicted upon savers

and pensioners is that it has blurred

to a dangerous extent monetary and

fiscal policy.

The Bank, one branch of the UK

state, purchased around 38bn worth

of gilts across August, September and

October. During that time, the Debt

Management Office, another branch

of the UK state, issued 46.4bn worth

of new gilts. For all intents and pur-

poses, one part of the state was

financing another part of the state, in

a bizarre, almost Ponzi-style scheme

that kept a deluded City happy but

EDITORS

LETTER

ALLISTER HEATH

End of quantitative easing will stop mad monetary recycling

FRIDAY 9 NOVEMBER 2012

has gradually been undermining the

integrity of the monetary system.

The private sector had to absorb just

8bn worth of gilts during that three

month period, while the Bank, in its

new role as the Treasurys top pay-

master, mopped up 82 per cent of the

net issuance. Needless to say, Osborne

took the credit, patting himself on

the back for the lack of a buyers

strike and for the UKs low gilt yields

even though the overwhelming

majority of the budget deficit was

financed by the creation of new

money, not by convincing investors to

part with their cash. There have even

been some periods such as in

August when the authorities

bought more gilts than the Treasury

issued. The end of QE means that this

mad monetary recycling has ended,

at least for now. The 3.5bn raised on

6 November received no support from

the Bank.

Suddenly, Osborne is on his own. He

is going to have to convince private

buyers to hand over real cash from

real pools of savings for his IOUs. We

shall soon find out how he fares in

the brave new world of real budget

constraints, economic rationality and

accountability unless, that is, the

Bank relents in a month or two and

comes running back to his rescue,

like the US cavalry in those old black

and white movies.

allowed to fail, the process of defining

resolution is if anything more impor-

tant than defining regulation, which

is absolutely right.

This last statement alone suggests

that Welby will be at least slightly bet-

ter than the current Archbishop of

Canterbury, who is so wrong, biased

and anti-capitalist that it eventually

became funny. But Welbys obsession

with corporate sin he even wrote a

thesis on it risks blinding him to all

the wealth and prosperity business

creates. People must act ethically, law-

breakers must be severely punished,

bailouts must be banished and the

City reformed but most people and

companies are generally good, not

bad. Endless preaching about sin isnt

going to get the economy growing.

THEOLOGICAL NONSENSE

I cant get excited by the news that

Justin Welby is to become the next

Archbishop of Canterbury. Welby is a

former oil executive who actually

understands derivatives and at least

some financial products, rather than

the usual clueless lifelong theologian,

and is a member of Andrew Tyries

Banking Commission. But just like

Vince Cable, who still dines out on his

time at Shell but whose views on the

economy are wrong-headed, having

spent a few years in the private sector

doesnt mean that Welby is right on

economics.

He recently argued that finance is

the cuckoo in the nest that pushed

all the other fledgling industries out

to die, which is clearly nonsense

empirically and theoretically, and far

too imbued with emotionalism. But

he did also say that all banks must be

ly disappointing, adding: Opening

these services up to the scrutiny of

competition delivers better quality

and value for the taxpayer.

G4S said in a statement it would

meet with officials in the coming days

to hear how its bids fell short.

Prisons minister Jeremy Wright told

the BBC yesterday that G4Ss loss is

no reflection on what they are doing

in prisons that they already operate

and it doesnt mean that they wont

have a part to play in some contracted-

out services, which we think there is

scope for across the prison estate.

The ministry hopes to call for bids to

run some ancillary services such as

catering in the spring.

Contracts to oversee two prison

groups are still up for grabs, with

Serco, Sodexo and MTC with Amey all

shortlisted.

G4S, which came under fire over its

botched Olympics security work, saw

its shares close 3.1 per cent lower.

Analysts said the loss for G4S, while

disappointing, is unlikely to have a

large impact on results at the firm,

which runs five other UK jails but

makes most of its revenue overseas.

The new jobs website for London professionals

CITYAMCAREERS.com

WHAT THE OTHER PAPERS SAY THIS MORNING

IN BRIEF

Obama to address fiscal cliff

nNewly re-elected President Barack

Obama will make a statement on the

economy today, the White House said,

setting the stage for a showdown with

congressional Republicans over

contentious tax and spending issues.

The president is likely to discuss

looming tax increases and

government spending cuts - the so-

called fiscal cliff that would go into

effect early next year unless Congress

acts to prevent them.

US closes in on tax evaders

nIn a step toward reining in offshore

tax evasion, the US Treasury

Department yesterday said it was

close to finalising tax information-

sharing pacts with countries ranging

from Canada to islands such as

Guernsey and the Isle of Man. Treasury

listed 47 jurisdictions, from India to

Sint Maarten, that are in various

negotiation stages on agreements

governing how their local financial

businesses can meet the US laws.

Bank trade body wants Libor cull

nMost Libor interest rates should be

scrapped by April to restore trust in

what remains of the rigged

benchmark, the British Bankers

Association (BBA) said. It said only 30

of 150 variations of the London

Interbank Offered Rate should stay

under a proposal it published for

consultation. The government has

asked the FSA to make changes to the

benchmark which is used to price

products like home loans.

A FORMER City oil executive widely

tipped to be unveiled as the new

Archbishop of Canterbury this morn-

ing is expected to keep his position

on a Parliamentary commission into

banking standards.

Bishop of Durham Reverend Justin

Welby, an Old Etonian who currently

helps scrutinise banking standards

as part of his role as a member of the

House of Lords, is expected to take

his seat at an evidence session for the

commission on Monday, when the

panel will take evidence from Sir

John Vickers, a Commission

spokesman confirmed to City A.M.

last night.

Reverend Welby, who worked in

corporate finance for two oil compa-

nies in both London and Paris for

eleven years, is set to be announced

as the leader of the worlds 80m

Anglicans by Downing Street this

morning.

Welby is set to succeed incumbent

Archbishop Rowan Williams when

he steps down on 31 December.

The commission is expected to pub-

lish its first report on its scrutiny of

the banking reform bill on 18

Parliamentary

bank probe to

retain Welby

BY MICHAEL BOW

December.

Yesterday, chairman of the

Parliamentary Commission on

Banking Standards Andrew Tyrie MP

backed Welby to stay on in the role,

saying he was making an outstand-

ing contribution.

The commission, which was set up

by chancellor George Osborne this

summer, appointed Welby to the post

to help scrutinise the banking sector

alongside other members of the

House of Lords.

Reverend Welby, who worked for

French oil giant Elf in Paris for five

years before moving to FTSE listed

firm Enterprise Oil for a further six

years, is a vociferous critic of banking

failures during the financial crisis.

Speaking last month, Welby said

pre-2008 financial markets were

exponents of anarchy and financial

services served nothing.

They involved wild and frantic

activity, often by exceptionally intelli-

gent people, working very long hours,

but they had no socially useful pur-

pose, he said.

The Bishop was ordained as deacon

in 1992 with a curacy in Nuneaton

before moving to become the Dean of

Liverpool in 2007.

EXCLUSIVE

BY TIM WALLACE

FRIDAY 9 NOVEMBER 2012

3

NEWS

cityam.com

SNR Denton set for three way

merger to create legal giant

CITY law firms SNR Denton, Salans

and Canadian outfit Fraser Milner

Casgrain yesterday announced plans

to merge the practices to create the

seventh largest law firm on the

planet.

In an explicit challenge to the

dominance of the Magic Circle law

firms in the City, the new business

will become the biggest energy and

mining sector legal practice in the

world.

The merged company, which is

set to be called Dentons, will also

BY MICHAEL BOW

seek to capitalise on Salans strong

insurance practice by using it to

boost the new firms presence in

the London insurance market.

The merger, which has been in

the works for months, will see the

creation of a 14 membership

executive board led by current SNR

Denton chief executive Elliott

Portnoy, who will remain leader of

the new merged company.

Describing the deal as a game

changer, management said more

practices in Canada could follow

the firms lead to merge with

outfits in the US and UK in future.

Portnoy told City A.M.: All three

firms know and respect each other

well and we all have shared clients.

The merger is a result of our

conversations.

Joe Andrew, currently SNR

Dentons global chair, added: We

are the challenger brand.

We are challenging the elite and

as the biggest newcomer we are

obviously defined as being

different.

The firms are set to put their

proposals to a vote of their partners

next week and will become active in

the first quarter of next year.

BANKS advising the government on

the industrys new ringfencing

rules are misleading regulators on

the kind of products small firms

want, and wrongly promoting

inappropriately complex products,

a leading campaigner told City A.M.

Small firms only want a handful

of very basic products, and nothing

else should be within the ringfence,

the Federation for Small Businesses

argues not the derivative

products which banks want to put

in the retail arms.

There is quite a lobby from

banks for simple derivatives to be

Small firms attack banks push

for widest possible ringfence

in the ringfence, but I have yet to

find a simple derivative product,

said the FSBs Priyen Patel.

He accused banks of claiming

SMEs want to be able to buy every

product, including derivatives,

through their local bank branch

something they cannot do now,

even without a ringfence.

Instead, the FSB wants

commercial deposit accounts,

loans, credit cards, overdrafts and

possibly merchant services to be

the only business products within

the retail entity.

If anything more complex is

within the ringfence, Patel warned,

it could lead to normal SMEs cross-

subsidising the riskier services.

Bishop of Durham Justin Welby is expected to be announced as the new Archbishop

INSURANCE giant Aviva yesterday

said it will sell its struggling US

business at a substantial discount in

order to ensure its radical turnaround

plan remains on track.

Executive chairman John

MacFarlane confirmed that the sale of

the Iowa-based business is on the hori-

zon and said it is set to fetch far less

than its 2.4bn book value. Aviva says

this is justified because it will release

reserve capital to support other divi-

sions. The firm also confirmed that

advisers have been appointed to work

on the sale of eight other units.

MacFarlane took over in May after

irate investors forced out former chief

executive Andrew Moss following

years of share price declines. He

immediately set about trying to revi-

talise the British firm by announcing

plans to withdraw from at least 16 of

the firms 58 businesses and remov-

ing layers of middle management.

In yesterdays announcement he

Aviva to sell US

unit at discount

to boost revival

BY JAMES WATERSON

said that in the process he had

encountered a culture that was more

used to collective decision making

and had more bureaucracy than

desirable. Meanwhile the search for a

new chief executive is now well

advanced with the final interviews

underway.

Barrie Cornes, an analyst at Panmure

Gordon, called Aviva a work in

progress but said it is compelling at

the current valuation. This is despite

the firm announcing a five per cent

drop in sales so far in 2012.

Samsung overtakes Apple as

Galaxy S3 becomes a bestseller

SAMSUNGS Galaxy S3 overtook

Apples iPhone 4S to become the

worlds bestselling smartphone in

the third quarter of the year,

according to research firm Strategy

Analytics.

Samsung shipped 18m of its

flagship model, compared to the

iPhone 4Ss 16.2m. This was partly

due to the fact that the latest

version of Apples device, the

iPhone 5, was introduced at the

end of the quarter. Apple shipped

BY JAMES TITCOMB 6m iPhone 5s in the period,

according to the research, meaning

that the combined figure for the 4S

and 5 was 22.2m. Even with this

caveat, it is the first time in years

that Apple has not had the top

selling model, demonstrating

serious competition from Samsung.

We expect the new iPhone 5 to

out-ship Samsungs Galaxy S3 in

the coming fourth quarter, Neil

Mawston of Strategy Analytics said.

Apple should soon reclaim the

title of the worlds most popular

smartphone model.

The news demonstrates the

continued rise of the Korean

company, which last year overtook

Apple to be the worlds biggest

smartphone manufacturer by sales.

The Galaxy S3 accounted for 11

per cent of all smartphone

shipments in the third quarter,

according to the research.

Total smartphone sales were

167.8m, up from 152.8m in the

previous quarter, even as the

number shipped was somewhat

subdued as people waited for the

launch of the iPhone 5.

Apple chief executive Tim Cook should see the iPhone 5 retake the lead in the next quarter

Aviva PLC

8Nov 2Nov 5Nov 6Nov 7Nov

337.5

335.0

340.0

342.5

332.5

330.0

p

330.30

8Nov

CREDIT rating agency Standard &

Poors (S&P) yesterday downgraded

its outlook on Lloyds TSB to

negative from stable, citing the

additional 1bn provision for

payment protection insurance (PPI)

mis-selling claims which the bank

made at last weeks third quarter

results.

S&P said the additional provision

makes it likely that Lloyds will see a

pre-tax loss for this year, and only a

modest profit next year. S&P said

this would prevent it revising its

assessment on Lloyds capital and

earnings to adequate from

moderate over the next year.

Despite the outlook downgrade,

S&P kept Lloyds credit rating at A

and said the bank had made

S&P revises Lloyds TSB rating

outlook due to profit forecasts

significant progress in repairing

its balance sheet.

The negative outlook on Lloyds

indicates a one-in-three chance that

its rating may be lowered over the

medium term (six to 24 months).

Rival banks including HSBC,

Barclays and Santander are also

currently on negative outlook with

S&P.

S&P put Barclays on negative

outlook in July citing strategic

uncertainties following Bob

Diamonds departure.

We are disappointed by this

change in outlook given the

excellent progress we have made in

de-risking and strengthening our

balance sheet. We would emphasise

that S&P has affirmed Lloyds

current ratings, said a

spokeswoman for Lloyds.

FRIDAY 9 NOVEMBER 2012

4

NEWS

cityam.com

www.blancpain.com

BLANCPAIN BOUTIQUES ABU DHABI BEIJING CANNES DUBAI EKATERINBURG GENEVA HONG KONG MACAU MADRID MANAMA

MOSCOW MUMBAI MUNICH NEW YORK PARIS SEOUL SHANGHAI SINGAPORE TAIPEI TOKYO ZURICH

0845 273 2500

Villeret Collection

Complete Calendar Half-Hunter

Patented under-lug correctors

Secured calendar and

moon-phases mechanism

Ref. 6664-3642-55B

BY KATIE HOPE

BANCO Popular Espanol, the Spanish

lender that is seeking to raise as

much as 2.5bn (2bn) in a make or

break share sale, has appointed STJ

Advisors, the London-based equity

advisory group, to advise on the deal.

The Spanish bank is believed to have

hired STJ to help it draw up a syndi-

cate of banks but some say the

appointment has caused friction

because STJ is known for seeking

a lot of investor information the

banks deem to be time-consuming

to provide.

STJ was one of the equity advisers to

the controversial IPO of Bankia.

Several months after the share issue,

Bankia was nationalised, leaving

many outraged shareholders out of

pocket. Reports last night suggested

that Banco Popular plans to hire

at least 10 banks to guarantee the

offering.

Banco Santander, Deutsche Bank

and JP Morgan will probably run the

sale. Over a dozen other banks have

been approached, including Bank of

America Merrill Lynch, Citigroup.

and UBS.

Popular, Spains sixth-largest lender,

should announce the names of

underwriters today. The bank needs

to raise the extra funds to avoid being

nationalised after failing a stress test

earlier this year.

Banco Popular

appoints STJ to

key rights issue

BY DAVID HELLIER

THE SALE of Greek lender Geniki

wiped out Societe Generales profits

in the third quarter, according to the

French banks financial results pub-

lished yesterday.

Profits plunged 86.3 per cent to

85m (67.8m), from 622m in the

third quarter of 2011. That takes prof-

its for the year to date to 1.25bn, 45.3

per cent below the 2.285bn recorded

in the same period of last year.

Much of that hit came from the sale

of the banks Greek unit Geniki to

Piraeus Bank, on which it made a loss

of 130m.

The sale of US-based fund manage-

ment unit TCW also cost the group

92m.

And financing and advisory profits

took a tumble, falling 21.9 per cent

from 616m to 481m.

But Societe Generale managed to

record strong growth in its invest-

ment banking profits, as market sen-

timent and activity levels improved.

The global markets arm saw profits

SocGen profits

demolished by

Greek writeoff

BY TIM WALLACE

boom 98.4 per cent to 1.252bn.

That was made up of 575m in equi-

ties, and 678m from fixed income,

currencies and commodities which

skyrocketed from 159m a year earlier.

Analysts said this shows the group is

stronger than headline profit suggests.

This slender profit fell short of ana-

lyst expectations, said Daiwa Capital

Markets Michael Symonds.

However the bottom line result was

impacted by numerous one-off and

non-operational items during the

quarter. When restated for these items

performance was more resilient.

WAS THE BOE RIGHT TO HOLD

INTEREST RATES AND QE?

Interviews by Alex Croell

No. I dont think its right. I think

for the economy to function

correctly interest rates should be kept

around four per cent.

These views are those of the individuals above andnot necessarily those of their company

CHARLES DAVIES

DBS VICKERS

I dont know. Whatever you do with

the interest rates, it wont change

the economy.

TERAS ULAKHOVICH

BARCLAYS CAPITAL

I dont know. The big question is

how it is going to be paid for,

because there is only so much money the

Bank of England can print.

JOHN STAMPER

JUDICIUM

Market doubts Commerzbank

shakeup will boost prospects

GERMAN lender Commerzbank

swung back to profits in the three

months to September, with

commission income growing,

according to figures published

yesterday.

The bank made a profit of 78m

(62.2m) in the quarter, compared

to a loss of 687m a year earlier.

Commerzbank said it will invest

2bn by 2016 to refocus on areas

BY TIM WALLACE

like the private customers business

and the SME unit.

But the banks long-term growth

strategy was branded flawed by

disappointed analysts.

Commerzbank hopes to grow its

way to efficiency (targeting flat

costs but a big drop in the cost-

income ratio) which you cannot do

in the current environment;

therefore it will fail, said

Berenbergs Nick Anderson.

CITYVIEWS

Societe Generale

8Nov 2Nov 5Nov 6Nov 7Nov

25.75

25.50

26.00

26.25

25.25

25.00

24.75

25.00

8Nov

Commerzbank

8Nov 2Nov 5Nov 6Nov 7Nov

1.50

1.45

1.55

1.60

1.42

8Nov

THE FRENCH and Belgian

governments agreed to pump

billions more into bailed-out bank

Dexia yesterday, after a year of

wrangling with the European

Commission over how best to

manage the lender.

The states also arranged an

85bn (67.8bn) liquidity guarantee,

on top of the 5.5bn capital hike.

Belgium will put in 53 per cent of

the aid, with France providing the

rest. That represents a shift from

the original even split, costing the

Dexia gets a new capital boost

from French and Belgian states

BY TIM WALLACE Belgian government an extra

165m on the initial plan.

But the government is thought to

be pleased with the deal, with its

share of the guarantee being 10bn

smaller than initially envisaged.

The latest credit injection came

as the groups net asset position

turned negative as the value of a

French unit tumbled.

The announcement came as the

bank reported a third-quarter loss

of 1.23bn, largely due to bad

loans, the writedown on asset sales.

The deal was in part arranged by

UBS, Belgiums sole advisor.

FRIDAY 9 NOVEMBER 2012

5

NEWS

cityam.com

Administrator Karel De Boeck said running down Dexias assets will take decades

US investment firm Carlyle Group

yesterday swung into the black in the

third quarter after firing on all cylin-

ders to boost fundraising, investor

returns and carry fund values.

The Washington DC based compa-

ny, which previously owned Dunkin

Donuts in the US and Le Figaro news-

paper in France, posted a three per

cent increase in returns for its invest-

ment funds for the quarter, led by

strong performance from its buyout

activities.

This helped boost economic net

income, a measure of profitability

for alternative investors, up to $219m

(137m) for the third quarter, better

than the second quarter, when it

posted a $57m loss.

It also planted in the ground

$1.6bn of new cash from investors in

86 new investments across some 24

of its funds and harvested $5.1bn

from 117 different investments to

give back to investors.

Bucking the tough fundraising

environment, Carlyle also raised an

extra $3.4bn for its funds from

investors for the quarter. This took

the total to $9.4bn for the year to

date.

The private equity group, which

floated on Nasdaq in May, said it was

very confident of the future direc-

tion of its business.

Rise in value of

assets boosts

Carlyles profit

BY MICHAEL BOW

Investors are coming back into the

market, co-founder David

Rubenstein said. They recognise

alternative investments probably pro-

duce better returns than any other

kind of investment.

But nobody is making commit-

ments overnight that would welcome

a fundraisers heart.

Carlyle Group, which was founded

in 1987 by Rubenstein, William

Conway and Daniel DAniello and is

headquartered on the same avenue as

the White House in Washington DC

this week also announced it had

raised $1.1bn for its new Carlyle

Equity Opportunity Fund.

Rubenstein said the days of mega-

funds made up of $10bn to $20bn of

commitments were over.

US funds today will be smaller, he

said. That is a major change in the

industry. Now if you have a good fund

you raise a successor that is smaller.

RSA relies on emerging markets as

European sales continue to struggle

THE PARENT company of insurer

More Than yesterday announced

flat sales of 2.7bn in the UK and

western Europe, where it has been

forced to do less business in the

hope of remaining profitable.

But RSA said its performance in

emerging markets including Latin

America, Asia and the Middle East

is a cause for optimism.

Net premiums from developing

countries hit 887m for the first

nine months of 2012, up 15 per cent

BY JAMES WATERSON

at constant exchange rates.

Our unique geographic footprint

gives us exposure to some of the

most attractive insurance markets

in the world, said chief executive

Simon Lee.

He admitted the UK market

remains challenging but said

we have delivered growth across

all business lines except motor.

Worldwide premiums rose

by four per cent to hit

6.2bn, with year-end

investment income

expected to be 500m.

The groups combined operating

ratio a measure of underwriting profit

that compares total premiums against

total costs is expected to be a healthy

96 per cent at the end of the year.

But Kevin Ryan, an analyst at Investec,

said the firms stock is already fully

valued: A mixture of competitive

insurance rates and poorly-performing

economies means that RSA will continue

to struggle to grow its top line.

Carlyle Group LP

8Nov 2Nov 5Nov 6Nov 7Nov

26.40

25.60

26.00

$

25.42

8Nov

Simon Lee said RSA is pleased with new

acquisitions in Canada and Argentina

LLOYDS of London insurer

Lancashire Holdings said yesterday

that premium rates will be

squeezed in January and

expressed surprise at the

optimism exhibited by some of its

rivals.

Nonetheless a quiet third

quarter, largely unaffected by

major catastrophes, enabled the

Lancashire Holdings warns of

premium pressure in January

BY JAMES WATERSON

firm to announce a special

dividend of around 56p a share

with a total payout cost of $145m

(90.6m). Profits for the period

stayed relatively flat at $78m.

The company is confident it can

absorb any impact from Hurricane

Sandy but warned investors that it

will have to wait for final figures.

It is simply too early to provide

any meaningful estimate for

reserves, said CFO Elaine Whelan.

FRIDAY 9 NOVEMBER 2012

6

NEWS

cityam.com

SWISS RE has become the third

reinsurer this week to unveil

expectation-busting profits,

following yesterdays announcement

that net income rose 62 per cent in

the third quarter.

European rivals Hannover Re and

Munich Re have already raised their

targets for 2012 following a year

characterised by surging investment

income and an absence of large

payouts. Reinsurers provide

additional cover for primary

insurers and their profitability

relies heavily on the absence of

major catastrophes such as last

years Tsunami in Japan and New

Zealand earthquake.

Swiss Re said profits were $2.2bn

(1.4bn) for the three months

between July and September,

smashing analysts forecasts of

$1.4bn. As a result the company

may choose to return some of the

money to shareholders.

If we are unable to find

opportunities that meet our return

expectations, we would look at

further measures to return excess

capital, such as a special dividend,

said George Quinn, Swiss Re CFO.

Third-quarter premiums rose 11

per cent year-on-year to $6.6bn and

the firm said steeper demand

following Hurricane Sandy could

help push up premiums in the

crucial January renewal period.

Swiss Re joins

reinsurance

profit bonanza

BY JAMES WATERSON

JP MORGAN Chase & Co revealed yes-

terday that US regulators have

approved a plan for the bank to use its

capital to buy back as much as $3bn

(1.87bn) of its stock in the first

quarter of 2013.

The company also disclosed that it

has reached an agreement in princi-

ple with the Securities and Exchange

Commission (SEC) to resolve two previ-

ously-disclosed investigations related

to mortgage-backed securities.

JP Morgan had suspended buybacks

in May and submitted a new capital

plan to the Federal Reserve in August

after containing its London Whale

derivatives losses at about $6.2bn.

The Fed told the bank on 5 November

that it had approved the plan, JP

Morgan said in a quarterly filing to the

Securities and Exchange Commission.

The losing derivatives positions were

disclosed by JP Morgan on 10 May,

more than a month after reports sur-

faced in the credit markets that Bruno

Iksil, a London-based trader for JP

Morgan known as the London Whale,

had made massive bets in credit

markets.

JP Morgan can

start buybacks

post Whale loss

BY HARRY BANKS

The approved plan provides for JP

Morgan to continue paying its current

quarterly dividend on common stock,

the filing said.

Chief executive Jamie Dimon told

investors on 21 May the bank had sus-

pended repurchases of its stock to

rebuild its capital and meet higher

requirements for financial safety.

Under restrictions imposed after the

financial crisis, JP Morgan and other

big banks cannot buy back stock or

increase their dividends without

approval from the Federal Reserve.

The company did not provide an esti-

mate of how much the settlements

with the SEC over mortgage securities

could cost.

JPMorgan Chase & Co

8Nov 2Nov 5Nov 6Nov 7Nov

42.50

40.50

41.50

43.50

$

40.40

8Nov

CHINAS outgoing President

yesterday talked down the prospect

of political reform as he prepared

to hand over the reins of the

countrys ruling Communist Party.

Hu Jintao said in a party summit

speech that the worlds second-

largest economy has held high the

great banner of socialism with

Chinese characteristics and neither

taken the old and rigid closed-door

policy nor taken the wrong path of

changing the banner.

He said China should deepen

the form of state-owned

enterprises but pointed towards

Chinese leader cheers growth

but talks down possible reform

BY MARION DAKERS making the renminbi exchange

rate more market-based.

Hu added in a two-hour speech

that Chinese firms should speed up

international expansion, following

the likes of CNOOC in making

global acquisitions.

He also issued a stark warning

against the corruption that has

dogged his party, most recently in

the expulsion of Bo Xilai, once

tipped as a leadership candidate,

amid allegations he hushed up his

wifes murder of British

businessman Neil Heywood.

Hu will be replaced by Vice

President Xi Jinping at the close of

the Communist Party congress.

FRIDAY 9 NOVEMBER 2012

7

NEWS

cityam.com

Hu Jintao will step down as general secretary of the Communist Party next week

CREDIT data firm Experian is to spend $110m

(69m) on a restructuring programme aimed at

reducing costs and increasing its focus on key

markets.

Chief executive Don Robert said the company,

best known for running consumer credit checks

for banks and retailers, expects the initiative to

result in annual savings of about $75m.

Experian, which reported six per cent growth

in underlying pre-tax profit in the first half, will

increase its use of off-shore facilities, reduce its

exposure to lower-growth activities and lower its

fixed costs relating to facilities, technology and

infrastructure, Robert said.

Experians underlying pre-tax profit of $563m

in the six months to 30 September was ahead of

the $561m expected by analysts in a company

poll. Experian said it expected to achieve high

single-digit organic revenue growth for the full

year.

Experian to invest

$110m as restructures

in bid to cut spending

BY CITY A.M. REPORTER

FALLING domestic traffic and rising costs have sent

regional airline Flybe to a half-year loss, the firm

announced yesterday.

Group revenues were broadly flat at 340.6m but

cost pressures have sent it to a pre-tax loss of 1.3m

for the first half of the year, compared to a profit of

14.8m a year ago.

The continuing challenges of the UK domestic

aviation market further validate the importance of

our decision to focus Flybes long-term strategy on

rebalancing our route network by growing our

European operations, said the airlines chairman

and chief executive Jim French.

The UK domestic aviation market continues to

show little sign of recovery, with the market

trending a year-on-year decline. Since this

represents around 75 per cent of Flybe UKs

passenger base, this decline continues to pose

challenges on our UK business.

The firm said it aims to save 2 per seat through

cost cuts in an attempt to return to profitability.

Shares fell 6.3 per cent to 52p yesterday.

Flybe to curb costs

as declining traffic

sends it into the red

BY MARION DAKERS

INDIA-based airline Kingfisher has plunged to a

record loss of 7.54bn rupees (86.7m) for the

quarter, piling further pressure on the embattled

carrier.

Kingfisher, which suspended all flights last

month and has struggled to pay its staff for most

of the year, said revenues crashed 87 per cent to

2bn rupees.

Creditors have reportedly set a 30 November

deadline for Vijay Mallyas airline to bring in

fresh equity or an investor.

Kingfisher has been scrambling without

success to find fresh investment. No global

airline has publicly expressed an interest in

buying a stake.

The Centre for Asia Pacific Aviation has said a

fully funded turnaround for Kingfisher would

cost at least $1bn. This week, a top government

official said India would not renew the airlines

licence if it failed to provide a turnaround plan

by the end of December.

Pressure mounts on

Indias Kingfisher

after record losses

BY MARION DAKERS

10

NEWS

FUNDS firm Schroders beat fore-

casts with 2.6bn of net new

money in the third quarter, but

profits fell and it struck a cautious

tone about the coming year.

The firm attracted 1.9bn net

inflows to its institutional funds

and 800m to its retail-focused

Intermediary unit, though clients

in its private banking arm pulled

out a net 100m.

While the firm smashed through

forecasts of 1.1bn total inflows, it

cast doubt on whether the trend

will continue.

It is not clear whether this more

positive tone in Intermediary will

be sustained given the uncertain

economic background, but long

term we are well positioned with a

broad product range, competitive

investment performance and

strong distribution, said Schroders

Schroders nets

new money but

stays cautious

BY MARION DAKERS

in a trading statement yesterday.

Funds under management rose to

202bn, up from 194.6bn three

months earlier. This was helped by

5.6bn of investment returns.

Overall quarterly profit fell 12.8

per cent to 88.6m, the bulk of

which came from Schroders asset

management arm. The private bank

made 4m, down 40 per cent, as

revenues dipped 16 per cent to

24.6m.

Schroders PLC

8Nov 2Nov 5Nov 6Nov 7Nov

1,610

1,600

1,620

1,630

1,590

1,570

1,580

1,560

p

1,565.00

8Nov

Chairman Sir David Howard

has hit out at the FSCS

11

NEWS

cityam.com

15 minutes every 15 minutes.

The smarter way between Heathrow and central London.

Book now at heathrowexpress.com

Slow lane? Fast track.

CHARLES Stanley has criticised the

levy it must pay into the Financial

Services Compensation Scheme,

which knocked 40 per cent off its

pre-tax profit for the first half of

the year.

Sir David Howard, chairman of

the stockbroker and investment

manager, said the 1.4m it

gave to the FSCS goes

towards funding

compensation linked to

areas of business

unrelated to his firm.

This is really no

more than a sort of tax

which is levied on us in a

way, and in amounts,

that we cant plan

Charles Stanley blames finance

levy for slump in its earnings

BY MARION DAKERS

for, he said.

The FSCS was set up in 2001 to

ensure customers of failed

financial firms do not lose all their

money. It is funded by levies on

FSA-registered companies.

But several investment

management firms including

Hargreaves Lansdown and

Rathbone Brothers have hit out at

the amounts they must contribute.

Charles Stanley yesterday

reported flat half-year revenues of

60m, while fees rose 11 per cent

to 36.8m.

Pre-tax profit slumped 35 per

cent to 3.4m, in part due to the

FSCS levy and restructuring costs.

GROUPONS quarterly results lagged

expectations as the daily deal compa-

nys European operations continued

to struggle, wiping 17 per cent off its

shares last night.

Groupon shares slid to a record

low of $3.25 in after hours trading

yesterday after closing at $3.92.

Revenue was $568.6m in the third

quarter, compared with $430.2m in

the third quarter of 2011.

Groupon reported a net loss of

$3m, or zero cents per common

share in the period, compared with a

net loss of $54.2m, or 18 cents a

share, in the third quarter of 2011.

Analysts had expected a profit of

three cents a share.

Andrew Mason, chief executive of

Groupon, said a solid performance

in North America was offset by

continued challenges in Europe.

Groupon hit

as revenue

disappoints

BY CITY A.M. REPORTER

Tate & Lyle PLC

8Nov 2Nov 5Nov 6Nov 7Nov

730

720

740

750

710

p

730.00

8Nov

BRITISH sweeteners and starches

maker Tate & Lyle said yesterday

that the cost of re-opening a

factory and tough trading in

Europe had reduced earnings

growth in its first half.

The group posted adjusted pre-

tax profit of 179m, up two per

cent, stifled by the cost of

restarting a second plant for its

zero-calorie sucralose sweetener

Splenda in Alabama earlier this

year. First-half sales rose seven per

cent to 1.63bn, despite

uncertainty around the wider

economy and corn quality and

pricing.

Chief executive Javed Ahmed

said the group made progress

against the backdrop of a strong

first half last year, softer market

conditions in Europe and the steep

change in fixed costs associated

with the restart of its Alabama

facility.

We continue to do fine in

Europe but we just havent seen a

lot of growth, he said.

BY HARRY BANKS

Tate & Lyle said it continued to

expect to make progress this

financial year.

The company dusted down its

McIntoch sucralose plant in

Alabama earlier this year as its

sole plant in Singapore was

struggling to cope with demand.

Shares in the group, which had

a strong run into the results,

rising 19 per cent since 10

September, fell 0.5 per cent.

The company is very healthy

and has high margins, said

Panmure Gordon analyst Graham

Jones.

12

NEWS

cityam.com

For purchase until midnight 15 November 2012. Fares include all taxes and charges. Fares correct as of 5 November 2012 and for travel between 17 December 2012 - 24 March 2013 with the exception of Brive, Deauville, Pau, Nantes and Florence, travel between

7 January 2013 - 24 March 2013. Available on selected ights only, limited availability, terms and conditions apply. For full terms and conditions, visit cityjet.com

EUROPE

FOR

LESS.

London City Airport to:

Germany FROM

99RTN

Holland FROM 109RTN

Belgium FROM 109RTN

France FROM 109RTN

Luxembourg FROM 109RTN

Italy FROM 119RTN

Scotland FROM 129RTN

Book at cityjet.com

Tate & Lyles profit dented by

expansion of sweetener plant

IN BRIEF

McDonalds struggles in October

n McDonalds yesterday reported a 1.8

per cent drop in October sales at

established restaurants around the world,

its first monthly sales fall since March

2003, hurt by stiff competition in a weak

economy. Analysts, on average, expected

a 1.07 per cent decline in sales at

restaurants open at least 13 months,

according to Consensus Metrix. The results

came just weeks after the worlds biggest

hamburger chain posted its worst

quarterly restaurant sales growth

performance in nine years. October sales

at restaurants open at least 13 months fell

2.2 per cent in both the US and Europe

and fell 2.4 per cent in the Asia/Pacific,

Middle East and Africa region. The US just

edges out Europe as McDonalds largest

market for sales.

Dairy Crest revenue drops 7pc

n Britains Dairy Crest Group, the maker

of Cathedral City cheese, reported a 16 per

cent fall in first-half profit as its core milk

business continued to struggle. April to

September adjusted pre-tax profit fell to

19.1m from 22.7m a year earlier.

Revenue fell seven per cent to 688.2m.

Revenue from dairies, which accounts for

three-quarters of total revenue, was down

about 11 per cent. UKs dairy industry has

been rocked by widescale protests by

dairy farmers demanding higher prices

from milk processors and supermarkets.

Dairy Crests higher-margin dairy foods

business has compensated for the decline

in its milk business. The company said total

sales of its four key brands Cathedral

City, Country Life, Clover and Frijj were

up 11 per cent during the period.

Walt Disney boosted by ESPN

n Media giant Walt Disney posted higher

quarterly profit on Thursday, lifted by an

increase in attendance at theme parks and

a gain in revenue at sports juggernaut

ESPN. Disney reported diluted earnings

per share of 68 cents for the quarter that

ended in September, in line with

expectations from Wall Street analysts.

Net income rose 14 per cent to $1.2bn in

the quarter. The theme parks division

gained from passengers spending more

time on Disney cruise ships plus a boost in

attendance at theme parks in Hong Kong,

California and Paris, the company said.

Disney shares dropped two per cent in

after-hours trading to $49. Earlier, shares

closed at $50.04 in the US. Disney last

week unveiled a $4.05bn agreement to

buy Lucasfilm from producer George Luca.

The recent share price underperformance had anticipated a weak update

and indeed, Morrisons update was disappointing. We expect underperformance to

continue into next year as changes to its marketing & promotional strategy

will take time for consumers to become aware of.

ANALYST VIEWS

The recent market share data for the UK supermarkets has contained one

clear and demonstrable alarm bell, to our minds at least, and that is the slowing

sales momentum and widening under performance of Morrisons...

Following this very disappointing update [we] reiterate our sell stance.

Morrisons third quarter update was as challenged as feared, with like-

for-likes declining 2.1 per cent.... Our unchanged estimates presume that this,

and softer comparables, translate into improving trading momentum

from the fourth quarter.

WHAT DOES THE FUTURE

HOLD FOR MORRISONS?

Interviews by Kasmira Jefford

KATE CALVERT SEYMOUR PIERCE

CLIVE BLACK SHORE CAPITAL

JAMES GRZINIC DEUTSCHE BANK

WM Morrison Supermarkets PLC

8Nov 2Nov 5Nov 6Nov 7Nov

267

268

265

266

269

270

271

263

264

p

263.50

8Nov

WM MORRISONS chief executive

admitted yesterday it had not done

enough to reach out to customers

after the supermarket posted a wors-

ening decline in sales and parted ways

with its commercial director.

Revealing a 2.1 per cent drop in third

quarter sales, Dalton Philips said it

had not promoted strengths that set it

apart from rivals such as its in-store

butchers and bakers and admitted to

losing out on promotions.

But he said it was about promoting

more effectively rather than promot-

ing more, adding you have got to

have promotions that stand out.

Philips said it had to adjust and

commercial director Richard Hodgson

would be replaced with veteran retail-

er Martyn Jones.

BY KASMIRA JEFFORD

Morrisons has lagged rivals in mov-

ing online and launching convenience

stores, prompting analysts to criticise

it for being stuck in the past.

The group will open 70 convenience

stores by the end of next year. It also

launched its online Morrisons Cellar

wine range this week and will update

on a full internet offering next year.

FRIDAY 9 NOVEMBER 2012

13

NEWS

cityam.com

SUPERGROUP has seen sales jump in

the second quarter of the year as cold-

er weather boosted sales of coats and

hoodies from its Superdry label.

Chief executive Julian Dunkerton

said: When it dropped three or four

degrees in one day...you are selling

more of your heavy knits and jackets

and you get more of a sense of

whether your brand is successful.

And thats how we feel, that we have

a successful range.

Retail sales increased by 32.2 per

cent to 52.2m in the quarter,

boosted by the clearance sales

following the re-branding of the

Cult stores to Superdry.

Like-for-like sales jumped 5.8 per

cent against weaker comparatives

last year when it reported a slump

in sales after stock ordering

problems.

Cold weather

heats up tills

at Supergroup

BY KASMIRA JEFFORD

Morrisons top

director leaves

as sales worsen

EUROZONE economic sentiment

worsened yet further going into the

fourth quarter, data showed yester-

day, as worries surrounding mem-

ber debt piles refused to go away.

Expert respondents rated the euro

area economic climate at 81.7 in

the fourth quarter, according to the

Ifo Institute, down from 88.9 in the

third quarter where 100 corre-

sponds to the climate in 2005.

These experts cited public budget

deficits as their biggest worry, and

the most important explanation of

the troubling economic circum-

stances, ahead of a lack of demand

and high unemployment.

And expectations for the future

were even gloomier, at 72.1, sig-

nalling the respondents had little

faith in EU and national govern-

ment schemes intended to bring

bloc countries back into recovery.

This survey data came as trade fig-

ures from both Germany and

Fourth quarter

sees Eurozone

even gloomier

BY BEN SOUTHWOOD

France revealed shrinking exports.

French exports declined 0.6bn

(0.48bn) to hit 37.6bn in

September, though a bigger fall in

imports meant the trade deficit

shrank to 5bn.

This data will only add to the case

for President Francois Hollandes

20bn package intended to reverse

the long-term slide in French com-

petitiveness which has seen the ero-

sion of some 750,000 factory jobs

over the past 10 years.

German exports were 91.7bn in

September, federal statistics office

Destatis said, down 3.4 per cent on

the same month last year though

the year-to-date figures showed mod-

est growth over 2011. This left the

balance of foreign trade at 16.9bn,

down from 17.3bn in September

last year. Manufacturing data rein-

forced this pessimistic interpreta-

tion of the data, showing that

manufacturing turnover slipped

three per cent compared to August,

driven by falling foreign business.

FRIDAY 9 NOVEMBER 2012

14

NEWS

cityam.com

Investors buy up Spanish long

term bonds giving Rajoy time

SPAIN showed yesterday that

investors will buy even its long-

term debt, with a successful bond

auction that completed its 2012

issuance programme, giving the

government breathing room to

hold out before requesting

international aid.

Most analysts still think Spain

will need to call on the European

Central Banks firing power

before long, but the smooth

auction could prompt Prime

Minister Mariano Rajoy to wait

BY CITY A.M. REPORTER

longer than expected before

seeking a bailout.

The auction of 4.8bn of bonds

raised more than the targeted

amount of up to 4.5bn. Finishing

the 2012 bond issuance

programme ahead of schedule

allows the Treasury to start

making headway on its plans for

next year, when it needs to raise

207bn for its own needs and

some 20bn more on behalf of

indebted autonomous regions.

Yesterdays sale included longer-

term bonds for the first time in a

year and a half, a sign that

investors are prepared to bet over

a longer horizon on one of the

economies worst hit by the

Eurozone crisis, mired in

prolonged recession. However

those 20-year bonds, which raised

731m, yielded 6.33 per cent, high

by historical standards.

The bulk of the sale 3.04bn

came from a new five-year bond

yielding 4.68 per cent. The

Treasurys borrowing cost fell on a

2015 bond, which sold 992m at

an average 3.66 per cent yield,

compared with a 3.96 per cent

yield when last sold on 4 October.

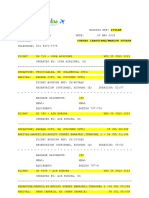

GREEK LABOUR MARKET COLLAPSE DEEPENS

Jul12 Jan 12 Jul 11 Jan 11 Jul 10 Jan 10 Jul 09 Jan 09 Jul 08 Jan08 Jul07 Jan07 Jul06 Jan 06

4,800

4,600

4,400

4,200

4,000

3,800

3,600

25.5%

20.5%

15.5%

10.5%

5.5%

Unemployment rate Employment (thousands)

EMPLOYMENT

UNEMPLOYMENT

HITS 25.4% HITS 3.72m

IN AUGUST

IN AUGUST

FROM 24.8% IN JULY

18.4% IN AUGUST 2011

FROM 3.81m IN JULY

4.03m IN AUGUST 2011

NEW JOBLESS claims in the US

continued to creep down in the

beginning of November, at least on

seasonally-adjusted figures,

according to data released

yesterday.

New unemployment insurance

claims dropped 8,000 in the week

ending 3 November, to reach

355,000, the Department of Labor

showed. But the bigger drop-off

came in total insured

Seasonally-adjusted US jobless

numbers show continued slide

BY BEN SOUTHWOOD unemployment, which fell 135,000

into the previous week, ending 27

October, putting them 517,000

lower than a year earlier, at a total

of 3,127,000.

This came in tandem with trade

balance data from the Bureau of

Economic Analysis and the Census

Bureau which showed a $2.9bn

(1.8bn) fall in the overall deficit in

September, compared to a year

earlier, bringing it to $41.5bn, on a

falling goods deficit combined with

a rising surplus in services.

16

NEWS

cityam.com

INSIDE

TRACK

DAVID HELLIER

I

t would be no exaggeration to say

that the boutique investment banks

are hurting due to the dearth of deal

activity but in their favour they have

increased their market share of deals

and every so often they pop up quite

spectacularly when one is least

expecting them.

Hence when BP bought (and then later

sold) its stake in BP-TNK it mandated

Lambert Energy to advise it on the deal

along with others. Similarly, and equally

noteworthy, Michael Kleins boutique

Klein & Co was instrumental in first get-

ting the chief executives of Glencore and

Xstrata together for its mega merger.

When relations deteriorated later in the

deal, it was the unusual intervention of

former PM Tony Blair that managed to

get the deal back on track.

Earlier this year Centreview Partners

advised Alliance Boots on its sale to

Walgreens of the US thanks to the long

association of banker Richard Gurling

with the target company. Boutiques

offer independence and pure corporate

finance support but obviously lack the

balance sheet strength of the bulge

bracket banks.

Now I hear that the former Mirror

Group chief executive David

Montgomery has hired Lepe Partners to

advise him on the acquisition of

Northcliffe Newspapers from DMGT.

Lepe was started by two former execu-

tives from Long Acre. Its advisory board

includes media luminaries such as

Brent Hoberman, the co-founder of

Lastminute.com and Michael Jackson,

the ex C4 chief executive officer.

Founder Johnny Goodwin, whose

clients have included the former

TalkSport chief executive Kelvin

MacKenzie (also a friend), left Jefferies

when it became clear it wanted to focus

on larger companies. Lepe is here to act

for and help entrepreneurs, Goodwin

told me this week, without confirming a

role in the Northcliffe transaction.

Were focused on going on journeys

with entrepreneurs. Also acting on

the deal, I hear, is City veteran Nick

Wells, whose journeys in the past

have included being with the likes of

retail tycoon Sir Philip Green and

Michael Ashcroft, who appears to be

one of the backers of any bid

Montgomery might make.

Montgomerys track record as a

businessman might be mixed but

theres no doubt he knows a lot

about newspapers and the technolog-

ical changes shaping the industry.

ORCEL STEPS IN AT UBS

After the drama of last weeks

announcement by UBS that it is plan-

ning to cut 10,000 staff worldwide,

new investment banking boss, the

charismatic Andrea Orcel, this week

went about the difficult task of try-

ing to raise morale.

In the early part of the week Orcel

addressed a group of around 500 sen-

ior London-based employees at a

meeting at the Honourable Artillery

Company at which he stressed the

bank had a bright future in corpo-

rate finance and wasnt going to sur-

render its rich heritage. The

investment bank isnt being shut

down and dont let anybody con-

vince you that it is, said Orcel, in a

speech described as very vibrant and

up-lifting. He then got on a plane to

New York, where he performed the

same task there.

david.hellier@cityam.com

THEFORUM

cityam.com/forum

L L

JOIN THE DEBATE

PAGES 26-27

David Montgomery

eyes Lepe back into

the newspaper world

Left to right: easyJet boss Carolyn McCall; Robert Swannell, chairman of Marks

and Spencer and Amber Rudd, MP for Hastings and Rye

Guy Hawney, equity dealer at Hermes Pensions Management, with his newly won scooter

BATED breaths around the City can

finally breathe deeply, the lucky win-

ner of Mondays competition has now

been revealed.

The proud new owner of the very

sleek Vmoto scooter, The Capitalist is

pleased to announce, is Guy Hawney,

equity dealer at Hermes Pensions

Management.

Hawney correctly guessed that the

top speed of the motorcycle was

Whos that man with the brand

new scooter? Our prize winner

30mph answer c).

Upon receiving his early Christmas

present, Hawney said: It looks like a

cracker, although I think there might

be some competition from my daugh-

ter in terms of who gets to ride it.

Thanks to all you City A.M. readers

who entered, and lest we forget, there

is still a prize available for whoever

sends the finest Movember specimen

to thecapitalist@cityam.com

FRIDAY 9 NOVEMBER 2012

17

cityam.com

cityam.com/the-capitalist

THECAPITALIST

Got A Story? Email

thecapitalist@cityam.com

Plenty of FTSE faces at

Rudds Finsbury bash

Left to right: Martin Gilbert, chief executive of Aberdeen Asset Management and

Roland Rudd, perfect party host and founder of City PR firm RLM Finsbury

Left to right: Simon Lewis, chief executive of the Association for Financial Markets

(AFME); Russell Chambers, senior adviser at Credit Suisse and Mervyn Metcalf,

managing director of Dean Street Advisers

EDITED BY CALLY SQUIRES

TO SW1 last night where senior City

figures attended the annual drinks

party given by Roland Rudd, boss of

City PR outfit RLM Finsbury. Among

the guest list were Stephen Hester of

RBS, Chris Gibson-Smith of British

Land, M&S chairman Robert

Swannell, easyJets boss Carolyn

McCall, Sir Charles Dunstone of

Carphone. Rolands sister Amber

Rudd told The Capitalist she had just

won an office battle to get her name

up on the door alongside George

Osborne, for whom she is now

Parliamentary private secretary. At

this rate, PR guru Roland will soon

have to start introducing himself as

Ambers brother at parties.

in store mobile carphonewarehouse.com

WE COMPARE ALL THE MAJOR NETWORKS

PERFECT ONE

TO FIND THE

FOR YOUR

5

TM and 2010 Apple Inc. All rights reserved.

ED WILLIAMS announced yesterday

he is to retire as chief executive of

Rightmove, 12 years after co-

founding the property website.

Nick McKittrick, who co-founded

Rightmove alongside Williams and

currently serves as finance director

and chief operating officer, will

succeed him as chief executive.

Rightmove was set up in 2000

with 10m and was valued at 425m

when floated on the stock exchange

six years later.

The pair have seen

the aggregation

website grow to

one of the UKs

top property

sites valued at

1.7bn today.

Shares last

night fell less

than one per

cent to close at

1,585.48p.

Rightmove

founder and

chief to retire

BY KASMIRA JEFFORD

LAND Securities said yesterday it had

clinched its third tenant at the Walkie

Talkie skyscraper scheme in the City,

as insurers help bolster the muted

office lettings market.

The property giant said its joint ven-

ture with Canary Wharf Group is now

23 per cent pre-let with a further 11

per cent in solicitors hands after sign-

ing a pre-let deal with insurer Ascot

Underwriting as well as Markel and

Kiln earlier this year.

In results for the six months to 30

September, the group said earnings

fell 10.2 per cent year-on-year after sell-

ing secondary sites and shopping

malls to fund its ambitious 1bn

development plans.

Chief executive Rob Noel shrugged

off concerns over its exposures to the

project, stressing it still only repre-

Land Secs bags

third tenant for

Walkie Talkie

BY KASMIRA JEFFORD

sented 15 per cent of its portfolio.

We are building much bigger build-

ings than we sold and the income will

come storming back again, he said.

Net asset value was flat in the period

at 864p a share, which was below con-

sensus forecasts of 868p, after a UK 3.4

per cent drop in retail property value

offset an 8.6 per cent growth in the

value of its developments.

Land Securities Group PLC

8Nov 2Nov 5Nov 6Nov 7Nov

790

800

810

820

830 p

794.50

8Nov

Balfour Beatty PLC

8Nov 2Nov 5Nov 6Nov 7Nov

260

250

270

280

290

300

310

320 p

261.23

8Nov

Land Securities says its Walkie Talkie skyscraper is now 23 per cent pre-let

FRIDAY 9 NOVEMBER 2012

19

NEWS

cityam.com

Ed Williams will

retire as CEO of

Rightmove

Balfour Beatty to review its

business after profit warning

BALFOUR Beatty said it is

studying whether to close parts

of its operations after issuing a

profit warning yesterday,

prompting its share price to dive

18 per cent.

We are definitely in a world

... where we are having to look

at desisting from certain areas

of the market, chief executive

Ian Tyler said.

His comments came as the

group warned it would miss its

profit guidance for 2012.

The construction sector

accounts for around 30 per cent

BY A CITY A.M. REPORTER

of Balfours business.

Weakness there caused by

public sector cuts and falling

business confidence has

squeezed margins across the

sector since the 2008

property crisis.

The group said it was

specifically reviewing its rail

construction operations in

light of critically low activity

levels in Italy and Spain as

well as low margins in the UK

and Germany.

Unfortunately for Balfour

there arent the big contracts

which historically they have

used to differentiate

themselves to get a bit of margin,

said Andrew Gibb at Investec.